Market Overview

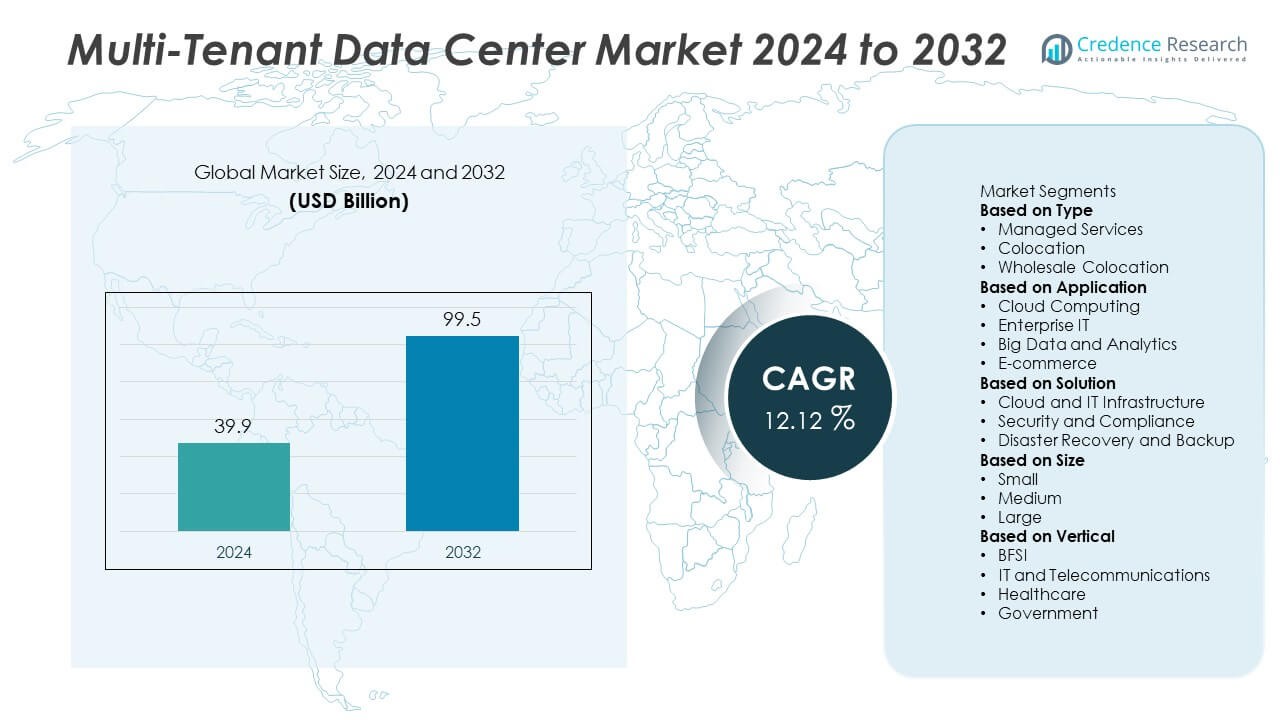

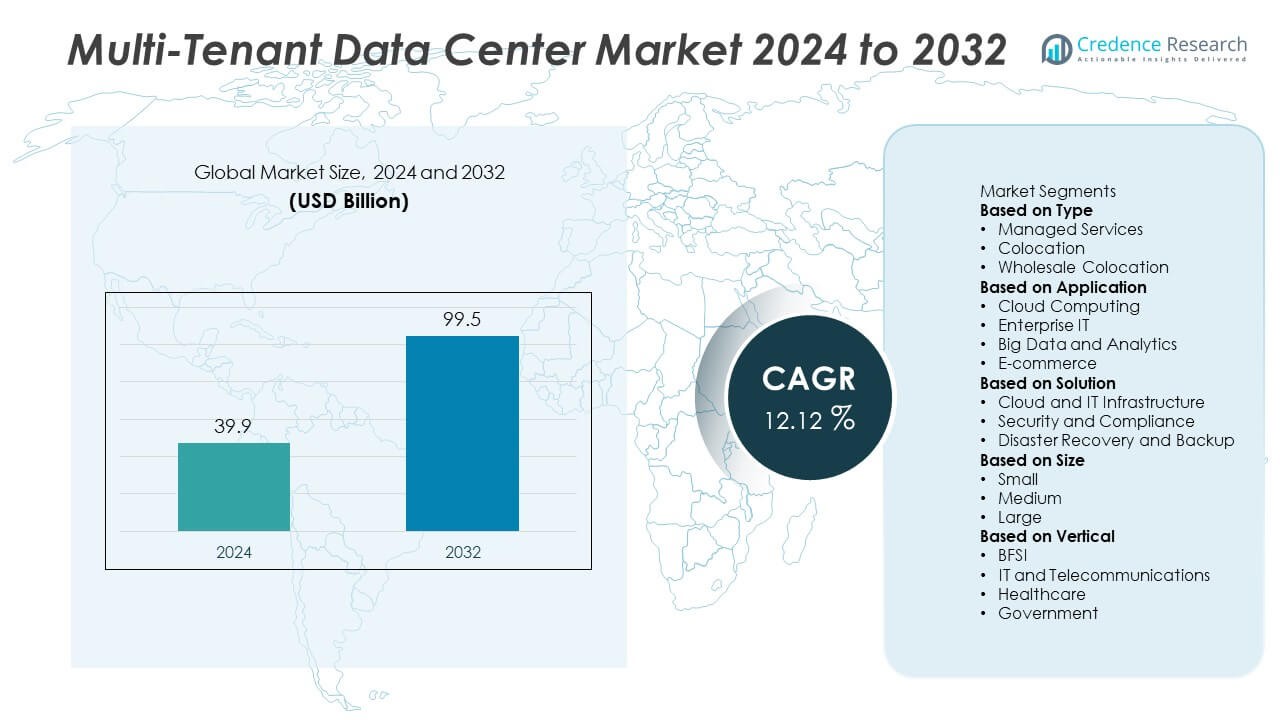

The Multi-Tenant Data Center Market was valued at USD 39.9 billion in 2024 and is projected to reach USD 99.5 billion by 2032, expanding at a CAGR of 12.12% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Multi-Tenant Data Center Market Size 2024 |

USD 39.9 Billion |

| Multi-Tenant Data Center Market, CAGR |

12.12% |

| Multi-Tenant Data Center Market Size 2032 |

USD 99.5 Billion |

The Multi-Tenant Data Center Market grows rapidly, driven by rising cloud adoption, digital transformation, and strong demand for cost-efficient infrastructure. Enterprises seek scalability, security, and operational flexibility while avoiding large capital investments in private data centers.

The Multi-Tenant Data Center Market shows strong presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America leads with robust infrastructure, advanced digital adoption, and concentration of hyperscale providers. Europe emphasizes sustainability and regulatory compliance, supported by major hubs in Frankfurt, London, Amsterdam, and Paris. Asia-Pacific emerges as the fastest-growing region, driven by rapid digitalization, rising mobile penetration, and expansion of cloud providers in China, India, and Japan. Latin America and the Middle East & Africa expand steadily through increasing investments in colocation and edge facilities. Key players shaping the competitive landscape include Equinix, a global leader in interconnection services, Digital Realty, known for large-scale colocation and wholesale offerings, and NTT, which expands through global networks and advanced solutions. Other significant contributors such as Interxion and Iron Mountain continue to strengthen their positions through strategic expansions and technology-driven innovations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Multi-Tenant Data Center Market was valued at USD 39.9 billion in 2024 and is projected to reach USD 99.5 billion by 2032, growing at a CAGR of 12.12%.

- Growth is supported by increasing adoption of cloud services and rising demand for scalable, cost-efficient infrastructure across enterprises of all sizes.

- Key trends highlight expansion of hyperscale and edge facilities, integration of renewable energy, and deployment of advanced cooling solutions to support high-density workloads.

