Market Overview

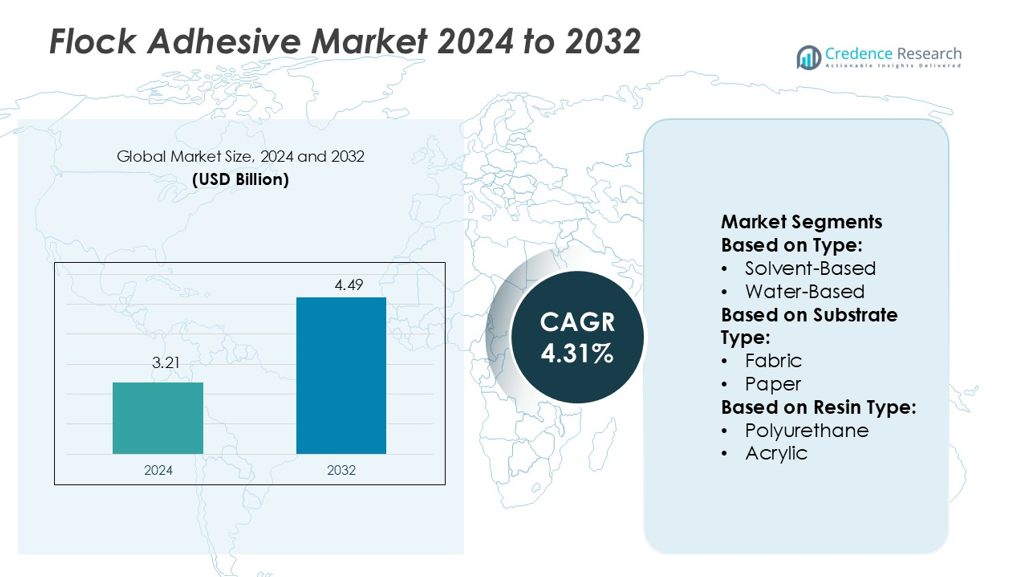

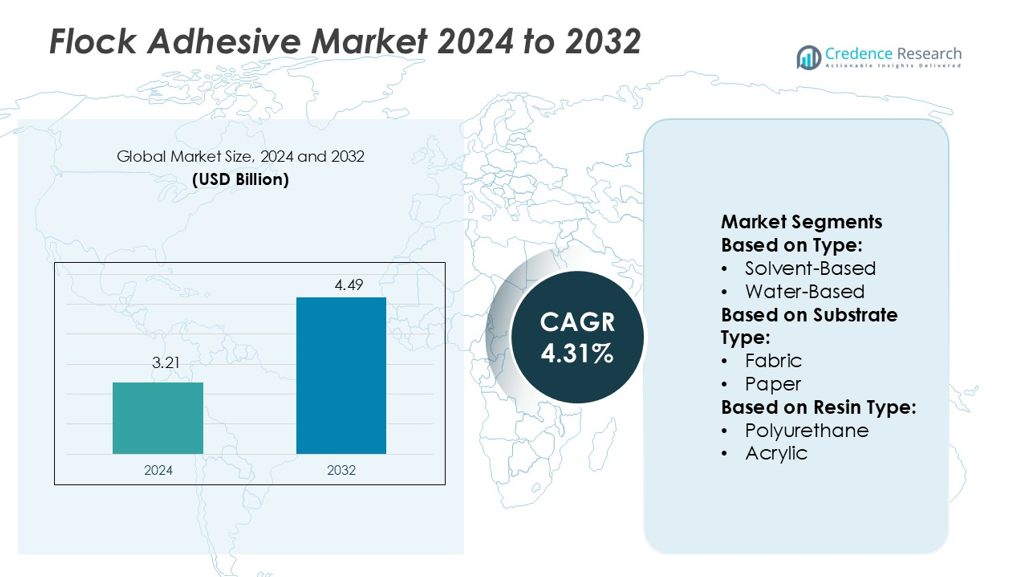

Flock Adhesive Market size was valued USD 3.21 billion in 2024 and is anticipated to reach USD 4.49 billion by 2032, at a CAGR of 4.31% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Flock Adhesive Market Size 2024 |

USD 3.21 billion |

| Flock Adhesive Market, CAGR |

4.31% |

| Flock Adhesive Market Size 2032 |

USD 4.49 billion |

The flock adhesive market is driven by strong competition among key players such as Dynamic Systems Inc., Sika AG, Chemique Adhesives Inc., Lord Corporation, Scott Bader Company Ltd., Henkel AG & Co. KGaA, Stahl Holdings B.V., Bostik SA, Franklin International, and H.B. Fuller Company. These companies focus on advanced resin formulations, sustainable adhesive solutions, and strategic partnerships to strengthen their market positions. North America leads the global market with a 34.6% share, supported by high automotive production, advanced textile manufacturing, and strong adoption of eco-friendly adhesives. Continuous R&D investments and expansion into emerging economies further enhance the competitive landscape, positioning these players to capitalize on growing demand across industries.

