Market Overview:

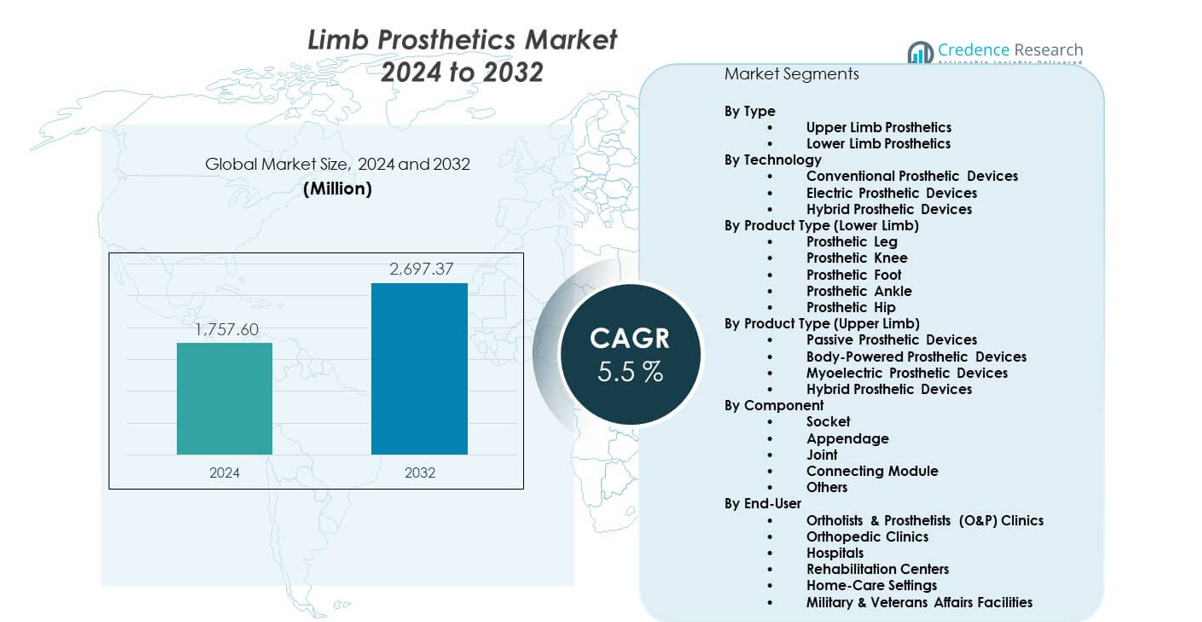

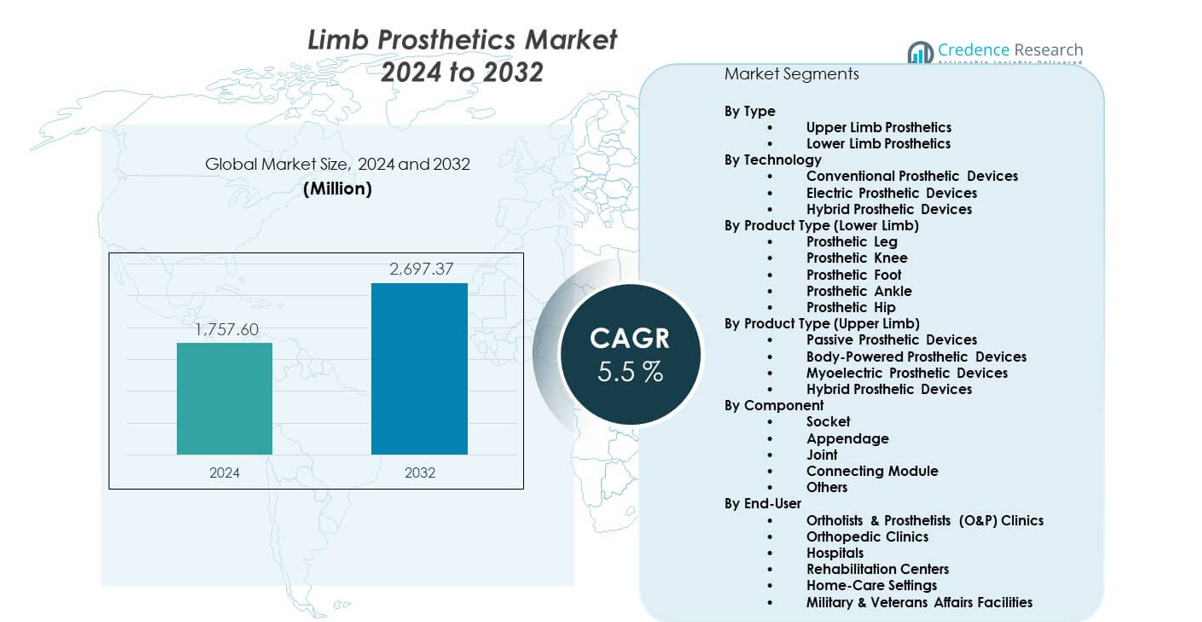

The Limb Prosthetics Market is projected to grow from USD 1,757.6 million in 2024 to an estimated USD 2,697.37 million by 2032, reflecting a CAGR of 5.5% during 2024–2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Limb Prosthetics Market Size 2024 |

USD 1,757.6 million |

| Limb Prosthetics Market, CAGR |

5.5% |

| Limb Prosthetics Market Size 2032 |

USD 2,697.37 million |

Growing demand comes from rising amputation numbers linked to accidents, vascular diseases, and diabetes. Manufacturers adopt active suspension systems, lightweight materials, and microprocessor-controlled joints to improve movement precision. Strong patient preference for comfort and natural gait drives innovation across product lines. Rehabilitation centers expand training programs to help users adapt faster to new devices. Higher awareness of quality-of-life improvements encourages early adoption. Research groups enhance neural-controlled systems for better mobility outcomes. These shifts strengthen market momentum.

North America leads due to advanced prosthetic engineering, strong reimbursement systems, and early adoption of digital and robotic components. Europe follows with steady investments in personalized mobility solutions and high clinical standards driving uptake. Asia Pacific emerges as the fastest-growing region due to expanding healthcare access, rising injury cases, and wider acceptance of modern assistive devices. Countries in the Middle East and Latin America show growing potential as national healthcare programs improve rehabilitation services and promote patient mobility.

Market Insights:

- The Limb Prosthetics Market was valued at USD 1,757.6 million in 2024 and is projected to reach USD 2,697.37 million by 2032, expanding at a 5.5% CAGR due to rising amputations, advanced prosthetic adoption, and stronger rehabilitation networks.

- North America (45.75%), Europe (30%), and Asia-Pacific (20) hold the highest shares, driven by strong clinical infrastructure, established prosthetist networks, and steady investment in high-performance prosthetic systems.

- Asia-Pacific, with 20 share, stands as the fastest-growing region due to expanding healthcare access, rising trauma and diabetes-linked amputations, and increasing production of cost-effective prosthetic components.

- Lower limb prosthetics dominate with the largest segment share, supported by higher incidence of mobility-related amputations and greater clinical dependency on leg, knee, and foot devices.

- Electric and hybrid prosthetic technologies capture a growing share within the technology mix, driven by demand for microprocessor-controlled joints, adaptive movement systems, and improved functional outcomes.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Focus on Functional Mobility Advancement

The Limb Prosthetics Market benefits from rising demand for devices that support natural gait and long-term comfort. Clinics promote advanced training programs to help patients adapt to new systems faster. Manufacturers design lighter frames to support wider daily use. Microprocessor-controlled joints enhance stability for active users. Patient awareness pushes stronger interest in long-lasting prosthetic solutions. Hospitals expand rehabilitation units to support structured recovery. Research teams develop smarter controls that improve movement precision. Healthcare networks strengthen access to modern prosthetic support.

