Market Overview

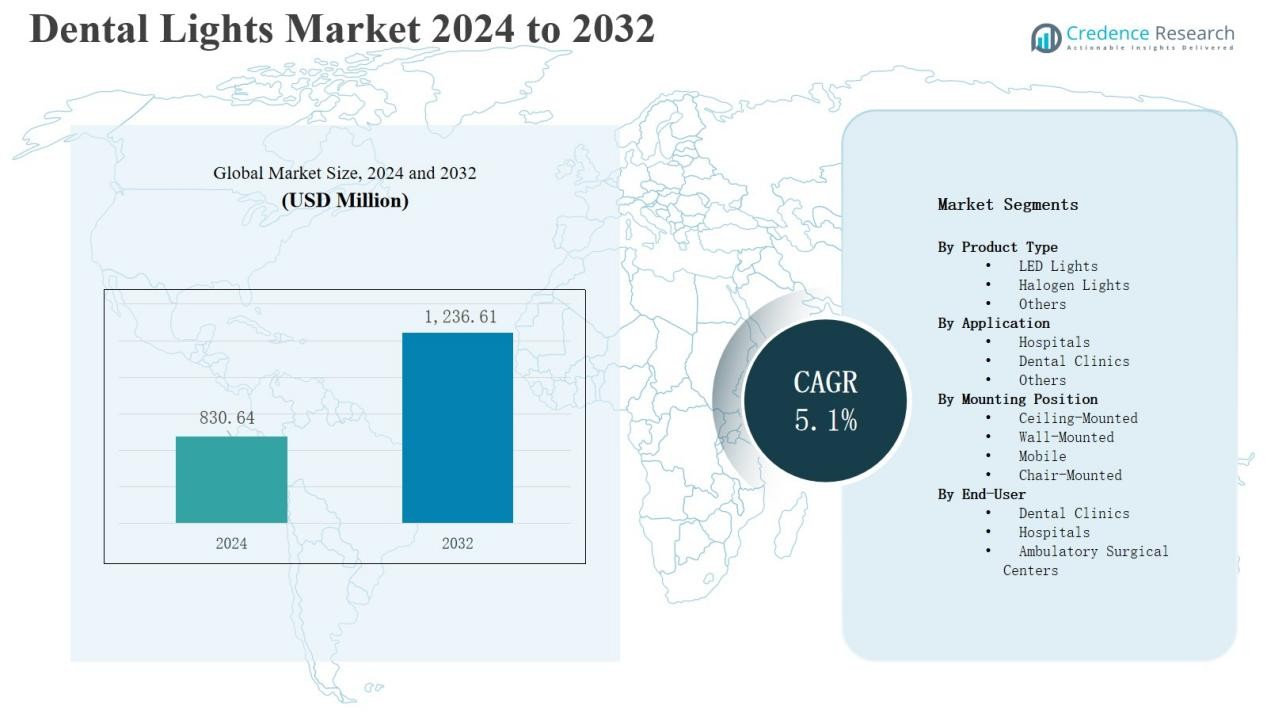

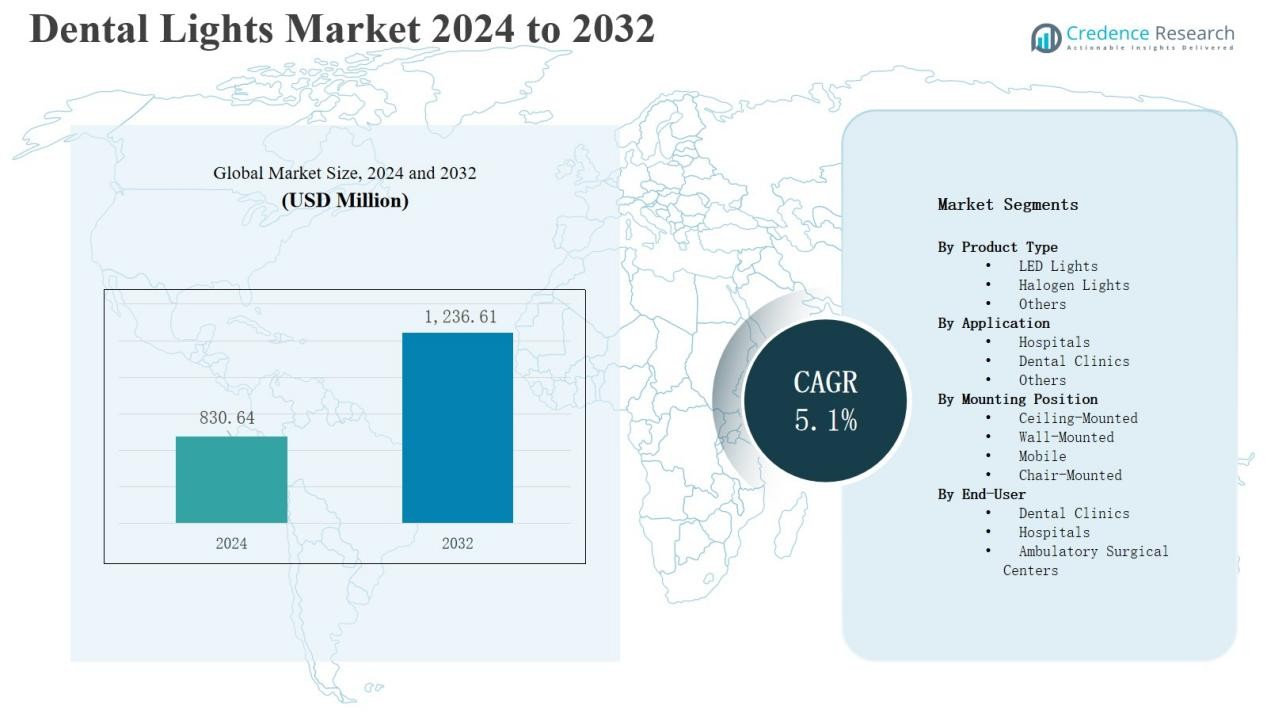

Dental Lights Market size was valued at USD 830.64 million in 2024 and is anticipated to reach USD 1,236.61 million by 2032, at a CAGR of 5.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dental Lights Market Size 2024 |

USD 830.64 Million |

| Dental Lights Market, CAGR |

5.1% |

| Dental Lights Market Size 2032 |

USD 1,236.61 Million |

The Dental Lights Market features strong competition among key players such as Midmark Corporation, Dentsply Sirona, Planmeca Group, A-dec Inc., 3M Company, DentalEZ, Inc., Ultradent Products, Inc., GC Corporation, KaVo Dental GmbH, and Danaher Corporation. These companies focus on LED innovation, ergonomic designs, and sustainable lighting systems to enhance clinical performance and energy efficiency. Strategic partnerships, product upgrades, and global distribution expansion strengthen their market presence. North America leads the Dental Lights Market with a 36% share in 2024, driven by advanced dental infrastructure, strong regulatory frameworks, and rapid adoption of modern LED lighting technologies across clinics and hospitals.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Dental Lights Market was valued at USD 830.64 million in 2024 and is projected to reach USD 1,236.61 million by 2032, growing at a CAGR of 5.1%.

- The LED lights segment dominates with 68% share in 2024, driven by superior illumination, energy efficiency, and longer lifespan over halogen alternatives.

- Dental clinics account for 57% of market share, supported by rising private clinic establishments, modern equipment upgrades, and growing focus on patient comfort.

- Ceiling-mounted lights lead with 44% share due to better illumination coverage, ergonomic design, and integration with digital dental systems.

- North America holds the largest regional share of 36% in 2024, supported by advanced dental infrastructure, early LED adoption, and strong regulatory standards.

