Market Overview:

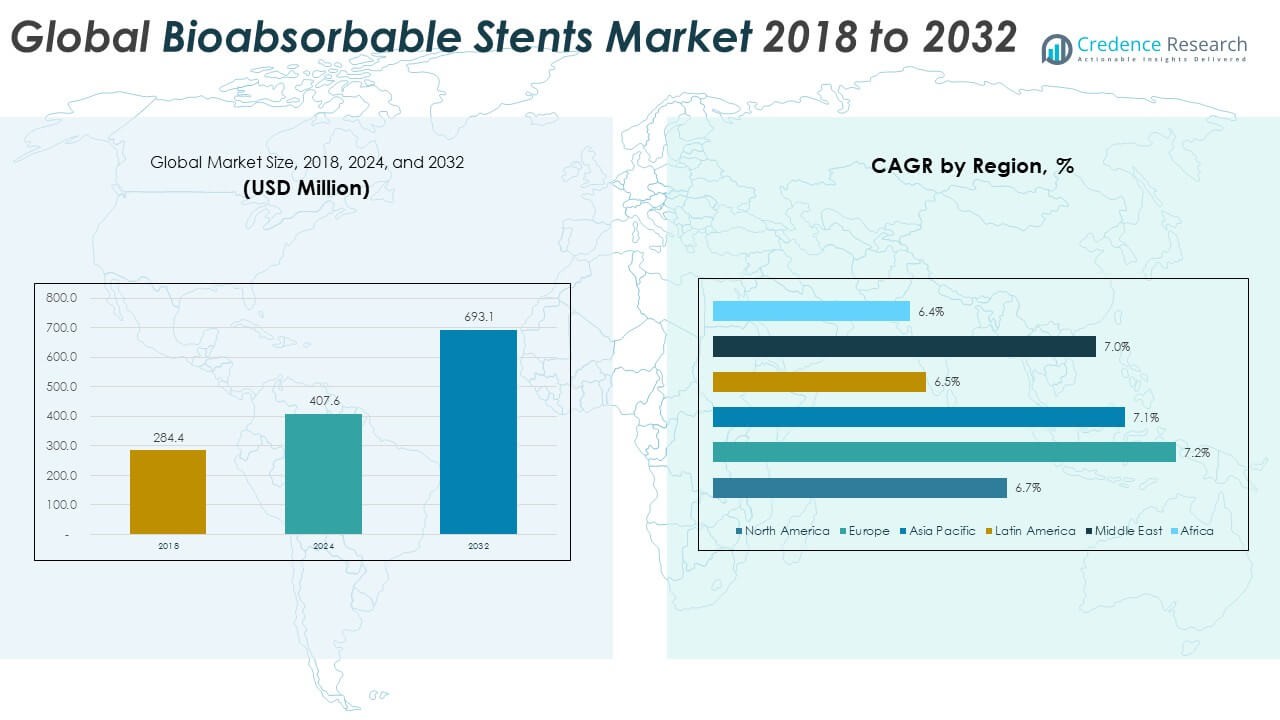

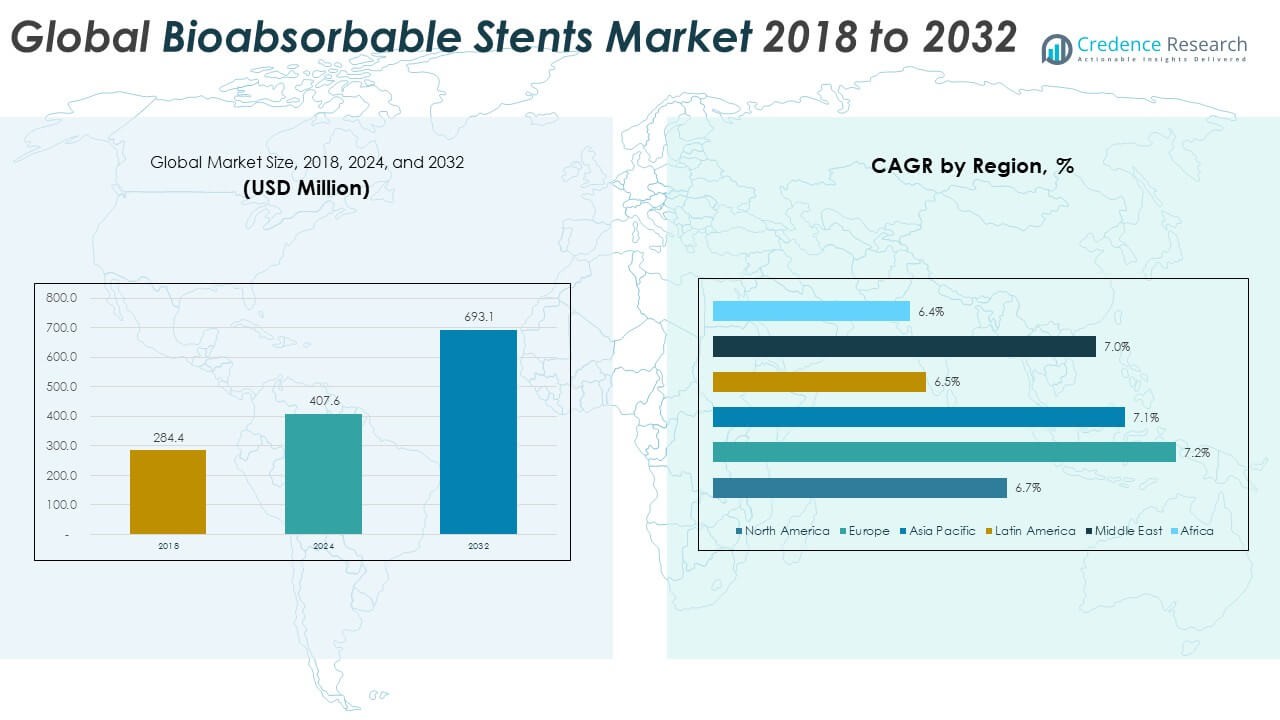

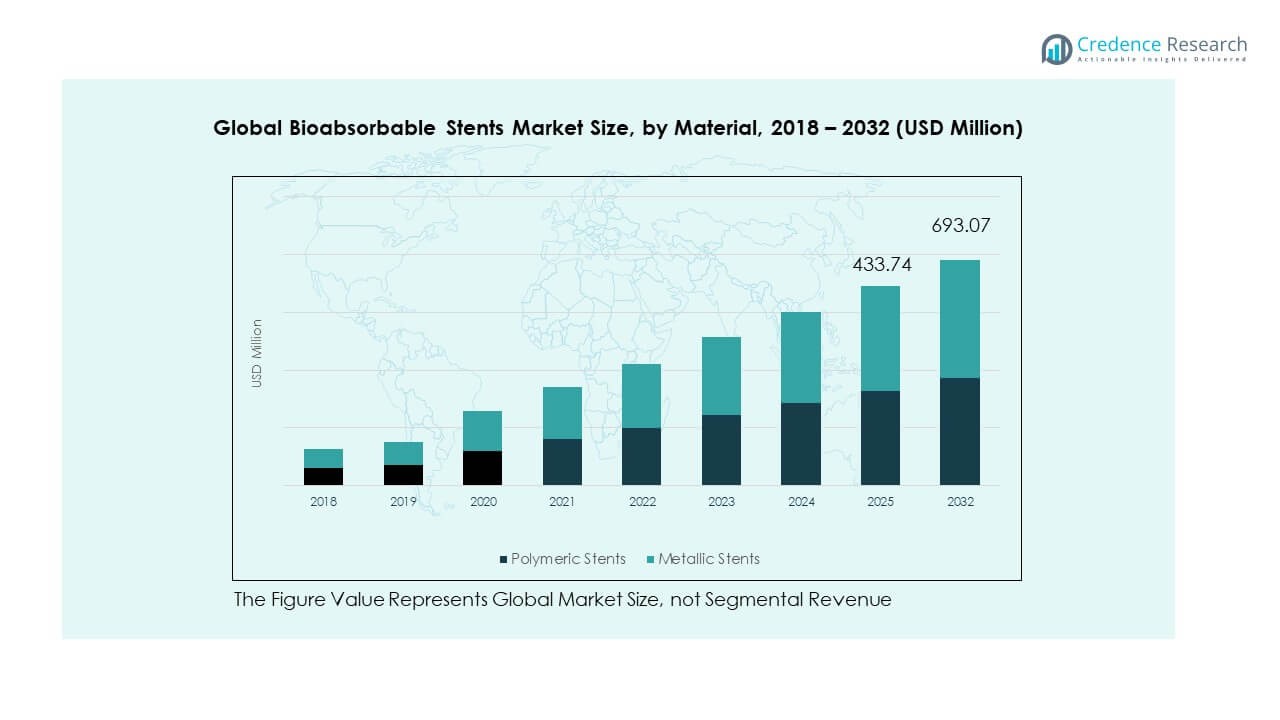

The Global Bioabsorbable Stents Market size was valued at USD 284.4 million in 2018 to USD 407.6 million in 2024 and is anticipated to reach USD 693.1 million by 2032, at a CAGR of 6.92% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Bioabsorbable Stents Market Size 2024 |

USD 407.6 Million |

| Bioabsorbable Stents Market, CAGR |

6.92% |

| Bioabsorbable Stents Market Size 2032 |

USD 693.1 Million |

The market is driven by the rising prevalence of cardiovascular diseases and the increasing demand for minimally invasive treatments. Bioabsorbable stents offer significant benefits, such as reduced long-term complications, improved vascular healing, and elimination of the need for permanent implants. Growing technological advancements in polymer materials and bioresorbable metal alloys are enhancing product performance and adoption among healthcare providers.

