Market Overview:

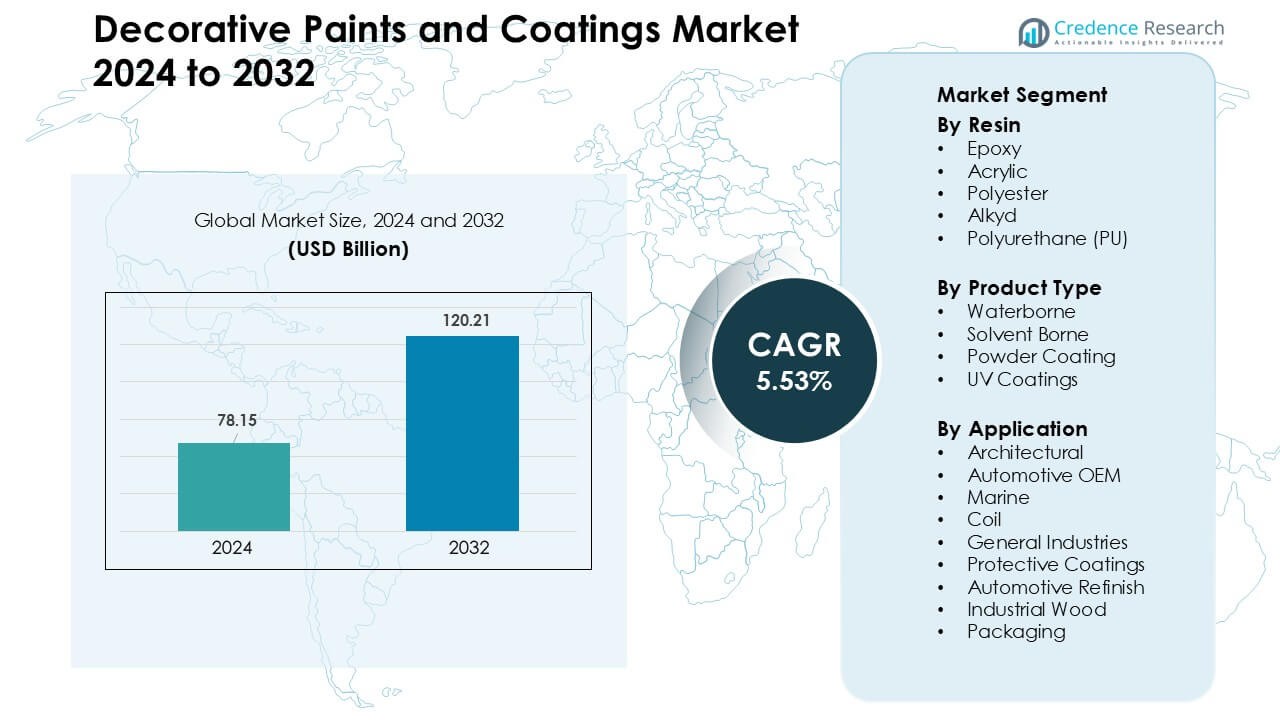

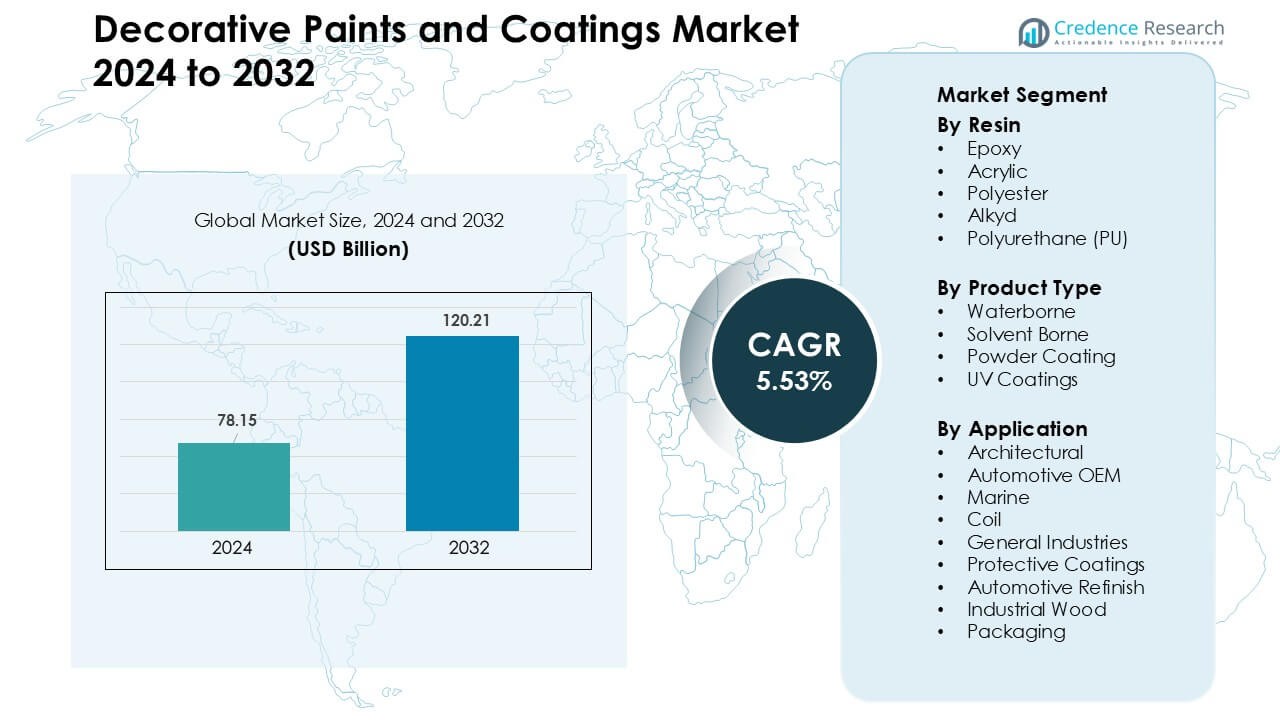

Decorative Paints and Coatings Market was valued at USD 78.15 billion in 2024 and is anticipated to reach USD 120.21 billion by 2032, growing at a CAGR of 5.53 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Decorative Paints and Coatings Market Size 2024 |

USD 78.15 Billion |

| Decorative Paints and Coatings Market, CAGR |

5.53 % |

| Decorative Paints and Coatings Market Size 2032 |

USD 120.21 Billion |

The decorative paints and coatings market is driven by strong competition among leading players such as Axalta Coating Systems, Jotun, Kansai Nerolac Paints Limited, TIKKURILA OYJ, NIPSEA GROUP, The Sherwin-Williams Company, Nippon Paint Holdings, Kwality Paints and Coatings Pvt. Ltd., AkzoNobel, and Kansai Paint Co. These companies enhance market reach through premium waterborne coatings, low-VOC formulations, and advanced digital color-matching systems. Strategic investments in regional manufacturing, retail expansion, and climate-specific product lines strengthen their competitive edge. Asia Pacific leads the market with nearly 38% share, supported by rapid urbanization, large-scale housing construction, and rising demand for premium interior finishes.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The decorative paints and coatings market reached USD 78.15 billion in 2024 and is projected to reach USD 120.21 billion by 2032, growing at a 5.53% CAGR during 2025–2032.

- Growth is driven by rising residential construction, premium interior finishes, and strong demand for low-VOC waterborne acrylic coatings, which held about 56% share within product types.

