Market Overview

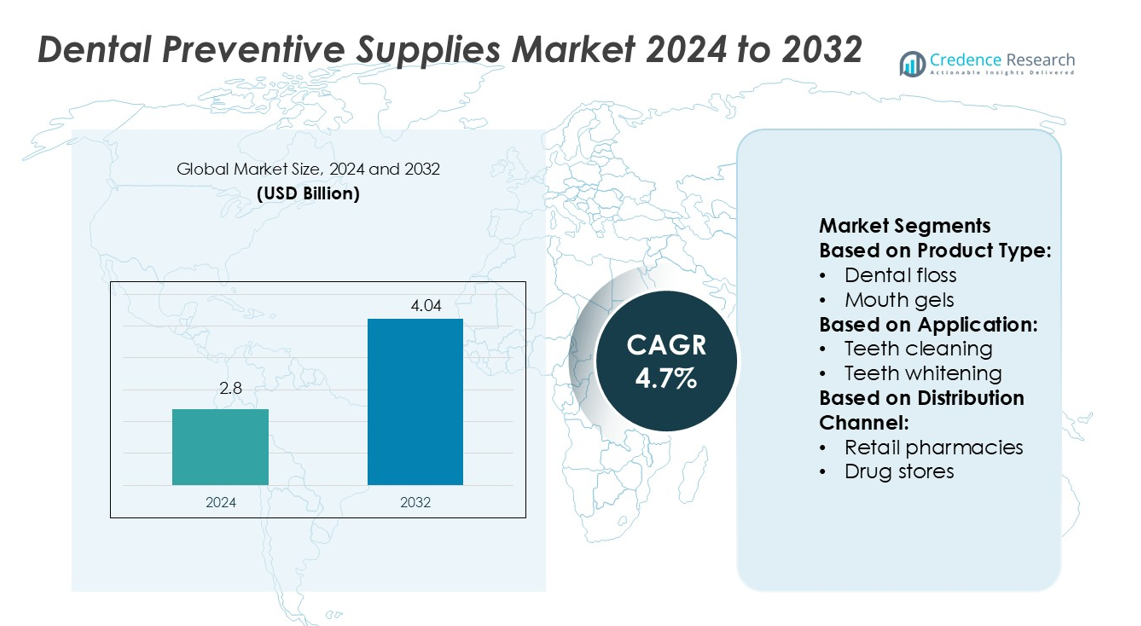

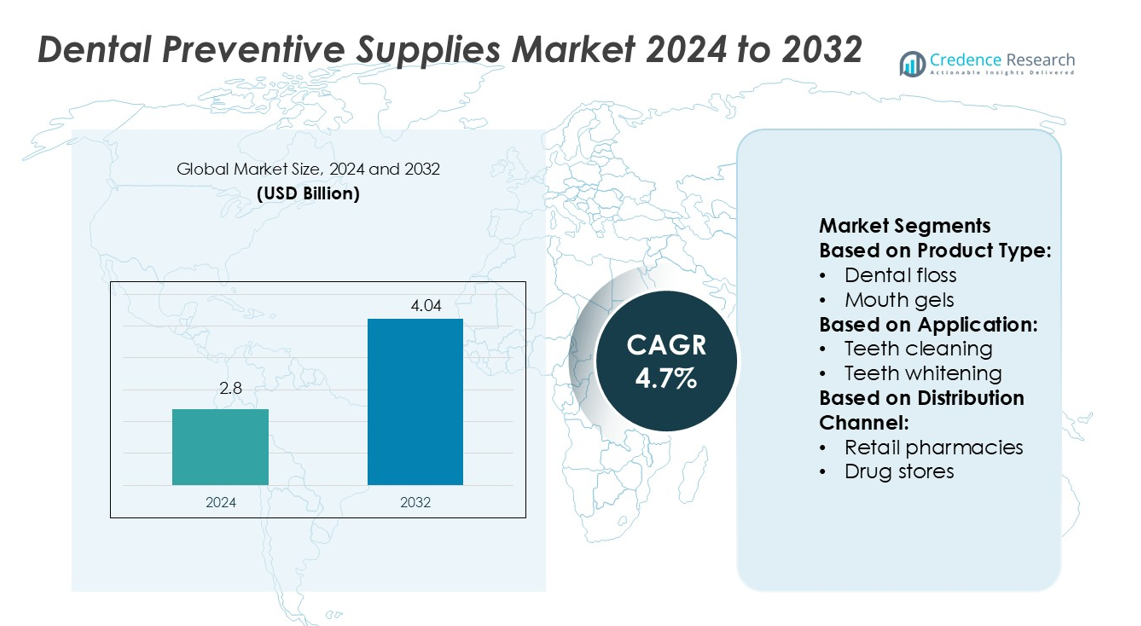

Dental Preventive Supplies Market size was valued USD 2.8 billion in 2024 and is anticipated to reach USD 4.04 billion by 2032, at a CAGR of 4.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dental Preventive Supplies Market Size 2024 |