- For instance, Össur’s RHEO KNEE uses magnetorheologic sensors performing over 1,000 micro-adjustments per second. Healthcare networks strengthen access to modern prosthetic support.

Rapid Adoption of Smart and Responsive Prosthetic Systems

Users seek devices that deliver real-time motion adjustments for smoother walking patterns. It gains momentum through stronger uptake of sensors that improve step alignment. Smart sockets improve load distribution to reduce discomfort. Engineers work on adaptive technologies that respond to muscle signals. Clinics recommend digitally tuned limbs for patients with higher activity needs. Wearable data tools help assess performance for better customization. Medical teams rely on advanced testing methods to match devices with user goals. Growing innovation encourages more clinics to upgrade prosthetic inventories.

- For instance, Hanger Clinic’s Patient Data Portal tracks gait symmetry and alignment through quantified mobility data. Medical teams rely on advanced testing methods to match devices with user goals. Growing innovation encourages more clinics to upgrade prosthetic inventories.

Rising Rehabilitation Investments Across Public and Private Ecosystems

Healthcare systems increase spending to modernize mobility centers across major cities. Hospitals expand prosthetic workshops to shorten fitting cycles. It benefits from rising awareness of early intervention programs. Rehabilitation teams provide structured guidance to reduce long-term dependency risks. New training devices support controlled motion for better balance. Governments promote initiatives that enhance patient access to skilled therapists. Partnerships between hospitals and manufacturers support wider trials. Strong institutional focus improves mobility outcomes for diverse patient groups.

Increasing Demand From Trauma, Injury, and Vascular-Related Amputations

Accident-related injuries continue to lift long-term prosthetic requirements. Surgeons report higher adoption of advanced limbs for younger patients with active lifestyles. It gains traction through better alignment techniques that shorten recovery time. Diabetes-linked amputations increase demand for stable lower-limb devices. Clinics focus on precision fitting to reduce secondary complications. Research centers create advanced sockets that improve skin compatibility. Patients embrace modular systems that support activity transitions. Broader lifestyle changes reinforce sustained needs across regions.

Market Trends:

Growth of Myoelectric and Neural Interface Prosthetic Solutions

The Limb Prosthetics Market sees rising interest in limbs controlled through muscle and nerve signals. Myoelectric hands offer greater precision for object handling. Neural interface prototypes show promise for more natural responses. Users gain better grip control through improved sensor accuracy. Clinics adopt training tools designed for advanced signal interpretation. Engineers refine algorithms that support smoother response times. Rehabilitation centers integrate new devices into practice modules. Interest rises among younger patients seeking high-performance solutions.

- For instance, Integrum’s OPRA Implant System supports neuromuscular signal transfer enabling direct prosthetic control in clinical trials. Users gain better grip control through improved sensor accuracy. Clinics adopt training tools designed for advanced signal interpretation.

Expansion of 3D Printing in Custom Prosthetic Manufacturing

Three-dimensional printing supports faster production of user-specific devices. It helps reduce manufacturing waste through optimized material use. Clinics gain flexibility through rapid prototyping for unique limb shapes. Engineers design lighter frames that support long-term comfort. Users appreciate better airflow and improved fit from printed sockets. Hospitals offer same-week adjustments using local printing labs. Designers test new materials to raise structural strength. This trend increases adoption in emerging markets seeking cost-efficient customization.

Shift Toward Hybrid Prosthetic Designs for Multi-Activity Use

Patients seek limbs that support walking, climbing, and daily tasks in one system. It drives interest in hybrid models offering flexible movement options. Designers blend mechanical strength with electronic precision. Clinics guide patients toward limbs compatible with active routines. Materials with higher durability support rugged use cases. Users choose modular attachments that support sports and work needs. Rehabilitation teams test hybrid devices in controlled environments. Growing preference for multi-use designs reshapes product portfolios.

