Market Overview

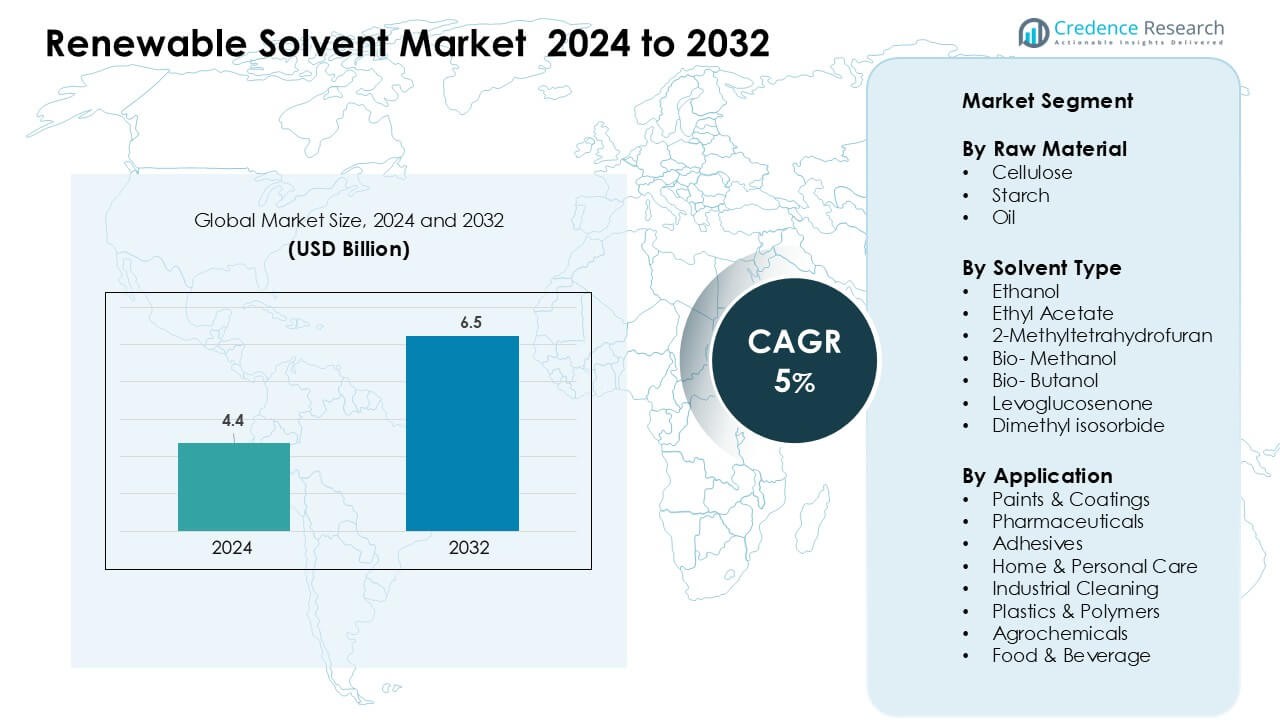

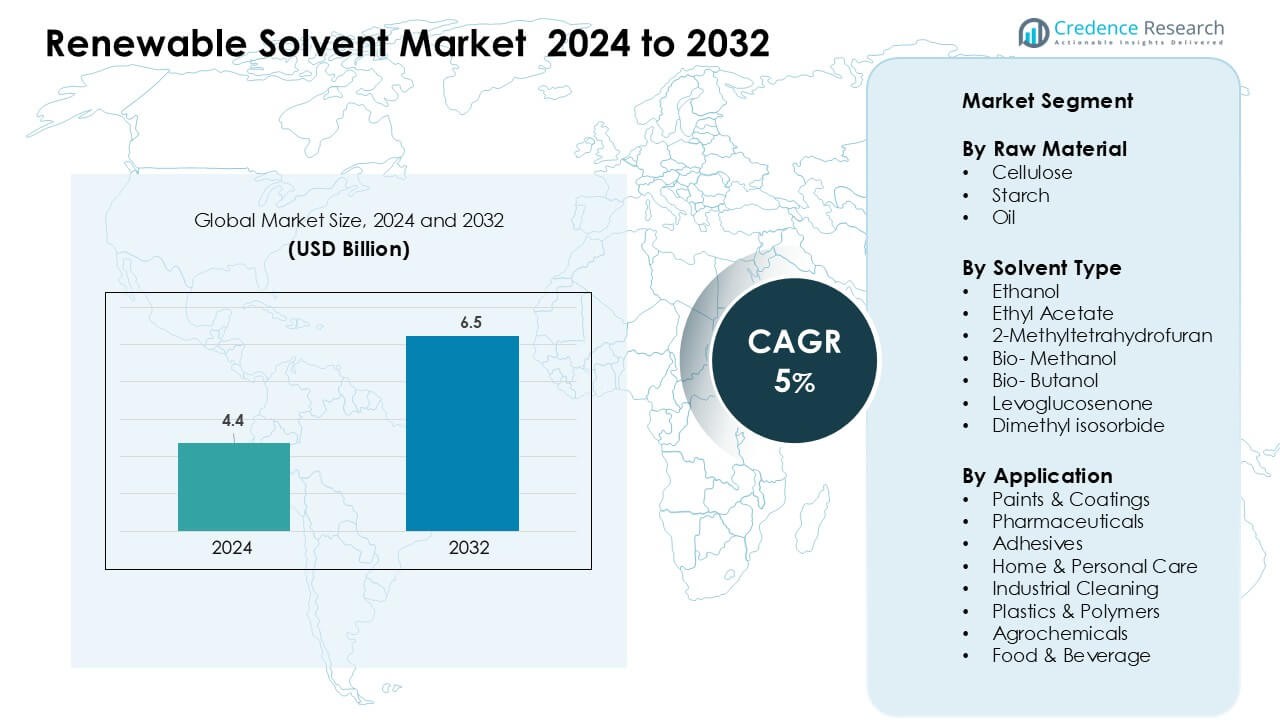

Renewable Solvent Market was valued at USD 4.4 billion in 2024 and is anticipated to reach USD 6.5 billion by 2032, growing at a CAGR of 5 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Renewable Solvent Market Size 2024 |

USD 4.4 Billion |

| Renewable Solvent Market, CAGR |

5% |

| Renewable Solvent Market Size 2032 |

USD 6.5 Billion |

The Renewable Solvent Market is shaped by leading players such as Wilmar Sugar Pty Ltd., Vertec BioSolvents, CREMER OLEO GmbH & Co. KG, InKemia Green Chemicals, Cargill, Neste, ADM, GODAVARI BIOREFINERIES LTD, Dow, and Liberty Chemicals SRL. These companies compete through advanced bio-refinery capabilities, diverse feedstock integration, and high-performance green-solvent formulations tailored for coatings, pharmaceuticals, industrial cleaning, and personal care applications. North America emerged as the leading region in 2024 with a 34% share, driven by strong regulatory support, rapid adoption of low-VOC materials, and expanding investments in sustainable chemical production.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Renewable Solvent Market reached USD 4.4 billion in 2024 and is projected to hit USD 6.5 billion by 2032, growing at a CAGR of 5%.

- Demand grew as industries shifted from petro-solvents to safer, biodegradable alternatives, driven by strict VOC rules and strong adoption across paints, coatings, pharmaceuticals, and industrial cleaning; cellulose-based solvents held the largest raw-material share at 42%.

