Market Overview

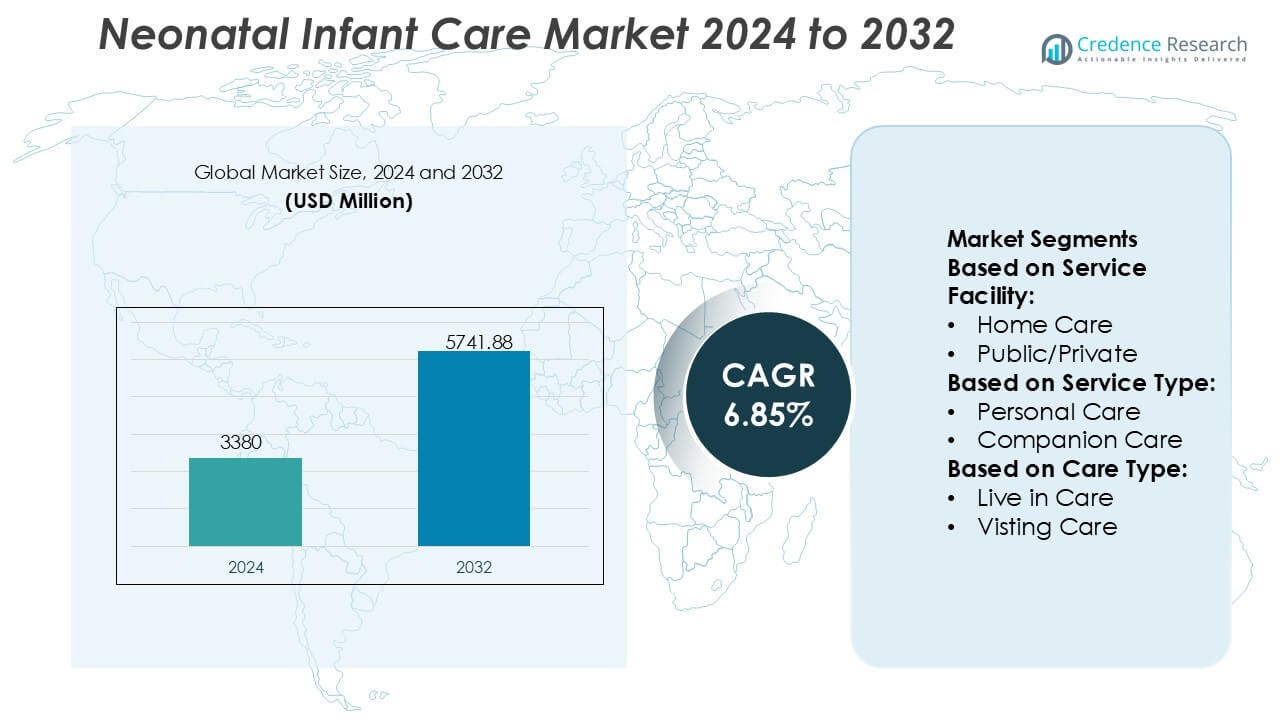

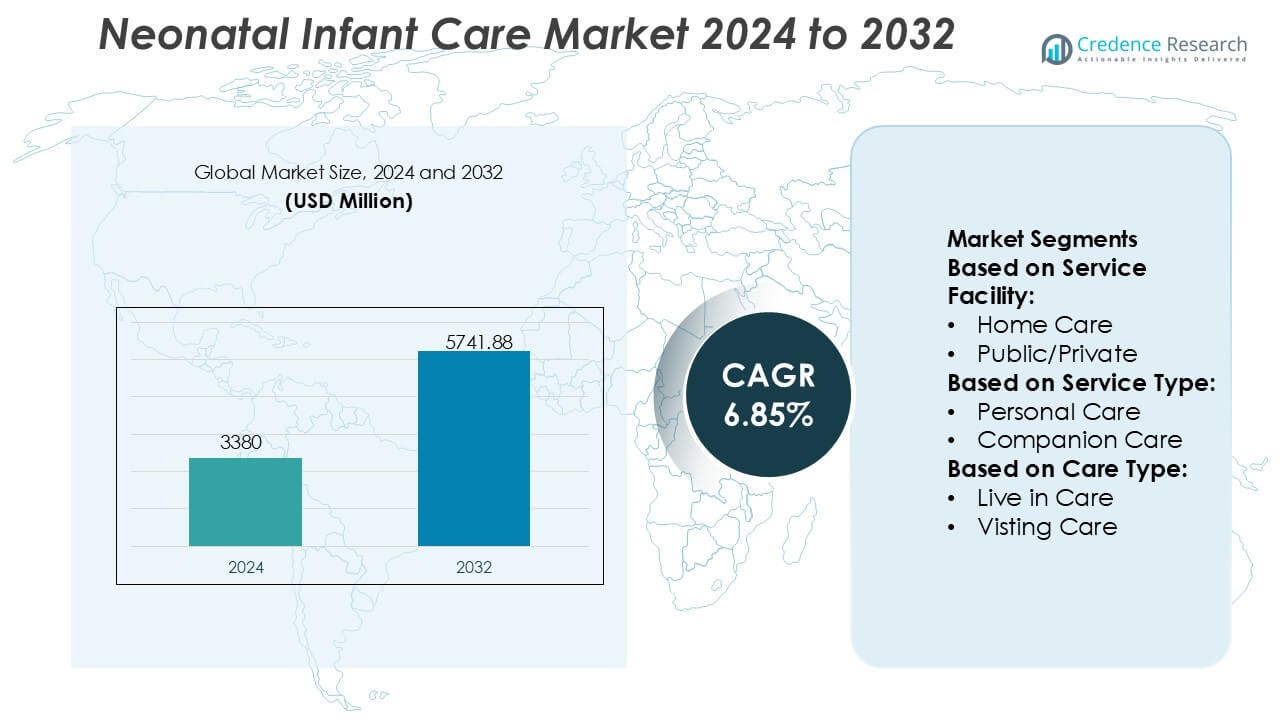

Neonatal Infant Care Market size was valued USD 3380 million in 2024 and is anticipated to reach USD 5741.88 million by 2032, at a CAGR of 6.85% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Neonatal Infant Care Market Size 2024 |

USD 3380 Million |

| Neonatal Infant Care Market, CAGR |

6.85% |

| Neonatal Infant Care Market Size 2032 |

USD 5741.88 Million |

The neonatal infant care market is led by a group of established global players that compete through strong brand portfolios, product safety, and wide distribution reach across infant nutrition, hygiene, skin care, and care accessories. Companies such as Johnson & Johnson, Kimberly-Clark Corporation, The Procter & Gamble Company, Nestlé S.A., Unilever, Beiersdorf AG, Chicco, Britax, Dorel Industries, and Fujian Hengan Group focus on innovation, regulatory compliance, and hospital as well as retail penetration to strengthen market presence. Competitive strategies emphasize gentle formulations, clinically tested products, and sustainable packaging to address evolving parental expectations. Regionally, North America dominates the neonatal infant care market with an exact 38% market share, supported by advanced healthcare infrastructure, high NICU adoption, strong reimbursement systems, and early uptake of premium neonatal care solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The neonatal infant care market was valued at USD 3,380 million in 2024 and is projected to reach USD 5,741.88 million by 2032, expanding at a CAGR of 6.85% during the forecast period.

- Market growth is driven by rising preterm births, higher NICU admissions, and increasing parental focus on infant safety, hygiene, nutrition, and early-life health outcomes.

- Product-based competition remains strong, with hygiene and diaper care products holding the dominant segment share of about 44%, supported by high consumption frequency and continuous product innovation.

- The competitive landscape features established global brands leveraging product safety, clinical validation, sustainable packaging, and strong hospital and retail distribution networks to maintain market positioning.

- North America leads with an exact 38% regional market share, supported by advanced healthcare infrastructure, high NICU penetration, favorable reimbursement frameworks, and early adoption of premium neonatal care solutions.

Market Segmentation Analysis:

By Service Facility

The service facility segment shows strong differentiation between home care and public/private institutional care. Public and private healthcare facilities dominate this segment, accounting for an estimated 62% market share, driven by the concentration of neonatal intensive care units (NICUs), access to advanced monitoring equipment, and availability of specialized neonatologists and nursing staff. These facilities manage high-risk and preterm infants requiring continuous clinical supervision. However, home care services continue to expand steadily, supported by shorter hospital stays, improved portable medical devices, and growing parental preference for post-discharge neonatal support in familiar home environments.

