Market Overview:

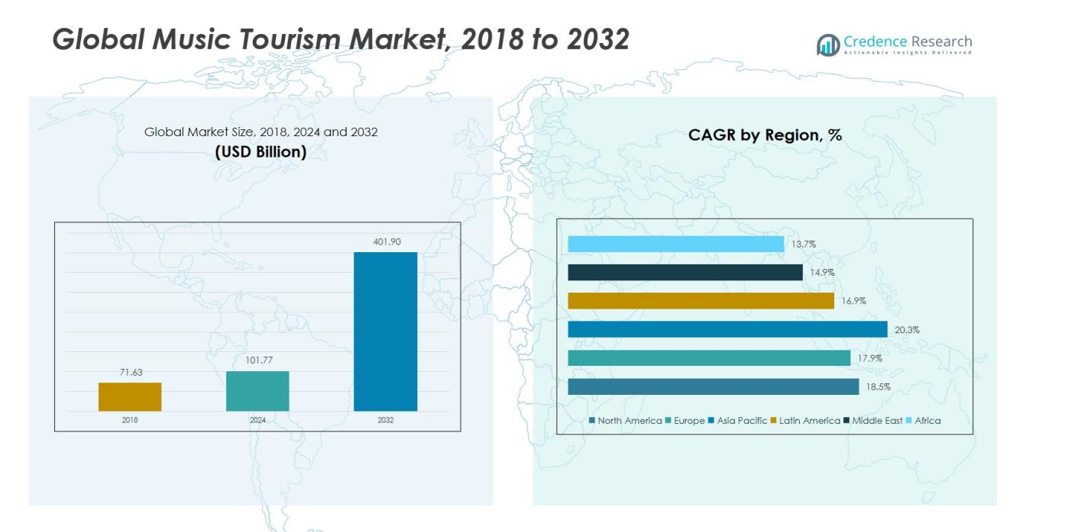

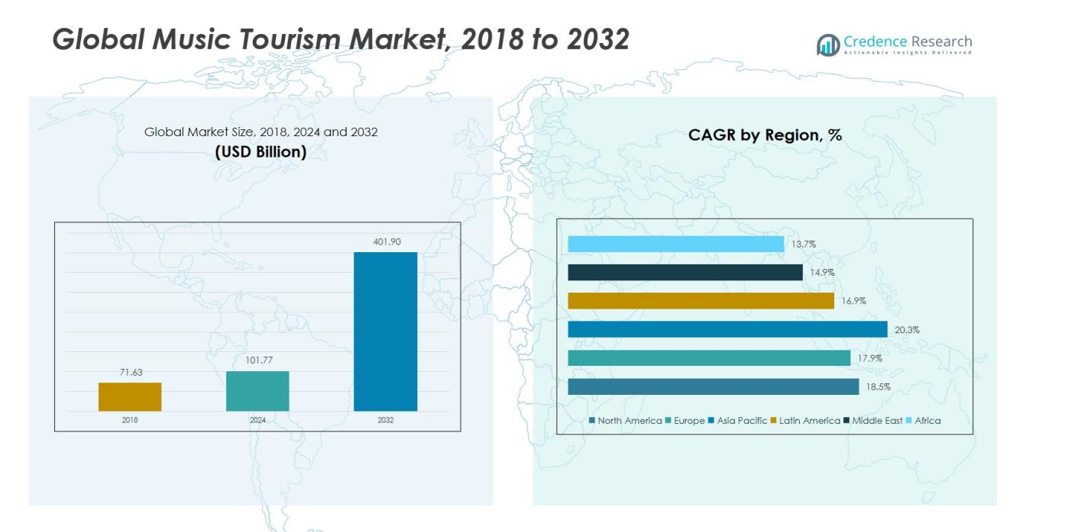

The Global Music Tourism Market size was valued at USD 71.63 million in 2018 to USD 101.77 million in 2024 and is anticipated to reach USD 401.90 million by 2032, at a CAGR of 18.56% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Music Tourism Market Size 2024 |

USD 101.77 million |

| Music Tourism Market, CAGR |

18.56% |

| Music Tourism Market Size 2032 |

USD 401.90 million |

The market growth is supported by several factors including the surge in live events, higher disposable incomes, and widespread social media influence. Governments and tourism boards are promoting music-based travel to strengthen cultural branding and local economies. The integration of advanced technologies such as online ticketing, augmented reality, and mobile engagement tools enhances visitor experience and event accessibility.

