Market Overview

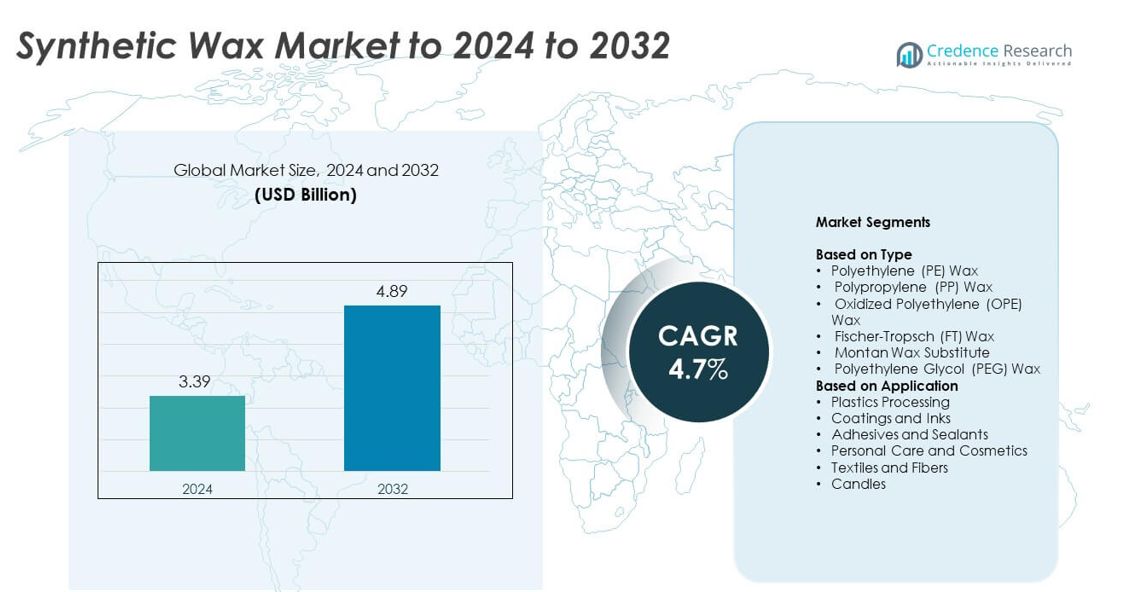

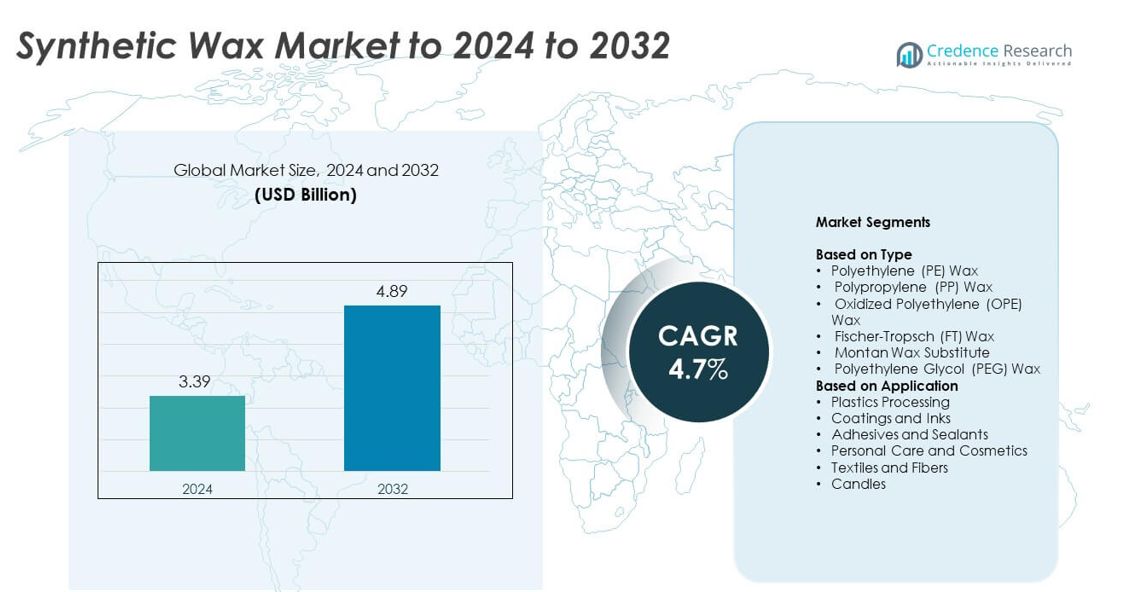

Synthetic Wax Market size was valued at USD 3.39 billion in 2024 and is anticipated to reach USD 4.89 billion by 2032, at a CAGR of 4.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Synthetic Wax Market Size 2024 |