USD 2.8 billion |

| Dental Preventive Supplies Market, CAGR |

4.7% |

| Dental Preventive Supplies Market Size 2032 |

USD 4.04 billion |

The Dental Preventive Supplies Market is shaped by major companies including Ivoclar Vivadent, Johnson & Johnson, Hu-Friedy Mfg. Co., LLC., Haleon, Colgate-Palmolive Company, 3M Company, Henry Schein, Inc., GC International AG, Church & Dwight Co., and Dentsply Sirona Inc. These players focus on developing advanced fluoride varnishes, whitening solutions, and sealants to strengthen their competitive positions. Strategic investments in R&D, sustainable formulations, and digital distribution are key strategies driving growth. North America leads the global market with a 34.5% share in 2025, supported by strong dental infrastructure, early adoption of preventive care, and a well-established retail pharmacy network.

Market Insights

- The Dental Preventive Supplies Market was valued at USD 2.8 billion in 2024 and is projected to reach USD 4.04 billion by 2032, growing at a CAGR of 4.7%.

- Strong demand for fluoride varnishes and whitening solutions is driving market growth, supported by rising preventive care awareness and expanding access to affordable dental products.

- E-commerce expansion, sustainable product development, and growing cosmetic dentistry trends are shaping market strategies and consumer behavior.

- The market is competitive, with major players focusing on innovation, strategic partnerships, and distribution expansion to strengthen their global presence.

- North America leads with a 34.5% share in 2025, followed by Europe at 28.3% and Asia Pacific at 24.7%, while dental fluorides and varnishes hold the largest segment share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Dental fluorides and varnish hold the largest share of the Dental Preventive Supplies Market, capturing 34.6% in 2025. This dominance is driven by rising awareness of fluoride’s role in preventing tooth decay and strengthening enamel. Fluoride treatments are widely adopted in preventive dental care programs and pediatric dentistry. Sealants and tooth whitening products are also seeing strong demand as patients focus more on oral aesthetics and long-term protection. Growing investments in dental hygiene campaigns and the launch of advanced fluoride-based formulations continue to boost this segment’s growth across developed and emerging markets.

- For instance, VOCO introduced its Profluorid Varnish system, which contains 22,600 ppm fluoride in a single-unit dose, enabling precise enamel protection and easier application in pediatric treatments.

By Application

Teeth cleaning remains the dominant application segment, accounting for 43.2% of the market share in 2025. Increased emphasis on oral hygiene and preventive care drives consistent demand for cleaning products such as fluoride varnishes, prophylactic pastes, and mouth gels. Dental professionals recommend routine cleanings to prevent plaque buildup and reduce caries risk. Teeth whitening and coating applications are also gaining popularity due to rising cosmetic dentistry trends. Expanding access to affordable preventive treatments in clinics and home-use kits further supports the segment’s strong position.

- For instance, Hu-Friedy launched its Harmony™ Ergonomic Scalers and Curettes, engineered with TrueFit™ Technology that analyzed 2,878,320 data points of pinch force and scaling pressure during development.

By Distribution Channel

Retail pharmacies dominate the distribution landscape, holding 39.7% of the market share in 2025. Consumers prefer pharmacies for trusted brands, easy availability, and professional recommendations. Drug stores follow closely, supported by strong penetration in urban and semi-urban regions. E-commerce is expanding rapidly, fueled by convenience, competitive pricing, and digital promotions. The growth of online dental care brands and subscription-based preventive kits is expected to further strengthen e-commerce’s role. However, retail pharmacies remain the primary channel for clinical-grade preventive dental supplies.

Key Growth Drivers

Rising Awareness of Preventive Oral Care

Growing awareness of preventive dental care is driving demand for dental fluorides, varnishes, and sealants. Governments and dental associations are promoting regular oral hygiene practices through campaigns and school programs. Patients are shifting focus from curative to preventive care, supporting steady product adoption. Dental professionals increasingly recommend fluoride varnishes and prophylactic pastes during routine checkups. This shift reduces long-term treatment costs and improves oral health outcomes. Strong educational efforts and expanding insurance coverage further accelerate product penetration across developed and emerging markets.

- For instance, Colgate’s in vitro viral inactivation trials, their stannous fluoride toothpaste reduced parainfluenza virus titers by 99.98% at 30 seconds and 99.99% at 120 seconds.