Regionally, North America dominates the Global Music Tourism Market with 38% share due to strong infrastructure and major event destinations in the U.S. and Canada. Europe follows with 30% share, led by globally recognized festivals and a strong cultural base. Asia Pacific is the fastest-growing region with a CAGR of 20.3%, supported by expanding youth participation, digital adoption, and regional festival growth across India, Japan, and South Korea.

Market Insights:

- The Global Music Tourism Market was valued at USD 71.63 million in 2018, grew to USD 101.77 million in 2024, and is expected to reach USD 401.90 million by 2032, registering a CAGR of 18.56% during the forecast period.

- North America holds 38% share of the Global Music Tourism Market, driven by strong entertainment infrastructure and world-renowned events such as Coachella and Lollapalooza. Europe follows with 30% share, supported by rich cultural heritage and major festivals across the UK, Germany, and France.

- Asia Pacific accounts for 22% share and remains the fastest-growing region, fueled by expanding youth populations, rising disposable incomes, and rapid digital adoption in Japan, South Korea, and India.

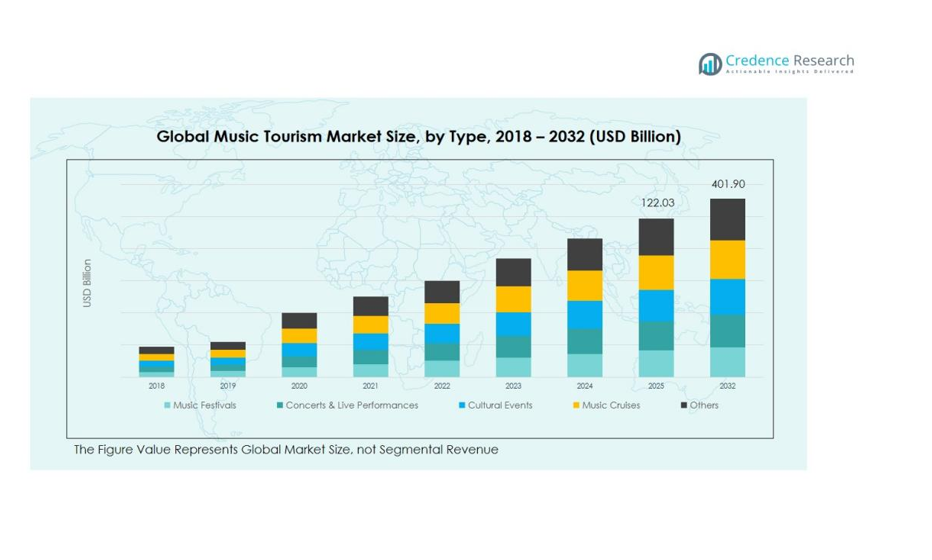

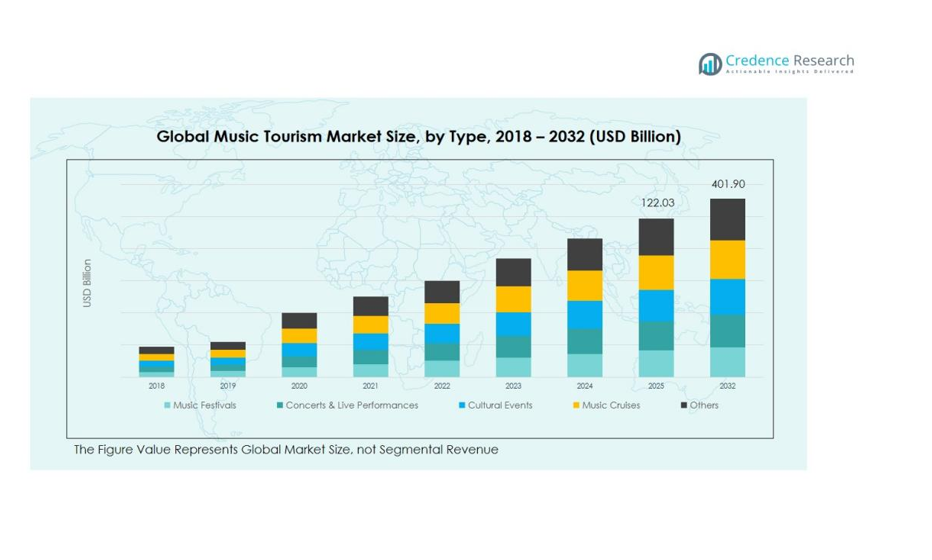

- By type, music festivals dominate the market with 42% share due to large international audiences and higher spending potential.

- Concerts and live performances account for 31% share, supported by steady global demand for real-time entertainment and growing participation in destination-based events.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Popularity of Live Events and Music Festivals

The Global Music Tourism Market is expanding due to the growing popularity of live concerts, global music festivals, and immersive cultural events. Travelers seek unique experiences that connect entertainment with travel, fueling ticket sales and tourism spending. Large-scale festivals such as Coachella, Glastonbury, and Tomorrowland attract international visitors, driving hotel bookings and local revenue. It benefits from governments and tourism boards promoting these events to boost regional economies and cultural exchange.

- For Instance, For instance, at the Glastonbury Festival in June 2024, the total licensed capacity was 210,000, which includes ticket-holders as well as staff and performers.

Growing Influence of Social Media and Digital Promotion