North America dominates the global market due to advanced healthcare infrastructure, high awareness levels, and strong R&D activities in cardiovascular interventions. Europe follows closely, supported by favorable reimbursement policies and increased clinical trials. The Asia-Pacific region is emerging rapidly, driven by expanding healthcare access, rising cardiac cases, and growing adoption of advanced medical technologies in countries like China, Japan, and India.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Bioabsorbable Stents Market was valued at USD 284.4 million in 2018, reaching USD 407.6 million in 2024, and is expected to hit USD 693.1 million by 2032, growing at a CAGR of 6.92%.

- North America holds the largest regional share at 32%, supported by advanced healthcare systems, strong R&D infrastructure, and early adoption of innovative cardiovascular technologies. Europe follows with 26% due to favorable reimbursement and regulatory policies, while Asia Pacific captures 27% backed by expanding healthcare access and rising cardiac disease prevalence.

- Asia Pacific remains the fastest-growing region with a 7.1% CAGR, driven by increasing medical tourism, local manufacturing initiatives, and government investments in cardiac care infrastructure.

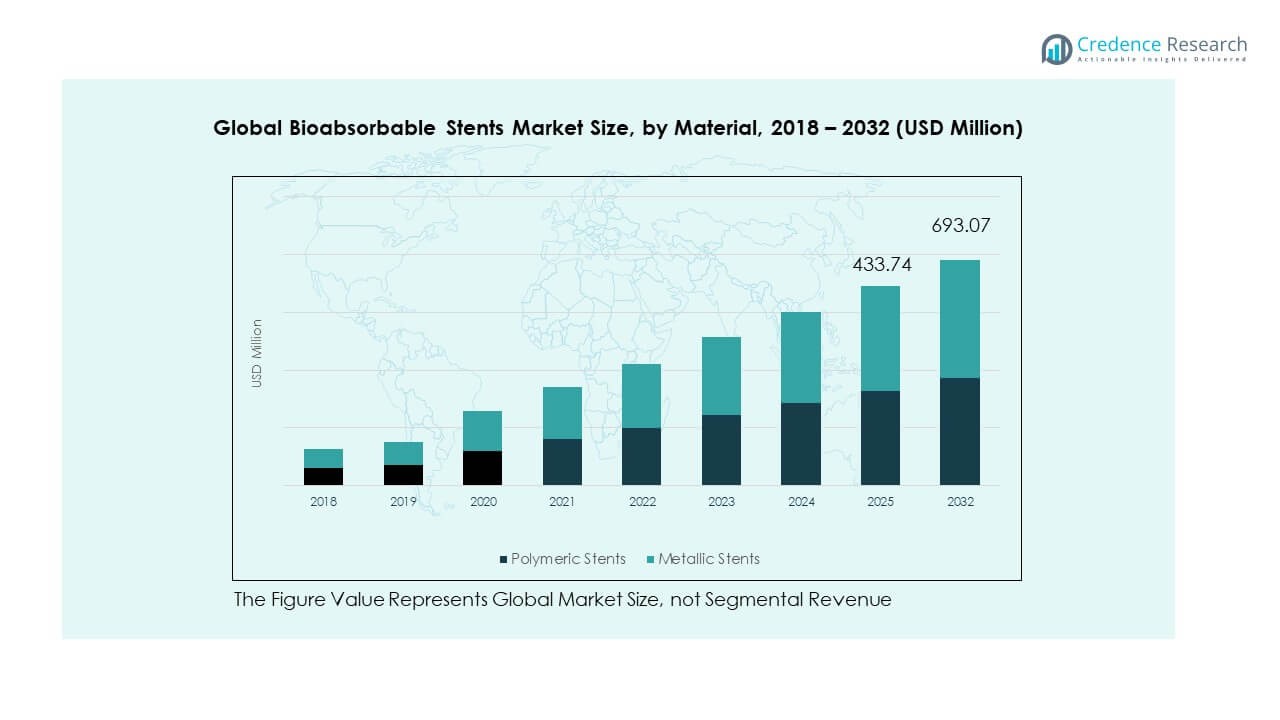

- Polymeric stents dominate the segment with approximately 63% share due to their superior biocompatibility, flexibility, and controlled degradation properties, making them preferred in coronary procedures.

- Metallic stents account for around 37% share, supported by growing adoption of magnesium-based designs offering enhanced strength and predictable bioresorption performance.

Market Drivers:

Rising Prevalence of Cardiovascular Diseases and Increasing Need for Minimally Invasive Interventions

The growing incidence of coronary artery disease and other cardiac disorders has increased the adoption of bioabsorbable stents worldwide. The Global Bioabsorbable Stents Market is gaining traction as patients and physicians seek alternatives to permanent metallic stents. The demand is driven by the ability of these stents to dissolve naturally after restoring normal blood flow, reducing the risk of long-term complications. It benefits patients by minimizing restenosis, thrombosis, and chronic inflammation. Hospitals and cardiac centers are increasingly adopting bioabsorbable stents for patients requiring flexible, temporary support. Rising healthcare expenditure and awareness about next-generation cardiovascular treatments are fueling the trend. The market is also supported by advancements in interventional cardiology techniques that enhance stent placement accuracy. These factors collectively contribute to consistent global market growth.

