Market Overview:

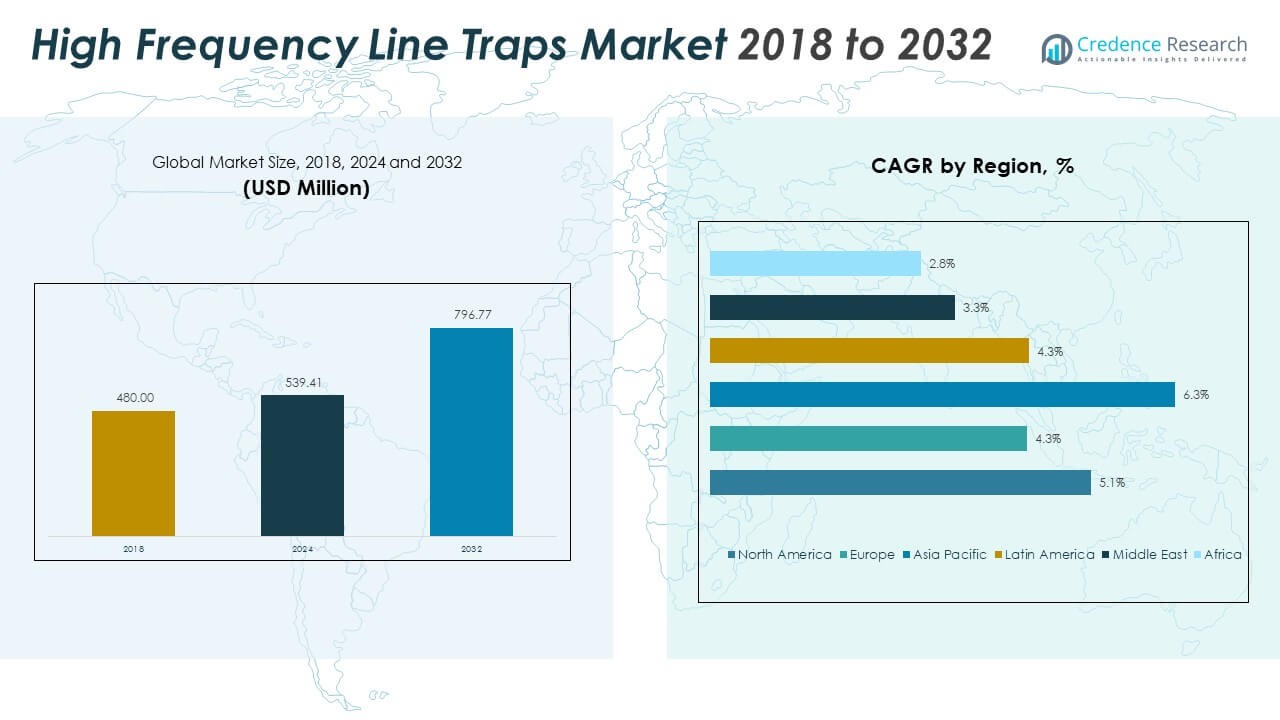

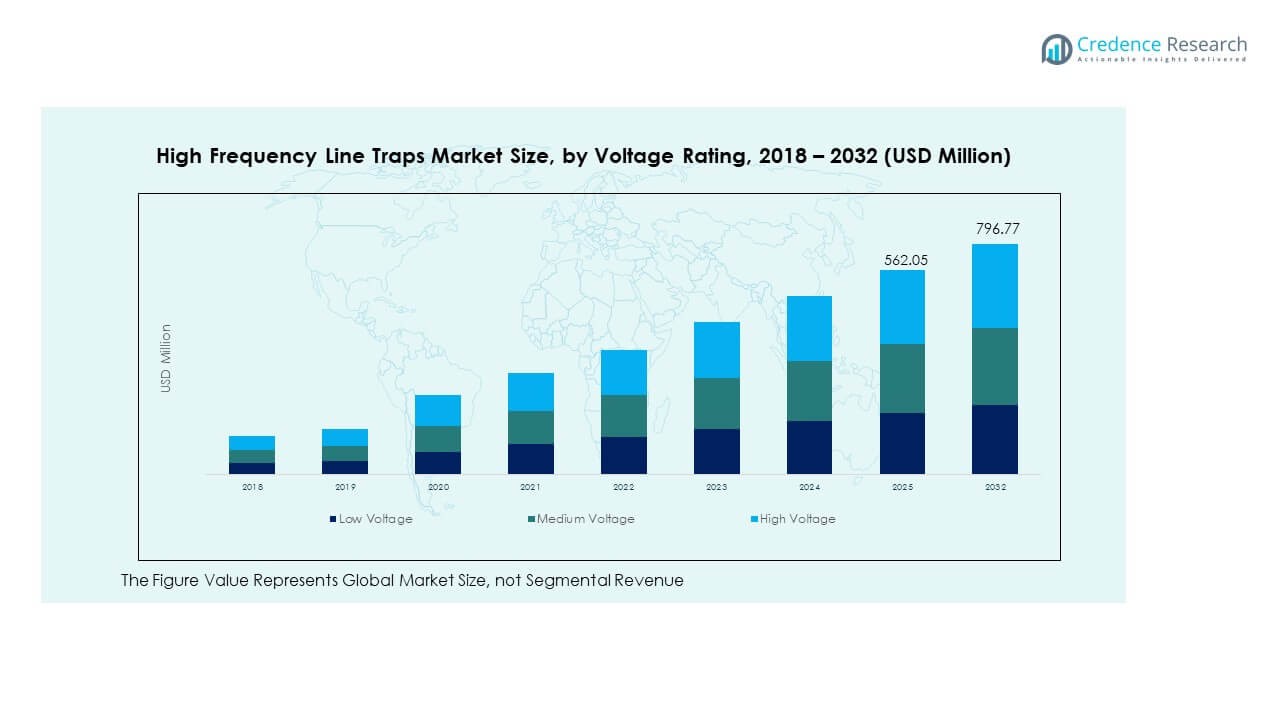

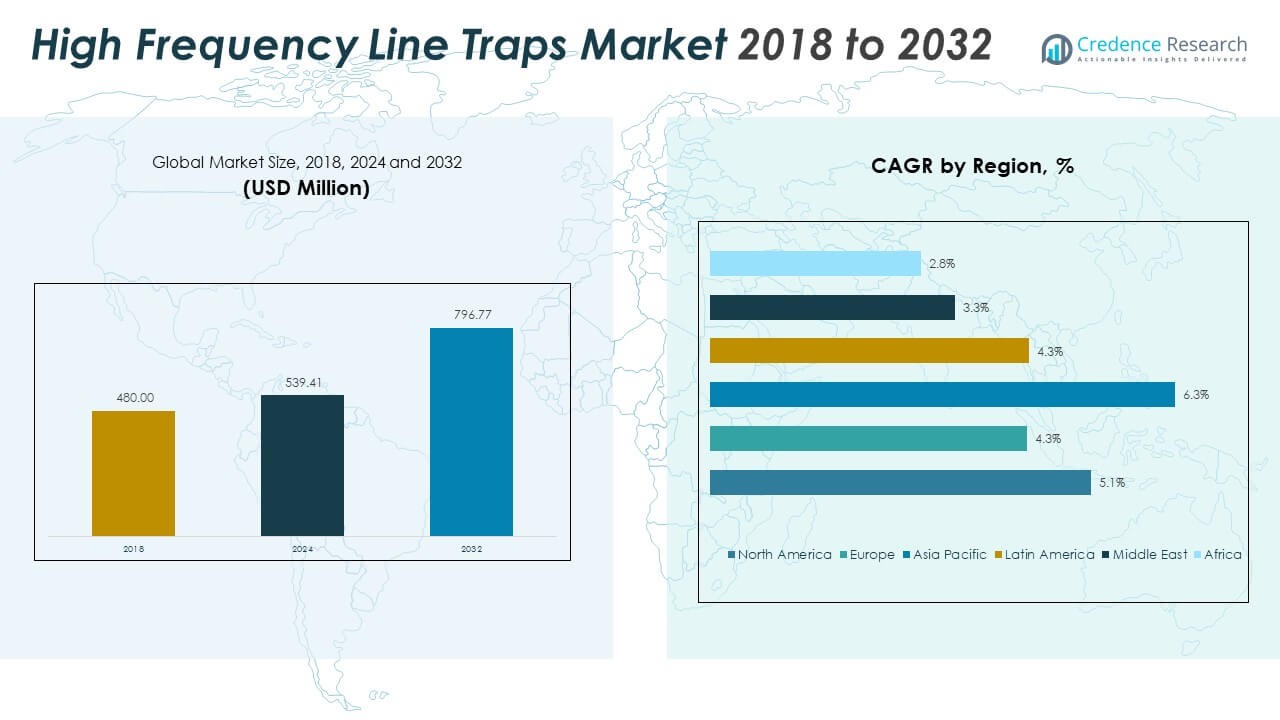

