Market Overview

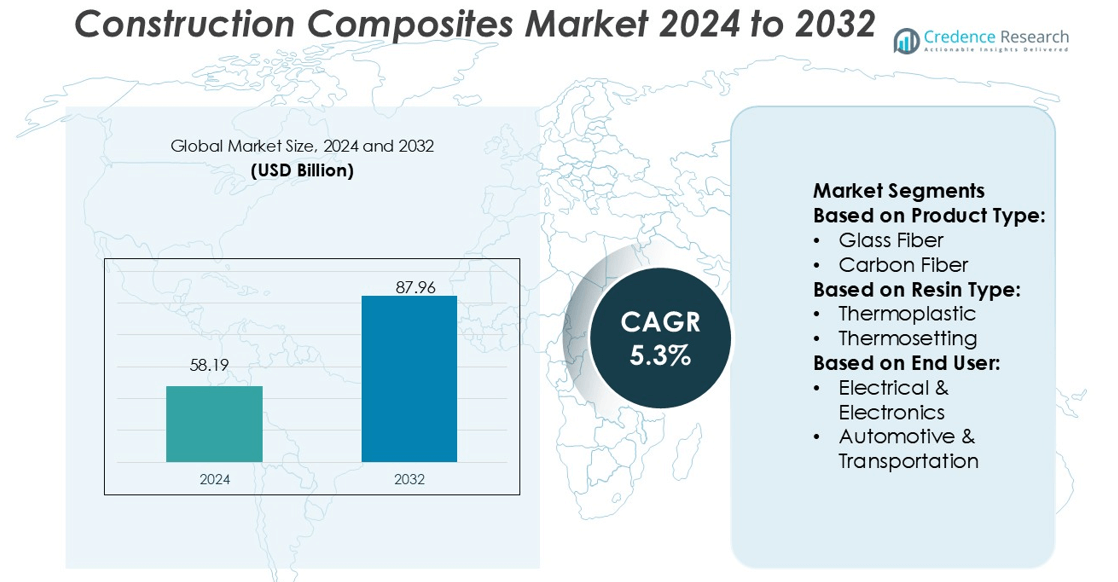

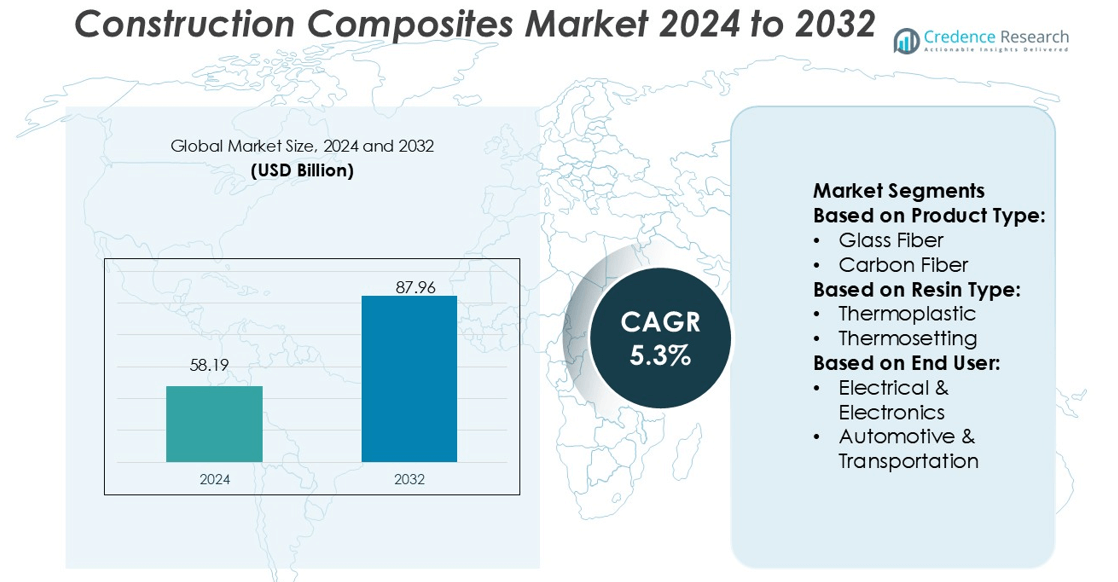

Construction Composites Market size was valued USD 58.19 billion in 2024 and is anticipated to reach USD 87.96 billion by 2032, at a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Construction Composites Market Size 2024 |

