Market Overview

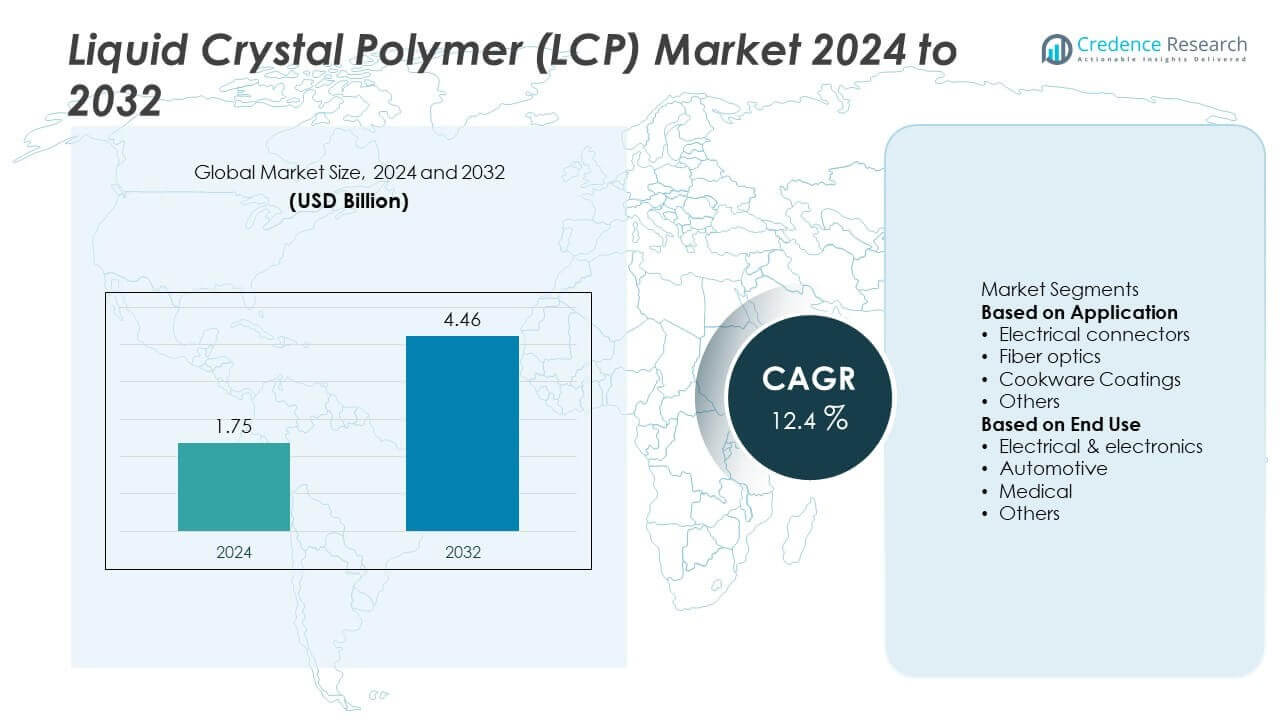

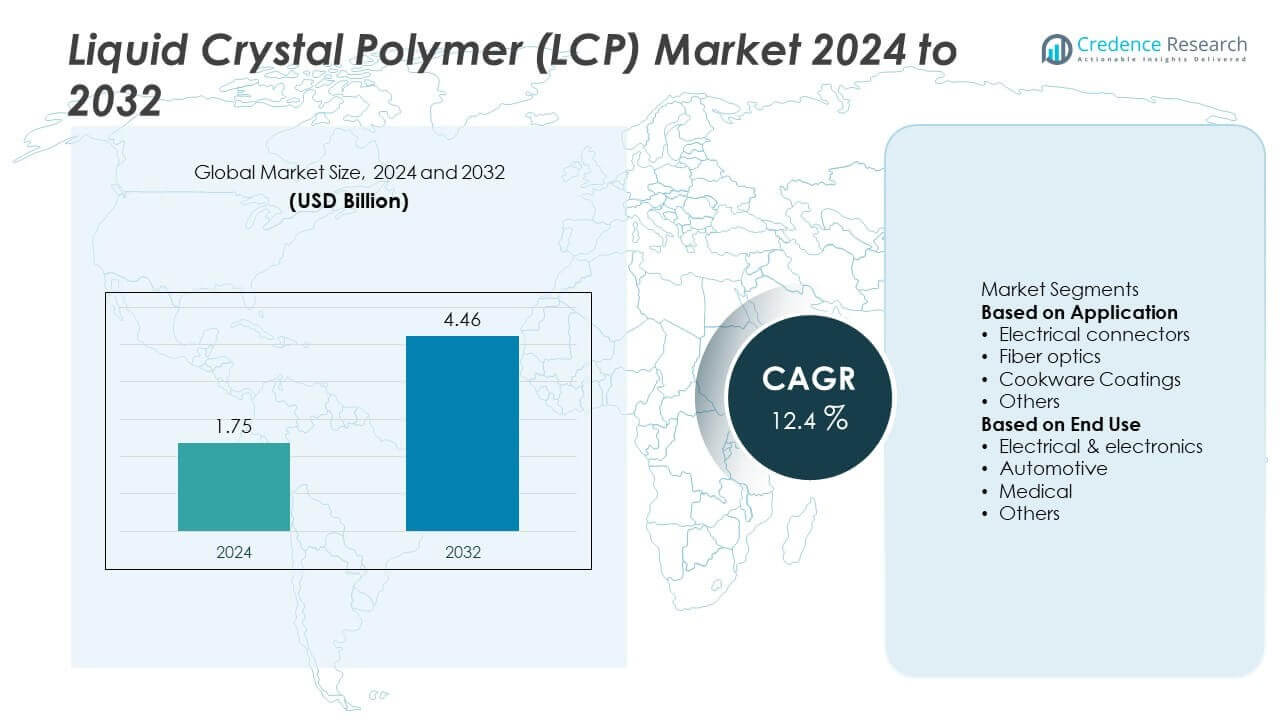

The Liquid Crystal Polymer (LCP) Market was valued at USD 1.75 billion in 2024 and is projected to reach USD 4.46 billion by 2032, growing at a CAGR of 12.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Liquid Crystal Polymer (LCP) Market Size 2024 |

USD 1.75 Billion |

| Liquid Crystal Polymer (LCP) Market, CAGR |

12.4% |

| Liquid Crystal Polymer (LCP) Market Size 2032 |

USD 4.46 Billion |

The Liquid Crystal Polymer (LCP) market is driven by key players including Chang Chung Group, Celanese Corporation, Zeus Company Inc., RTP Company, TORAY INDUSTRIES, INC., Polyplastics Co., Daken Chem, Solvay, Sumitomo Chemical Company, and UENO FINE CHEMICALS INDUSTRY, LTD. These companies focus on expanding production capacities, advancing LCP formulations, and building partnerships with electronics and automotive manufacturers to strengthen their global presence. Asia-Pacific led the market with 44% share in 2024, supported by large-scale electronics and automotive manufacturing, while North America held 24% share, driven by high adoption in semiconductors and medical devices. Europe accounted for 22%, reinforced by stringent environmental standards and strong demand in automotive applications.

Market Insights

Market Insights

- The Liquid Crystal Polymer (LCP) market was valued at USD 1.75 billion in 2024 and is projected to reach USD 4.46 billion by 2032, growing at a CAGR of 12.4% during the forecast period.

- Electrical connectors dominated with 47% share in 2024, driven by growing demand in smartphones, laptops, and telecom networks, while the electrical & electronics sector led end-use with 59% share, supported by miniaturization and high-frequency applications.

- A key trend is the rising use of LCP in 5G infrastructure and fiber optics, with opportunities expanding in flexible circuits, EV components, and medical devices requiring biocompatibility and sterilization resistance.

- Leading players such as Chang Chung Group, Celanese Corporation, Zeus Company Inc., RTP Company, TORAY INDUSTRIES, INC., Polyplastics Co., Daken Chem, Solvay, Sumitomo Chemical Company, and UENO FINE CHEMICALS INDUSTRY, LTD. focus on innovation, eco-friendly formulations, and regional expansions to remain competitive.