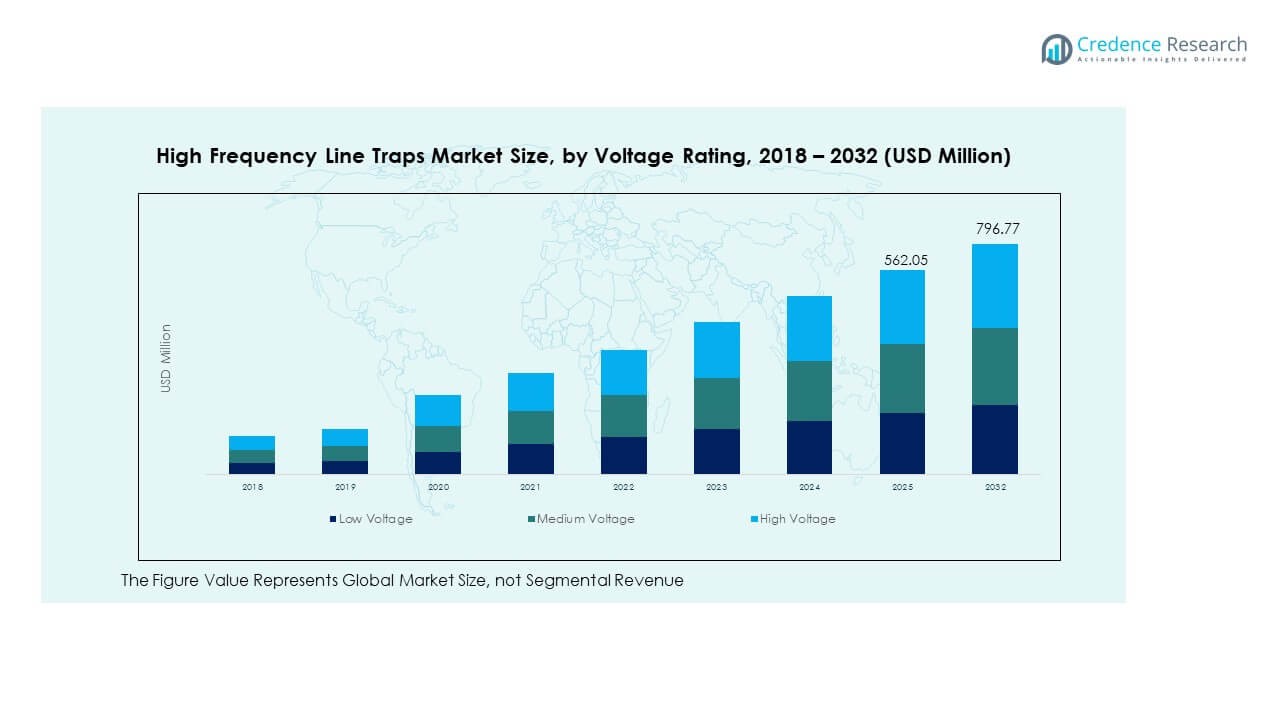

The High Frequency Line Traps Market size was valued at USD 480.00 million in 2018 to USD 539.41 million in 2024 and is anticipated to reach USD 796.77 million by 2032, at a CAGR of 5.11% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| High Frequency Line Traps Market Size 2024 |

