Market Overview

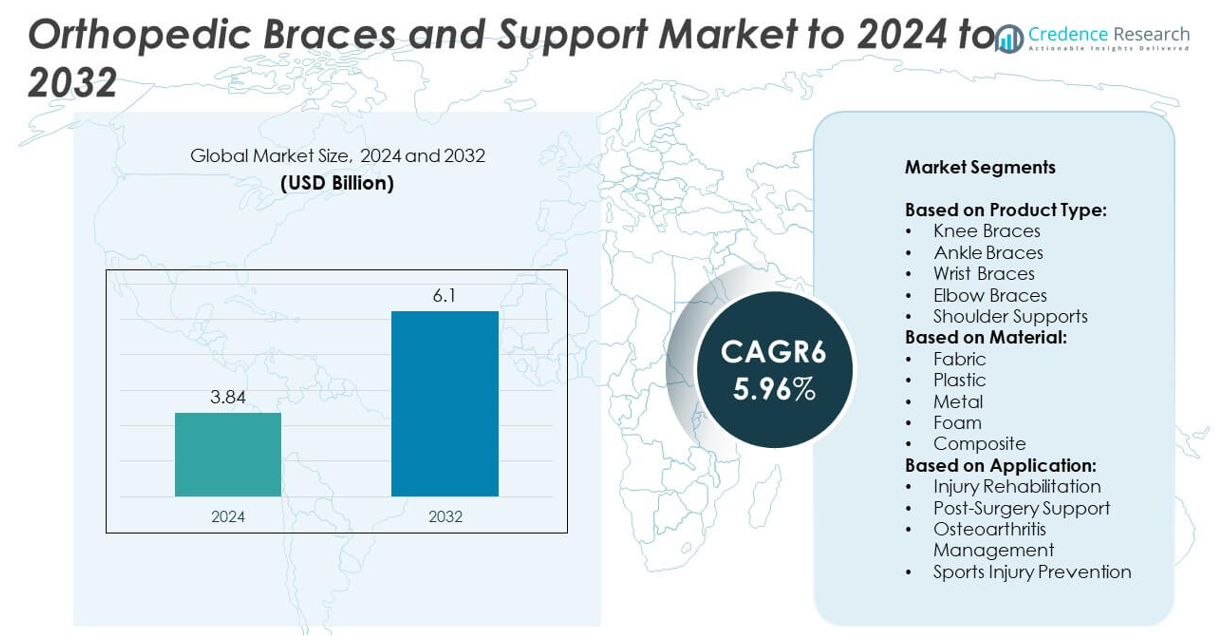

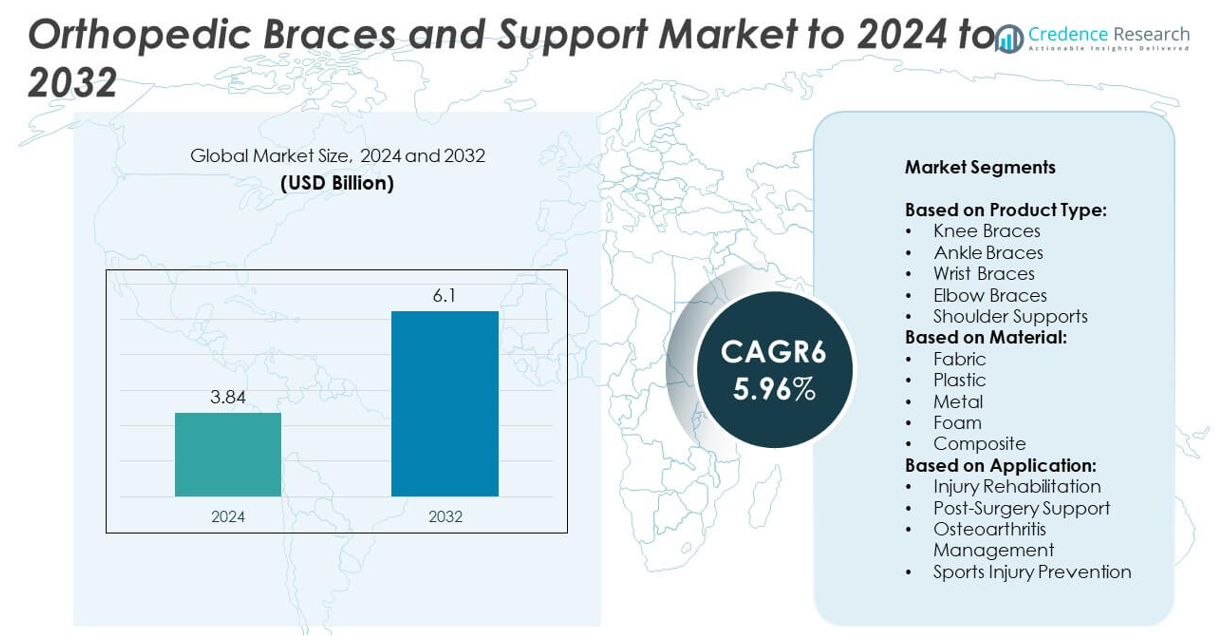

The orthopedic braces and support market size was valued at USD 3.84 billion in 2024 and is anticipated to reach USD 6.1 billion by 2032, at a CAGR of 5.96% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2019-2022 |

