Market Overview

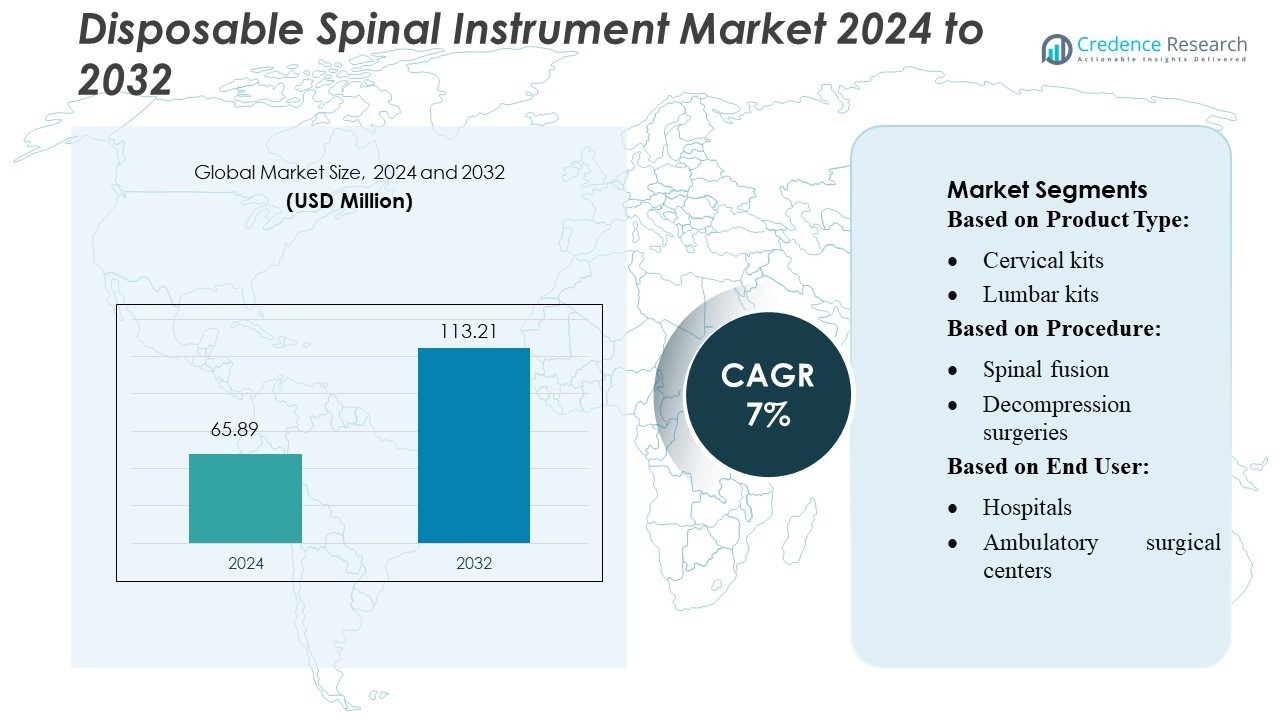

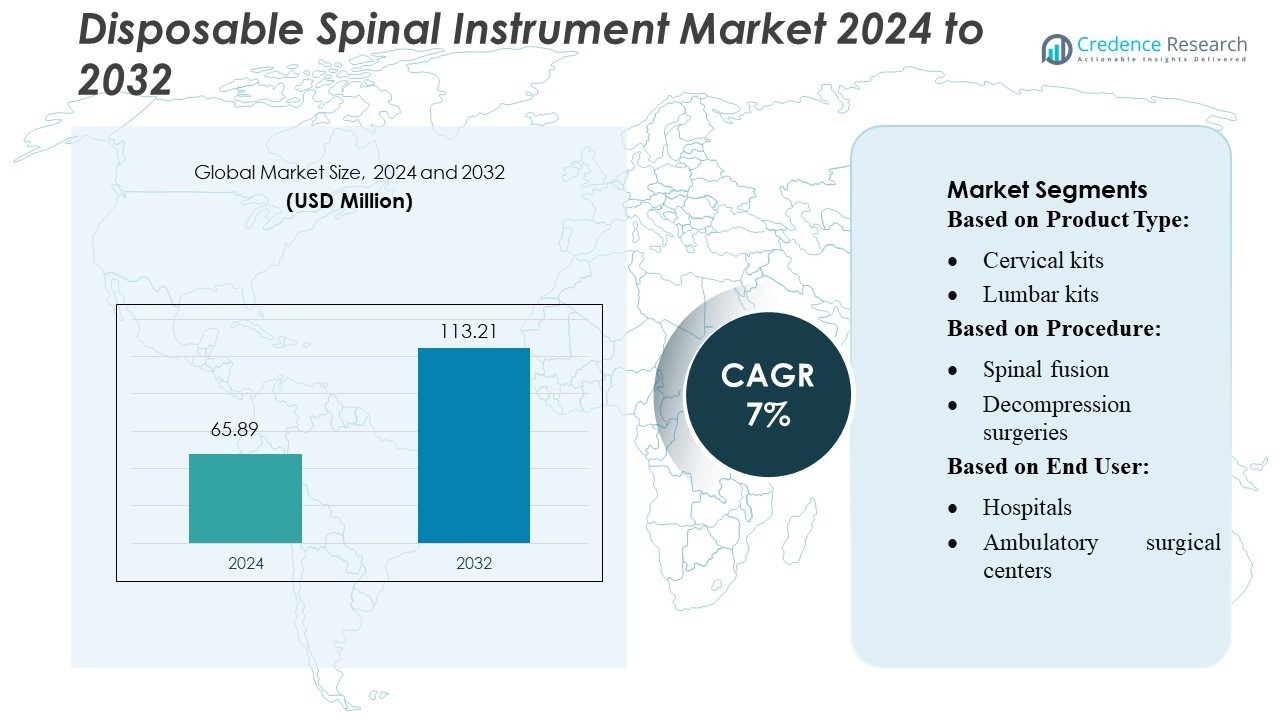

Disposable Spinal Instrument Market size was valued USD 65.89 million in 2024 and is anticipated to reach USD 113.21 million by 2032, at a CAGR of 7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Disposable Spinal Instrument Market Size 2024 |

USD 65.89 Million |

| Disposable Spinal Instrument Market, CAGR |

7% |

| Disposable Spinal Instrument Market Size 2032 |

USD 113.21 Million |

The Disposable Spinal Instrument Market is shaped by the presence of several global and regional manufacturers that continue to expand their product portfolios and strengthen distribution networks to meet rising surgical demand. These companies focus on enhancing material quality, procedural efficiency, and regulatory compliance, enabling them to serve high-volume hospitals and ambulatory surgery centers. North America leads the market with 40% share, supported by advanced healthcare infrastructure, strong adoption of minimally invasive procedures, and consistent product innovation. The region’s emphasis on infection control and cost-efficient surgical workflows further reinforces its dominance, positioning it as the primary growth engine for disposable spinal solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Disposable Spinal Instrument Market was valued at USD 65.89 million in 2024 and is projected to reach USD 113.21 million by 2032, registering a 7% CAGR, driven by rising spinal procedure volumes and increasing adoption of single-use surgical solutions.

- Demand continues to strengthen as hospitals and ASCs prioritize infection prevention and cost efficiency, with disposable kits reducing reprocessing needs and improving procedural workflow.

- Technology trends focus on lightweight materials, ergonomic designs, and procedure-specific disposable sets that enhance precision in fusion and decompression surgeries, supporting higher adoption across end users.

- Competitive activity intensifies as manufacturers expand portfolios, strengthen distribution networks, and pursue regulatory compliance, with North America maintaining dominance at 40% share and the spinal fusion segment holding the largest share among procedures.

- Regional growth remains robust in Asia Pacific, backed by rising surgical infrastructure and patient volumes, while Europe maintains steady demand due to strong infection-control standards and high spinal surgery rates.

Market Segmentation Analysis:

By Product Type

The disposable spinal instrument market includes cervical kits, lumbar kits, and system kits such as pedicle screw and cervical plate systems. Pedicle screw systems hold the dominant position with an estimated around 45% market share, driven by rising spinal fusion volumes and the need for stable fixation in complex procedures. Their single-use format reduces sterilization costs, lowers infection risks, and enhances surgical efficiency, prompting hospitals and ASCs to increasingly shift from reusable to disposable fixation tools.

- For instance, Neo Medical’s NEO Pedicle Screw System — delivered in sterile, single-use instrument kits — has been shown to reduce operating room time by up to 23 minutes per case.

By Procedure

Across procedures, the market is segmented into spinal fusion and decompression surgeries. Spinal fusion leads the segment with roughly about 60–62% market share, supported by growing cases of degenerative disc disease, trauma, and chronic instability. Surgeons prefer disposable instruments in fusion procedures due to their superior sterility, consistent performance, and reduced reprocessing time. The shift toward minimally invasive fusion techniques further boosts demand, as disposable kits offer precision and convenience for high-volume fusion workflows.

- For instance, Northrop Grumman secured a contract worth up to 483.3 million (including options) for the delivery of advanced EOD robotic systems and support services to support defense operations, which enhanced their autonomous navigation and precision handling capabilities.

By End-User

End-users include hospitals, ambulatory surgical centres (ASCs), and orthopaedic clinics. Hospitals dominate the segment with the largest market share due to higher surgical volumes and the availability of advanced spinal care infrastructure. Their adoption of disposable spinal instruments is driven by strict infection-control protocols, workflow efficiency needs, and the rising complexity of spinal procedures. While hospitals lead, ASCs are expanding rapidly as outpatient spinal surgeries grow, supported by cost-effective care models and increased use of disposable kits for quick turnaround procedures.

Key Growth Drivers

Increasing Demand for Single-Use Surgical Solutions

Hospitals and surgical centers increasingly adopt disposable spinal instruments to reduce infection risk and avoid cross-contamination during complex procedures. This shift accelerates due to stricter sterilization regulations, higher surgical volumes, and rising awareness of patient safety. Single-use kits also reduce operational delays associated with reprocessing reusable tools. These advantages make disposable systems attractive for both high-acuity and routine spinal surgeries, driving sustained demand across developed and emerging healthcare markets.

- For instance, Teledyne FLIR has delivered orders valued at over 100 million in total through the MTRS Inc II program for its Centaur unmanned ground vehicles (UGVs), which are equipped with advanced sensors for EOD missions.

Efficiency Gains and Cost Optimization in Surgical Workflows

Disposable spinal instruments enable predictable cost structures and minimize the need for sterilization equipment, staffing, and maintenance. Healthcare facilities increasingly evaluate total cost of ownership, where disposables outperform reusables by reducing reprocessing time and lowering infection-related complication costs. The consistent precision and readiness of sterile, pre-packaged kits also streamline operating room efficiency. As healthcare systems prioritize performance-based procurement and cost savings, disposable instrument adoption continues to accelerate.

- For instance, NP Aerospace secured a contract valued at 71 million for the supply of vehicle support, and offers advanced bomb disposal suits with integrated cooling systems and high-mobility design features, enabling extended wear during prolonged operations.

Growing Burden of Spinal Disorders and Expanding Procedural Volumes

The rising prevalence of degenerative spinal conditions, trauma injuries, and age-related musculoskeletal diseases significantly increases the number of spinal surgeries worldwide. Minimally invasive procedures, which favor compact, single-use instruments, are expanding rapidly across hospitals and ASCs. Surgeons prefer disposable systems for their consistency, ergonomic improvements, and reduced variability during high-volume procedures. This expanding clinical need, combined with broader access to advanced spinal care, drives robust market growth.

Key Trends & Opportunities

Expansion of Procedure-Specific Disposable Kits

Manufacturers increasingly develop integrated, procedure-specific disposable kits tailored for cervical, lumbar, and minimally invasive surgeries. These kits offer standardized tool sets that reduce intraoperative variability and enhance surgical precision, making them highly attractive to value-based care models. As hospitals aim for predictable outcomes and reduced turnover times, the demand for specialized disposable solutions continues to grow, creating opportunities for companies to differentiate through kit design and workflow optimization.

- For instance, FLIR Systems secured a contract valued at 18.6 million for the delivery of Centaur unmanned ground vehicles to military units, equipped with advanced manipulator arms, high-definition cameras, and autonomous navigation for hazardous environment operations.

Adoption of Advanced Materials and Ergonomic Designs

Opportunities emerge from incorporating lightweight, high-strength polymers and advanced composites into disposable spinal instruments. These materials enhance durability, tactile feedback, and surgeon comfort while maintaining sterility and cost-effectiveness. Continuous innovation in instrument geometry and handle design supports better precision in minimally invasive procedures. This trend drives premiumization within the disposable segment and opens space for technology-led product expansions across global markets.

- For instance, Sabert Corporation launched 333 new products in its most recent innovation cycle, operates 7 manufacturing facilities and employs over 2,000 people, and has completed regional certifications such as its Texas plant’s BPI certification.

Growing Penetration Across Ambulatory Surgical Centers (ASCs)

The shift of spinal procedures toward outpatient and ASC settings creates a major opportunity for disposable instruments, which align well with ASC operational models. Disposable systems reduce reliance on sterilization infrastructure, offer predictable pricing, and improve efficiency—critical factors for ASCs operating under cost-controlled reimbursements. As minimally invasive spinal techniques gain traction in outpatient care, market penetration of disposable tools is expected to rise sharply.

Key Challenges

Cost Pressures and Affordability Constraints in Developing Regions

Despite operational advantages, disposable spinal instruments remain cost-prohibitive for many hospitals in emerging markets. Budget-constrained facilities often rely on reusable systems to manage long-term expenses. The higher upfront cost of disposables, combined with inconsistent reimbursement frameworks, limits adoption. Manufacturers must address pricing gaps, enhance distribution networks, and provide value-based economic evidence to overcome this barrier and expand global market reach.

Environmental Concerns Linked to Increased Medical Waste

The growing use of single-use spinal instruments raises concerns about rising medical waste volumes and sustainability impacts. Healthcare systems face pressure to reduce plastic consumption and adopt greener procurement practices. Manufacturers must innovate with recyclable materials, eco-friendly packaging, and waste-minimization strategies to address regulatory and public health expectations. Failure to adapt may slow adoption among environmentally focused healthcare providers and regions with strict waste-management policies.

Regional Analysis

North America

North America holds the largest share of the Disposable Spinal Instrument Market, contributing around 40% due to its strong surgical infrastructure and high adoption of advanced minimally invasive technologies. Growth remains driven by the rising prevalence of spinal disorders, expanding spinal fusion and decompression procedures, and steady product innovation by leading U.S.-based manufacturers. Hospitals and ambulatory surgery centers increasingly prefer disposable kits to reduce cross-contamination risks and improve procedural efficiency. Reimbursement support and stringent infection control policies further strengthen market penetration. The region continues to witness sustained product launches, reinforcing North America’s position as the primary revenue-generating market.

Europe

Europe accounts for nearly 25% of the global market, supported by well-established healthcare systems, a high volume of spinal surgeries, and strong regulatory emphasis on patient safety. Adoption of disposable spinal kits accelerates as hospitals aim to reduce sterilization costs and comply with stricter infection-control standards. Key markets such as Germany, the U.K., France, and Italy lead demand, driven by aging populations and expanding orthopedic surgical programs. The region also benefits from rising acceptance of cost-efficient, single-use instrument sets in high-volume surgical centers. Continued focus on technologically efficient devices positions Europe as a stable growth contributor.

Asia Pacific

Asia Pacific represents roughly 22% of market share, emerging as the fastest-growing region due to expanding healthcare investments, strengthening surgical capacities, and increasing awareness of minimally invasive spinal treatments. China, India, Japan, and South Korea drive demand as patient volumes rise and hospitals modernize operating environments. The shift toward disposable kits is gaining traction as facilities improve infection-prevention standards and seek cost-effective solutions for high-throughput procedures. Growing medical tourism, particularly in Southeast Asia, further supports market expansion. Increasing entry of global manufacturers and regional partnerships enhances accessibility and accelerates APAC’s growth trajectory.

Latin America

Latin America contributes around 8% to the global market, with growth anchored by expanding spinal surgery capabilities in Brazil, Mexico, and Argentina. The region’s adoption curve for disposable spinal instruments is steadily improving as hospitals aim to reduce postoperative complications linked to improper sterilization. Budget-conscious healthcare systems increasingly recognize the long-term cost benefits of single-use kits. Medical tourism hubs in Brazil and Mexico also stimulate demand for advanced spinal procedures. Limited reimbursement frameworks and varying regulatory environments remain challenges, yet rising private-sector investments and improved procurement systems support moderate but consistent market growth.

Middle East & Africa

The Middle East & Africa region holds roughly 5% of the market, supported by increasing investments in surgical infrastructure across the UAE, Saudi Arabia, and South Africa. Adoption of disposable spinal instruments is gradually rising as hospitals modernize operating rooms and prioritize infection-control compliance. Growth is also driven by a rising burden of degenerative spinal conditions and expanding orthopedic specialty centers in Gulf countries. However, limited access to advanced devices and cost constraints in parts of Africa temper broader market penetration. Ongoing healthcare reforms and private-sector participation are expected to gradually elevate regional uptake.

Market Segmentations:

By Product Type:

- Cervical kits

- Lumbar kits

By Procedure:

- Spinal fusion

- Decompression surgeries

By End User:

- Hospitals

- Ambulatory surgical centers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Disposable Spinal Instrument Market features an increasingly competitive environment, with leading global and regional participants such as Go Pak Group, Genpak LLC, R+R Packaging Ltd., Sabert Corp., Contital Srl, Interplast Group, Graphic Packaging International LLC, Pactiv LLC, Sonoco Products Company, and Huhtamaki Food Service. the Disposable Spinal Instrument Market is characterized by continuous innovation, expanding product portfolios, and a strong focus on infection prevention and procedural efficiency. Manufacturers increasingly prioritize the development of ergonomic, high-precision, single-use kits that help healthcare facilities reduce sterilization costs and minimize contamination risks during spinal surgeries. The market also witnesses growing investment in sustainable materials and advanced production technologies to meet evolving regulatory and environmental standards. Companies actively strengthen global distribution networks, form strategic partnerships, and enhance manufacturing capabilities to address rising surgical volumes worldwide. As hospitals and ambulatory surgery centers shift toward disposable solutions, competition intensifies around pricing strategies, product differentiation, and supply chain resilience, shaping a dynamic and rapidly evolving market environment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Go Pak Group

- Genpak LLC

- R+R Packaging Ltd.

- Sabert Corp.

- Contital Srl

- Interplast Group

- Graphic Packaging International LLC

- Pactiv LLC

- Sonoco Products Company

- Huhtamaki Food Service

Recent Developments

- In October 2025, Pompano Beach Chiropractic Clinic announced the expansion of its services to include Spinal Decompression Therapy, featuring the advanced KDT (Kennedy Decompression Technique) system.

- In June 2025, Johnson & Johnson launched a disposable multifocal toric contact lens, ACUVUE OASYS MAX 1-Day MULTIFOCAL. The lens is useful for a person suffering from presbyopia and astigmatism. The lens offers stable, crisp, and clear vision across all distances.

- In April 2025, Intco Medical launched new Syntex synthetic disposable latex gloves. The gloves are fully compliant with EU CE and FDA standards. Syntex gloves are available for use in various industries like industrial protection, healthcare, and food processing. The gloves have strong chemical & puncture resistance and provide high elasticity.

- In December 2024, ConTIPI Medical launched the ProVate disposable device for pelvic organ prolapse in the United States. The patients can easily use the device at home, and it is available in six sizes. The device can be used up to 7 days and is available for physicians.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Procedure, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily as hospitals accelerate the shift toward single-use spinal instruments to reduce infection risks.

- Adoption of disposable kits will rise with the growing volume of minimally invasive spinal procedures worldwide.

- Manufacturers will increasingly integrate lightweight, ergonomic designs to enhance surgical precision and ease of handling.

- Demand will strengthen as healthcare facilities prioritize cost savings by eliminating sterilization and reprocessing requirements.

- Regulatory bodies will enforce stricter infection-control standards, driving wider acceptance of disposable systems.

- Technological advancements will improve material strength, durability, and compatibility with complex spinal surgeries.

- Growth in ambulatory surgery centers will support higher use of disposable instrument sets for fast-turnover procedures.

- Companies will expand global distribution networks to improve product availability in emerging markets.

- Sustainability initiatives will encourage the development of eco-friendly disposable components and packaging.

- Competitive pressures will increase product innovation, leading to diversified, procedure-specific disposable spinal kits.