USD 539.41 Million |

| High Frequency Line Traps Market, CAGR |

5.11% |

| High Frequency Line Traps Market Size 2032 |

USD 796.77 Million |

The market growth is primarily driven by the rising need for efficient communication in modernized grid systems. Utilities seek solutions that ensure reliable signal transmission between substations while reducing interference and power loss. It benefits from increasing renewable integration, smart grid expansion, and government initiatives promoting secure and automated power systems. The ongoing replacement of aging grid components and emphasis on system protection also support the widespread use of high-frequency line traps in transmission applications.

Regionally, Asia Pacific dominates the market, followed by North America and Europe. China and India lead due to strong investment in grid expansion and renewable energy integration. North America experiences significant growth from digital substation deployment, while Europe advances through modernization of legacy infrastructure. Emerging economies in Latin America, the Middle East, and Africa show increasing adoption of line traps, driven by electrification efforts and expansion of cross-border power networks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The High Frequency Line Traps Market was valued at USD 480.00 million in 2018, reached USD 539.41 million in 2024, and is projected to attain USD 796.77 million by 2032, expanding at a CAGR of 5.11% during the forecast period.

- North America (36%), Asia Pacific (31%), and Europe (21%) dominate the market due to extensive grid modernization, renewable integration, and government-backed infrastructure programs enhancing transmission reliability.

- Asia Pacific, the fastest-growing region with a 6.3% CAGR, benefits from large-scale electrification projects in China and India and growing renewable capacity, strengthening high-voltage line trap demand.

- High Voltage systems account for 45% of total market share, driven by long-distance transmission networks and smart substation deployments.

- Medium Voltage holds 35% share, supported by industrial automation and distributed power generation applications, ensuring stable signal transmission across grid networks.

Market Drivers

Growing Investment in Smart Grid and High-Voltage Transmission Infrastructure

Rising demand for reliable power transmission drives large-scale investment in grid modernization and expansion projects. Utilities are upgrading high-voltage networks to ensure efficient communication and fault detection, which enhances operational reliability. The High Frequency Line Traps Market benefits from strong adoption of advanced grid technologies in urban and industrial centers. Governments in developing countries promote grid expansion to meet growing electricity demand. Line traps help isolate carrier communication signals, improving grid stability and reducing interference. It supports the transmission of control data critical for remote operations. Increasing integration of renewable power sources strengthens the need for stable communication systems. The market’s growth aligns with the rising focus on digital and automated grid management.

Rising Demand for Power Quality and System Reliability

Power quality issues, such as harmonics and signal interference, affect transmission efficiency and equipment life. High-frequency line traps play a critical role in preventing unwanted carrier signal loss and maintaining communication channel integrity. It ensures consistent data flow between substations, improving response times during grid faults. Growing reliance on automated relay systems and smart substations drives product adoption across utilities. Demand for uninterrupted electricity in manufacturing and data center operations further boosts installation rates. Utility operators prioritize devices that enhance reliability and reduce maintenance downtime. Growing emphasis on consistent communication within grid networks accelerates deployment. The market continues to expand with the global shift toward stable, digital energy infrastructure.

Integration of Renewable Energy and Distributed Power Generation

The shift toward renewable energy sources increases the complexity of transmission networks. High-frequency line traps enable smoother operation between renewable generation units and main grids. The High Frequency Line Traps Market benefits from increasing installation in solar and wind power projects. It ensures accurate data transmission for real-time monitoring and control. Rising interconnection of distributed generation units requires effective isolation of carrier signals to prevent signal distortion. Manufacturers develop line traps with higher current ratings to handle variable renewable inputs. Governments emphasize grid stability and efficiency for green energy expansion. The growing renewable energy infrastructure strengthens long-term market demand.