- For instance, Beiersdorf’s commitment to these standards specifically using ingredients like Pro-Vitamin B5, Shea Butter, and Calendula is designed to help strengthen the infant skin barrier from birth.

By Service Type

By service type, personal care emerges as the dominant sub-segment with an estimated 41% market share, reflecting its critical role in feeding support, hygiene management, vital sign observation, and basic clinical assistance for newborns. Demand rises due to increasing premature birth rates and heightened awareness of early neonatal health management. Companion care and homemaking services support family well-being, while rehabilitation and recovery services gain traction for infants with developmental risks. Growth across this segment is driven by holistic care models that integrate medical and non-medical support to improve neonatal outcomes.

- For instance, Maxi-Cosi is a global leader in infant transport, having carried over 60 million babies home from birth. Its products are a standard part of “first ride home” scenarios and at-home infant care.

By Care Type

The care type segment is led by visiting care, holding an estimated 48% market share, supported by its flexibility, cost efficiency, and suitability for routine neonatal monitoring and parental guidance. Visiting care allows trained professionals to deliver scheduled support without long-term residential arrangements, aligning well with urban family structures. Live-in care serves complex or high-dependency cases requiring continuous attention, while respite care addresses caregiver fatigue and short-term relief needs. Segment growth is driven by rising nuclear families, increasing maternal employment, and the need for scalable, adaptable neonatal care solutions.

Key Growth Drivers

Rising Preterm Births and Neonatal Morbidity

Increasing rates of preterm births, low birth weight, and neonatal complications continue to drive demand for specialized neonatal infant care services and equipment. Healthcare systems prioritize early intervention to reduce mortality and long-term developmental risks, which accelerates adoption of advanced neonatal intensive care, respiratory support, and monitoring solutions. Improved survival rates among premature infants further extend care duration and intensity. Governments and healthcare providers also expand neonatal care capacity to manage growing caseloads, reinforcing sustained demand across hospitals, specialized neonatal units, and post-discharge care settings.

- For instance, Nestlé S.A. has documented that its PreNAN® preterm infant formula delivers approximately 2.9 g of protein per 100 kcal and an energy density of 80 kcal per 100 mL, specifications designed to support accelerated catch-up growth in very-low-birth-weight infants.

Advancements in Neonatal Medical Technology

Continuous innovation in neonatal care technologies significantly supports market growth. Modern incubators, non-invasive ventilation systems, smart monitors, and integrated clinical information platforms enhance care precision and safety for vulnerable infants. These technologies enable real-time monitoring of vital parameters, early detection of complications, and improved clinical outcomes. Automation and digital integration also reduce caregiver workload and human error. Healthcare facilities increasingly invest in technologically advanced neonatal solutions to meet clinical standards, improve survival rates, and comply with evolving regulatory and quality-of-care requirements.

- For instance, Chicco (Artsana Group) has engineered its neonatal-grade digital monitoring and thermometry devices with clinically validated accuracy of ±0.1 °C in the 35.0–39.0 °C range.

Expansion of Healthcare Infrastructure and NICU Capacity

Public and private investment in healthcare infrastructure strongly influences neonatal infant care market expansion. Many countries prioritize the development of neonatal intensive care units, maternal–child health centers, and specialized referral hospitals. Capacity expansion supports higher admission volumes and broader access to advanced neonatal services. Favorable reimbursement policies and government-backed maternal and child health programs further encourage infrastructure development. Growing awareness among parents regarding quality neonatal care also drives demand for well-equipped facilities and trained professionals, strengthening long-term market growth.

Key Trends & Opportunities

Growth of Home-Based and Post-Discharge Neonatal Care

Home-based neonatal care is emerging as a key opportunity, supported by advances in portable monitoring devices and telehealth platforms. Early discharge programs increasingly rely on remote monitoring, visiting care services, and caregiver training to maintain continuity of care. This approach reduces hospital burden, lowers costs, and improves family-centered care experiences. Providers expand home care offerings to support stable preterm infants and those requiring extended recovery, creating new service models and revenue streams within the neonatal infant care ecosystem.