USD 3.39 billion |

| Synthetic Wax Market, CAGR |

4.7% |

| Synthetic Wax Market Size 2032 |

USD 4.89 billion |

The Synthetic Wax Market is driven by major players including Honeywell International Inc, Mitsui Chemicals Inc, BASF SE, Evonik Industries AG, Westlake Chemical Corporation, The Lubrizol Corporation, Sasol, Dow, The International Group Inc, and Clariant AG. These companies compete by offering high-purity polyethylene, polypropylene, and Fischer-Tropsch wax grades that support plastics, coatings, inks, adhesives, and personal care applications. Asia Pacific led the market in 2024 with about 31% share due to strong industrial output and rising plastics consumption, followed by North America with nearly 33% share driven by mature manufacturing demand, while Europe accounted for roughly 28% share supported by advanced coatings and packaging industries.

Market Insights

- The Synthetic Wax Market was valued at USD 3.39 billion in 2024 and is projected to reach USD 4.89 billion by 2032, growing at a CAGR of 4.7%.

- Growth is driven by strong use in plastics processing, where the segment held about 41% share in 2024 due to rising demand for improved melt flow, lubrication, and dispersion performance.

- Trends include expanding adoption in coatings and inks as industries shift toward low-emission, high-purity wax grades that enhance gloss, surface quality, and stability in industrial formulations.

- Competition intensifies as leading players focus on high-performance Fischer-Tropsch and polyethylene wax grades, product customization, and expansion of production capacity to improve supply reliability.

- Regionally, North America held around 33% share in 2024, Europe accounted for nearly 28%, and Asia Pacific led with about 31%, supported by strong plastics output and rapid growth in packaging, adhesives, and personal care applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Polyethylene (PE) wax dominated the type segment in 2024 with about 34% share of the Synthetic Wax Market. Demand stayed strong because PE wax offers high hardness, thermal stability, and excellent lubrication, which supports large use in plastics, coatings, and masterbatches. Industries preferred this wax due to consistent performance in high-volume extrusion and injection molding. Fischer-Tropsch wax also expanded as manufacturers sought cleaner and high-purity wax grades for packaging, inks, and rubber processing.

- For instance, Sasol’s Fischer-Tropsch Wax Expansion Project in Sasolburg was expected to add about 116,000 tons of hard wax production in 2018 after Phase 2 reached beneficial operation in 2018.

By Application

Plastics processing led the application segment in 2024 with nearly 41% share of the Synthetic Wax Market. Growth came from steady consumption in PVC pipes, masterbatches, and engineering plastics, where synthetic wax improves flow, reduces friction, and enhances surface quality. Producers favored these waxes due to their controlled melt properties and superior dispersion. Coatings and inks also advanced as demand grew for gloss improvement, anti-blocking features, and smooth film formation across industrial and consumer applications.

- For instance, LyondellBasell’s Knapsack site in Germany became the world’s largest polypropylene compounding facility in 2019, with total annual capacity above 200,000 metric tons after a new line adding 25,000 metric tons per year.

Key Growth Drivers

Rising Demand in Plastics and Masterbatches

Growth accelerated as plastics and masterbatch producers used synthetic wax to improve melt flow, boost dispersion, and enhance surface finish. The material supported higher output in extrusion and injection molding, which helped meet rising consumption in packaging, automotive parts, and construction products. Manufacturers preferred synthetic wax because the product delivers stable performance at various processing temperatures. Expanding PVC pipe production and demand for lightweight materials strengthened this driver across major economies.

- For instance, ExxonMobil’s performance polyethylene plant at Mont Belvieu in Texas reached more than 2.5 million tons of annual polyethylene capacity in 2017, supplying high-performance packaging and film grades worldwide.

