Market Overview

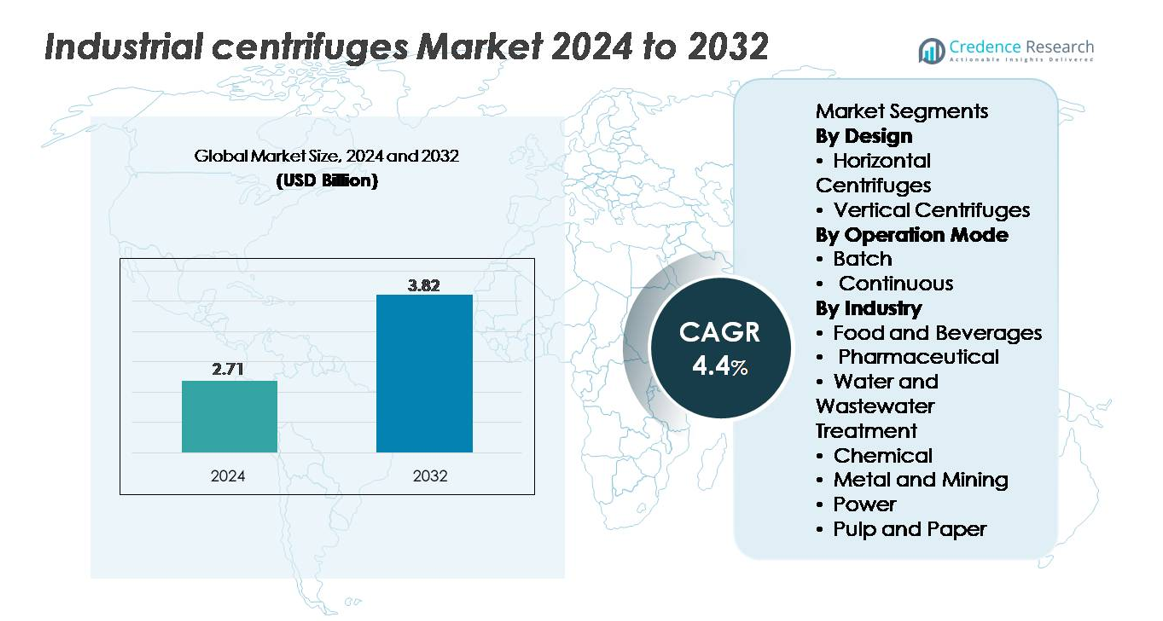

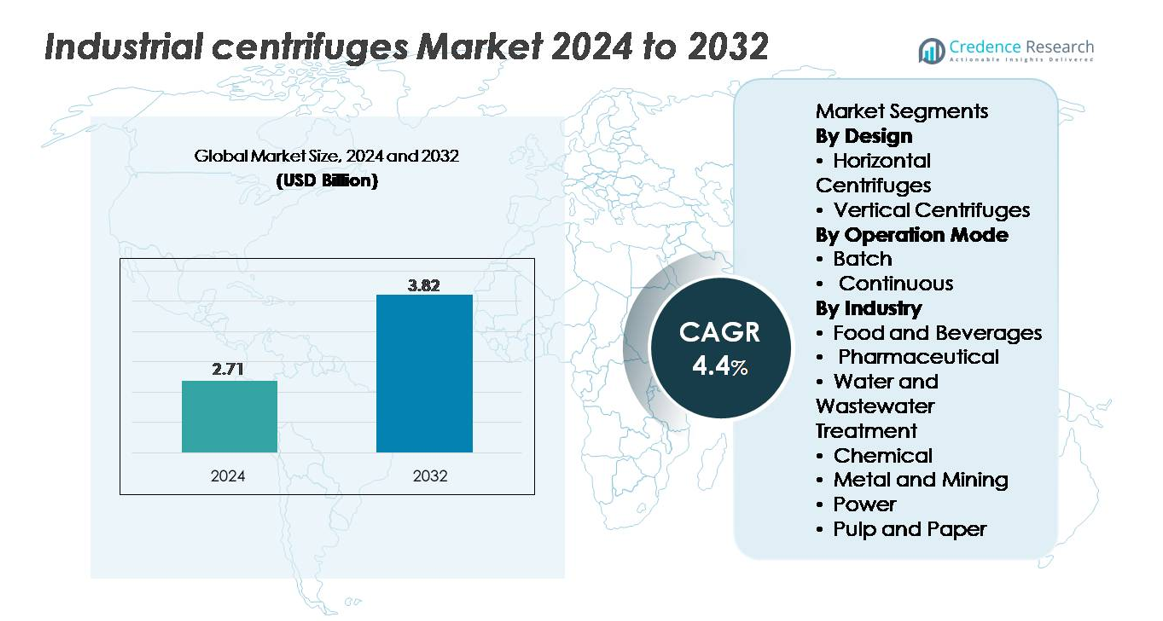

The industrial centrifuges market was valued at USD 2.71 billion in 2024 and is projected to reach USD 3.82 billion by 2032, expanding at a CAGR of 4.4% during the forecast period (2025–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Industrial Centrifuges Market Size 2024 |

USD 2.71 billion |

| Industrial Centrifuges Market, CAGR |

4.4% |

| Industrial Centrifuges Market Size 2032 |

USD 3.82 billion |

The industrial centrifuges market is shaped by strong competition among leading players such as Flottweg SE, GEA Group, HAUS Centrifuge Technologies, Alfa Laval AB, and Andritz AG, each leveraging advanced separation technologies, automation capabilities, and extensive service networks to strengthen their global presence. These companies focus on high-efficiency decanter, disc-stack, and tubular systems tailored for wastewater treatment, chemicals, food processing, and bioprocessing applications. Asia-Pacific leads the market with a 34% share, driven by rapid industrialization, expanding municipal treatment projects, and strong adoption across manufacturing sectors. North America and Europe follow, supported by stringent regulatory standards and advanced processing infrastructure

Market Insights

- The industrial centrifuges market reached USD 2.71 billion in 2024 and is projected to hit USD 3.82 billion by 2032, reflecting a CAGR of 4.4%.

- Strong demand for high-efficiency solid–liquid separation in wastewater treatment, chemicals, and pharmaceuticals drives adoption, with continuous centrifuges holding a 58% share due to higher throughput and automated operation.

- Market trends favor energy-efficient, digitally monitored decanter and disc-stack systems, while horizontal centrifuges account for 62% of the design segment, supported by better solids handling and scalability.