- For instance, Unilever has implemented over 500 AI-based capabilities worldwide that span supply chain planning, logistics, consumer insights and predictive analytics.

Integration of Digital Health and Tele-Neonatology

Digital health adoption continues to reshape neonatal care delivery. Tele-neonatology platforms enable remote consultations, clinical decision support, and real-time data sharing between tertiary hospitals and regional care centers. These solutions improve access to specialist expertise, particularly in underserved regions. Data analytics and AI-assisted monitoring tools also enhance predictive care and early intervention. Healthcare providers increasingly view digital integration as a strategic opportunity to improve outcomes, optimize resource utilization, and standardize neonatal care protocols across networks.

- For instance, Johnson & Johnson reported that over 33,000 employees completed generative AI training as part of a structured roll-out of AI capabilities across the enterprise’s health and operational functions, illustrating the company’s internal investment in scaling data-driven digital health solutions that support predictive analytics and clinical decision support workflows.

Rising Focus on Family-Centered and Developmental Care Models

Neonatal care increasingly emphasizes developmental and family-centered approaches that support both clinical outcomes and parental involvement. Practices such as skin-to-skin care, personalized nutrition plans, and supportive caregiving environments gain wider adoption. Hospitals invest in staff training and facility redesign to accommodate these models. This trend creates opportunities for specialized services, caregiver education programs, and supportive technologies that enhance infant development while improving parent satisfaction and engagement throughout the care journey.

Key Challenges

High Cost of Advanced Neonatal Care Services

The high cost associated with neonatal intensive care remains a major challenge for the market. Advanced medical equipment, specialized infrastructure, and highly trained professionals significantly increase operational expenses. In many regions, limited reimbursement coverage and budget constraints restrict access to comprehensive neonatal services. Smaller hospitals and rural facilities often struggle to afford advanced technologies, leading to disparities in care quality. Cost pressures also affect long-term sustainability for providers, particularly in markets with price-sensitive healthcare systems.

Shortage of Skilled Neonatal Healthcare Professionals

A persistent shortage of trained neonatologists, neonatal nurses, and respiratory therapists constrains market growth. Neonatal care requires specialized clinical expertise and continuous training, which limits workforce availability. High workload intensity and burnout further exacerbate staffing challenges. This shortage affects care quality, increases operational risks, and restricts capacity expansion. Healthcare providers must invest in training, retention programs, and workflow optimization to address workforce gaps and ensure consistent delivery of high-quality neonatal infant care services.

Regional Analysis

North America

North America leads the neonatal infant care market with an exact 38% share, supported by advanced healthcare infrastructure, high neonatal intensive care unit (NICU) penetration, and strong reimbursement frameworks. The region benefits from early adoption of advanced neonatal technologies, including smart monitoring systems and non-invasive respiratory support. High awareness of neonatal health, strong clinical protocols, and widespread availability of skilled professionals further strengthen market leadership. Government-backed maternal and child health programs, along with sustained investment by private healthcare providers, continue to enhance neonatal care quality and service accessibility across the region.

Europe

Europe accounts for an exact 27% share of the neonatal infant care market, driven by universal healthcare systems and strong regulatory emphasis on maternal and neonatal outcomes. Countries across Western and Northern Europe maintain well-established NICU networks and standardized neonatal care protocols. Rising focus on developmental and family-centered care models supports service expansion. Public funding for neonatal services and continuous upgrades of hospital infrastructure further contribute to steady growth. Eastern European markets also show improving access to neonatal care, supported by healthcare modernization initiatives and increasing government investment.

Asia-Pacific

Asia-Pacific holds an exact 25% share and represents the fastest-growing regional market for neonatal infant care. High birth rates, rising preterm deliveries, and improving access to hospital-based care drive strong demand. Rapid expansion of healthcare infrastructure in countries such as China, India, and Southeast Asian nations supports market growth. Governments increasingly prioritize maternal and child health programs, while private healthcare providers expand NICU capacity. Growing urbanization, rising healthcare spending, and increasing awareness of neonatal outcomes continue to strengthen the region’s long-term growth potential.

Latin America

Latin America accounts for an exact 6% share of the neonatal infant care market, supported by gradual improvements in healthcare infrastructure and neonatal survival initiatives. Public healthcare systems dominate service delivery, while private hospitals increasingly invest in advanced neonatal equipment and specialized care units. Government programs aimed at reducing infant mortality encourage expansion of neonatal services. However, access disparities between urban and rural areas persist. Ongoing investments in maternal healthcare, training of neonatal professionals, and modernization of hospital facilities are expected to support steady regional progress.

Middle East & Africa

The Middle East & Africa region holds an exact 4% share of the neonatal infant care market, reflecting uneven healthcare development across countries. Gulf nations lead regional adoption due to strong healthcare investment, modern hospitals, and advanced neonatal technologies. In contrast, parts of Africa face limited access to specialized neonatal care due to infrastructure and workforce constraints. International aid programs and government-led maternal health initiatives support gradual improvements. Expanding private healthcare participation and increased focus on reducing neonatal mortality continue to drive incremental market growth.

Market Segmentations:

By Service Facility:

By Service Type:

- Personal Care

- Companion Care

By Care Type:

- Live in Care

- Visting Care

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The neonatal infant care market players such as Beiersdorf AG, Dorel Industries, Nestlé S.A., Chicco, Kimberly-Clark Corporation, Fujian Hengan Group, Britax, Unilever, Johnson & Johnson, The Procter & Gamble Company. The neonatal infant care market exhibits a highly competitive landscape characterized by continuous product innovation, strong emphasis on safety standards, and broadening service and distribution networks. Market participants compete by expanding portfolios across infant nutrition, hygiene, skin care, feeding, and safety solutions tailored to neonatal requirements. Differentiation centers on clinically validated products, gentle formulations, and materials designed to protect sensitive neonatal skin and health. Companies prioritize compliance with stringent regulatory frameworks while investing in research, quality assurance, and branding. Strategic focus also includes expansion into emerging markets, partnerships with healthcare providers, and adoption of sustainable practices. Growing parental awareness, demand for premium care solutions, and rising expectations for product transparency continue to intensify competition and shape long-term market dynamics.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In May 2025, Philips and March of Dimes announced a collaboration aimed at improving maternal health education through the Philips Avent Pregnancy+ app. Under the partnership, Philips will integrate essential March of Dimes content into the app to help improve health literacy and create awareness for topics such as preparing for a Neonatal Intensive Care Unit (NICU) stay, preterm birth, and vaccinations. This initiative is expected to improve the awareness regarding overall maternal and infant health.

- In October 2024, Dräger India announced the launch of the BabyRoo TN 300 open warmer. The product comes with state-of-the-art thermoregulation capabilities as well as advanced integrated technologies to support emergency resuscitation and family-centered care. This development enabled the company to improve its presence in the Indian market.

- In February 2024, The Health Department of Karnataka has started providing neonatal ambulance services. While Karnataka offers a multi-tiered infant care system, with specialist intervention frequently requiring transit to higher-level facilities with sophisticated capabilities, essential care is provided at designated birth locations.

- In February 2024, The Paediatric Neuroimaging Group released a series of animations at the Department of Paediatrics to help parents better understand how premature infants’ developing brains affect respiration and apneas, or the stopping of breathing.

Report Coverage

The research report offers an in-depth analysis based on Service Facility, Service Type, Care Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for advanced neonatal care services will increase due to rising preterm births and improved survival rates.

- Healthcare providers will continue expanding neonatal intensive care unit capacity across public and private facilities.

- Adoption of non-invasive monitoring and respiratory support technologies will accelerate to improve safety and outcomes.

- Home-based and post-discharge neonatal care services will gain wider acceptance and integration.

- Digital health platforms and tele-neonatology solutions will support remote monitoring and specialist access.

- Family-centered and developmental care models will become standard practice in neonatal settings.

- Training and upskilling of neonatal healthcare professionals will receive greater institutional focus.

- Emerging economies will witness faster expansion of neonatal care infrastructure and services.

- Sustainability and safety compliance will increasingly influence product design and procurement decisions.

- Collaboration between healthcare providers, technology developers, and caregivers will strengthen care continuity.