Market Overview

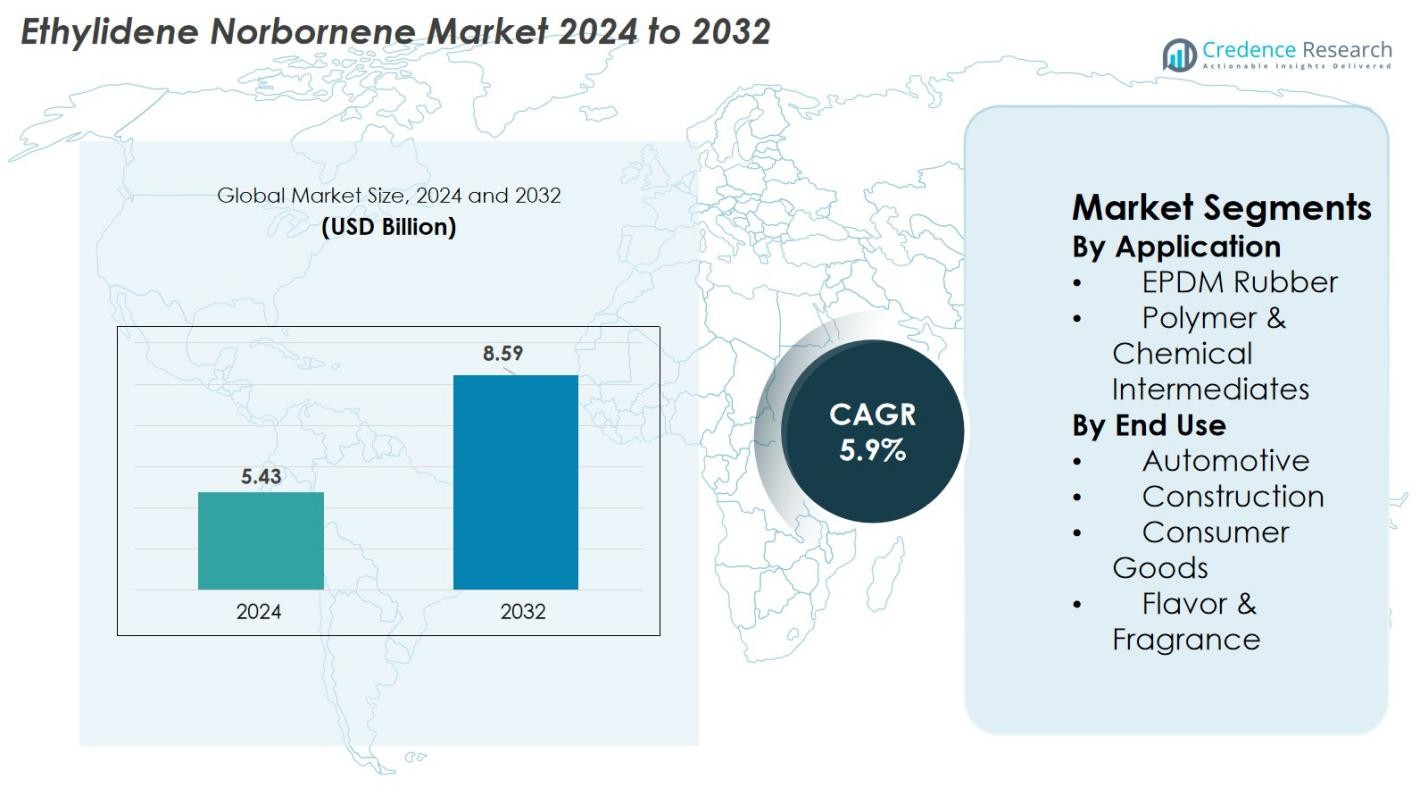

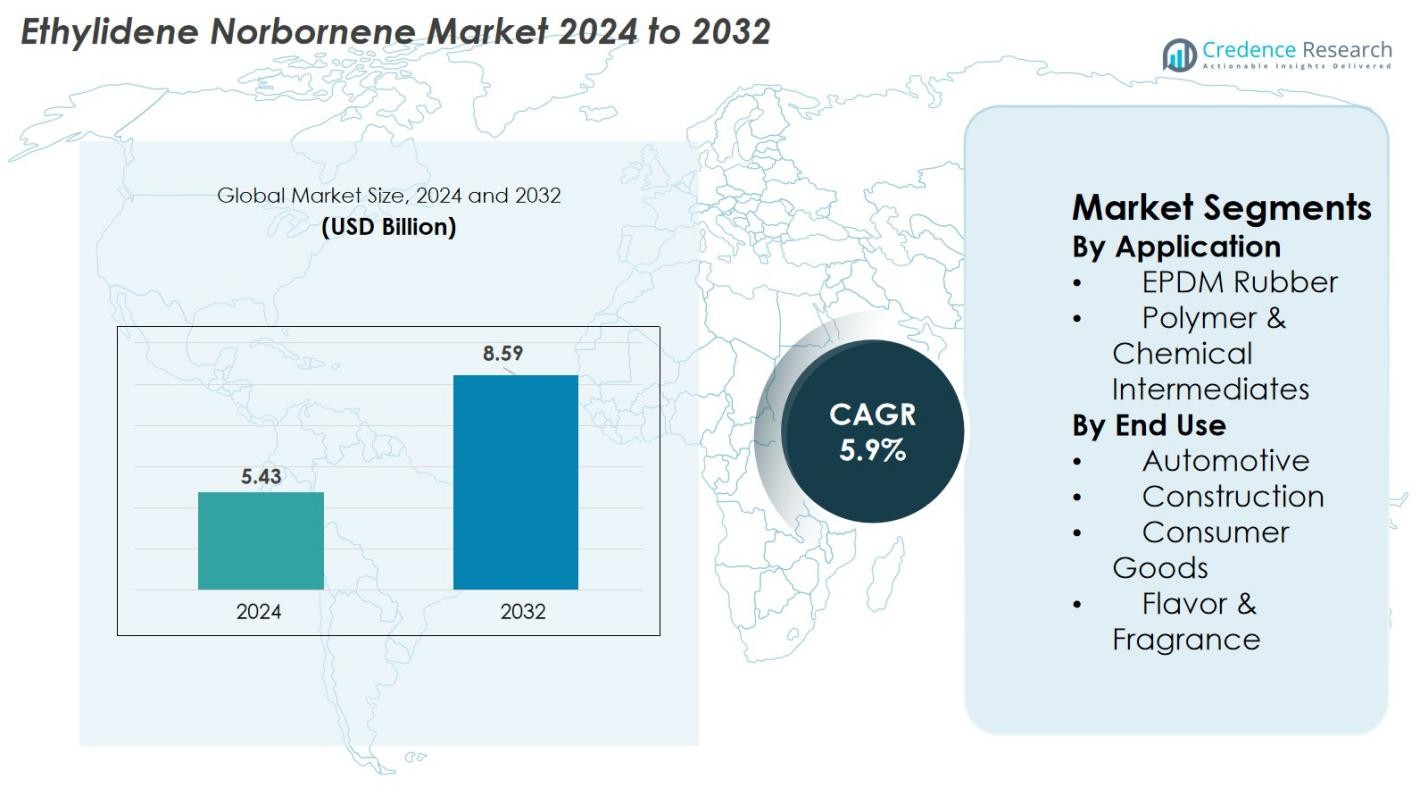

The Ethylidene Norbornene Market size was valued at USD 5.43 billion in 2024 and is anticipated to reach USD 8.59 billion by 2032, at a CAGR of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ethylidene Norbornene Market Size 2024 |

USD 5.43 Billion |

| Ethylidene Norbornene Market, CAGR |

5.9% |

| Ethylidene Norbornene Market Size 2032 |

USD 8.59 Billion |

Ethylidene Norbornene Market has several leading players, including JXTG Nippon Oil & Energy, INEOS Oxide, Dow, Exxon Mobil, Ningbo Titan Unichem, CHEMOS, Crescent Chemical, Beyond Industries, and Simagchem, driving innovation, capacity expansion, and supply‑chain integration. The market shows a clear regional concentration: Asia‑Pacific leads with a market share of 33.45 %, reflecting strong demand from automotive and construction sectors. North America also projects robust growth, supported by technological strength and regulatory demand for high‑performance elastomers. Europe and other regions contribute to the global footprint, but the dominance of Asia‑Pacific and rising North American demand position these regions as core hubs for future ENB consumption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Ethylidene Norbornene Market size was valued at USD 5.43 billion in 2024 and is projected to reach USD 8.59 billion by 2032, growing at a CAGR of 5.9% during the forecast period.

