Market Overview

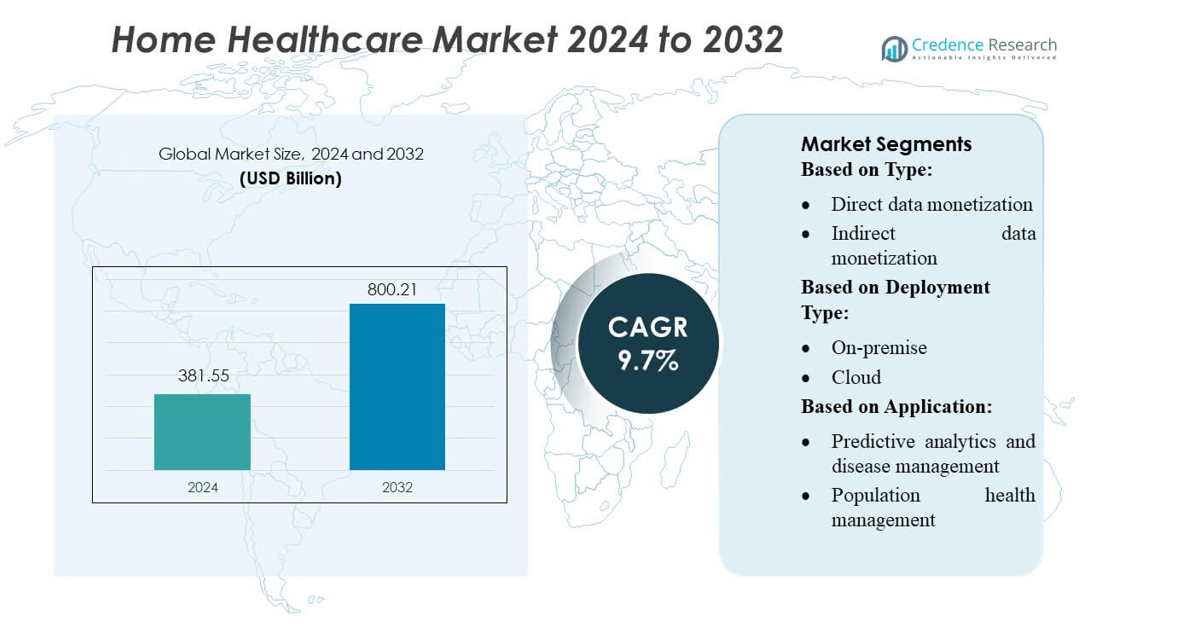

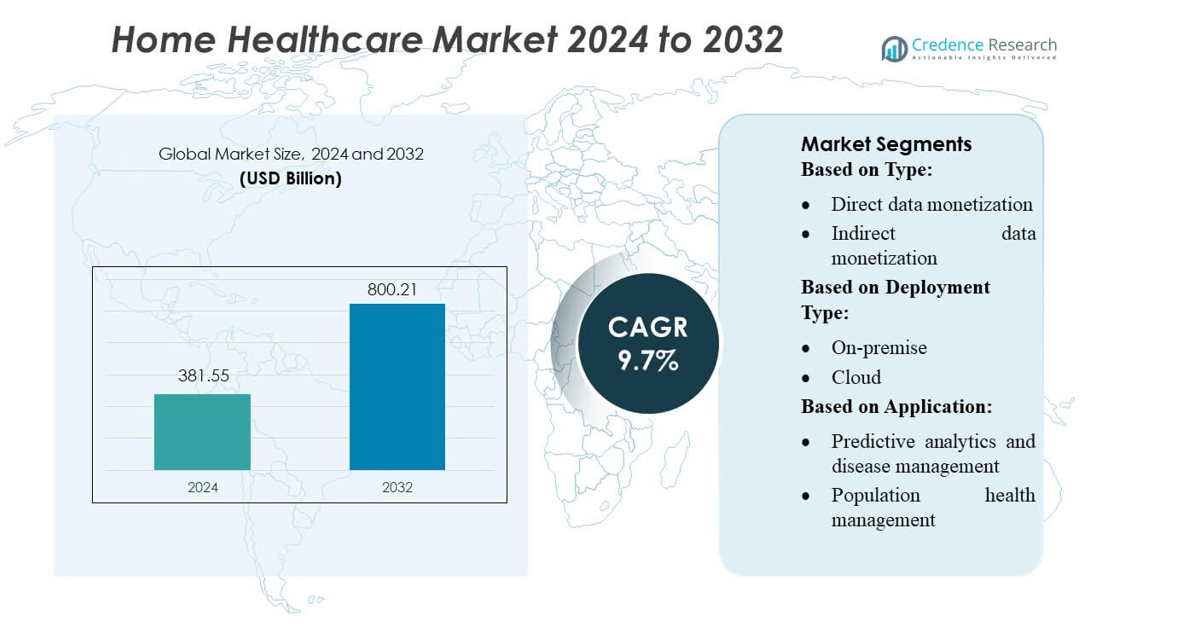

Home Healthcare Market size was valued USD 381.55 billion in 2024 and is anticipated to reach USD 800.21 billion by 2032, at a CAGR of 9.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Home Healthcare Market Size 2024 |

USD 381.55 billion |

| Home Healthcare Market, CAGR |

9.7% |

| Home Healthcare Market Size 2032 |

USD 800.21 billion |

The Home Healthcare Market is increasingly shaped by leading players including Amedisys, Inc., Medtronic PLC, Sunrise Medical, Cardinal Health Inc., B. Braun Melsungen AG, Air Liquide, Baxter International Inc., Abbott, 3M Healthcare, and F. Hoffmann-La Roche AG, each leveraging strengths in remote monitoring, infusion therapy, and mobility aids. North America remains the dominant region, commanding approximately 42.5 % of the global market share in 2023, driven by its advanced healthcare infrastructure, high telehealth adoption, and strong reimbursement frameworks.

Market Insights

- The Home Healthcare Market reached USD 381.55 billion in 2024 and is projected to hit USD 800.21 billion by 2032 at a 9.7% CAGR, reflecting strong global demand for home-based medical services.

- Market growth is driven by rising chronic disease prevalence, rapid adoption of remote monitoring technologies, and increasing preference for cost-effective, non-hospital care supported by advanced digital platforms.

- Key trends include accelerated integration of AI-based diagnostics, expansion of home infusion and respiratory therapy, and growing investment in connected mobility aids by major players to enhance patient outcomes.

- Competitive intensity continues to rise as leading companies strengthen portfolios through innovation, product diversification, and telehealth partnerships, while pricing pressures and regulatory compliance requirements remain major restraints.

- Regionally, North America holds a 42.5% share, supported by strong reimbursement systems, while segment-wise, home monitoring devices represent the largest share due to increasing use of connected health tools for chronic disease management.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Direct data monetization holds the dominant share in the home healthcare market, accounting for an estimated 55–60% due to rising adoption of structured patient-generated data for clinical decision support and reimbursement optimization. Providers increasingly commercialize de-identified datasets, enabling research institutions and health-tech firms to enhance algorithm performance and disease-risk prediction models. Indirect monetization grows steadily as organizations leverage data to improve operational efficiency, reduce readmission rates, and enhance patient engagement. Its expansion is driven by the integration of remote monitoring systems and value-based care models that depend on better clinical insights.

- For instance, Amedisys has implemented the Medalogix Pulse clinical decision-support tool across its network of 354 branch locations, managing an average daily census (ADC) of over 78,000 patients through Pulse, and delivering visit recommendations at the start of care for more than 91% of those patients.

By Deployment Type

Cloud deployment is the leading segment with an estimated 65–70% market share, driven by scalable storage needs, lower upfront infrastructure costs, and rapid integration with remote patient monitoring platforms. Providers increasingly adopt cloud-native analytics, telehealth systems, and compliance-ready hosting environments to support continuous data flow from wearable and in-home sensors. On-premise solutions retain relevance among large providers requiring stringent data sovereignty, but their share declines as organizations shift toward interoperable cloud ecosystems that accelerate analytics, improve uptime reliability, and support multi-location home-care operations.

- For instance, Medtronic’s HealthCast™ Vital Sync™ remote-patient-monitoring platform (a cloud-based solution) integrates physiological data — including SpO₂, respiratory rate, pulse rate, EtCO₂, and ventilator metrics — in near real time on any web-enabled device or mobile app.

By Application

Predictive analytics and disease management represent the largest application segment with over 30% share, supported by rising demand for early-risk detection and proactive care pathways. Population health management grows as providers integrate longitudinal home-care data to support chronic disease monitoring and reduce emergency visits. Revenue cycle management adoption increases through automated coding and reimbursement optimization tools. Precision medicine advances as genomic data and home-based diagnostics converge to support tailored treatment plans. Other applications expand moderately, driven by workflow automation, medication adherence tracking, and AI-enabled triage tools for home-based clinical support.

Key Growth Drivers

Rising Chronic Disease Prevalence and Aging Population

The global increase in chronic illnesses such as diabetes, cardiovascular disease, and respiratory disorders, combined with a rapidly aging population, continues to fuel strong demand for home healthcare services. Older adults increasingly prefer receiving long-term care in home settings to reduce hospitalization frequency and maintain independence. This demographic shift encourages higher adoption of home-based monitoring, nursing, and therapeutic services. As healthcare systems face capacity constraints, home healthcare models emerge as cost-efficient alternatives, accelerating market expansion and supporting sustained long-term demand.

- For instance, Sunrise Medical has recently introduced Voice Activation to its CTRL+5 power seating control module, making it the first in the industry to allow hands-free voice control of reclining, tilting, and leg elevation.

Advancements in Remote Monitoring and Connected Care Technologies

Rapid technological innovation in remote monitoring and connected medical devices significantly strengthens the market’s growth trajectory. Solutions such as wireless vital-sign monitors, AI-enabled diagnostic tools, and cloud-integrated health platforms improve real-time patient oversight, enabling early intervention and reduced emergency visits. Continuous connectivity between caregivers and patients supports more personalized and proactive care management. The increasing integration of telehealth with home-based devices enhances treatment accuracy, minimizes manual processes, and expands access to specialized care—particularly in underserved or rural regions—boosting adoption among healthcare providers and payers.

- For instance, B. Braun secured ISO 27001 certification for its information-security processes covering active medical devices and automated infusion systems — a key foundation for its connected-device operations.

Cost Efficiency and Shift Toward Value-Based Care Models

Healthcare systems globally are placing greater emphasis on value-based care, encouraging providers to reduce costs while improving patient outcomes. Home healthcare delivers significant cost advantages by lowering hospital stays, decreasing readmissions, and optimizing resource utilization. Payers increasingly incentivize home-based treatment plans due to measurable improvements in efficiency and patient satisfaction. Governments and insurers also expand reimbursement frameworks for home services, accelerating adoption. As health systems prioritize scalable, decentralized care delivery, home healthcare emerges as a strategic solution for cost-effective chronic disease and post-acute management.

Key Trends & Opportunities

Increased Adoption of Telehealth-Integrated Home Care Models

The integration of telehealth with home healthcare creates notable opportunities for expanding service reach and enhancing patient management. Virtual consultations combined with remote diagnostics support continuous engagement between clinicians and patients, improving adherence and reducing unnecessary clinical visits. The trend toward hybrid care models—merging in-person home visits with digital monitoring—enables providers to scale services with fewer staffing constraints. This shift offers significant opportunity for technology integrators, telemedicine platforms, and home health agencies aiming to optimize care coordination and expand chronic care pathways.

- For instance, Air Liquide will support 70,000 home-respiratory-care patients via a model that includes telemonitoring, video consultations, predictive algorithms, and an app already used by 100,000 patients.

Growing Demand for Home-Based Rehabilitation and Post-Acute Care

Increasing pressure on hospitals to reduce inpatient occupancy drives strong growth in home-based rehabilitation and post-acute care services. Patients recovering from surgeries, trauma, or complex illnesses often experience better outcomes through personalized home therapies. Advanced rehabilitation technologies—such as portable mobility aids, remote physiotherapy tools, and digital therapeutic applications—enhance recovery timelines and reduce dependence on facility-based care. This trend opens new opportunities for service providers and device manufacturers offering tailored rehabilitation solutions designed for convenient, continuous use in residential environments.

- For instance, Baxter has made major strides in its infusion-therapy devices that can support post-acute and home care. In its Q1 2024 results, Baxter reported FDA 510(k) clearance of its Novum IQ large-volume infusion pump (LVP) with Dose IQ Safety Software.

Expansion of AI-Driven Predictive and Preventive Home Care Solutions

AI and data analytics introduce new opportunities to enhance preventive care in home settings. Algorithms that predict patient deterioration, detect abnormal patterns, or automate care workflows strengthen proactive management of chronic diseases. AI-enabled platforms supporting medication adherence, behavioral monitoring, and personalized care planning improve the efficiency and accuracy of home-based services. As healthcare data becomes more interoperable across devices and electronic health records, providers can deploy more sophisticated AI tools to reduce complications, optimize resource allocation, and improve overall patient outcomes.

Key Challenges

Shortage of Skilled Home Healthcare Professionals

A persistent shortage of trained home healthcare nurses, therapists, and aides presents a major barrier to scaling services. High workload, uneven geographic distribution of professionals, and limited training programs strain service availability. As demand for complex home-based care rises, providers face increasing difficulty maintaining consistent service quality. Labor shortages also drive higher operational costs and restrict expansion into underserved areas. Without significant workforce development initiatives and improved retention strategies, care providers may struggle to meet projected demand growth.

Data Privacy, Security, and Interoperability Constraints

The increasing use of connected devices and digital platforms amplifies concerns around patient data privacy and cybersecurity. Many home healthcare systems face challenges integrating data across multiple devices, electronic health records, and monitoring tools, resulting in fragmented care coordination. Vulnerabilities in remote monitoring systems elevate the risk of data breaches, regulatory non-compliance, and patient mistrust. Ensuring secure, interoperable, and compliant digital infrastructure requires significant investment and standardization. These challenges slow technology adoption and complicate the delivery of seamless, data-driven home care.

Regional Analysis

North America

North America holds the largest share of the home healthcare market at around 42–43%. Growth is driven by strong adoption of home-based medical devices, advanced telehealth systems, and supportive reimbursement programs such as Medicare. The region’s high prevalence of chronic illnesses and rapidly aging population increases demand for home nursing, monitoring, and rehabilitation services. Strong presence of major service providers and device manufacturers also helps expand access to home-based care. As hospitals focus on reducing costs and readmissions, home healthcare continues to gain importance as a preferred care model in the United States and Canada.

Europe

Europe accounts for about 25–27% of the global home healthcare market. Growth is supported by well-established public healthcare systems, increasing elderly populations, and rising adoption of home-based nursing and therapy services. Countries such as Germany, France, and the UK drive strong demand for remote monitoring and post-acute home care. The region’s shift toward reducing hospital stays and expanding community-based care boosts reliance on home healthcare solutions. Digital health integration across Europe further improves service coordination, making home healthcare a central element of long-term care and chronic disease management strategies.

Asia-Pacific

Asia-Pacific represents 20–26% of the home healthcare market and is the fastest-growing region. Rising healthcare spending, expanding middle-class populations, and increased awareness of home-based care drive strong market growth. Aging populations in Japan and China significantly increase demand for home nursing, monitoring devices, and rehabilitation services. Governments across the region are investing in telemedicine and community health programs, helping shift care from hospitals to homes. Affordable home health devices and increasing smartphone penetration also support rapid adoption in India and Southeast Asia, making the region a major growth engine.

Latin America

Latin America holds around 7% of the global home healthcare market. Growth is driven by increasing chronic disease rates, expanding home-based services in Brazil and Mexico, and rising awareness of cost-effective care options. The region is gradually adopting telehealth and remote monitoring tools to improve access, especially in underserved areas. Economic constraints limit large-scale deployment, but home nursing, infusion therapy, and basic monitoring devices are gaining popularity. Government efforts to strengthen primary healthcare systems are also supporting the shift toward home-based chronic care and post-acute recovery services.

Middle East & Africa (MEA)

The Middle East & Africa region represents about 8–9% of the home healthcare market. Growth is influenced by rising non-communicable diseases, increasing investment in health infrastructure, and expansion of private home-care service providers. Countries like Saudi Arabia and the UAE are adopting home monitoring and nursing services rapidly as part of healthcare modernization plans. Rising demand for elderly care, chronic disease management, and in-home medical support contributes to market expansion. Although adoption is uneven across the region, improving digital health capabilities are gradually supporting broader use of home-based care.

Market Segmentations:

By Type:

- Direct data monetization

- Indirect data monetization

By Deployment Type:

By Application:

- Predictive analytics and disease management

- Population health management

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Home Healthcare Market features leading companies such as Amedisys, Inc., Medtronic PLC, Sunrise Medical, Cardinal Health Inc., B. Braun Melsungen AG, Air Liquide, Baxter International Inc., Abbott, 3M Healthcare, and F. Hoffmann-La Roche AG. The Home Healthcare Market continues to evolve as companies intensify their focus on technology integration, service diversification, and patient-centric care models. Market participants increasingly invest in remote monitoring systems, advanced therapeutic devices, and digital platforms to enhance home-based treatment delivery and improve clinical outcomes. Competition is further driven by strategic partnerships with telehealth providers, expansion into chronic disease management services, and the development of connected solutions that support real-time data sharing. Companies also emphasize regulatory compliance, supply chain efficiency, and strong distribution networks to maintain operational resilience. As demand grows for cost-effective and personalized home healthcare, firms differentiate themselves through product reliability, service quality, and innovative care delivery models that align with shifting patient preferences and healthcare system priorities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Amedisys, Inc.

- Medtronic PLC

- Sunrise Medical

- Cardinal Health Inc.

- Braun Melsungen AG

- Air Liquide

- Baxter International Inc.

- Abbott

- 3M Healthcare

- Hoffmann-La Roche AG

Recent Developments

- In December 2024, Atropos Health, a leader in turning clinical data into high-quality, personalized real-world evidence (RWE) for care, started AI model training on the Atropos Evidence Network. This is the largest federated healthcare data network with over 200 million patient records. The real-world data was de-identified and used to train AI models.

- In July 2024, Star Health and Allied Insurance Company expanded its offerings to include home healthcare services, which are now available in over 50 cities across India. This initiative is part of a broader strategy to enhance accessibility and affordability of healthcare for customers, particularly in the context of rising healthcare costs and the challenges posed by limited infrastructure.

- In May 2024, LG Electronics announced the launch of a new venture, Primefocus Health, which will develop a provider-facing healthcare-delivery platform that leverages technologies and therapies to aid in remote patient monitoring and give patients access to new therapies through technology applications.

- In April 2024, The U.S. FDA initiated a program known as the Home as a Health Care Hub, aimed at transforming the home environment into an integral part of the healthcare system. This initiative is particularly focused on advancing health equity across diverse populations in the U.S., especially those who are underserved or have limited access to traditional healthcare facilities

Report Coverage

The research report offers an in-depth analysis based on Type, Deployment Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will increasingly adopt remote monitoring technologies to support chronic disease management at home.

- Demand for AI-enabled home diagnostics and predictive care tools will continue to rise.

- Home-based infusion, respiratory therapy, and rehabilitation services will expand as care shifts away from hospitals.

- Digital platforms will strengthen coordination between clinicians, caregivers, and patients in real time.

- Smart medical devices will gain wider acceptance due to improved accuracy, automation, and connectivity.

- Personalized home care plans will grow as providers leverage data analytics for tailored interventions.

- Partnerships between home healthcare companies and telehealth providers will accelerate integrated care delivery.

- Workforce shortages will drive greater adoption of automation and remote support solutions.

- Regulatory frameworks will evolve to support reimbursement for broader home-based care services.

- Investment in home healthcare logistics and supply chain optimization will enhance service reliability and patient reach.