Market Segment Insights

By Product Type

The LED lights segment dominates the Dental Lights Market, accounting for 68% of total revenue in 2024. It leads due to superior energy efficiency, longer lifespan, and better illumination quality compared to halogen models. Dental professionals prefer LED lights for their reduced heat emission and improved visibility during procedures. Growing adoption of eco-friendly lighting solutions and declining LED costs further support this dominance, driving continuous replacement of traditional halogen units across dental facilities worldwide.

- For instance, A-dec Inc. expanded its A-dec 500 LED light line, improving brightness control and energy efficiency through optimized optical lens engineering for ergonomic procedures.

By Application

Dental clinics hold the largest share in the Dental Lights Market, representing 57% in 2024. This dominance stems from rising establishment of private clinics and increasing dental care awareness. Clinics demand advanced lighting systems that enhance precision and reduce operator fatigue. The trend toward aesthetic dentistry and digital workflow integration also drives clinic upgrades to modern lighting technologies. Hospitals and academic institutions follow, supported by growing focus on patient comfort and improved clinical efficiency.

- For instance, Midmark upgraded its LED Dental Lighting System with motion-activated controls, enhancing workflow efficiency and patient comfort in high-volume dental clinics.

By Mounting Position

Ceiling-mounted lights lead the Dental Lights Market, accounting for 44% of total revenue in 2024. Their dominance is attributed to better illumination coverage, ergonomic flexibility, and space optimization in dental operatories. These systems support adjustable positioning for complex procedures and integrate easily with digital dental units. Increasing modernization of dental clinics and preference for fixed, hygienic, and durable setups continue to strengthen demand for ceiling-mounted lights over mobile or chair-mounted alternatives.

Key Growth Drivers

Rising Demand for Advanced Dental Equipment

The Dental Lights Market grows with the increasing adoption of advanced dental equipment in clinics and hospitals. Dental practitioners prefer modern lighting systems that offer precision, color accuracy, and reduced glare for complex procedures. Growing awareness of oral health and the rising number of dental treatments also stimulate demand. Continuous technological upgrades and integration with digital imaging further enhance workflow efficiency, encouraging clinics to replace outdated lighting systems with energy-efficient LED models.

- For instance, Midmark Corporation launched an LED dental light model featuring a wired connection for power and data, with various permanent mounting options (including ceiling, wall, track, and chair mounts) for use within a single operatory room.

Expansion of Dental Clinics and Healthcare Infrastructure

The rapid expansion of dental clinics and hospital infrastructure boosts the Dental Lights Market. Urbanization and growing disposable incomes have led to higher spending on dental care services. Private practitioners and corporate dental chains are investing in modern equipment to improve patient comfort and service quality. Emerging economies, especially in Asia-Pacific and Latin America, are witnessing increased dental infrastructure investments, creating steady demand for ceiling- and wall-mounted lighting systems across both private and institutional settings.

- For instance, Mexico’s dental sector is growing with a shift toward private dental care supported by insurance and medical tourism, leading to increased investments in modern dental clinics equipped with state-of-the-art lighting solutions that enhance clinical visibility and patient comfort in both private and institutional facilities.

Shift Toward Energy-Efficient and Eco-Friendly Solutions

Energy efficiency is a key growth driver for the Dental Lights Market. LED-based lights consume less power, generate minimal heat, and offer longer service life compared to halogen lights. Governments and healthcare institutions are promoting sustainable lighting adoption to reduce operational costs and environmental impact. The shift aligns with global efforts toward green healthcare practices. Manufacturers are also investing in recyclable materials and low-UV emission designs, appealing to environmentally conscious dental professionals and facility managers.

Key Trends & Opportunities

Integration of Smart and Sensor-Based Technologies

Smart and sensor-based lighting systems are a growing trend in the Dental Lights Market. These lights offer motion detection, touchless control, and brightness adjustment, enhancing hygiene and workflow efficiency. Integration with digital dental units enables precise light intensity control and data tracking. The trend supports ergonomic design and operator comfort while reducing energy waste. Companies focusing on AI-enabled illumination systems and wireless connectivity are expected to gain competitive advantages in premium dental setups.