Rising Integration of Digital Platforms for Remote Monitoring

Remote platforms help clinicians track prosthetic performance in real time. The Limb Prosthetics Market benefits from more accurate data on user mobility. Apps support quicker issue detection for socket pressure or gait imbalance. Users report improved confidence due to continuous support systems. Engineers refine sensors that send stable data streams. Clinics adopt dashboards that guide performance-based modifications. Rehabilitation teams access detailed movement logs for better planning. This trend strengthens long-term device engagement.

Market Challenges Analysis:

High Cost of Advanced Prosthetic Systems and Limited Reimbursement Support

The Limb Prosthetics Market faces pressure from high device prices across advanced categories. Many patients struggle to afford microprocessor-controlled components. It reflects gaps between device cost and available reimbursement programs. Clinics report long approval cycles that delay access to care. Manufacturers face challenges balancing innovation and affordability. Rural regions show reduced adoption due to low insurance coverage. Hospitals see rising budget strain while upgrading prosthetic labs. These factors limit broad penetration across developing regions.

Technical Complexity, Training Barriers, and Device Compatibility Issues

Modern prosthetic systems require skilled clinicians for precise fitting and maintenance. Many regions lack trained specialists in advanced prosthetic alignment. It complicates adoption for patients needing high-performance devices. Users face long learning curves before achieving stable mobility. Compatibility issues arise when pairing older sockets with new components. Clinics report difficulty integrating digital systems into legacy workflows. Rehabilitation delays reduce user confidence in long-term device use. These barriers slow market maturity across several countries.

Market Opportunities:

Expansion of Personalized and AI-Driven Prosthetic Solutions

The Limb Prosthetics Market gains strong opportunities through rapid adoption of AI-enhanced designs. Smart systems support real-time movement prediction for smoother walking. It enables precise adjustments that improve user confidence. Clinics adopt personalized digital models for faster fitting cycles. Engineers explore materials that improve durability. Hospitals invest in advanced gait-analysis tools. Growth rises in regions promoting digital health programs. Wider AI use supports better patient outcomes.

Rising Potential in Emerging Markets and Community Rehabilitation Programs

Emerging regions invest in broader mobility access through public healthcare upgrades. It creates new demand for cost-effective prosthetic models. Clinics expand outreach programs for rural patients. Training centers support community-driven rehabilitation. Manufacturers launch durable designs suited for varied climates. Governments promote disability inclusion programs. Local production units cut delivery delays. These factors open strong growth pathways for long-term adoption.

Market Segmentation Analysis:

By Type

The Limb Prosthetics Market is led by lower limb prosthetics due to higher incidence of mobility-related amputations and wider clinical adoption across trauma and vascular cases. Upper limb prosthetics show steady growth as myoelectric and hybrid devices gain stronger acceptance among active users seeking improved dexterity and control.

- For instance, the Psyonic Ability Hand offers multi-grip modes and touch sensors with a closing speed of 200 milliseconds.

By Technology

Conventional prosthetic devices maintain strong use in cost-sensitive regions, while electric prosthetic devices deliver higher precision for advanced mobility needs. Hybrid prosthetic devices gain attention for combining strength and responsiveness, supporting broader adoption across diverse patient groups.

- For instance, the College Park Odyssey K3 prosthetic foot blends a dynamic carbon fiber mechanical spring with a patented hydraulic ankle to support smooth rollover mechanics and promote a natural gait across varied terrain.

By Product Type – Lower Limb

Prosthetic legs, knees, and feet remain the most prescribed solutions due to their role in core mobility support. Prosthetic ankles and hips expand gradually with demand tied to better gait efficiency and comfort for high-activity users.

By Product Type – Upper Limb

Passive prosthetic devices remain preferred for basic functional needs, while body-powered systems support reliable movement for daily tasks. Myoelectric prosthetic devices gain momentum due to improved grip control. Hybrid designs attract users seeking natural motion with reduced fatigue.

