Market Overview:

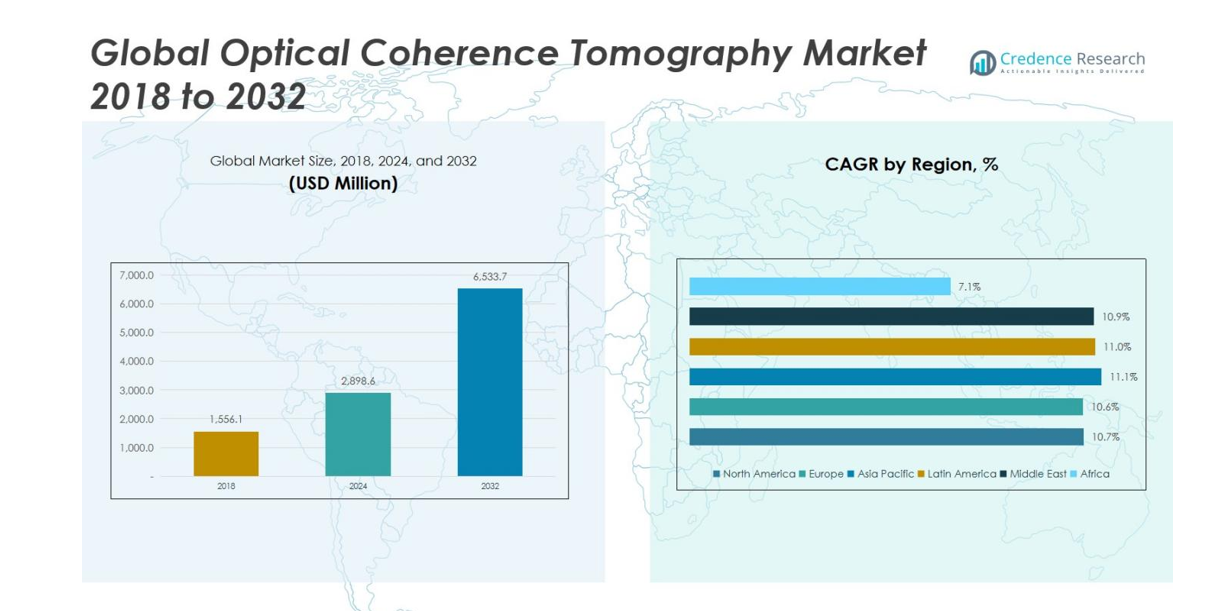

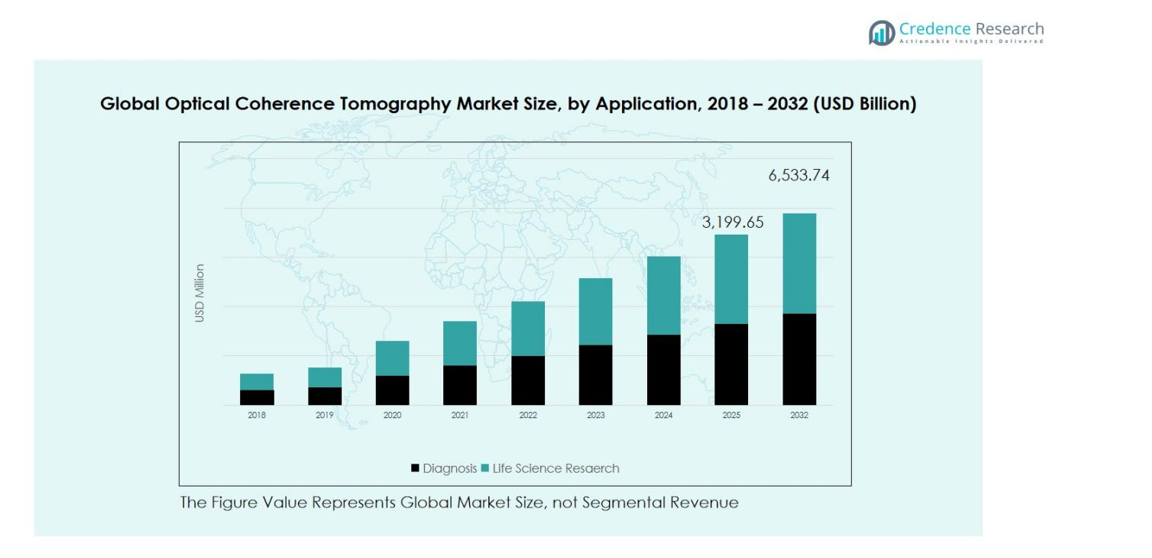

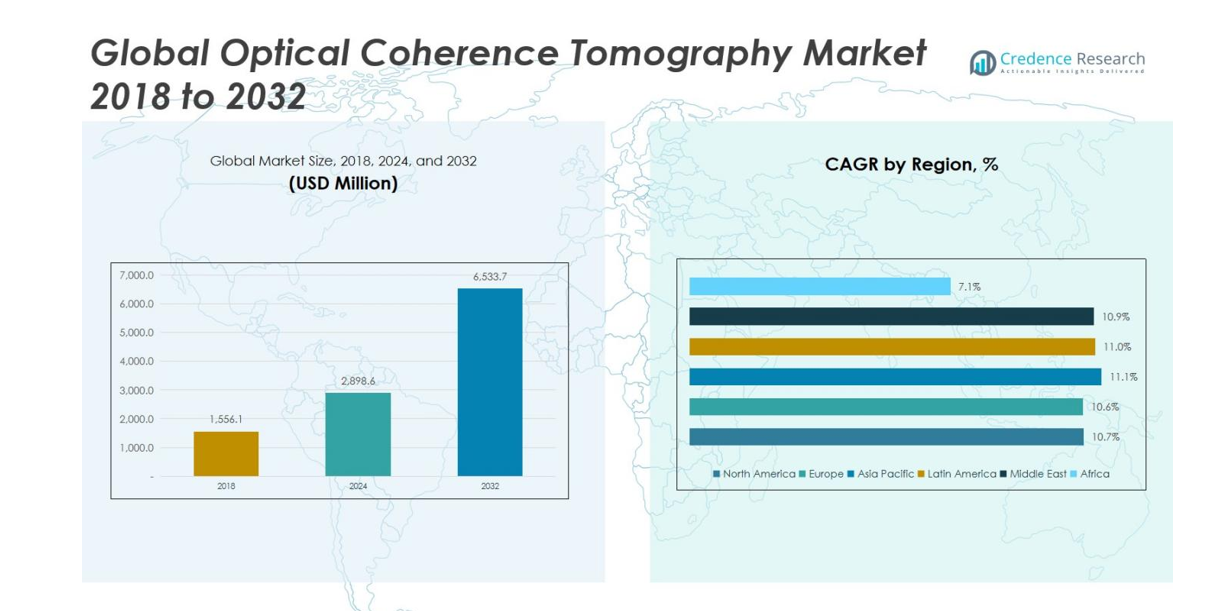

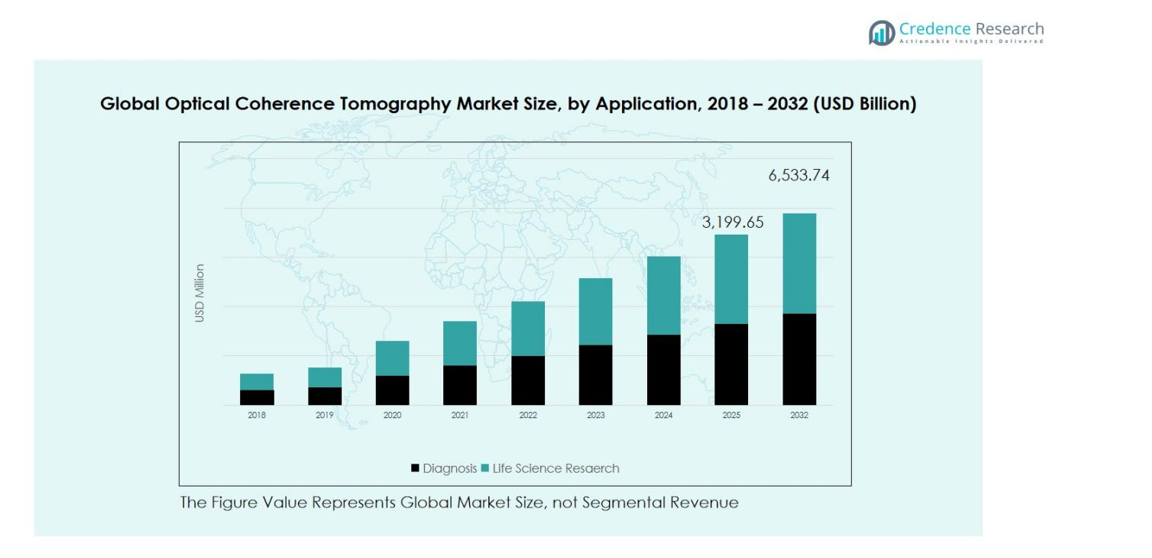

The Optical Coherence Tomography Market size was valued at USD 1,556.1 million in 2018, reaching USD 2,898.6 million in 2024, and is anticipated to attain USD 6,533.7 million by 2032, registering a CAGR of 10.74% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Optical Coherence Tomography Market Size 2024 |

USD 2,898.6 million |

| Optical Coherence Tomography Market , CAGR |

10.74% |

| Optical Coherence Tomography Market Size 2032 |

USD 6,533.7 million |

The Optical Coherence Tomography (OCT) Market is led by key players such as Carl Zeiss Meditec AG, Heidelberg Engineering GmbH, Topcon Corporation, Abbott Laboratories, Optovue Inc., and Agfa-Gevaert Group, who dominate through continuous innovation, strategic partnerships, and expansion of clinical applications across ophthalmology, cardiology, and dermatology. These companies focus on developing high-resolution, non-invasive imaging systems, including swept-source and spectral-domain OCT, to meet growing diagnostic demands. Regionally, Asia Pacific leads the market with a 31.11% share in 2018, driven by increasing healthcare infrastructure, medical tourism, and government initiatives promoting early disease detection. Europe holds 26.33%, supported by advanced healthcare systems and strong adoption of diagnostic imaging, while North America accounts for 22.99%, benefiting from technological advancement and high prevalence of retinal disorders. Collectively, these top players and leading regions shape the competitive landscape and drive sustained global market growth.

Market Insights

- The Optical Coherence Tomography Market was valued at USD 2,898.6 million in 2024 and is projected to reach USD 6,533.7 million by 2032, growing at a CAGR of 10.74%.

- Growth is driven by rising prevalence of eye disorders such as glaucoma and diabetic retinopathy, increasing adoption of non-invasive diagnostic imaging, and technological advancements in high-resolution OCT systems.

- Market trends include the shift toward spectral-domain and swept-source OCT technologies, integration of artificial intelligence for automated image analysis, and the development of portable and handheld devices for point-of-care diagnostics.

- The competitive landscape is dominated by key players including Carl Zeiss Meditec AG, Heidelberg Engineering GmbH, Topcon Corporation, Abbott Laboratories, and Optovue Inc., who focus on innovation, partnerships, and expanding applications across ophthalmology, cardiology, and dermatology.

- Regionally, Asia Pacific leads with a 31.11% share, followed by Europe at 26.33% and North America at 22.99%; ophthalmology remains the largest application segment, accounting for around 65% of the market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

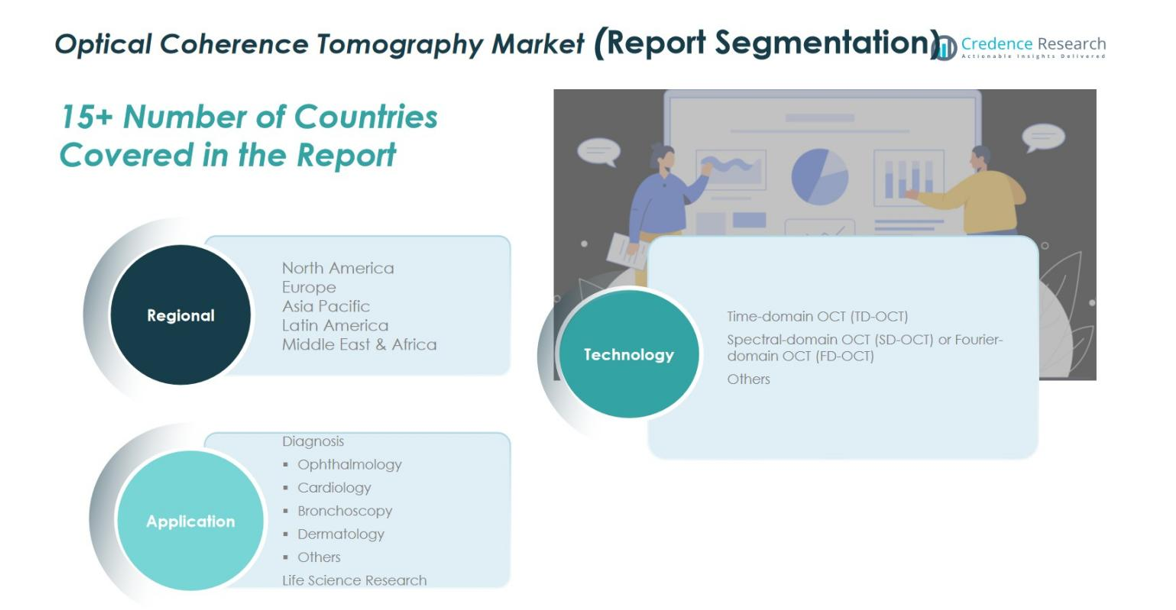

Market Segmentation Analysis:

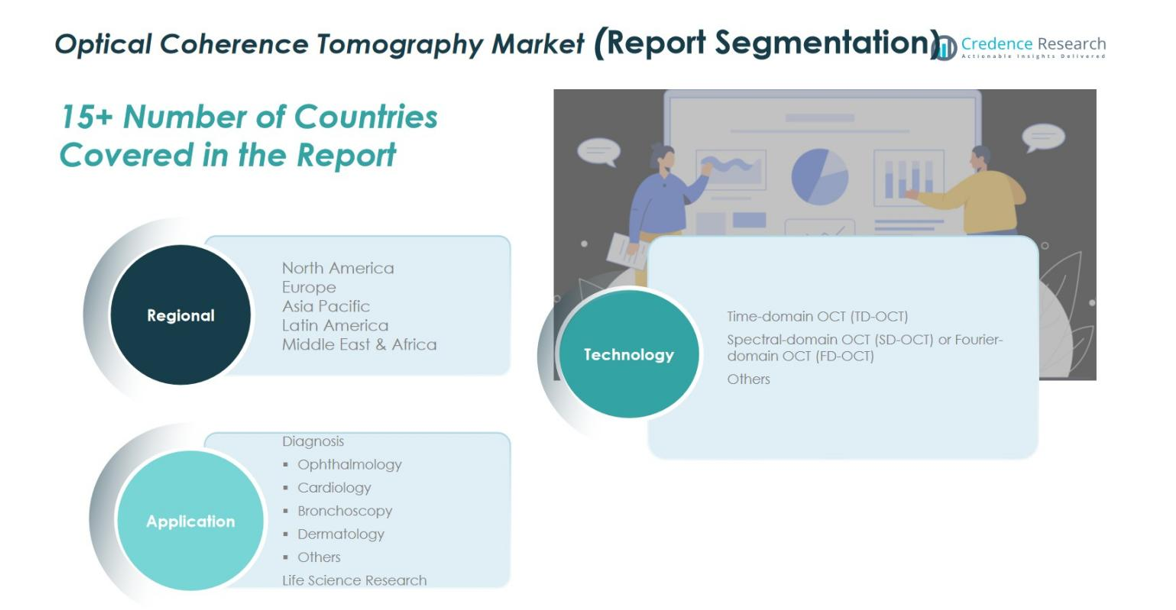

By Technology

The Optical Coherence Tomography (OCT) Market by technology is dominated by Spectral-domain OCT (SD-OCT) / Fourier-domain OCT (FD-OCT), accounting for around 38% of the global market share in 2024. This segment leads due to its superior imaging speed, high resolution, and ability to capture three-dimensional images for precise diagnosis, particularly in ophthalmology. The growing preference for advanced diagnostic imaging, coupled with technological innovation and adoption in hospitals and eye clinics, continues to strengthen SD-OCT’s dominance. Meanwhile, Time-domain OCT (TD-OCT) holds a smaller but stable share, driven by its affordability and use in basic imaging applications, whereas other technologies, such as swept-source OCT, are gaining traction for deeper tissue imaging and versatility across non-ophthalmic uses.

- For instance, Carl Zeiss Meditec’s CIRRUS 6000 SD-OCT system is widely utilized in eye clinics for its advanced imaging speed and high axial resolution, enhancing the diagnosis and monitoring of retinal diseases.

By Application

By application, Ophthalmology remains the leading segment, representing about 65% of the total OCT market share in 2024. The dominance of this segment stems from the high prevalence of eye disorders such as glaucoma, diabetic retinopathy, and age-related macular degeneration, which demand early and accurate detection. The strong presence of OCT in routine eye care, alongside government support and improved reimbursement for retinal imaging, fuels further expansion. Other applications, including cardiology, bronchoscopy, and dermatology, collectively account for the remaining market share and are expected to grow rapidly as OCT technology extends into vascular imaging, skin diagnostics, and pulmonary assessments.

- For instance, Heidelberg Engineering’s SPECTRALIS platform integrates OCT with scanning laser fundus imaging, allowing co-localizable, high-resolution monitoring of retinal diseases such as glaucoma and age-related macular degeneration in clinical trials and routine care.

Key Growth Drivers

Rising Prevalence of Eye Disorders

The growing incidence of eye disorders such as glaucoma, diabetic retinopathy, and age-related macular degeneration is a primary driver of the Optical Coherence Tomography (OCT) Market. Early and accurate detection of these conditions is critical for effective treatment, and OCT provides high-resolution, non-invasive imaging that supports routine screening and monitoring. Increasing awareness among patients and healthcare providers about the benefits of early diagnosis is driving demand for OCT systems in clinics, hospitals, and specialty eye care centers worldwide.

- For instance, ZEISS’s Cirrus 6000 OCT system has demonstrated high diagnostic accuracy for glaucoma by measuring retinal nerve fiber layer thickness, with studies showing an Area Under the Receiver Operating Characteristic curve (AUROC) of 0.897 for glaucoma detection, enabling earlier intervention.

Technological Advancements in OCT Devices

Continuous innovations in OCT technology, including spectral-domain, Fourier-domain, and swept-source systems, are fueling market growth. These advancements offer higher resolution, faster imaging, and deeper tissue penetration, making OCT suitable for diverse applications beyond ophthalmology, such as cardiology and dermatology. Integration with artificial intelligence and cloud-based analysis further enhances diagnostic accuracy and workflow efficiency. Healthcare providers increasingly prefer advanced OCT systems, which drives adoption and encourages investment from manufacturers in research and development.

- For instance, research at the Technical University of Denmark introduced a novel 1.6 MHz swept-source OCT instrument enabling real-time volumetric imaging of the human retina, demonstrating the leap in imaging speed and resolution.

Expansion of Healthcare Infrastructure in Emerging Markets

Rapid development of healthcare infrastructure in emerging regions such as Asia Pacific, Latin America, and the Middle East is a significant growth driver. Investments in hospitals, diagnostic centers, and specialized eye care facilities enhance accessibility to advanced imaging technologies. Rising healthcare expenditure, improved insurance coverage, and government initiatives for early disease detection increase OCT adoption. Expanding medical tourism in countries like India and China also contributes to market growth, as international patients seek high-quality diagnostic services that rely on OCT technology.

Key Trends & Opportunities

Shift Towards Portable and Handheld OCT Devices

The market is witnessing a trend toward portable and handheld OCT systems that enable point-of-care diagnostics in clinics, community health centers, and mobile screening units. These devices provide flexibility, reduce patient wait times, and support early detection in remote or underserved areas. Manufacturers are increasingly focusing on miniaturized, affordable solutions, creating new revenue opportunities in emerging economies. The adoption of portable OCT devices also aligns with preventive healthcare initiatives, enabling routine screenings and improving overall accessibility to advanced imaging technology.

- For instance, the briefcase spectral-domain OCT system developed by researchers integrates all key optical components and a laptop into a self-contained unit weighing 9 kg, costing around $8000, and designed for use in primary care and remote locations.

