| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electromagnetic Compatibility (EMC) Filters and Shields Market Size 2024 |

USD 3,505.9 million |

| Electromagnetic Compatibility (EMC) Filters and Shields Market, CAGR |

4.59% |

| Electromagnetic Compatibility (EMC) Filters and Shields Market Size 2032 |

USD 5,034.3 million |

Market Overview

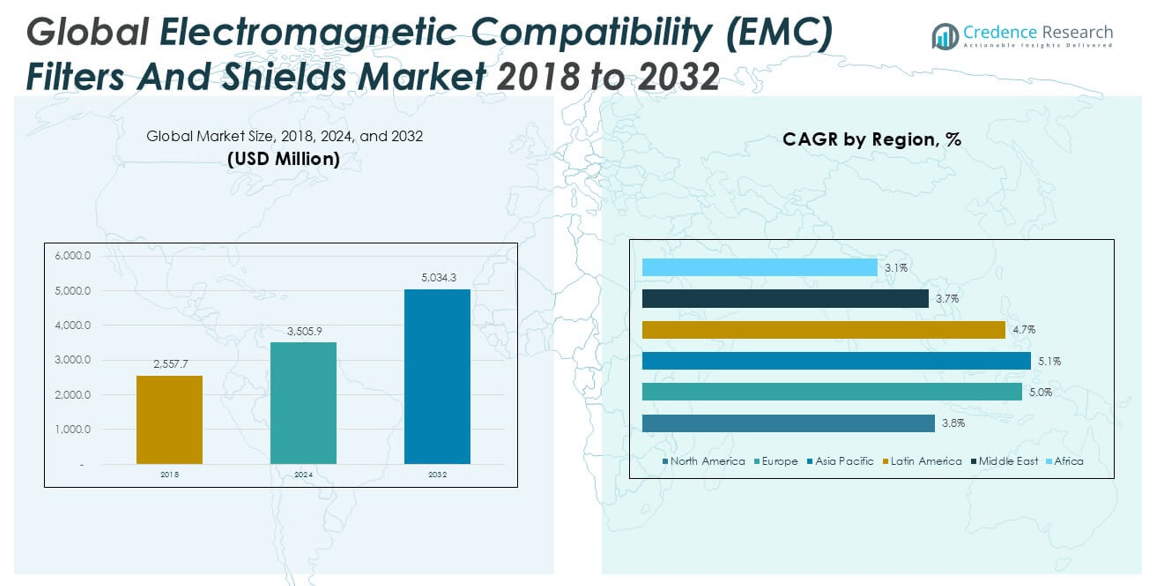

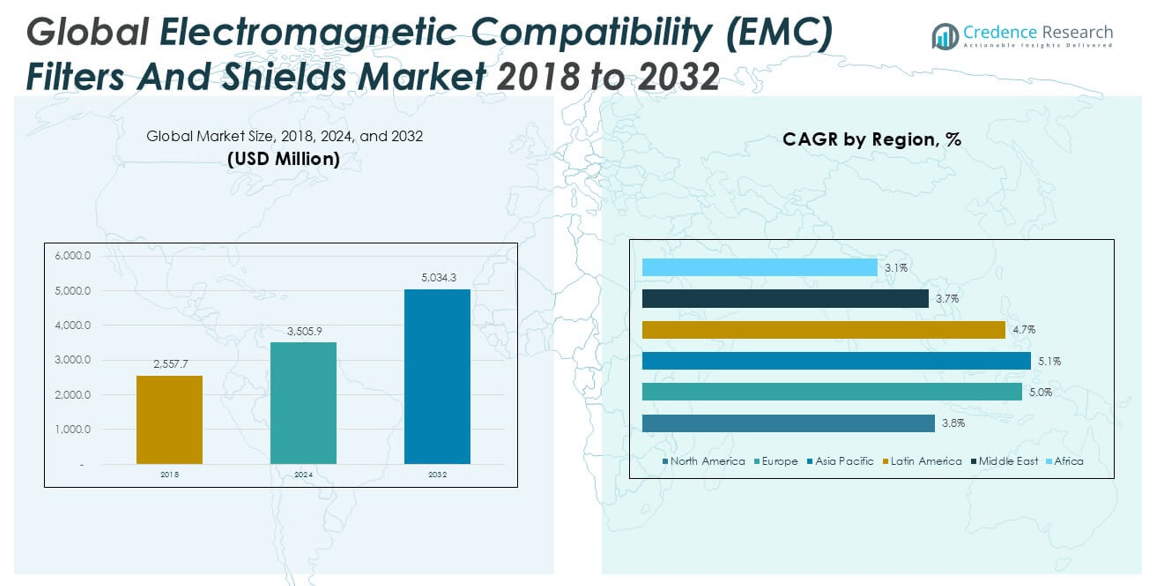

The Global Electromagnetic Compatibility (EMC) Filters and Shields Market is projected to grow from USD 3,505.9 million in 2024 to an estimated USD 5,034.3 million by 2032, with a compound annual growth rate (CAGR) of 4.59% from 2025 to 2032.

Rising adoption of electric vehicles, advancements in 5G infrastructure, and the proliferation of IoT devices have significantly contributed to the need for advanced EMC solutions. Manufacturers are focusing on developing compact, high-performance filters and shielding materials to address space constraints and improve signal integrity. In addition, stringent regulatory standards for electromagnetic emissions across regions have intensified the deployment of EMC solutions in both legacy and modern systems. The trend towards miniaturization of electronics and the increasing frequency of operation are also prompting innovation in EMC technologies.

Geographically, North America holds a significant share of the market due to its strong presence of aerospace and defense sectors, along with technological leadership in telecommunications and consumer electronics. Asia Pacific is expected to witness the fastest growth during the forecast period, primarily driven by rapid industrialization and the expansion of automotive and electronics manufacturing hubs in countries like China, Japan, and South Korea. Key players in the market include TE Connectivity, Laird Technologies, Schaffner Holding AG, TDK Corporation, and ETS-Lindgren.

Market Insights

- The market is projected to grow from USD 3,505.9 million in 2024 to USD 5,034.3 million by 2032, at a CAGR of 4.59% from 2025 to 2032.

- The rise in electronic content in vehicles, industrial systems, and smart devices is driving the need for advanced EMC filters and shielding solutions.

- Growing deployment of 5G networks and connected infrastructure has amplified EMI risks, fueling demand for high-performance EMC components.