- Trends highlighted rapid growth in waste-to-solvent technologies, rising use of bio-methanol and ethyl acetate, and increasing investment in next-generation bio-refineries producing high-purity green solvents for specialty chemicals.

- Competition intensified as Wilmar Sugar, Vertec BioSolvents, CREMER OLEO, Neste, Cargill, ADM, Dow, and GODAVARI BIOREFINERIES expanded production capacity, improved feedstock integration, and partnered with coating and personal-care manufacturers for sustainable formulations.

- North America led the market with 34% share, followed by Europe at 31% and Asia-Pacific at 27%, while paints and coatings remained the dominant application segment with a 34% share.

Market Segmentation Analysis:

By Raw Material

Cellulose held the dominant share at about 42% in 2024 due to strong demand from paints, coatings, and pharmaceutical producers seeking low-toxicity and biodegradable inputs. Cellulose-based solvents offer stable performance, support VOC reduction, and align with global sustainability rules. Starch followed as brands used bio-based feedstocks to improve product safety across home and personal care goods. Oil-derived renewable solvents also grew as manufacturers adopted plant-based esters for better solvency and improved compatibility in industrial cleaning and adhesive applications.

- For example, Circa Group developed Cyrene™, a bio-based solvent derived from cellulose waste. The company operated a demonstration plant in Tasmania with about 50 tonnes annual capacity.