Integration of Artificial Intelligence in OCT Systems

Artificial intelligence (AI) integration in OCT platforms is transforming diagnostic workflows by enabling automated image interpretation and predictive analytics. AI-assisted systems enhance accuracy, reduce human error, and allow clinicians to process large volumes of data efficiently. This technological convergence opens opportunities for expanding OCT applications beyond traditional ophthalmology, including cardiology, dermatology, and oncology. The development of AI-driven solutions strengthens the competitive position of manufacturers and accelerates adoption across regions seeking faster, precise, and data-driven diagnostic tools.

- For instance, Altris AI’s platform, implemented in over 500 eye care practices globally, detects more than 70 retinal pathologies and biomarkers using AI, enabling automated patient triage, progression tracking, and early glaucoma risk assessment through GCC asymmetry and optic disc analysis.

Key Challenges

High Cost of Advanced OCT Systems

The significant investment required for purchasing and maintaining high-resolution OCT devices poses a challenge for market expansion. Advanced systems, such as spectral-domain and swept-source OCT, involve substantial capital expenditure and operational costs, limiting adoption in small clinics and emerging markets. Budget constraints and limited insurance reimbursement in certain regions further impede deployment. Manufacturers must balance technological innovation with cost-effective solutions to ensure wider market penetration while addressing affordability concerns for healthcare providers and patients.

Limited Skilled Professionals for OCT Operation

A key challenge in the Optical Coherence Tomography Market is the shortage of trained professionals capable of operating sophisticated OCT systems and interpreting results accurately. Misinterpretation of imaging data can affect diagnosis and treatment outcomes. Training programs, certification courses, and ongoing technical support are essential to equip clinicians and technicians with the necessary expertise. This skill gap slows adoption in regions with limited access to specialized medical personnel, highlighting the need for user-friendly devices and automated systems to reduce dependency on highly skilled operators.

Regional Analysis

North America

The North America Optical Coherence Tomography (OCT) market was valued at USD 357.89 million in 2018, reaching USD 663.94 million in 2024, and is projected to attain USD 1,488.39 million by 2032, expanding at a CAGR of 10.87%. The region accounts for nearly 22.99% of the global share, driven by advanced healthcare systems, early technology adoption, and strong presence of key manufacturers such as Abbott and Carl Zeiss Meditec AG. The growing prevalence of retinal diseases and favorable reimbursement policies continue to support steady market growth across the U.S., Canada, and Mexico.

Europe

Europe held a 26.33% share of the global OCT market in 2018, valued at USD 409.86 million, which increased to USD 759.63 million in 2024, and is expected to reach USD 1,700.73 million by 2032, registering a CAGR of 10.81%. The region benefits from well-established healthcare infrastructure and strong adoption of diagnostic imaging systems in countries like Germany, France, and the UK. Rising cases of age-related macular degeneration, growing demand for advanced imaging, and R&D collaborations across medical institutions are major factors fueling OCT market expansion in Europe.

Asia Pacific

Asia Pacific dominated the OCT market with the largest share of 31.11% in 2018, valued at USD 484.09 million, which grew to USD 922.49 million in 2024 and is anticipated to reach USD 2,141.76 million by 2032, exhibiting the fastest CAGR of 11.37%. The region’s rapid growth is attributed to expanding healthcare access, increasing medical tourism, and government initiatives promoting early disease diagnosis. Countries such as China, Japan, and India are driving demand through rising ophthalmic care investments and technological advancements in imaging systems, positioning Asia Pacific as the most promising market globally.

Latin America

The Latin America OCT market was valued at USD 166.03 million in 2018, rising to USD 313.38 million in 2024, and is expected to reach USD 718.71 million by 2032, growing at a CAGR of 10.94%. Holding 10.67% of the global market share, the region is expanding steadily due to improving healthcare infrastructure and increasing adoption of non-invasive diagnostic tools. Brazil and Mexico are the primary contributors, supported by growing private healthcare investment, early disease screening initiatives, and technological integration in ophthalmology and cardiology imaging practices.

