Market Overview:

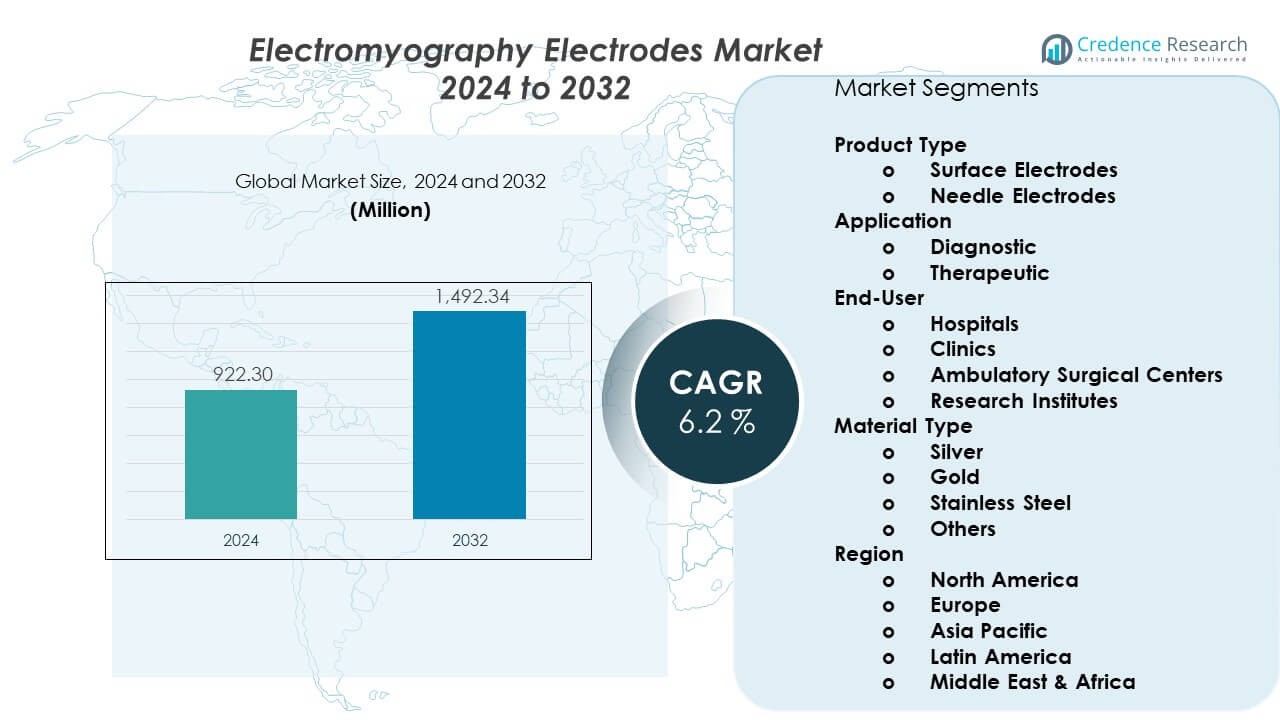

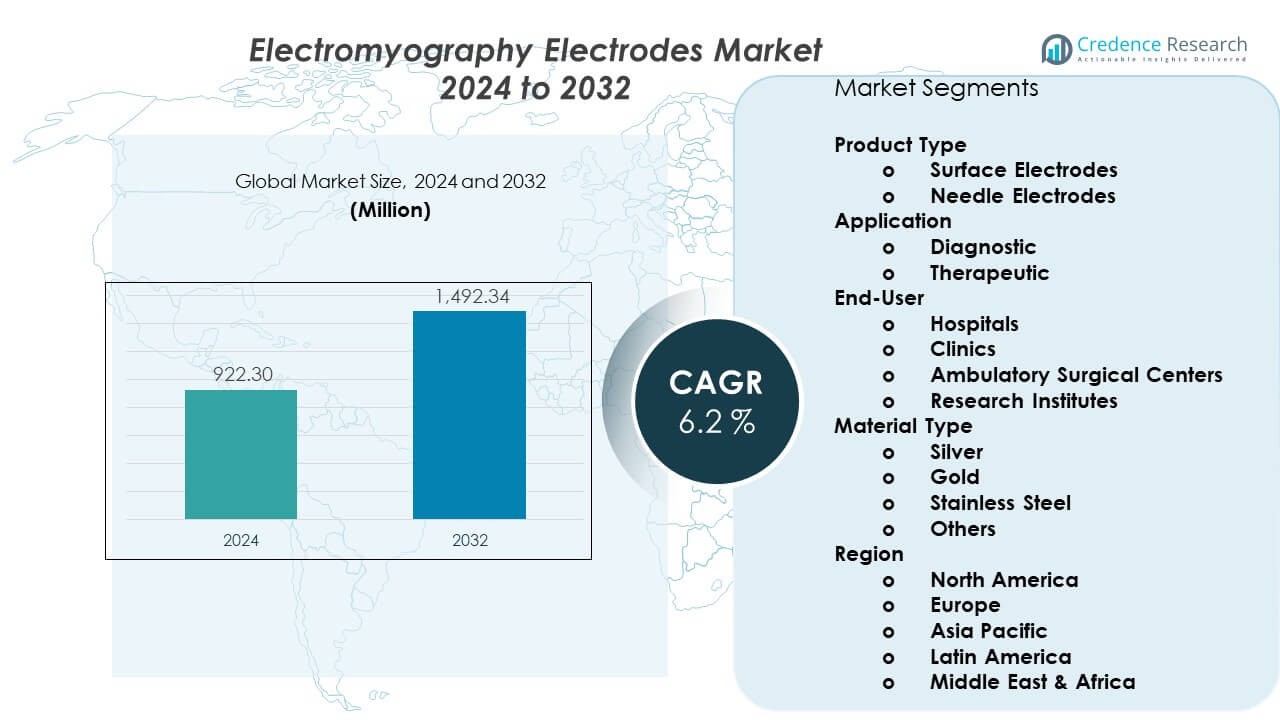

The Electromyography Electrodes Market is projected to grow from USD 922.3 million in 2024 to an estimated USD 1,492.34 million by 2032, with a CAGR of 6.2% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electromyography Electrodes Market Size 2024 |

USD 922.3 Million |

| Electromyography Electrodes Market, CAGR |

6.2% |

| Electromyography Electrodes Market Size 2032 |

USD 1,492.34 Million |

Strong demand builds as healthcare providers prioritize early detection of nerve and muscle issues. Clinics use surface and needle electrodes to support accurate diagnosis across routine and complex cases. Rehabilitation programs rely on EMG monitoring to guide therapy progress in patients with mobility loss. Sports medicine adds advanced electrodes to measure muscle activation during training. Medical device makers enhance signal clarity and biocompatibility, which lifts replacement cycles. These factors strengthen trust among practitioners and help accelerate adoption across multiple care environments.

North America leads the Electromyography Electrodes Market due to established neurodiagnostic networks and strong clinical adoption across hospitals and specialty centers. Europe follows with steady use in rehabilitation, neurology, and sports medicine programs supported by advanced healthcare systems. Asia-Pacific emerges as the fastest-growing region as investments rise in diagnostic infrastructure and training facilities. China and India expand EMG use due to higher awareness and rising patient volumes. Latin America and the Middle East show growing interest driven by improving access to neuromuscular care and broader adoption of modern testing tools.