Market Overview

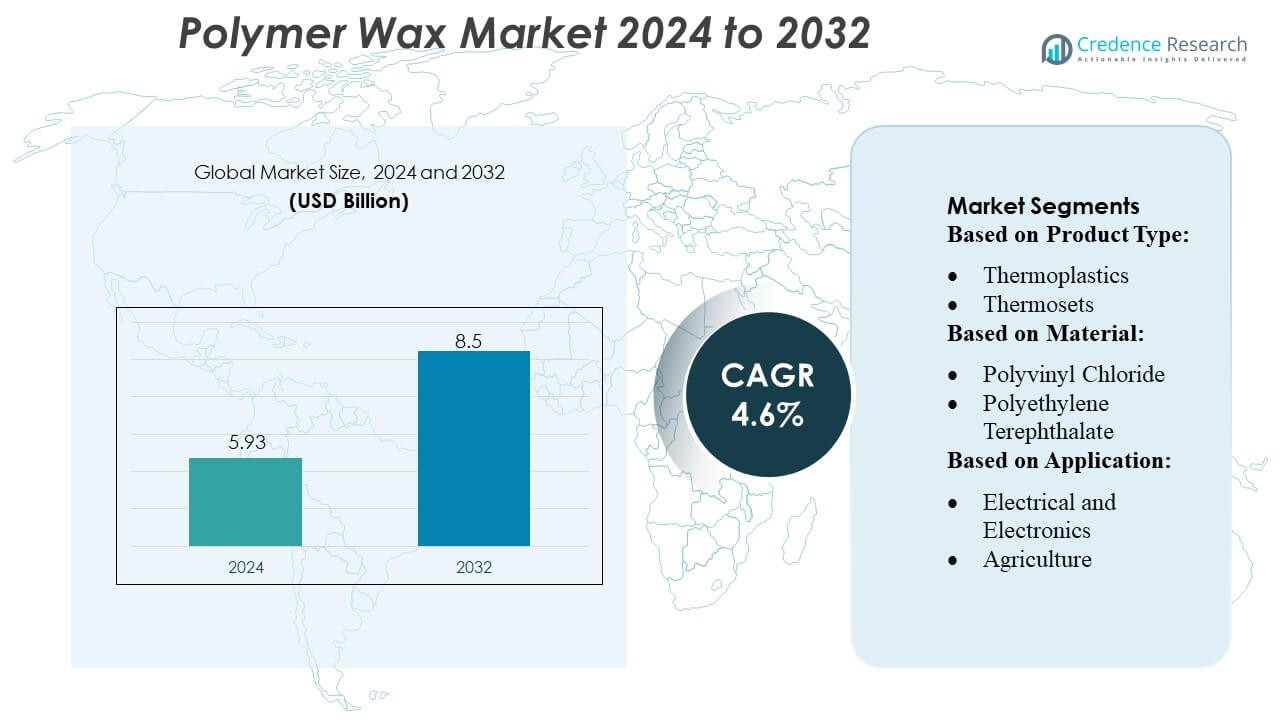

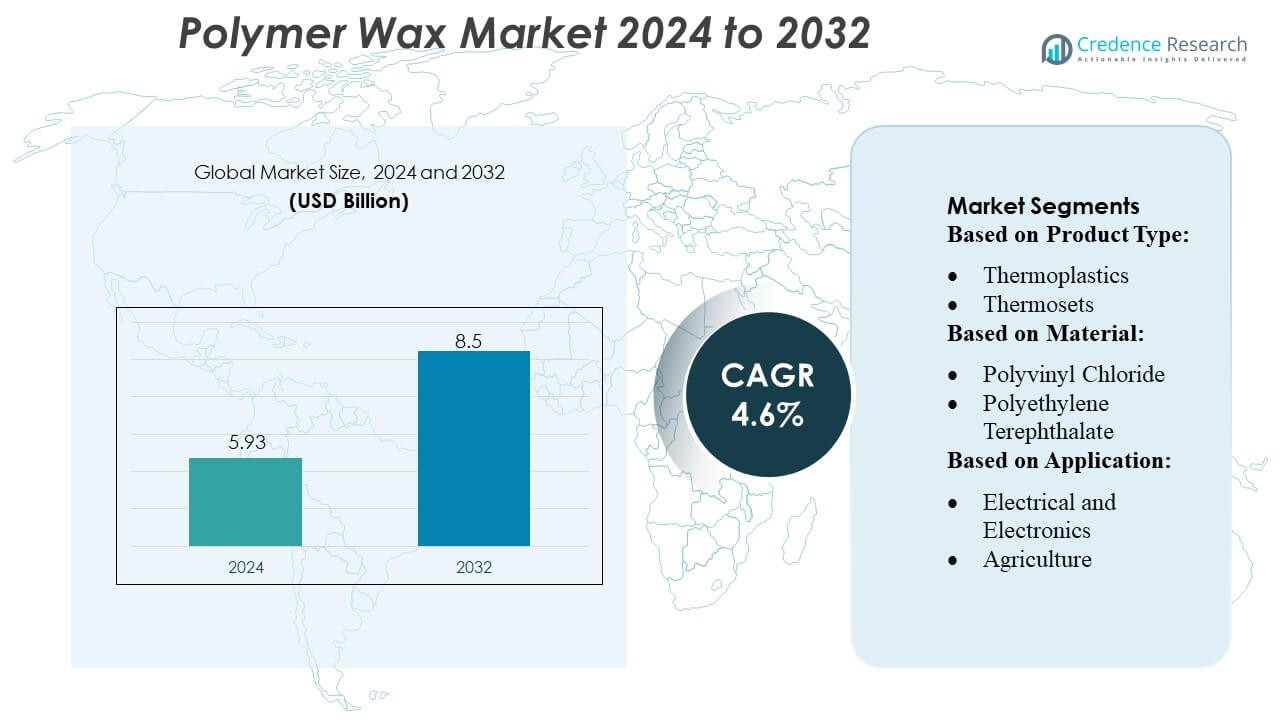

Polymer Wax Market size was valued USD 5.93 billion in 2024 and is anticipated to reach USD 8.5 billion by 2032, at a CAGR of 4.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polymer Wax Market Size 2024 |

USD 5.93 Billion |

| Polymer Wax Market, CAGR |

4.6% |

| Polymer Wax Market Size 2032 |

USD 8.5 Billion |

The Polymer Wax Market is shaped by a mix of global chemical producers and specialty additive manufacturers that compete through technological innovation, advanced formulation capabilities, and strong integration across downstream processing industries. These companies focus on developing high-purity, application-specific polymer waxes that enhance lubrication, dispersion, and surface performance in packaging, coatings, plastics compounding, and adhesives. Asia-Pacific remains the leading regional market with approximately 38–40% share, driven by large-scale polymer manufacturing, rapid industrial expansion, and strong demand for high-performance processing additives. Continuous investments in production capacity, R&D, and sustainable wax technologies further reinforce the competitive position of top market participants.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Polymer Wax Market was valued at USD 5.93 billion in 2024 and is projected to reach USD 8.5 billion by 2032, registering a CAGR of 4.6% during the forecast period.

- Market growth is driven by rising demand for high-purity wax additives that improve lubrication, dispersion, and processing efficiency across packaging, coatings, plastics compounding, and adhesives applications, with packaging emerging as the dominant segment holding the largest share.

