Market Overview

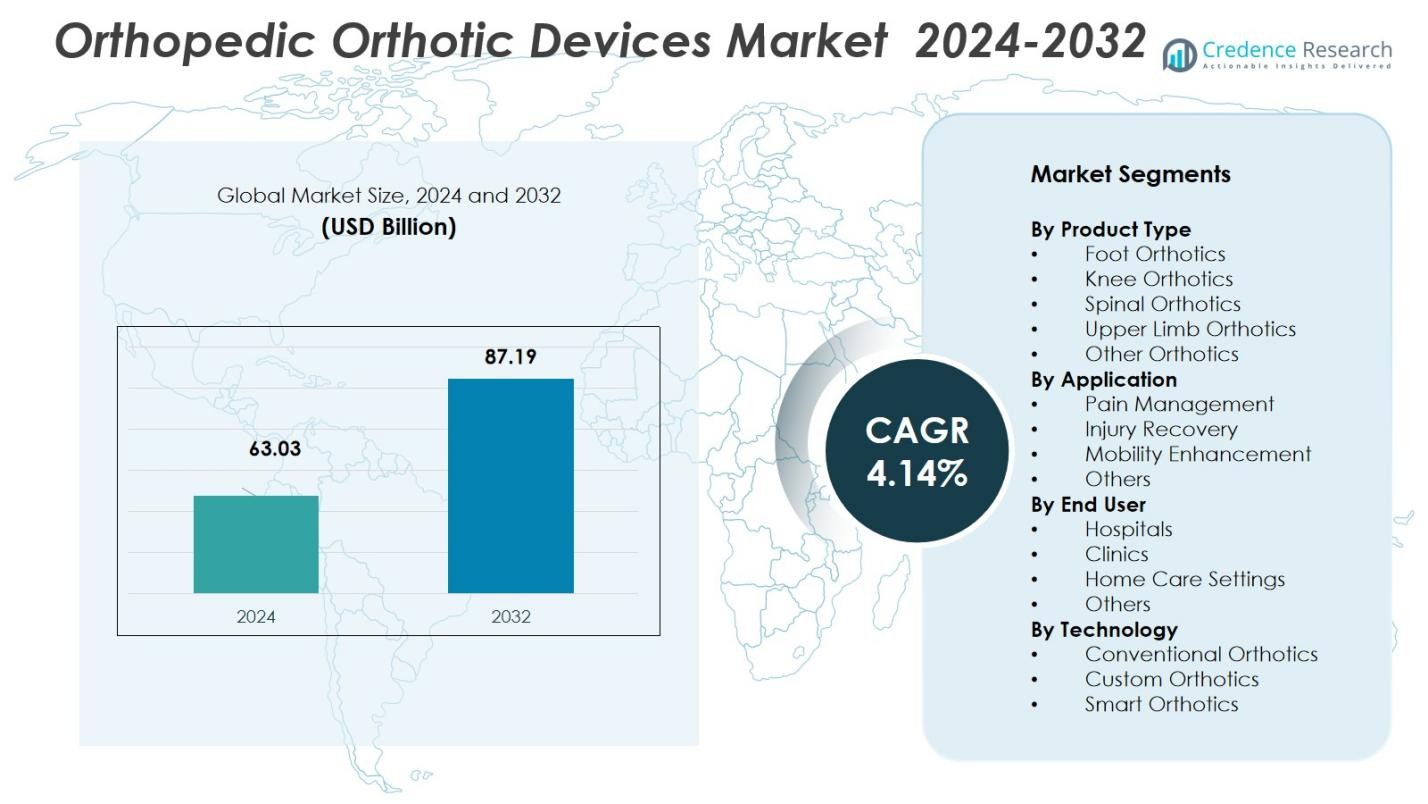

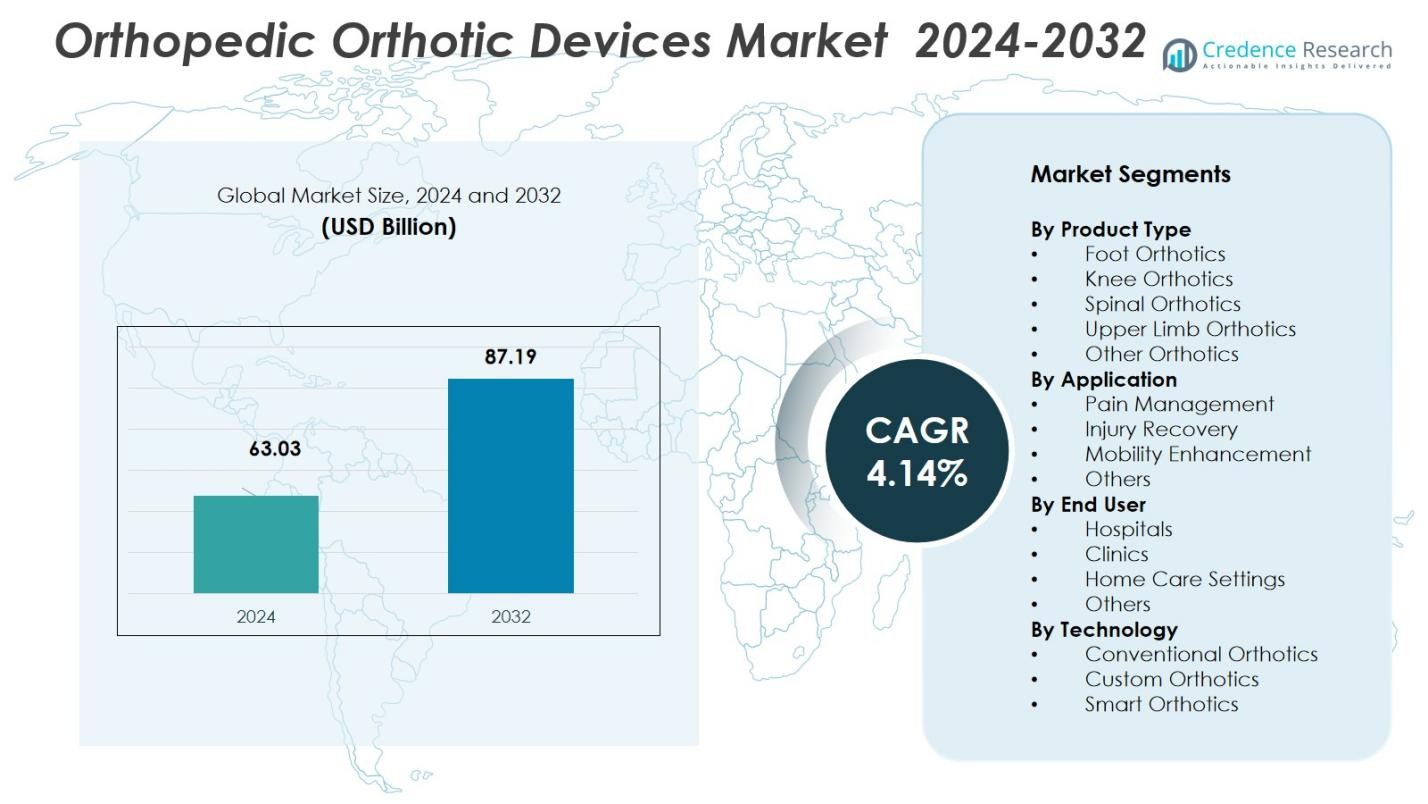

The Orthopedic Orthotic Devices Market size was valued at USD 63.03 billion in 2024 and is anticipated to reach USD 87.19 billion by 2032, at a CAGR of 4.14% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Orthopedic Orthotic Devices Market Size 2024 |

USD 63.03 Billion |

| Orthopedic Orthotic Devices Market, CAGR |

4.14% |

| Orthopedic Orthotic Devices Market Size 2032 |

USD 87.19 Billion |

The Orthopedic Orthotic Devices Market is led by key players such as Össur, DJO Global, Ottobock, Breg, Inc., DeRoyal Industries, Thuasne Group, Hanger, Inc., Fillauer LLC, Allard USA, and Bauerfeind AG. These companies dominate the market through their extensive product portfolios, advanced technology integration, and global presence. North America holds the largest market share at 38.6% in 2024, driven by the high prevalence of musculoskeletal disorders, an aging population, and robust healthcare infrastructure. Europe follows with 30.2%, fueled by an increasing elderly population and rising healthcare awareness. The Asia Pacific region is witnessing rapid growth, accounting for 20.4% of the market share, attributed to improving healthcare systems and growing demand for orthopedic solutions in emerging economies. These regions, alongside significant investments in technological advancements, are expected to drive continued growth in the orthopedic orthotic devices market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Orthopedic Orthotic Devices Market size was valued at USD 63.03 billion in 2024 and is anticipated to reach USD 87.19 billion by 2032, at a CAGR of 4.14%

- Growing burden of musculoskeletal disorders and ageing populations globally drive demand, with Foot Orthotics leading at 32.5% share in 2024.