- Competition intensifies as leading players expand service networks and introduce predictive-maintenance-enabled models, although high capital costs and operational complexity restrain adoption across cost-sensitive industries.

- Regionally, Asia-Pacific leads with 34% share, followed by North America (31%) and Europe (28%), while wastewater treatment remains the largest end-use segment with over 40% share, driven by regulatory compliance and expanding municipal infrastructure

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Design (Horizontal vs. Vertical Centrifuges)

Horizontal centrifuges command the dominant market share due to their superior capacity, efficient solids handling, and adaptability for continuous, high-throughput operations. Their wide adoption in wastewater treatment, chemical processing, and mining strengthens their leadership, supported by lower maintenance requirements and effective separation of high-solid-content slurries. Vertical centrifuges remain relevant for applications requiring compact installation and higher clarification precision, especially in pharmaceuticals and food processing. However, the scalability, operational stability, and enhanced dewatering efficiency of horizontal systems position them as the preferred choice across large industrial installations, reinforcing their strong market presence.

- For instance, Flottweg’s X-Series horizontal decanter centrifuges such as the Xelletor system achieve bowl speeds of up to 4,500 rpm, delivering clarified centrate with dry-solids discharge rates exceeding 3,500 kg/h in sludge dewatering applications, while Alfa Laval’s AVNX horizontal decanters handle feed capacities of up to 130 cubic meters per hour in mining operations.

