Market Overview

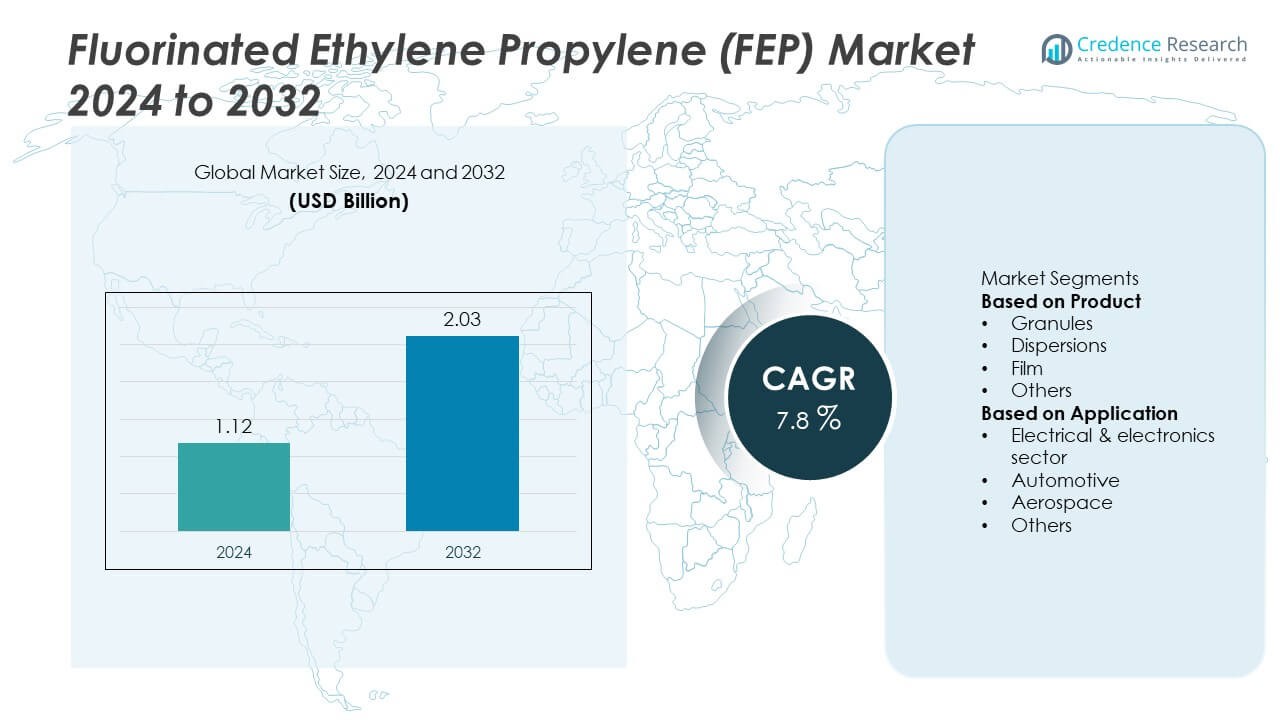

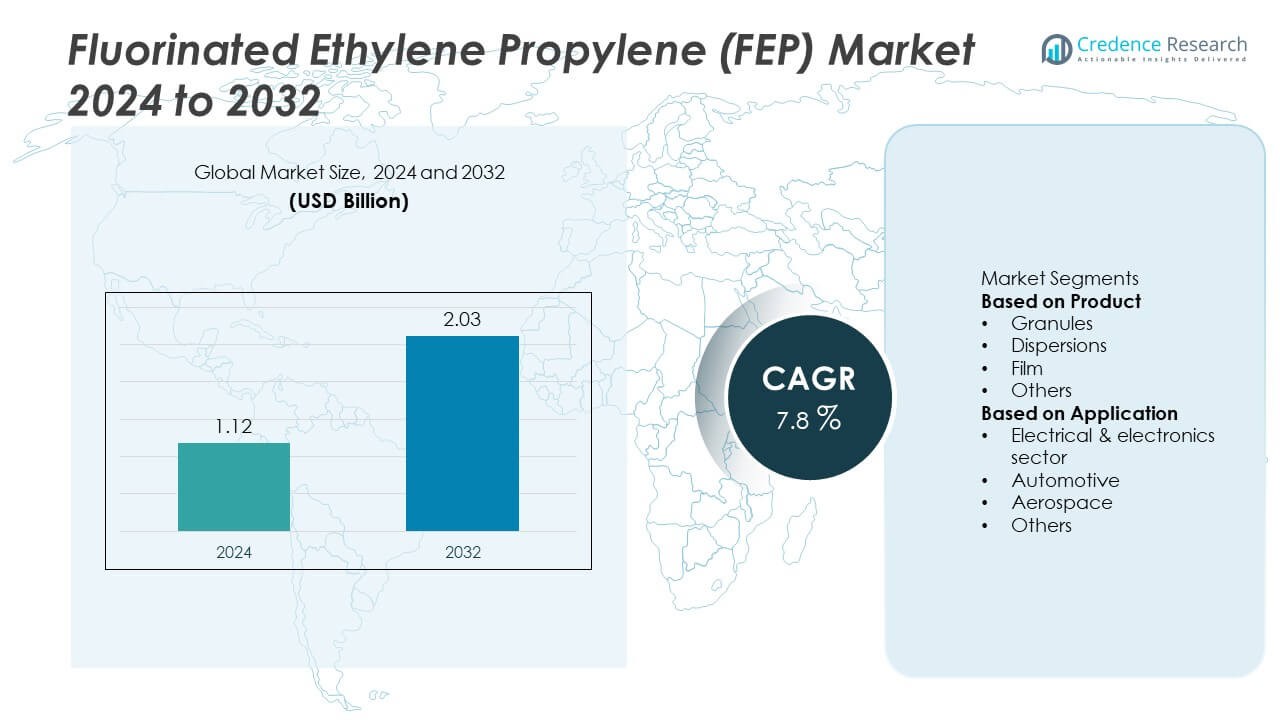

The global fluorinated ethylene propylene (FEP) market was valued at USD 1.12 billion in 2024 and is projected to reach USD 2.03 billion by 2032, growing at a CAGR of 7.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fluorinated Ethylene Propylene (FEP) Market Size 2024 |

USD 1.12 Million |

| Fluorinated Ethylene Propylene (FEP) Market, CAGR |

4% |

| Fluorinated Ethylene Propylene (FEP) Market Size 2032 |

USD 2.03 Million |

The fluorinated ethylene propylene (FEP) market is led by major companies such as Chemours Company, Daikin Industries Ltd., 3M Company, AGC Inc., Saint-Gobain Performance Plastics, Solvay S.A., Dongyue Group Limited, HaloPolymer OJSC, Gujarat Fluorochemicals Limited, and Zhejiang Juhua Co., Ltd. These players dominate through technological expertise, large-scale production, and strategic partnerships across key end-use industries. They focus on developing high-purity, energy-efficient, and sustainable FEP materials for electronics, automotive, and chemical sectors. North America leads the market with a 35% share, followed by Asia-Pacific at 30% and Europe at 27%, driven by advanced manufacturing capabilities and expanding semiconductor and electrical applications.

Market Insights

- The global fluorinated ethylene propylene (FEP) market was valued at USD 1.12 billion in 2024 and is projected to reach USD 2.03 billion by 2032, growing at a CAGR of 7.8% during the forecast period.

- Rising demand from electrical, electronics, and automotive sectors drives market growth, with the granules segment holding 47% share due to its use in wire insulation and chemical processing components.

- Increasing adoption of high-purity, melt-processable FEP grades and eco-friendly formulations represents a key market trend among global manufacturers.

- Leading players such as Chemours Company, Daikin Industries Ltd., and Solvay S.A. compete through advanced material innovation, sustainable production, and regional expansion strategies.

