Market Overview:

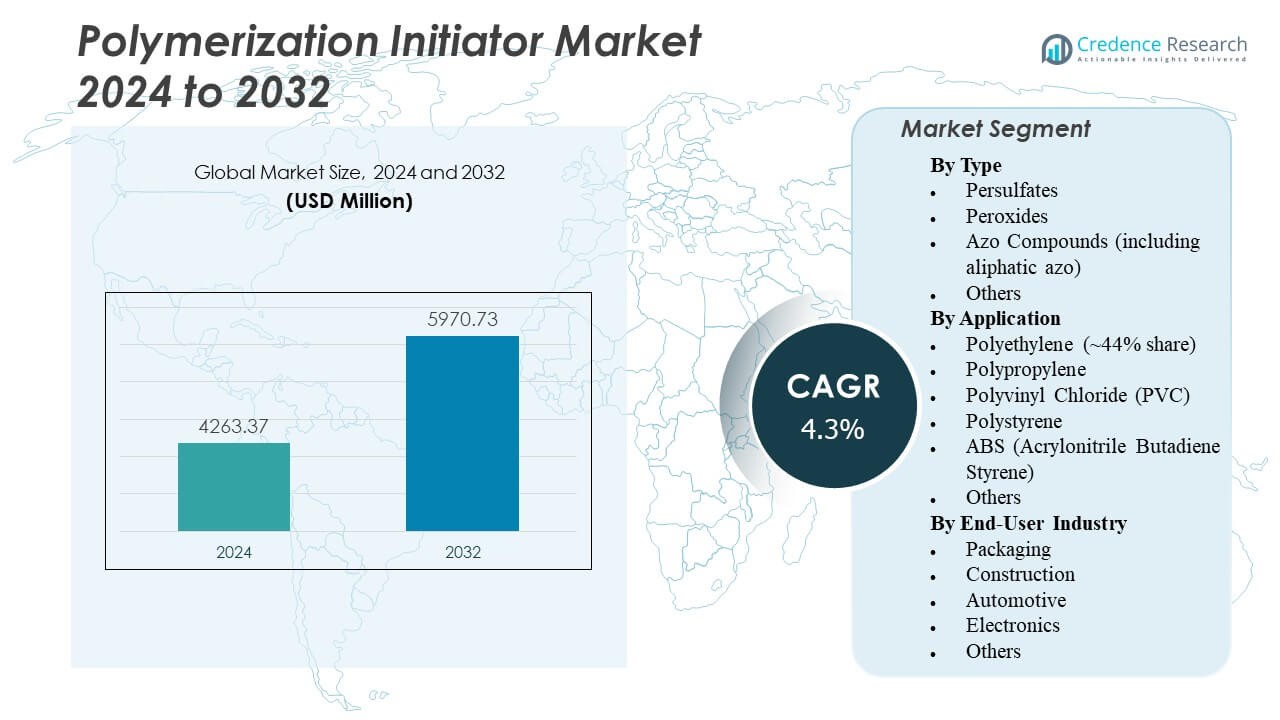

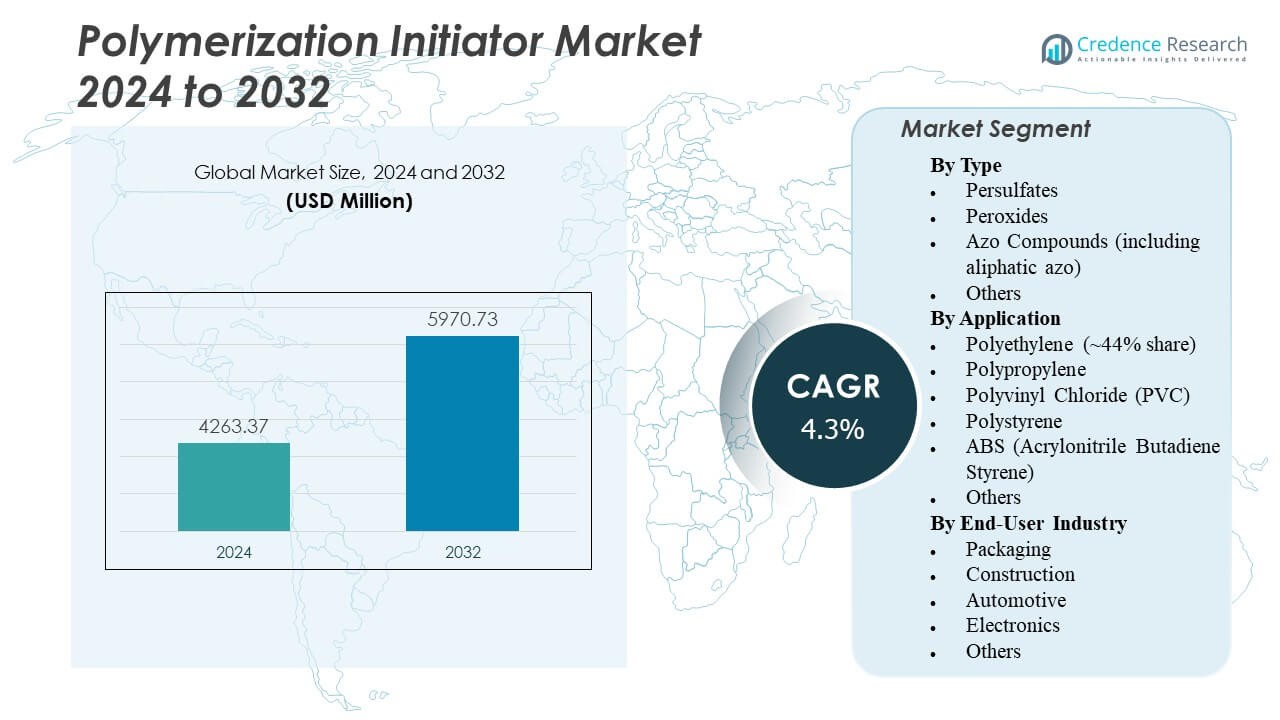

The Polymerization Initiator Market is projected to grow from USD 4,263.37 million in 2024 to an estimated USD 5,970.73 million by 2032, with a compound annual growth rate (CAGR) of 4.3% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polymerization Initiator Market Size 2024 |

USD 4,263.37 Million |

| Polymerization Initiator Market, CAGR |

4.3% |

| Polymerization Initiator Market Size 2032 |

USD 5,970.73 Million |

Rising demand for polymers in packaging, automotive, and construction sectors drives steady market growth. Manufacturers focus on efficient polymerization processes to improve production output and material performance. Technological advancements in peroxide and azo-based initiators enhance reaction control and stability. Increasing adoption of eco-friendly and low-emission materials supports sustainability goals. Strategic collaborations between chemical producers and end-use industries strengthen supply chains and innovation in specialty polymers.

Asia-Pacific leads the Polymerization Initiator Market due to its strong polymer manufacturing base in China, India, Japan, and South Korea. North America shows consistent growth supported by industrial innovation and a well-developed chemical infrastructure. Europe maintains a stable position with rising adoption of sustainable initiators under strict environmental regulations. Emerging markets in Latin America and the Middle East & Africa display growing opportunities driven by infrastructure expansion and increasing polymer consumption in construction and packaging applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Polymerization Initiator Market is valued at USD 4,263.37 million in 2024 and is projected to reach USD 5,970.73 million by 2032, registering a CAGR of 4.3%.

- Growing demand for polymers in packaging, construction, and automotive sectors continues to drive steady market expansion.

- Technological advancements in peroxide and azo-based initiators improve efficiency, stability, and control during polymerization.

- Rising focus on sustainable, low-emission materials encourages manufacturers to adopt eco-friendly polymerization technologies.

- High production capacity in Asia-Pacific solidifies the region’s dominance, supported by rapid industrialization.

- North America shows strong growth momentum, driven by innovation and process automation in chemical manufacturing.

- Europe’s market benefits from sustainability regulations, while Latin America and the Middle East & Africa emerge through growing industrial investments.

Market Drivers

Rising Demand from Polymer and Plastic Manufacturing Industries

The Polymerization Initiator Market gains strong momentum from growing polymer and plastic production across industries. Manufacturers increase capacity to meet the global rise in synthetic resins and coatings. Expanding packaging and construction sectors rely heavily on polymer-based materials, driving consistent initiator use. It supports production of durable, high-performance materials essential for modern infrastructure. Chemical producers optimize formulations for enhanced process efficiency and faster curing. Innovation in radical and peroxide initiators boosts product stability and reactivity. This expansion strengthens global supply chains for large-scale plastic manufacturing.