Market Insights

- The flock adhesive market was valued at USD 3.21 billion in 2024 and is projected to reach USD 4.49 billion by 2032, registering a CAGR of 4.31% during the forecast period.

- Rising demand from automotive and textile industries drives steady market growth, supported by increasing use of solvent-based adhesives, which hold a 46.3% segment share.

- Strong competition among major companies and growing adoption of sustainable adhesive technologies shape the competitive landscape.

- Fluctuating raw material prices and strict environmental regulations act as key restraints for market expansion.

- North America leads the market with a 34.6% regional share, followed by Europe at 28.1% and Asia Pacific at 26.7%, driven by strong industrial bases and rising investment in eco-friendly solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Solvent-based flock adhesive holds the dominant position in the flock adhesive market with a 46.3% share. Its strong bonding strength, quick drying time, and compatibility with a wide range of substrates drive demand across automotive, textile, and packaging industries. Water-based flock adhesive is growing steadily due to environmental regulations and low VOC emissions, making it suitable for sustainable applications. Hot-melt flock adhesive is preferred in high-speed production lines, offering fast setting and reduced processing time. Increased investments in eco-friendly adhesive technologies support the market growth of both solvent- and water-based types.

- For instance, Sika’s SikaTherm®-4150 water-borne flock adhesive has a solid content of ~38% and a viscosity of ~17 000 mPa·s at 20 °C. The manufacturer specifies that flock processing should occur immediately after adhesive application, without an initial drying time.

By Substrate Type

Fabric dominates the flock adhesive market with a 38.7% share, driven by high usage in apparel, upholstery, and decorative applications. The superior adhesion, durability, and flexibility of flock adhesives on textile surfaces enhance product quality and finish. Plastic substrates are also widely used, particularly in the automotive and consumer goods sectors, where flocking improves surface aesthetics and performance. Metal and rubber substrates are gaining traction in industrial applications. Advancements in multi-surface adhesion technologies support the expansion of flock adhesives across diverse substrate types.

- For instance, Chemique’s Bondseal 2080 synthetic-rubber aerosol adhesive adheres to a wide range of materials, including metal, plastic, fabric, and foam. It offers an instant grab, though its open and dry times are longer than 10 seconds.

By Resin Type

Polyurethane resin leads the flock adhesive market with a 41.5% share due to its excellent flexibility, impact resistance, and adhesion properties. It is widely used in automotive interiors, textiles, and packaging applications where strong bonding and durability are required. Acrylic resins are favored for their water resistance and environmental benefits, making them suitable for eco-friendly product lines. Epoxy and rubber resins cater to specialized applications requiring heat and chemical resistance. The growing demand for high-performance bonding solutions supports continuous innovation in polyurethane and acrylic adhesive technologies

Key Growth Drivers

Rising Demand from Automotive and Textile Industries

The automotive and textile industries are major drivers of the flock adhesive market. Automakers use flock adhesives to enhance interior aesthetics, reduce noise, and improve surface durability. In textiles, flocking improves fabric quality and comfort, supporting premium product demand. Lightweight and soft-touch materials are gaining traction in luxury vehicle interiors and home furnishings. Growing vehicle production and textile exports in Asia Pacific further accelerate adoption. These factors create a steady demand base, positioning automotive and textile applications as core growth pillars for the market.

- For instance, Lord’s Flocklok ® 852 single-coat adhesive achieves a wet film thickness of 101-152 µm (4-6 mil) and a solids content of 50-55% by weight when applied to elastomer substrates.

Growing Shift Toward Eco-Friendly Adhesives

Increasing environmental regulations and customer preference for sustainable products drive the shift toward low-VOC, water-based flock adhesives. Manufacturers are adopting green chemistry practices to meet compliance standards and reduce emissions. This shift improves brand positioning and supports wider market access in regions with strict environmental norms. Water-based adhesives also lower operational hazards, making them suitable for industries with tight worker safety guidelines. Expanding investments in sustainable adhesive technologies strengthen market opportunities and align with global environmental goals.

- For instance, Scott Bader’s Texicryl® 13-023 binder features a solids content of 50 % and a viscosity of 95 mPa·s at 25 °C, with a minimum film formation temperature of 27 °C and a glass-transition temperature of 30 °C — and is marketed as “low VOC / APEO free.”