- North America leads with 35% share, followed by Asia-Pacific at 30% and Europe at 27%, while Latin America (5%) and Middle East & Africa (3%) show emerging potential supported by growing industrial and infrastructure applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The granules segment dominated the fluorinated ethylene propylene (FEP) market in 2024, accounting for 47% share. Its leadership is attributed to widespread use in wire and cable insulation, chemical processing components, and injection-molded parts. FEP granules offer superior thermal stability, low friction, and excellent chemical resistance, making them suitable for high-performance industrial applications. The growing demand for durable, non-stick coatings and corrosion-resistant linings in automotive and electronics manufacturing further supports segment growth. Manufacturers are expanding production capacity to meet rising demand for high-purity FEP granules across industrial and electrical sectors.

- For instance, Chemours also upgraded its Parkersburg facility to improve polymer purity levels to 99.9%, enabling use in semiconductor etching systems and medical tubing manufacturing.

By Application

The electrical and electronics segment held the largest share of 42% in the FEP market in 2024. Its dominance stems from the material’s high dielectric strength, low surface energy, and exceptional heat resistance. FEP is extensively used for wire coatings, cable insulation, and semiconductor processing components. The rapid expansion of 5G infrastructure, electric vehicles, and miniaturized electronic devices fuels demand for reliable high-performance insulating materials. Additionally, the aerospace and automotive industries are increasingly adopting FEP for lightweight wiring and fuel handling systems due to its superior chemical and temperature endurance.

- For instance, DuPont offers high-performance Kapton polyimide films with excellent dielectric strength and thermal stability, which are widely used as a dielectric substrate for flexible circuit assemblies in electronics.

Key Growth Drivers

Expanding Demand from Electrical and Electronics Industry

The growing demand for high-performance insulating materials is a major driver for the FEP market. Its superior dielectric strength, chemical resistance, and thermal stability make it ideal for wire insulation, cable coatings, and semiconductor applications. The rise of 5G networks, electric vehicles, and miniaturized electronic devices continues to boost usage. FEP’s ability to maintain performance under high-frequency and high-temperature conditions strengthens its preference over conventional polymers. Rapid expansion of consumer electronics manufacturing in Asia-Pacific further accelerates market growth.

- For instance, Saint-Gobain upgraded its extrusion facility in Wayne, New Jersey, adding a precision FEP tubing line capable of producing 5,000 meters per day for semiconductor processing equipment.

Rising Adoption in Automotive and Aerospace Sectors

The increasing use of lightweight, durable materials in automotive and aerospace industries drives FEP consumption. Its resistance to fuel, chemicals, and extreme temperatures makes it suitable for fuel lines, wire coatings, and sealing components. With electric vehicle adoption rising, FEP’s non-stick and flame-retardant properties are in high demand for battery insulation and high-voltage cables. Aerospace manufacturers are also incorporating FEP in aircraft wiring systems to improve safety and reduce maintenance. These advantages continue to expand its industrial footprint globally.

- For instance, some automakers use lightweight materials such as aluminum for high-voltage cables in electric vehicles to reduce weight and increase efficiency. Fluorinated Ethylene Propylene (FEP) is also used for cable insulation due to its durability, high-temperature resistance, and excellent electrical properties.

Growing Use in Chemical Processing Applications

FEP’s exceptional chemical inertness and non-reactive nature make it a preferred material in chemical and pharmaceutical processing. It is widely used for linings, valves, tubing, and pumps handling corrosive fluids. The rise in global demand for specialty chemicals and high-purity products has accelerated the adoption of FEP-based components. Its low permeability and smooth surface minimize contamination and improve equipment longevity. As industries shift toward safer and more efficient production systems, the need for FEP in corrosion-resistant infrastructure continues to grow significantly.