Middle East

The Middle East OCT market accounted for USD 67.53 million in 2018, expanding to USD 127.16 million in 2024, and is projected to reach USD 290.75 million by 2032, at a CAGR of 10.99%. Representing a 4.34% global share, the market’s growth is driven by healthcare modernization, rising diabetes-related eye disorders, and increased investments in diagnostic imaging. GCC countries, especially the UAE and Saudi Arabia, are leading adoption with partnerships between hospitals and OCT device manufacturers, enhancing diagnostic capabilities in ophthalmology and cardiovascular imaging.

Africa

Africa’s OCT market was valued at USD 70.64 million in 2018, increasing to USD 111.97 million in 2024, and is projected to reach USD 193.40 million by 2032, growing at a CAGR of 8.79%. Holding 4.54% of the global market share, the region shows gradual growth due to improved healthcare accessibility and the introduction of portable imaging systems. South Africa and Egypt dominate regional demand, supported by the expansion of ophthalmology centers and awareness campaigns for early eye disease detection, positioning Africa as an emerging market with long-term growth potential.

Market Segmentations:

By Technology

- Time-domain OCT (TD-OCT)

- Spectral-domain OCT (SD-OCT) / Fourier-domain OCT (FD-OCT)

- Others

By Application

- Ophthalmology

- Cardiology

- Bronchoscopy

- Dermatology

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Optical Coherence Tomography (OCT) Market is defined by leading players such as Carl Zeiss Meditec AG, Heidelberg Engineering GmbH, Topcon Corporation, Abbott Laboratories, Optovue Inc., and Agfa-Gevaert Group. These companies dominate through technological innovation, strategic collaborations, and product advancements that enhance imaging accuracy and speed. The market is moderately consolidated, with firms focusing on expanding their clinical applications in ophthalmology, cardiology, and dermatology. Continuous investment in research and development is driving innovations like swept-source and spectral-domain OCT systems for higher precision and non-invasive diagnostics. Strategic mergers, acquisitions, and partnerships are common, allowing companies to strengthen their distribution networks and product portfolios globally. Moreover, the rising integration of artificial intelligence in OCT devices for automated image interpretation is reshaping the competitive dynamics. New entrants are emphasizing affordable, portable OCT systems to tap into emerging markets, fostering healthy competition across the diagnostic imaging sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2024, Visionix USA launched a new topography module for its Solix OCT/OCT-A systems at Vision Expo West, combining topography, OCT, and OCT-A technologies to enhance diagnostic capabilities in ophthalmology.

- In 2024, Carl Zeiss Meditec AG upgraded its CIRRUS® 6000 OCT system with the largest U.S. OCT reference database and advanced cybersecurity features to support data-driven patient care.

- In 2024, EssilorLuxottica acquired an 80% stake in Heidelberg Engineering, a Germany-based company specializing in diagnostic solutions for clinical ophthalmology, strengthening its position in the medical technology sector.

Report Coverage

The research report offers an in-depth analysis based on Technology, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of OCT systems will accelerate as non-invasive diagnostic imaging becomes a standard of care across ophthalmology, cardiology and dermatology.

- The transition to higher-resolution technologies (e.g., swept-source and Fourier-domain OCT) will drive replacement cycles and incremental device upgrades.

- Portable and handheld OCT devices will become more common, enabling point-of-care use in clinics, community health settings and mobile screening units.

- Artificial intelligence and cloud-based image-analysis software will be increasingly embedded in OCT platforms, improving diagnostician productivity and diagnostic accuracy.

- Growth in emerging markets (Asia-Pacific, Latin America, Middle East & Africa) will outpace mature regions as infrastructure expands and reimbursement improves.

- Applications beyond ophthalmology—such as intravascular imaging in cardiology, dermatologic skin lesion assessment and oncology margins—will broaden the use cases for OCT.

- Established players will pursue strategic partnerships, mergers and new product introductions to stay competitive amid expanding global demand.

- Cost-pressure and demand for affordable diagnostics will push OCT manufacturers to develop lower-cost models and modular systems tailored for emerging-economy use.

- Regulatory approvals and reimbursement frameworks will increasingly recognise OCT for screening and monitoring, which will support uptake and long-term adoption.

- As healthcare shifts toward preventive diagnostics, early screening of chronic diseases using OCT will become more common, reinforcing OCT’s role in routine care.