- For instance, the Absorb GT1 bioresorbable scaffold by Abbott, in a Japan PMS study with 135 patients (139 lesions), demonstrated an impressive 0% definite/probable scaffold thrombosis rate and a cumulative target lesion failure of just 5.1% over 5 years when intracoronary imaging-guided implantation protocols were closely followed.

Technological Advancements in Polymer Science and Bioabsorbable Metal Alloys

Continuous innovation in polymer chemistry and biodegradable metals has improved the safety and performance of bioabsorbable stents. It has led to the development of devices with controlled degradation rates, enhanced radial strength, and better biocompatibility. Research in magnesium and iron-based alloys has expanded the design options for next-generation products. The Global Bioabsorbable Stents Market benefits from collaborations between research institutions and medical device manufacturers focusing on material optimization. Advanced manufacturing technologies such as 3D printing and nanocoating are further enhancing structural precision. These developments reduce inflammatory responses and promote faster endothelial healing. Companies are also working to refine polymer formulations for predictable absorption timelines. This technological evolution is strengthening the adoption rate among clinicians worldwide.

- For instance, the Magmaris magnesium-based scaffold by Biotronik showed a 12-month target lesion failure (TLF) rate of 4.3% in the initial cohort of the BIOSOLVE-IV registry, which included 1,075 patients. In this group, the cardiac death rate was 0.2%, and there were five definite/probable scaffold thrombosis events, representing a rate of 0.5%. Four of these thrombosis events occurred after patients prematurely stopped their dual antiplatelet therapy (DAPT), highlighting the need for strict medication adherence. This study confirms the scaffold’s good safety and performance in a large, low-risk patient population.

Supportive Regulatory Approvals and Rising Clinical Evidence of Safety and Efficacy

Global regulatory agencies are increasingly approving bioabsorbable stents backed by robust clinical trial data. The Global Bioabsorbable Stents Market is expanding as companies gain FDA and CE Mark certifications for advanced devices. Regulatory confidence is growing due to improved patient outcomes and reduced post-surgical complications. It has encouraged hospitals to integrate bioabsorbable stents into mainstream cardiovascular care. Clinical studies continue to demonstrate lower restenosis rates compared to conventional stents. Positive long-term results are influencing reimbursement decisions across key healthcare markets. Government health programs are supporting the inclusion of such stents under insurance coverage. This favorable environment is driving wider patient access and adoption in both developed and emerging regions.

Rising Healthcare Investments and Expansion of Interventional Cardiology Infrastructure

Increasing investments in cardiac care infrastructure are boosting adoption of bioabsorbable stents globally. The Global Bioabsorbable Stents Market benefits from hospital expansions, better catheterization laboratories, and growing physician training initiatives. Developing economies are improving healthcare accessibility, supporting early diagnosis and intervention in cardiac diseases. It is also driven by rising private and public funding in medical technology innovation. Strategic partnerships between global and regional healthcare providers are improving product penetration. Governments are emphasizing cardiovascular disease management through advanced therapies. The trend toward value-based healthcare is promoting the use of safer and long-term cost-effective treatments. These combined factors are reinforcing demand across hospitals, specialty clinics, and research institutes.

Market Trends:

Shift Toward Next-Generation Fully Degradable Scaffolds with Enhanced Structural Integrity

Manufacturers are focusing on designing fully bioresorbable scaffolds with improved mechanical properties. The Global Bioabsorbable Stents Market is witnessing a transition from first-generation polymers to advanced composites that offer longer vessel support. These innovations aim to maintain lumen integrity while ensuring timely absorption after healing. It is encouraging product differentiation and greater clinical confidence. Companies are introducing stents with thinner struts and improved radial strength to minimize complications. This shift also reduces patient recovery time and improves vascular remodeling. Researchers are emphasizing uniform degradation patterns for better safety profiles. Such advancements are shaping the future of cardiovascular stenting solutions.

- For instance, clinical reports of the Elixir Medical DESolve Nx bioresorbable scaffold demonstrated a late lumen loss of 0.19 mm and 0% binary restenosis at 6 months in early multicenter trials, illustrating enhanced vessel support and positive remodeling.

Growing Integration of Imaging and Computational Modeling in Stent Development

Emerging trends highlight the integration of advanced imaging and computational tools to design and evaluate stent behavior. The Global Bioabsorbable Stents Market is leveraging simulation-based modeling for predicting mechanical and biological interactions. These tools enable precise customization of stent geometry and material properties. It supports better clinical outcomes through improved performance predictability. Imaging-guided deployment using intravascular ultrasound and optical coherence tomography enhances placement accuracy. Manufacturers are using AI-based analytics to optimize product prototypes. This approach reduces time-to-market and development costs for next-generation products. The combination of imaging and modeling is transforming design validation in the cardiovascular field.