- For instance, GE Grid Solutions supplied line traps rated up to 400 kV to support integration of over 6 GW of renewable power in India’s Green Energy Corridor project, enhancing grid synchronization and frequency management capabilities.

Upgradation of Aging Transmission Networks Across Developed Economies

Many developed regions face challenges with aging transmission infrastructure that hampers operational efficiency. High-frequency line traps are being deployed to replace outdated components and enhance communication reliability across old networks. The High Frequency Line Traps Market gains traction from modernization programs launched by major utilities in Europe and North America. It supports smooth transmission by isolating carrier frequency signals from power frequency signals. Integration with automated substation monitoring and digital relay systems improves grid intelligence. Vendors offer maintenance-free line traps with advanced insulation and compact design. Continuous retrofitting ensures compliance with evolving safety and communication standards. Modernized grids help utilities manage peak loads and minimize outage risks.

- For instance, Arteche Group manufactures line traps rated up to 500 kV, designed for carrier communication and high-frequency signal isolation in transmission networks. These products feature high insulation resistance and modular coil configurations, ensuring compatibility with modern digital protection relays used in advanced substations worldwide.

Market Trends

Adoption of Digital Substation Technology and Advanced Communication Protocols

Digital substations transform the way power systems communicate and operate. The High Frequency Line Traps Market aligns with this shift, supporting real-time data transfer between remote and local control units. It plays a vital role in enhancing substation automation by improving carrier frequency communication efficiency. Utilities focus on technologies that ensure rapid fault response and seamless signal flow. The shift toward IEC 61850 communication standards promotes advanced interoperability. Growing deployment of fiber-optic and IP-based systems strengthens demand for modern line traps. Equipment manufacturers integrate intelligent diagnostic tools to ensure operational transparency. These trends underline the move toward connected and data-driven grid infrastructure.

- For instance, ABB implemented a 500 kV IEC 61850-compliant digital substation equipped with Intelligent Electronic Devices (IEDs) and advanced automation protocols under its Ability™ Digital Substation program, enabling real-time monitoring, fault isolation, and integrated grid control.

Increased Use of Composite and Lightweight Materials in Design

Manufacturers are developing line traps using composite materials that offer better thermal and mechanical performance. The High Frequency Line Traps Market witnesses rising adoption of products with corrosion-resistant components for outdoor installations. It ensures durability in varying climatic conditions while reducing maintenance costs. Composite housings improve reliability against electrical stress and enhance insulation efficiency. Lightweight materials simplify installation and reduce transportation costs for large-scale grid projects. Advancements in manufacturing processes increase the lifespan of these components. Utilities prefer equipment that delivers long operational life and withstands harsh conditions. The focus on efficiency and sustainability shapes new product design standards.

- For instance, Siemens Energy produces Type 3FL composite long rod insulators rated up to 800 kV, featuring high mechanical strength, one-piece silicone housing, and compliance with IEC 61109 and ANSI standards to ensure superior insulation performance and reduced installation effort.

Growing Role of Condition Monitoring and Predictive Maintenance Systems

Utilities prioritize predictive maintenance to ensure high system uptime. The High Frequency Line Traps Market evolves with the integration of sensors and remote monitoring technologies. It enables continuous performance tracking and early fault identification. Data analytics tools help operators make informed maintenance decisions. Manufacturers embed digital interfaces that provide real-time operational health updates. This approach reduces unplanned outages and operational costs. Utilities adopt monitoring systems that improve efficiency and extend asset life. The trend reflects the broader digital transformation across power management infrastructure.

Development of High-Capacity Traps for Ultra-High Voltage Networks

Expansion of ultra-high voltage transmission lines requires traps capable of handling higher loads. The High Frequency Line Traps Market addresses this demand by offering devices with enhanced inductance and frequency isolation features. It improves signal clarity across long-distance transmission networks. Manufacturers design line traps for both AC and DC systems to support mixed-voltage operations. These products ensure minimal energy loss and stable signal propagation. Rising investments in cross-border power projects increase deployment of advanced line traps. Equipment innovation focuses on improved heat dissipation and compact coil structures. High-voltage infrastructure development continues to define the market’s technological trajectory.

Market Challenges Analysis

High Installation and Maintenance Costs Limiting Broader Adoption

The cost of installing and maintaining high-frequency line traps remains a key obstacle for many utilities. It involves significant capital outlay, especially in developing regions where grid budgets are constrained. The High Frequency Line Traps Market faces challenges in large-scale deployment across rural and semi-urban networks. Maintenance requires skilled personnel and periodic testing to ensure communication integrity. Downtime during servicing affects operational efficiency and network reliability. Limited access to spare parts and delayed procurement cycles further complicate grid management. Utility operators often delay upgrades to reduce financial strain. The long-term benefits are evident, but high upfront expenses limit faster modernization.

Technical Compatibility Issues and Standardization Barriers Across Regions

Lack of universal technical standards poses interoperability issues for line traps across different grid systems. It creates complexity in integrating new communication protocols with existing infrastructure. The High Frequency Line Traps Market must address variations in voltage levels and frequency bands used by utilities. Differences in national regulations slow cross-border equipment deployment. Manufacturers face difficulties in aligning design specifications with region-specific compliance codes. Complex testing procedures increase product approval timelines. Limited coordination between standardization agencies restricts innovation. Industry players need harmonized frameworks to ensure smooth integration across diverse power networks.

Market Opportunities

Integration with Smart Grid Communication and IoT-Enabled Systems

Smart grid communication expansion presents significant growth prospects for advanced line trap solutions. The High Frequency Line Traps Market stands to benefit from integration with IoT-based monitoring platforms. It allows continuous supervision of signal integrity and performance metrics. Enhanced connectivity supports predictive diagnostics and maintenance planning. Utilities invest in automation technologies to ensure secure data exchange between substations. The opportunity lies in developing line traps that combine reliability with real-time data communication. Manufacturers focusing on smart-enabled devices are likely to capture emerging demand.

Growing Electrification Projects and Expansion in Developing Regions

Developing economies continue to invest in large-scale electrification programs. The High Frequency Line Traps Market experiences growth due to rising infrastructure projects in Asia, Africa, and Latin America. It plays an essential role in supporting stable power delivery over expanding networks. Demand grows with the construction of high-voltage transmission lines and renewable energy grids. Governments prioritize modernization to ensure consistent energy access for industries and communities. Manufacturers expanding local production facilities can benefit from these projects. The rising focus on grid efficiency strengthens long-term growth potential across emerging markets.

Market Segmentation Analysis:

By product type, air-core line traps hold a major share due to their lightweight design, low maintenance, and ability to operate effectively in high-frequency environments. Iron-core line traps serve specialized applications requiring higher inductance and compact configurations, especially in industrial and substation networks. The High Frequency Line Traps Market benefits from steady demand for both types as utilities seek optimized performance and reliability across transmission systems.

- For instance, in August 2024, Quality Power supplied 765 kV air-core line traps to Power Grid Corporation of India Limited (PGCIL) for high-voltage transmission projects, reinforcing reliable carrier communication and grid stability across India’s interstate transmission network.

By application, power transmission remains the dominant segment, driven by rising grid modernization and cross-border interconnection projects. Communication applications expand with the growing adoption of carrier frequency systems for data transfer between substations. Industrial and other applications use line traps to maintain consistent signal quality and prevent frequency interference in automated facilities.

- For instance, GE Vernova integrates line traps in its Power Line Carrier (PLC) systems, operating across 30 kHz–500 kHz carrier frequencies to enable secure, interference-free communication between substations an international standard widely adopted in high-voltage utility networks.

By end user, utilities lead due to large-scale deployment across national and regional grids. Industrial end users adopt line traps for process reliability and network protection. Commercial installations contribute steady demand through smart building and distributed energy setups.