USD 58.19 billion |

| Construction Composites Market, CAGR |

5.3% |

| Construction Composites Market Size 2032 |

USD 87.96 billion |

The Construction Composites Market is shaped by key players such as Fiberon LLC, Exel Composites Oyj, Jamco Corporation, Trex Company Inc, Diversified Structural Composites, Schoeck International, Bedford Reinforced Plastics, Strongwell Corporation, Advanced Environmental Recycling Technologies Inc, and UPM Biocomposites. These companies focus on expanding production capacities, developing sustainable materials, and enhancing structural performance through advanced fiber and resin technologies. Strategic collaborations and innovations in recycled composites strengthen their global presence. Asia-Pacific leads the global market with a 34% share in 2024, driven by rapid urbanization, large-scale infrastructure projects, and rising adoption of lightweight, corrosion-resistant materials across construction and industrial applications.

Market Insights

- The Construction Composites Market was valued at USD 58.19 billion in 2024 and is projected to reach USD 87.96 billion by 2032, registering a CAGR of 5.3%.

- Market growth is driven by the rising demand for lightweight, durable, and corrosion-resistant materials in infrastructure, automotive, and energy applications.

- Sustainable construction trends and innovations in fiber-reinforced polymers are shaping industry advancement, with increased adoption of recyclable and bio-based composites.

- Key players focus on product diversification, automation, and strategic partnerships to strengthen global competitiveness and enhance production efficiency.

- Asia-Pacific holds a 34% regional share, leading global growth, while the construction and infrastructure segment dominates the market due to expanding urban development and modernization projects worldwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Glass fiber dominates the Construction Composites Market, accounting for the largest share in 2024. Its high strength-to-weight ratio, corrosion resistance, and cost-effectiveness make it ideal for structural and non-structural applications. The product is widely used in panels, rebar, and bridge decks. Carbon fiber is gaining traction due to superior stiffness and fatigue resistance, though its high cost limits widespread use. Other fibers, including aramid and basalt, find niche use in demanding construction projects that require added impact resistance and long-term durability.

- For instance, Toray T700 carbon fiber, with a tensile modulus of 230 GPa, is commonly used in structural reinforcement applications for infrastructure like bridges, enabling much lighter materials.

By Resin Type

Thermosetting resins hold the dominant market share in 2024, driven by their superior mechanical strength and chemical resistance. Epoxy, polyester, and vinyl ester resins are widely used for composite reinforcement in construction and infrastructure applications. Thermoplastic resins are emerging in lightweight and recyclable construction components due to their reusability and lower processing times. Other resins, such as phenolic and polyurethane, cater to specialized needs like fire resistance and thermal insulation, enhancing structural safety and energy efficiency in construction projects.

- For instance, Exel’s structural profiles use epoxy, vinyl ester, and polyester systems with cured cross-sectional glass fiber volume fractions up to about 65 % (per their product datasheets).

By End User

The construction and infrastructure segment leads the market with the highest share in 2024. The rising adoption of composite materials in bridges, buildings, and road reinforcement projects is driving demand. Their lightweight nature, resistance to corrosion, and extended service life reduce maintenance costs and improve performance in harsh environments. Automotive and transportation sectors are also expanding usage, while wind energy and aerospace applications contribute significantly through the integration of advanced carbon and glass fiber composites for strength and energy efficiency.

Key Growth Drivers

Rising Demand for Lightweight and Durable Construction Materials

Construction composites are increasingly used to replace traditional materials such as steel and concrete. Their lightweight, corrosion-resistant, and high-strength properties make them ideal for bridges, facades, and modular structures. Governments and private developers are adopting composite materials to reduce maintenance costs and extend infrastructure lifespan. The demand for energy-efficient and high-performance buildings is further accelerating adoption, particularly in regions promoting sustainable construction practices and green building certifications like LEED and BREEAM.

- For instance, Trex’s high-performance decking combines up to 95% recycled and reclaimed content, including polyethylene plastic film (like from plastic bags and packaging), and reclaimed wood fibers from woodworking operations and agricultural waste.

Growing Infrastructure Development and Urbanization

Rapid urbanization and large-scale infrastructure investments are driving the construction composites market. Expanding metro networks, smart city projects, and renewable energy installations rely on advanced composite materials for strength and design flexibility. Countries such as China, India, and the United States are increasing infrastructure budgets to support economic growth, creating significant opportunities for composite manufacturers. The materials’ superior load-bearing capacity and resistance to harsh environments enhance long-term project efficiency and durability across multiple construction sectors.

- For instance, Schöck also deploys its Combar® glass fiber composite rebar as non-metallic reinforcement in underground parking decks. Combar® has a characteristic long-term tensile strength of about 445 N/mm² and a design tensile strength of 435 N/mm².

Increased Adoption of Sustainable and Energy-Efficient Materials

Sustainability initiatives and environmental regulations are boosting demand for eco-friendly construction composites. Manufacturers are developing recyclable and bio-based composites that reduce carbon emissions and waste. These materials align with global decarbonization goals and green construction mandates. The shift toward circular economy principles encourages the use of composites in prefabricated and modular buildings. Growing awareness of environmental impacts among contractors and developers is accelerating the transition to sustainable composite solutions across both public and private construction projects.

Key Trends & Opportunities

Integration of Advanced Manufacturing Technologies

Automation, 3D printing, and resin transfer molding are revolutionizing composite production. These techniques reduce waste, enhance design precision, and enable mass customization for complex structures. Companies are investing in smart manufacturing to improve scalability and lower production costs. The use of digital design tools and AI-driven process optimization supports faster development cycles. This trend presents strong opportunities for suppliers offering technology-enabled composite solutions for next-generation construction applications.

- For instance, companies operating large 3D printing facilities often use dozens or even hundreds of industrial 3D printers to produce a wide range of parts, such as custom jigs, molds, and small structural components.

Expansion in Renewable Energy and Green Infrastructure Projects

The growing focus on renewable energy is opening new markets for construction composites. Wind turbine blades, solar panel frames, and green building components increasingly use glass and carbon fiber composites. These materials offer high strength-to-weight ratios, improving energy efficiency and reducing installation costs. Global commitments to net-zero emissions are promoting long-term demand for sustainable infrastructure. This shift creates profitable opportunities for composite manufacturers in energy, transportation, and smart city developments.

- For instance, MoistureShield offers composite decking products with varying limited fade and stain warranties. For example, some of its product lines previously offered a 25-year warranty against fading and staining, though warranty terms can differ across products and over time.

Rising Use in Prefabricated and Modular Construction

Prefabrication and modular building techniques are gaining traction for faster and more sustainable project delivery. Construction composites, due to their lightweight and customizable nature, fit perfectly into this model. They allow rapid assembly, reduced labor costs, and improved thermal performance. The trend toward urban housing and portable infrastructure solutions is strengthening this opportunity. Manufacturers focusing on ready-to-install composite systems are likely to benefit from growing modular construction adoption worldwide.

Key Challenges

High Production and Material Costs

The cost of producing construction composites remains higher than traditional materials like concrete and steel. Advanced fibers, resin systems, and fabrication processes contribute to elevated expenses. These costs limit adoption in price-sensitive markets, especially in developing economies. Manufacturers face challenges in achieving economies of scale while maintaining quality standards. Reducing material costs through automation, local sourcing, and alternative resins is essential to improve affordability and market competitiveness.

Limited Awareness and Lack of Standardization

Many construction firms remain unaware of the long-term benefits of composites compared to conventional materials. Inconsistent standards and testing methods across regions also hinder large-scale adoption. The absence of unified design codes creates uncertainty among architects and engineers. This challenge slows project approvals and reduces trust in composite performance. Expanding educational initiatives, certification programs, and international standard harmonization can help overcome these adoption barriers and strengthen market growth.

Regional Analysis

North America

North America holds a 32% share of the global Construction Composites Market in 2024, driven by rising infrastructure modernization and sustainable building initiatives. The United States leads regional demand, supported by increased adoption of fiber-reinforced polymers in bridges, pipelines, and commercial structures. The Infrastructure Investment and Jobs Act has further accelerated composite integration in transportation and utility projects. Canada is also expanding usage in wind energy and marine construction. Strong presence of composite manufacturers and research institutions continues to enhance product innovation and standardization across key construction applications.

Europe

Europe accounts for a 28% share of the Construction Composites Market, supported by stringent environmental policies and high investments in green infrastructure. Countries such as Germany, France, and the United Kingdom are adopting lightweight, recyclable composites for sustainable urban development. The region’s strong emphasis on carbon reduction and building energy efficiency drives composite demand in public infrastructure and residential projects. The European Union’s focus on circular economy principles and funding for low-emission materials further supports market expansion, especially in prefabricated and modular construction solutions.

Asia-Pacific

Asia-Pacific dominates the global Construction Composites Market with a 34% share in 2024. Rapid urbanization, industrialization, and smart city developments across China, India, and Japan fuel strong demand. The region benefits from large-scale investments in transport infrastructure, renewable energy, and industrial facilities. Governments are promoting the use of corrosion-resistant and durable materials to reduce maintenance costs and enhance building longevity. Growing domestic manufacturing capabilities and cost-efficient production further strengthen Asia-Pacific’s leadership, making it a key hub for global composite exports and technological advancement.

Latin America

Latin America holds a 4% share of the Construction Composites Market, driven by steady growth in infrastructure and housing projects. Brazil and Mexico are leading adopters, focusing on energy-efficient materials for public works and residential development. Increasing government initiatives for urban renewal and private sector investments in industrial facilities support demand. The use of fiber-reinforced composites in bridge decks and pipelines is growing due to their durability and corrosion resistance. Regional challenges include limited production capacity and dependence on imported raw materials, which may restrain faster market expansion.

Middle East & Africa

The Middle East & Africa region accounts for a 2% share of the Construction Composites Market. Demand is rising in Gulf countries due to large-scale infrastructure, oil, and gas construction projects. The United Arab Emirates and Saudi Arabia are key markets adopting composites for lightweight, durable, and heat-resistant structures. Africa is witnessing gradual adoption through urban housing and transportation developments. Increased focus on sustainable construction, coupled with rising investments in renewable energy, supports market opportunities. However, high material costs and limited technical expertise remain key challenges to regional growth.

Market Segmentations:

By Product Type:

By Resin Type:

- Thermoplastic

- Thermosetting

By End User:

- Electrical & Electronics

- Automotive & Transportation

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Construction Composites Market features strong competition among major players such as Fiberon LLC, Exel Composites Oyj, Jamco Corporation, Trex Company Inc, Diversified Structural Composites, Schoeck International, Bedford Reinforced Plastics, Strongwell Corporation, Advanced Environmental Recycling Technologies Inc, and UPM Biocomposites. The Construction Composites Market is highly competitive, driven by rapid innovation and expanding global infrastructure needs. Manufacturers are focusing on developing lightweight, corrosion-resistant, and sustainable materials to replace traditional steel and concrete. Advancements in resin systems, fiber reinforcements, and automated fabrication processes are improving product performance and cost efficiency. Companies are increasingly investing in recyclable and bio-based composites to meet green building standards and environmental regulations. Strategic collaborations, capacity expansions, and mergers are shaping the industry landscape, while R&D efforts aim to enhance strength, thermal stability, and design flexibility across diverse construction applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Fiberon LLC

- Exel Composites Oyj

- Jamco Corporation

- Trex Company Inc

- Diversified Structural Composites

- Schoeck International

- Bedford Reinforced Plastics

- Strongwell Corporation

- Advanced Environmental Recycling Technologies Inc

- UPM Biocomposites

Recent Developments

- In January 2025, BASF signed an agreement to sell its Styrodur® business, which produces extruded polystyrene (XPS) insulation materials, to Karl Bachl Kunststoffverarbeitung GmbH & Co. KG (BACHL). BACHL is a leading manufacturer of insulation materials in Germany and has been a long-standing distribution partner of BASF.

- In January 2025, British Gypsum, launched the Gyproc SoundBloc Infinaé 100 plasterboard in the UK. This product is made entirely from recycled materials, marking a significant step towards sustainable construction practices and supporting the circular economy.

- In November 2024, Teknor Apex, a trusted provider of custom plastic compounds for the healthcare industry, declared the expansion of its medical-grade thermoplastic elastomer (TPE) portfolio with new grades specifically designed for biopharmaceutical tubing applications.

- In June 2024, Ensinger is investing in production capacity expansion for its composites division. Very soon, a high-performance double belt press will begin operation in Rottenburg-Ergenzingen. The new facility enables the efficient production of thermoplastics composite materials

Report Coverage

The research report offers an in-depth analysis based on Product Type, Resin Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for lightweight and high-strength materials will continue to rise in infrastructure projects.

- Sustainable and recyclable composites will gain traction due to stricter environmental regulations.

- Integration of automation and digital manufacturing will improve production efficiency and precision.

- The construction sector will adopt more fiber-reinforced composites for bridges and building structures.

- Advancements in resin technology will enhance material performance and durability.

- Growing investments in renewable energy projects will boost composite applications in wind and solar structures.

- Prefabricated and modular construction will increase the use of composite panels and beams.

- Emerging economies will experience stronger market growth driven by urbanization and infrastructure expansion.

- Collaboration between construction firms and material innovators will accelerate product development.

- Continuous R&D in cost-effective composites will make them more competitive against traditional materials.