- for instance, Arkema’s Luperox® organic peroxides reduced cure time from 9 minutes at 170°C to 3 minutes at 185°C in EPDM crosslinking for plastic applications.

Growing Applications in Coatings, Adhesives, and Composites

Rapid adoption of polymerization initiators in coatings and adhesives fuels long-term growth. Industrial coatings use initiators for enhanced film strength and thermal resistance. Adhesive manufacturers depend on them for better curing and performance in variable environments. It helps deliver consistent quality in construction, electronics, and automotive applications. The composite materials industry benefits from polymeric reinforcement driven by strong initiator chemistry. Growing preference for lightweight materials enhances initiator consumption across aerospace and transport sectors. Manufacturers focus on solvent-free formulations to meet evolving sustainability standards.

Technological Advancements in Initiator Formulations

Continuous technological innovation shapes the Polymerization Initiator Market through improved efficiency and precision. New photoinitiators and azo compounds enable controlled polymerization under specific conditions. Research targets low-temperature activation for safer and faster curing systems. It helps reduce energy consumption and enhances process predictability. Smart initiators now offer selective reactivity, minimizing unwanted side reactions. Such developments boost adoption across digital printing, coatings, and biomedical uses. Global players invest in R&D to tailor initiators for next-generation polymer systems.

Rising Focus on Sustainability and Bio-Based Alternatives

The market witnesses steady transition toward bio-based initiators to address environmental regulations. Increasing awareness of green chemistry drives interest in biodegradable compounds. It encourages producers to explore renewable feedstocks such as organic peroxides and natural catalysts. Chemical firms align portfolios with circular economy principles and low-carbon processes. The packaging industry supports eco-friendly initiators to reduce environmental impact. Stringent emission standards in Europe and North America strengthen sustainable product demand. Collaboration between chemical innovators and research institutions accelerates cleaner production pathways.

- For instance, Nouryon’s bio-based Perkadox® initiators derived from renewable feedstocks enable up to 50% lower carbon footprint in polymer production.

Market Trends

Shift Toward Photoinitiators and UV-Curable Systems

The Polymerization Initiator Market trends toward high-efficiency photoinitiators for coatings and inks. UV-curable systems gain preference for their faster curing times and low emissions. It enables instant polymerization suitable for digital printing, electronics, and medical devices. Advancements in LED curing technology enhance compatibility with diverse substrates. Manufacturers develop low-odor and solvent-free variants to meet environmental norms. Industrial applications expand in optical fiber coatings and microelectronics packaging. These developments redefine processing speeds and surface performance standards globally.

- For instance, Miltec UV systems enable rapid photopolymerization, curing coatings within seconds while occupying only 5 to 10 feet of production line space, compared to conventional thermal ovens requiring over 100 feet for similar processing.

Integration of Automation and Process Optimization Technologies

Automation across production plants supports consistent initiator quality and precision blending. Digital monitoring systems track reaction kinetics in real time. It enhances productivity while ensuring stable polymer chain formation. AI-driven modeling predicts initiator performance under varying thermal conditions. This approach reduces production waste and operational downtime. Adoption of process control systems in large-scale polymer units improves reproducibility. The trend underlines a shift toward intelligent manufacturing within chemical sectors.

Growing Role of Specialty and Custom Polymerization Initiators

Demand for customized initiators rises across niche industries requiring tailored polymerization outcomes. Specialty compounds designed for biomedical and nanocomposite applications gain traction. It supports development of advanced materials with unique electrical or mechanical properties. High-value applications in photolithography and precision adhesives encourage innovation. Firms design multi-functional initiators capable of dual activation under UV and thermal exposure. The shift toward small-batch specialty production increases market diversity. Collaborative research with end-users drives co-development of next-generation initiators.

- For instance, anthracene derivatives combined with photoinitiators like 907 achieve up to 90-100% conversion after 5 minutes of UV-LED exposure at 365 nm.

Rising Investments in Asia-Pacific Industrialization

The Asia-Pacific region becomes a vital hub for initiator manufacturing expansion. China, India, and South Korea attract investments in polymer chemistry facilities. It benefits from abundant raw material supply and favorable trade policies. Governments support local production through incentives for chemical innovation. The surge in automotive and packaging exports boosts regional consumption. Domestic producers integrate sustainable practices to meet export standards. This trend positions Asia-Pacific as the fastest-evolving regional contributor to global initiator output.