By voltage rating, high-voltage systems account for the largest share due to wide transmission networks and long-distance power flow. Medium-voltage networks follow with expanding renewable integration, while low-voltage segments support urban distribution and industrial automation projects. The market continues to evolve with the growing need for efficient and stable power communication infrastructure across all voltage levels.

Segmentation:

By Product Type

- Air-Core Line Traps

- Iron-Core Line Traps

By Application

- Power Transmission

- Communication

- Industrial

- Others

By End User

- Utilities

- Industrial

- Commercial

- Others

By Voltage Rating

- Low Voltage

- Medium Voltage

- High Voltage

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America High Frequency Line Traps Market size was valued at USD 176.64 million in 2018 to USD 196.13 million in 2024 and is anticipated to reach USD 289.31 million by 2032, at a CAGR of 5.1% during the forecast period. North America accounts for 36% market share driven by large-scale grid modernization and renewable integration. The region benefits from substantial investments in transmission upgrades and digital substations. The U.S. leads due to early adoption of smart grid systems and advanced communication technologies. It focuses on ensuring network reliability across long transmission routes and high-capacity substations. Canada strengthens its grid through renewable interconnections and rural electrification programs. Mexico’s infrastructure expansion further supports cross-border power transmission projects. The regional market shows strong alignment with grid automation initiatives and advanced monitoring standards.

Europe

The Europe High Frequency Line Traps Market size was valued at USD 109.68 million in 2018 to USD 117.74 million in 2024 and is anticipated to reach USD 162.74 million by 2032, at a CAGR of 4.3% during the forecast period. Europe holds 21% market share, driven by modernization of legacy networks and renewable energy integration targets. The region prioritizes energy efficiency and transmission reliability across multi-country power corridors. The UK, Germany, and France lead installations in response to stringent energy policies. It emphasizes the adoption of carrier-based communication systems for seamless data flow. Southern and Eastern Europe experience steady growth supported by infrastructure renovation programs. The region maintains strong collaboration through EU-backed digital grid initiatives. Increased deployment of smart substations continues to strengthen market adoption.

Asia Pacific

The Asia Pacific High Frequency Line Traps Market size was valued at USD 133.87 million in 2018 to USD 156.29 million in 2024 and is anticipated to reach USD 251.94 million by 2032, at a CAGR of 6.3% during the forecast period. Asia Pacific dominates with 31% market share due to expanding grid capacity and government-driven electrification initiatives. China and India invest heavily in high-voltage transmission and smart substation technologies. It benefits from large-scale renewable integration, especially solar and wind power. Japan and South Korea upgrade grid systems to enhance operational security and digital control. Southeast Asian countries accelerate infrastructure growth through regional energy cooperation. Expanding urbanization and industrialization stimulate demand for reliable power communication. The region’s rapid technology adoption ensures continued market leadership.

Latin America

The Latin America High Frequency Line Traps Market size was valued at USD 35.04 million in 2018 to USD 39.05 million in 2024 and is anticipated to reach USD 54.08 million by 2032, at a CAGR of 4.3% during the forecast period. Latin America contributes 7% market share, supported by infrastructure modernization and grid interconnection projects. Brazil drives regional demand with significant investment in high-voltage lines. It emphasizes grid stability and power quality improvements across large geographic areas. Argentina and Chile expand renewable integration to enhance energy independence. The region’s utilities focus on minimizing signal interference and improving operational efficiency. Growing industrialization strengthens adoption of communication line equipment. Ongoing digital transformation initiatives create new growth opportunities across national grids.

Middle East

The Middle East High Frequency Line Traps Market size was valued at USD 13.87 million in 2018 to USD 14.29 million in 2024 and is anticipated to reach USD 18.33 million by 2032, at a CAGR of 3.3% during the forecast period. The region accounts for 3% market share, supported by expanding transmission infrastructure and industrial diversification. GCC countries lead with strong investment in cross-border grid connectivity. It focuses on reliable energy supply for oil, gas, and industrial sectors. Israel and Turkey enhance grid systems to support growing renewable energy capacity. Upgrades to substations and long-distance transmission corridors improve communication reliability. Regional governments prioritize digital grid transformation through public–private partnerships. Expanding demand for automation strengthens the long-term market potential.