- Strict global regulations on electromagnetic interference and emissions are compelling manufacturers to integrate EMC compliance early in product design.

- Design complexity and high costs associated with miniaturized, high-frequency EMC solutions limit adoption for some small and mid-size manufacturers.

- Asia Pacific holds the largest market share in 2024, led by China, Japan, and South Korea due to strong electronics and automotive manufacturing.

- Europe and North America remain strong markets driven by regulatory compliance and technological advancements in defense, telecom, and healthcare sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Surging Demand for Consumer Electronics and High-Frequency Devices

The Global Electromagnetic Compatibility (EMC) Filters and Shields Market benefits significantly from the rising consumption of consumer electronics such as smartphones, laptops, tablets, and smart home devices. These devices require robust EMC compliance due to the dense integration of components and increased signal transmission rates. With the shift toward 5G and high-frequency wireless technologies, manufacturers must adopt advanced shielding and filtering solutions to maintain performance integrity. The miniaturization of components further increases electromagnetic interference (EMI) risks, making shielding essential. Consumer expectations for high-speed performance and uninterrupted connectivity push OEMs to prioritize EMC measures. It supports continued product innovation while ensuring safety and compliance across devices.

- For instance, global smartphone shipments reached approximately 1.4 billion units in 2024, reflecting the scale of consumer electronics driving EMC filter and shield demand.

Expansion of Electric Vehicles and Automotive Electronics

Automotive OEMs drive major demand in the Global Electromagnetic Compatibility (EMC) Filters and Shields Market. Modern vehicles incorporate extensive electronics, including ADAS, infotainment systems, battery management systems, and autonomous driving components. These electronics are highly susceptible to EMI, which can affect performance or safety. EMC filters and shields prevent internal signal interference and protect critical components. The rapid growth of electric and hybrid vehicles increases EMC complexity, pushing suppliers to enhance performance and reduce component footprint. It addresses both functional safety and regulatory compliance within electric mobility platforms.