Social media platforms play a vital role in promoting music tourism experiences and shaping traveler preferences. Fans discover events through influencer marketing, live streaming, and targeted digital advertising campaigns. The Global Music Tourism Market leverages these channels to increase visibility and engagement among younger demographics. It allows travelers to share content, encouraging peer-driven tourism behavior and repeat participation in global events.

- For Instance, Tomorrowland utilizes a comprehensive digital strategy that includes live streams and influencer partnerships across multiple platforms, such as Instagram and TikTok. In 2025, a year-long partnership with TikTok saw the festival’s account gain 1.9 million new followers, bringing its total on that platform to 9.2 million.

Expansion of Tourism Infrastructure and Government Support

Strong government initiatives to develop entertainment infrastructure are fueling the market’s growth. Investments in concert venues, transport facilities, and festival logistics enhance visitor convenience and attract international performers. The Global Music Tourism Market benefits from tourism authorities integrating music-focused packages and travel incentives. It creates sustainable opportunities for local economies while strengthening cultural branding.

Rising Disposable Income and Shift Toward Experiential Travel

A growing middle-class population and higher disposable income levels are increasing consumer spending on travel and entertainment. Tourists now prioritize experiences over material possessions, choosing destinations that offer emotional and cultural value. The Global Music Tourism Market thrives on this behavioral shift, supported by affordable travel options and diverse event offerings. It continues to attract international visitors seeking memorable, multi-sensory entertainment experiences.

Market Trends:

Integration of Technology with Travel and Live Music Events

The Global Music Tourism Market sees rising adoption of digital tools that enhance event-travel experiences. Organisers use virtual reality tours and augmented reality for pre-event engagement and travel planning. Platforms deliver personalised travel-packages with concert tickets, accommodations and local experiences bundled. Fan apps enable real-time updates, interactive maps and social sharing features that motivate destination choices. Travel and event companies form alliances to create seamless music-tourism journeys that combine live performance with local culture. The move toward tech-enabled experiences drives higher visitor satisfaction and repeat travel.