Africa

The Africa High Frequency Line Traps Market size was valued at USD 10.90 million in 2018 to USD 15.91 million in 2024 and is anticipated to reach USD 20.37 million by 2032, at a CAGR of 2.8% during the forecast period. Africa captures 2% market share, supported by rural electrification and expanding utility networks. South Africa leads in adoption with ongoing grid modernization projects. It strengthens communication reliability across fragmented power systems. Egypt’s growing infrastructure investments improve interconnection with neighboring grids. Sub-Saharan nations implement new transmission corridors to enhance energy access. Localized renewable projects accelerate need for stable power communication. The market benefits from foreign-funded energy programs and technology partnerships. Gradual improvements in infrastructure create long-term growth prospects.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- ABB Ltd.

- Siemens AG

- GE Grid Solutions

- Schneider Electric SE

- Arteche Group

- L&T Electrical & Automation

- Trench Group

- Phoenix Electric Corporation

- Zhejiang Farady Electric Co., Ltd.

- Toshiba Corporation

- Mitsubishi Electric Corporation

- Hyosung Heavy Industries

- CG Power and Industrial Solutions Limited

- Tavrida Electric

- Eaton Corporation

- Hitachi Energy

- Rongxin Power Electronic Co., Ltd.

Competitive Analysis:

The High Frequency Line Traps Market features strong competition among global power transmission equipment manufacturers and regional suppliers. Leading players such as ABB Ltd., Siemens AG, GE Grid Solutions, and Schneider Electric SE focus on innovation, product reliability, and grid compatibility. It emphasizes advanced materials, compact designs, and intelligent monitoring features to enhance operational efficiency. Companies like Arteche Group, L&T Electrical & Automation, and Trench Group expand portfolios through digital and high-voltage solutions. Strategic initiatives such as mergers, capacity expansion, and technology integration strengthen market positioning. Emerging manufacturers in Asia and the Middle East compete by offering cost-effective and region-specific solutions. Continuous R&D investment drives product differentiation and compliance with evolving power grid standards. The competitive landscape remains dynamic, shaped by increasing demand for smart grid communication and transmission reliability worldwide.

Recent Developments:

- In October 2025, ABB India announced a boost in local output with the launch of a new range of energy-efficient drives, strengthening its presence in the industrial automation and transmission solutions segment. The drive solutions, intrinsic to ABB’s broader push in smart grid components including High Frequency Line Traps are targeted at supporting enhanced reliability and efficiency for transmission, substations, and grid management applications.

- In March 2025, Phoenix Electric Corporation introduced a new line trap model featuring advanced surge protection and compact design, aimed at high-frequency signal management for expanded power transmission and telecom applications.

- In October 2024, Siemens announced a strategic partnership with Dutch network company Alliander to implement advanced grid management solutions, including smart grid integration for line traps. The collaboration focuses on deploying Siemens’ Gridscale X software, which enables real-time visibility and actionable insights for optimizing grid utilization and supporting the integration of renewable energy sources.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Application, End User, and Voltage Rating. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing investment in transmission and distribution infrastructure will strengthen long-term product demand.

- Integration of smart grid technologies will create new opportunities for intelligent and self-diagnostic line traps.

- Rising renewable energy adoption will increase the need for reliable communication and isolation systems.

- Manufacturers will focus on lightweight composite materials to enhance efficiency and reduce maintenance.

- Expansion of high-voltage networks will drive technological advancements in inductance and frequency control.

- Utilities will adopt IoT-enabled systems for predictive monitoring and improved network reliability.

- Regional governments will prioritize power quality improvements through digital grid modernization programs.

- Collaboration between global manufacturers and local suppliers will improve cost efficiency and availability.

- Increased focus on sustainable designs will support compliance with evolving environmental standards.

- Continued R&D in communication-based protection systems will define the market’s next phase of innovation.