Market Overview:

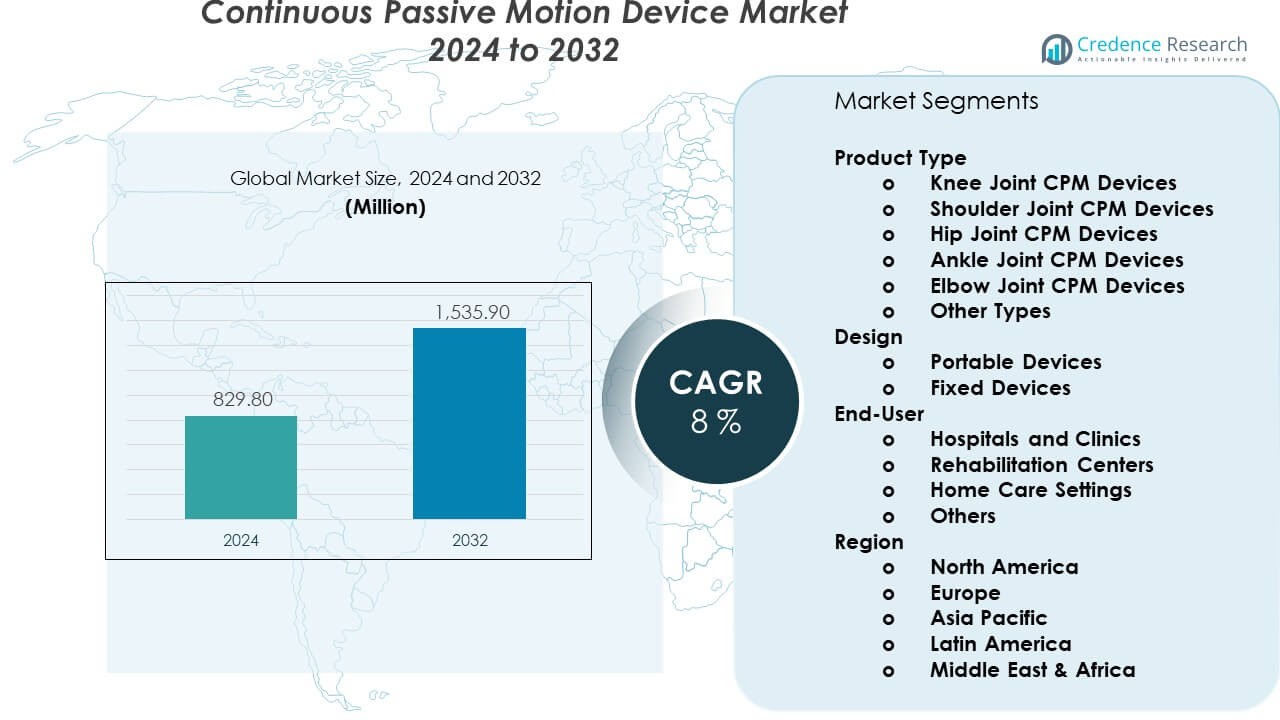

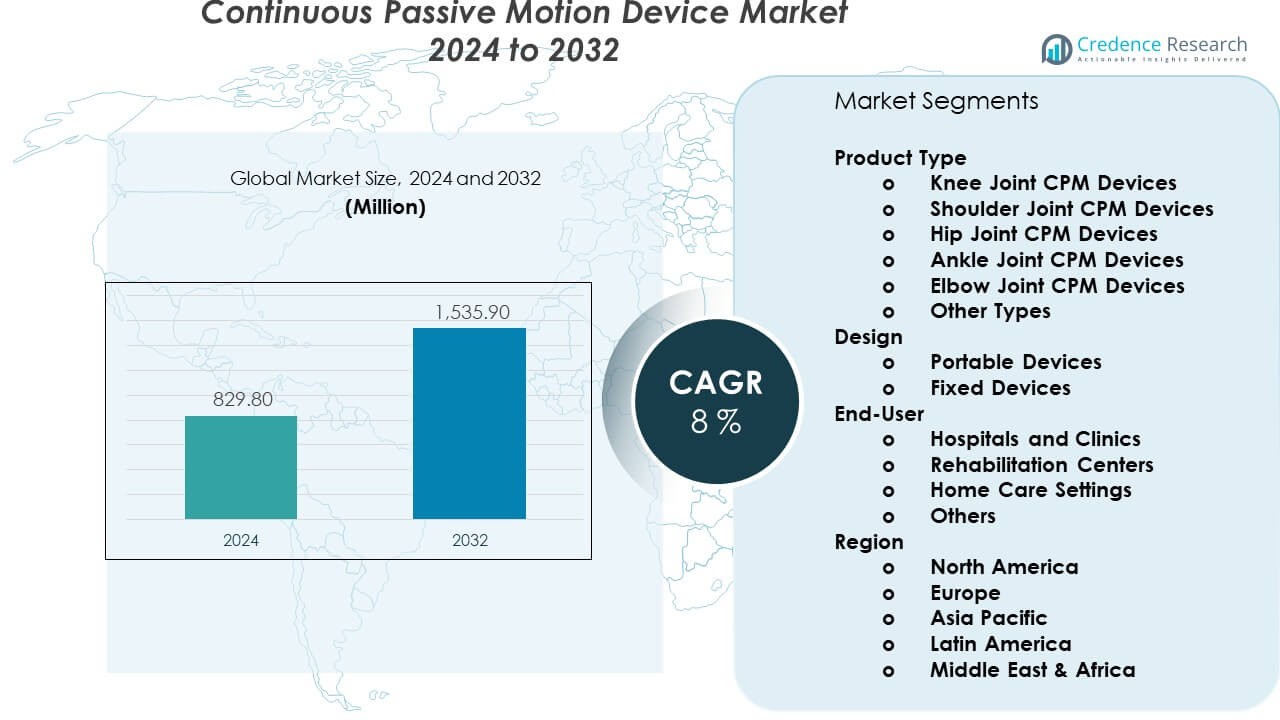

The Continuous Passive Motion Device Market is projected to grow from USD 829.8 million in 2024 to an estimated USD 1,535.9 million by 2032, with a CAGR of 8% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Continuous Passive Motion Device Market Size 2024 |

USD 829.8 Million |

| Continuous Passive Motion Device Market, CAGR |

8% |

| Continuous Passive Motion Device Market Size 2032 |

USD 1,535.9 Million |

Demand rises due to the growing need for effective rehabilitation support across surgical recovery programs. Hospitals use these systems to maintain joint motion after replacements and ligament repair. Home-care users prefer compact units that reduce stiffness and lift comfort during early recovery. Device makers enhance control precision and safety features to improve outcomes across therapy cycles. Aging groups seek solutions that support long-term mobility. Surgeons recommend these tools to lower complication risks and support patient adherence.

Leading regions include North America and Europe due to advanced orthopedic care, strong hospital infrastructure, and high surgery rates. These regions adopt new therapy systems faster because of wider insurance backing and early technology uptake. Asia Pacific emerges as a strong growth hub with rising joint procedures and broader access to rehabilitation services. Countries in Latin America and the Middle East show steady interest as medical tourism expands and hospitals upgrade therapy units. This shift strengthens global adoption across varied clinical settings.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Continuous Passive Motion Device Market is set to rise from USD 829.8 million in 2024 to USD 1,535.9 million by 2032, growing at a CAGR of 8%, driven by strong demand for post-surgical mobility support across hospitals and home-care settings.

- North America (38%), Europe (27%), and Asia Pacific (22%) hold the largest shares due to advanced orthopedic care systems, high joint-replacement volumes, and early adoption of rehabilitation technologies. Their strong clinical infrastructure keeps device demand consistently high.

- Asia Pacific, holding 22%, stands as the fastest-growing region fueled by rising joint procedures, expanding rehabilitation access, and higher investment in post-operative care.

- Knee Joint CPM Devices account for around 40% of product-type share due to their essential role in knee-replacement recovery, while shoulder and hip devices collectively capture about 28%, supported by increasing arthroscopy volumes.

- Hospitals and clinics represent nearly 45% of end-user share due to structured recovery programs, while home-care settings hold close to 25% driven by preference for portable and compact rehabilitation solutions.

Market Drivers:

Growing Demand for Post-Surgical Rehabilitation Support Across Orthopedic Care

Hospitals increase dependence on continuous passive motion units to speed joint recovery. Surgeons recommend these systems to reduce stiffness after knee and hip surgeries. Patients prefer structured therapy cycles that support predictable outcomes during early healing. Home-care settings expand usage because units help maintain controlled movement. The Continuous Passive Motion Device Market gains steady traction due to rising replacement procedures. Providers value reduced complication risks when motion support follows surgery. Insurers support coverage for selected therapy plans to lift adherence. Stronger focus on mobility preservation pushes wider use across clinical groups.

- For instance, the KLC Services Flex-Mate K500 allows a full range of motion from -10° extension to 120° flexion, with the speed of motion adjustable in 10° increments ranging from 30° to 150° per minute, to support surgeon-defined protocols.

Rising Preference for Home-Based Therapy Solutions With Greater Comfort

Patients want devices that offer flexibility without extended hospital stays. Home-care teams deploy compact systems that support frequent therapy sessions. Manufacturers enhance ergonomics to lift patient comfort and safety during long sessions. Remote guidance tools help users follow surgeon-directed routines with accuracy. The Continuous Passive Motion Device Market benefits from this shift toward home recovery. Patients report better compliance when units support easy operation. Providers value stable outcomes due to consistent joint motion patterns. Growing awareness of home rehabilitation strengthens long-term adoption.

- For instance, Chattanooga’s Continuous Passive Motion line includes digital touch interfaces that provide guided setup prompts for home users.

Higher Adoption Across Sports Injury Management and Rehabilitation Clinics

Sports medicine centers rely on structured movement cycles to manage ligament injuries. Clinics use these units to stabilize mobility during controlled healing phases. Athletes recover faster when joints retain steady motion after surgery or trauma. Device makers focus on precise motion control to support varied injury needs. The Continuous Passive Motion Device Market expands due to higher sports injury cases. Therapy teams prefer predictable recovery timelines supported by movement consistency. Clinics integrate systems into personalized rehabilitation programs. Strong attention to faster return-to-activity goals lifts system usage.

Growing Use Among Elderly Groups Requiring Joint Mobility Preservation

Aging groups seek solutions that reduce stiffness linked to chronic joint issues. Rehabilitation units support flexibility during early recovery after replacement surgeries. Providers see improved patient comfort when passive motion starts soon after procedures. Home-care groups deploy units for individuals with weaker mobility. The Continuous Passive Motion Device Market benefits from the rising elderly population. Hospitals integrate these devices to lower post-surgery complications. Families adopt home-based models to support continued therapy. Population aging builds long-term demand across varied care settings.

Market Trends:

Rising Integration of Smart Controls and Digital Monitoring Functions in Rehabilitation Units

Manufacturers introduce digital dashboards that guide users through precise movement cycles. Smart sensors track therapy progress with higher accuracy and stability. Remote monitoring allows therapists to adjust settings without clinic visits. Patients value real-time feedback that lifts confidence during recovery. The Continuous Passive Motion Device Market shifts toward connected platforms. Cloud-linked logs help providers assess joint progression during follow-ups. Digital upgrades improve device usability across home settings. This trend accelerates technology adoption across multiple care pathways.

- For instance, Kinetec’s Kompanion app enables remote monitoring of CPM usage data, including session duration and ROM progress. Remote monitoring allows therapists to adjust settings without clinic visits. Patients value real-time feedback that lifts confidence during recovery.

Growing Development of Lightweight and Portable Systems for Flexible Use

Brands design compact models that support easier handling during therapy sessions. Lightweight components help elderly users operate units without strain. Clinics welcome portable units that shift across treatment rooms. Home users prefer devices that reduce space concerns. The Continuous Passive Motion Device Market adapts to portability needs that support daily therapy plans. Manufacturers focus on foldable frames and improved cushioning. Compact formats lift user comfort during long routines. This trend strengthens acceptance across mobility-focused programs.

Increasing Customization Features Tailored to Individual Joint and Recovery Needs

Therapists demand units that support knee, shoulder, elbow, and hip variations. Brands design adjustable motion limits that match surgeon protocols. Personalized settings help reduce discomfort during long sessions. Clinics prefer systems with programmable cycles that match patient strength. The Continuous Passive Motion Device Market gains value through patient-specific customization. Electronic modules guide precise extension and flexion ranges. Custom options improve adherence across home recovery plans. Strong focus on personalization reshapes next-generation device lines.

Higher Use of Passive Motion Units as Part of Multimodal Rehabilitation Pathways

Clinics integrate passive motion with muscle training and pain-relief therapies. Providers combine sessions to stabilize movement outcomes across recovery phases. Surgeons include passive motion routines in early-stage programs. Therapy centers observe higher patient comfort when multiple approaches align. The Continuous Passive Motion Device Market benefits from adoption within integrated care models. Rehab teams track progression to refine combined therapy cycles. Multimodal plans improve patient transition toward active therapy steps. This trend positions passive motion devices as core rehabilitation tools.

Market Challenges Analysis:

Limited Awareness in Low-Income Regions and Inconsistent Clinical Adoption Patterns

Lower-income areas struggle to adopt advanced therapy systems due to budget limits. Hospitals delay upgrades because procurement priorities differ across regions. Patients lack exposure to structured passive therapy programs. Providers cannot standardize recovery protocols when training varies. The Continuous Passive Motion Device Market faces slower penetration in underdeveloped healthcare systems. Clinical teams prefer manual exercises when device access remains limited. Awareness gaps reduce early-stage adoption. These factors restrict demand growth across several regions.

High Cost Barriers and Maintenance Issues Reducing Long-Term Utilization Rates

Units require stable maintenance cycles that raise operational costs. Smaller clinics delay purchases when budgets remain restrained. Home users limit adoption due to high upfront device prices. Providers expect long-lasting parts that support repeated therapy cycles. The Continuous Passive Motion Device Market experiences purchase hesitation when affordability declines. Repair needs disrupt therapy schedules and reduce user satisfaction. Technicians must maintain calibration to support joint accuracy. These challenges slow wider adoption across cost-sensitive groups.

Market Opportunities:

Rising Scope for Advanced Home-Care Rehabilitation Models Supported by Smart Devices

Rapid growth in home-based therapy creates room for expanded device placement. Smart feedback modules help users follow recovery protocols with precision. Providers integrate remote support tools that guide patients daily. The Continuous Passive Motion Device Market gains strong potential through digital home-care models. Compact systems match modern patient expectations for convenience. Aging groups prefer home therapy that reduces hospital visits. Brands can introduce subscription-based rehab plans that lift retention. These factors shape new product development opportunities.

Growing Demand Across Emerging Regions With Expanding Orthopedic Care Infrastructure

Developing countries increase investment in joint surgery capabilities. Clinics adopt modern rehab systems to support early recovery phases. Patients show rising interest in structured therapy routines. The Continuous Passive Motion Device Market benefits from broader healthcare expansion. Manufacturers can target local distributors for faster outreach. Training programs improve confidence among rehab teams. This shift supports deeper market penetration across growing regions.

Market Segmentation Analysis:

Product Type

Knee joint systems lead due to high adoption in post-surgical knee rehabilitation programs. Hospitals prefer these units to manage stiffness after replacement and ligament repair procedures. Shoulder and hip devices gain steady traction due to rising arthroscopy and joint reconstruction cases. Ankle and elbow units support targeted rehabilitation needs in trauma care. Other types remain relevant across niche orthopedic procedures. The Continuous Passive Motion Device Market grows because each product category supports distinct recovery goals. Clinics adopt varied models to match joint-specific protocols.

- For instance, DJO Global’s Optiflex-K1 knee CPM device permits extension and flexion of the knee joint in the range of -10°/0°/120°, allowing patients to achieve the required greater than or equal to 100 degrees of range of motion needed to complete activities of daily living.

Design

Portable devices maintain strong demand due to rising home-care rehabilitation across diverse patient groups. Users prefer compact designs that support frequent therapy cycles without clinical supervision. Fixed devices retain importance in hospitals that manage higher patient loads. Providers value their stability and wider motion range during early recovery. It supports consistent therapy delivery across structured rehabilitation pathways. Both formats help maintain controlled joint movement. Demand for ergonomic systems strengthens design diversification.

- For instance, DJO Global’s Optiflex-K1 weighs just 23 lbs (10.4 kg), making it the lightest knee CPM on the market at only 38 inches (97 cm) long, with a wide low-profile closed-base frame for stability and faster motor speed.

End-User

Hospitals and clinics dominate due to higher surgery volumes and structured rehabilitation workflows. Rehabilitation centers rely on continuous motion units to support predictable recovery after orthopedic procedures. Home care settings show rapid growth due to interest in flexible therapy routines that lower hospital visits. Other end users, including sports centers and long-term care facilities, integrate these devices to support specialized recovery needs. It strengthens multi-setting adoption across varied therapy models.

Segmentation:

Product Type

- Knee Joint CPM Devices

- Shoulder Joint CPM Devices

- Hip Joint CPM Devices

- Ankle Joint CPM Devices

- Elbow Joint CPM Devices

- Other Types

Design

- Portable Devices

- Fixed Devices

End-User

- Hospitals and Clinics

- Rehabilitation Centers

- Home Care Settings

- Others

Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America holds the largest share of the Continuous Passive Motion Device Market due to strong orthopedic procedure volumes and advanced rehabilitation infrastructure. Hospitals adopt these systems to support early recovery after joint replacements. Patients show higher acceptance of home-based therapy units that improve mobility outcomes. Providers invest in upgraded models that offer better motion control and comfort. Insurers support selected therapy plans that lift device usage across care settings. It strengthens demand across both clinical and home environments. Continuous focus on recovery optimization sustains the region’s leadership.