Expansion of Coatings, Inks, and Adhesives

The coatings and inks sector increased its use of synthetic wax due to strong need for scratch resistance, anti-blocking behavior, and gloss control. Demand grew in industrial wood coatings, printing inks, and metal packaging as producers shifted toward high-performance formulations. Adhesive makers also adopted synthetic wax to improve bond strength and reduce viscosity variations in hot-melt systems. Rising investments in construction, furniture, and flexible packaging reinforced this driver in both developed and emerging regions.

- For instance, PPG’s expansion of its Weingarten automotive coatings site in Germany added a 10,000-square-foot building designed to produce over 5,000 metric tons of waterborne basecoats per year for OEM customers.

Shift Toward High-Purity and Customizable Wax Grades

Producers invested in advanced Fischer-Tropsch and polyethylene-based grades to supply industries needing consistent purity, narrow molecular weights, and better thermal stability. Buyers in personal care, rubber processing, and technical textiles chose customized wax to meet specific performance needs. This focus increased adoption in high-value applications and supported long-term contracts with large manufacturers. The shift toward cleaner and low-emission additives encouraged further use of synthetic wax across regulated markets.

Key Trends and Opportunities

Growth of Sustainable and Low-Emission Formulations

A major trend emerged as companies moved toward low-VOC, low-odor, and eco-friendly wax solutions. Demand increased in coatings, inks, and personal care applications where buyers preferred safer and cleaner ingredients. Synthetic wax offered predictable performance while supporting sustainable product lines. Investments in bio-based synthetic wax and advanced catalytic processes opened new opportunities for suppliers targeting premium and regulatory-sensitive markets.

- For instance, BASF reported purchasing around 1 million metric tons of renewable raw materials in 2023 to use in detergents, cleaners, and cosmetic ingredients as substitutes for fossil feedstocks.

Rising Use in High-Performance Industrial Applications

Industries adopted synthetic wax to improve durability, friction control, and heat resistance in products such as automotive parts, wires, cables, and technical films. Opportunities expanded because end users sought consistent properties that natural waxes could not provide. Synthetic wax enabled better surface finish, improved lubrication, and stable processing in challenging manufacturing environments. Growth accelerated in sectors focusing on advanced materials and precision manufacturing.

- For instance, INERATEC’s power-to-liquids plant using Clariant catalysts is designed to produce up to 2,500 tons of synthetic fuels and waxes per year, making it one of the largest such operations.

Expansion in Personal Care and Cosmetic Formulations

Personal care brands used synthetic wax for thickening, structure building, and sensory enhancement in creams, balms, and color cosmetics. Demand rose as companies shifted toward stable, non-crystalline waxes that provide smooth texture and better compatibility with oils and polymers. Opportunities increased due to rising cosmetic consumption in Asia Pacific, along with strong interest in premium and long-lasting formulations supported by synthetic wax.

Key Challenges

Fluctuating Raw Material Availability and Costs

Producers faced challenges linked to changing supply and pricing of feedstocks such as ethylene, propylene, and natural gas. Volatility affected production planning and long-term contracts, especially for polyethylene and polypropylene wax makers. Manufacturers needed strategic sourcing and flexible pricing models to manage unpredictable cost cycles. These fluctuations sometimes reduced margins and delayed expansion plans for smaller suppliers.

Competition from Natural and Bio-Based Alternatives

The market faced stronger competition from natural waxes such as carnauba, beeswax, and emerging bio-based options promoted by sustainability-focused industries. Some buyers shifted to plant-derived waxes to meet eco-label requirements, which created pressure on synthetic wax in select applications. Producers had to innovate through cleaner processes, specialty grades, and enhanced performance to maintain market share. This challenge pushed suppliers to differentiate more clearly on quality and functionality.

Regional Analysis

North America

North America held about 33% share of the Synthetic Wax Market in 2024. Demand grew as plastics, coatings, adhesives, and packaging manufacturers increased their use of high-performance waxes to improve processing stability and product quality. The region benefited from strong PVC pipe production, rising demand for masterbatches, and steady growth in printing inks. Expansion in personal care and cosmetic formulations also supported consumption. Well-developed manufacturing infrastructure and strict quality standards drove the adoption of high-purity wax grades across the United States and Canada.

Europe

Europe accounted for nearly 28% share of the Synthetic Wax Market in 2024. Growth was supported by strong activity in packaging, automotive components, engineered plastics, and industrial coatings. Regulatory pressure to reduce emissions increased the use of synthetic wax in low-VOC formulations, especially in Germany, France, and the United Kingdom. Demand for Fischer-Tropsch and polyethylene wax rose due to their consistent performance and clean-burning properties. The region also saw steady adoption in adhesives, wood coatings, and technical textiles as manufacturers shifted toward more stable and high-purity additives.