- The demand for EPDM rubber, which dominates the market with a 68% share in 2024, is driven by its use in automotive, construction, and industrial applications, further spurred by infrastructure development and the rise of electric vehicles.

- Technological advancements in rubber manufacturing and increasing regulatory focus on sustainable, high-performance materials are key trends boosting the market.

- Fluctuating raw material prices and environmental regulations are significant restraints, potentially impacting profit margins and production costs.

- Asia-Pacific leads the market with a 33.45% share, driven by industrialization, automotive growth, and infrastructure development, while North America holds 40% of the market, driven by demand from automotive and consumer goods sectors.

Market Segmentation Analysis

By Application

The Ethylidene Norbornene (ENB) market is segmented by application into EPDM rubber and polymer & chemical intermediates. The EPDM rubber sub-segment is dominant, holding a market share of 68% in 2024. This growth is driven by the increased demand for durable, high-performance materials in automotive, construction, and industrial applications. EPDM’s superior resistance to weathering, ozone, and aging makes it ideal for various applications, particularly in automotive seals, hoses, and roofing materials. As infrastructure development and automotive production continue to rise, the demand for EPDM rubber will sustain its dominance in the market.

- For instance, Mitsui Chemicals’ EPDM brand “Mitsui EPT” is widely used in automotive weather-strip applications, supported by documented performance advantages in heat-resistant sealing systems (Mitsui Chemicals Product Data).

By End Use

The end-use segment of the Ethylidene Norbornene market includes automotive, construction, consumer goods, and flavor & fragrance. The automotive segment holds the largest share, accounting for 44% of the market in 2024. This dominance is driven by the automotive industry’s increasing use of EPDM rubber in components such as weather seals, gaskets, and vibration dampers. The growing automotive production, especially in emerging economies, and the rising demand for lightweight, durable, and sustainable materials are key drivers for ENB’s use in the automotive sector. These trends are expected to fuel continued growth within this segment.

- For instance, Honda’s global models such as the CR-V and Civic use EPDM-based weather-strip systems, documented in supplier material specifications for sealing performance and UV resistance.

Key Growth Drivers

Increasing Demand for EPDM Rubber

One of the major growth drivers for the Ethylidene Norbornene (ENB) market is the escalating demand for EPDM rubber, which dominates the application segment. EPDM rubber’s superior properties, such as high resistance to ozone, UV rays, and aging, have made it the material of choice for automotive, construction, and industrial applications. As the automotive industry increasingly adopts EPDM rubber for components like seals, gaskets, and hoses, and as the construction sector continues to grow with infrastructure developments, the demand for ENB is expected to surge in the coming years.

- For instance, Bridgestone’s EPDM-based automotive sealing systems are documented for long-term UV and ozone resistance, supporting their use in door weather-strips and under-the-hood components (Bridgestone Technical Data).

Expansion of Automotive Production

The growing automotive industry is a key driver for the Ethylidene Norbornene market. As global vehicle production rises, especially in emerging markets, the demand for high-performance materials like EPDM rubber, which requires ENB as a key component, continues to increase. The automotive sector’s emphasis on durable and sustainable materials for parts such as weather seals and vibration dampers has accelerated the use of ENB in rubber formulations. This trend is further supported by the push toward electric vehicles (EVs) and advanced automotive technologies, driving market growth.

- For instance, BMW incorporates EPDM rubber in gaskets and high-temperature cable protection components in EV platforms like the BMW i4, supported by material requirement sheets specifying ozone and heat-aging resistance.

Sustainability and Green Building Initiatives

The increasing focus on sustainability and green building initiatives is another significant growth driver for the ENB market. As the construction industry moves towards eco-friendly building materials and energy-efficient solutions, EPDM rubber, which is durable, recyclable, and has a low environmental impact, has gained traction. The material is used extensively in roofing membranes, insulation, and window seals. Moreover, the shift toward sustainable materials in construction applications, driven by regulatory frameworks and consumer preferences, is expected to further boost the demand for ENB in the building and construction sector.

Key Trends & Opportunities

Adoption of High-Performance Materials in Automotive

A key trend in the Ethylidene Norbornene market is the growing adoption of high-performance materials in the automotive sector. Manufacturers are increasingly relying on ENB-based EPDM rubber to meet the rising demands for lightweight, durable, and weather-resistant components. The trend towards electric vehicles (EVs) also presents a unique opportunity for ENB, as EVs require advanced rubber materials to optimize energy efficiency, battery performance, and component durability. The automotive industry’s shift toward sustainability further enhances ENB’s role as a critical component in eco-friendly vehicle production.

- For instance, Ford uses EPDM-based sealing systems in EV models like the Mustang Mach-E, supported by documented material requirements emphasizing ozone resistance, lightweight design, and reduced cabin noise.

Technological Advancements in Rubber Manufacturing

Technological advancements in rubber manufacturing processes are creating new opportunities for the ENB market. Innovations such as improved polymerization techniques and enhanced formulations are allowing manufacturers to create more efficient, cost-effective, and high-performing ENB-based products. These advancements are particularly relevant in industries such as automotive, where the need for precision and performance is crucial. As manufacturers continue to explore advanced rubber production technologies, the demand for high-quality ENB is set to grow, driven by the ability to meet evolving market needs for specialized applications in various sectors.

- For instance, ExxonMobil’s advanced metallocene catalyst technology has improved EPDM polymer uniformity, enabling better control over molecular weight distribution, which enhances sealing performance in automotive components.

Key Challenges

Fluctuating Raw Material Prices

A significant challenge faced by the Ethylidene Norbornene market is the fluctuation in the prices of raw materials, particularly those used in the production of ENB and its derivatives. The cost of petroleum-based feedstocks, which are key ingredients in ENB production, has been volatile, influenced by global supply chain disruptions and geopolitical factors. These price fluctuations create uncertainty for manufacturers, impacting their profit margins and product pricing. As the cost of raw materials rises, it could also hinder the market’s growth, especially for smaller players with limited resources.

Environmental Concerns and Regulatory Pressure

Environmental concerns and increasing regulatory pressure regarding the use of certain chemicals and materials present a challenge for the Ethylidene Norbornene market. The production of ENB and its use in various applications could face stricter environmental regulations in the future, particularly in regions like Europe and North America, which have stringent environmental standards. Compliance with these regulations may require significant investment in research and development to develop environmentally friendly production methods. This challenge could slow the growth of the market, particularly for companies that rely on traditional production techniques.

Regional Analysis

North America

The Ethylidene Norbornene (ENB) market in North America commands a substantial market share of 40%. The region’s growth is driven by strong demand from the automotive and consumer goods sectors, where high-performance elastomers and durable materials are critical. The presence of mature manufacturing infrastructure, advanced material-science capabilities, and a well-established chemical supply chain further reinforce North America’s position. Additionally, regulatory emphasis on performance standards encourages the adoption of ENB-based EPDM rubber for seals, gaskets, and other applications, thereby sustaining its market share.

Europe

Europe holds a significant portion of the ENB market, with a share of 30%. The region’s well-established automotive and construction industries demand high-quality elastomers and specialty chemicals, fueling the adoption of ENB-based materials. Stringent environmental and regulatory frameworks also encourage manufacturers to deploy high-performance and compliant materials, including ENB-derived EPDM rubber. European producers’ emphasis on sustainability and innovation in polymer formulations further supports ENB usage in automotive seals, construction membranes, and industrial products, reinforcing the region’s steady market position.

Asia-Pacific

The Asia-Pacific region leads the global ENB market with a dominant share of 33.45%. Rapid industrialization, expanding automotive manufacturing, and accelerated infrastructure development in countries such as China, India, Japan, and South Korea propel demand. The region’s booming construction sector drives consumption of EPDM rubber for roofing, waterproofing, and sealing applications. Additionally, the fast-growing automotive sector, including rising production of conventional and electric vehicles, amplifies the need for ENB-based elastomers. These drivers combined ensure Asia-Pacific’s dominance in the ENB market.