- Competition intensifies with global players such as Equinix, Digital Realty, NTT, and Interxion expanding their global footprints through acquisitions, partnerships, and technology upgrades.

- High operational costs, power shortages in certain regions, and complex regulatory compliance requirements act as restraints for sustained growth.

- North America leads with advanced infrastructure and hyperscale investments, Europe emphasizes sustainability and regulatory compliance, while Asia-Pacific shows the fastest growth through rapid digital adoption and mobile penetration.

- Emerging markets in Latin America and the Middle East & Africa present opportunities, with increasing investments in colocation, cloud services, and edge facilities, supported by government-led digital transformation programs.

Market Drivers

Rising Adoption of Cloud Services and Digital Transformation Initiatives

The Multi-Tenant Data Center Market benefits from the rapid expansion of cloud computing across industries. Enterprises shift workloads to shared infrastructure to reduce costs and increase scalability. Digital transformation strategies encourage organizations to modernize IT operations through flexible and secure data hosting. It creates strong demand for facilities that deliver reliable connectivity and high computing capacity. Global enterprises require agile infrastructure to support hybrid and multi-cloud models. The trend supports continuous investments in colocation and shared environments.

- For instance, As of late 2024 and mid-2025, Equinix owns and operates a network of approximately 270 data centers located in 75 major metropolitan areas worldwide, serving over 10,000 customers who connect across its global platform.

Growing Demand for Cost Efficiency and Operational Flexibility

Companies seek to minimize capital expenditure by avoiding large upfront investments in private data centers. The Multi-Tenant Data Center Market addresses this challenge by offering shared infrastructure with predictable costs. Businesses achieve operational flexibility by scaling resources based on dynamic needs. It enables smaller enterprises to access high-performance infrastructure without heavy financial commitments. Large organizations also benefit from streamlined operations and efficient resource allocation. The model strengthens adoption across diverse sectors from banking to healthcare.

- For instance, Digital Realty manages over 300 facilities across six continents with more than 5,000 global customers relying on its colocation services to optimize operating expenses.

Expansion of Data Traffic from IoT, AI, and Big Data Applications

The rise of IoT devices, AI-driven tools, and data-intensive applications drives higher network traffic. The Multi-Tenant Data Center Market responds by enhancing storage capacity and connectivity solutions. Enterprises need environments that handle complex workloads while maintaining uptime and security. It ensures uninterrupted performance for critical applications in real-time analytics and automation. Growing data volumes encourage investments in high-density server environments. The trend fuels demand for colocation facilities that can manage rapid scaling requirements.

Strengthening Focus on Security, Compliance, and Reliability

Enterprises prioritize security and compliance while outsourcing critical workloads. The Multi-Tenant Data Center Market gains momentum by offering robust measures such as advanced firewalls, biometric access, and regulatory certifications. It builds trust for industries with strict compliance needs, including finance and healthcare. Facilities emphasize redundancy, disaster recovery, and energy-efficient systems to maintain uptime. The focus on reliability ensures continuous service delivery across global markets. These factors reinforce adoption among enterprises managing sensitive and mission-critical data.

Market Trends

Accelerated Adoption of Hyperscale Facilities and Edge Data Centers

The Multi-Tenant Data Center Market shows rapid growth in hyperscale facilities designed for global cloud providers. Enterprises expand storage and processing capabilities to meet surging digital demands. Edge data centers gain momentum to support low-latency services for IoT, 5G, and AI applications. It ensures faster delivery of digital services across diverse geographies. Providers integrate distributed networks with core facilities to manage heavy workloads. This shift strengthens infrastructure investments in both developed and emerging economies.

- For instance, NTT DATA’s Global Data Centers division is one of the world’s largest data center providers, operating over 160 data centers in more than 20 countries and regions across Asia, Europe, and North America.

Increasing Integration of Renewable Energy and Sustainable Practices

Sustainability becomes a critical factor influencing investment and operations across the Multi-Tenant Data Center Market. Operators focus on renewable energy sources such as solar and wind to reduce carbon emissions. It highlights a stronger commitment to meeting environmental regulations and corporate sustainability goals. Cooling innovations and energy-efficient designs reduce power usage effectiveness across facilities. Enterprises prefer providers with green certifications to align with ESG priorities. The trend drives continuous advancements in sustainable infrastructure strategies.

- For instance, Iron Mountain has covered 100% of its global data center electricity consumption with renewable energy purchases each year since 2017. In 2024, its data centers achieved 100% clean energy use, while its overall global facilities reached 91%. The company also supplies green-powered colocation capacity to customers through its Green Power Pass program. As of early 2025, the company has scaled to a total potential data center capacity of nearly 1.3 gigawatts.

Growing Demand for High-Density Infrastructure and Advanced Cooling Solutions

The Multi-Tenant Data Center Market experiences rising demand for high-density computing driven by AI, analytics, and big data. Providers implement liquid cooling and modular systems to handle intensive workloads. It improves efficiency while maintaining consistent uptime for mission-critical applications. High-performance computing requirements push facilities to adopt innovative rack designs and airflow management. Enterprises prioritize data centers that deliver scalability without compromising performance. This trend positions advanced cooling systems as a central feature of modern infrastructure.

Expansion of Strategic Partnerships and Global Colocation Networks

Collaborations between data center operators, cloud providers, and telecom companies continue to accelerate. The Multi-Tenant Data Center Market strengthens through global partnerships that expand colocation and interconnection services. It helps enterprises gain seamless access to multiple markets and service ecosystems. Network operators integrate cross-border connectivity solutions to meet multinational business needs. Partnerships drive standardization and improve service efficiency across regions. These developments shape a globally interconnected ecosystem that supports enterprise digital growth.

Market Challenges Analysis

High Operational Costs and Energy Consumption Concerns

The Multi-Tenant Data Center Market faces challenges from high operating costs driven by power and cooling needs. Facilities consume massive amounts of electricity to support servers, storage, and networking equipment. It creates pressure on operators to balance rising energy demand with sustainability goals. Power shortages in certain regions intensify the challenge and restrict expansion plans. Investors demand efficient cost structures, but infrastructure upgrades remain capital intensive. These financial and environmental constraints limit profitability for many providers.

Regulatory Compliance and Data Security Risks

The Multi-Tenant Data Center Market also contends with complex regulations and heightened security risks. Enterprises demand strict adherence to international standards for data protection, including GDPR and HIPAA. It pushes operators to implement advanced security systems and continuous monitoring. Failure to comply can result in penalties and reputational damage. Cybersecurity threats grow as facilities host critical workloads for multiple tenants. Maintaining resilience against evolving risks requires significant investments, which many smaller operators struggle to manage.

Market Opportunities

Rising Demand from Emerging Economies and Digital Infrastructure Growth

The Multi-Tenant Data Center Market presents strong opportunities in emerging economies experiencing rapid digital adoption. Countries in Asia-Pacific, Latin America, and Africa expand internet penetration, e-commerce, and cloud services. It creates demand for modern facilities that deliver scalability and cost efficiency. Governments support digital transformation through infrastructure development and favorable policies. Telecom operators and enterprises partner with colocation providers to address rising connectivity needs. These regions hold significant potential for long-term investment and expansion.

Advancements in 5G, AI, and Edge Computing Ecosystems

The Multi-Tenant Data Center Market benefits from opportunities linked to 5G, AI, and edge computing. Enterprises require low-latency environments to run advanced analytics, autonomous applications, and connected devices. It drives the construction of edge facilities positioned closer to end-users. Integration of AI within data centers also enables predictive maintenance and resource optimization. Providers offering hybrid solutions gain an advantage by meeting both central and distributed processing needs. These technological shifts open new revenue streams for global operators.

Market Segmentation Analysis:

By Type

The Multi-Tenant Data Center Market is segmented into retail and wholesale types. Retail colocation dominates due to its suitability for small and medium-sized enterprises requiring flexible space and bandwidth. It offers businesses cost efficiency and quick scalability without large upfront investments. Wholesale colocation appeals to large enterprises and cloud providers managing heavy workloads. The segment continues to expand as hyperscale companies invest in larger facilities. Both models remain critical to supporting global data demands across industries.

- For instance, Digital Realty operates over 300 data centers globally. Its total power capacity is approximately 2.7 gigawatts. The company is actively expanding, with a land bank capable of supporting nearly 4 gigawatts of additional capacity.

By Application

Applications span across IT and telecom, BFSI, healthcare, government, and other sectors. The Multi-Tenant Data Center Market witnesses high demand from IT and telecom, where digital transformation and cloud adoption drive infrastructure needs. BFSI relies on secure colocation facilities to safeguard sensitive financial data and support growing digital transactions. Healthcare organizations adopt data centers to manage electronic health records, telemedicine platforms, and imaging data. It ensures compliance with strict industry regulations while enabling reliable service delivery. Government institutions invest in shared facilities to modernize operations and strengthen national digital ecosystems.

By Solution

Solutions in the Multi-Tenant Data Center Market include cooling, power, networking, and security systems. Cooling solutions play a vital role in maintaining energy efficiency for high-density workloads. Power management systems focus on uninterrupted supply and redundancy for mission-critical applications. Networking solutions provide robust interconnection, enabling seamless collaboration across multiple geographies. It supports enterprise adoption of hybrid and multi-cloud strategies. Security solutions gain importance with rising cyber threats, driving investments in advanced firewalls, biometric access, and monitoring technologies. Together, these solutions shape the reliability and efficiency of multi-tenant infrastructure.

- For instance, For instance, Vertiv’s Liebert DSE free-cooling system is available in packaged solutions that provide high-capacity cooling, such as 400 kW and 500 kW. The system uses a pumped refrigerant economizer to maximize efficiency by reducing or eliminating the need for compressors when outdoor temperatures are favorable.

Segments:

Based on Type

- Managed Services

- Colocation

- Wholesale Colocation

Based on Application

- Cloud Computing

- Enterprise IT

- Big Data and Analytics

- E-commerce

Based on Solution

- Cloud and IT Infrastructure

- Security and Compliance

- Disaster Recovery and Backup

Based on Size

Based on Vertical

- BFSI

- IT and Telecommunications

- Healthcare

- Government

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Multi-Tenant Data Center Market, accounting for nearly 38% in 2024. The region benefits from the presence of leading cloud service providers, advanced IT infrastructure, and strong enterprise adoption of digital services. The United States drives growth with its large base of hyperscale operators and data-intensive industries such as BFSI, healthcare, and e-commerce. It also benefits from favorable government initiatives supporting digital transformation and sustainable energy practices. Canada contributes significantly with investments in colocation facilities to support growing cloud adoption among enterprises. Demand for high-density infrastructure, strong compliance standards, and sustainable operations continue to shape the market in this region.

Europe

Europe represents around 27% of the Multi-Tenant Data Center Market in 2024, driven by demand for secure and energy-efficient colocation solutions. Countries such as Germany, the United Kingdom, and France dominate due to strong enterprise digitalization and stringent data protection regulations like GDPR. It supports investment in advanced security systems and regulatory-compliant infrastructure. The region emphasizes sustainability, with operators increasingly adopting renewable energy sources to reduce carbon emissions. Eastern European countries are witnessing steady expansion as enterprises explore colocation services for cost efficiency. Growing interconnection hubs in Frankfurt, London, Amsterdam, and Paris consolidate Europe’s role as a strategic market for multi-tenant facilities.

Asia-Pacific

Asia-Pacific holds a 24% share of the Multi-Tenant Data Center Market in 2024, emerging as the fastest-growing regional market. Rapid digital adoption, increasing mobile usage, and the expansion of cloud providers fuel demand. China, India, and Japan drive large-scale investments in hyperscale and colocation facilities. It reflects the rising need for reliable infrastructure to support e-commerce, fintech, and government digital programs. The growing adoption of AI, IoT, and 5G also accelerates demand for edge data centers in the region. Asia-Pacific remains a focal point for global providers expanding their presence to capture strong growth opportunities.

Latin America

Latin America accounts for about 6% of the Multi-Tenant Data Center Market in 2024, supported by rising demand for digital services and improving connectivity infrastructure. Brazil leads the regional market with major investments in colocation and hyperscale facilities. Mexico and Chile also play vital roles, attracting data center providers to serve multinational enterprises. It faces challenges from limited power availability and high energy costs, but investment momentum continues to strengthen. Growing e-commerce activity, digital banking, and cloud adoption support market expansion across the region. Local governments are also encouraging partnerships to strengthen digital ecosystems.

Middle East & Africa

The Middle East & Africa region contributes nearly 5% of the Multi-Tenant Data Center Market in 2024, with gradual but steady expansion. The United Arab Emirates and Saudi Arabia lead investments, supported by national digital transformation programs. South Africa acts as a regional hub for colocation services, with growing demand from telecom and financial industries. It continues to benefit from investments in renewable-powered facilities that align with sustainability goals. Limited infrastructure and regulatory complexities remain challenges, but rising adoption of cloud services creates new opportunities. Global players increasingly form partnerships with local operators to expand their footprint in this region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- GREEN

- Equinix

- Sabey Data Centers

- Iron Mountain

- Interxion

- Digital Realty

- Telehouse

- Kenedix

- NTT

- 21Vianet

Competitive Analysis

Competitive landscape of the Multi-Tenant Data Center Market is defined by leading players including Equinix, Digital Realty, NTT, Interxion, Iron Mountain, Sabey Data Centers, Telehouse, GREEN, Kenedix, and 21Vianet. These companies focus on expanding their global presence through acquisitions, partnerships, and development of advanced colocation facilities to meet rising demand for scalable infrastructure. They invest heavily in hyperscale and edge data centers to address growing needs from cloud providers, enterprises, and telecom operators. Strong emphasis is placed on sustainability, with major players integrating renewable energy and advanced cooling solutions to reduce carbon footprints. Security and compliance remain central strategies, ensuring adherence to international data protection regulations and building trust among industries such as BFSI, healthcare, and government. Operators also focus on interconnection services, enabling seamless cross-border connectivity and hybrid cloud adoption. Intense competition fosters continuous innovation, where differentiation is achieved through energy efficiency, reliability, and the ability to support data-intensive applications.

Recent Developments

- In June 2025, Sabey broke ground on Building A at its Ashburn campus, adding 54 MW of leasable power.

- In May 2025, Equinix launched JK1, its first AI‑ready data center in Jakarta, providing high‑performance interconnection with over 50 network providers.

- In April 2025, Sabey expanded capacity in the Pacific Northwest, adding 6 MW of Tier 3 power and carbon‑free operations.

- In March 2025, Digital Realty entered the Indonesian market via a joint venture.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Solution, Size, Vertical and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Cloud adoption will rise further, prompting increased reliance on shared data center infrastructure.

- Hyperscale and edge deployments will expand rapidly to meet latency-sensitive and high-compute needs.

- Operators will invest more in renewable energy and efficient cooling to cut costs and meet ESG goals.

- Data centers with stronger interconnection and hybrid cloud capabilities will attract enterprise demand.

- Developers will adopt AI-driven operations for predictive maintenance and real-time capacity management.

- Demand for high-density configurations will grow to support advanced AI, analytics, and big data workloads.

- Regional expansion will target emerging markets with improving digital infrastructure and favourable policies.

- Strategic partnerships between data center providers, telecoms, and cloud firms will proliferate for seamless service delivery.

- Security and compliance innovation will play a critical role in serving regulated sectors like finance and healthcare.

- Customizable, modular designs will enable faster deployment and flexible scalability for diverse customer needs.