- Asia-Pacific held 44% share in 2024, followed by North America at 24% and Europe at 22%, while Latin America accounted for 6% and Middle East & Africa 4%, reflecting balanced global demand.

Market Segmentation Analysis:

By Application

Electrical connectors dominated the Liquid Crystal Polymer (LCP) market in 2024, holding 47% share. This leadership is driven by growing demand for lightweight, high-performance materials in smartphones, laptops, and telecom infrastructure. LCPs provide excellent dielectric properties, high heat resistance, and low moisture absorption, making them ideal for miniaturized, high-frequency connectors. Fiber optics followed with 28% share, supported by rapid expansion in 5G networks and data centers. Cookware coatings and other applications together accounted for 25%, benefiting from LCP’s durability and resistance to high temperatures in niche uses.

- For instance, Celanese Corporation’s Vectra® LCP is used in high-frequency connectors for 5G base stations, achieving dielectric constant values below 3.2 and dissipation factor under 0.004 at 10 GHz, ensuring low signal loss in miniaturized designs.

By End Use

The electrical & electronics sector led the market in 2024, capturing 59% share. Demand is driven by rising adoption of LCPs in semiconductor packaging, connectors, and flexible circuits to support miniaturization and high-speed data transmission. Automotive accounted for 21% share, fueled by increasing use in lightweight components and advanced driver-assistance systems. The medical segment contributed 13% share, reflecting adoption in surgical instruments and devices requiring sterilization resistance. Other industries, holding 7% share, apply LCP in specialized high-performance environments. The dominance of electronics highlights LCP’s critical role in next-generation technologies.

- For instance, Sumitomo Chemical’s SUMIKASUPER™ LCP is used in semiconductor packages with heat deflection temperature above 300 °C and moisture absorption less than 0.04%, enabling reliable performance in ultra-thin IC substrates for high-speed electronics.

Key Growth Drivers

Rising Demand in Electrical and Electronics

The electrical and electronics sector accounted for 59% share of the LCP market in 2024, making it the primary growth driver. Increasing use of LCP in semiconductor packaging, connectors, and flexible circuits supports miniaturization and high-speed data transfer. Demand for 5G infrastructure, IoT devices, and cloud data centers further boosts consumption. LCP’s dielectric stability, flame resistance, and low moisture absorption make it indispensable for advanced electronics. This rapid adoption reinforces electronics as the core application segment driving global market expansion.

- For instance, Polyplastics’ LAPEROS® LCP grades are used in high-frequency connectors for 5G antennas, delivering dielectric constant values of 3.1 and dissipation factor of 0.002 at 10 GHz, enabling stable signal transmission in compact electronic components.

Growing Role in Automotive Lightweighting

Automotive applications contributed 21% share in 2024, fueled by the industry’s shift toward lightweight, high-performance materials. LCP is increasingly used in under-the-hood parts, connectors, and advanced driver-assistance systems due to its heat resistance and dimensional stability. The rising penetration of electric vehicles (EVs) also accelerates adoption, as EV batteries and charging infrastructure require durable, high-precision connectors. Automotive OEMs prioritize LCP to meet stricter efficiency and safety standards. This alignment with industry trends ensures steady growth of LCP applications in the global automotive sector.

- For instance, TORAY’s SIVERAS® LCP is applied in EV battery module connectors, offering excellent heat resistance with a heat deflection temperature of 250°C or higher, ensuring reliable performance under continuous high-temperature operating conditions.

Expanding Use in Medical Applications

Medical devices accounted for 13% share of the LCP market in 2024, supported by the material’s biocompatibility and resistance to sterilization. LCP is widely used in surgical instruments, diagnostic devices, and drug delivery systems where precision and reliability are critical. Growing demand for minimally invasive devices and wearable health technologies further drives adoption. As healthcare spending rises globally, especially in emerging economies, the medical sector is expected to offer high-growth opportunities for LCP. This segment highlights the material’s expanding role beyond electronics and automotive industries.

