Market Overview:

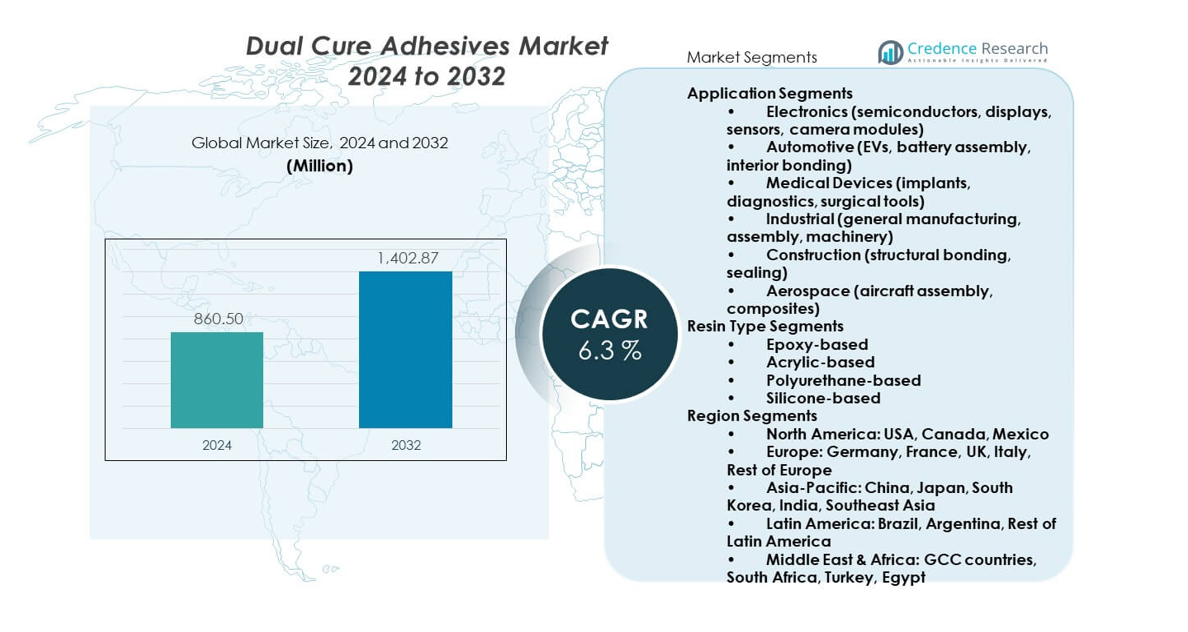

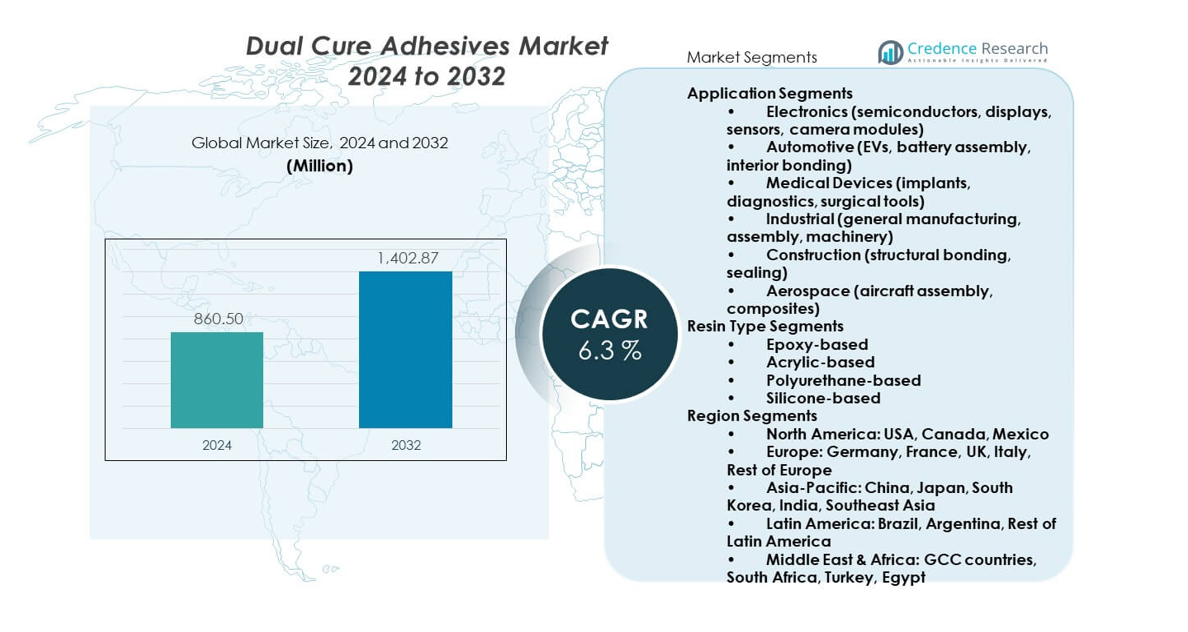

The Dual cure adhesives market is projected to grow from USD 860.5 million in 2024 to an estimated USD 1402.87 million by 2032, with a compound annual growth rate (CAGR) of 6.3% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dual Cure Adhesives Market Size 2024 |

USD 860.5 million |

| Dual Cure Adhesives Market, CAGR |

6.3% |

| Dual Cure Adhesives Market Size 2032 |

USD 1402.87 million |

Rising demand across electronics and automotive sectors strengthens adoption due to higher need for durable bonding solutions. Companies focus on adhesives that support quick curing under UV and heat, which improves throughput in multi-step production lines. Product designers choose dual-cure grades to manage mixed substrates and tough geometries. Medical device makers prefer these systems to support biocompatible assemblies. Strong regulations push brands to create low-VOC versions. Growing automation boosts interest in formulations that work with robotic dispensing. These trends create wider acceptance across key industries.

North America leads due to strong electronics assembly, advanced automotive production, and early adoption of hybrid adhesives. Europe follows with a mature industrial base and steady demand from medical and mobility sectors. Asia Pacific grows at a fast rate, driven by rising manufacturing clusters in China, Japan, and South Korea. Growth in Southeast Asia strengthens as local plants expand production capacity. Latin America shows gradual progress led by automotive and appliance manufacturing. The Middle East and Africa remain emerging markets where adoption increases with ongoing industrial development.

Market Insights:

- The Dual cure adhesives market reached USD 860.5 million in 2024 and is expected to hit USD 1,402.87 million by 2032, growing at a 6.3% CAGR, supported by expanding electronics, EV, and medical manufacturing.

- North America (32%), Europe (27%), and Asia Pacific (25%) hold the largest shares due to strong electronics assembly, advanced automotive production, and well-established medical device industries.