Key Trends and Opportunities

Shift Toward High-Purity and Melt-Processable Fluoropolymers

The industry is witnessing increasing demand for high-purity, melt-processable fluoropolymers such as FEP due to their ease of processing and superior performance. Manufacturers are focusing on advanced extrusion and compounding technologies to enhance transparency, mechanical strength, and thermal resistance. This trend is particularly strong in the semiconductor and medical device industries. The ability to produce cleaner and defect-free components gives FEP an edge in precision applications. Continuous innovation in melt-processable grades presents new growth opportunities for high-tech manufacturing sectors.

- For instance, AGC Chemicals introduced a high-purity FEP resin with metal ion contamination levels below 10 parts per billion, optimized for semiconductor wafer processing tubes.

Sustainability and Recycling Advancements

Environmental awareness and regulatory pressure are pushing manufacturers to develop eco-friendly FEP production processes. Advances in chemical recycling and reprocessing technologies are enabling partial material recovery without compromising quality. Companies are also reducing emissions by adopting energy-efficient fluorination methods. Growing interest in sustainable wire coatings, low-emission automotive systems, and green building materials provides additional market opportunities. This shift toward sustainability not only enhances brand reputation but also aligns the FEP market with global circular economy goals.

- For instance, Daikin Industries has committed to reducing its greenhouse gas emissions and is transitioning its fluoropolymer manufacturing processes to more sustainable technologies by around 2030. The company has invested significantly to capture polymerization emulsifiers in its manufacturing process water and has set targets to achieve net-zero GHG emissions by 2050.

Key Challenges

High Production and Processing Costs

FEP production involves complex fluorination processes and high-cost raw materials, which limit affordability for small-scale users. Its processing requires specialized equipment and high-temperature extrusion systems, increasing capital expenditure. These cost challenges hinder broader adoption, especially in price-sensitive industries. Manufacturers are investing in process optimization and automation to improve yield and reduce waste. However, achieving cost efficiency while maintaining material purity remains a key challenge affecting the overall competitiveness of FEP products.

Environmental and Regulatory Restrictions

Stringent environmental regulations on fluorinated chemicals pose challenges to FEP production and disposal. Growing scrutiny over per- and polyfluoroalkyl substances (PFAS) has led to tighter controls on emissions and waste management. Manufacturers must comply with evolving global standards such as REACH and EPA guidelines. Developing PFAS-free alternatives while preserving FEP’s performance properties remains difficult. These regulatory hurdles may restrict production flexibility and increase compliance costs, pressuring market players to adopt cleaner technologies and invest in sustainable innovation.

Regional Analysis

North America

North America held the largest share of 35% in the fluorinated ethylene propylene (FEP) market in 2024. The region’s dominance is driven by strong demand from the electrical, aerospace, and chemical processing sectors. The U.S. leads with widespread use of FEP in high-performance wiring, semiconductors, and industrial coatings. Strict safety and emission standards promote adoption of advanced fluoropolymer materials. Ongoing investments in electric vehicle manufacturing and renewable energy infrastructure further support market expansion. Major players like Chemours and Daikin America drive innovation through enhanced production capabilities and environmentally sustainable FEP solutions.

Europe

Europe accounted for 27% of the global FEP market in 2024, supported by the region’s strong focus on environmental compliance and advanced manufacturing. Countries such as Germany, France, and the U.K. lead in automotive and aerospace applications where high-performance fluoropolymers are in demand. The European Union’s emphasis on energy efficiency and sustainability promotes the use of FEP in lightweight wiring and green technologies. Growing adoption in medical tubing and chemical-resistant coatings also supports regional growth. European manufacturers continue to invest in cleaner production technologies to align with evolving PFAS regulatory frameworks.

Asia-Pacific

Asia-Pacific held 30% share of the global FEP market in 2024 and emerged as the fastest-growing region. The expansion of electronics, automotive, and semiconductor industries in China, Japan, and South Korea is driving strong consumption. India and Southeast Asian countries are also contributing through growing investment in electrical infrastructure and industrial manufacturing. Regional players benefit from lower production costs and rising demand for high-purity FEP materials. Increasing adoption in EV batteries, telecommunications, and solar energy applications further fuels regional growth, positioning Asia-Pacific as a key hub for future FEP production and exports.