Key Trends & Opportunities

Integration with 5G and High-Frequency Applications

The rollout of 5G networks and increasing reliance on high-frequency electronics create strong opportunities for LCP adoption. Its low dielectric constant and loss characteristics make it ideal for antenna substrates, high-speed connectors, and base station components. With telecom infrastructure expanding rapidly in Asia-Pacific and North America, demand for LCP is expected to accelerate. Manufacturers are also exploring LCP in flexible circuits for compact devices, further broadening its scope in high-frequency applications. This trend positions LCP as a critical enabler of next-generation communication technologies.

- For instance, Solvay’s Xydar® LCP is used in high-frequency connectors and antenna components, featuring a dielectric constant of 3.0 and dissipation factor of 0.002 at 10 GHz, while maintaining thermal stability above 320 °C, making it suitable for 5G base stations and mmWave applications.

Focus on Sustainability and Recycling

Sustainability has become a central trend, with manufacturers exploring recyclable and eco-friendly LCP solutions. While traditionally considered difficult to recycle, innovations in polymer reprocessing and blending are emerging. Companies are investing in cleaner production methods to align with global regulations on waste and emissions. This creates opportunities for LCP adoption in markets where environmental compliance is a priority, particularly in Europe. The push for sustainable materials not only enhances brand reputation but also opens new avenues for growth across electronics and automotive industries.

- For instance, Celanese Corporation introduced the Vectra® | Zenite® LCP ECO-B series with up to 60% renewable content using a mass-balance approach. These materials are stated to offer the same high-quality performance and dimensional stability as standard LCPs, providing a sustainable option without compromising quality in electronics and automotive connectors.

Key Challenges

High Production Costs

The cost of producing LCP remains significantly higher than conventional polymers due to complex processing and raw material requirements. Specialized equipment and high-precision molding add to expenses, limiting affordability in cost-sensitive markets. This creates challenges for adoption in emerging economies where price competition is strong. While large-scale manufacturers benefit from economies of scale, smaller firms face barriers to entry. Unless cost structures are optimized, high production costs will remain a restraint on broader market penetration of LCP across multiple industries.

Competition from Alternative High-Performance Polymers

LCP faces increasing competition from alternative materials such as polyphenylene sulfide (PPS), polyether ether ketone (PEEK), and high-performance nylons. These polymers also offer strength, heat resistance, and dimensional stability at lower costs, making them attractive substitutes in automotive and electronics applications. In sectors where performance requirements are less stringent, these alternatives often replace LCP. This competition exerts pricing pressure on manufacturers and challenges LCP’s ability to expand market share. Differentiation through superior properties and innovations remains critical to overcoming this challenge.

Regional Analysis

North America

North America accounted for 24% share of the Liquid Crystal Polymer (LCP) market in 2024, supported by strong demand from electronics, automotive, and medical industries. The U.S. led the region due to widespread use of LCP in high-performance electrical connectors and semiconductor packaging. Growth in electric vehicles and 5G infrastructure projects also reinforced adoption. Canada contributed through expanding healthcare applications, while Mexico added demand from the automotive supply chain. Regulatory support for advanced materials and continued technological innovation ensures North America’s stable role as a leading market for LCP during the forecast period.

Europe

Europe held 22% share of the LCP market in 2024, driven by advanced automotive manufacturing and stringent environmental regulations. Germany, France, and the U.K. accounted for the majority of demand, particularly in lightweight automotive parts, electronics, and medical devices. The region’s emphasis on sustainable and high-performance materials aligns with the growing use of LCP in industrial and healthcare applications. Eastern Europe contributed incremental growth through expanding automotive production and electronics assembly. Europe’s combination of innovation, regulatory standards, and demand for eco-friendly materials positions it as a key contributor to global LCP expansion.

Asia-Pacific

Asia-Pacific dominated the Liquid Crystal Polymer (LCP) market in 2024 with 44% share, supported by large-scale electronics manufacturing and rapid urbanization. China led consumption due to strong demand in smartphones, 5G infrastructure, and data centers, while Japan and South Korea drove adoption through advanced automotive and semiconductor industries. India and Southeast Asia added growth from expanding consumer electronics and automotive production. Cost-effective manufacturing capabilities and increasing exports further strengthen the region’s leadership. With rising investment in telecom and healthcare, Asia-Pacific will remain the largest and fastest-growing regional market for LCP through 2032.

Latin America

Latin America represented 6% share of the LCP market in 2024, with Brazil and Mexico leading regional demand. Growth was supported by expanding automotive production and rising use of LCP in consumer electronics assembly. The medical sector in Brazil also contributed to adoption, with demand for biocompatible and sterilization-resistant polymers in surgical devices. However, economic volatility and limited technological infrastructure constrained broader growth. Manufacturers are increasingly targeting mid-range applications and partnerships with local industries to strengthen their presence. With steady expansion in electronics and automotive sectors, Latin America is expected to achieve gradual growth.

Middle East & Africa

The Middle East & Africa accounted for 4% share of the LCP market in 2024, with demand concentrated in the Gulf nations. Saudi Arabia and the UAE supported adoption through investments in advanced infrastructure and industrial projects requiring high-performance polymers. South Africa contributed demand from medical and automotive applications. Limited local production capacity created reliance on imports, offering opportunities for global suppliers. Rising awareness of advanced materials and the push for diversification in manufacturing sectors are expected to gradually support market growth, although high costs and limited expertise remain key challenges in the region.

Market Segmentations:

By Application

- Electrical connectors

- Fiber optics

- Cookware Coatings

- Others

By End Use

- Electrical & electronics

- Automotive

- Medical

- Others

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The competitive landscape of the Liquid Crystal Polymer (LCP) market is defined by leading players such as Chang Chung Group, Celanese Corporation, Zeus Company Inc., RTP Company, TORAY INDUSTRIES, INC., Polyplastics Co., Daken Chem, Solvay, Sumitomo Chemical Company, and UENO FINE CHEMICALS INDUSTRY, LTD. These companies compete by focusing on advanced product formulations, process innovations, and expanding applications in high-growth sectors such as electronics, automotive, and medical devices. Strategic investments in research and development aim to enhance thermal stability, mechanical strength, and dielectric performance of LCPs, addressing growing demand for miniaturized and high-frequency components. Partnerships with semiconductor and automotive manufacturers strengthen supply chains, while sustainability initiatives are driving efforts to develop recyclable and eco-friendly LCP solutions. Regional expansion, particularly in Asia-Pacific and North America, remains a critical focus to capture rising demand from 5G infrastructure, electric vehicles, and advanced healthcare systems. Differentiation through quality, performance, and compliance continues to define competitiveness in this market.

Key Player Analysis

- Chang Chung Group

- Celanese Corporation

- Zeus Company Inc.

- RTP Company

- TORAY INDUSTRIES, INC.

- Polyplastics Co.

- Daken Chem

- Solvay

- Sumitomo Chemical Company

- UENO FINE CHEMICALS INDUSTRY, LTD.

Recent Developments

- In 2025, Celanese’s new LCP grade release (mentioned above) was cited as a key trend in industry forecasts.

- In 2025, Celanese Corporation and distributor Biesterfeld expanded their partnership to include LCP families Vectra® and Zenite® across additional regions.

- In April 2024, Celanese Corporation unveiled Vectra® | Zenite® LCP ECO-B with up to 60% recycled/renewable content, targeting E&E and automotive at Chinaplas 2024.

- In 2024, Polyplastics Co. announced LAPEROS® bG-LCP (biomass-balanced) slated for commercialization in spring 2025, with properties matching conventional LCP.

Report Coverage

The research report offers an in-depth analysis based on Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for LCP will rise in electrical connectors as 5G and IoT adoption expands.

- Fiber optics applications will grow with increasing investment in telecom and data center infrastructure.

- Automotive adoption will strengthen as EV production and lightweighting needs accelerate.

- Medical devices will drive demand for biocompatible and sterilization-resistant LCP components.

- Miniaturization of electronics will continue to support strong growth in semiconductor packaging.

- Asia-Pacific will maintain leadership due to large-scale electronics and automotive manufacturing bases.

- North America will grow steadily, led by semiconductors and medical technology advancements.

- Europe will expand demand with sustainability regulations and advanced automotive applications.

- Innovation in recyclable and eco-friendly LCP formulations will shape long-term competitiveness.

- Competition from alternative high-performance polymers will push manufacturers toward product differentiation.

Market Insights

Market Insights