- Key trends include the rapid adoption of sustainable and bio-based wax variants, increasing use of advanced extrusion technologies, and strong industry focus on low-emission, high-performance formulations.

- Competitive activity intensifies as manufacturers invest in R&D, expand production capacities, and strengthen integration with downstream processors to enhance supply reliability and product specialization.

- Asia-Pacific leads the global market with 38–40% share, supported by large-scale polymer production and industrial growth, while North America and Europe maintain steady demand through mature manufacturing bases and sustainability-driven innovations.

Market Segmentation Analysis:

By Product Type

Thermoplastics dominate the Polymer Wax Market with an estimated 55–60% share, supported by their melt-processability, recyclability, and compatibility with a wide range of polymer matrices. Their strong uptake in packaging, coatings, and masterbatch production strengthens their leadership due to consistent performance, cost efficiency, and broad application versatility. Thermosets hold a moderate share, driven by demand for high-temperature-resistant and chemically stable formulations, particularly in industrial and construction applications. Elastomers capture the remaining market share, supported by their flexibility, durability, and expanding use in automotive and specialty product manufacturing.

- For instance, Evonik offers high‑performance thermoplastics such as VESTAKEEP® (PEEK) and VESTAMID® (PA12) under its High Performance Polymers business line — these polymers enable continuous working temperatures up to 200 °C when used in fiber composites and deliver high stiffness, low water absorption, and excellent chemical resistance.