Asia Pacific

Asia Pacific led with about 31% share of the Synthetic Wax Market in 2024. Strong consumption in China, India, Japan, and Southeast Asia came from expansion in plastics processing, packaging, textiles, and printing inks. Rapid industrial growth and rising production of PVC pipes, masterbatches, and molded components sharply increased demand. Synthetic wax adoption grew as manufacturers sought better lubrication, improved surface finish, and stable melt behavior for high-volume operations. The region’s fast-growing cosmetics and personal care industries further supported usage, driven by rising disposable income and premium product demand.

Latin America

Latin America captured nearly 5% share of the Synthetic Wax Market in 2024. Growth remained steady due to expanding plastics, construction, packaging, and automotive sectors in Brazil, Mexico, and Argentina. Demand for synthetic wax increased as industries adopted higher-quality additives to enhance melt flow and product durability. The region also saw rising interest in coatings, adhesives, and printing inks as manufacturing output improved. Local producers focused on cost-effective solutions, but reliance on imports for specialty wax grades influenced overall market performance across key industries.

Middle East and Africa

Middle East and Africa held around 3% share of the Synthetic Wax Market in 2024. Consumption rose gradually as industrial development expanded in construction materials, packaging, textiles, and plastics processing. Gulf countries increased use of synthetic wax in coatings and polymer applications linked to infrastructure and manufacturing projects. Africa experienced demand from adhesives, candles, and low-cost plastics production. Limited regional production of specialty wax led to higher import dependence, but long-term opportunities grew with rising investments in industrial processing and downstream petrochemical capacity.

Market Segmentations:

By Type

- Polyethylene (PE) Wax

- Polypropylene (PP) Wax

- Oxidized Polyethylene (OPE) Wax

- Fischer-Tropsch (FT) Wax

- Montan Wax Substitute

- Polyethylene Glycol (PEG) Wax

By Application

- Plastics Processing

- Coatings and Inks

- Adhesives and Sealants

- Personal Care and Cosmetics

- Textiles and Fibers

- Candles

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Synthetic Wax Market is shaped by leading companies such as Honeywell International Inc, Mitsui Chemicals Inc, BASF SE, Evonik Industries AG, Westlake Chemical Corporation, The Lubrizol Corporation, Sasol, Dow, The International Group Inc, and Clariant AG. Competition focuses on advancing high-purity wax grades, improving process efficiency, and meeting performance needs in plastics, coatings, adhesives, and personal care applications. Producers invest in R&D to develop cleaner, low-emission formulations that support regulatory compliance and premium product lines. Many companies expand production capacity to serve fast-growing regions and strengthen supply reliability. Strategic partnerships and technology upgrades help suppliers deliver consistent melt properties, better lubrication, and enhanced surface quality across applications. Competitors also emphasize product customization to secure long-term contracts with converters and formulators seeking tailored wax solutions. Market rivalry continues to intensify as manufacturers push toward high-performance, sustainable, and application-specific synthetic wax grades.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Clariant AG launched Ceridust™ 1310, a micronized rice bran wax compound aimed at providing a reliable, bio-based alternative to carnauba wax.

- In February 2025, Sasol Chemicals launched two new micronized wax products: SASOLWAX LC Spray 30 G and LC Spray 30 G-EF.

- In 2025, Evonik Industries AG announced the strategic merger of its Silica and Silanes business lines into a new entity called Smart Effects.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as plastics and masterbatch production increases across major regions.

- Demand for high-purity Fischer-Tropsch wax will rise due to cleaner processing needs.

- Growth in coatings and inks will support wider adoption of synthetic wax for surface enhancement.

- Personal care companies will use more synthetic wax to improve texture and stability in formulations.

- Adhesives and sealants will adopt advanced wax grades to enhance bonding efficiency and melt control.

- Bio-based and low-emission wax options will gain traction in sustainability-focused industries.

- Manufacturers will invest in customized wax grades tailored for specific industrial applications.

- Asia Pacific will strengthen its lead as industrial output and packaging demand continue to rise.

- Automation in plastics processing will increase reliance on waxes that offer consistent melt behavior.

- Competition from natural waxes will encourage innovation in performance-driven synthetic wax solutions.