By Operation Mode (Batch vs. Continuous)

Continuous centrifuges represent the dominant sub-segment, holding the largest share due to their ability to support uninterrupted, automated processing in high-volume industries. They deliver consistent separation efficiency, reduced labor dependency, and faster cycle times, making them indispensable for chemicals, wastewater treatment, and mining applications. Batch centrifuges maintain a strong role in operations demanding formulation flexibility, sterility, and precise parameter control, especially in pharmaceuticals and specialty food ingredients. Yet, the growing shift toward process optimization, minimal downtime, and cost efficiency continues to accelerate adoption of continuous systems across global industrial facilities.

- For instance, ANDRITZ’s D-Series decanter centrifuges offer solid throughputs up to about 25,000 kg/h and hydraulic capacities reaching nearly 450 m³/h in large chemical and mineral-processing lines. HAUS decanter centrifuges used in municipal sludge treatment operate within a published capacity range of roughly 1–180 m³/h depending on the model and sludge load.

By Industry (Food & Beverage, Pharmaceutical, Water & Wastewater, Chemical, Metal & Mining, Power, Pulp & Paper)

Water and wastewater treatment emerges as the dominant industry sub-segment, driven by expanding municipal infrastructure, stricter discharge regulations, and rising sludge management requirements. Industrial centrifuges are increasingly deployed for sludge thickening, dewatering, and biosolids processing due to their reliability and high solids recovery. The chemical and food & beverage sectors also exhibit strong adoption for clarification and purification tasks, while mining applications rely on centrifuges for ore processing efficiency. In pharmaceuticals, centrifuges support sterility and product purity standards. However, escalating global water treatment demand firmly positions wastewater applications as the largest revenue contributor.

Key Growth Drivers

Rising Demand for High-Efficiency Solid–Liquid Separation Across Process Industries

Industrial centrifuges benefit from expanding demand for high-performance separation technologies across chemicals, pharmaceuticals, food processing, and wastewater treatment industries. Companies increasingly prioritize equipment that enhances throughput, reduces moisture content, and improves purity in downstream processes. The growth of precision manufacturing, stringent product quality norms, and rising utilization of biomass, polymers, specialty chemicals, and fermentation-based products reinforce uptake. Environmental mandates are also compelling industries to adopt centrifuges that minimize waste volumes and optimize resource recovery. Modern centrifuges offer automated control, vibration monitoring, and high-speed separation to support continuous operations. As industries invest in operational efficiency, energy savings, and production scalability, centrifuges emerge as essential assets that streamline filtration steps, reduce manual intervention, and support stable, repeatable separation performance in demanding processing environments.

- For instance, Alfa Laval’s ALDEC G3 decanter centrifuges used in sludge treatment operate at bowl speeds in the 4,000–4,500 rpm range and are engineered for high torque to improve cake dryness and energy efficiency. Flottweg’s C-Series decanters feature Simp Drive® for precise differential-speed control and support solids throughputs that, depending on model size, reach well above 10,000 kg/h in industrial separation lines.

Expansion of Wastewater Treatment and Sludge Management Infrastructure

The global focus on sustainable water management, rising urbanization, and industrial discharge regulations is accelerating adoption of centrifuges for sludge thickening, dewatering, and clarification. Municipal utilities and industrial facilities employ decanter and disc-stack centrifuges to reduce sludge volume, enhance solids capture, and improve biosolids handling economics. Compliance requirements governing effluent quality, nutrient removal, and recovery of recyclable material further stimulate installation of advanced centrifuge systems. The shift toward decentralized wastewater treatment facilities, zero-liquid-discharge systems, and circular water reuse strategies strengthens market demand. Industrial centrifuges provide compact installation, continuous operation capability, and lower lifecycle costs than conventional drying beds or filter presses. As utilities modernize outdated wastewater frameworks, centrifuges play a central role in achieving operational reliability, regulatory compliance, and environmental sustainability.