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Electromyography Electrodes Market is valued at USD 922.3 million in 2024 and is projected to reach USD 1,492.34 million by 2032, growing at a CAGR of 6.2% driven by rising neuromuscular diagnostics and wider rehabilitation use.

- North America holds about 38%, supported by advanced diagnostic infrastructure; Europe follows with 28%, driven by strong rehabilitation networks; Asia Pacific holds 22%, backed by expanding neurology services. These markets dominate due to higher clinical adoption and strong provider capacity.

- Asia Pacific is the fastest-growing region with a 22% share, driven by rapid healthcare investment, rising diagnostic awareness, and broader EMG use across clinics and rehabilitation centers.

- Surface electrodes account for about 60% of product share, supported by ease of use and strong suitability for routine diagnostics across hospitals and clinics.

- Hospitals represent nearly 45% of end-user share, driven by high testing volumes and strong integration of EMG into neurology and rehabilitation workflows.

Market Drivers:

Growing Use Of EMG Testing Across Neurology, Rehabilitation, And Pain Clinics

Demand grows due to wider screening for nerve and muscle disorders across hospital networks. Clinics adopt EMG systems to support precise symptom evaluation. Doctors rely on electrodes to detect early functional deficits. Rehabilitation centers track patient recovery through structured EMG sessions. Pain clinics expand testing to validate treatment pathways. Sports medicine teams use neuromuscular mapping to guide training. The Electromyography Electrodes Market gains steady traction as more providers integrate diagnostic monitoring. It supports stronger decision-making across diverse clinical teams.