By Material

Polyethylene leads the market with 40–45% share, driven by its excellent lubrication properties, low friction coefficient, and compatibility with both extrusion and molding processes. Its widespread use in packaging, coatings, and polymer compounding reinforces its leadership position. Polypropylene follows with a notable share owing to its heat resistance and suitability for high-performance masterbatches and automotive components. PVC, PET, PS, and PU together represent the remaining share, each supported by niche applications—PVC in construction, PET in packaging, PS in consumer goods, and PU in specialty coatings—driven by increasing demand for durable and lightweight polymer systems.

- For instance, Sasol offers Low Density Polyethylene (LDPE) grades such as grade LM2065, which has a melt flow index (MFI) of 6.5 g/10 min and a density of 0.918 g/cm³.

By Application

Packaging remains the dominant application, accounting for over 35% of market share, fueled by continuous demand for rigid and flexible packaging, improved barrier properties, and enhanced processing efficiency in films and containers. Building and construction follow with steady adoption of polymer waxes in roofing, flooring, and window profiles due to improved stability and surface performance. The automotive segment benefits from rising use in tires, body panels, and engine components for better durability and reduced wear. Electrical and electronics, agriculture, medical, and other sectors contribute incremental demand, each driven by specialized performance needs and process optimization.

Key Growth Drivers

1. Rising Demand for Lightweight and High-Performance Materials

The growing emphasis on lightweight, high-strength materials across automotive, packaging, and consumer goods sectors significantly drives demand for polymer waxes. These waxes enhance processing efficiency, improve melt flow, and deliver superior mechanical consistency in plastics and coatings manufacturing. The ability of polymer waxes to reduce friction, improve dispersion, and support thin-wall molding reinforces their adoption in high-volume production environments. As manufacturers target cost optimization and durability, polymer waxes play a critical role in improving product performance and energy-efficient processing.

- For instance, IGI’s paraffin‑wax product IGI 1297A has a melting point range of 148–154 °F and a kinematic viscosity at 100 °C of 5.0–6.6 cSt, per its technical data sheet — which makes it suitable as a process aid or release wax for plastics and elastomer processing.

2. Expansion of Flexible Packaging and E-Commerce Logistics

Rapid expansion of flexible packaging fueled by rising e-commerce activities and changing consumer preferences strengthens the growth momentum of the Polymer Wax Market. Polymer waxes enhance slip properties, anti-blocking performance, and sealing behavior, making them essential additives in films, laminates, and printing inks. Their contribution to improving printability and surface appearance aligns with branding requirements for retail and food packaging. As sustainability-driven lightweight packaging materials grow, demand for polymer waxes that support recyclability and efficiency continues to accelerate across global supply chains.

- For instance, Nippon Seiro’s microcrystalline wax grade Hi‑Mic 1080 has a melting point (ASTM D127) of ~ 85.0 °C ± 2.7 °C, with an oil content (ASTM D721) of no more than 0.50% and a penetration (ASTM D1321, 25 °C) of 13 ± 3 (and 20 ± 5 at 35 °C) — indicating a firm, consistent base-wax suitable for use where slip, anti‑blocking and controlled flow / solidification are required.

3. Technological Advancements in Polymer Processing

Innovations in polymerization methods, catalyst systems, and advanced compounding technologies contribute to significant growth in polymer wax consumption. Manufacturers increasingly adopt polymer waxes to optimize extrusion, injection molding, and hot-melt adhesive production. Emergence of engineered wax grades tailored for specific melt ranges, compatibility requirements, and performance attributes enhances market penetration. These advancements support high-speed manufacturing lines, reduce defects, and improve formulation stability, enabling polymer wax suppliers to address diverse industrial needs while maintaining stringent quality and regulatory compliance standards.

Key Trends & Opportunities

1. Growing Shift Toward Sustainable and Bio-Based Polymer Waxes

The shift toward sustainability and circular economy practices drives interest in bio-based and recycled polymer waxes. Manufacturers are investing in renewable feedstocks and eco-friendly catalysts to replace petroleum-derived alternatives. These materials offer lower carbon footprints, improved biodegradability, and performance characteristics comparable to synthetic waxes. As governments enforce stricter environmental regulations, opportunities arise for companies developing green wax technologies for packaging, coatings, and agricultural films. This trend positions bio-based polymer waxes as a premium growth category with strong long-term market potential.

- For instance, Baker Hughes’s synthetic wax line, POLYWAX™ polyethylenes, are fully saturated homopolymers of ethylene with a very narrow molecular‑weight distribution (polydispersity Mw/Mn ≈ 1.08).