- For instance, Flottweg’s C7E decanter centrifuge used in municipal sludge processing supports hydraulic capacities of up to about 160 m³/h for thickening and around 120 m³/h for dewatering, with Simp Drive® technology providing automatic differential-speed control to maintain stable performance under fluctuating sludge conditions.

Increasing Automation, Digital Monitoring, and Predictive Maintenance Adoption

Automation and digitalization significantly reinforce centrifuge deployment by enabling accurate process control, reduced downtime, and performance optimization. Modern centrifuges integrate PLC-based control systems, automated feed regulation, torque management, and real-time vibration diagnostics that minimize failures and enhance safety. Predictive maintenance platforms use sensor-based monitoring and analytics to detect bearing wear, imbalance, or temperature deviations early, allowing timely interventions. Remote dashboards empower operators to adjust parameters and track separation efficiency across multi-line plants. Industries investing in Industry 4.0 frameworks adopt centrifuges with greater data visibility, enhanced energy efficiency, and intelligent fault prediction capabilities. These digital features improve overall equipment effectiveness (OEE), reduce operator dependency, and align with corporate sustainability goals, making automated centrifuges highly preferred for large-scale, continuous processing operations.

Key Trends & Opportunities

Growing Shift Toward Continuous Processing and High-Capacity Decanter Systems

A major trend reshaping the industrial centrifuges landscape is the accelerated transition from batch to continuous processing in chemicals, minerals, food ingredients, and wastewater treatment sectors. High-capacity decanter centrifuges deliver predictable separation efficiency, reduced downtime, and automated solids discharge, supporting round-the-clock industrial operations. The demand for scalable separation solutions is driving manufacturers to develop decanters with higher g-force ratings, wear-resistant components, and optimized scroll designs tailored for abrasive slurries. As industries face pressure to increase productivity and lower operational expenditure, investment intensifies in continuous centrifuge lines that integrate seamlessly with upstream and downstream automation systems. This trend opens opportunities for suppliers offering energy-efficient drives, modular layouts, and process-specific customization.

- For instance, ANDRITZ’s A-Series decanter centrifuges used in mineral and potash processing support high solids-handling capacities that can exceed 20,000–30,000 kg/h depending on the model, with abrasion-resistant tungsten-carbide scroll protection designed for continuous operation in abrasive slurries. These decanters operate with differential speeds in the typical low-rpm range to ensure stable and uniform solids conveyance

Increasing Opportunities in Bioprocessing, Fermentation, and Pharmaceutical Production

Biopharmaceutical and fermentation-based industries are generating new opportunities for advanced centrifugation technologies capable of gentle handling, aseptic processing, and high-purity biomass separation. The surge in demand for biologics, vaccines, probiotics, enzymes, and cell-culture products is stimulating adoption of disc-stack and tubular centrifuges designed for shear-sensitive materials. Regulatory emphasis on contamination control and product consistency encourages deployment of hermetic seals, CIP/SIP-enabled centrifuges, and hygienic stainless-steel construction. The expansion of contract manufacturing organizations (CMOs) and single-use bioprocessing systems creates demand for flexible, small-footprint centrifuges that support rapid changeover. As pharmaceutical pipelines shift toward complex biologics, the market sees heightened investment in precision separation systems suitable for large-scale fermentation.

- For example, GEA Westfalia Separator’s disc-stack units are used in pharmaceutical and biotech processes for aseptic liquid–solid separation, offering self-cleaning, sterilizable bowl designs and hygienic drives to ensure sterile, continuous clarification of cell-culture harvests in clean-room environments.

Rising Adoption of Energy-Efficient and Low-Maintenance Centrifuge Designs

Energy consumption and maintenance costs have become critical decision factors for industries modernizing separation infrastructure. This is fueling development of centrifuges equipped with high-efficiency motors, variable frequency drives, optimized bowl geometries, and low-wear components. Manufacturers are introducing designs that reduce friction losses, extend lubrication intervals, and enhance rotor durability. Opportunities arise in markets transitioning away from energy-intensive filtration and thermal drying processes, particularly in chemicals, wastewater, and food sectors. Companies adopting sustainability targets seek centrifuges that minimize operating costs, reduce carbon footprint, and offer predictable long-term reliability. The industry is also witnessing increased interest in retrofitting and service upgrades, enabling modernization without complete system replacement.