- For instance, Delsys’ Trigno wireless EMG sensors record muscle activity at up to 2,000 Hz per channel, supporting high-accuracy assessments in clinical and sports environments.

Rising Preference For Non-Invasive And Patient-Friendly Electrodes For Routine Diagnostics

Surface electrodes gain acceptance due to higher comfort across frequent testing cycles. Hospitals use these formats to speed patient throughput. Manufacturers enhance adhesive strength to lift stability during long sessions. Signal clarity improves with new conductive materials. Clinicians prefer disposable models to reduce cross-contamination. Pediatric units rely on soft-gel designs to ease testing for young patients. Demand strengthens across outpatient centers that seek faster workflows. Expanded use supports wider adoption across early detection programs.

- For instance, Ambu BlueSensor electrodes feature a highly conductive wetgel and a silver/silver-chloride (Ag/AgCl) sensor that ensures stable signals during extended monitoring.

Strong Growth In EMG Use For Sports Science, Performance Tracking, And Injury Prevention

Sports labs measure muscle activation to guide personalized training plans. Coaches rely on real-time feedback to improve athlete movement patterns. EMG sensors help detect strain patterns linked to fatigue. Physiotherapists build recovery plans with data-driven insights. Universities use EMG research to study biomechanics. Device makers create flexible electrodes that support movement without signal drop. Professional teams adopt portable systems for field use. Broader adoption lifts the role of EMG in sports performance research.

Advances In Biocompatible Materials And Signal Processing Enhancing Diagnostic Accuracy

Developers improve electrode coatings to reduce skin irritation. Signal noise drops due to better filtering tools. Hospitals invest in systems that support stable recordings. Research teams gain deeper insight through high-resolution signals. Manufacturers use new hydrogels to lift conductivity. Neurodiagnostic labs value consistency across repeated tests. Better materials support longer wear cycles without discomfort. These improvements help raise confidence across routine and advanced diagnostic needs.

Market Trends:

Expansion Of Wireless, Wearable, And Portable EMG Systems Across Clinical And Research Use

Innovation shifts toward lightweight electrodes that support mobility. Researchers deploy portable units for field assessments. Clinics adopt wireless formats to simplify cable management. Sports teams measure activity during natural movement. Wearable designs help capture long-duration muscle activity. Hospitals integrate mobile carts for bedside EMG testing. The Electromyography Electrodes Market gains momentum as users prefer greater flexibility. It supports more efficient workflows across high-volume setups.

- For instance, Noraxon’s Ultium EMG sensors offer up to 4,000 Hz sampling and 14-hour battery life, enabling wireless, high-fidelity mobility studies. The Electromyography Electrodes Market gains momentum as users prefer greater flexibility.

Growing Integration Of EMG Data With AI-Based Analytics And Digital Reporting Platforms

Developers link EMG signals with software that automates interpretation. AI tools classify muscle patterns with higher precision. Labs use dashboards to store and compare patient data. Clinicians rely on digital summaries to shorten reporting time. Rehabilitation units track progress with trend charts. Research teams use big-data models for pattern analysis. Integrated platforms support consistent accuracy across tests. Adoption rises across institutions that seek data-rich reporting.

- For instance, ADInstruments’ LabChart software integrates EMG data with automated signal filtering and real-time spectral analysis, helping researchers interpret muscle activity more efficiently.

Rising Use Of EMG Electrodes In Robotics, Exoskeleton Systems, And Human-Machine Interfaces

Robotics teams use muscle signals to guide motion control. Exoskeleton developers map user intent through real-time EMG inputs. Engineers refine movement algorithms based on neural activation. Medical robotics deploy EMG for precise limb support. Research units test hybrid systems that merge EMG with motion sensors. Industrial automation explores gesture-based controls. These fields widen the relevance of EMG technology. Growth expands beyond healthcare into engineering-focused applications.

Shift Toward Eco-Friendly, Sustainable, And Low-Waste Electrode Manufacturing

Producers reduce waste by using recyclable materials. Hospitals seek low-waste consumables for high-volume testing. Biodegradable components gain early interest in outpatient centers. Labs value reduced disposal loads. Durable materials extend electrode life in reusable formats. Cleaner production lines help meet institutional standards. Sustainability goals influence procurement policies. These shifts open new adoption pathways across healthcare systems.

Market Challenges Analysis:

High Cost Barriers Linked To Advanced EMG Systems And Limited Budget Allocation Among Small Clinics

Specialty centers invest heavily in advanced diagnostic tools, yet small clinics face constraints. Providers struggle to justify high spending on premium electrode formats. Limited budgets reduce access to upgraded neurodiagnostic platforms. Training gaps limit the use of advanced EMG tools. Some regions lack reimbursement structures that support routine EMG use. Procurement delays slow replacement cycles in many hospitals. The Electromyography Electrodes Market faces slower penetration across cost-sensitive environments. It must address affordability to drive wider adoption.

Concerns Over Signal Variability, Skin Sensitivity, And Operational Inconsistencies Across Testing Environments

Clinicians report variation in signal quality due to skin impedance shifts. Sensitive patients experience irritation during long tests. Labs lose time due to repeated adjustments. Operators require consistent training to maintain accuracy. Busy clinics struggle to manage electrode disposal loads. Variability creates uncertainty during complex diagnoses. Hospitals demand standardized materials to reduce inconsistency. These hurdles influence clinical preference and slow broader scaling.

Market Opportunities:

Rising Adoption Of EMG Tools Across Preventive Care, Telehealth, And Home-Based Rehabilitation Models

Providers test patients earlier through preventive screening programs. Telehealth networks integrate remote EMG monitoring for ongoing care. Home rehabilitation teams use compact electrodes to support daily therapy routines. Sports coaches apply remote tracking for structured performance plans. Hospitals expand outreach programs for underserved groups. The Electromyography Electrodes Market benefits from deeper integration into long-term care pathways. It gains new revenue channels through outpatient and digital-health platforms. These shifts increase access across broader patient populations.

Growing Scope For Advanced Materials, Custom-Fit Designs, And Hybrid Sensors Across Emerging Applications

Manufacturers invest in ultra-thin materials that improve signal stability. Labs test custom-fit electrodes for specific muscle groups. Hybrid sensors combine EMG data with motion or pressure inputs. Engineers develop electrodes suited for robotics and exoskeleton systems. Research teams create flexible designs for extended wear. Healthcare centers value better durability during repeat sessions. Demand grows across industrial and sports-tech domains. These advancements open new innovation pipelines across multiple sectors.

Market Segmentation Analysis:

Product Type

Surface electrodes hold a major share due to their comfort, quick setup, and suitability for routine assessments. Clinics prefer these formats for frequent neuromuscular evaluations. Needle electrodes support deeper diagnostic needs in complex cases. Hospitals use both types to balance accuracy and patient tolerance. Research labs rely on needle variants for high-precision studies. Sports centers prefer surface models for movement-based testing. The Electromyography Electrodes Market benefits from strong demand across both categories. It reflects rising use in multidisciplinary environments.

- For instance, Natus Medical’s Dantec needle electrodes include ultra-fine designs with 30–0.45 mm diameters for high-precision intramuscular recordings.

Application

Diagnostic use dominates due to rising screening for nerve and muscle disorders. Providers perform more tests to detect early functional deficits. Neurology units rely on EMG data to guide treatment planning. Therapeutic use grows through rehabilitation programs. Physiotherapists track progress using structured EMG sessions. Sports recovery centers use EMG feedback to monitor muscle balance. Remote care platforms start integrating diagnostic and therapeutic workflows. This shift supports broader adoption.

- For instance, GE Healthcare’s EMG-enabled neurodiagnostic platforms support multi-channel data capture, enabling clinicians to assess both diagnostic and therapeutic responses during recovery.

End-User

Hospitals lead due to advanced testing capacity and higher patient volumes. Clinics expand use to support early detection workflows. Ambulatory surgical centers employ EMG tools during postoperative care. Research institutes drive innovation through advanced signal studies. Sports labs and physiotherapy units contribute to growing demand. Outpatient centers value compact devices for daily evaluations. Each setting strengthens the market’s reach. It helps diversify product use across care pathways.

Material Type

Silver electrodes lead due to strong conductivity and stability. Gold formats support sensitive-skin applications. Stainless steel variants offer durability for repeated testing. Other materials include hydrogels and polymer blends for comfort. Labs select materials based on required precision. Hospitals focus on safe, biocompatible options. These choices shape procurement patterns across regions.

Segmentation:

By Product Type

- Surface Electrodes

- Needle Electrodes

By Application

By End-User

- Hospitals

- Clinics

- Ambulatory Surgical Centers

- Research Institutes

By Material Type

- Silver

- Gold

- Stainless Steel

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America holds the largest share of the Electromyography Electrodes Market, supported by advanced diagnostic infrastructure and strong clinical adoption. Hospitals invest in high-precision EMG tools to manage growing neuromuscular case volumes. Clinics expand routine testing due to wider insurance coverage. Research institutes drive innovation with extensive biomechanical and neurodiagnostic studies. Sports facilities adopt EMG systems for performance tracking. Manufacturers operate strong distribution networks across the region. It maintains leadership due to steady investment in neurophysiology programs.

Europe

Europe accounts for a significant share driven by established rehabilitation centers and strong clinical training standards. Providers use EMG systems to support early detection and post-therapy evaluations. Hospitals rely on surface and needle electrodes across neurology and physiotherapy units. Clinics increase adoption due to growing awareness of muscle and nerve disorders. Research bodies conduct long-term studies on movement science and gait analysis. Adoption strengthens across countries with aging populations. It gains steady traction through structured healthcare pathways.

Asia Pacific, Latin America, and Middle East & Africa

Asia Pacific holds a fast-growing share supported by rapid healthcare expansion and rising diagnostic awareness. China and India invest in neurodiagnostic equipment to serve large patient bases. Clinics scale EMG services across urban centers. Latin America records moderate growth due to improving access to rehabilitation care. Middle East & Africa show rising interest through new specialty clinics and imported EMG systems. Providers seek affordable and durable electrode formats. It gains momentum in emerging regions that prioritize diagnostic modernization.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Natus Medical Incorporated

- Nihon Kohden Corporation

- Cadwell Industries, Inc.

- Noraxon USA Inc.

- Compumedics Limited

- Ambu A/S

- ADInstruments

- Delsys Incorporated

- 3M

- GE Healthcare

- Medtronic plc

- Koninklijke Philips N.V.

Competitive Analysis:

The Electromyography Electrodes Market features strong competition led by global medical device companies and specialized neurodiagnostic brands. Manufacturers focus on signal accuracy, patient comfort, and advanced material engineering. Leading firms expand portfolios with wireless and biocompatible designs to meet rising diagnostic and therapeutic needs. Hospitals and clinics prefer companies with reliable distribution networks. Research institutes choose brands that offer high-precision electrode systems. Partnerships with sports science labs and rehabilitation centers strengthen competitive positioning. It continues to reward companies that invest in innovation, training, and long-term clinical support.

Recent Developments:

- Cadwell Industries, Inc. announced a strategic investment in Seer Medical in April 2025, partnering with investors Breakthrough Victoria and TrialCap to expand home-based epilepsy diagnostics capabilities. This investment enables Cadwell to integrate Seer Medical’s innovative long-term home-based video EEG monitoring technology with Cadwell’s existing comprehensive EEG portfolio, creating an industry-leading product line for clinical, ambulatory, and hospital-based epilepsy diagnostic centers.

- Nihon Kohden Corporation made a strategic move in the electromyography electrodes space through a significant acquisition announced in November 2024. The company acquired a 71.4% stake in NeuroAdvanced Corp., the parent company of Ad-Tech Medical Instrument Corporation, which specializes in intracranial electrodes for epilepsy treatment and neurodiagnostic procedures. This acquisition, valued at approximately ¥16 billion ($103.66 million), strengthens Nihon Kohden’s ability to deliver comprehensive epilepsy care solutions from diagnosis to advanced interventions by combining the company’s established EEG expertise with Ad-Tech’s specialized electrode technologies.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Application, End-User, and Material Type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising use of surface and needle electrodes across neurology and rehabilitation programs.

- Strong need for accurate EMG monitoring driving material and design innovations.

- Expanding demand for wireless and portable diagnostic tools.

- Higher adoption across sports science and performance analytics labs.

- Wider integration of EMG data into AI-based analysis platforms.

- Growth opportunities emerging across home-rehabilitation and telehealth services.

- Increasing preference for single-use electrodes to reduce contamination risks.

- Stronger research collaborations shaping next-generation EMG technologies.

- Hospitals upgrading neurodiagnostic units to support early detection needs.

- Broader penetration across Asia Pacific due to rising healthcare investments.