- For instance, A-dec’s 500 LED dental light features touchless activation combined with three intensity settings (15,000 to 30,000 lux) and auto on/off functions that contribute to aseptic protocols and ergonomic use.

Rising Demand in Emerging Markets

Emerging markets present strong opportunities for Dental Lights Market expansion. Countries in Asia-Pacific, the Middle East, and Africa are experiencing rising healthcare expenditure and government-backed oral health programs. The growing middle-class population and increasing dental tourism further create demand for advanced lighting solutions. Manufacturers are expanding distribution networks and offering cost-effective LED models to attract local buyers. These regions also witness strong adoption of modern dental infrastructure, driving long-term growth potential.

- For instance, Planmeca Oy expanded its distribution partnerships across the UAE and Saudi Arabia for the Planmeca Solanna Vision, featuring an integrated 4K camera for precision lighting in cosmetic dentistry.

Key Challenges

High Initial Installation and Maintenance Costs

The high cost of advanced LED lighting systems poses a major challenge for market expansion. Small clinics and developing regions often prefer low-cost halogen options due to limited budgets. Although LEDs offer long-term savings, the upfront investment for installation, control systems, and maintenance discourages adoption. Manufacturers face the challenge of offering affordable solutions without compromising quality. Reducing component costs and offering financing options may help mitigate this barrier to market penetration.

Limited Awareness and Training Among Practitioners

A lack of awareness and technical training among dental professionals restricts the optimal use of modern lighting systems. Many practitioners still rely on traditional halogen lights due to familiarity and minimal technical understanding. Limited knowledge about light color temperature, illumination angles, and ergonomic benefits hinders adoption. Training programs and manufacturer-led workshops can bridge this gap, ensuring dental practitioners leverage advanced lighting for improved diagnostic accuracy and procedural comfort.

Product Standardization and Regulatory Compliance

Stringent regulatory standards and lack of uniform product specifications challenge manufacturers in the Dental Lights Market. Each region enforces different safety and performance certifications, complicating global product distribution. Compliance with medical lighting standards, electromagnetic safety, and sterilization guidelines increases development costs and approval timelines. Manufacturers must invest in R&D and testing to meet diverse requirements. Streamlining certification processes and harmonizing standards can help improve product accessibility and global competitiveness.

Regional Analysis

North America

North America dominates the Dental Lights Market, holding 36% of total revenue in 2024. Strong dental care infrastructure, high awareness of oral hygiene, and early adoption of advanced technology drive regional growth. The United States leads with widespread installation of LED-based lights across private clinics and hospital facilities. Regulatory standards promoting patient safety and ergonomic designs also strengthen product demand. Major manufacturers and distributors operate actively across this region, enhancing availability and service support. The growing preference for energy-efficient systems continues to sustain steady expansion.

Europe

Europe accounts for 29% of the global Dental Lights Market in 2024. It benefits from a well-established dental healthcare system and continuous modernization of clinical facilities. Countries such as Germany, the United Kingdom, and France lead the demand due to high professional adoption rates. The focus on eco-friendly lighting and strict compliance with medical device regulations supports LED product penetration. Growing investments in dental education and infrastructure development strengthen regional demand. Leading European brands also influence product innovation and export activity.

Asia-Pacific

Asia-Pacific holds 23% share of the Dental Lights Market in 2024 and represents the fastest-growing region. Rapid urbanization, rising disposable incomes, and expanding dental tourism contribute to growth. China, Japan, and India witness strong demand driven by new clinic establishments and government oral health initiatives. Increasing awareness of advanced dental procedures supports market expansion. The region attracts global manufacturers setting up production bases to reduce costs. It continues to show strong momentum due to affordable LED solutions and healthcare modernization.

Latin America

Latin America captures 7% share of the Dental Lights Market in 2024. Market growth is supported by expanding private dental practices and gradual modernization of public healthcare systems. Brazil and Mexico lead due to increased dental treatment adoption and infrastructure upgrades. The demand for affordable and durable lighting systems remains strong among small and mid-sized clinics. Manufacturers are targeting the region with cost-effective LED models. Rising focus on oral health programs strengthens long-term market development.

Middle East & Africa

The Middle East & Africa hold 5% of the global Dental Lights Market in 2024. Growth is driven by expanding hospital infrastructure and government efforts to enhance dental care accessibility. The UAE and Saudi Arabia lead adoption due to modern healthcare facilities and dental tourism growth. African countries show potential with improving oral health awareness and international partnerships. The shift from halogen to LED lights gains momentum with new clinic setups. Market development remains steady with growing public-private healthcare collaboration.

Market Segmentations:

By Product Type

- LED Lights

- Halogen Lights

- Others

By Application

- Hospitals

- Dental Clinics

- Others

By Mounting Position

- Ceiling-Mounted

- Wall-Mounted

- Mobile

- Chair-Mounted

By End-User

- Dental Clinics

- Hospitals

- Ambulatory Surgical Centers

By Region

-

- Germany

- France

- UK

- Spain

- Italy

- Russia

- Nordics

-

- China

- India

- Japan

- South Korea

- ANZ

- Southeast Asia

- MEA

- UAE

- South Africa

- Saudi Arabia

Competitive Landscape

The Dental Lights Market is highly competitive, with global and regional players focusing on innovation, product quality, and distribution expansion. Key companies include Midmark Corporation, Ultradent Products, Inc., KaVo Dental GmbH, GC Corporation, Planmeca Group, A-dec Inc., DentalEZ, Inc., Dentsply Sirona, 3M Company, and Danaher Corporation. These firms compete through continuous technological upgrades, LED integration, and ergonomic product designs that enhance clinical precision and patient comfort. Strategic initiatives such as product launches, partnerships, and mergers strengthen their market reach. Manufacturers emphasize energy-efficient, sensor-controlled, and customizable lighting systems to meet evolving practitioner needs. Strong after-sales support and adherence to medical device regulations also help leading brands maintain customer trust and expand globally. Emerging players target cost-sensitive markets by offering affordable yet reliable solutions, intensifying competition across mid- and low-price segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Midmark Corporation

- Ultradent Products, Inc.

- KaVo Dental GmbH

- GC Corporation

- Planmeca Group

- A-dec Inc.

- DentalEZ, Inc.

- Dentsply Sirona

- 3M Company

- Danaher Corporation

Recent Developments

- In July 2025, Planmeca launched Romexis 7, featuring AI-powered imaging and implant planning tools to enhance clinical precision and workflow efficiency.

- In February 2024, A-dec introduced its Certified Pre-Owned Equipment program to provide affordable, high-quality solutions for dental clinics upgrading to newer models.

- In February 2024, Dentsply Sirona and A-dec expanded their collaboration by integrating Primescan Connect into A-dec delivery systems.

- In 2025, KaVo Dental launched its KaVo Luminatreatment light, promoting advanced luminaire innovation.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, Mounting Position, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of LED-based dental lights will continue to replace halogen models globally.

- Demand for energy-efficient and low-heat emission lighting systems will rise.

- Integration of smart sensors and motion-control features will expand in premium setups.

- Emerging markets in Asia-Pacific and Latin America will drive new installations.

- Manufacturers will focus on ergonomic designs that reduce operator fatigue.

- Government healthcare investments will support modernization of dental infrastructure.

- Wireless and touchless lighting controls will gain popularity for hygiene and convenience.

- Product innovation will emphasize adjustable color temperature and precision illumination.

- Strategic collaborations between dental equipment brands and clinics will strengthen distribution.

- Growing awareness of oral health and aesthetic dentistry will sustain long-term demand.