Market Challenges Analysis

Stringent Environmental Regulations and Safety Concerns

The Polymerization Initiator Market faces challenges due to strict environmental and safety laws. Many peroxide-based and azo initiators involve hazardous decomposition risks. Compliance with emission and disposal standards increases operational costs. It compels manufacturers to invest in safer handling systems and cleaner technologies. Regulatory shifts in Europe limit certain chemical formulations, reducing flexibility for producers. Smaller firms struggle with rising certification and compliance expenses. Balancing industrial demand with ecological obligations becomes a key management challenge.

Volatility in Raw Material Supply and Pricing

Fluctuations in crude oil and organic feedstock prices affect initiator cost structures. The dependence on petrochemical inputs exposes producers to market instability. It hampers profit margins, especially for peroxide and hydrocarbon-based initiators. Supply chain disruptions caused by geopolitical tensions further strain availability. Transport restrictions and energy price surges elevate logistics costs. Manufacturers explore diversification of raw material sourcing to mitigate risks. Long-term stability depends on efficient procurement and local production strategies.

Market Opportunities

Emergence of Bio-Based and Green Polymerization Solutions

The Polymerization Initiator Market finds new opportunities in bio-derived initiators and green chemistry. Environmental awareness drives demand for low-toxicity, renewable alternatives. It stimulates innovation in peroxide-free formulations and enzyme-catalyzed polymerization. Research explores biomass feedstocks that support sustainability without sacrificing performance. Governments promote eco-innovation through funding for cleaner chemical technologies. Growing biodegradable plastic adoption in packaging enhances commercial prospects. This transition enables producers to secure long-term growth aligned with global climate goals.

Expanding Use in High-Value Industrial and Medical Applications

Emerging fields such as advanced composites, dental polymers, and photopolymer resins create new growth fronts. The integration of initiators in additive manufacturing boosts demand for controlled reactivity systems. It drives product development for 3D printing resins, specialty coatings, and functional biomaterials. Increased healthcare spending supports polymer use in medical devices and prosthetics. Collaboration between chemical firms and medical researchers fosters precision-grade initiator designs. Such advancements expand product diversity and strengthen industrial competitiveness. The ongoing R&D focus ensures sustained momentum in high-value segments.

Market Segmentation Analysis:

By Type

The Polymerization Initiator Market is divided into persulfates, peroxides, azo compounds, and others. Peroxides hold the dominant share due to their extensive use in radical polymerization for coatings, adhesives, and elastomers. It offers excellent thermal stability and cost efficiency, making them suitable for large-scale polymer production. Persulfates find growing use in emulsion polymerization for latex and water-based coatings. Azo compounds, including aliphatic azo types, gain demand in specialty polymers that require controlled reaction temperatures. Other initiators address niche applications with advanced reactivity profiles.

- For instance, Arkema’s Luperox® 101 peroxide offers excellent thermal stability and cost efficiency, supporting safe handling in polymer processing and making it suitable for large-scale polymer production.

By Application

The market is segmented by application into polyethylene, polypropylene, polyvinyl chloride (PVC), polystyrene, ABS, and others. Polyethylene accounts for nearly 44% of the total demand due to its widespread use in packaging, construction, and automotive products. It benefits from consistent initiator usage for efficient polymer chain growth. Polypropylene and PVC follow with significant applications in consumer goods and building materials. Polystyrene supports insulation and electronic component manufacturing, while ABS finds use in durable automotive parts. Other specialty polymers expand initiator adoption in adhesives and coatings.

- For instance, high-density polyethylene production uses Ziegler-Natta catalysts composed of triethylaluminum and titanium tetrachloride for controlled polymerization.

By End-User Industry

The end-user segmentation includes packaging, construction, automotive, electronics, and others. Packaging leads due to its reliance on lightweight and recyclable polymer materials that require stable initiator systems. Construction maintains steady growth from adhesives, sealants, and surface coatings. It strengthens performance in infrastructure and industrial applications. Automotive use focuses on heat-resistant and high-strength polymers for components and interiors. Electronics depend on initiators for insulation and encapsulation materials. Other sectors such as healthcare and consumer goods continue to expand initiator utilization globally.