- For instance, while a specific post-market surveillance study in Japan did use Optical Coherence Tomography (OCT) on over 91% of lesions treated with the Absorb GT1 scaffold and was associated with a low rate of scaffold thrombosis within that controlled setting, the manufacturer voluntarily withdrew the product globally in 2017 following data from larger trials showing higher rates of major adverse cardiac events and scaffold thrombosis compared to metallic stents.

Increasing Focus on Personalized Medicine and Patient-Specific Treatment Approaches

Personalized cardiology solutions are gaining attention among healthcare providers worldwide. The Global Bioabsorbable Stents Market is adapting to this trend by offering tailored solutions based on patient anatomy and disease complexity. It allows physicians to choose stents optimized for vessel size, lesion type, and healing rate. Advanced diagnostic systems support individualized treatment planning. Companies are developing adjustable degradation timelines to match biological healing responses. Hospitals are adopting precision-based interventional procedures for better recovery outcomes. The movement toward patient-centered care is promoting clinical confidence in bioabsorbable devices. These developments underline a shift toward precision healthcare in cardiac treatment.

Rise in Strategic Collaborations Between Medical Device Companies and Research Institutions

Collaborations between industry and academia are accelerating innovation across the bioabsorbable stent ecosystem. The Global Bioabsorbable Stents Market benefits from shared research, material testing, and clinical validation programs. It fosters faster regulatory approval and product commercialization. Joint ventures are focusing on improving stent design, drug elution, and absorption behavior. This partnership-driven model supports access to advanced R&D resources and clinical expertise. Emerging startups are partnering with established medical device firms for technology transfer and scaling. Collaborative research has also expanded the understanding of bioresorption mechanisms. This growing ecosystem is driving technological diversity and competitive differentiation.

Market Challenges Analysis:

High Manufacturing Costs and Complex Production Processes Limiting Large-Scale Commercialization

The development of bioabsorbable stents involves complex engineering, precision molding, and advanced materials, which increase production costs. The Global Bioabsorbable Stents Market faces limitations due to the high capital required for R&D and testing. It is challenging for small manufacturers to sustain profitability amid rising development expenses. Limited economies of scale and regulatory compliance costs further constrain pricing flexibility. Variability in degradation rates and mechanical stability remains a technical challenge. Hospitals often hesitate to adopt costly stents when conventional alternatives are cheaper. Manufacturing consistency is another concern, with minor deviations impacting performance. The need for specialized equipment and skilled personnel adds further cost pressure to the supply chain.

Regulatory and Clinical Performance Barriers Slowing Market Expansion

Stringent approval requirements and lengthy clinical validation timelines restrict product launches. The Global Bioabsorbable Stents Market must meet multiple international safety standards before commercialization. It is affected by variability in patient responses and long-term data availability. Some early-generation products faced recalls due to unpredictable degradation, influencing market perception. Physicians often remain cautious due to limited post-market surveillance data. Achieving consistent clinical outcomes across diverse patient groups remains difficult. Reimbursement challenges in developing regions reduce affordability and accessibility. Continuous trials and regulatory hurdles make market entry slower for new participants. These issues collectively delay mass adoption and revenue scalability.

Market Opportunities:

Rising Demand in Emerging Economies and Untapped Healthcare Markets

Developing regions are witnessing a surge in cardiovascular cases due to changing lifestyles and aging populations. The Global Bioabsorbable Stents Market is well-positioned to expand across Asia-Pacific, Latin America, and the Middle East. It benefits from increasing healthcare spending and government focus on cardiac disease management. Local manufacturing initiatives are expected to reduce import dependency. Partnerships with regional distributors are helping major players strengthen their presence. Growing medical tourism and awareness campaigns are also improving patient acceptance. These developments create profitable opportunities for global and regional manufacturers. Expanding infrastructure in emerging markets continues to open new growth avenues.

Advancements in Hybrid Materials and Drug-Eluting Technologies Enhancing Product Value

Ongoing research into hybrid bioabsorbable materials and controlled drug-release coatings is reshaping product potential. The Global Bioabsorbable Stents Market is experiencing a technological evolution toward smarter, multifunctional stent designs. It enables longer-term protection against restenosis while maintaining biocompatibility. Integration of anti-inflammatory drugs and bioactive coatings improves vascular healing. Collaborations between material scientists and medical experts are driving performance optimization. Emerging 3D printing and nanotechnology applications offer precision manufacturing advantages. These innovations present lucrative opportunities for companies developing differentiated next-generation solutions.

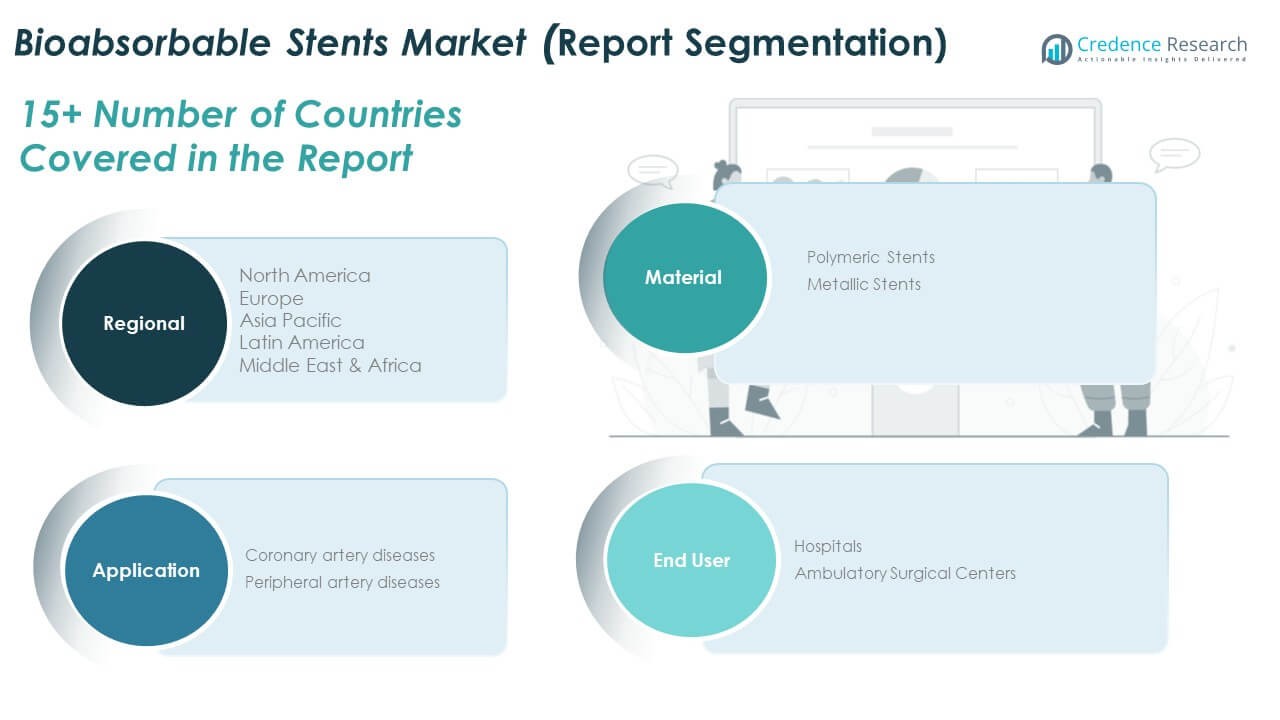

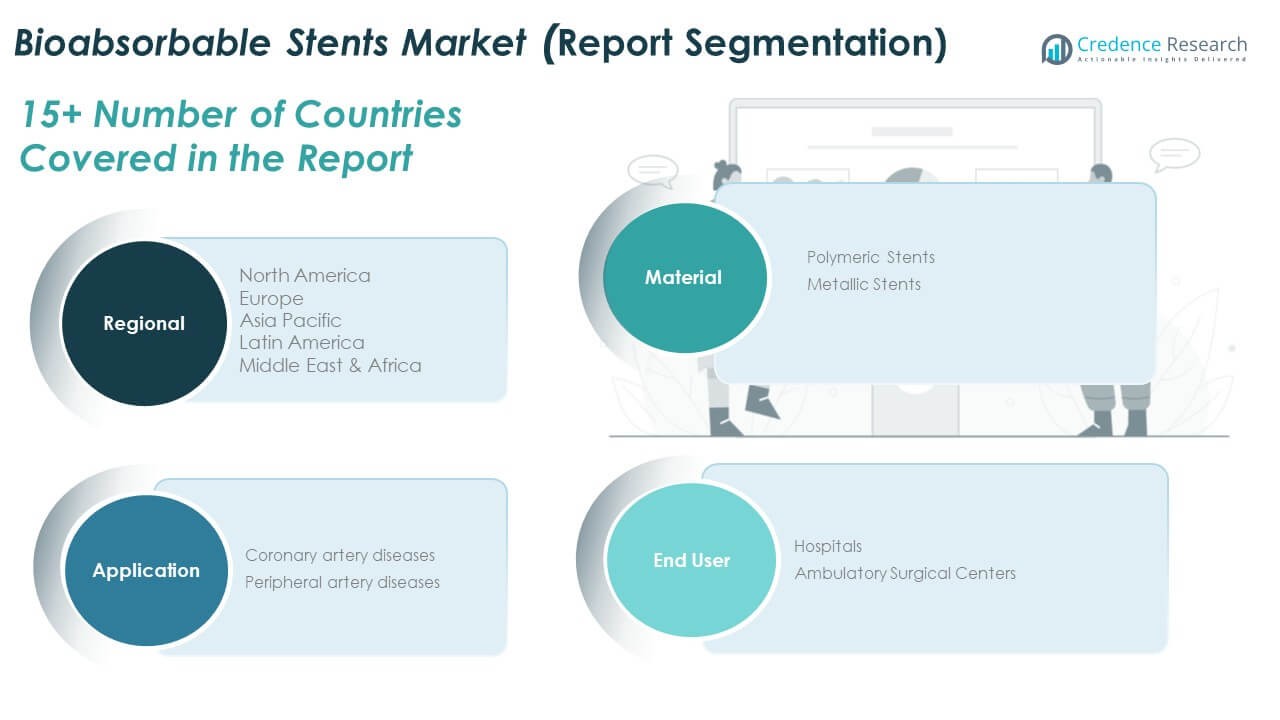

Market Segmentation Analysis:

By Material

The Global Bioabsorbable Stents Market is segmented into polymeric and metallic stents. Polymeric stents dominate due to their superior biocompatibility, controlled degradation, and reduced long-term complications. These stents are widely adopted in coronary procedures owing to their flexibility and ease of deployment. It benefits patients by eliminating the need for permanent implants and minimizing inflammatory risks. Metallic stents, particularly those made of magnesium alloys, are gaining traction for their enhanced mechanical strength and predictable absorption behavior. Continuous innovation in material science is expanding their clinical utility. Both materials are evolving toward improved safety and faster healing outcomes.

- For instance, the Magmaris metallic scaffold by Biotronik is noted for its faster resorption compared to early polymer-based options, and registry data show minimal long-term inflammatory risk and robust mechanical performance at 12 months.

By Application

Based on application, the market is divided into coronary artery diseases and peripheral artery diseases. Coronary artery diseases account for the major share due to the global rise in cardiac disorders requiring stent implantation. It is driven by increasing preference for bioresorbable options that restore vessel functionality without long-term interference. Peripheral artery diseases represent a growing area, supported by expanding awareness of advanced vascular treatments. Clinical adoption in non-coronary applications is expected to strengthen over the forecast period.

By End User

By end user, the market includes hospitals and ambulatory surgical centers. Hospitals hold the largest share due to advanced cardiac care facilities and access to skilled interventional cardiologists. It is supported by higher patient inflow and favorable reimbursement structures. Ambulatory surgical centers are emerging rapidly as outpatient procedures rise globally. Their cost efficiency and faster recovery times are making them an important growth contributor.

Segmentation:

By Material

- Polymeric Stents

- Metallic Stents

By Application

- Coronary Artery Diseases

- Peripheral Artery Diseases

By End User

- Hospitals

- Ambulatory Surgical Centers

By Region

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Regional Analysis:

North America

The North America Global Bioabsorbable Stents Market size was valued at USD 93.90 million in 2018 to USD 132.95 million in 2024 and is anticipated to reach USD 222.41 million by 2032, at a CAGR of 6.7% during the forecast period. North America holds nearly 32% share of the global market, driven by advanced healthcare infrastructure and strong adoption of innovative cardiovascular technologies. It benefits from the presence of key manufacturers and favorable regulatory pathways supporting product approvals. The United States leads regional demand, supported by high healthcare spending and early adoption of next-generation devices. Clinical trials and academic collaborations strengthen innovation and evidence-based practices. Canada and Mexico contribute steadily through expanding cardiac care networks. The region’s high awareness of minimally invasive procedures continues to fuel demand. Strong reimbursement frameworks and physician expertise further reinforce North America’s leadership position.

Europe

The Europe Global Bioabsorbable Stents Market size was valued at USD 70.47 million in 2018 to USD 102.74 million in 2024 and is anticipated to reach USD 178.67 million by 2032, at a CAGR of 7.2% during the forecast period. Europe accounts for about 26% of the global market, supported by technological advancement and favorable clinical trial infrastructure. Germany, France, and the UK dominate regional revenue, driven by strong R&D investment and hospital networks. It benefits from regulatory harmonization under CE Mark guidelines, ensuring consistent product quality. The growing focus on patient safety and post-procedure outcomes is strengthening adoption rates. Healthcare providers are increasingly using bioresorbable stents in complex coronary interventions. Rising public awareness and government support for cardiac research enhance long-term market potential. Regional manufacturers are investing in new materials and drug-eluting technologies to maintain competitiveness.

Asia Pacific

The Asia Pacific Global Bioabsorbable Stents Market size was valued at USD 74.85 million in 2018 to USD 108.14 million in 2024 and is anticipated to reach USD 185.88 million by 2032, at a CAGR of 7.1% during the forecast period. Asia Pacific holds nearly 27% share of the global market and is the fastest-growing regional segment. Rapid urbanization, increasing cardiovascular disease prevalence, and expanding healthcare infrastructure are key growth factors. China, Japan, and India lead adoption through large patient populations and ongoing healthcare reforms. It benefits from local manufacturing expansion and government initiatives promoting advanced medical devices. Regional players are collaborating with global firms to introduce cost-effective solutions. Awareness of minimally invasive procedures is increasing across hospitals and clinics. Rising medical tourism and improved insurance coverage are also stimulating market growth. Continued innovation and affordability improvements are likely to sustain regional momentum.