Technological Advancements in Adhesive Formulations

Technological innovation plays a vital role in enhancing adhesive performance. New resin blends and hybrid adhesive systems offer superior bonding strength, faster curing, and improved resistance to temperature and chemicals. These advancements enable wider application across diverse substrates, including plastics, metals, and textiles. High-speed production compatibility and automated application systems also support efficiency gains. Continuous R&D investment by leading manufacturers helps expand product portfolios, strengthen performance characteristics, and address niche industrial requirements. This innovation-centric growth boosts the global adoption of flock adhesives.

Key Trends & Opportunities

Increasing Adoption in Sustainable Manufacturing

The rising focus on sustainability encourages the use of water-based and solvent-free flock adhesives. Manufacturers are aligning with green building certifications and circular economy models to meet eco-friendly goals. This trend is most visible in textiles, packaging, and automotive industries, where low-emission materials are prioritized. Companies are investing in cleaner production lines and recyclable substrates to expand their customer base. This shift opens strong growth opportunities, particularly in regions with strict environmental compliance such as Europe and North America.

- For instance, Henkel’s two-component adhesive system Loctite Liofol LA 4220 RE/LA 3180 RE is recognized as 100 % solids and solvent-free for flexible packaging lamination.

Integration with Advanced Automation and Coating Technologies

The integration of advanced automation systems and precision coating equipment enhances production efficiency and adhesive quality. Automated flocking systems ensure consistent adhesive application, reduced material waste, and lower operational costs. This trend is driving adoption across automotive, packaging, and consumer goods sectors. Manufacturers are upgrading production lines to handle high-speed flocking processes. As industries push for cost efficiency and precision, technology-driven application methods present a strong opportunity for adhesive suppliers to scale operations.

- For instance, Stahl’s RelcaDur® water-based rubber-to-substrate bonding system achieves a VOC content as low as 0.1 g/L in the adhesive layer, and emits about 6 000 to 9 400 times less CO₂-eq per kg compared to traditional solvent systems.

Rising Penetration in Emerging Economies

Emerging markets in Asia Pacific, Latin America, and the Middle East present strong growth potential for flock adhesives. Rapid industrialization, rising vehicle production, and expanding textile industries support demand. Favorable government initiatives to promote local manufacturing strengthen market expansion. Increased foreign investment and low production costs attract global players to set up regional facilities. This growing industrial base creates new opportunities for manufacturers to penetrate untapped markets with cost-effective adhesive solutions.

Key Challenges

Fluctuating Raw Material Prices

Volatile raw material prices pose a major challenge for flock adhesive manufacturers. Many resin components are derived from petrochemicals, making them sensitive to oil price fluctuations. Price instability impacts profit margins and makes cost planning difficult for producers. These fluctuations also affect downstream industries, leading to pricing pressures on end products. Companies are responding by diversifying supply chains and exploring bio-based alternatives. However, sustained volatility remains a significant risk factor for market stability.

Stringent Environmental and Safety Regulations

Strict environmental and safety regulations increase compliance costs for manufacturers, especially for solvent-based adhesives. Many regions have tightened VOC emission limits, pushing companies to invest in reformulation and certification processes. Adhering to these rules often requires upgrading production lines, which raises operational expenses. Non-compliance risks penalties and reduced market access, especially in North America and Europe. Balancing regulatory compliance with cost efficiency remains a key challenge for producers aiming to maintain competitiveness.

Regional Analysis

North America

North America leads the flock adhesive market with a 34.6% share. Strong automotive production and advanced textile manufacturing drive steady demand in the region. The U.S. dominates due to its well-established automotive interior component industry and expanding packaging sector. Manufacturers are increasingly adopting water-based adhesives to meet environmental standards and enhance worker safety. High investment in R&D and advanced coating technologies further supports market expansion. Rising demand for premium interior finishes in vehicles and growing adoption of eco-friendly materials strengthen North America’s leadership in the global flock adhesive market.

Europe

Europe holds a 28.1% share in the flock adhesive market, supported by stringent environmental regulations and a strong focus on sustainability. Germany, France, and Italy lead adoption, driven by high automotive production and growing demand in the textile and home furnishing sectors. Manufacturers are transitioning from solvent-based to water-based adhesives to comply with VOC regulations. The region also benefits from advanced automation in adhesive application processes. High-quality standards and strong R&D activities support continued market growth. Strategic investments in sustainable production enhance Europe’s competitive position in the global market.