- Texture, matte, and antimicrobial coatings remain key trends as consumers upgrade home aesthetics, while digital color-visualization tools accelerate product selection and boost premium segment adoption.

- Competition intensifies as major players expand eco-friendly portfolios, strengthen digital retail, and enhance contractor programs, while pricing pressure persists in developing markets with strong local manufacturer presence.

- Asia Pacific leads with nearly 38% share, followed by North America at 28% and Europe at 25%, supported by rapid housing growth and strong renovation activity; the architectural application segment dominates globally with about 62% share.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Resin

Acrylic resins dominated the resin segment in 2024 with about 44% share, driven by strong demand for durable, UV-stable, and low-VOC decorative finishes across residential and commercial spaces. Acrylic chemistries gained wider adoption as builders shifted toward waterborne paints for improved indoor air quality and quicker drying performance. Epoxy and polyurethane coatings expanded in premium interior and metal-finish applications due to higher chemical resistance. Polyester and alkyd systems saw steady use in cost-sensitive markets but lost share as regulatory pressure pushed users toward cleaner acrylic-based decorative solutions.

- For instance, Röhm GmbH announced that its new facility in Bay City (Texas, USA) will produce 250,000 metric tons of methyl methacrylate (MMA) annually using its LiMA technology a key upstream monomer for acrylic resins.

By Product Type

Waterborne coatings led the product type segment in 2024 with nearly 56% share, supported by rising environmental rules, low-odor formulations, and strong use in both interior and exterior decorative applications. Manufacturers promoted waterborne systems because these coatings reduce emissions and improve worker safety during large-scale projects. Solvent-borne coatings retained relevance in heavy-duty decorative work requiring stronger adhesion. Powder coatings grew in metal furniture, appliances, and architectural frames, while UV coatings advanced in premium decorative panels due to fast curing and high surface hardness.

- For instance, AkzoNobel completed a capacity expansion at its Como, Italy powder‑coatings plant by adding four new manufacturing lines, strengthening its supply for architectural and appliance segments.

By Application

Architectural coatings dominated the application segment in 2024 with about 62% share, driven by rapid housing upgrades, commercial renovations, and rising preference for long-lasting wall finishes. Demand increased as consumers preferred low-VOC and stain-resistant coatings for homes, schools, and offices. Automotive OEM and refinish coatings-maintained growth through color-styling upgrades. Protective and marine coatings expanded with infrastructure repair programs. Industrial wood and packaging coatings advanced due to higher output in furniture and consumer goods manufacturing, though both segments remained smaller than the large and consistent architectural demand base.

Key Growth Drivers

Rising Construction and Real Estate Expansion

Global construction growth continues to stimulate strong demand for decorative paints and coatings. Housing upgrades, smart city programs, and urban redevelopment projects increase consumption of interior and exterior coatings across residential and commercial buildings. Builders favor high-performance acrylic and polyurethane formulations due to stronger durability, stain resistance, and reduced maintenance cycles. Renovation volumes are rising in North America, Europe, and Asia as consumers update aging infrastructure and improve energy efficiency through reflective and insulation-supportive coating systems. Decorative coatings also gain traction in fast-growing markets such as India, Southeast Asia, and the Middle East, where accelerated urban migration and higher disposable incomes support greater spending on premium wall finishes, textures, and waterproofing products. The shift toward branded products in developing countries expands retail penetration and improves awareness of advanced coating features. Strong real estate investment and steady refurbishment cycles continue to anchor long-term demand across the global market.

- For instance, in India, about 70% of total paint demand is estimated to come from the real estate sector, according to CareEdge Ratings.

Shift Toward Low-VOC and Sustainable Formulations

Environmental regulations, consumer awareness, and stricter manufacturing norms are driving rapid adoption of low-VOC decorative paints. Governments continue tightening emission limits for solvents, hazardous compounds, and indoor pollutants, accelerating the shift from solvent-borne paints to waterborne acrylic systems. Manufacturers invest in bio-based resins, recycled raw materials, and low-odor formulations to meet sustainability goals and qualify for green building certifications. Retail buyers increasingly choose eco-friendly paints due to better indoor air quality and safer application in homes, schools, and healthcare facilities. Sustainability trends also push suppliers to develop long-life coatings that reduce repaint cycles and lower lifecycle environmental impact. Innovations in plant-based binders, biodegradable additives, and energy-efficient curing technologies expand product differentiation. The sustainability momentum positions green coatings as a mainstream category rather than a niche, strengthening long-term market growth.

- For instance, the EU’s Paints Directive (2004/42/EC) mandates a maximum VOC content of 30 g/L for waterborne flat interior wall coatings.

Advancements in Coating Technology and Digital Color Tools

Technological improvements enhance coating performance and accelerate adoption of premium decorative finishes. New polymer chemistries provide superior washability, UV resistance, mildew protection, and dirt-repelling properties. Self-cleaning and anti-microbial coatings gain wider use in residential and commercial spaces, especially in humid or high-traffic environments. Digital color-matching tools and visualization apps transform the consumer buying process by enabling precise shade selection and faster decision-making. These tools also improve customer engagement for retailers and paint manufacturers. Nanotechnology and functional additives help brands create ultra-smooth textures, matte-stain hybrids, and advanced protective layers. Automated tinting systems support consistent color quality across retail networks. Together, these innovations raise consumer willingness to pay for premium decorative coatings, boosting revenue across organized brands.

Key Trend & Opportunity

Growth of Premium, Texture, and Specialty Decorative Finishes

Premium textures and designer finishes continue gaining momentum as consumers upgrade home aesthetics. Demand rises for metallic, stone, silk, and concrete-effect coatings that deliver unique visual appeal without structural modifications. Interior designers and contractors promote these finishes due to faster application and stronger customization potential compared with traditional plaster systems. Growing disposable income pushes homeowners toward luxury decorative solutions, especially in urban regions. Specialty finishes for kitchens, bathrooms, and moisture-prone environments create new revenue opportunities for brands offering waterproof, stain-proof, and heat-resistant coatings. Expansion of professional painting services further strengthens adoption of premium products.

- For instance, AkzoNobel’s Interpon D2525 Structura powder coating line provides a sand-blasted textured finish that offers a 20-year film integrity warranty when applied by an approved applicator in accordance with application guidelines, combining both longevity and design appeal.

Expansion of E-Commerce and Organized Retail Distribution

Digital channels reshape the decorative paint purchase cycle by providing product comparisons, shade previews, and doorstep service options. Online platforms boost visibility for premium and eco-friendly coatings while allowing manufacturers to offer virtual consultations and digital design support. Organized retail networks continue expanding in emerging markets, replacing fragmented dealer-based supply chains. These stores provide better tinting systems, broader product displays, and higher service quality, improving customer experience. Online color visualizers and AR tools enhance consumer confidence and reduce decision time. Brands use digital channels to launch exclusive collections and capture younger, tech-savvy buyers, unlocking new growth opportunities.

- For instance, BASF launched its Refinish Hub web app in India, enabling painters to search, upload, and share color formulas in a crowdsourced database helping reduce waste and speeding up formula look-up.

Key Challenge

Volatile Raw Material Prices and Supply Chain Disruptions

Raw material volatility remains a significant challenge due to fluctuating prices of titanium dioxide, resins, additives, and petrochemical-derived solvents. Supply chain disruptions, freight delays, and geopolitical uncertainties create cost pressure for paint manufacturers, affecting margins and pricing strategies. Many companies struggle to maintain stable production schedules when raw materials become scarce or expensive. Substitutes for titanium dioxide and specialty resins often lack identical performance, limiting flexibility in reformulation. These pressures encourage manufacturers to secure long-term contracts, diversify suppliers, and invest in local production hubs to reduce risks.

Intense Competition and Strong Price Sensitivity in Emerging Markets

The decorative paints market faces intense competition between global brands, regional players, and low-cost local manufacturers. Price sensitivity remains high in developing markets, where consumers often choose lower-priced paints despite reduced longevity or quality. This puts pressure on leading brands to balance affordability and performance while maintaining strong retail presence. High promotional spending, dealer incentives, and frequent product launches add to competitive intensity. Smaller players compete aggressively on price, making premium segment expansion slower in certain regions. Maintaining differentiation through innovation, branding, and customer service remains essential but demands sustained investment.

Regional Analysis

North America

North America held about 28% share in 2024, driven by strong residential renovation cycles, premium interior finishes, and steady commercial repainting demand. The United States led the region as homeowners upgraded surfaces with low-VOC acrylic and advanced stain-resistant coatings. Energy-efficient and reflective exterior paints gained traction as buildings adopted sustainability-focused standards. Canada recorded stable growth through rising home refurbishments and better penetration of waterborne technologies. Manufacturers expanded retail networks, digital shade-selection tools, and contractor loyalty programs to support regional competitiveness. Regulatory pressure on solvent-borne chemistry further strengthened the shift toward eco-friendly decorative coatings.

Europe

Europe accounted for around 25% share in 2024, supported by strict environmental rules that accelerated adoption of waterborne acrylic coatings across both residential and commercial segments. Demand rose as consumers favored long-life decorative finishes, matte textures, and antimicrobial interior paints. Germany, France, and the UK remained the largest markets due to frequent renovation cycles and government incentives for green buildings. Energy-efficient insulation coatings gained momentum in colder regions. Southern Europe saw recovery in tourism-related construction, boosting decorative repainting. Sustainability certifications and circular-economy programs pushed manufacturers to expand bio-based and low-emission decorative coating portfolios.

Asia Pacific

Asia Pacific dominated the global market with nearly 38% share in 2024, driven by rapid urbanization, large housing construction, and expanding middle-class spending on premium finishes. China and India led growth as new residential units, high-rise projects, and repainting cycles increased decorative coating consumption. Southeast Asia recorded strong demand for moisture-resistant exterior paints due to tropical weather conditions. Waterborne coatings gained wider adoption as governments tightened VOC norms. Organized retail expansion and rising adoption of digital color-visualization tools improved buying behavior. Multinational brands invested heavily in capacity expansion and localized product lines to match regional climate needs.