- Asia Pacific, with a 25% share, remains the fastest-growing region, driven by rising semiconductor output, EV battery production, and rapid manufacturing expansion across China, Japan, and South Korea.

- The electronics segment holds 34% of the market, driven by demand from semiconductors, displays, sensors, and camera modules that require precise and fast-curing bonding solutions.

- The automotive segment accounts for 22%, supported by rising EV adoption, battery module bonding needs, and higher reliance on lightweight structural materials.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Adoption Across Electronics and Automotive Manufacturing

Rising use of compact devices strengthens demand for precise bonding solutions. Automotive plants shift toward lightweight components that need hybrid curing systems. Production teams value faster processing supported by UV and thermal activation. Engineers select adhesives that work across complex joints in high-load assemblies. Medical device makers adopt safer low-migration grades for sensitive equipment. Regulatory norms guide suppliers toward cleaner chemistries. Industrial units prefer materials that deliver stable strength across mixed substrates. The Dual cure adhesives market gains wider acceptance through broad industrial usage.

- For instance, Henkel’s LOCTITE AA 3951 supports medical wearables and meets ISO 10993 standards while offering UV-thermal cure capability.

Shift Toward High-Efficiency Production With Faster Curing Needs

Manufacturers prefer dual-cure systems that reduce workflow delays in multi-step builds. High-volume lines choose materials that cure uniformly across shaded zones. UV-heat synergy improves cycle time during intricate assembly operations. Automated lines benefit from predictable viscosity and accurate placement. Robotics adoption expands interest in stable curing profiles. Companies search for adhesives that maintain strength under thermal fluctuation. Electronics plants appreciate formulations designed for fine structural bonds. The Dual cure adhesives market advances with strong focus on high-speed processing gains.