- For instance, global electric vehicle sales surpassed 10 million units in 2024, highlighting the growing need for advanced EMC filters and shields in automotive electronics.

Stringent EMC Regulations and Testing Requirements Across Industries

Government regulations mandating EMC compliance across regions remain a key driver. Various international standards, such as those from the FCC, CISPR, and IEC, enforce strict EMC limits for electronic and electrical equipment. The Global Electromagnetic Compatibility (EMC) Filters and Shields Market gains momentum due to rising enforcement of these standards across telecom, medical, defense, and industrial sectors. Manufacturers must integrate effective EMC solutions early in product design to meet testing benchmarks. Failure to comply can delay market entry or cause costly redesigns. It encourages adoption of certified EMC filters and shields across new product lines

Industrial Automation and IoT Integration Driving EMC Complexity

Industrial environments now feature automated machinery, robotics, and interconnected IoT systems operating simultaneously. This level of connectivity introduces overlapping signals and increases vulnerability to EMI. The Global Electromagnetic Compatibility (EMC) Filters and Shields Market supports industrial manufacturers in mitigating these risks and maintaining uninterrupted operations. Filters and shields ensure accurate signal transmission and reduce failure rates in high-noise environments. Growth in smart manufacturing and digital control systems heightens EMC concerns in production lines. It makes EMC design an integral part of modern industrial equipment architecture.

Market Trends

Integration of EMC Solutions in 5G Infrastructure and High-Speed Networks

Telecommunications advancements, particularly in 5G infrastructure, have created a strong demand for advanced EMC filters and shields. High-frequency transmission and dense network deployments increase the risk of signal interference, which necessitates reliable EMI mitigation strategies. The Global Electromagnetic Compatibility (EMC) Filters and Shields Market sees strong traction from telecom equipment manufacturers who must maintain data integrity and signal clarity. It supports stable performance in base stations, antennas, and network nodes where multiple signals interact. As operators expand 5G coverage globally, shielding materials and high-performance filters play a vital role in maintaining uninterrupted connectivity. These requirements shape the design and selection of EMC components across telecom infrastructure.

- For instance, China’s Ministry of Industry and Information Technology indicated that by the end of 2023, telecom operators in China deployed over 2.9 million 5G base stations, each requiring specialized EMC filters to manage electromagnetic interference and ensure reliable high-speed connections.

Growing Use of Compact and Multi-Functional Electronic Devices

The trend toward miniaturization of electronics in medical, consumer, and industrial sectors continues to influence EMC filter and shield innovation. Devices today often integrate multiple functions in limited space, creating increased EMI potential. It drives the need for smaller, yet more efficient, EMC components that offer high attenuation without occupying much volume. The Global Electromagnetic Compatibility (EMC) Filters and Shields Market responds with flexible materials and integrated shielding solutions tailored for compact applications. Engineers seek low-profile, surface-mountable filters compatible with dense PCBs. This evolution pushes suppliers to balance physical constraints with electromagnetic performance.

- For instance, Samsung Electronics reported that in 2023, it shipped more than 13 million Galaxy Z Fold and Z Flip devices globally, all of which incorporate highly compact EMC shielding and filters to maintain performance in flexible, multi-functional form factors.

Rising Adoption of Flexible and Advanced Shielding Materials

Material innovation is reshaping the EMC market with the introduction of flexible, lightweight, and conductive shielding materials. These materials offer design flexibility and durability while supporting advanced electronic functions in automotive, aerospace, and wearable technologies. The Global Electromagnetic Compatibility (EMC) Filters and Shields Market evolves to include fabric-based, polymer-coated, and nanomaterial shields. It aligns with the growing preference for non-metallic and hybrid shielding solutions in environments where traditional metals are unsuitable. Designers choose these alternatives for complex geometries and high-vibration settings. This trend expands material choices and enhances product adaptability.

Increasing Focus on EMC Design Integration in Early Development Stages

Manufacturers across industries now integrate EMC design at the concept and prototyping stages rather than treating it as a final compliance check. Early incorporation allows better optimization of product layout, shielding placement, and grounding techniques. It reduces the risk of late-stage design changes and regulatory setbacks. The Global Electromagnetic Compatibility (EMC) Filters and Shields Market benefits from this shift, as companies seek customized solutions that fit specific design parameters. EMC becomes a core consideration in product innovation, especially for mission-critical sectors. This trend emphasizes the importance of simulation tools, co-design services, and collaborative engineering support.