Latin America

Latin America captured about 6% share in 2024, supported by growing construction activity in Brazil, Mexico, and Colombia. Rising urban housing projects and expanding informal repainting cycles sustained consistent demand for economical acrylic and alkyd coatings. Economic fluctuations limited premium paint penetration, but organized retail growth improved product availability. Weather-resistant exterior coatings gained adoption in tropical and coastal zones. Manufacturers focused on low-VOC affordability lines and wide color palettes to meet varied customer preferences. Investments in localization and improved distributor networks helped strengthen presence despite pricing pressure and macroeconomic instability.

Middle East & Africa

The Middle East & Africa region held around 3% share in 2024, driven by infrastructure upgrades, housing development, and rising demand for heat-reflective and sand-resistant exterior coatings. GCC countries led the market as large residential compounds, hospitality projects, and commercial complexes expanded decorative coating usage. Africa showed steady growth through urban migration and increasing small-home renovations. Waterborne coatings advanced as governments promoted healthier indoor environments and reduced reliance on solvent-based products. Manufacturers introduced climate-adaptive coatings suited for high temperatures and UV exposure, helping the region transition toward higher-performance decorative formulations.

Market Segmentations

By Resin

- Epoxy

- Acrylic

- Polyester

- Alkyd

- Polyurethane (PU)

By Product Type

- Waterborne

- Solvent Borne

- Powder Coating

- UV Coatings

By Application

- Architectural

- Automotive OEM

- Marine

- Coil

- General Industries

- Protective Coatings

- Automotive Refinish

- Industrial Wood

- Packaging

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the decorative paints and coatings market features strong participation from global brands and regional manufacturers that compete through product innovation, distribution strength, and advanced formulation capabilities. Leading companies such as Axalta Coating Systems, Jotun, Kansai Nerolac Paints Limited, TIKKURILA OYJ, NIPSEA GROUP, The Sherwin-Williams Company, Nippon Paint Holdings, Kwality Paints and Coatings Pvt. Ltd., AkzoNobel, and Kansai Paint Co. focus on expanding premium waterborne acrylic lines, eco-friendly solutions, and digitally assisted color-selection platforms. These players invest in improved tinting technologies, localized color palettes, and climate-adaptive coatings to strengthen regional relevance. Strategic moves include capacity expansion in high-growth Asian markets, portfolio upgrades targeting low-VOC regulations, and partnerships with retail chains and contractor networks. Pricing competition remains intense in developing economies, prompting companies to balance affordability with durability. Continuous R&D, stronger brand visibility, and integrated service offerings help major players maintain leadership in this dynamic market.

Key Player Analysis

- Axalta Coating Systems (U.S.)

- Jotun (Norway)

- Kansai Nerolac Paints Limited (India)

- TIKKURILA OYJ (Finland)

- NIPSEA GROUP (Singapore)

- The Sherwin-Williams Company (U.S.)

- Nippon Paint Holdings Co., Ltd. (Japan)

- Kwality Paints and Coatings Pvt. Ltd. (KPCPL) (India)

- AkzoNobel (Netherlands)

- Nippon and Kansai (Kansai Paint Co., Ltd.) (Japan)

Recent Developments

- In October 2025, Sherwin-Williams completed acquisition of a major decorative-paints business in Brazil (from BASF), including production sites, brands (e.g. Suvinil, Glasu!) and ~1,000 employees.

- In September 2025, Kwality Paints continues to position itself as an Indian specialty/coatings manufacturer (industrial & automotive focus) its corporate site lists product expansion in water-based and specialty industrial coatings and ongoing capacity/ISO claims.

- In 2025, Nippon published a medium-term strategy update (Asset-Assembler model) emphasizing continued M&A, EPS compounding, sustainability and geographic expansion signaling continued inorganic expansion of its decorative and specialty coatings businesses.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Resin, Product Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for premium interior and exterior finishes will rise as consumers prioritize durability and aesthetics.

- Waterborne and low-VOC formulations will gain stronger adoption due to stricter environmental rules.

- Digital color tools and virtual visualization platforms will shape buying behavior and support premium product growth.

- Texture, designer, and specialty coatings will expand as home customization becomes more popular.

- Companies will invest more in bio-based resins and sustainable raw materials to meet green building goals.

- Fast-growing Asian markets will drive capacity expansion and localized product development.

- Smart coatings with self-cleaning, anti-microbial, and heat-reflective functions will see broader use.

- Retail consolidation and e-commerce channels will accelerate product reach and brand visibility.

- Manufacturers will focus on improving supply-chain resilience to manage raw material volatility.

- Competitive intensity will increase as global and regional players expand portfolios and strengthen contractor networks.

Market Segmentation Analysis:

Market Segmentation Analysis: