Market Overview

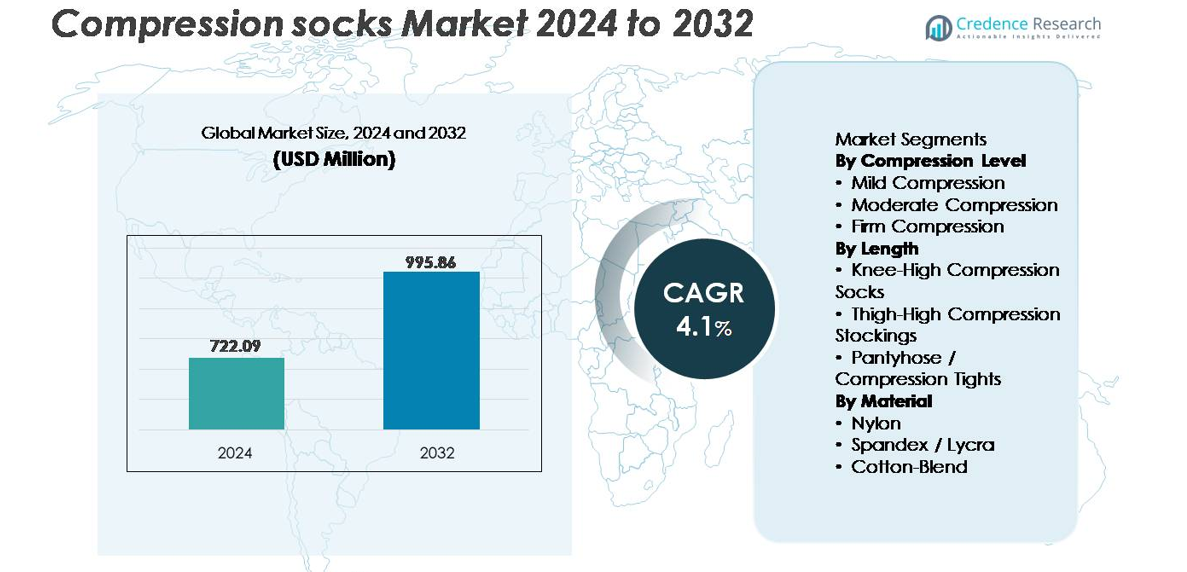

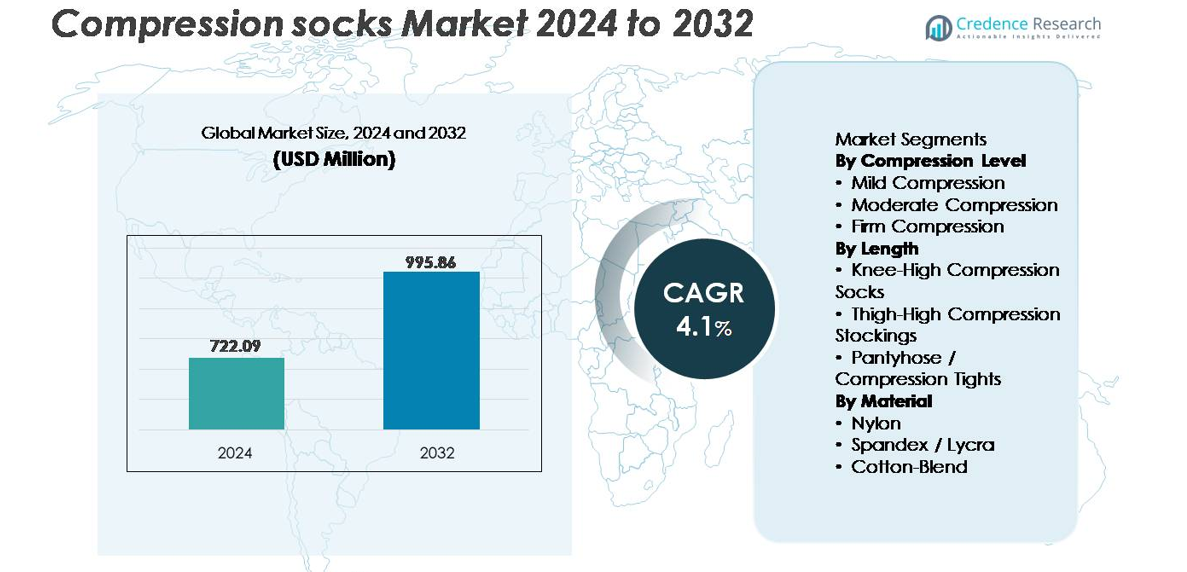

The global compression socks market was valued at USD 722.09 million in 2024 and is projected to reach approximately USD 995.86 million by 2032, reflecting a CAGR of 4.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Compression Socks Market Size 2024 |

USD 722.09 million |

| Compression Socks Market, CAGR |

4.1% |

| Compression Socks Market Size 2032 |

USD 995.86 million |

The compression socks market features a competitive landscape led by established medical and performance brands including SIGVARIS, BSN Medical, Thuasne, Medi GmbH and Co. KG, Euromi S.A., Calze G.T. S.r.l., Sanyleg S.r.l., KOSEMED, Novamed, and Santemol Group Medikal. These companies compete through innovations in graduated compression, moisture-wicking materials, and therapeutic wear optimized for post-surgical and chronic venous management. North America represents the leading regional market, accounting for over 35% of the global share, driven by strong clinical adoption, robust healthcare spending, and early consumer acceptance of preventive compression wear. Europe follows closely with significant demand across sports recovery, travel, and chronic vein treatment applications supported by structured reimbursement frameworks.

Market Insights

- The global compression socks market was valued at USD 722.09 million in 2024 and is projected to reach USD 995.86 million by 2032, expanding at a CAGR of 4.1% during the forecast period.

- Growing awareness of venous health, preventive circulation care, and rising post-surgical recovery needs continue to drive demand, particularly for moderate-compression products, which hold the largest segment share due to their suitability for daily medical and lifestyle use.

- Athleisure trends, advanced moisture-control fabrics, and seamless knitting technologies support adoption in sports recovery, travel, maternity wear, and occupational wear, expanding the non-medical consumer base.

- Competitive pressure intensifies as premium medical-grade brands face pricing challenges from low-cost entrants, while compliance concerns related to discomfort or difficulty wearing high-compression products pose restraints.

- Regionally, North America accounts for over 35% of the market, followed by Europe at nearly 30%, while Asia Pacific emerges as a fast-growing region supported by expanding healthcare access and e-commerce penetration.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Compression Level:

Moderate compression represents the dominant sub-segment, accounting for the largest market share due to its clinical effectiveness in managing varicose veins, post-surgical recovery, and long-haul travel needs. These products offer balanced pressure support without requiring a prescription, making them widely adopted across medical and preventive use cases. Mild compression is preferred for everyday comfort and athletic recovery, while firm compression remains a specialized segment prescribed for severe venous disorders. Growing awareness of early-stage circulatory health, combined with increasing demand among aging populations, continues to strengthen the market position of moderate compression solutions.

- For instance, companies such as SIGVARIS manufacture moderate to firm-compression garments engineered to deliver graduated pressure profiles starting around 20 mmHg at the ankle and tapering to a lower pressure at the calf.

By Length:

Knee-high compression socks hold the largest share in the market as they provide targeted support for common lower-leg circulation issues, including swelling and calf muscle fatigue, while maintaining comfort and ease of use. Their suitability for daily wear, athletics, travel, and occupational use drives consumer adoption. Thigh-high and pantyhose tights serve more advanced therapeutic needs and post-treatment applications but have lower adoption rates due to higher cost and less convenience. The trend toward preventive wellness and rising usage among professionals who stand for long durations reinforces the dominance of knee-high designs.

- For instance, Thuasne produces knee-high graduated compression socks that deliver ankle pressure levels up to 20 mmHg in the Class I range. Independent durability testing shows stable pressure retention across multiple wash cycles, supporting their use by workers who stand for long hours.

By Material:

Nylon-based compression socks dominate the material segment owing to their durability, elasticity retention, lightweight feel, and superior moisture-wicking properties that enhance comfort during prolonged wear. Spandex and Lycra blends support performance-driven applications, providing stretch and compression stability essential for sports and recovery. Cotton-blend variants cater to consumers prioritizing breathability and skin-friendly fabrics, though they offer lower compression consistency compared to synthetics. The increasing preference for antimicrobial, odor-resistant textiles and seamless knitting technologies continues to favor nylon-based compression socks in both medical-grade and lifestyle-oriented product lines.

Key Growth Drivers

Rising Adoption for Preventive and Therapeutic Use Cases

Demand for compression socks continues to rise as consumers proactively address circulatory health, swelling, and fatigue associated with sedentary lifestyles, frequent travel, and aging populations. Healthcare professionals increasingly recommend compression solutions to manage early-stage venous insufficiency, DVT prevention, and post-operative recovery, expanding medical and non-medical usage. The growth of wellness culture is encouraging younger demographics, including athletes and frequent flyers, to adopt compression socks for muscle stabilization and faster recovery. Retail expansion through pharmacies, e-commerce platforms, and sporting goods stores makes access easier, while targeted marketing campaigns educate consumers on health benefits. Greater penetration in preventive care and long-duration occupational settings will continue to accelerate adoption globally.

- For instance, CEP Compression, a medi GmbH brand, produces sports compression socks delivering clinically verified 20–30 mmHg ankle pressure, confirmed through Hohenstein Institute testing. The certification ensures sustained graduated compression and long-term pressure accuracy for athletic performance support.

Increasing Prevalence of Venous Disorders and Lifestyle-Related Conditions

Chronic venous diseases, varicose veins, edema, and leg ulcer risks are contributing to strong demand for therapeutic compression wear. Rising obesity rates, prolonged sitting, remote work culture, and reduced physical activity have intensified lower-limb circulation challenges. Clinical studies and physician support have reinforced the role of compression socks in reducing pain, swelling, and complications related to venous insufficiency, driving patient compliance. Hospitals and specialty clinics are integrating compression garments into post-surgical protocols and long-term therapy programs. As lifestyle-related cardiovascular issues and diabetes escalate, compression products serve as cost-effective, non-invasive solutions, strengthening their role as a preferred intervention before surgical treatments are considered.

- For instance, BSN Medical’s JOBST® medical compression line incorporates engineered graduated pressure designs capable of delivering up to 30 mmHg of controlled therapeutic compression, validated through garment testing protocols that maintain pressure loss within 3 mmHg after 100 flex cycles, supporting its positioning as a non-invasive intervention before surgical treatment options are considered.

Expansion of Sports, Fitness, and Recovery Applications

Compression socks have seen notable growth within athletic and fitness communities due to their perceived performance benefits, including improved blood flow, oxygen delivery, and reduced muscle fatigue. Endurance athletes, runners, cyclists, and gym users increasingly adopt compression wear for faster post-training recovery and injury prevention. Brands are leveraging athlete endorsements, research-backed performance claims, and advanced textile innovations to reinforce credibility. Product differentiation through moisture control, graduated compression, and seamless knitting enhances consumer experience. The integration of compression wear into recovery routines and physiotherapy regimens strongly supports recurring demand. This segment will continue to benefit from growing awareness of sports medicine and rising participation in recreational fitness.

Key Trends & Opportunities

Advancements in Smart Fabrics and Wearable Compression Technologies

Integration of technology into compression garments presents a major opportunity, driven by advancements in smart textiles, biosensors, and digitally monitored compression systems. Manufacturers are exploring garments that track leg pressure, muscle movement, hydration, and temperature, offering real-time health insights. Smart compression stockings for post-surgery patients can help monitor swelling and adjust support levels, improving outcomes and compliance. Opportunities also emerge through partnerships with digital health platforms and telemedicine providers, enabling remote monitoring for chronic disease management. Innovations in antimicrobial fabric, recycled fibers, and seamless cushioning also align with sustainability requirements and enhance comfort for all-day wear. This trend positions compression socks as both medical devices and lifestyle wearables.

- For instance, medi GmbH & Co. KG develops medical compression stockings validated through Hohenstein Institute testing, ensuring accurate graduated pressure delivery across classes up to 40 mmHg. The company also integrates digital adherence tools like the medi companion app, which provides guided fitting support and usage tracking to enhance therapy compliance.

Growth of Online Retail and Direct-to-Consumer Personalization Models

E-commerce and direct-to-consumer strategies provide significant market expansion opportunities by eliminating geographic limitations and simplifying prescription-level purchasing. Digital platforms allow brands to offer size customization, compression-level selection, and personalized fitting recommendations. AI-driven sizing tools reduce product returns and improve user satisfaction. Subscription programs for athletic and medical segments build recurring revenue and consumer loyalty. Social media marketing, influencer partnerships, and targeted campaigns amplify brand visibility, while comparison-based shopping accelerates consumer decision-making. Online availability also supports global adoption across developing markets, enabling consumers to access specialized products previously limited to hospital or pharmacy environments.

- For instance, SIGVARIS Group offers medical compression stockings in verified 15–20 mmHg, 20–30 mmHg, and 30–40 mmHg classes, produced under ISO 13485:2016 and certified through RAL-GZ 387 testing. The company also provides digital sizing tools that help clinicians match patients to appropriate compression levels across its regulated product catalog.

Key Challenges

Compliance Issues and Discomfort Affecting Long-Term Use

Despite proven clinical benefits, patient compliance remains a core challenge due to discomfort, difficulty wearing higher compression levels, and heat or skin irritation during prolonged use. Improper sizing and lack of education on correct donning techniques lead to inconsistent results and dissatisfaction. Older patients or individuals with reduced mobility may find it difficult to apply or remove tight compression garments, limiting adherence to prescribed therapy routines. Manufacturers must invest in softer textiles, improved ventilation, and flexible ergonomics to improve comfort. Education initiatives by clinicians, pharmacists, and digital platforms are essential to help users understand fit, duration, and proper maintenance to achieve intended therapeutic outcomes.

Pricing Barriers and Limited Insurance Coverage in Some Regions

High-quality medical-grade compression socks often carry premium pricing, creating affordability concerns for uninsured or low-income patient groups. In many regions, compression garments are categorized as consumer products rather than reimbursable medical devices, restricting insurance coverage for chronic conditions that require long-term or multiple pair replacements yearly. This challenge intensifies in markets with limited healthcare coverage or low awareness of venous disorders. Competitive pricing from low-cost manufacturers may impact brand perception and confuse consumers about clinically effective standards. For sustained growth, stakeholders must address reimbursement policies, strengthen clinical validation, and communicate value through evidence-based outcomes and improved durability.

Regional Analysis

North America

North America holds the largest share of the compression socks market, contributing over 35% of global revenue, supported by a well-established medical infrastructure and high adoption for post-surgical recovery and venous disorder management. Rising cases of varicose veins, obesity, and diabetes contribute significantly to demand. The U.S. drives most sales through hospitals, sports retailers, and digital D2C channels, while Canada shows expanding uptake in preventive and athletic recovery uses. Growth is further reinforced by strong insurance integration for physician-prescribed compression wear and a mature consumer base accustomed to premium healthcare and lifestyle wellness products.

Europe

Europe accounts for nearly 30% of the global market, driven by aging demographics, strong reimbursement frameworks, and high awareness of circulatory healthcare. Countries such as Germany, France, and the U.K. represent major revenue hubs, particularly for medical-grade compression garments prescribed for venous insufficiency and lymphatic disorders. EU regulations and CE-certified products reinforce quality standards and patient safety, supporting market stability. Growing adoption for travel-related swelling, occupational health, and preventive wellness further expands demand. Eastern Europe shows rising penetration as healthcare access improves and lifestyle-related conditions increase, offering new growth potential for manufacturers.

Asia Pacific

Asia Pacific is among the fastest-growing regions, representing close to 20% market share, driven by increasing urbanization, lifestyle-induced vascular disorders, and expanding healthcare expenditure. Japan, South Korea, and China lead product consumption due to strong retail networks and rising acceptance of compression wear as preventive therapy. E-commerce accessibility allows brands to reach underserved demographics in India and Southeast Asia. The fitness boom and heightened consumer awareness of mobility-related health are key drivers. Local manufacturers offering cost-effective synthetic-based compression socks are accelerating adoption, positioning the region for continued expansion across both medical and sports applications.