Key Challenges

High Capital Investment and Maintenance Requirements

Industrial centrifuges demand substantial capital expenditure due to their complex mechanical design, high-grade materials, and stringent safety and reliability requirements. For smaller industries or facilities with limited budgets, upfront costs can restrict adoption. Maintenance presents an additional challenge, as centrifuges require routine servicing of bearings, seals, scroll mechanisms, and high-speed rotors to ensure safe operation. Abrasive slurries in mining and chemical processing accelerate wear, increasing long-term expenses. Skilled technicians are essential for troubleshooting and balancing operations, but workforce shortages can impede timely servicing. These factors make ownership costly for organizations lacking robust operational budgets and technical capabilities.

Operational Complexity and Sensitivity to Feed Variability

Centrifuge performance is highly dependent on feed characteristics such as particle size distribution, viscosity, solids concentration, and temperature. Variations in feed quality can reduce separation efficiency, trigger imbalance, or cause equipment vibration, leading to unplanned shutdowns. Continuous systems especially require stable feed conditions to maintain optimal throughput. Operators must understand precise load handling, differential speed adjustments, and torque fluctuations to ensure reliable operation. Industries with inconsistent raw materials, such as mining and wastewater treatment, face greater performance challenges. This operational sensitivity necessitates advanced monitoring, trained personnel, and strict process control, which not all facilities can readily implement.

Regional Analysis

North America

North America holds a 31% market share, supported by strong industrial automation, advanced wastewater treatment frameworks, and extensive adoption in pharmaceuticals and biotechnology. The U.S. leads installations of high-capacity decanter and disc-stack centrifuges driven by strict EPA effluent norms and rising investments in bioprocessing. Food producers increasingly deploy hygienic, high-speed centrifuges to ensure product consistency and regulatory compliance. Modernization of oil refining and chemical plants further accelerates demand. Canada benefits from upgrades in municipal wastewater infrastructure and mining operations, reinforcing the region’s steady requirement for durable, energy-efficient separation systems.

Europe

Europe accounts for 28% of the market, driven by stringent EU wastewater directives, strong chemical manufacturing bases, and advanced pharmaceutical production. Germany, Italy, and the Nordic countries lead adoption due to active investments in sludge management, fermentation processing, and food ingredient purification. The region’s emphasis on energy efficiency and circular economy principles accelerates deployment of high-efficiency decanters and hermetically sealed separators. Expanding biomanufacturing capacity in Belgium and Ireland further supports high-precision centrifuge demand. Continuous technological upgrades in dairy, brewing, and specialty chemicals reinforce Europe’s position as a key market for premium, automated centrifuge systems.

Asia-Pacific

Asia-Pacific holds the largest market share at 34%, driven by rapid industrialization, expanding municipal wastewater projects, and strong chemical and mining sectors across China, India, and Southeast Asia. Massive investments in food processing, pharmaceuticals, fermentation-based industries, and mineral extraction create robust demand for continuous, high-throughput centrifuge systems. China leads capacity additions, while India accelerates installations through wastewater reforms and growing biopharmaceutical production. Increasing adoption of automation and high-speed separation technologies strengthens market penetration. The region’s cost-sensitive industries also encourage procurement of energy-efficient, low-maintenance centrifuges, reinforcing Asia-Pacific’s dominant market position.

Latin America

Latin America represents 5% of the market, with demand primarily driven by wastewater treatment expansions, mining operations, and food processing activities. Brazil and Mexico lead adoption as industries modernize sludge-handling capacities and strengthen compliance with environmental discharge norms. The mining sector in Chile and Peru generates steady demand for solid–liquid separation equipment capable of handling abrasive slurries. Growth in edible oils, sugar processing, and beverage production also supports centrifuge utilization. However, investment restrictions and slower industrial modernization temper growth rates, although ongoing infrastructure upgrades create opportunities for durable, high-capacity centrifuge systems.