Latin America

Latin America captured 5% share of the FEP market in 2024, driven by expanding demand from chemical processing, energy, and automotive industries. Brazil and Mexico are leading markets due to increasing industrial modernization and adoption of corrosion-resistant materials. Growth in infrastructure and power distribution sectors further boosts regional demand. However, high import dependency and limited local manufacturing capabilities restrain large-scale market expansion. International suppliers are strengthening distribution networks to improve accessibility, while sustainability initiatives and industrial investments are gradually supporting FEP adoption across key Latin American economies.

Middle East & Africa

The Middle East & Africa accounted for 3% share of the global FEP market in 2024. Regional growth is supported by rising applications in oil and gas, construction, and power generation industries. The UAE and Saudi Arabia lead with large-scale energy and petrochemical projects requiring corrosion-resistant materials. Increasing demand for high-performance coatings and insulated cables further supports adoption. Efforts toward industrial diversification and renewable energy development are creating new opportunities. Ongoing infrastructure modernization and strategic collaborations with global manufacturers are expected to strengthen FEP market growth across the region.

Market Segmentations:

By Product

- Granules

- Dispersions

- Film

- Others

By Application

- Electrical & electronics sector

- Automotive

- Aerospace

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the fluorinated ethylene propylene (FEP) market is characterized by the presence of key players such as Chemours Company, Daikin Industries Ltd., 3M Company, AGC Inc., Saint-Gobain Performance Plastics, Solvay S.A., Dongyue Group Limited, HaloPolymer OJSC, Gujarat Fluorochemicals Limited, and Zhejiang Juhua Co., Ltd. These companies compete through innovation in melt-processable FEP grades, expansion of production facilities, and sustainable manufacturing practices. Leading producers focus on developing high-purity, low-emission formulations for semiconductor, electronics, and automotive applications. Strategic collaborations, mergers, and global supply chain expansions are strengthening their market positions. Manufacturers are also investing in recycling technologies and PFAS-free alternatives to comply with tightening environmental regulations. Continuous R&D in improving thermal stability, dielectric strength, and processability remains central to maintaining competitiveness in this high-performance fluoropolymer market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Chemours Company

- Daikin Industries Ltd.

- 3M Company

- AGC Inc.

- Saint-Gobain Performance Plastics

- Solvay S.A.

- Dongyue Group Limited

- HaloPolymer OJSC

- Gujarat Fluorochemicals Limited

- Zhejiang Juhua Co., Ltd.

Recent Developments

- In May 2025, Chemours announced an agreement with Navin Fluorine to manufacture a new liquid-cooling product as part of Chemours’ expanded liquid-cooling venture.

- In Aug 2024, AGC publicized development of a lower-impact surfactant-free fluoropolymer manufacturing technology being developed toward industrial scale (relevant to fluoropolymers such as FEP/related products).

- In May 2024, Daikin exhibited and promoted fluorochemical solutions (including FEP products) at the Automotive Engineering Exposition 2024 Daikin’s product pages also document their FEP product line.

Report Coverage

The research report offers an in-depth analysis based on Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The fluorinated ethylene propylene (FEP) market will grow steadily driven by rising industrial applications.

- Increasing demand from electronics and semiconductor manufacturing will remain a key growth factor.

- The automotive sector will adopt more FEP materials for electric vehicle wiring and insulation.

- Advancements in melt-processable and high-purity grades will enhance product performance.

- Manufacturers will focus on PFAS-free and recyclable FEP formulations to meet regulations.

- Asia-Pacific will record the fastest growth due to rapid industrialization and export capacity expansion.

- North America will maintain dominance supported by advanced technology and strong R&D investment.

- Europe will drive sustainability-focused innovation in fluoropolymer production and usage.

- Strategic partnerships and capacity expansions will strengthen global supply networks.

- Continuous R&D in eco-friendly and high-performance FEP materials will define future market competitiveness.