- For instance, Dymax 9771 is a dual-cure conformal coating that utilizes a secondary ambient moisture cure in shadowed areas to ensure complete polymerization of the material, which is typically fully cured within seconds using the primary UV/Visible light exposure.

Rising Demand for Stronger Bonds Across Lightweight Components

Lightweight platforms used in mobility and electronics rely on high-strength bonding. Adhesives replace fasteners in modules that need vibration resistance. Strength retention under temperature swings supports reliability goals. Firms adopt grades tailored for structural needs in compact assemblies. Electronics producers need materials that pass tough drop-test standards. Designers value adhesives that secure parts without adding excess weight. Product teams choose hybrid systems to meet demanding durability targets. The Dual cure adhesives market gains traction as lightweight engineering expands.

Growing Emphasis on Cleaner Chemistries and Safer Materials

Industrial buyers prefer low-VOC materials that comply with strict health rules. Brands develop cleaner formulations to support medical and wearable technologies. Regulations push adoption of safer photoinitiators in sensitive segments. Certified materials appeal to companies building trust-critical components. Producers aim for high performance while eliminating harmful additives. Safety-driven markets demand solutions optimized for global compliance. Clean production methods support better workplace adoption. The Dual cure adhesives market benefits from strong movement toward responsible chemical use.

Market Trends:

Increasing Use of Smart Dispensing and Process Monitoring Systems

Production units deploy sensors that improve accuracy across high-speed lines. Smart dispensers regulate adhesive volume with strict control. Real-time monitoring helps operators maintain consistent curing outcomes. Plants use automated inspection to lower defect rates. Data tools track adhesive behavior during each curing stage. Robotics integration raises demand for digital feedback systems. High-precision workflows need steady output supported by automation. The Dual cure adhesives market aligns with rising use of intelligent manufacturing tools.

- For instance, advanced dispensing equipment can detect dispensing volume issues and prevent glue overflow or insufficient adhesion, maintaining consistent product quality. Real-time monitoring helps operators maintain consistent curing outcomes by tracking adhesive temperature and viscosity, both critical factors affecting dispensing defect rates.

Expansion of UV-LED Curing Technologies Across Industrial Plants

UV-LED modules replace mercury lamps due to better safety and low heat output. Energy savings attract large-scale production facilities. Narrow-band emission improves accuracy during complex builds. LED systems need limited maintenance during long operations. Compact design supports installation in tight assembly zones. Reduced thermal impact protects sensitive components during curing. Long service life increases reliability in repeated runs. The Dual cure adhesives market gains value from fast adoption of UV-LED systems.

- For instance, UV-LED technology achieves 95% conversion rates of carbon-carbon bonds and 98% gel fraction efficiency, substantially exceeding conventional UV-mercury lamp performance. Energy savings attract large-scale production facilities—UV-LED curing consumes 50% to 75% less energy than equivalent mercury arc lamps, representing significant operational cost reduction for high-volume manufacturing environments.

Growing Focus on Adhesives Tailored for Electric Vehicle Platforms

EV designers select adhesives that manage vibration and thermal pressure. Battery modules need bonding solutions that work under shifting loads. Automakers adopt hybrid curing to handle tight production cycles. Adhesives support secure connections in compact electronic assemblies. Rising EV demand pushes interest in high-endurance grades. Lightweight structures depend on stable bonding strength. Plants integrate dual-cure systems for better reliability in safety-critical units. The Dual cure adhesives market expands with EV-specific product development.

Wider Use of Precision Bonding for Advanced Medical and Optical Devices

Medical equipment makers rely on adhesives suited for delicate parts. Optical device producers choose formulas that resist yellowing over time. High-clarity grades support clean edges in transparent assemblies. Controlled curing helps protect sensitive surfaces. Manufacturers prefer adhesives that work with low-energy light sources. Compact tools require materials that maintain long-term stability. Performance consistency raises usage in diagnostic devices. The Dual cure adhesives market benefits from rising demand across precision manufacturing.

Market Challenges Analysis:

High Material Costs and Complex Compliance Requirements

Premium formulations raise cost pressure across small and mid-size plants. Buyers face challenges when sourcing grades that meet strict safety codes. Regulatory checks extend approval cycles for new materials. High-purity raw materials push production expenses upward. Companies struggle to balance cost with long-term performance. Limited access to skilled operators slows adoption across some regions. Complex compliance norms require heavy documentation efforts. The Dual cure adhesives market faces hurdles linked to cost and regulation.

Technical Constraints Across Mixed Substrates and Harsh Environments

Bonding issues arise when substrates expand at different rates. Thermal shifts reduce durability if materials lack proper flexibility. Shadowed zones demand precise curing control to prevent weak spots. Production teams struggle with uneven adhesion on textured surfaces. Harsh environments reduce bond life when grades lack strong resistance. Some lines need equipment upgrades to support hybrid curing modes. Process standardization remains difficult for varied product sets. The Dual cure adhesives market manages technical challenges that limit full-scale deployment.

Market Opportunities:

Rising Scope Across Advanced Electronics, EV Platforms, and Smart Manufacturing

High-density electronics require stronger and faster-curing bonding solutions. EV growth pushes demand for adhesives that support thermal and mechanical stability. Smart factories adopt hybrid materials to optimize automated workflows. Medical and wearable devices open new space for biocompatible grades. Compact product design favors materials with stable performance under stress. Growth in robotics encourages use of adhesives with predictable curing. Multi-industry expansion creates new entry points. The Dual cure adhesives market gains broad opportunity across next-generation technologies.

Expanding Adoption in Emerging Regions With Rising Industrial Output

Growing manufacturing clusters support higher adhesive consumption. Plants in developing markets install automated lines that need hybrid systems. Local industries shift toward quality-focused production. Strong interest in lightweight structures creates new demand pockets. Suppliers expand distribution networks to reach fast-growing zones. Regulations support cleaner materials in many developing economies. Industrial diversification drives uptake across multiple applications. The Dual cure adhesives market benefits from increasing global penetration.

Market Segmentation Analysis:

Application Segments

The Dual cure adhesives market shows strong momentum across major application areas. Electronics leads due to demand for precise bonding in semiconductors, displays, sensors, and camera modules. Automotive follows with rising use in EVs, battery packs, and interior components. Medical device manufacturers prefer controlled curing for implants, diagnostics, and surgical tools. Industrial users adopt hybrid systems for machinery, assembly lines, and multi-material production. Construction firms rely on dual-cure grades for structural bonding and sealing tasks. Aerospace applications expand with reliance on composite assembly and lightweight structures. The Dual cure adhesives market benefits from broad functional use across high-performance sectors.

- For instance, Henkel’s ADAS adhesives enable alignment accuracy of 100 nanometers for high-resolution camera systems critical to autonomous vehicle safety. Automotive follows with rising use in EVs, battery packs, and interior components—the electric vehicle market is experiencing exponential growth, with EVs comprising 10% of global new car sales in 2023, a new record.

Resin Type Segments

Epoxy-based systems hold a strong position due to high strength and thermal stability. Acrylic-based grades gain traction for fast curing and reliable adhesion on plastics and metals. Polyurethane-based materials support flexible bonding needs across automotive and industrial uses. Silicone-based dual-cure systems serve electronics and medical devices that require heat resistance and long-term stability. Buyers choose each resin type based on durability, substrate mix, and curing speed. Product developers target advanced formulations to support next-generation devices. Hybrid resin innovation improves performance in demanding environments. It maintains steady adoption across sectors that require versatile bonding solutions.

- For instance, ThreeBond epoxy formulations achieve thermal conductivity of 2.1 W/m·K with tensile shear bond strength of 6.0 MPa, meeting stringent requirements for battery thermal management. Acrylic-based grades gain traction for fast curing and reliable adhesion on plastics and metals, with UV-LED acrylic systems achieving 95% conversion efficiency.