Middle East & Africa

Middle East & Africa hold a 2% market share, supported by rising adoption of centrifuges in oil refining, desalination, and wastewater treatment operations. The Gulf countries invest heavily in advanced separation systems to enhance effluent quality and support petrochemical processing. Mining activities in South Africa and metal extraction operations across the region contribute additional demand for rugged, high-solids centrifuges. Water scarcity drives adoption of reliable sludge dewatering technologies in municipal treatment plants. Although industrial diversification remains gradual, long-term infrastructure investments and environmental compliance initiatives steadily improve centrifuge deployment across MEA.

Market Segmentations:

By Design

- Horizontal Centrifuges

- Vertical Centrifuges

By Operation Mode

By Industry

- Food and Beverages

- Pharmaceutical

- Water and Wastewater Treatment

- Chemical

- Metal and Mining

- Power

- Pulp and Paper

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the industrial centrifuges market is characterized by a mix of global engineering firms and specialized separation technology manufacturers competing through innovation, performance reliability, and application-specific customization. Leading players focus on expanding their portfolios of decanter, disc-stack, and tubular centrifuges while integrating automation, predictive maintenance, and energy-efficient drive systems to strengthen differentiation. Strategic priorities include expanding global service networks, enhancing aftermarket capabilities, and investing in modular, high-capacity designs tailored for wastewater treatment, chemicals, bioprocessing, and food industries. Companies increasingly pursue partnerships with EPC contractors, municipal utilities, and biopharmaceutical producers to access long-term projects. Competitive intensity is further shaped by rising demand for digital monitoring platforms, which encourages suppliers to integrate IoT-enabled diagnostics, vibration analytics, and remote-control interfaces. As industries emphasize sustainability, vendors offering lower power consumption, reduced maintenance downtime, and superior solids-handling efficiency gain stronger market positioning.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Flottweg SE

- GEA Group

- HAUS Centrifuge Technologies

- Alfa Laval AB

- Andritz AG

Recent Developments

- In June 2025 (FEW 2025), Flottweg showcased its decanter, tricanter, and Sedicanter centrifuges customised for ethanol production and high-value co-product recovery at International Fuel Ethanol Workshop & Expo 2025, signalling active product positioning toward biofuels industry applications.

- In May 2025, Flottweg celebrated the assembly of its 16,000th machine for solid/liquid separation, marking a major production milestone in its history.

- In March 2025, GEA entered into a technology partnership with Rock Tech Lithium Inc. to supply centrifuge-based crystallization and zero-liquid discharge (ZLD) systems for a lithium converter facility in Guben, Germany thereby extending its centrifuge applications into battery-material processing / chemical-energy sectors

Report Coverage

The research report offers an in-depth analysis based on Design, Operation mode, Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-capacity decanter and disc-stack centrifuges will rise as industries prioritize continuous, automated processing.

- Adoption of energy-efficient centrifuge designs will accelerate as manufacturers target lower power consumption and reduced operating costs.

- Digitalization and remote diagnostics will become standard, with predictive maintenance improving uptime and asset reliability.

- Wastewater treatment expansion and stricter discharge norms will drive strong long-term demand across municipal and industrial facilities.

- Biopharmaceutical and fermentation industries will increasingly use specialized centrifuges for high-purity, shear-sensitive applications.

- Mining and chemical sectors will continue investing in rugged, abrasion-resistant centrifuges to improve solids handling.

- Modular and skid-mounted units will gain traction for decentralized treatment plants and mobile industrial operations.

- Replacement and retrofit demand will grow as facilities modernize legacy equipment for efficiency and automation.

- Emerging economies will accelerate centrifuge adoption through industrial expansion and infrastructure upgrades.

- Sustainability goals will push manufacturers to develop recyclable components and low-emission production processes.