Market Challenges

High Design Complexity and Cost Constraints for Advanced EMC Solutions

Developing effective EMC filters and shields involves complex design considerations, especially for compact and high-frequency electronic systems. Engineers must balance performance, size, weight, and cost while meeting strict regulatory standards. This complexity often leads to longer development cycles and higher design expenses. The Global Electromagnetic Compatibility (EMC) Filters and Shields Market faces challenges from manufacturers seeking low-cost solutions without compromising compliance. It requires continuous investment in R\&D and simulation tools to achieve performance targets. Small and mid-sized companies may struggle to adopt advanced EMC technologies due to budget limitations.

- For instance, the typical development cycle for advanced EMC filters and shields extends to approximately 18 months, with average R&D investments around 25 million US dollars for major project

Regulatory Variations and Compliance Barriers Across Global Markets

Diverse EMC regulations across countries create challenges for companies operating in multiple regions. Compliance requirements differ in testing procedures, frequency limits, and documentation, complicating global product rollout. The Global Electromagnetic Compatibility (EMC) Filters and Shields Market must adapt to these fragmented standards, which increase costs and delay time to market. It demands close coordination with certification bodies and up-to-date knowledge of evolving regulatory landscapes. Failure to meet any regional compliance standard can restrict market access. These regulatory differences place pressure on manufacturers to design universally compliant yet cost-effective EMC solutions.

Market Opportunities

Emerging Demand from Electric Vehicles and Autonomous Mobility Technologies

The transition to electric and autonomous vehicles presents a major opportunity for EMC solution providers. These platforms rely on high-voltage systems, advanced sensors, and communication modules that increase susceptibility to electromagnetic interference. The Global Electromagnetic Compatibility (EMC) Filters and Shields Market stands to gain as automakers invest in shielding solutions to ensure system reliability and passenger safety. It supports integration of EMI mitigation strategies into battery packs, control units, and navigation systems. Growth in vehicle electrification across North America, Europe, and Asia expands the scope for customized EMC components. This trend opens new revenue streams for suppliers with automotive-grade certifications.

Expansion of Industrial IoT and Smart Manufacturing Applications

The rapid digitization of factories and infrastructure creates strong demand for EMC protection across industrial systems. Smart manufacturing environments use interconnected machinery, sensors, and wireless communication tools that require robust EMC management. The Global Electromagnetic Compatibility (EMC) Filters and Shields Market benefits from increased deployment of filters and shields in automation controllers, drives, and monitoring equipment. It enables stable performance of industrial electronics in high-interference environments. Growth in Industry 4.0 adoption in emerging markets strengthens long-term demand. Suppliers offering compact, rugged, and high-frequency compatible EMC solutions are well-positioned to capture industrial opportunities.