By Solvent Type

Ethanol led the segment with nearly 38% share in 2024, supported by wide availability, low cost, and strong acceptance across coatings, cleaning agents, and pharmaceutical formulations. Ethyl acetate and bio-methanol expanded due to their higher biodegradability and improved evaporation profiles that help reduce harmful emissions. Advanced options like 2-methyltetrahydrofuran and levoglucosenone gained traction in specialty chemical processes as producers shifted toward safer, non-petroleum solvent systems to meet tightening environmental and workplace-safety rules worldwide.

- For instance, Circa Group’s Cyrene™ is a cellulose-derived renewable solvent positioned as a safer alternative to NMP and DMF. Company and partner evaluations show Cyrene™ delivers comparable solvency and polarity in demanding chemical processes. The solvent is produced at Circa’s demonstration facility in Tasmania with an annual capacity of about 50 tonnes.

By Application

Paints and coatings dominated the application segment with around 34% share in 2024, driven by rising adoption of eco-friendly formulations in construction, automotive, and industrial sectors. Pharmaceuticals also posted steady growth as drug manufacturers integrated renewable solvents to enhance worker safety and meet green-chemistry mandates. Adhesives, industrial cleaning, and personal care applications expanded as brands targeted lower emissions and stronger regulatory compliance. Plastics, polymers, agrochemicals, and food and beverage producers also increased usage to improve sustainability scores and reduce petrochemical dependence.

Key Growth Drivers

Growing Demand for Low-Emission and Bio-Based Chemicals

Manufacturers across coatings, pharmaceuticals, and cleaning products increased their use of renewable solvents as regulations pushed industries toward safer and lower-emission chemistry. The shift came from rising restrictions on petroleum-based solvents that contribute to VOC emissions and workplace hazards. Producers adopted renewable options to align with global climate goals and strengthen compliance with regional rules. Companies also pushed bio-based products to improve brand sustainability and reduce reliance on fossil feedstocks. The transition accelerated as industries sought materials with strong solvency power, safer handling profiles, and reduced environmental impact. This trend positioned renewable solvents as a strategic component in long-term decarbonization plans.

- For instance, Eastman is a global specialty materials company with a strong presence in bio-based solvents. The company markets Eastman Omnia™ solvent, which is derived from cellulose-based renewable feedstocks. Eastman also applies cellulose ester technologies across its sustainable materials portfolio.

Expansion of Green Manufacturing Across Industries

Industries adopted green manufacturing systems, raising demand for renewable solvents that support cleaner processing. Growth came from automotive, construction, and consumer goods companies that shifted to eco-friendly coatings, adhesives, and cleaning agents. Many brands redesigned production lines to lower emissions and meet internal sustainability targets. Renewable solvents offered compatibility with water-based systems and improved performance in high-value formulations. Demand also rose from pharmaceutical and polymer sectors where manufacturers upgraded equipment to handle bio-derived compounds. These changes increased purchasing of renewable solvents with stable boiling points, strong solvency, and better worker-safety performance. The broad adoption strengthened long-term demand.

- For instance, SC Johnson’s Greenlist™ process is a long-standing, internal, science-based program launched in 2001 to evaluate the human health and environmental impact of ingredients and continuously improve the safety profile of their product formulations.

Rising Consumer Preference for Safer and Natural Products

Consumer awareness pushed brands to adopt renewable solvents that help reduce harmful residues in home, personal care, and food-related applications. Shoppers preferred products made with plant-derived, biodegradable components that align with clean-label expectations. Companies reformulated cleaners, cosmetics, and packaging coatings to meet these preferences while enhancing product safety. Increased retail focus on sustainability labels further supported demand for bio-based solvents. Manufacturers used renewable options to lower toxic exposure risks and improve indoor air quality. This change contributed to rapid adoption across household and hygiene categories, expanding the market for high-purity, natural-origin solvent solutions.

Key Trends & Opportunities

Adoption of Advanced Bio-Derived Solvent Technologies

Producers invested in next-generation bio-derived solvents that deliver higher purity and improved performance for specialty applications. Technologies such as engineered fermentation and catalytic conversion created solvents with predictable reaction behavior and reduced impurities. These innovations helped companies replace petrochemical equivalents in pharmaceuticals, agrochemicals, and polymer processing. New bio-based molecules also enabled higher efficiency in coatings and specialty chemical manufacturing. Firms entering this space gained opportunities through patented solvent technologies that support strong growth in sustainable formulations. Rising demand for high-performance green solvents created space for differentiated product lines.

Growth of Circular and Waste-Based Feedstock Pathways

Producers explored circular feedstock models using agricultural waste, cellulose residue, and biomass side-streams. These processes reduced landfill disposal and cut carbon intensity across solvent production chains. Companies developed new routes to produce ethanol, ethyl acetate, and specialty solvents using waste sugars and lignocellulosic raw materials. This trend opened opportunities for cost-effective production and stronger sustainability claims. Governments supported these pathways through incentives for waste valorization and low-carbon manufacturing. The shift enabled manufacturers to secure stable feedstock supplies while reducing exposure to volatile petroleum prices. Circular production models created long-term scalability for renewable solvents.

- For instance, LanzaTech uses gas-fermentation technology to convert industrial waste gases into ethanol. The company operates commercial facilities producing tens of thousands of tonnes of ethanol annually from waste carbon. This ethanol is supplied as a renewable feedstock for downstream chemical manufacturing.

Expansion of Green Chemistry in High-Value Industries

Pharmaceutical, electronics, and polymer industries expanded the use of green-chemistry practices, creating strong opportunities for renewable solvent adoption. These sectors required high-purity solvents that deliver consistent performance in sensitive reactions. Renewable options aligned with regulatory guidelines for safer chemical processes. Companies replaced traditional solvents to improve worker safety, cut hazardous waste, and maintain compliance with international safety standards. These changes supported demand for high-grade renewable solvents in APIs, coatings for electronics, and advanced materials. The trend opened opportunities for premium pricing and differentiated supply partnerships.

- For instance, BASF supplies bio-based ethyl lactate for pharmaceutical and industrial applications. The solvent is derived from renewable feedstocks and meets high-purity processing requirements. BASF produces these materials within established chemical manufacturing systems.

Key Challenges

High Production Costs and Limited Economies of Scale

Renewable solvent producers faced higher manufacturing costs compared to traditional petrochemical alternatives. Limited capacity, expensive bio-based feedstocks, and complex processing technologies increased the final cost per unit. Many renewable solvent facilities operated below full scale, restricting their ability to compete on pricing with large petrochemical plants. These constraints slowed adoption in cost-sensitive segments such as adhesives, industrial cleaning, and polymers. Companies struggled to justify premium pricing in markets where buyers prioritized low-cost raw materials. Achieving competitive pricing required investment in larger facilities, improved process efficiency, and optimized feedstock sourcing.

Technical Performance Limitations in Certain Applications

Some renewable solvents did not match the performance of petrochemical counterparts in high-temperature, high-reactivity, or heavy-industrial applications. Limitations in evaporation rate, solvency strength, or material compatibility restricted adoption in specialized coatings, aerospace composites, and advanced polymer systems. Manufacturers hesitated to switch when reliability and performance remained critical. Engineers also faced challenges integrating new solvents into existing production lines without modifying equipment. These barriers created longer qualification cycles and increased development costs. Overcoming these constraints required more R&D investment, improved molecular engineering, and better performance testing to match industry expectations.

Regional Analysis

North America

North America led the Renewable Solvent Market with about 34% share in 2024, driven by strict VOC regulations and rapid adoption of green manufacturing practices across coatings, pharmaceuticals, and household products. The U.S. dominated regional demand as producers shifted from petroleum-based solvents to safer, plant-derived alternatives. Growth also came from strong investment in bio-refineries using corn, cellulose, and agricultural waste. Canada expanded its use of bio-based solvents in industrial cleaning and food-related applications due to rising sustainability mandates. The region’s focus on cleaner chemistry continued to support long-term market expansion.

Europe

Europe accounted for roughly 31% share in 2024, supported by aggressive climate policies, strict chemical regulations, and widespread adoption of circular manufacturing models. Germany, France, and the U.K. led solvent substitution programs as industries aligned with REACH and carbon-neutrality goals. Demand grew across industrial coatings, automotive, adhesives, and pharmaceutical production, where companies prioritized low-toxicity and biodegradable formulations. Bio-refinery development using lignocellulosic and waste feedstocks advanced regional supply capabilities. The EU’s strong push toward green chemicals positioned Europe as a key hub for high-performance renewable solvent technologies.

Asia-Pacific

Asia-Pacific held about 27% share in 2024 and remained the fastest-growing region due to expanding manufacturing capacity and rising environmental compliance. China and India increased renewable solvent use in paints, coatings, agrochemicals, and personal care as air-quality standards tightened. Japan and South Korea advanced bio-chemical R&D for high-purity solvents used in electronics and pharmaceuticals. Strong adoption of biomass-derived feedstocks and cost-efficient production supported regional competitiveness. The region’s large industrial base and scaling bio-refinery projects continued to strengthen demand for renewable solvent solutions.

Latin America

Latin America captured nearly 5% share in 2024, driven by increasing use of renewable solvents in agricultural chemicals, food processing, and household-care products. Brazil led demand due to its abundant biomass resources and strong ethanol industry, which supported local production of bio-based solvents. Mexico expanded usage in coatings and cleaning formulations as manufacturers aligned with global sustainability standards. Regional adoption increased as companies sought safer materials and reduced reliance on imported petrochemical solvents. Government initiatives promoting cleaner industry practices supported gradual market growth.

Middle East & Africa

The Middle East & Africa region held about 3% share in 2024, with growth centered on industrial diversification and rising interest in sustainable manufacturing. The UAE and Saudi Arabia advanced green-industry initiatives that encouraged companies to test renewable solvent alternatives in coatings, cleaning chemicals, and packaging applications. South Africa expanded usage in food, beverage, and personal-care sectors as demand for safer consumer goods increased. Limited bio-refinery infrastructure slowed wider adoption, but ongoing sustainability programs and investment in circular materials created opportunities for long-term market expansion.

Market Segmentations:

By Raw Material

By Solvent Type

- Ethanol

- Ethyl Acetate

- 2-Methyltetrahydrofuran

- Bio- Methanol

- Bio- Butanol

- Levoglucosenone

- Dimethyl iso-sorbide

By Application

- Paints & Coatings

- Pharmaceuticals

- Adhesives

- Home & Personal Care

- Industrial Cleaning

- Plastics & Polymers

- Agrochemicals

- Food & Beverage

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Renewable Solvent Market features strong competition among global producers that focus on bio-based chemistry, diversified feedstocks, and high-performance solvent technologies. Leading companies such as Wilmar Sugar Pty Ltd., Vertec BioSolvents, CREMER OLEO, InKemia Green Chemicals, Cargill, Neste, ADM, GODAVARI BIOREFINERIES, Dow, and Liberty Chemicals SRL strengthened their positions through integrated supply chains and continuous product innovation. These firms expanded renewable solvent portfolios across ethanol, ethyl acetate, bio-methanol, and specialty green solvents tailored for coatings, pharmaceuticals, and cleaning applications. Many competitors invested in bio-refineries, circular feedstock systems, and advanced fermentation technologies to reduce carbon intensity and ensure stable raw-material availability. Strategic partnerships with coatings, personal care, and industrial manufacturers increased market reach and encouraged co-development of sustainable formulations. Companies also enhanced global presence through capacity expansions, compliance-focused product lines, and R&D programs focused on high-purity, low-toxicity solvent alternatives.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In June 2025, Wilmar Sugar & Renewables announced the start of the 2025 production season and investments in mill/renewables infrastructure (e.g., new boiler stack at Kalamia Mill), reflecting ongoing scale-up of renewable processing capacity that supports ethanol/bio-based solvent supply.

- In December 2024, GODAVARI BIOREFINERIES LTD (India) – Godavari Biorefineries announced a ₹130 crore investment in a new 200 KLPD corn/grain-based ethanol distillery, strengthening renewable ethanol feedstock that is used to produce bio-based chemicals such as bio-ethyl acetate, an important green solvent.

Report Coverage

The research report offers an in-depth analysis based on Raw Material, Solvent Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for renewable solvents will rise as industries accelerate the shift toward low-emission chemical ingredients.

- Adoption will grow in paints, coatings, and adhesives as companies replace petroleum-based formulations.

- Bio-refineries will expand capacity, improving supply stability and lowering production costs.

- Circular feedstocks such as agricultural waste will gain wider use in solvent manufacturing.

- High-purity renewable solvents will find increased demand in pharmaceuticals and electronics.

- Advances in fermentation and catalytic processes will improve performance across solvent types.

- More manufacturers will pursue carbon-neutral production pathways to meet global climate goals.

- Regulatory pressure will encourage faster substitution of traditional petrochemical solvents.

- Strategic partnerships between chemical producers and end-use industries will strengthen product innovation.

- Emerging markets in Asia-Pacific and Latin America will adopt renewable solvents more rapidly due to growing sustainability programs.