| Base Year |

2023 |

| Forecast Period |

2024-2032 |

| Orthopedic Braces and Supports Market Size 2024 |

USD 3.84 billion |

| Orthopedic Braces and Supports Market, CAGR |

5.96% |

| Orthopedic Braces and Supports Market Size 2032 |

USD 6.1 billion |

The orthopedic braces and support market is shaped by prominent players including Zimmer Biomet, Boston Scientific, 3M, Bauerfeind, Stryker, Medtronic, DJO Global, DeRoyal Industries, Hanger, Smith and Nephew, Breg, Tynor Orthotics, and Geneva Healthcare. These companies focus on innovation in materials, ergonomic designs, and digital distribution platforms to strengthen their competitive positions. North America emerged as the leading region in 2024, commanding 38% of the global market share, driven by advanced healthcare infrastructure, favorable reimbursement policies, and high adoption of technologically advanced braces. Europe followed with 30% share, supported by aging populations and preventive healthcare initiatives.

Market Insights

- The orthopedic braces and support market was valued at USD 3.84 billion in 2024 and is projected to reach USD 6.1 billion by 2032, growing at a CAGR of 5.96%.

- Rising prevalence of musculoskeletal disorders, sports injuries, and osteoarthritis is driving strong demand for knee braces, which held over 35% share in 2024.

- Key trends include increasing adoption of fabric-based braces, accounting for 40% share, and the growing use of e-commerce platforms to improve product accessibility and reach.

- The market is highly competitive with players investing in lightweight materials, ergonomic designs, and digital solutions to strengthen positioning, while high costs of advanced braces limit adoption in price-sensitive regions.

- North America led the global market with 38% share in 2024, followed by Europe with 30%, while Asia Pacific captured 22% and emerged as the fastest-growing region due to rising healthcare spending and expanding patient awareness.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Knee braces held the dominant share of the orthopedic braces and support market in 2024, accounting for over 35% of the total revenue. Their leadership stems from widespread use in osteoarthritis management, ligament injuries, and post-operative recovery. Increasing sports participation and rising prevalence of knee-related conditions further drive demand. Ankle and wrist braces also see significant adoption due to rising cases of sprains and fractures, while shoulder and elbow supports are gaining traction in rehabilitation and sports injury management, expanding the segment’s contribution across hospitals and homecare settings.

- For instance, Breg serves over 1 million patients annually through its network of over 2,500 clinics, 6,000 orthopedic surgeons, and 1,500 Integrated Delivery Networks (IDNs).

By Material

Fabric-based braces accounted for the largest share, holding around 40% of the orthopedic braces and support market in 2024. Their dominance is attributed to comfort, flexibility, and breathability, making them preferred for long-term use in osteoarthritis and post-surgical recovery. Foam and composites follow due to their lightweight and customizable properties, while plastic and metal braces remain vital in providing rigid support for severe injuries. Growing demand for advanced composite materials that combine strength with patient comfort supports market expansion, particularly in specialized sports and rehabilitation applications.

- For instance, DeRoyal manufactures 25,000+ healthcare products, including rigid braces.

By Application

Injury rehabilitation emerged as the leading application, capturing over 38% of the orthopedic braces and support market in 2024. Rising cases of sports injuries, accidents, and trauma drive this dominance. Post-surgery support ranks next, fueled by an increasing number of orthopedic procedures and growing focus on enhanced recovery. Osteoarthritis management also contributes strongly, supported by an aging population and lifestyle-related joint conditions. Sports injury prevention is steadily growing, driven by higher adoption of braces among athletes and fitness enthusiasts for protection and performance sustainability.

Key Growth Drivers

Rising Prevalence of Musculoskeletal Disorders

The growing burden of musculoskeletal disorders such as osteoarthritis and ligament injuries is a major driver of the orthopedic braces and support market. Increasing sedentary lifestyles, obesity, and aging populations contribute to joint deterioration, creating consistent demand for braces. Knee and ankle braces are especially in demand as they support mobility and pain management. This rise in chronic and degenerative joint conditions ensures steady adoption across hospitals, orthopedic centers, and homecare settings, making it a primary growth factor for the industry.