Latin America

Latin America represents a growing segment of the global ENB market, capturing a smaller share of 8%. Rising industrialization and expanding construction and automotive sectors are fueling demand for ENB. Increasing infrastructure investments and the growth of consumer goods production create a gradually rising requirement for high-performance elastomers like EPDM rubber. As regional manufacturing capabilities improve and demand for durable, weather-resistant materials increases, Latin America is poised to capture a larger portion of ENB consumption in the coming years.

Middle East & Africa

The Middle East & Africa region currently holds a smaller share of 6% in the ENB market but demonstrates promising growth potential. The growing petrochemical and construction industries, along with increasing automotive component demand, support gradual uptake of ENB-based materials. Investments in industrial infrastructure and expanding capacity for specialty chemicals contribute to market development. As regional economies diversify and urbanization accelerates, demand for high-performance elastomers and chemical intermediates using ENB will likely grow, offering a rising opportunity for market participants.

Market Segmentations

By Application

- EPDM Rubber

- Polymer & Chemical Intermediates

By End Use

- Automotive

- Construction

- Consumer Goods

- Flavor & Fragrance

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Ethylidene Norbornene (ENB) market is highly competitive, with several key players driving innovation and market growth. Prominent companies in the market include JXTG Nippon Oil & Energy, INEOS Oxide, Dow, Exxon Mobil, Uniroyal, Ningbo Titan Unichem, CHEMOS, Crescent Chemical, Beyond Industries, and Simagchem. These companies focus on expanding their product portfolios, improving production capabilities, and establishing strategic partnerships to strengthen their market presence. Dow and Exxon Mobil have been instrumental in advancing chemical processes that improve the efficiency of ENB production. Additionally, companies like JXTG Nippon Oil & Energy and INEOS Oxide leverage their extensive global networks to capture significant market share in the automotive, construction, and consumer goods industries. Innovation in sustainable production techniques and increasing demand for high-performance materials are also key strategies for maintaining a competitive edge in this growing market. These players are poised to maintain strong positions in the face of rising demand and industry shifts.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Crescent Chemical

- Dow

- Beyond Industries

- Ningbo Titan Unichem

- Exxon Mobil

- CHEMOS

- JXTG Nippon Oil & Energy

- INEOS Oxide

- Uniroyal

- Simagchem

Recent Developments

- In October 2025, The Dow Chemical Company and MEGlobal finalized an agreement for Dow to supply an additional 100 KTA of ethylene from its U.S. Gulf Coast operations to MEGlobal’s co-located ethylene glycol facility.

- In December 2023, INEOS Group announced an agreement to acquire LyondellBasell’s Ethylene Oxide and Derivatives business, including the Bayport Underwood facility in Texas, for approximately $700 million.

Report Coverage

The research report offers an in-depth analysis based on Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for Ethylidene Norbornene is expected to grow significantly due to the increasing adoption of EPDM rubber in the automotive and construction sectors

- Rising infrastructure development and urbanization in emerging markets will drive higher consumption of ENB-based materials in construction applications.

- The automotive industry’s shift toward electric vehicles will create new opportunities for ENB, as high-performance materials are essential for EV component durability.

- The ongoing focus on sustainability and eco-friendly materials will encourage the adoption of ENB in green building and energy-efficient construction projects.

- Technological advancements in rubber manufacturing are likely to lead to more efficient ENB production methods, reducing costs and improving performance.

- Key players are expected to invest in expanding production capacity and forming strategic partnerships to meet growing global demand.

- As the global demand for high-quality elastomers rises, ENB’s role in specialized industries like aerospace and medical devices will increase.

- The increasing focus on regulatory compliance for high-performance materials will further boost the demand for ENB-based products in multiple sectors.

- The market is likely to see more collaborations between ENB producers and automotive manufacturers to develop advanced rubber formulations for vehicle components.

- The rising demand for durable, weather-resistant materials in various industries will maintain the growth trajectory of the ENB market, particularly in regions with rapid industrialization.