Market Segmentation Analysis

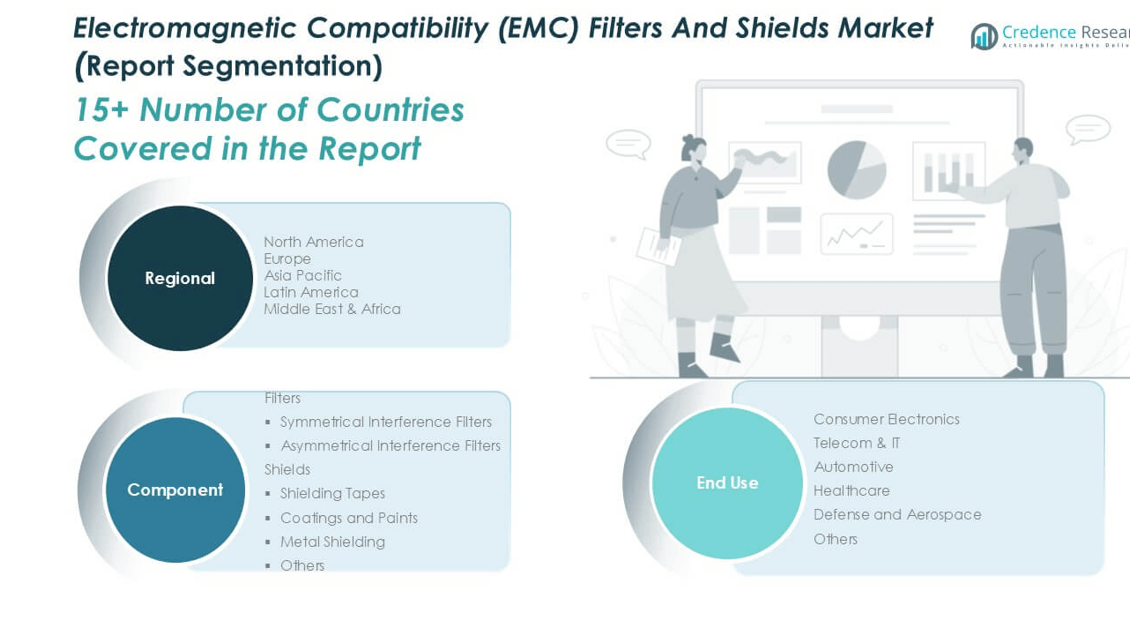

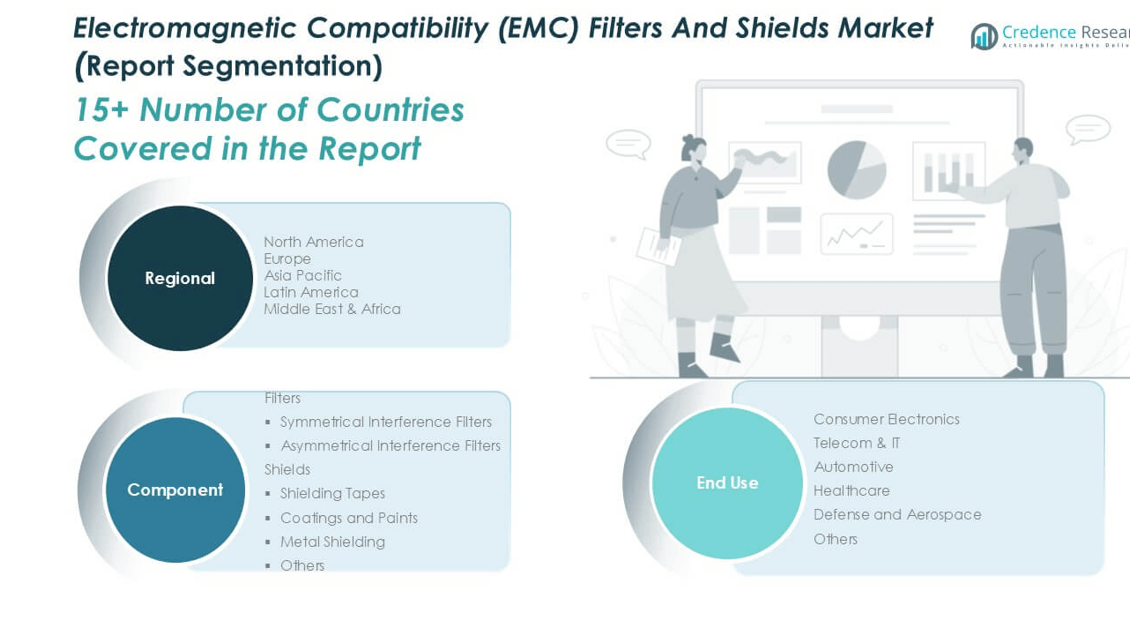

By Component

The Global Electromagnetic Compatibility (EMC) Filters and Shields Market is segmented into filters and shields, each addressing specific interference mitigation needs. The filter segment includes symmetrical and asymmetrical interference filters. Symmetrical filters offer balanced noise suppression across power lines, while asymmetrical filters focus on differential mode interference in high-speed circuits. The shield segment comprises shielding tapes, coatings and paints, metal shielding, and other materials. Shielding tapes and conductive coatings are widely used in compact devices for their flexibility and ease of application. Metal shielding, offering high attenuation, is preferred in high-power and industrial applications. It supports broad adoption across industries requiring targeted EMI protection in both internal and external device architectures.

- For instance, approximately 320,000 EMC filters and 210,000 EMC shields were produced globally in 2023 to address various interference mitigation needs.