Latin America

The Latin America Global Bioabsorbable Stents Market size was valued at USD 20.82 million in 2018 to USD 29.08 million in 2024 and is anticipated to reach USD 47.75 million by 2032, at a CAGR of 6.5% during the forecast period. Latin America represents around 7% share of the global market, driven by expanding access to cardiac treatments and increasing hospital investments. Brazil and Mexico dominate the region due to better healthcare systems and growing adoption of advanced stenting technologies. It is supported by international partnerships and training programs improving physician expertise. Economic recovery and policy focus on public health are driving infrastructure upgrades. Medical tourism and private sector participation are enhancing accessibility to modern treatments. Challenges such as uneven reimbursement and limited awareness still affect penetration. However, rising clinical exposure and distribution partnerships are improving market reach.

Middle East

The Middle East Global Bioabsorbable Stents Market size was valued at USD 16.44 million in 2018 to USD 23.63 million in 2024 and is anticipated to reach USD 40.34 million by 2032, at a CAGR of 7.0% during the forecast period. The Middle East holds about 5.8% share of the global market, driven by growing healthcare modernization and investment in cardiovascular infrastructure. Gulf Cooperation Council (GCC) countries are leading in adoption through well-funded public hospitals and specialist cardiac centers. It benefits from increased government spending on advanced medical devices and patient safety initiatives. Rising prevalence of obesity and lifestyle-related cardiac disorders is creating strong demand. Regional distributors are expanding networks to supply bioresorbable stents efficiently. Partnerships between international manufacturers and local healthcare providers are improving market accessibility. The focus on premium care and early diagnosis continues to accelerate adoption across key economies.

Africa

The Africa Global Bioabsorbable Stents Market size was valued at USD 7.91 million in 2018 to USD 11.02 million in 2024 and is anticipated to reach USD 18.02 million by 2032, at a CAGR of 6.4% during the forecast period. Africa accounts for about 2.5% share of the global market, showing gradual but steady progress. Rising cardiovascular disease burden and healthcare awareness are key drivers of adoption. South Africa leads regional demand, supported by private healthcare investments and specialized treatment centers. It benefits from international aid programs and technology transfers improving cardiac care availability. Limited infrastructure and high costs still restrict market expansion in low-income regions. Growing government efforts toward healthcare modernization are improving long-term prospects. Training initiatives and telemedicine integration are strengthening procedural capabilities. Increased collaborations with global suppliers are expected to support sustainable market growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Abbott

- Biotronik SE & Co. KG

- Reva Medical Inc.

- Elixir Medical Corporation

- Kyoto Medical Planning Co., Ltd

- Braun

- Sinomed

- MeKo Manufacturing e.K.

- Meril Life Sciences

- Boston Scientific Corporation

Competitive Analysis:

The Global Bioabsorbable Stents Market is highly competitive, characterized by continuous innovation and strong R&D activities among global and regional players. It is driven by advancements in materials, drug-eluting technologies, and precision manufacturing processes. Abbott and Boston Scientific lead with established product portfolios and regulatory approvals. Emerging firms such as Meril Life Sciences and Elixir Medical Corporation are strengthening their presence through clinical trials and cost-effective solutions. Collaborations, product launches, and geographic expansion remain key competitive strategies. Companies focus on biocompatibility, controlled degradation, and improved procedural outcomes to gain a strategic edge.

Recent Developments:

- In August 2025, Abbott achieved a significant regulatory milestone with the CE Mark approval for its Esprit™ BTK Everolimus Eluting Resorbable Scaffold, designed for the treatment of peripheral artery disease below the knee. The device represents the company’s latest innovation in bioabsorbable scaffold technology, intended to offer new therapeutic options for patients suffering from critical limb ischemia and improve overall vascular care outcomes.

- In July 2025, Biotronik SE & Co. KG’s Vascular Intervention business was officially acquired by Teleflex Incorporated for €760 million. This acquisition substantially strengthens Teleflex’s interventional cardiology offerings, particularly expanding its global reach in the bioabsorbable stent segment. The integration includes advanced technologies and the initiation of further clinical trial programs focused on resorbable scaffold devices compliant with the CE Mark.

- In September 2025, Reva Medical Inc. reported positive 36-month results for its MOTIV Bioresorbable Scaffold in treating below-the-knee vascular disease. These findings support the company’s ongoing push for FDA approval while reinforcing its focus on clinical advancement and product pipeline expansion within the global bioabsorbable stents market.

Report Coverage:

The research report offers an in-depth analysis based on Material, Application, and End User segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing preference for polymeric stents with predictable bioresorption timelines.

- Increased adoption of magnesium-based stents offering superior mechanical strength.

- Expansion of clinical research to validate long-term efficacy and safety outcomes.

- Rising healthcare investment in cardiovascular infrastructure across emerging economies.

- Enhanced focus on integrating AI and simulation in stent design and testing.

- Greater emphasis on patient-specific solutions and precision cardiology.

- Surge in partnerships between global firms and regional distributors.

- Advancement of hybrid materials combining drug-elution and bioresorption benefits.

- Expansion of regulatory approvals facilitating faster global market entry.

- Continuous innovation driving reduced procedure time and improved patient recovery.