- For instance, Lux Machina deployed the Leica RTC360 laser scanner at Coachella 2024 to create a 3 billion polygon digital twin of the festival grounds, enabling precise augmented reality experiences across two stages simultaneously

Emergence of Niche Genres and Sustainable Destination Tourism

The market shifts toward smaller, genre-specific festivals and music-tourism models that highlight local culture and sustainability. Travel operators design eco-friendly travel packages around regional music scenes rather than only global superstar tours. Destinations promote indigenous music heritage and create boutique events that appeal to discerning travellers. Sustainable practices around venue operations, travel and hospitality attract environmentally aware tourists. The trend supports destination diversification and opens growth in under-served regions. It strengthens destination branding and yields longer-term value for local communities.

- For Instance, Rainforest World Music Festival in Malaysia brought together 184 performers from 20 countries. The festival was organized in collaboration with the Sarawak Tourism Board to promote local culture and increase economic activity in the region.

Market Challenges Analysis:

High Operational Costs and Event Management Complexities

The Global Music Tourism Market faces challenges from the high costs of organizing large-scale events and maintaining quality visitor experiences. Logistics, artist bookings, safety protocols, and infrastructure demand significant investments that strain profitability. Smaller organizers often struggle to secure sponsorships or manage fluctuating ticket demand. It also faces unpredictable weather conditions, venue limitations, and fluctuating exchange rates that affect travel and accommodation pricing. Rising costs of equipment and insurance further complicate operations, reducing margins for promoters and travel partners.

Regulatory Barriers and Environmental Sustainability Concerns

Music tourism expansion is hindered by diverse regulations governing event permits, international travel, and crowd management. The Global Music Tourism Market must navigate visa restrictions, licensing rules, and safety compliance across multiple countries. It also contends with growing scrutiny over carbon emissions, waste management, and resource use during major festivals. Local communities sometimes resist large-scale gatherings due to environmental or noise impacts. Managing sustainability while preserving cultural authenticity remains a significant challenge for long-term growth and stakeholder acceptance.

Market Opportunities:

Expansion of Cross-Border Music Tourism and Emerging Destinations

The Global Music Tourism Market presents strong opportunities in cross-border travel and untapped regional destinations. Emerging economies in Asia, Africa, and Latin America are investing in music festivals and cultural events to attract global audiences. It benefits from rising air connectivity, digital ticketing platforms, and government initiatives promoting creative tourism. Countries such as India, Thailand, and Brazil are positioning themselves as new music-travel hubs. Event organizers can design packages combining local heritage with international performances to enhance global appeal. These efforts create new value streams and reduce overdependence on traditional Western markets.

Adoption of Hybrid and Experiential Travel Models

The market can leverage hybrid event models that blend live performances with virtual experiences for wider audience reach. The Global Music Tourism Market gains from travelers seeking immersive, personalized entertainment combined with cultural exploration. It encourages partnerships between event promoters, travel agencies, and hospitality providers to offer full-service experiences. Interactive technologies such as AR and VR enhance fan engagement and increase participation among remote audiences. Sustainable tourism practices and eco-friendly event planning also open fresh business avenues. The shift toward immersive and responsible tourism supports long-term profitability and global expansion.

Market Segmentation Analysis:

By Type

The Global Music Tourism Market is segmented into music festivals, concerts and live performances, cultural events, music cruises, and others. Music festivals hold the largest share due to their mass appeal and international participation. Concerts and live performances attract strong demand from both local and global travelers seeking real-time experiences. Cultural events and music cruises are gaining traction among niche travelers who value unique and immersive entertainment. It benefits from rising global travel spending and event-based tourism.

- For instance, Tomorrowland, held in Belgium, attracted over 400,000 attendees from more than 200 countries in July 2024, marking one of the highest international footfalls for any music festival globally.