By End Use

The end-use segmentation includes consumer electronics, telecom & IT, automotive, healthcare, defense and aerospace, and others. The Global Electromagnetic Compatibility (EMC) Filters and Shields Market sees strong demand from consumer electronics and telecom sectors due to the increasing density and speed of electronic circuits. In automotive, the rise of electric and autonomous vehicles amplifies the need for high-performance EMC components. Healthcare applications rely on precise signal integrity in diagnostic and monitoring equipment, further driving adoption. Defense and aerospace sectors prioritize EMC compliance to ensure secure and interference-free communication systems. It highlights the expanding role of EMC solutions across safety-critical and high-reliability environments.

- For instance, the consumer electronics sector utilized around 450,000 EMC components in 2023, followed by telecom & IT with 380,000 units, and automotive with 270,000 units, reflecting strong demand across these industries.

Segments

Based on Component

- Filters

- Symmetrical Interference Filters

- Asymmetrical Interference Filters

- Shields

- Shielding Tapes

- Coatings and Paints

- Metal Shielding

- Others

Based on End Use

- Consumer Electronics

- Telecom & IT

- Automotive

- Healthcare

- Defense and Aerospace

- Others

Based on Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Electromagnetic Compatibility (EMC) Filters and Shields Market

North America accounted for a market size of USD 668.93 million in 2024 and is projected to reach USD 906.17 million by 2032, expanding at a CAGR of 3.8%. The region holds approximately 19.1% of the global market share in 2024. The United States leads regional demand, driven by advanced aerospace, defense, and medical device sectors that require strict EMC compliance. It benefits from strong regulatory enforcement and high adoption of advanced technologies in automotive and telecommunications. Canada supports growth with continued investments in smart infrastructure and industrial automation. The regional market reflects strong demand for high-reliability filters and shielding materials in safety-critical applications.

Europe Electromagnetic Compatibility (EMC) Filters and Shields Market

Europe reached a value of USD 802.75 million in 2024 and is estimated to grow to USD 1,186.08 million by 2032, recording a CAGR of 5.0%. It represents 22.9% of the global market share in 2024. Countries such as Germany, the UK, and France dominate due to their strong automotive, industrial, and aerospace sectors. The European Union’s regulatory framework emphasizes EMC compliance across electronics and electrical systems. The region also sees rising demand for shielding materials in renewable energy and smart grid applications. It supports continuous innovation through collaboration between industry and research institutions.

Asia Pacific Electromagnetic Compatibility (EMC) Filters and Shields Market

Asia Pacific leads globally with a market value of USD 1,216.50 million in 2024, projected to reach USD 1,813.85 million by 2032, growing at the highest CAGR of 5.1%. The region holds the largest share at 34.7% in 2024. China, Japan, South Korea, and India drive growth through rapid electronics manufacturing, automotive expansion, and 5G infrastructure development. It benefits from cost-effective production capabilities and a robust semiconductor supply chain. Regulatory advancements in EMC standards across emerging economies strengthen adoption. Demand continues to rise from both OEMs and contract manufacturers serving global clients.

Latin America Electromagnetic Compatibility (EMC) Filters and Shields Market

The Latin American market is valued at USD 372.13 million in 2024 and is forecasted to reach USD 540.68 million by 2032, growing at a CAGR of 4.7%. It accounts for 10.6% of the global market share in 2024. Brazil and Mexico dominate, supported by growing automotive production and consumer electronics assembly. The region is experiencing steady growth in industrial automation, driving the need for EMC filters in control systems. Infrastructure modernization and smart city initiatives contribute to market development. It sees increasing engagement from global suppliers through local partnerships and distribution networks.

Middle East Electromagnetic Compatibility (EMC) Filters and Shields Market

The Middle East market is projected to grow from USD 261.84 million in 2024 to USD 352.40 million by 2032, at a CAGR of 3.7%. It holds a 7.5% share of the global market in 2024. Countries like the UAE and Saudi Arabia are investing in digital transformation, telecommunications, and defense modernization. These sectors rely on reliable EMC systems for uninterrupted operations. The market benefits from national infrastructure projects and industrial diversification agendas. It supports demand for both filters and shields in harsh environmental conditions and mission-critical systems.

