Market Overview

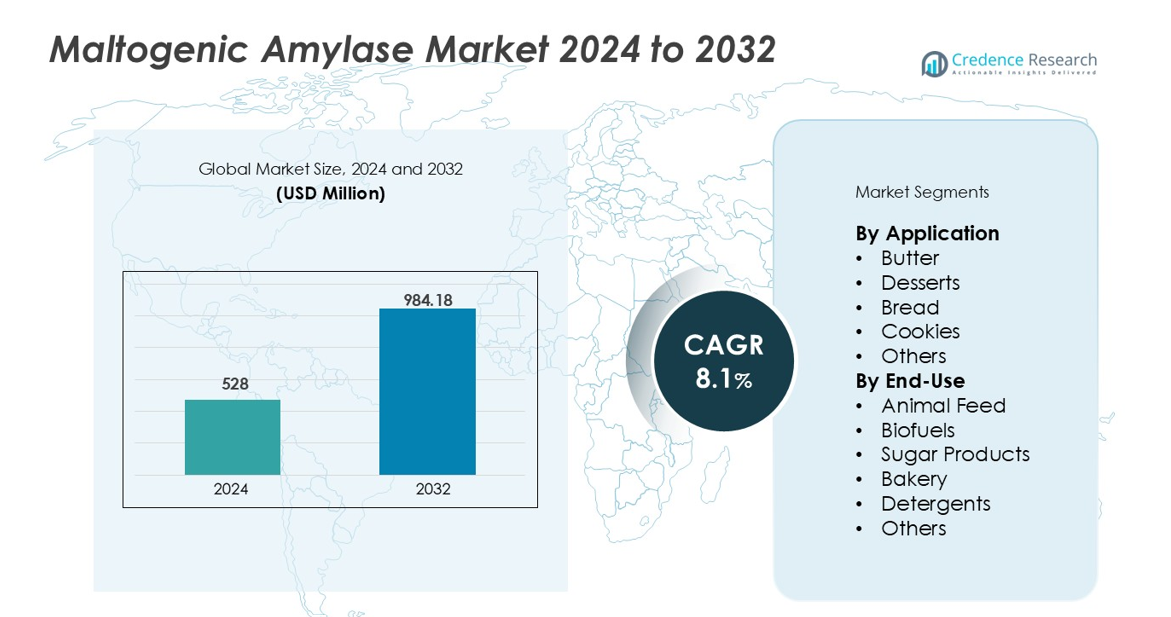

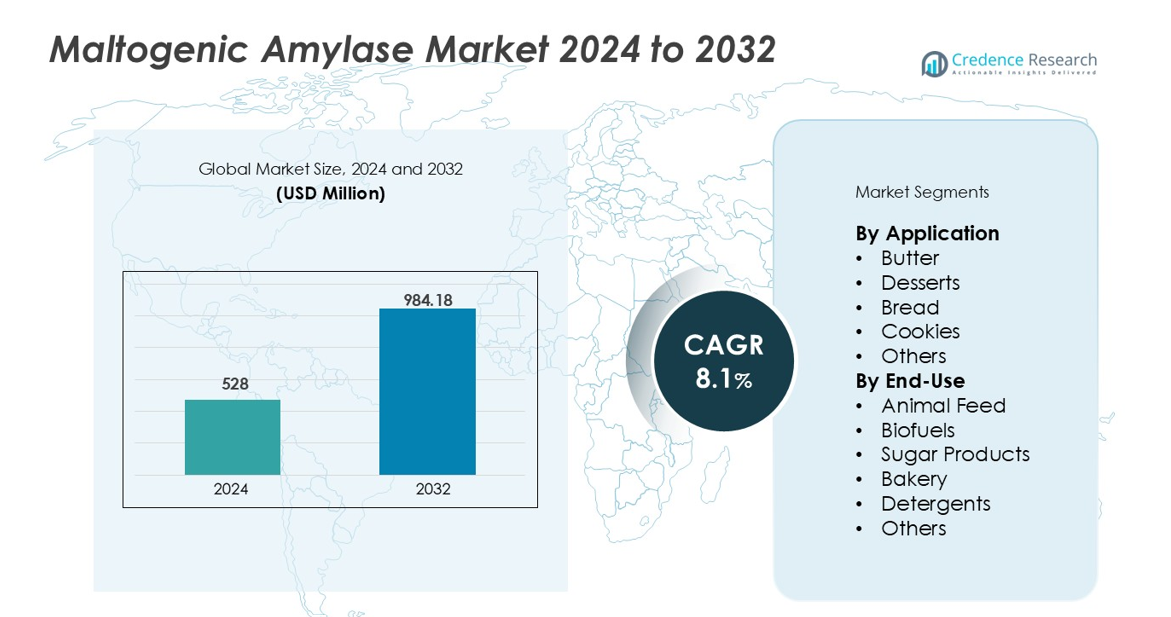

Maltogenic Amylase market size was valued USD 528 million in 2024 and is anticipated to reach USD 984.18 million by 2032, at a CAGR of 8.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Maltogenic Amylase Market Size 2024 |

USD 528 million |

| Maltogenic Amylase Market, CAGR |

8.1% |

| Maltogenic Amylase Market Size 2032 |

USD 984.18 million |

The Maltogenic Amylase market features strong competition among global and regional enzyme producers. Key players include Novozymes A/S, DSM, AB Enzymes, Amano Enzyme, Advanced Enzyme, Angel Yeast, and SUNSON Industry Group. These companies lead through strong formulation expertise and bakery-focused solutions. Novozymes and DSM maintain wide global reach and technical support networks. Asian players compete on cost and regional supply strength. North America leads the market with an exact share of 35%, driven by large-scale industrial bakeries and packaged food demand. Europe follows as a mature market, while Asia Pacific shows the fastest expansion. Regional leadership reflects advanced food processing infrastructure and high enzyme adoption.

Market Insights

- The Maltogenic Amylase market was valued at USD 528 million in 2024 and is projected to reach USD 984.18 million by 2032, growing at a CAGR of 8.1% during the forecast period.

- Market growth is driven by rising industrial bakery production, where bread applications hold nearly 35% segment share due to shelf-life extension needs. Packaged bakery demand supports stable enzyme adoption across large-scale processing units.

- Clean-label trends and enzyme-based processing shape market trends. Food manufacturers replace chemical improvers with maltogenic amylase to improve texture and freshness, especially in bread and cookies. Bakery end use dominates with about 40% share.

- Competition remains moderate, led by global enzyme producers focusing on formulation efficiency and technical support. Regional players compete through cost advantages and local supply strength. Product consistency and dosage efficiency drive differentiation.

- North America leads with around 35% market share, followed by Europe at 28% and Asia Pacific at 25%. Asia Pacific remains the fastest-growing region due to expanding packaged food consumption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Application

The application segment shows strong demand from bakery and confectionery products. Bread remains the dominant sub-segment, accounting for nearly 35% market share. Bakeries use maltogenic amylase to improve crumb softness and extend shelf life. Consistent texture and delayed staling support large-scale bread production. Cookies and desserts follow due to rising packaged food consumption. Butter and specialty applications hold smaller shares but show steady use in premium products. Growth drivers include industrial baking expansion, clean-label enzyme adoption, and rising demand for consistent product quality across high-volume food processing.

- For instance, Novozymes’ Novamyl® 3D enzyme solution extends bread shelf life by up to 10–14 days while maintaining softness and elasticity, enabling commercial bakeries to reduce waste and optimize inventory cycles.

By End-Use

The bakery end-use segment leads the market with an estimated 40% share. Commercial bakeries rely on maltogenic amylase to maintain freshness during distribution. Sugar products represent the next major sub-segment, driven by texture control in confectionery processing. Animal feed and biofuels show moderate adoption due to starch modification needs. Detergents hold a niche share focused on specialty enzyme blends. Key drivers include rising industrial food processing, efficiency gains in starch conversion, and increased enzyme penetration across non-food applications seeking process stability and performance consistency.

- For instance, DSM’s BakeZyme® Master 4.0 is used in industrial bakeries to reduce firmness by over 25% after 7 days in packaged bread products, supporting shelf-life extension and maintaining consumer-acceptable texture.

Key Growth Drivers

Rising Demand from Industrial Bakery Processing

Industrial bakeries drive strong demand for maltogenic amylase worldwide. Manufacturers use the enzyme to delay starch retrogradation in baked goods. This function improves softness and shelf life in packaged bread. Large retail chains require longer freshness during transport and storage. Maltogenic amylase supports consistent texture across high-volume production lines. Frozen and par-baked products also rely on enzyme support. Growth in quick-service restaurants increases standardized bread usage. Urban lifestyles favor packaged bakery consumption. Enzyme solutions reduce product waste and return. Cost savings strengthen adoption among commercial bakers. This driver remains central to sustained market expansion.

- For instance, Angel Yeast markets a maltogenic amylase product, Annzyme MAM100, which is used in the baking industry to extend bread shelf life, improve elasticity, and reduce staling. In general industry trials and scientific studies, maltogenic amylase enzymes have been shown to effectively keep packaged bread soft during storage periods that can exceed 12 days.

Expansion of Processed and Convenience Food Consumption

Processed food demand continues to rise across regions. Consumers prefer ready-to-eat and long-shelf-life bakery products. Maltogenic amylase helps manufacturers meet these needs efficiently. The enzyme improves mouthfeel and freshness without recipe changes. Clean processing benefits align with modern food production goals. Food brands seek stable quality across batches and geographies. Enzyme use supports scalable manufacturing systems. Emerging economies show strong packaged food growth. Urban population growth increases demand for consistent bakery output. This trend supports long-term enzyme market growth.

- For instance, AB Enzymes’ VERON® MAXIMA was deployed by a major snack food company in Brazil to enhance the softness of pre-packed rolls for over 10 days without affecting the dough formula, improving batch consistency across 9 processing facilities.

Advancements In Enzyme Engineering and Formulation

Enzyme producers invest in improved maltogenic amylase variants. New formulations offer higher temperature and pH stability. These features suit diverse baking conditions. Improved specificity enhances starch conversion control. Manufacturers achieve better product consistency with lower dosages. Liquid and granulated formats improve handling efficiency. Longer enzyme activity extends freshness benefits. These innovations improve cost efficiency for end users. Food processors prefer reliable and predictable enzyme performance. Technology progress strengthens adoption across food and non-food applications.

Key Trends & Opportunities

Growing Adoption of Clean-Label and Enzyme-Based Solutions

Food producers shift toward clean-label processing aids. Maltogenic amylase replaces chemical dough conditioners in many recipes. Enzymes support simpler ingredient lists without sensory compromise. Regulatory acceptance of food enzymes supports this shift. Consumers favor products with familiar ingredient profiles. Bakery brands use enzymes to maintain quality claims. This trend creates strong opportunities for enzyme suppliers. Premium and health-focused bakery segments show higher adoption. Innovation in label-friendly enzyme blends expands application scope. Clean-label positioning strengthens long-term market opportunities.

- For instance, the use of maltogenic amylase is a well-established industry practice adopted by various organic bread brands to eliminate the need for chemical additives like mono- and diglycerides from their ingredient lists across numerous retail SKUs, while maintaining softness for several days post-bake.

Increasing Use Beyond Traditional Bakery Applications

The market sees rising use outside core bakery segments. Sugar processing uses maltogenic amylase for controlled hydrolysis. Animal feed producers apply enzymes to improve digestibility. Biofuel producers adopt enzymes for starch conversion efficiency. These applications diversify revenue streams. Industrial processors value process optimization benefits. Enzyme blends tailored for non-food uses gain traction. Emerging industrial markets support incremental growth. This trend reduces dependence on bakery demand alone. Broader application scope creates new growth pathways

Key Challenges

Sensitivity to Processing Conditions and Formulation Limits

Maltogenic amylase performance depends on precise conditions. Temperature and pH variations affect enzyme activity. Improper handling reduces effectiveness in baking processes. Smaller producers face formulation challenges during scale-up. Inconsistent results discourage adoption in some facilities. Storage stability also affects enzyme performance. Manufacturers must ensure correct dosing and process control. Technical support becomes critical for end users. These factors increase operational complexity. Such limitations can slow adoption among less advanced processors.

Price Pressure and Competition from Alternative Enzymes

The market faces pricing pressure from competing enzyme solutions. Amylase blends and multifunctional enzymes offer substitution options. Large food processors negotiate aggressive pricing contracts. Cost-sensitive regions favor lower-priced alternatives. Enzyme commoditization affects margin stability. Smaller suppliers struggle to differentiate offerings. Continuous innovation requires high development investment. Regulatory compliance adds further cost burden. These challenges affect profitability across the value chain. Competitive intensity remains a key restraint on market growth.

Regional Analysis

North America

North America holds the largest market share at around 35%. The region benefits from advanced industrial bakery infrastructure and high enzyme adoption. Large commercial bakeries rely on maltogenic amylase to extend shelf life. Strong demand comes from packaged bread and frozen bakery products. Clean-label reformulation remains a key focus for food brands. The United States leads regional consumption due to large-scale food processing. Canada supports steady growth through premium baked goods. Mature supply chains ensure stable enzyme availability. Continuous product innovation sustains regional leadership.

Europe

Europe accounts for nearly 28% of the global market share. The region shows strong demand from artisanal and industrial bakeries. Shelf-life improvement remains critical for cross-border distribution. Clean-label regulations favor enzyme-based processing aids. Countries such as Germany, France, and the United Kingdom lead adoption. Bakers focus on texture consistency and waste reduction. Strong regulatory clarity supports enzyme usage. Premium bread and confectionery segments drive demand. Sustainable food processing trends further support regional growth.

Asia Pacific

Asia Pacific represents about 25% of the market share and shows the fastest growth. Rising urbanization increases packaged bakery consumption. Expanding middle-class populations drive demand for convenience foods. China and India lead volume growth due to large populations. Japan and South Korea support high-value enzyme applications. Industrial bakeries expand capacity to meet retail demand. Shelf-life stability remains a major driver. Local manufacturers increase enzyme adoption to improve quality. The region offers strong long-term growth potential.

Latin America

Latin America holds approximately 7% of the global market share. Brazil and Mexico lead regional demand. Growth comes from expanding commercial bakery chains. Packaged bread consumption increases across urban centers. Cost efficiency remains a key purchase factor. Enzyme use helps reduce product losses during distribution. Local producers adopt maltogenic amylase gradually. Regulatory frameworks continue to evolve. Rising investment in food processing supports moderate growth. The region shows steady but controlled market expansion.

Middle East & Africa

The Middle East & Africa region accounts for around 5% market share. Urban population growth supports bakery demand. Gulf countries lead adoption due to modern food processing facilities. Long shelf life remains essential in hot climates. Imported bakery products increase enzyme usage. Local production capacity continues to expand slowly. Africa shows early-stage adoption in packaged foods. Cost sensitivity limits rapid penetration. Distribution infrastructure improvements support gradual growth. The region presents long-term opportunity with developing food industries.

Market Segmentations:

By Application

- Butter

- Desserts

- Bread

- Cookies

- Others

By End-Use

- Animal Feed

- Biofuels

- Sugar Products

- Bakery

- Detergents

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Maltogenic Amylase market shows a moderately consolidated competitive landscape. Leading players focus on product performance, formulation stability, and application-specific solutions. Global enzyme producers leverage strong research capabilities and established distribution networks. Companies invest in enzyme engineering to improve thermal stability and shelf-life extension effects. Strategic partnerships with industrial bakeries strengthen long-term supply contracts. Regional manufacturers compete through cost-efficient offerings and localized technical support. Product differentiation centers on dosage efficiency and consistent performance. Clean-label compliance influences product development strategies. Competitive intensity remains high due to price sensitivity among large buyers. Ongoing innovation and application expansion define long-term positioning across the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Novozymes A/S

- DSM

- AB Enzymes

- Amano Enzyme

- Advanced Enzyme

- Angel Yeast

- SUNSON Industry Group

- Infinita Biotech

- Antozyme Biotech

- Henan Chemsino Industrial

- Creative Enzymes

- LEVEKING

Recent Developments

- In June 2022, Royal DSM, a global purpose-led science-based company acquired Prodap, Brazilian animal nutrition, and technology company.

- In May 2022, BASF Enzymes launched its new brand SpartecTM for the North American bioethanol market. To provide sustainable solutions and create cutting-edge enzymes that add value for ethanol producers, BASF Bioenergy continuously works with customers and strategic partners.

Report Coverage

The research report offers an in-depth analysis based on Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Industrial bakeries will increase maltogenic amylase adoption to extend product freshness.

- Packaged bread and frozen bakery demand will support steady enzyme consumption.

- Clean-label product reformulation will accelerate enzyme-based processing use.

- Enzyme suppliers will focus on higher stability and lower dosage formulations.

- Application scope will expand beyond bakery into sugar processing and animal feed.

- Asia Pacific will remain the fastest-growing regional market.

- Regional producers will strengthen cost-competitive enzyme offerings.

- Technical support services will play a larger role in supplier selection.

- Competition will intensify through formulation efficiency and performance reliability.

- Long-term growth will depend on innovation and diversified end-use applications.