Asia Pacific

Asia Pacific accounts for 26.7% of the flock adhesive market and is the fastest-growing region. Rapid industrialization, expanding automotive manufacturing, and strong textile exports drive demand. China, India, and Japan are key contributors due to their large production capacities and cost-effective manufacturing. Rising consumer demand for premium products and increasing adoption of sustainable adhesives are shaping regional trends. Manufacturers are also investing in new production facilities to meet export demand. Favorable government initiatives supporting local manufacturing further strengthen the region’s growth potential and market share.

Latin America

Latin America represents 6.1% of the flock adhesive market, with Brazil and Mexico being the major contributors. The growing automotive component industry and rising demand for decorative textiles are key growth drivers. Local manufacturers are increasingly adopting modern adhesive technologies to improve product quality and production efficiency. Economic reforms and increased foreign investments in manufacturing support market expansion. Although solvent-based adhesives remain common, environmental policies are gradually driving a shift toward sustainable options. This evolving regulatory framework positions Latin America for moderate but steady market growth.

Middle East & Africa

The Middle East & Africa region holds a 4.5% share of the flock adhesive market. The construction and automotive aftermarkets are the primary demand sources. Countries such as the UAE and Saudi Arabia are investing in local manufacturing to reduce import dependency. Infrastructure development projects create additional opportunities for adhesive applications in decorative and functional textiles. However, limited production capacity and reliance on imported raw materials restrict faster growth. Increasing awareness of eco-friendly adhesives and government diversification initiatives support long-term market expansion in the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Type:

- Solvent-Based

- Water-Based

By Substrate Type:

By Resin Type:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The flock adhesive market is characterized by strong competition among Dynamic Systems Inc., Sika AG, Chemique Adhesives Inc., Lord Corporation, Scott Bader Company Ltd., Henkel AG & Co. KGaA, Stahl Holdings B.V., Bostik SA, Franklin International, and H.B. Fuller Company. The flock adhesive market is witnessing intense competition driven by rapid technological advancements and rising demand across multiple industries. Manufacturers are focusing on developing sustainable, high-performance adhesive solutions that meet evolving environmental regulations and industry standards. Investments in R&D aim to improve bonding strength, reduce VOC emissions, and enhance application efficiency. Companies are also expanding their production capacities and establishing strategic partnerships with end-use industries such as automotive, textiles, and packaging. Additionally, regional expansion strategies and product innovation help suppliers strengthen their market presence. This competitive environment encourages continuous innovation and supports long-term market growth.

Key Player Analysis

- Dynamic Systems Inc.

- Sika AG

- Chemique Adhesives Inc

- Lord Corporation

- Scott Bader Company Ltd.

- Henkel AG & Co. KGaA

- Stahl Holdings B.V.

- Bostik SA

- Franklin International

- B. Fuller Company

Recent Developments

- In April 2025, Mapei Egypt opened its plant for production of adhesives, mortars, and admixtures specific for local construction markets. The regional diversification of Mapei allows it to enhance its provision for resin systems extremely required for tile adhesive applications in infrastructure.

- In July 2024, Magicrete launched a new ad campaign featuring actor Sumeet Vyas, promoting its tile adhesive over traditional cement-based methods. The campaign highlights the superior strength, durability, and ease of use of Magicrete’s adhesive, addressing common issues with sand and cement, such as cracking and debonding.

- In January 2024, Omnicol launched a range of powdered tile adhesives, including the PL200 Omnicem, a highly flexible S2 adhesive suitable for various applications. Ideal for both walls and floors, indoors and outdoors, it supports recent cement screeds and reduces curing time from 90 to 28 days.

- In May 2023, Sika AG acquired BCC Group, seeking to strengthen the positioning of the company within the construction value chain and develop the portfolio of products over the entire lifecycle of construction offering in boosting the efficiency of structural strengthening through high-performance construction chemicals and systems.

Report Coverage

The research report offers an in-depth analysis based on Type, Substrate Type, Resin Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with growing demand from automotive and textile industries.

- Manufacturers will increase investments in sustainable and low-VOC adhesive technologies.

- Water-based and hybrid adhesive formulations will gain wider market acceptance.

- Automation in adhesive application will enhance production efficiency and consistency.

- Strategic partnerships with end-use industries will strengthen supply chain networks.

- Emerging economies will offer strong growth opportunities for market penetration.

- Environmental regulations will accelerate the shift toward eco-friendly adhesive solutions.

- R&D activities will focus on improving bonding strength and curing time.

- Product diversification will support applications across multiple industrial sectors.

- Global competition will intensify, driving innovation and cost-effective manufacturing.