By Component

Sockets hold a dominant role due to their impact on fit and comfort. Appendages, joints, and connecting modules support functional performance, while other components address customization needs for varied clinical profiles.

By End-User

Orthotists & Prosthetists clinics lead adoption through specialized fitting expertise. Orthopedic clinics and hospitals support surgical-linked demand, while rehabilitation centers help improve long-term outcomes. Home-care settings and military facilities expand usage to support ongoing recovery and active-duty needs.

Segmentation:

By Type

- Upper Limb Prosthetics

- Lower Limb Prosthetics

By Technology

- Conventional Prosthetic Devices

- Electric Prosthetic Devices

- Hybrid Prosthetic Devices

By Product Type (Lower Limb)

- Prosthetic Leg

- Prosthetic Knee

- Prosthetic Foot

- Prosthetic Ankle

- Prosthetic Hip

By Product Type (Upper Limb)

- Passive Prosthetic Devices

- Body-Powered Prosthetic Devices

- Myoelectric Prosthetic Devices

- Hybrid Prosthetic Devices

By Component

- Socket

- Appendage

- Joint

- Connecting Module

- Others

By End-User

- Orthotists & Prosthetists (O&P) Clinics

- Orthopedic Clinics

- Hospitals

- Rehabilitation Centers

- Home-Care Settings

- Military & Veterans Affairs Facilities

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The Limb Prosthetics Market in North America holds the largest share at 45.75%, driven by strong clinical infrastructure and high adoption of advanced prosthetic technologies. It gains support from mature reimbursement systems that improve patient access to premium devices. Research groups develop next-generation solutions that strengthen regional leadership. Clinics adopt myoelectric and hybrid systems to enhance mobility outcomes. High awareness of rehabilitation standards increases long-term device use. Veterans programs create steady demand across upper and lower limb categories. Strong collaboration between manufacturers and healthcare networks sustains leadership.

Europe

Europe secures the second-largest share at roughly 28–30%, supported by established orthopedic centers and strong preference for high-performance prosthetics. It benefits from structured rehabilitation frameworks that promote early device integration. Countries such as Germany, the U.K., and France lead demand due to wider access to specialized prosthetists. Rising focus on personalized sockets and lightweight materials drives continuous upgrades. Public health programs promote mobility solutions for aging populations, improving uptake across multiple device categories. Growing investment in robotic and neural-linked limbs expands adoption. Steady innovation across regional players strengthens competitive positioning.

Asia-Pacific, Latin America, and Middle East & Africa

Asia-Pacific represents the fastest-growing region with an estimated 20–22% share supported by expanding healthcare access and a rising base of trauma and diabetes-linked amputations. It shows strong adoption in China, India, Japan, and South Korea due to rapid improvements in prosthetic training and manufacturing capacity. Latin America holds 8–10% share with demand influenced by growing rehabilitation investments in Brazil and Mexico. Middle East & Africa accounts for 5–7% share driven by rising amputee care programs and gradual clinical modernization. These regions benefit from increasing awareness of advanced prosthetic solutions. It gains momentum as governments invest in mobility-focused health programs. Steady expansion of local production units supports long-term growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Ottobock SE & Co. KGaA (Germany)

- Össur hf (Iceland)

- Fillauer LLC (U.S.)

- Hanger, Inc. (U.S.)

- Blatchford Group / Blatchford Limited (U.K.)

- WillowWood Global LLC (U.S.)

- Enovis (U.S.)

- College Park Industries (U.S.)

- Endolite (U.S.)

- Touch Bionics Inc. (subsidiary of Össur)

- Steeper Group / Steeper Inc. (U.K.)

- TRS Inc. (U.S.)

- Naked Prosthetics (U.S.)

- DePuy Synthes (U.S.)

- PROTEOR Group

- Stryker Corporation

- Zimmer Biomet Holdings Inc.