By Application

Applications include leisure, corporate, and cultural tourism. Leisure travel dominates the segment, driven by younger audiences seeking experiential trips around major music destinations. Corporate travel contributes through incentive events and brand-sponsored music experiences. Cultural tourism is expanding as travelers engage with heritage music, traditional performances, and local festivals. It creates steady growth through destination branding and cross-cultural exposure.

- For Instance, The Celebration Tour” concluded, it was widely reported that the first four of her six sold-out nights at the O2 Arena in London grossed $14.7 million and drew 60,000 attendees. An additional $7.5 million was generated from the final two London shows, adding another 31,000 attendees.

By Technology

Technology segments include online ticketing platforms, event promotion tools, mobile apps, augmented reality experiences, and AI-powered personalization. Online ticketing platforms lead due to convenience and global reach. Mobile apps and event promotion tools enhance user engagement and streamline event access. Emerging technologies such as AR and AI support immersive and personalized experiences for travelers. It strengthens event visibility, accessibility, and consumer retention across digital ecosystems.

Segmentations:

By Type

- Music Festivals

- Concerts & Live Performances

- Cultural Events

- Music Cruises

- Others

By Technology

- Online Ticketing Platforms

- Event Promotion Tools

- Mobile Apps

- Augmented Reality Experiences

- Others (AI-Powered Personalization & Analytics)

By End-User

- Leisure Travelers

- Music Enthusiasts

- Corporate Clients

By Age Group

- 18 and Less

- 18–34 Years

- 34–54 Years

- 55+ Years

By Booking Mode

- Direct Booking

- Travel Agents

- Online Travel Agencies

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Music Tourism Market size was valued at USD 27.01 billion in 2018 to USD 37.91 billion in 2024 and is anticipated to reach USD 150.19 billion by 2032, at a CAGR of 18.5% during the forecast period. The region holds 38% share of the Global Music Tourism Market, supported by strong entertainment infrastructure and high consumer spending on live experiences. The United States dominates with major festivals and concert destinations such as Coachella, Lollapalooza, and Austin City Limits. Canada and Mexico contribute through cultural events and cross-border music tourism. It benefits from advanced ticketing systems, digital promotion platforms, and diversified event formats. Strong alliances between tourism boards and event organizers enhance brand visibility and international attendance.

Europe

The Europe Music Tourism Market size was valued at USD 21.31 billion in 2018 to USD 29.23 billion in 2024 and is anticipated to reach USD 109.02 billion by 2032, at a CAGR of 17.9% during the forecast period. The region accounts for 30% of the Global Music Tourism Market, driven by rich cultural heritage and globally recognized festivals. The United Kingdom, Germany, France, and Spain remain leading hubs for large-scale events. It thrives on well-developed transportation networks and consistent government support for cultural industries. The region attracts steady inflows of international visitors through its blend of modern entertainment and traditional music scenes. Sustainability practices and digital engagement strengthen its long-term appeal.

Asia Pacific

The Asia Pacific Music Tourism Market size was valued at USD 16.81 billion in 2018 to USD 25.52 billion in 2024 and is anticipated to reach USD 111.88 billion by 2032, at a CAGR of 20.3% during the forecast period. The region holds 22% share of the Global Music Tourism Market and represents the fastest-growing regional market. Expanding youth populations, rising disposable income, and growing urbanization increase participation in concerts and festivals. Japan, South Korea, India, and Australia drive growth through global collaborations and high-profile events. It benefits from digital adoption, affordable air travel, and regional tourism initiatives. Enhanced cross-border connectivity continues to boost entertainment-driven travel demand.

Latin America

The Latin America Music Tourism Market size was valued at USD 4.06 billion in 2018 to USD 5.70 billion in 2024 and is anticipated to reach USD 20.36 billion by 2032, at a CAGR of 16.9% during the forecast period. The region represents 6% share of the Global Music Tourism Market, supported by strong cultural traditions and vibrant festival ecosystems. Brazil, Argentina, and Chile lead with globally known events like Rock in Rio and Lollapalooza Chile. It benefits from growing regional air routes, digital engagement, and active government tourism promotion. The focus on Latin and fusion music genres attracts diverse international audiences. Increasing investment in infrastructure and event logistics further strengthens the regional tourism framework.

Middle East

The Middle East Music Tourism Market size was valued at USD 1.39 billion in 2018 to USD 1.73 billion in 2024 and is anticipated to reach USD 5.21 billion by 2032, at a CAGR of 14.9% during the forecast period. The region holds 3% share of the Global Music Tourism Market, driven by rising investment in entertainment and cultural diversification. The UAE and Saudi Arabia dominate with large-scale concerts and global music festivals. It benefits from national tourism strategies that integrate music events with cultural branding. Improved infrastructure and international partnerships support high-profile performances. Ongoing regulatory reforms and global artist collaborations enhance regional recognition.

Africa

The Africa Music Tourism Market size was valued at USD 1.07 billion in 2018 to USD 1.68 billion in 2024 and is anticipated to reach USD 5.24 billion by 2032, at a CAGR of 13.7% during the forecast period. The region captures 2% share of the Global Music Tourism Market, supported by the growing influence of African music genres on global audiences. Nigeria, South Africa, and Morocco are leading countries hosting major regional festivals. It gains strength from investments in tourism development and creative economy programs. The rise of Afrobeats and pan-African collaborations attracts music enthusiasts from across continents. Expanding digital promotion and improved air connectivity continue to enhance Africa’s global music tourism profile.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Global Music Tourism Market is highly competitive, driven by the presence of established event organizers, entertainment groups, and festival brands. Major players include Live Nation Entertainment, AEG Presents, SFX Entertainment, Eventbrite, C3 Presents, Tomorrowland, and Glastonbury Festival Events. These companies focus on large-scale event management, artist partnerships, and international expansion to strengthen their market position. It benefits from collaborations between event organizers, digital platforms, and tourism boards that enhance visitor engagement and global reach. Firms are investing in digital ticketing, immersive event technologies, and sustainability initiatives to attract diverse audiences. Continuous innovation in event design and strategic acquisitions are helping companies secure long-term growth in the evolving music tourism landscape.

Recent Developments:

- In July 2025, Live Nation Entertainment announced its intention to accelerate the purchase of an additional 24% stake in the Mexican concert promoter Ocesa, strengthening its presence in Mexico’s fast-growing live music sector and extending the CEO’s contract, with the deal expected to close by the end of August 2025.

- In July 2025, AEG Presents, in partnership with Groupe Combat, acquired the French festival ‘We Love Green’, broadening its global footprint of music events and adding the trailblazing Paris festival to its portfolio.

Report Coverage:

The research report offers an in-depth analysis based on Type, Technology, End-User, Age Group, Booking Mode and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing integration of immersive technologies such as augmented and virtual reality will redefine music event experiences and travel engagement.

- Expansion of cross-border festival tourism will attract a larger share of international travelers and global audiences.

- Collaborations between music labels, travel agencies, and hospitality providers will enhance bundled event-tourism offerings.

- Rising investments in digital ticketing and real-time event analytics will improve visitor convenience and operational efficiency.

- Sustainable event management practices will gain importance as travelers prioritize eco-friendly tourism experiences.

- Cultural diversification in festival content will attract new demographics and strengthen local tourism economies.

- Partnerships between governments and private organizers will support infrastructure development and event promotion.

- Social media and influencer marketing will remain critical in shaping traveler preferences and boosting attendance.

- Personalized travel itineraries powered by AI and data analytics will drive customer engagement and loyalty.

- Continuous globalization of music genres will expand destination appeal and reinforce the Global Music Tourism Market as a key contributor to the travel and entertainment industry.