Expansion of Cosmetic and Aesthetic Dentistry

Rising interest in dental aesthetics is fueling demand for whitening and desensitizing products. Consumers are prioritizing brighter smiles, boosting the use of over-the-counter and clinic-based whitening solutions. Dental clinics offer advanced whitening procedures, creating strong demand for professional-grade preventive supplies. This growth is reinforced by new formulations that offer fast results with minimal sensitivity. Influencer marketing and digital campaigns amplify product visibility. The cosmetic trend aligns with preventive goals, driving strong growth for whitening and cleaning solutions in both retail and clinical settings.

- For instance, 3M’s Fast Release Varnish contains 22,600 ppm sodium fluoride and is delivered in 0.4 mL unit-dose trays (about 9 mg fluoride ion) for precise dosing.

Technological Advancements in Dental Materials

Continuous innovation in dental preventive materials enhances treatment effectiveness and patient comfort. Advanced fluoride varnishes and sealants now provide longer-lasting protection and easier application. New bioactive materials help strengthen enamel while reducing the risk of caries. Manufacturers are investing in research to improve product safety and efficacy. These developments align with clinical needs for quick application and better patient outcomes. The growing integration of advanced formulations across both pediatric and adult dental care strengthens market growth prospects globally.

Key Trends & Opportunities

Growth of E-commerce Dental Products

E-commerce is emerging as a major distribution channel for dental preventive supplies. Online platforms offer a wide product range, competitive pricing, and doorstep delivery. Consumers prefer trusted brands and subscription-based oral care kits. Dental professionals also use online procurement channels for clinical-grade products. The ease of comparison, bundled offers, and digital marketing strategies are boosting online sales. This trend creates opportunities for manufacturers to expand direct-to-consumer models and enhance brand visibility, especially in urban and semi-urban areas.

- For instance, Henry Schein, Inc. has continuously expanded its e-commerce ecosystem, with platforms offering over 300,000 branded and private-label SKUs covering preventive care, restorative materials, infection control, and hygiene consumables.

Rising Adoption of Pediatric Preventive Dentistry

Pediatric dentistry is gaining importance as early preventive measures reduce future dental complications. Fluoride varnishes, sealants, and gentle cleaning products are widely used for children. Governments and health organizations support preventive programs in schools and community centers. Parents are becoming more aware of the benefits of early oral care. Manufacturers are launching child-friendly formulations to improve acceptance and compliance. This focus on early prevention creates a sustained demand pipeline and supports market expansion in multiple regions.

- For instance, GC International AG markets MI Varnish®, a 5 % sodium fluoride varnish that also carries CPP-ACP (Recaldent®) to deliver bioavailable calcium, phosphate, and fluoride ions.

Key Challenges

High Cost of Advanced Preventive Products

The high cost of advanced preventive dental supplies limits adoption in low- and middle-income regions. Premium fluoride varnishes and whitening kits are often not covered by insurance, restricting patient access. Dental clinics face cost challenges in offering preventive treatments at scale. This pricing gap leads to unequal access between urban and rural populations. Manufacturers need cost-effective solutions to penetrate price-sensitive markets and support broader adoption.

Limited Access to Dental Care in Developing Regions

Access to preventive dental care remains limited in several developing countries. Shortages of dental professionals, low patient awareness, and underdeveloped distribution networks restrict market reach. Many patients seek treatment only when problems become severe, reducing preventive product uptake. Weak infrastructure and low insurance coverage further slow growth. Expanding training programs, improving supply chains, and supporting public health initiatives are critical to overcoming this barrier and achieving wider adoption.

Regional Analysis

North America

North America leads the Dental Preventive Supplies Market with a 34.5% share in 2025. High awareness of preventive oral care, strong insurance coverage, and regular dental checkups drive demand. The U.S. dominates due to advanced dental infrastructure and strong adoption of fluoride varnishes and whitening solutions. Pediatric preventive programs in schools further strengthen product penetration. E-commerce platforms and retail pharmacy networks enhance accessibility for consumers. Key manufacturers are investing in product innovation and targeted marketing strategies, supporting consistent growth. The region also benefits from early adoption of bioactive materials and advanced sealants.

Europe

Europe holds 28.3% of the Dental Preventive Supplies Market in 2025. The region benefits from strong regulatory support for oral care programs and growing adoption of fluoride-based products. Countries such as Germany, France, and the UK are major contributors due to established dental service networks and patient education campaigns. Whitening and desensitizing products are seeing increased uptake as cosmetic dentistry gains popularity. Universal healthcare systems and insurance coverage encourage preventive treatments. E-commerce and drug store channels are expanding access to quality products. Manufacturers also focus on sustainable and bio-friendly materials to meet regional environmental regulations.