- Mobius Bionics LLC (DJO company)

Competitive Analysis:

The Limb Prosthetics Market features strong competition driven by innovation in myoelectric systems, lightweight materials, and personalized socket design. Global leaders expand portfolios to strengthen performance, comfort, and durability across upper and lower limb devices. It gains momentum through heavy investment in neural-linked technologies and hybrid systems. Companies focus on improving grip accuracy, stability, and joint responsiveness to raise patient mobility. Established brands acquire specialized firms to access new patents and design capabilities. Emerging players introduce 3D-printed and AI-integrated components to compete with premium offerings. Partnerships with rehabilitation centers support rapid clinical adoption. Strong research pipelines shape market rivalry across all device categories.

Recent Developments:

- In June 2025, Ottobock launched the new Speedhand Solution, a breakthrough prosthetic hand featuring innovative technology including a newly developed speedhand joint that enables natural wrist flex movement. This next-generation solution incorporates myosmart control system that allows users to precisely define hand response through residual muscle activity detection. The speedhand also features the myosmart cuff app, enabling users to independently adjust settings such as response speed directly from Apple or Android devices. The device operates more quietly than ever thanks to reduced motor noise, and the thumb automatically moves into a relaxed position when not in use. Additionally, in the first half of 2025, Ottobock completed seven strategic acquisitions and made significant investments in start-ups including Phantom Neuro, BionicSkins, and Musclemetrix LLC to advance human-machine interfaces for neural control of prostheses. The company also launched the next generation of the Exopulse Suit and the active exoskeleton Volton during H1 2025. In March 2025, Ottobock expanded its product portfolio for children with the introduction of movido junior prosthetic knee joints and a new prosthetic foot designed for pediatric patients, enabling children with prostheses to lead more active and independent lives.

- In July 2024, Hanger Inc. announced the acquisition of O&P Insight, an established leader in orthotic and prosthetic consulting, with the transaction expected to close in Q3 2024. This move enhanced Hanger’s service and innovation footprint in the prosthetics market. In October 2025, Hanger Clinic deepened its digital transformation by implementing the Hyperscience Hypercell platform across its more than 925 patient-care locations to automate clinical and administrative data processing and reduce manual paperwork. Additionally, in 2024 Hanger launched Hanger Ventures, a wholly owned subsidiary focused on accelerating innovation in orthotics and prosthetics, providing resources to entrepreneurs and small businesses developing new O&P technologies.

- In January 2024, Össur acquired Fior & Gentz, a German company specializing in knee and ankle orthotic joints for patients with neurological conditions, for an enterprise value of EUR 100 million plus conditional earnout payments of EUR 10-20 million. This acquisition marked Össur’s strategic entry into the fast-growing neuro orthotics market, with Fior & Gentz’s key markets estimated to be growing at 10-12 percent annually. The company continues to expand its prosthetics portfolio with its Power Knee microprocessor prosthetic knee system featuring motor-powered smart capabilities with advanced algorithms that detect human movement patterns in real-time.

Report Coverage:

The research report offers an in-depth analysis based on Type, Technology, Lower Limb Product Type, Upper Limb Product Type, Component, End-User, and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market. [replace all segments in report coverage].

Future Outlook:

- Demand for advanced lower limb prosthetics will rise due to wider adoption of active mobility systems.

- Myoelectric and neural interface technologies will gain strong traction among upper limb users.

- AI-based gait analysis tools will improve device personalization across clinical settings.

- Lightweight composites and 3D-printed components will expand use in cost-sensitive markets.

- Rehabilitation centers will integrate digital training modules to enhance patient outcomes.

- Hybrid prosthetic designs will gain popularity for multi-activity and high-performance needs.

- Military and veterans programs will strengthen procurement of durable, high-precision devices.

- Emerging markets will invest in localized production to shorten fitting and delivery cycles.

- Home-care users will adopt modular devices that support practical daily movement.

- Industry partnerships will accelerate innovation across sockets, joints, and adaptive control systems.