Segmentation:

By Type

- Persulfates

- Peroxides

- Azo Compounds (including aliphatic azo)

- Others

By Application

- Polyethylene (~44% share)

- Polypropylene

- Polyvinyl Chloride (PVC)

- Polystyrene

- ABS (Acrylonitrile Butadiene Styrene)

- Others

By End-User Industry

- Packaging

- Construction

- Automotive

- Electronics

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

The Polymerization Initiator Market finds its largest foothold in the Asia-Pacific region, which accounts for approximately 35% of the global market share. Strong polymer production capacity in China, India, Japan, and South Korea drives this dominance. High demand from packaging, automotive, construction, and electronics industries sustains initiator consumption across the region. Rapid industrialization, availability of raw materials, and supportive government policies further enhance regional performance. Many regional chemical producers emphasize large-scale peroxide and persulfate production, reinforcing Asia-Pacific’s leadership in global initiator supply and export potential.

North America follows closely, holding around 28% of the global market share. The region benefits from a well-established chemical manufacturing base and robust demand from automotive, electronics, and packaging sectors. It maintains a leading position in specialty polymer innovation, supported by advanced process technology and stringent safety standards. Strong investment in R&D and digital manufacturing integration strengthens competitiveness across initiator applications. The presence of major multinational producers and consistent end-user demand contribute to its continued dominance in value-added chemical markets.

Europe captures about 23% of the global market share, supported by its mature polymer, coatings, and construction industries. The region’s focus on sustainability and regulatory compliance drives adoption of low-emission and bio-based initiators. Demand remains steady across automotive, construction, and packaging applications, reflecting stable industrial consumption. European producers invest heavily in process optimization and environmental technologies to meet evolving standards. Emerging regions such as Latin America and the Middle East & Africa together account for nearly 14% of global share, driven by growing industrialization, infrastructure development, and expanding polymerization capacity for consumer and construction applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Arkema S.A.

- LANXESS AG

- BASF SE

- United Initiators GmbH

- Nouryon

- ADEKA Corporation

- NOF Corporation

- Pergan GmbH

- Dongsung Chemical

- LyondellBasell Industries

- AkzoNobel

- Celanese Corporation

Competitive Analysis:

The Polymerization Initiator Market features a concentrated set of global players with strong product portfolios. Key companies include BASF SE, Arkema S.A., LANXESS AG, Nouryon, United Initiators GmbH and ADEKA Corporation. These firms supply peroxides, persulfates, azo compounds and speciality initiators across global markets. They maintain competitiveness through strong R&D capabilities, wide regional presence and integrated supply chains. It helps these companies address demand across polyethylene, polypropylene and specialty polymers for packaging, automotive and electronics applications. Their scale enables cost-efficient production and stable raw-material sourcing. Smaller or new entrants encounter high capital and regulatory barriers. Established players’ global footprint and product breadth preserve market stability and competitive advantage.

Recent Developments:

- In October 2025, Arkema USA launched advanced polymerization initiators with enhanced thermal stability and controlled reaction rates for specialty polymer production.

- In September 2025, SI Group completed the acquisition of a U.S.-based polymer chemistry startup to expand its polymerization initiator offerings.

- In August 2025, Celanese Corporation received FDA approval for new polymerization initiators used in food-grade polymers and medical applications.

Report Coverage:

The research report offers an in-depth analysis based on Type, Application and End-User Industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Polymerization Initiator Market is expected to witness steady expansion driven by rising polymer production across packaging, automotive, and construction sectors.

- Increasing demand for high-performance plastics will strengthen the adoption of peroxides and azo-based initiators in industrial manufacturing.

- Innovation in low-temperature and photoinitiator technologies will enhance process efficiency and product safety across applications.

- Growing investment in bio-based and eco-friendly initiators will align the market with global sustainability goals.

- Expansion of digital manufacturing and process automation will improve reaction control and reduce production downtime.

- Advancements in radical chemistry will open opportunities for new polymer blends in electronics and healthcare materials.

- Strategic partnerships between chemical producers and end-use industries will drive tailored initiator formulations for specialized uses.

- Rising industrialization in Asia-Pacific will continue to make the region a global hub for initiator production and export.

- Regulatory emphasis on environmental compliance will encourage innovation in low-emission initiator compounds.

- Continuous R&D investment will help manufacturers expand portfolios toward green chemistry and next-generation polymerization systems.