Africa Electromagnetic Compatibility (EMC) Filters and Shields Market

Africa recorded a market value of USD 183.76 million in 2024, expected to reach USD 235.10 million by 2032, growing at a CAGR of 3.1%. It represents 5.2% of the global market share in 2024. South Africa, Nigeria, and Egypt are the primary contributors, with increased investment in healthcare, industrial automation, and telecommunications. Market growth is supported by gradual regulatory improvements and rising demand for consumer electronics. It faces challenges such as limited local manufacturing, but imports and infrastructure upgrades help stimulate demand. International players are expanding their footprint in the region through distributor networks and partnerships.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key players

- Schaffner Holding AG

- AG Pro Technology Corp.

- ETS-Lindgren

- EPCOS AG

- TE Connectivity Ltd.

- Schurter Holding AG

- Rohde & Schwarz GMBH & CO. KG

- Laird Plc.

- AR Inc.

- Teq AG

Competitive Analysis

The Global Electromagnetic Compatibility (EMC) Filters and Shields Market features a moderately fragmented landscape with key players focusing on innovation, regional expansion, and strategic acquisitions. Companies such as Schaffner Holding AG, TE Connectivity Ltd., and ETS-Lindgren lead the market with strong product portfolios and global distribution networks. It shows rising competition as firms enhance R\&D to develop compact, high-performance solutions tailored for automotive, telecom, and defense sectors. Emerging players like AG Pro Technology Corp. and AR Inc. seek growth through niche applications and targeted partnerships. Established companies focus on advanced materials and integrated shielding systems to meet evolving regulatory standards. Competitive intensity is increasing with rising demand across regions and industries.

Recent Developments

- In April 2025, TE Connectivity finalized the acquisition of Richards Manufacturing, a move designed to bolster its presence in the energy infrastructure sector. This acquisition is intended to leverage the ongoing grid replacement and upgrade cycle in North America, positioning TE Connectivity for further growth in serving utilities and other energy customers

Market Concentration and Characteristics

The Global Electromagnetic Compatibility (EMC) Filters and Shields Market demonstrates moderate market concentration, with several established players holding significant shares through extensive product portfolios and global reach. It features a mix of multinational corporations and regional specialists competing on performance, customization, and regulatory compliance. The market is characterized by high technical complexity, continuous product innovation, and strong integration into end-user applications such as automotive, telecom, and industrial automation. Barriers to entry remain moderate due to regulatory requirements and advanced design capabilities. It emphasizes reliability, miniaturization, and compatibility with high-frequency systems, driving continuous R&D investment across the value chain.

Report Coverage

The research report offers an in-depth analysis based on Component, End Use and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for EMC solutions will rise steadily with the expansion of 5G, high-speed data, and wireless systems. High-frequency operations will require advanced shielding and filtering components for performance stability.

- The growing electric vehicle and autonomous mobility sectors will drive demand for compact and reliable EMC solutions. Automotive manufacturers will increasingly embed EMC compliance in early design phases.

- The adoption of AI and simulation tools will transform EMC design and testing processes. Manufacturers will use predictive modeling to optimize filter and shield performance across device architectures.

- Advanced medical devices will require precise EMC management to avoid cross-interference and ensure patient safety. Demand will increase for certified shielding materials used in diagnostic and monitoring systems.

- Asia Pacific will witness increased local manufacturing of EMC components, supported by electronics and automotive supply chain hubs. This shift will enhance cost efficiency and regional responsiveness.

- Suppliers will invest in developing flexible, conductive fabrics and composite materials. These alternatives will meet needs in wearable tech, consumer electronics, and aerospace applications.

- Governments and regulatory bodies will tighten standards across sectors, mandating earlier integration of EMC measures. Companies will align with evolving regional compliance frameworks to secure market access.

- The rollout of smart factories and connected infrastructure will accelerate demand for EMC filters in control panels, robotics, and IoT-enabled systems. EMC will become integral to system uptime and safety.

- Market players will pursue M\&A and alliances to enhance technology capabilities and expand geographic presence. Strategic collaboration will help address complex customer requirements across industries.

- Customers will seek EMC solutions tailored to specific performance, size, and weight constraints. Manufacturers will focus on delivering compact, application-specific components that integrate easily into modern electronics.