- Rising interest in preventive care and enhanced mobility fuels uptake of lightweight, customizable orthotic devices, particularly among elderly and physically active populations.

- Major firms such as Össur, DJO Global, Ottobock, Breg, Inc., and others expand global presence and product innovation, reinforcing leadership across key markets.

- Regional dynamics reflect North America holding 38.6% share, Europe 30.2%, and Asia Pacific 20.4% in 2024; restraints include high device costs and limited insurance coverage in emerging regions.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product Type

The Foot Orthotics sub‑segment holds a dominant share, accounting for 32.5% of the market in 2024 by product type, driven by growing consumer awareness of foot health and increasing demand for insoles to prevent or manage plantar fasciitis, flat feet, and diabetic foot‑related complications. The growing emphasis on non‑invasive musculoskeletal support and preventive orthopedic care boosts the adoption of foot orthotics among both patients and comfort‑seeking consumers. Meanwhile, rising prevalence of obesity, aging population, and sports‑related foot injuries contribute significantly to demand growth for foot orthotic devices globally.

- For instance, Superfeet has introduced custom-fit insoles using 3D printing technology to reduce plantar pressure and enhance comfort, particularly for diabetic patients and athletes requiring precise biomechanical support.

By Application

Within the Application segmentation, Pain Management emerges as the dominant sub‑segment, holding 41.2% of the market share, propelled by the rising incidence of chronic musculoskeletal disorders, osteoarthritis, and degenerative conditions worldwide. The non‑invasive nature of orthotic devices makes them a preferred first‑line intervention to relieve pain, improve joint alignment, and provide support without the need for surgery. Additionally, the increasing geriatric population and prolonged sedentary lifestyles amplify demand for orthotic devices aimed at managing pain and preventing further deterioration of musculoskeletal health.

- For instance, Össur’s Unloader One knee brace is clinically proven to reduce pain and improve mobility for osteoarthritis patients by unloading pressure from the affected joint.

By End User

The Hospitals end‑user segment maintains its lead as the dominant channel for orthopedic orthotic devices, holding 47.3% of the market in 2024, owing to its well‑established infrastructure, availability of trained orthopedic practitioners, and high patient inflow for diagnosis and treatment of musculoskeletal conditions. Hospitals remain the primary recommendation source for orthotic prescriptions and fitting, reinforcing their position as the largest end‑user. Moreover, rising orthopedic cases, post‑operative rehabilitation demand, and growing adoption of orthotic therapy in hospital settings particularly in developed healthcare markets further strengthen the hospitals segment’s dominance.

Key Growth Drivers

Increasing Prevalence of Musculoskeletal Disorders

The rising prevalence of musculoskeletal disorders, such as osteoarthritis, rheumatoid arthritis, and degenerative joint diseases, is a major growth driver for the orthopedic orthotic devices market. As the global population ages, the incidence of these conditions continues to climb, creating a larger patient pool that requires long‑term management and support. Orthotic devices are becoming an integral part of treatment plans, offering non‑invasive solutions for pain relief, mobility improvement, and injury prevention, thus fueling the demand for these products across various regions.

- For instance, Bauerfeind’s GenuTrain knee brace, clinically recognized for improving stability and aiding rehabilitation in degenerative joint diseases, continues to see increased adoption among orthopedic patients seeking non-invasive relief.

Growing Awareness of Preventive Healthcare

With an increasing focus on preventive healthcare, individuals are becoming more proactive in managing their health, particularly when it comes to musculoskeletal well-being. The demand for orthotic devices is being driven by awareness campaigns and education around the benefits of early intervention in managing joint pain and preventing future injuries. As consumers seek to maintain active lifestyles and avoid the need for invasive treatments or surgery, the adoption of orthopedic orthotics as a preventive measure continues to rise, contributing significantly to market expansion.

Advances in Material Technology

Innovations in materials and manufacturing techniques are revolutionizing the orthopedic orthotic devices market. The development of lightweight, breathable, and durable materials has led to more comfortable and effective orthotics. New technologies, such as 3D printing, are enhancing customization options, allowing for a better fit and improved performance. These advancements provide enhanced comfort, better patient compliance, and quicker recovery times, further propelling the demand for orthopedic orthotics across various demographics, particularly in the aging population.

- For instance, Ottobock developed the C-Brace®, a microprocessor-controlled orthotic offering dynamic support that adapts to different walking conditions, improving mobility and recovery outcomes.

Key Trends & Opportunities

Integration of Smart Technology

One of the key trends in the orthopedic orthotic devices market is the integration of smart technology into devices for enhanced functionality. Wearable orthotics, such as smart insoles and braces, are being equipped with sensors to track movement, pressure, and other relevant metrics in real time. This data is used to monitor patient progress, adjust treatment plans, and even prevent further injury. The growing interest in digital health solutions presents a significant opportunity for companies to innovate and provide smarter, more personalized orthopedic care.

- For instance, Zimmer Biomet has pioneered smart orthopedic implants with FDA-approved smart knee implants that provide real-time data to monitor patient recovery and optimize treatment plans.

Growing Demand in Emerging Markets

As healthcare systems improve in emerging economies, there is a growing demand for orthopedic solutions, including orthotic devices. Rising disposable incomes, expanding healthcare infrastructure, and an increasing focus on quality of life have contributed to an uptick in the adoption of orthopedic products in regions such as Asia Pacific, Latin America, and the Middle East. With the increasing prevalence of chronic diseases, lifestyle-related injuries, and aging populations in these regions, there is significant untapped potential for growth in the orthopedic orthotics market.

- For instance, Johnson & Johnson’s DePuy Synthes offers globally utilized, premium knee implant systems in India, such as the ATTUNE and SIGMA models, which have seen wide adoption due to their advanced design and proven clinical outcomes.

Key Challenges

High Cost of Advanced Orthotic Devices

One of the major challenges facing the orthopedic orthotic devices market is the high cost of advanced, customized orthotic solutions. While innovations in materials and smart technology are improving the effectiveness and comfort of devices, they also increase the cost of production. This can make orthopedic orthotics less accessible for lower‑income populations and in regions with limited healthcare budgets. The need for affordability and insurance coverage remains a significant hurdle to widespread adoption, particularly in developing countries.

Regulatory Challenges and Compliance

The orthopedic orthotic devices market faces regulatory challenges that vary across regions. Compliance with diverse regulatory requirements, such as those set by the FDA, CE Mark, and other global health authorities, can delay product development and market entry. Ensuring that devices meet safety, efficacy, and quality standards requires significant investment in research and testing. The complexity of regulatory approvals, particularly in new and emerging technologies, can slow down innovation and market penetration, presenting a key challenge for manufacturers.

Regional Analysis

North America

North America dominates the orthopedic orthotic devices market, accounting for 38.6% of the global market share in 2024. The region’s strong market position is driven by the increasing prevalence of musculoskeletal disorders, an aging population, and high healthcare spending. Advanced healthcare infrastructure, along with a high adoption rate of innovative orthotic solutions, further fuels demand. The presence of key industry players and a well-established reimbursement system for orthopedic devices in the U.S. enhance market growth. Additionally, ongoing advancements in materials and 3D printing technology are expected to further accelerate market expansion in the region.

Europe

Europe holds a significant share of the orthopedic orthotic devices market, representing 30.2% of the total market in 2024. Factors such as a growing elderly population, rising healthcare expenditure, and an increasing awareness of musculoskeletal health contribute to market growth. The region benefits from a robust healthcare system and widespread availability of orthopedic services. Additionally, technological advancements in device materials and an increasing focus on preventive healthcare are propelling demand. The market is expected to experience steady growth, driven by government investments in healthcare infrastructure and the rising adoption of advanced orthotic solutions.

Asia Pacific

The Asia Pacific region is expected to witness significant growth in the orthopedic orthotic devices market, capturing 20.4% of the market share in 2024. This growth is attributed to the rising incidence of chronic diseases, lifestyle-related injuries, and an aging population in key countries such as China, India, and Japan. The growing middle-class population, improved healthcare infrastructure, and increased disposable income are driving the demand for orthopedic solutions. Additionally, the rising awareness of musculoskeletal disorders and the adoption of preventive care measures are expected to contribute to the expansion of the market in this region.

Latin America

Latin America accounts for 6.3% of the orthopedic orthotic devices market in 2024. The market in this region is expanding due to the increasing prevalence of musculoskeletal conditions, the aging population, and rising healthcare awareness. Governments in key countries such as Brazil and Mexico are investing in healthcare reforms, enhancing accessibility to orthopedic treatments. However, the market faces challenges such as affordability and healthcare infrastructure limitations. Despite these barriers, there is significant potential for growth, driven by increased healthcare spending and demand for advanced medical devices in urban and semi-urban areas.

Middle East & Africa

The Middle East and Africa (MEA) region holds 4.5% of the orthopedic orthotic devices market share in 2024. The market is experiencing moderate growth due to factors such as an increasing incidence of musculoskeletal disorders and rising healthcare awareness in countries like the UAE, Saudi Arabia, and South Africa. The region’s growing healthcare infrastructure, combined with government initiatives to improve access to orthopedic treatments, is expected to drive further growth. However, challenges such as economic disparities, lack of widespread healthcare access in rural areas, and high costs of advanced devices may hinder faster market expansion in certain regions.

Market Segmentations:

By Product Type

- Foot Orthotics

- Knee Orthotics

- Spinal Orthotics

- Upper Limb Orthotics

- Other Orthotics

By Application

- Pain Management

- Injury Recovery

- Mobility Enhancement

- Others

By End User

- Hospitals

- Clinics

- Home Care Settings

- Others

By Technology

- Conventional Orthotics

- Custom Orthotics

- Smart Orthotics

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive analysis in the orthopedic orthotic devices market reveals a dynamic landscape with key players such as Össur, DJO Global, Ottobock, Breg, Inc., DeRoyal Industries, Thuasne Group, Hanger, Inc., Fillauer LLC, Allard USA, and Bauerfeind AG dominating the industry. These companies leverage advanced technologies, such as 3D printing and smart sensors, to develop highly customized and effective orthotic solutions. The market is characterized by strong competition driven by product innovation, strategic acquisitions, and collaborations. Leading players focus on enhancing product offerings by integrating smart technology into orthotic devices, improving functionality, and increasing patient compliance. Furthermore, companies are expanding their market presence by targeting emerging economies, where the demand for orthopedic solutions is growing rapidly. The market also witnesses mergers and partnerships, allowing key players to broaden their product portfolios and expand their reach. Price competition and the need for cost-effective solutions remain key considerations in the market’s competitive dynamics.

Key Player Analysis

- DeRoyal Industries

- Hanger, Inc.

- Ottobock

- Fillauer LLC

- Bauerfeind AG

- Breg, Inc.

- Allard USA

- DJO Global

- Thuasne Group

- Össur

Recent Developments

- In January 2025, Aspen Medical Products acquired Advanced Orthopaedics, expanding its portfolio of spine and orthopedic soft‑goods.

- In January 2024, OrthoPediatrics Corp. acquired Boston Orthotics & Prosthetics, strengthening its pediatric orthotics business.

- In November 2025, Advita Ortho officially launched as a new global medical‑device company focused on orthopedic technologies, signaling fresh competition and potential innovations in orthotic and implant solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End User, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The orthopedic orthotic devices market is expected to continue growing steadily due to the increasing prevalence of musculoskeletal disorders and an aging population globally

- Advances in material technologies, such as lightweight, durable, and breathable materials, will drive the development of more comfortable and effective devices.

- The integration of smart technologies, including sensors and wearable devices, will enhance the functionality and personalization of orthotics, improving patient outcomes.

- The rising demand for preventive healthcare and non-invasive treatments will further boost the adoption of orthopedic orthotic devices.

- Increasing healthcare awareness, particularly in emerging markets, will create new opportunities for market expansion and product penetration.

- The adoption of 3D printing and customization technologies will enable more precise fitting and tailored orthopedic solutions for patients.

- Strategic collaborations, partnerships, and acquisitions among key players will lead to the development of innovative products and broader market reach.

- A growing emphasis on rehabilitation and post-surgery care will support the increasing use of orthopedic orthotic devices.

- The market is likely to see greater integration of digital health solutions, with devices offering real-time monitoring and feedback.

- Rising disposable incomes and improved healthcare access in developing countries will contribute significantly to the market’s growth in these regions.

Market Segmentation Analysis:

Market Segmentation Analysis: