Market Overview

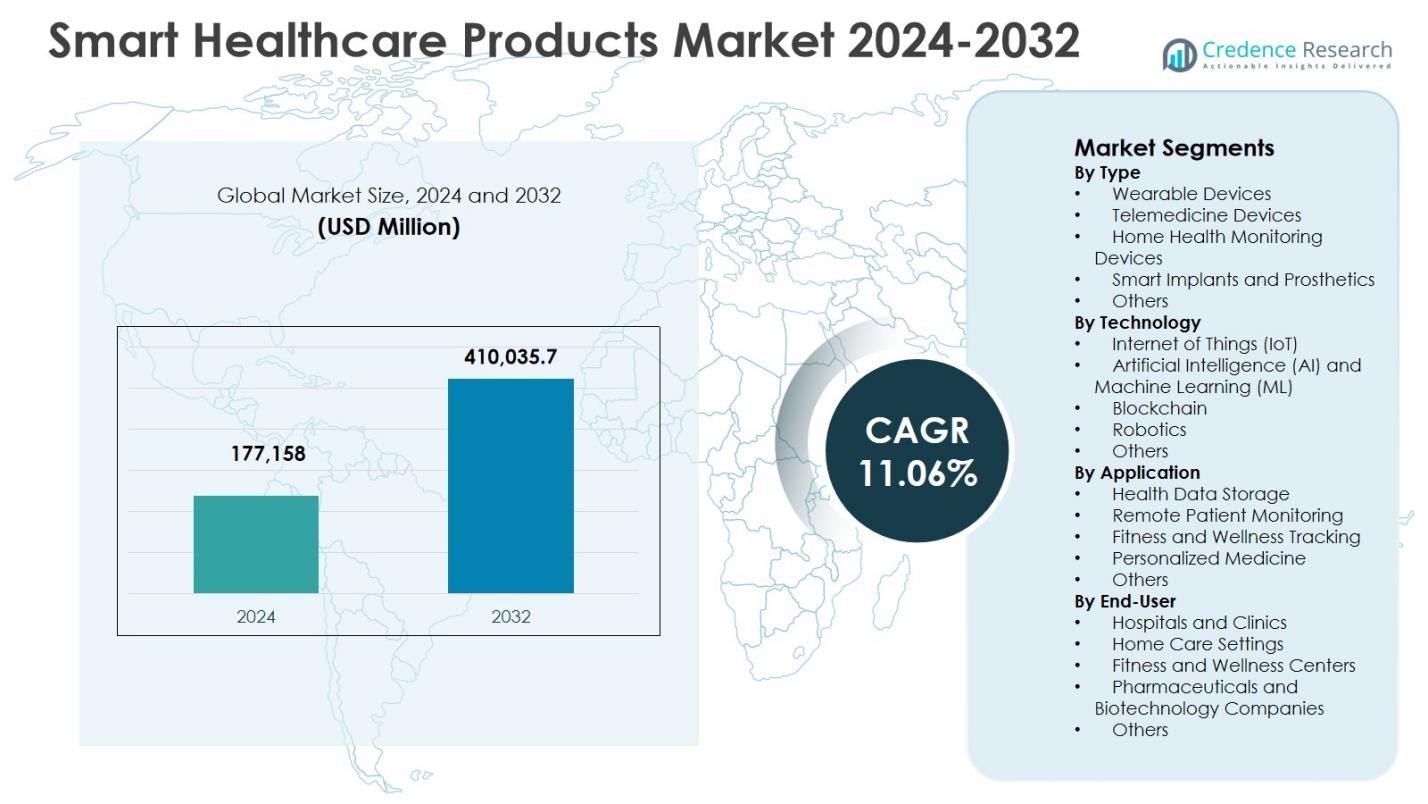

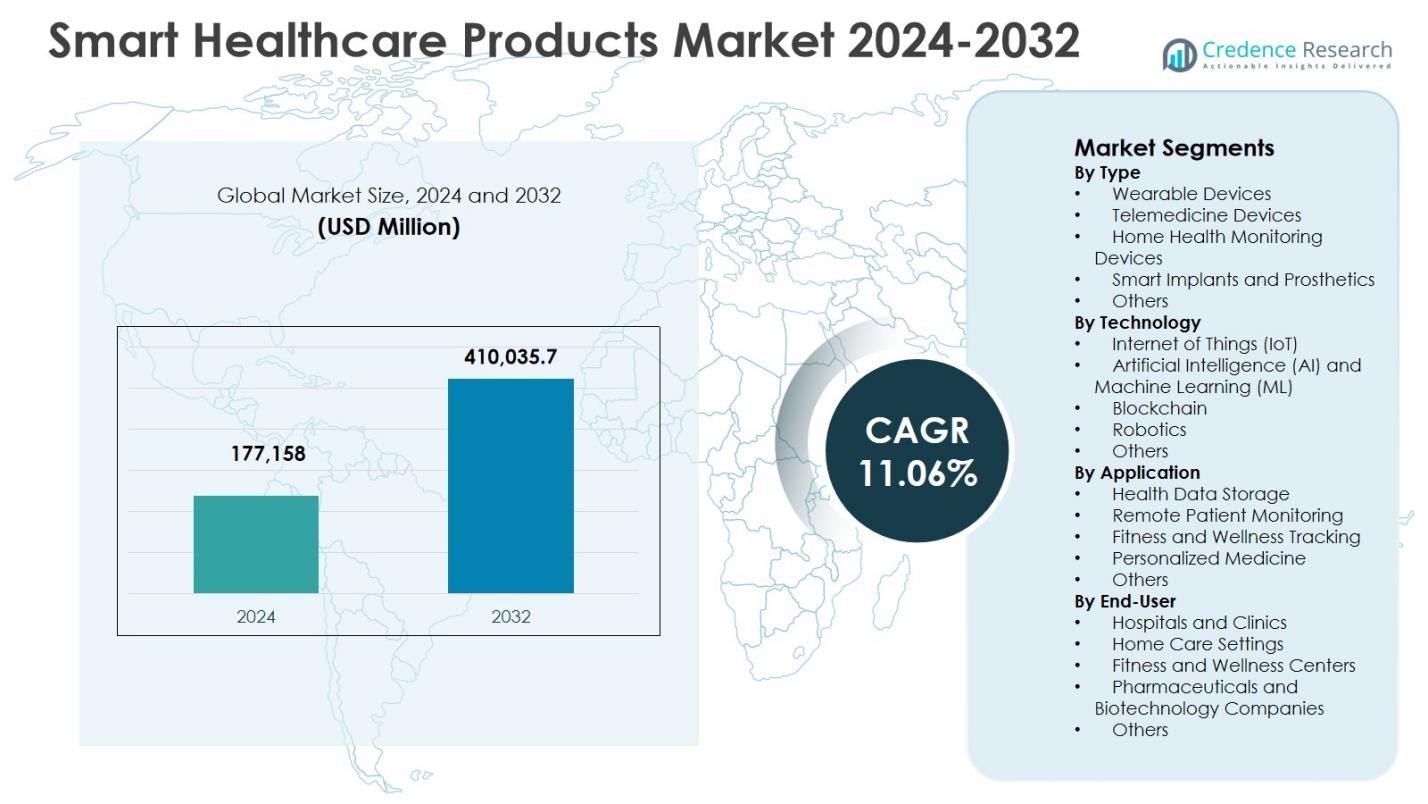

The Smart Healthcare Products Market size was valued at USD 177,158 Million in 2024 and is anticipated to reach USD 410,035.7 Million by 2032, growing at a CAGR of 11.06% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Smart Healthcare Products Market Size 2024 |

USD 177,158 Million |

| Smart Healthcare Products Market, CAGR |

11.06% |

| Smart Healthcare Products Market Size 2032 |

USD 410,035.7 Million |

Smart Healthcare Products Market is led by key players such as Abbott Laboratories, Apple Inc., Dexcom Inc., Cerner Corporation, Honeywell International Inc., Fitbit Inc., Olympus Corporation, Athenahealth, Airstrip, and BioTelemetry Inc. These companies drive market growth through continuous innovation in wearable devices, telemedicine platforms, home health monitoring solutions, and AI- and IoT-enabled healthcare technologies. North America dominates the market with a 36.2% share in 2024, supported by advanced healthcare infrastructure, high adoption of smart devices, and government initiatives promoting digital health. Europe holds 27.4% share, fueled by strong regulatory support and integration of AI, IoT, and robotics in healthcare facilities. Asia-Pacific captures 28.5% share, driven by increasing healthcare awareness, smartphone penetration, and government programs promoting remote monitoring and telemedicine. Collectively, these regions and leading players shape the global expansion of smart healthcare solutions across clinical and consumer applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Smart Healthcare Products Market size was valued at USD 177,158 Million in 2024 and is projected to reach USD 410,035.7 Million by 2032, growing at a CAGR of 11.06% during the forecast period. The Wearable Devices sub-segment holds 3% share in 2024, while Remote Patient Monitoring leads applications with 44.1% share.

- Rising adoption of wearable devices, telemedicine solutions, and home health monitoring devices is driving market growth. Increasing prevalence of chronic diseases, aging populations, and growing health awareness are key factors fueling demand globally.

- Key trends include integration of smart healthcare devices with mobile health platforms and the emergence of personalized and preventive healthcare solutions, enhancing patient engagement and data-driven care.

- Leading players such as Abbott Laboratories, Apple Inc., Dexcom Inc., Cerner Corporation, and Fitbit Inc. focus on innovation, strategic partnerships, and AI- and IoT-enabled product development to strengthen market presence.

- North America leads with 2% share in 2024, followed by Asia-Pacific 28.5%, Europe 27.4%, Latin America 4.7%, and Middle East & Africa 3.2%, reflecting regional adoption trends and healthcare infrastructure differences.

Market Segmentation Analysis:

By Type:

The Wearable Devices sub-segment dominates the Smart Healthcare Products Market by type, holding 42.3% share in 2024. Rising adoption of smartwatches, fitness trackers, and wearable ECG monitors drives this growth. Increasing consumer awareness about preventive healthcare, growing prevalence of chronic diseases, and integration of real-time health monitoring capabilities support market expansion. Telemedicine devices follow with substantial adoption due to remote consultation needs, but wearables remain the primary revenue contributor as they enable continuous health monitoring, promote patient engagement, and facilitate early detection of health anomalies across both developed and emerging regions.

- For instance, Fitbit devices analyze heart rate and step data with AI models that predict hospitalization risks with 91% accuracy among over 14,000 U.S. participants, aiding chronic condition management.

By Technology:

The Internet of Things (IoT) sub-segment leads the technology category with 39.7% market share in 2024. IoT-enabled devices allow seamless connectivity between sensors, wearable devices, and healthcare platforms, providing real-time patient data and analytics. Key growth drivers include rising demand for remote patient monitoring, advancements in cloud computing, and interoperability between smart devices and hospital management systems. AI & ML technologies complement IoT, enhancing predictive diagnostics, but IoT’s widespread integration in wearable and home health monitoring solutions positions it as the dominant technology for the smart healthcare ecosystem.

- For instance, Medtronic deploys IoT-enabled smart insulin pumps and cardiac monitors that transmit real-time health data from wearable and implantable devices to cloud platforms for remote monitoring.

By Application:

Within applications, Remote Patient Monitoring (RPM) is the dominant sub-segment, accounting for 44.1% share in 2024. RPM adoption is fueled by the increasing need to manage chronic conditions, reduce hospital readmissions, and enable continuous care outside clinical settings. The rising geriatric population, government initiatives supporting home-based healthcare, and insurance reimbursement policies for telemonitoring accelerate growth. Fitness and wellness tracking, while growing, remains secondary as RPM delivers higher clinical value by integrating wearable devices, telemedicine platforms, and AI analytics, providing healthcare providers actionable insights for improved patient outcomes.

Key Growth Drivers

Rising Adoption of Wearable and Remote Monitoring Devices

The growing adoption of wearable devices and remote patient monitoring solutions is a major growth driver in the Smart Healthcare Products Market. Increasing prevalence of chronic diseases, aging populations, and rising health awareness drive demand for continuous monitoring and early disease detection. Integration of wearable sensors with mobile applications and cloud-based platforms enables real-time data collection and patient engagement. This seamless connectivity empowers healthcare providers to make informed decisions, reduces hospital readmissions, and enhances preventive care, significantly contributing to market expansion.

- For instance, Abbott’s FreeStyle Libre sensor, worn on the upper arm for 14 days, measures glucose levels continuously and transfers 8 hours of data per scan without finger pricks. The reader displays current readings, trends, and stores up to 90 days of data for real-time graphs.

Technological Advancements in AI, IoT, and Robotics

Advancements in Artificial Intelligence (AI), Internet of Things (IoT), and robotics are accelerating the Smart Healthcare Products Market. AI-driven predictive analytics, IoT-enabled remote monitoring, and robotic-assisted procedures enhance healthcare efficiency, accuracy, and patient outcomes. These technologies facilitate personalized medicine, automated diagnostics, and seamless health data management. Healthcare providers increasingly adopt smart solutions to improve clinical workflows and patient care. The continuous innovation in these technologies is a critical driver, enabling scalable, connected, and intelligent healthcare ecosystems across developed and emerging markets.

- For instance, CloudMedX employs deep neural networks trained on 54 million patient encounters to generate risk assessment scores from medical data, outperforming physicians by 10% in mock clinical exams when used collaboratively.

Government Initiatives and Healthcare Digitization

Government initiatives promoting digital healthcare, telemedicine, and smart device adoption strongly support market growth. Policies facilitating reimbursement for remote monitoring, investments in health IT infrastructure, and regulatory support for connected devices encourage adoption of smart healthcare solutions. Increasing public–private collaborations and funding for IoT- and AI-based healthcare projects enable wide-scale deployment. These initiatives enhance accessibility, improve disease management, and reduce healthcare costs, driving the demand for smart healthcare products globally and creating a favorable environment for manufacturers and service providers to expand their offerings.

Key Trends & Opportunities

Integration of Smart Healthcare Products with Mobile Health Platforms

The integration of smart healthcare devices with mobile health (mHealth) platforms is a key trend offering substantial opportunities. Mobile applications provide real-time health tracking, personalized feedback, and remote clinician access, enhancing patient engagement. This trend enables seamless synchronization of wearable devices, telemedicine tools, and home monitoring systems, creating connected healthcare ecosystems. Increasing smartphone penetration and preference for digital health management amplify market potential. Manufacturers can capitalize on this trend by offering interoperable, user-friendly devices that connect across multiple healthcare platforms and improve patient adherence.

- For instance, Dexcom G7 shares glucose data with Apple Health on Apple devices, though with a three-hour delay for non-real-time viewing.

Emergence of Personalized and Preventive Healthcare Solutions

Smart healthcare products are increasingly being used to support personalized and preventive healthcare, presenting significant market opportunities. By leveraging AI, IoT, and wearable technologies, providers can offer tailored health insights, early disease detection, and individualized treatment plans. Consumers’ growing focus on wellness, fitness, and preventive care fuels demand for smart solutions that monitor vitals, track lifestyle metrics, and support remote care. Companies developing predictive analytics and personalized monitoring devices can tap into this expanding segment, catering to both clinical and consumer health applications.

- For instance, Apple Watch’s ECG app enables users to record electrocardiograms for AFib assessment. Clinical trials show it achieves 98.3% sensitivity and 99.6% specificity in classifying AFib versus sinus rhythm among classifiable recordings.

Key Challenges

Data Privacy and Security Concerns

Data privacy and cybersecurity challenges pose a significant obstacle for the Smart Healthcare Products Market. The transmission of sensitive patient information through wearable devices, IoT sensors, and cloud platforms increases vulnerability to breaches and unauthorized access. Compliance with stringent regulations, such as HIPAA and GDPR, is complex and resource-intensive. Concerns over data misuse and patient confidentiality may slow adoption, particularly in regions with strict regulatory environments. Manufacturers must invest in robust security frameworks, encryption, and secure interoperability to maintain trust and ensure market growth.

High Cost of Advanced Healthcare Devices

The high cost of smart healthcare devices and associated infrastructure limits widespread adoption, especially in developing regions. Wearables, telemedicine systems, and AI-integrated devices require substantial investment for procurement, integration, and maintenance. Small healthcare providers and individual consumers may face affordability constraints, restricting market penetration. Additionally, ongoing software updates and training further increase total costs. Price sensitivity and limited reimbursement mechanisms challenge manufacturers to balance innovation with cost-effectiveness, necessitating strategies that improve accessibility while maintaining technological sophistication.

Regional Analysis

North America

North America leads the Smart Healthcare Products Market with a market share of 36.2% in 2024, driven by advanced healthcare infrastructure, high adoption of wearable and telemedicine devices, and supportive government initiatives. The United States dominates the region, fueled by rising chronic disease prevalence, growing geriatric population, and strong investment in AI- and IoT-enabled healthcare solutions. Canada’s increasing focus on remote patient monitoring further supports regional growth. Key players actively collaborate with hospitals and technology providers to expand connected healthcare networks, ensuring seamless data management and enhanced patient outcomes, reinforcing North America’s leadership position in the global market.

Europe

Europe holds a market share of 27.4% in 2024 in the Smart Healthcare Products Market, driven by widespread adoption of digital health technologies and strong regulatory frameworks. Countries like Germany, the UK, and France lead the region with investments in telemedicine, wearable devices, and smart home healthcare solutions. The rising demand for personalized medicine and preventive care, coupled with supportive reimbursement policies, enhances market growth. Integration of AI, IoT, and robotics in hospitals and clinics is increasing efficiency and patient care quality. European manufacturers are expanding partnerships and innovative product launches, strengthening the region’s position in smart healthcare globally.

Asia-Pacific

Asia-Pacific accounts for 28.5% market share in 2024, driven by rising healthcare awareness, expanding middle-class populations, and increasing smartphone penetration facilitating mobile health solutions. China, Japan, and India are key contributors, with rapid adoption of wearable devices, home monitoring systems, and telemedicine platforms. Government initiatives promoting digital healthcare, investments in IoT infrastructure, and the rising prevalence of chronic diseases further fuel market growth. The region presents significant opportunities for manufacturers to develop cost-effective smart healthcare solutions for emerging markets. Rising consumer inclination towards preventive care and fitness tracking continues to boost adoption across urban and semi-urban areas.

Latin America

Latin America holds a market share of 4.7% in 2024, with Brazil and Mexico leading adoption of smart healthcare products. Growth is driven by increasing government support for telemedicine initiatives, rising prevalence of chronic conditions, and growing healthcare digitization. Wearable devices and remote patient monitoring solutions are gaining traction as consumers increasingly seek convenient and accessible healthcare options. Market expansion is supported by collaborations between technology providers and hospitals to implement connected healthcare systems. However, challenges such as limited infrastructure in rural areas and cost sensitivity influence adoption rates. Strategic partnerships and affordable product offerings continue to enhance regional growth.

Middle East & Africa

Middle East & Africa represents a market share of 3.2% in 2024, led by the UAE, Saudi Arabia, and South Africa. Growth is supported by government initiatives promoting digital health, smart hospital projects, and increasing adoption of telemedicine and wearable healthcare solutions. Rising healthcare awareness, coupled with investment in IoT and AI-enabled healthcare infrastructure, fuels demand. The region presents opportunities in chronic disease management and fitness tracking. Challenges include disparities in healthcare access and limited technology penetration in certain areas. Strategic investments and public–private collaborations are driving adoption, establishing Middle East & Africa as an emerging market for smart healthcare products.

Market Segmentations:

By Type

- Wearable Devices

- Telemedicine Devices

- Home Health Monitoring Devices

- Smart Implants and Prosthetics

- Others

By Technology

- Internet of Things (IoT)

- Artificial Intelligence (AI) and Machine Learning (ML)

- Blockchain

- Robotics

- Others

By Application

- Health Data Storage

- Remote Patient Monitoring

- Fitness and Wellness Tracking

- Personalized Medicine

- Others

By End-User

- Hospitals and Clinics

- Home Care Settings

- Fitness and Wellness Centers

- Pharmaceuticals and Biotechnology Companies

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape of the Smart Healthcare Products Market features key players such as Abbott Laboratories, Apple Inc., Dexcom Inc., Cerner Corporation, Honeywell International Inc., Fitbit Inc., Olympus Corporation, Athenahealth, Airstrip, and BioTelemetry Inc. These companies focus on innovation, strategic collaborations, and technology integration to strengthen their market presence. Product launches in wearable devices, telemedicine platforms, and home health monitoring solutions drive differentiation, while investments in AI, IoT, and cloud-based healthcare analytics enhance value propositions. Partnerships with hospitals, insurers, and tech providers facilitate broader adoption of connected healthcare ecosystems. Regional expansions, mergers, and acquisitions enable penetration into emerging markets. Continuous research and development efforts, coupled with regulatory compliance, allow players to maintain technological leadership, improve patient outcomes, and capitalize on the growing demand for personalized and remote healthcare solutions globally.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2025, Samsung Electronics announced the acquisition of Xealth, a healthcare integration platform that unifies digital health tools from wearables with clinical data for enhanced preventive care and real-time patient monitoring.

- In November 2024, Dexcom and ŌURA announced a strategic partnership to integrate Dexcom glucose biosensor data with the Oura Ring and App, enhancing holistic metabolic health tracking for users.

- In December 2025, Included Health launched an AI-powered personal health assistant named Dot to provide on‑demand health support by leveraging medical data and clinician escalation features.

Report Coverage

The research report offers an in-depth analysis based on Type, Technology, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of wearable devices and remote monitoring solutions will continue to grow globally.

- Integration of AI and IoT technologies will enhance predictive diagnostics and personalized care.

- Telemedicine and home healthcare solutions will expand, improving access to medical services.

- Increasing focus on preventive healthcare will drive demand for smart health monitoring devices.

- Expansion of mobile health platforms will facilitate seamless data sharing and patient engagement.

- Chronic disease management will remain a key driver for smart healthcare product adoption.

- Partnerships between technology providers and healthcare institutions will strengthen market reach.

- Regulatory support and government initiatives will accelerate digital healthcare adoption.

- Development of cost-effective solutions will enable wider adoption in emerging regions.

- Continuous innovation in robotics, sensors, and AI analytics will shape future market growth.