2. Increasing Integration in High-Precision Industrial Applications

Polymer waxes find expanding opportunities in high-precision sectors including electronics, medical devices, and engineered components. Their ability to provide controlled lubrication, dimensional stability, and improved mold release enhances their suitability for advanced manufacturing environments. Growing use in powder metallurgy, 3D printing, and micro-molding creates a rising demand for specialty polymer wax formulations. As industrial production shifts toward miniaturization and performance consistency, polymer wax suppliers benefit from emerging niches requiring tightly engineered material properties.

- For instance, CNPC (2023‑05‑13), the wax has a measured melting point of 61.7 °C, oil content of 0.30% (max 0.5%), Saybolt colour +30 (min +25), needle penetration at 25 °C of 17 (max 19), and a kinematic viscosity at 100 °C of 4.418 mm²/s.

3. Advancements in Surface Modification and Coating Technologies

R&D in surface modification technologies provides new opportunities for polymer waxes used in specialty coatings, ink additives, and protective finishes. Enhanced abrasion resistance, gloss control, and anti-scratch properties enable wider adoption in automotive refinishing, wood coatings, textiles, and decorative materials. With manufacturers prioritizing aesthetic appeal and durability, polymer waxes become key ingredients in high-performance surface treatment systems. This trend supports premium-grade formulations aligned with evolving end-user expectations.

Key Challenges

1. Volatility in Raw Material Prices

Dependence on petroleum-based feedstocks exposes polymer wax manufacturers to price fluctuations in crude oil and derivatives. Raw material volatility directly influences production costs, supply stability, and pricing strategies for finished wax products. Such unpredictability pressures manufacturers to optimize operational efficiency and diversify supply sources. Additionally, rising demand for high-purity polymer waxes complicates cost management, particularly for small and mid-size companies operating with tight profit margins, making supply chain resilience a persistent challenge.

2. Environmental Regulations and Sustainability Pressures

Stringent environmental regulations targeting emissions, plastics waste, and chemical additives pose challenges for polymer wax producers. Compliance with evolving global standards increases R&D costs and requires continuous reformulation to eliminate restricted substances. The shift toward sustainable materials intensifies pressure to develop bio-based waxes while maintaining performance and cost competitiveness. Manufacturers must balance regulatory demands, customer expectations, and production feasibility, making sustainability adaptation a structural challenge across the value chain.

Regional Analysis

North America

North America holds approximately 32–34% of the Polymer Wax Market, supported by strong demand from packaging converters, industrial coatings, and advanced plastic processing sectors. The region benefits from a mature manufacturing ecosystem, high adoption of performance-enhancing additives, and widespread use of polymer wax in hot-melt adhesives, PVC processing, and automotive applications. Demand grows steadily as industries prioritize product durability, energy-efficient production, and improved surface performance. The United States leads consumption due to large-scale packaging and chemical industries, while Canada contributes through rising adoption in construction materials and extrusion processes. Regulatory support for sustainable materials further accelerates market penetration.

Europe

Europe accounts for roughly 27–29% of the Polymer Wax Market, driven by stringent environmental regulations, advanced R&D capabilities, and strong demand from coatings, plastics, and rubber industries. The region emphasizes high-performance, low-emission additives, boosting polymer wax adoption across packaging films, masterbatches, and technical coatings. Germany, Italy, and the U.K. lead consumption due to robust automotive, construction, and industrial manufacturing activities. Increasing focus on recyclable packaging materials and circular economy initiatives amplifies demand for polymer waxes that enhance processability and surface quality. The shift toward bio-based and specialty wax solutions further supports long-term market expansion across the region.

Asia-Pacific

Asia-Pacific dominates the Polymer Wax Market with a substantial 38–40% share, driven by rapid industrialization, large-scale plastics production, and expanding packaging and construction sectors. China leads regional demand due to its strong polymer processing base and rising investments in adhesives, coatings, and masterbatch production. India and Southeast Asia follow with increasing consumption supported by urban infrastructure development and growing manufacturing activity. The region’s competitive production costs and high-volume output enable significant adoption of polymer wax in extrusion, compounding, and surface modification applications. Expanding e-commerce packaging and rising demand for high-quality processed materials strengthen continuous market growth.

Latin America

Latin America holds an estimated 5–7% share of the Polymer Wax Market, with growth driven by increasing use in packaging, PVC processing, and automotive component manufacturing. Brazil and Mexico represent the largest contributors due to their expanding industrial bases and rising demand for high-performance plastic additives. The region benefits from growing consumption of flexible packaging materials, adhesive solutions, and construction plastics. Investments in manufacturing modernization and gradual adoption of advanced extrusion technologies support polymer wax utilization. Despite economic fluctuations, the market continues to expand as industries seek improved processing efficiency, smoother product finishes, and cost-effective performance additives.

Middle East & Africa

The Middle East & Africa region captures approximately 3–5% of the Polymer Wax Market, with steady growth supported by rising industrial diversification, expanding construction activities, and increasing plastics production. GCC countries drive demand through investments in polymer manufacturing, packaging solutions, and high-performance coatings. The presence of major petrochemical players strengthens access to raw materials, enabling broader adoption in compounding and extrusion applications. Africa’s demand grows gradually as infrastructure development and industrial activities expand. Although market penetration remains lower than other regions, rising consumption of processed plastics and adhesives reinforces long-term growth prospects for polymer wax across MEA.

Market Segmentations:

By Product Type:

- Thermoplastics

- Thermosets

By Material:

- Polyvinyl Chloride

- Polyethylene Terephthalate

By Application:

- Electrical and Electronics

- Agriculture

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Polymer Wax Market features leading participants such as Evonik Industries AG, Sasol Limited, BP P.L.C, The International Group, Inc., Nippon Seiro Co., Ltd, Exxon Mobil Corporation, Baker Hughes Company, HollyFrontier Corporation, China National Petroleum Corporation, and Sinopec Corp. the Polymer Wax Market is characterized by continuous innovation, capacity optimization, and expanding application versatility across packaging, industrial coatings, plastics processing, and adhesives. Companies focus on producing high-purity, specialty-grade polymer waxes that enhance thermal stability, lubrication efficiency, and surface performance in extrusion, compounding, and masterbatch operations. Market participants strengthen their positions through investments in R&D, development of bio-based and low-emission formulations, and adoption of advanced manufacturing technologies that improve consistency and processability. Strategic collaborations with downstream manufacturers, regional capacity expansions, and integrated supply chain capabilities further support competitiveness. As sustainability regulations intensify, leading producers prioritize circular-material solutions and environmentally compliant wax chemistries, reinforcing long-term market growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Evonik Industries AG

- Sasol Limited

- BP P.L.C

- The International Group, Inc.

- Nippon Seiro Co., Ltd

- Exxon Mobil Corporation

- Baker Hughes Company

- HollyFrontier Corporation

- China National Petroleum Corporation

- Sinopec Corp

Recent Developments

- In February 2025, Sasol Chemicals expanded its micronized waxes with the launch of SASOLWAX LC Spray 30 G and LC Spray 30 G-EF, which feature a 32% lower Product Carbon Footprint (PCF) compared to their standard grades. These new waxes are specifically designed for coatings, inks, and packaging applications and offer performance benefits like enhanced surface protection, slip, and rub resistance.

- In May 2024, Clariant introduced Licolub PED 1316 is a new oxidized high-density polyethylene (HDPE) wax for internal and external use in PVC processing such as the launch of this innovative solution is poised to significantly influence the polyethylene wax market by meeting growing demands for sustainability and operational efficiency.

- In May 2024, Kydex and Kasiglas collaborated on a transparent, aviation-grade polymer, building on Kydex’s history in aircraft interiors. Kydex, manufactured by Sekisui Kydex, LLC, is a thermoplastics brand that has expanded its aviation product portfolio to include this new transparent material through the partnership with Kasiglas.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady demand growth driven by rising consumption in packaging, coatings, and plastics processing.

- Manufacturers will focus on developing high-performance polymer waxes that enhance lubrication, dispersion, and thermal stability.

- Adoption of bio-based and sustainable wax alternatives will increase as environmental regulations tighten.

- Advances in extrusion and compounding technologies will expand the use of specialty polymer waxes across industrial applications.

- Growth in automotive, construction, and electronics sectors will support higher usage of performance-enhancing additives.

- Global producers will invest in capacity expansions to meet increasing demand from fast-growing Asian markets.

- Integration of polymer waxes into high-strength, recyclable packaging materials will gain momentum.

- Digitalization and process automation in manufacturing will improve product consistency and production efficiency.

- Strategic partnerships between resin producers and wax formulators will strengthen supply chain reliability.

- Innovation in ultra-pure and application-specific wax grades will shape long-term competitiveness in the market.