Segmentation:

Application Segments

- Electronics (semiconductors, displays, sensors, camera modules)

- Automotive (EVs, battery assembly, interior bonding)

- Medical Devices (implants, diagnostics, surgical tools)

- Industrial (general manufacturing, assembly, machinery)

- Construction (structural bonding, sealing)

- Aerospace (aircraft assembly, composites)

Resin Type Segments

- Epoxy-based

- Acrylic-based

- Polyurethane-based

- Silicone-based

Region Segments

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America holds the largest share of the Dual cure adhesives market due to strong electronics and automotive production bases. The USA leads regional demand with advanced assembly lines and steady investment in automation. Canada supports growth through medical device manufacturing and industrial applications. Mexico strengthens its role with expanding automotive clusters and rising electronics output. Regional buyers prefer high-performance grades that support fast curing in complex builds. The Dual cure adhesives market gains consistent traction in North America due to mature technology adoption and reliable industrial capacity.

Europe

Europe accounts for a significant share supported by strong automotive, aerospace, and medical device manufacturing. Germany leads with high-volume production in mobility and precision engineering. France and the UK contribute to demand through electronics, composites, and advanced machinery. Italy supports market growth with strong industrial output and rising interest in lightweight structures. Strict compliance rules push firms toward safer and cleaner hybrid formulations. Regional producers value dual-cure systems that offer balanced strength and controlled curing performance. It continues to gain acceptance across European industries that focus on durable and high-quality bonding.

Asia Pacific

Asia Pacific holds a fast-growing share driven by large-scale electronics and automotive expansion. China leads due to strong semiconductor, EV, and consumer electronics production. Japan and South Korea strengthen market growth with advanced optical devices and precision bonding needs. India and Southeast Asia expand demand through rising industrialization and new manufacturing facilities. Regional supply chains support high-volume adoption of hybrid systems that fit complex assemblies. Strong investment in EV platforms accelerates use of durable and thermally stable adhesives. The Dual cure adhesives market experiences rapid expansion across Asia Pacific due to strong manufacturing momentum and broad sector diversification.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Henkel AG & Co. KGaA

- 3M Company

- Dow Inc.

- DELO Adhesives

- B. Fuller Company

- Dymax Corporation

- DIC Corporation

- Shin-Etsu Chemical Co., Ltd.

- Epotek, Inc.

- NAMICS Corporation

- Addison Clear Wave

- ThreeBond Co., Ltd.

- Ajinomoto Fine-Techno Co., Ltd.

- Permabond Engineering Adhesives

- Ashland Inc.

Competitive Analysis:

The Dual cure adhesives market features strong competition led by global chemical and materials companies with deep R&D pipelines. Leading brands focus on hybrid curing systems that support faster assembly, tighter tolerances, and diverse substrates. Firms expand product portfolios to serve electronics, EVs, medical devices, and industrial manufacturing. Competitors invest in formulations that improve thermal resistance, shrinkage control, and long-term durability. Market leaders strengthen distribution networks across Asia Pacific, Europe, and North America. Many companies align strategies around automation, digital dispensing, and compliance with stricter environmental rules. The Dual cure adhesives market maintains high competitive intensity driven by innovation-focused players.

Recent Developments:

- In September 2025, Henkel AG & Co. KGaA launched a new range of flexible and rigid adhesives under its Loctite brand, specifically engineered for demanding applications in medical devices, further expanding its dual cure adhesive portfolio for precision assembly and reliability in sensitive environments.

- In July 2024, Dow Inc. launched the DOWSIL CC-8000 Series UV and dual moisture cure conformal coatings, a solventless, dual-curable silicone coating designed for rapid curing and strong protection of electronic components, supporting trends in sustainability and high-throughput manufacturing.

Report Coverage:

The research report offers an in-depth analysis based on Application Segments and Resin Type Segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand rises with growth in semiconductors, EVs, and precision devices.

- Cleaner chemistries support strong adoption across regulated industries.

- UV-LED curing expansion strengthens penetration in high-speed lines.

- Lightweight engineering boosts reliance on high-strength hybrid systems.

- Robotics integration drives interest in consistent curing performance.

- Medical wearables and diagnostics create new growth avenues.

- High-temperature grades gain traction in EV and aerospace modules.

- Advanced optical bonding expands usage in imaging and sensor assemblies.

- Regional manufacturing shifts broaden opportunities in emerging economies.

- Digital process monitoring supports better quality control in production.