- For instance, Embla Medical, formerly known as Össur, operates in more than 36 countries with approximately 4,000 employees. It supplies orthopedic braces and other mobility solutions for musculoskeletal conditions to healthcare providers worldwide, including hospitals and clinics. The company officially rebranded from Össur to Embla Medical in April 2024.

Growing Sports Participation and Injury Incidences

Expanding global interest in sports and fitness activities has led to a higher number of sports-related injuries, boosting the demand for orthopedic braces. Athletes and fitness enthusiasts use braces for both rehabilitation and injury prevention. With rising participation in professional and recreational sports, demand for supportive devices like knee, ankle, and wrist braces continues to grow. The trend is further supported by awareness campaigns from sports associations and orthopedic specialists, highlighting the importance of braces in recovery and performance enhancement.

- For instance, DonJoy, a brand of Enovis Corporation, distributes its sports braces across 44 countries, making them widely available to athletes for injury care and prevention. The company leverages Enovis’ global network of partners and distributors to ensure availability for athletes worldwide.

Technological Advancements in Product Design

Innovations in materials and ergonomic designs significantly contribute to market growth by improving patient compliance and outcomes. Modern braces integrate lightweight composites, breathable fabrics, and adjustable features, providing both comfort and durability. Some products are also adopting digital technologies, such as smart sensors, to track rehabilitation progress. These advancements attract both healthcare providers and patients seeking effective and user-friendly solutions. The shift toward customizable and patient-centric designs is strengthening demand, positioning product innovation as a critical growth driver in this industry.

Key Trends & Opportunities

Expansion of E-commerce and Retail Distribution

The rising penetration of e-commerce platforms presents a strong opportunity for orthopedic braces manufacturers. Online channels enable broader accessibility and allow patients to compare products, consult experts, and receive home delivery. This trend is especially significant for non-critical braces used in sports injury prevention and daily support. Pharmacies and retailers continue to play a vital role, but digital platforms are reshaping the distribution landscape. This shift expands consumer reach, drives competitive pricing, and encourages product diversification to meet growing global demand.

- For instance, Thuasne sells its products in 110 countries through its network, which included 19 subsidiaries and nearly 200 distributors in 2024.

Focus on Preventive Healthcare and Lifestyle Management

A growing emphasis on preventive healthcare is creating opportunities in the orthopedic braces market. Increasing awareness about sports injury prevention, workplace ergonomics, and maintaining mobility in older populations has boosted adoption of braces beyond traditional medical settings. Braces designed for daily use are gaining traction among health-conscious consumers. Companies focusing on lightweight, discreet, and lifestyle-compatible designs are well positioned to capture this segment. This trend also complements the rising popularity of fitness and wellness programs across both developed and emerging markets.

- For instance, Decathlon operated 1,817 stores across 79 countries in 2024, with local e-commerce services.

Key Challenges

High Cost of Advanced Braces

The high cost of technologically advanced braces limits widespread adoption, especially in price-sensitive markets. Products that incorporate innovative materials, ergonomic adjustments, or smart sensors often come at a premium, restricting access for low-income patients. This challenge is more pronounced in developing regions where reimbursement support is limited. Although basic fabric and foam braces remain affordable, patients requiring specialized rehabilitation solutions face significant cost barriers. This pricing gap creates uneven adoption and poses a challenge for manufacturers targeting global expansion.

Limited Reimbursement Policies

In many regions, inadequate reimbursement coverage restricts patients from accessing orthopedic braces, particularly advanced models. While some countries provide partial support, most insurance systems consider braces non-essential or secondary care, leaving patients to pay out-of-pocket. This financial burden reduces adoption rates, especially among aging populations and those in long-term rehabilitation. Manufacturers face challenges in expanding their market without favorable reimbursement frameworks. Limited policy support not only slows demand growth but also discourages investment in innovative, higher-value brace technologies.

Regional Analysis

North America

North America held the largest share of the orthopedic braces and support market in 2024, accounting for 38% of global revenue. High prevalence of osteoarthritis, sports injuries, and obesity drives consistent demand in the region. Strong healthcare infrastructure, favorable reimbursement policies, and wide adoption of technologically advanced braces support growth. The United States dominates the regional market due to increasing surgical procedures and higher consumer awareness. Canada follows with steady adoption in both rehabilitation and preventive applications. Continuous investments in product innovation and expansion of e-commerce distribution channels further strengthen regional leadership.

Europe

Europe captured 30% of the orthopedic braces and support market in 2024, driven by growing aging populations and rising cases of musculoskeletal disorders. Countries such as Germany, France, and the United Kingdom are leading contributors, supported by advanced healthcare systems and supportive government initiatives. Adoption of preventive healthcare measures and rising awareness about sports injury management also contribute significantly. The presence of key market players and technological innovation enhances product accessibility. Expanding e-commerce channels, combined with increasing focus on mobility aids for older adults, reinforce Europe’s position as a strong market for orthopedic braces and support.

Asia Pacific

Asia Pacific accounted for 22% of the orthopedic braces and support market in 2024, emerging as the fastest-growing regional segment. Rising healthcare investments, expanding middle-class populations, and higher prevalence of road accidents and sports injuries are key growth drivers. China, Japan, and India lead the market, supported by growing adoption of modern orthopedic treatments. Increasing awareness about lifestyle-related joint disorders and the need for cost-effective rehabilitation products fuel demand. Local manufacturing capabilities and the expansion of e-commerce platforms enhance accessibility, positioning Asia Pacific as a significant growth hub for future orthopedic brace adoption.

Latin America

Latin America represented 6% of the orthopedic braces and support market in 2024, with growth driven by increasing awareness of orthopedic conditions and gradual improvements in healthcare infrastructure. Brazil and Mexico dominate regional demand, supported by a rising number of surgical procedures and higher adoption of sports injury management solutions. However, limited reimbursement support and cost sensitivity remain key challenges. Expanding retail distribution and the entry of international players provide opportunities for greater accessibility. The growing emphasis on preventive care and rehabilitation programs is expected to drive steady adoption in the coming years.

Middle East and Africa

The Middle East and Africa accounted for 4% of the orthopedic braces and support market in 2024, reflecting modest but growing demand. Rising healthcare investments, particularly in the Gulf countries, support the adoption of orthopedic solutions. Increasing prevalence of lifestyle-related disorders, accidents, and sports activities contribute to regional demand. However, affordability and limited insurance coverage restrict widespread use, especially in parts of Africa. Growth opportunities exist through government healthcare initiatives and expanding private hospital infrastructure. International manufacturers focusing on affordable and durable braces are expected to gain traction in the region over time.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Product Type:

- Knee Braces

- Ankle Braces

- Wrist Braces

- Elbow Braces

- Shoulder Supports

By Material:

- Fabric

- Plastic

- Metal

- Foam

- Composite

By Application:

- Injury Rehabilitation

- Post-Surgery Support

- Osteoarthritis Management

- Sports Injury Prevention

By Geography:

North America

Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

Latin America

- Brazil

- Argentina

- Rest of Latin America

Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The orthopedic braces and support market is highly competitive, with leading players such as Zimmer Biomet, Boston Scientific, Geneva Healthcare, 3M, Bauerfeind, Smith and Nephew, Breg, Stryker, Hanger, DeRoyal Industries, Medtronic, Tynor Orthotics, DJO Global, and Knee Braces shaping the industry landscape. Companies focus on innovation in materials and ergonomic designs to enhance patient comfort and compliance, while also expanding digital platforms for product distribution. Strong emphasis is placed on integrating lightweight composites, breathable fabrics, and customizable solutions to meet diverse rehabilitation and preventive care needs. Strategic collaborations with healthcare providers and sports organizations further strengthen brand visibility. Regional expansions, particularly in Asia Pacific and Latin America, are pursued to tap into rising demand from aging populations and growing healthcare access. Competitive rivalry is marked by continuous product launches, investments in R&D, and the pursuit of affordability and accessibility, ensuring steady growth across both developed and emerging markets.

Key Player Analysis

- Zimmer Biomet

- Boston Scientific

- Geneva Healthcare

- 3M

- Bauerfeind

- Smith and Nephew

- Breg

- Stryker

- Hanger

- DeRoyal Industries

- Medtronic

- Tynor Orthotics

- DJO Global

- Knee Braces

Recent Developments

- In 2025, Zimmer Biomet officially launched its latest orthopedic innovations in India, including mymobility, an AI-powered digital care management platform.

- In December 2023, Tynor inaugurated a new manufacturing facility in Punjab, India, to produce a wider range of healthcare solutions, including advanced knee braces.

- In March 2023, Breg partnered with HealthMe to launch a direct-pay solution for orthopedic cold therapy products, making them more accessible to patients.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily, driven by rising musculoskeletal disorders worldwide.

- Knee braces will continue to dominate demand due to their broad medical applications.

- Fabric-based braces will retain leadership with strong patient comfort and affordability.

- Injury rehabilitation will remain the largest application segment in the forecast period.

- Asia Pacific will witness the fastest growth supported by rising healthcare investments.

- E-commerce platforms will enhance product accessibility and expand consumer reach.

- Technological innovation will introduce lighter, more ergonomic, and sensor-enabled braces.

- Preventive healthcare adoption will increase demand for sports injury protection devices.

- High costs of advanced braces will remain a restraint in developing regions.

- Strategic partnerships and product customization will shape competitive growth opportunities.