Europe

Europe secures the second-largest market share due to structured rehabilitation programs and widespread adoption of motion therapy systems. Clinics deploy these devices to manage recovery after ligament repair and arthroscopy. Patients rely on early mobility protocols that support stronger recovery timelines. Home-care programs expand access to portable devices across key countries. Manufacturers introduce ergonomic designs that match regional therapy guidelines. It supports steady uptake across public and private healthcare settings. Rising joint surgery rates contribute to stable long-term demand.

Asia Pacific, Latin America, and Middle East & Africa

Asia Pacific shows fast growth and holds a rising share supported by expanding orthopedic care capabilities. Hospitals increase procedure volumes, which drives interest in early mobility tools. Home-care adoption strengthens due to growing awareness of structured recovery pathways. Latin America maintains a moderate share with gradual improvements in rehabilitation infrastructure. Middle East & Africa hold a smaller share but gain traction through new specialty clinics and private healthcare investment. It expands access to modern therapy systems across urban centers. These regions shape emerging opportunities for future market penetration.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Surgi-Care Inc.

- Furniss Corporation

- Bio-Med Inc.

- BTL Corporate

- Chattanooga

- OPED GmbH

- Chinesport Rehabilitation

- Medival

- Rimec

- DJO Global, Inc.

- Zimmer Biomet Holdings

- Stryker Corporation

- Smith & Nephew

- Breg

- Össur

- CONMED

- Kinetec Medical Products

- DynQuest Medical

- Medzer

Competitive Analysis:

The Continuous Passive Motion Device Market features strong competition driven by innovation in rehabilitation technologies. Key players focus on advanced motion control, ergonomic designs, and patient-centric features that improve therapy adherence. Companies invest in R&D to expand joint-specific device portfolios and strengthen clinical relevance. Leading brands compete through broader distribution networks that support hospitals, rehabilitation centers, and home-care users. Firms enhance digital integration to improve real-time monitoring and remote guidance. It gains steady momentum as portability, precision, and durability influence purchasing decisions. Partnerships with orthopedic clinics help expand clinical acceptance. Competitive intensity remains high due to the presence of global and regional manufacturers.

Recent Developments:

- In February 2025, Stryker Corporation completed the acquisition of Inari Medical, Inc. for $80 per share in cash, representing a total equity value of approximately $4.9 billion. The tender offer resulted in approximately 81.69% of Inari’s outstanding shares being validly tendered, and following the merger completion on February 19, 2025, Inari became a wholly owned subsidiary of Stryker. Inari’s product portfolio includes the FlowTriever System for pulmonary embolism treatment and the ClotTriever System for peripheral vessel thrombectomy, which complement Stryker’s Neurovascular business. The definitive agreement had been announced on January 6, 2025, with the boards of directors of both companies unanimously approving the transaction.

- In January 2025, Zimmer Biomet Holdings announced a definitive agreement to acquire Paragon 28 for an enterprise value of approximately $1.2 billion. The acquisition was completed on April 21, 2025, with each share of Paragon 28’s common stock converted into the right to receive $13.00 in cash and one contingent value right. Paragon 28 became a wholly owned subsidiary of Zimmer Biomet following the merger, and its common stock was delisted from the New York Stock Exchange. The transaction had previously received HSR Act clearance on March 10, 2025, representing a significant milestone in the regulatory approval process.

- In February 2024, Smith & Nephew announced the commercial launch of its AETOS Shoulder System for anatomic and reverse shoulder replacement at the AAOS 2024 Annual Meeting. The system received FDA 510(k) clearance in June 2023 and includes the AETOS Stemless implant, which is designed to maximize metaphyseal fixation and stability with an inlay collar, cruciate fins, and porous titanium coating. In December 2024, Smith+Nephew announced it had received 510(k) clearance for the stemless anatomic total shoulder component of the AETOS Shoulder System, expanding the portfolio to enable streamlined convertibility from Stemless to Meta Stem. The AETOS Shoulder System represents the latest solution in Smith+Nephew’s expanding Upper Extremity portfolio, complementing their market-leading Sports Medicine shoulder repair and biologics solutions.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Design, and End-User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for advanced rehabilitation systems will rise with higher joint-replacement procedures.

- Home-care adoption will expand due to compact and portable device designs.

- Digital integration will enhance remote monitoring and therapy personalization.

- Sports medicine centers will increase use to support structured injury recovery.

- Hospitals will upgrade systems to improve early-stage mobility protocols.

- Aging populations will drive long-term need for mobility-support devices.

- Manufacturers will introduce joint-specific systems with improved ergonomics.

- Emerging markets will exhibit strong uptake due to expanding orthopedic care.

- Partnerships with rehab centers will strengthen device training and clinical use.

- Sustainability and durable design features will influence product development.