Latin America

Latin America represents approximately 8% of global revenue, with growth influenced by expanding private healthcare access, increasing sports participation, and rising incidence of venous insufficiency among urban populations. Brazil and Mexico account for the majority of regional sales, supported by improved retail distribution and growing online marketplaces. Price-sensitive demand shapes consumption patterns, and affordability of non-prescription preventive compression socks boosts adoption. However, limited insurance coverage and inconsistent product standards pose challenges. Manufacturers focusing on lower-cost materials and localized branding strategies gain competitive advantage as awareness of postoperative and travel-related compression benefits increases.

Middle East & Africa

The Middle East & Africa region captures around 7% of the market, supported by growing healthcare modernization, medical tourism, and investment in chronic disease management. Gulf countries, particularly UAE and Saudi Arabia, lead adoption due to high prevalence of diabetes and vascular disorders, along with access to premium therapeutic products. In Africa, uptake remains gradual, constrained by limited distribution and affordability challenges. However, demand is rising in urban centers for travel compression wear and maternity applications. Expanded pharmacy networks and targeted education campaigns present opportunities to increase usage and strengthen patient compliance across the region.

Market Segmentations:

By Compression Level

- Mild Compression

- Moderate Compression

- Firm Compression

By Length

- Knee-High Compression Socks

- Thigh-High Compression Stockings

- Pantyhose / Compression Tights

By Material

- Nylon

- Spandex / Lycra

- Cotton-Blend

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the compression socks market is characterized by a mix of established medical device companies, sports performance brands, and emerging direct-to-consumer businesses focused on targeted health solutions. Leading players compete on product differentiation through compression levels, fabric technologies, and specialized designs for travel, maternity, post-surgical recovery, and athletic performance. Innovation centers on seamless knitting, antimicrobial fibers, moisture management, and breathable materials that enhance long-duration comfort, while smart wearable integration represents an evolving frontier. Global brands benefit from strong distribution through hospital networks, pharmacies, and e-commerce platforms, whereas regional manufacturers capitalize on cost-effective offerings and localized marketing. Partnerships with physiotherapists, orthopedic specialists, and telemedicine platforms strengthen clinical validation and market credibility. Price competition remains significant, especially in emerging markets where affordability influences adoption and unregulated low-cost imports challenge premium brands. Continuous investment in user education, regulatory compliance, and personalized sizing solutions supports long-term brand loyalty and sustainable competitive advantage.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- SIGVARIS

- KOSEMED

- Calze G.T. S.r.l.

- BSN Medical

- Thuasne

- Medi GmbH and Co. KG

- Santemol Group Medikal

- Sanyleg S.r.l.

Recent Developments

- In June 2024, Medi expanded its compression product range introducing new stockings for oedema therapy and venous treatment updating both design and therapeutic options available.

- In May 2024, SIGVARIS launched two accessory products: a donning aid (“Doff N’Donner Cone”) to simplify putting on compression stockings, and a roll-on adhesive lotion (“FIX”) to help secure compression garments without grip tops.

Report Coverage

The research report offers an in-depth analysis based on Compression level, Length, Material and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Compression socks will continue gaining adoption in preventive circulatory care among aging and working populations.

- Demand will rise in sports and fitness recovery as performance-focused products become mainstream.

- Smart compression technologies with sensor-based monitoring will shape product innovation pipelines.

- Personalized sizing and custom-fit solutions will improve compliance and user experience.

- E-commerce and subscription-based replenishment programs will strengthen recurring revenue models.

- Sustainable, recycled, and antimicrobial fabrics will gain preference among environmentally conscious consumers.

- Medical-grade compression will expand with growing diagnosis of venous disorders and post-surgical care requirements.

- Partnerships between manufacturers and healthcare providers will enhance clinical validation and brand credibility.

- Emerging markets will experience rapid adoption fueled by affordability and retail expansion.

- Price differentiation strategies will intensify as global brands compete with low-cost regional manufacturers.