Asia Pacific

Asia Pacific accounts for 24.7% of the Dental Preventive Supplies Market in 2025. Rising disposable income, expanding dental infrastructure, and growing awareness of oral hygiene are driving growth. Countries such as China, Japan, India, and South Korea show strong demand for fluorides, sealants, and whitening products. Governments are promoting preventive dentistry through school programs and awareness campaigns. The region has a fast-growing e-commerce sector, which improves product accessibility. Global manufacturers are expanding their presence to meet increasing urban and rural demand. Technological advancements and affordable pricing strategies are expected to further boost market penetration.

Latin America

Latin America holds 7.1% of the Dental Preventive Supplies Market in 2025. Brazil and Mexico lead regional demand with growing investments in dental clinics and preventive health programs. Rising middle-class income and increased awareness of dental hygiene support product adoption. Fluoride varnishes, desensitizers, and mouth gels are gaining popularity in urban centers. However, access in rural areas remains limited due to infrastructure gaps. Expanding pharmacy chains and e-commerce platforms are improving product reach. Manufacturers are focusing on affordable preventive solutions to strengthen their position in this price-sensitive market.

Middle East & Africa

The Middle East & Africa region captures 5.4% of the Dental Preventive Supplies Market in 2025. Market growth is supported by increasing healthcare investments and rising dental care awareness. Countries such as the UAE and South Africa are leading adoption with improved access to modern clinics. Fluoride varnishes and whitening kits are witnessing steady growth in urban centers. Limited access to dental services in rural areas remains a challenge. E-commerce and retail pharmacy expansions are improving product availability. Manufacturers are targeting partnerships with local distributors to tap into emerging demand across both segments.

Market Segmentations:

By Product Type:

By Application:

- Teeth cleaning

- Teeth whitening

By Distribution Channel:

- Retail pharmacies

- Drug stores

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Dental Preventive Supplies Market is shaped by key players including Ivoclar Vivadent, Johnson & Johnson, Hu-Friedy Mfg. Co., LLC., Haleon, Colgate-Palmolive Company, 3M Company, Henry Schein, Inc., GC International AG, Church & Dwight Co., and Dentsply Sirona Inc. The Dental Preventive Supplies Market is highly competitive, driven by rapid product innovation, strong brand positioning, and expanding global distribution. Companies are focusing on developing advanced fluoride varnishes, desensitizers, and bioactive sealants that offer long-lasting protection and improved patient experience. Strategic collaborations with dental service providers and e-commerce platforms are strengthening product accessibility and brand reach. Manufacturers are also emphasizing sustainable formulations and eco-friendly packaging to align with evolving regulatory standards. Continuous investment in R&D supports faster product launches and clinical validation. This competitive environment fosters technological advancement, enhances preventive care outcomes, and accelerates global market expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Ivoclar Vivadent

- Johnson & Johnson

- Hu-Friedy Mfg. Co., LLC.

- Haleon

- Colgate-Palmolive Company

- 3M Company

- Henry Schein, Inc.

- GC International AG

- Church & Dwight Co.

- Dentsply Sirona Inc.

Recent Developments

- In June 2024, Ivoclar launched the Vivadent aerosol reduction gel to improve the experience of ultrasonic tooth cleaning and enhance prophylactic abilities at the dental practice. The gel is colorless and water-based and does not leave tooth stains or cling to clothing or surfaces.

- In January 2024, DentaSEAL Pro introduced its derivative, ‘clinical care innovation,’ which coincided with the launch of a next-generation sealant and a first-of-its-kind appliance topcoat.

- In January 2024, Dentsply Sirona entered into a four-year partnership with the International Association for Disability & Oral Health (iADH) to increase oral care access for people with disabilities.

- In January 2024, Align Technology, Inc. announced the launch of iTero Lumina intraoral scanner with a 3X wider field of capture in a 50% smaller and 45% lighter wand to deliver faster scanning speed, superior visualization, higher accuracy, and a more comfortable scanning experience

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Preventive dental care will gain stronger focus through public health initiatives and awareness programs.

- Demand for fluoride varnishes and sealants will increase in both developed and emerging markets.

- E-commerce platforms will play a bigger role in product distribution and consumer engagement.

- Technological innovations will improve product effectiveness, ease of application, and patient comfort.

- Cosmetic dentistry trends will continue to drive whitening and desensitizing product adoption.

- Sustainable and eco-friendly dental products will gain higher market preference.

- Pediatric preventive dentistry programs will expand, strengthening early oral care adoption.

- Strategic partnerships with dental clinics and retailers will enhance product reach.

- Emerging markets will contribute significantly to overall market growth.

- Digital marketing and subscription-based preventive kits will shape future consumer buying patterns.