CHAPTER NO. 1 : INTRODUCTION 24

1.1.1. Report Description 24

Purpose of the Report 24

USP & Key Offerings 24

1.1.2. Key Benefits for Stakeholders 24

1.1.3. Target Audience 25

1.1.4. Report Scope 25

1.1.5. Regional Scope 26

CHAPTER NO. 2 : EXECUTIVE SUMMARY 27

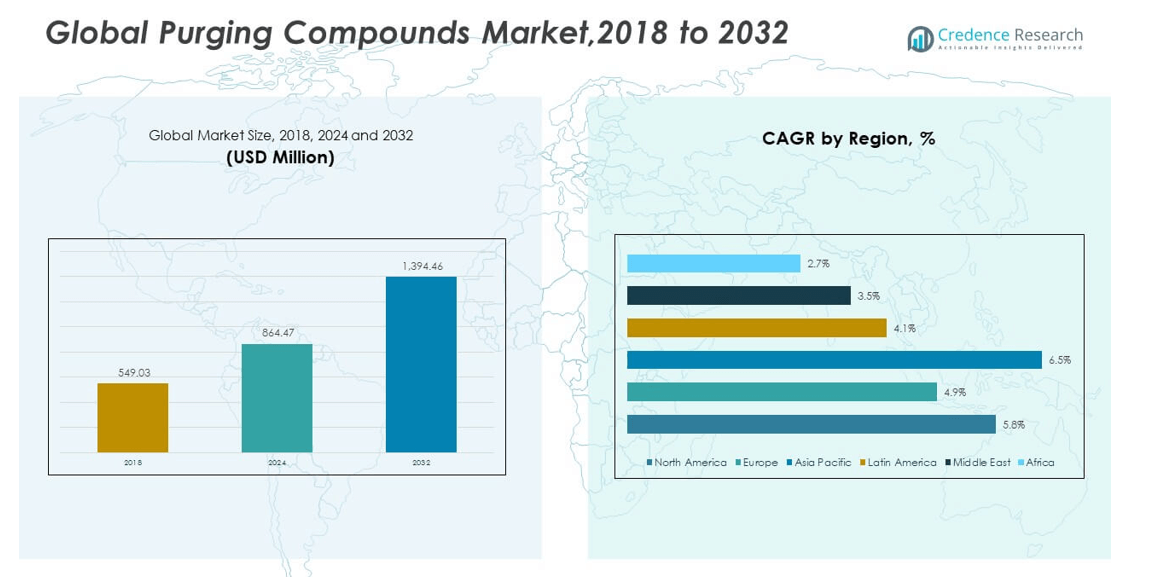

2.1. Purging Compounds Market Snapshot 27

2.1.1. Global Purging Compounds Market, 2018 – 2032 (Metric Tons) (USD Million) 29

2.2. Insights from Primary Respondents CHAPTER NO. 1 : INTRODUCTION 24

1.1.1. Report Description 24

Purpose of the Report 24

USP & Key Offerings 24

1.1.2. Key Benefits for Stakeholders 24

1.1.3. Target Audience 25

1.1.4. Report Scope 25

1.1.5. Regional Scope 26

CHAPTER NO. 2 : EXECUTIVE SUMMARY 27

2.1. Purging Compounds Market Snapshot 27

2.1.1. Global Purging Compounds Market, 2018 – 2032 (Metric Tons) (USD Million) 29

2.2. Insights from Primary Respondents 29

CHAPTER NO. 3 : PURGING COMPOUNDS MARKET – INDUSTRY ANALYSIS 30

3.1. Introduction 30

3.2. Market Drivers 31

3.2.1. Increasing demand for reduced machine downtime and faster material changeovers 31

3.2.2. Rising emphasis on high-quality plastic processing and defect-free outputs 32

3.3. Market Restraints 33

3.3.1. High cost of specialty purging compounds compared to basic resins 33

3.4. Market Opportunities 34

3.4.1. Market Opportunity Analysis 34

3.5. Porter’s Five Forces Analysis 35

3.6. Value Chain Analysis 36

3.7. Buying Criteria 37

CHAPTER NO. 4 : IMPORT EXPORT ANALYSIS 38

4.1. Import Analysis by Region 38

4.1.1. Global Purging Compounds Market Import Volume/Revenue, By Region, 2018 – 2023 38

4.2. Export Analysis by Region 39

4.2.1. Global Purging Compounds Market Export Volume/Revenue, By Region, 2018 – 2023 39

CHAPTER NO. 5 : PRODUCTION ANALYSIS 40

5.1. Production Analysis by Region 40

5.1.1. Global Purging Compounds Market Production Volume/Revenue, By Region, 2018 – 2023 40

5.1.2. Global Purging Compounds Market Production Volume, By Region, 2018 – 2023 (Metric Tons) 41

CHAPTER NO. 6 : PRICE ANALYSIS 42

6.1. Price Analysis by Region 42

6.1.1. Global Purging Compounds Market Price, By Region, 2018 – 2023 42

6.1.2. Global Type Market Price, By Region, 2018 – 2023 42

6.2. Price Analysis by Type 43

6.2.1. Global Purging Compounds Market Price, By Type, 2018 – 2023 43

6.2.2. Global Type Market Price, By Type, 2018 – 2023 43

CHAPTER NO. 7 : ANALYSIS COMPETITIVE LANDSCAPE 44

7.1. Company Market Share Analysis – 2023 44

7.1.1. Global Purging Compounds Market: Company Market Share, by Volume, 2023 44

7.1.2. Global Purging Compounds Market: Company Market Share, by Revenue, 2023 45

7.1.3. Global Purging Compounds Market: Top 6 Company Market Share, by Revenue, 2023 45

7.1.4. Global Purging Compounds Market: Top 3 Company Market Share, by Revenue, 2023 46

7.2. Global Purging Compounds Market Company Volume Market Share, 2023 47

7.3. Global Purging Compounds Market Company Revenue Market Share, 2023 48

7.4. Company Assessment Metrics, 2023 49

7.4.1. Stars 49

7.4.2. Emerging Leaders 49

7.4.3. Pervasive Players 49

7.4.4. Participants 49

7.5. Start-ups /SMEs Assessment Metrics, 2023 49

7.5.1. Progressive Companies 49

7.5.2. Responsive Companies 49

7.5.3. Dynamic Companies 49

7.5.4. Starting Blocks 49

7.6. Strategic Developments 50

7.6.1. Acquisitions & Mergers 50

New Product Launch 50

Regional Expansion 50

7.7. Key Players Product Matrix 51

CHAPTER NO. 8 : PESTEL & ADJACENT MARKET ANALYSIS 52

8.1. PESTEL 52

8.1.1. Political Factors 52

8.1.2. Economic Factors 52

8.1.3. Social Factors 52

8.1.4. Technological Factors 52

8.1.5. Environmental Factors 52

8.1.6. Legal Factors 52

8.2. Adjacent Market Analysis 52

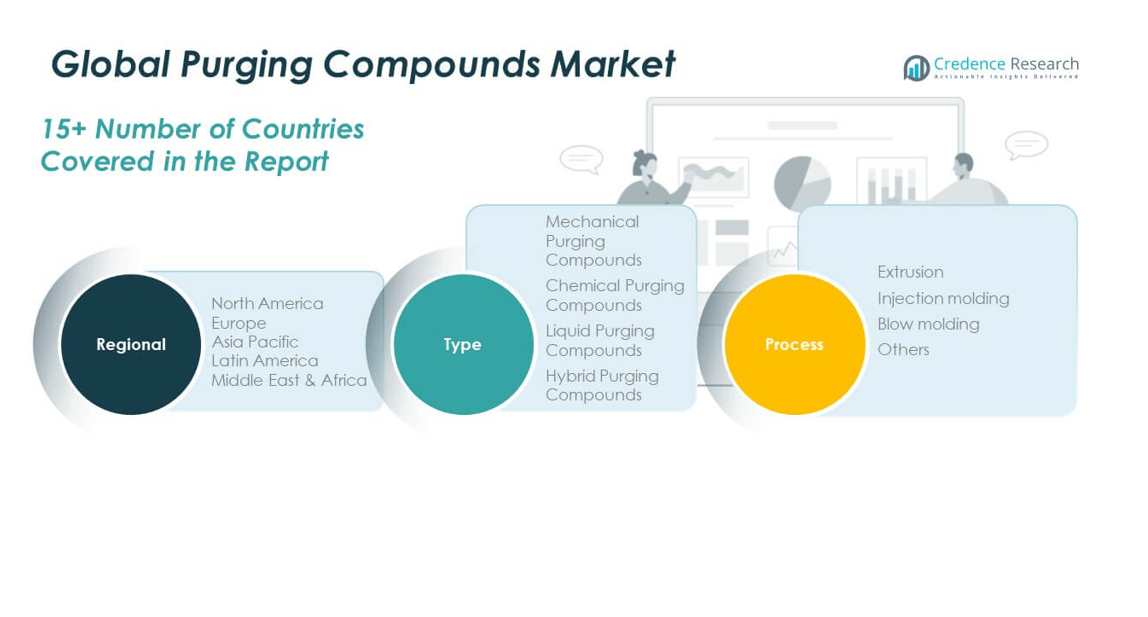

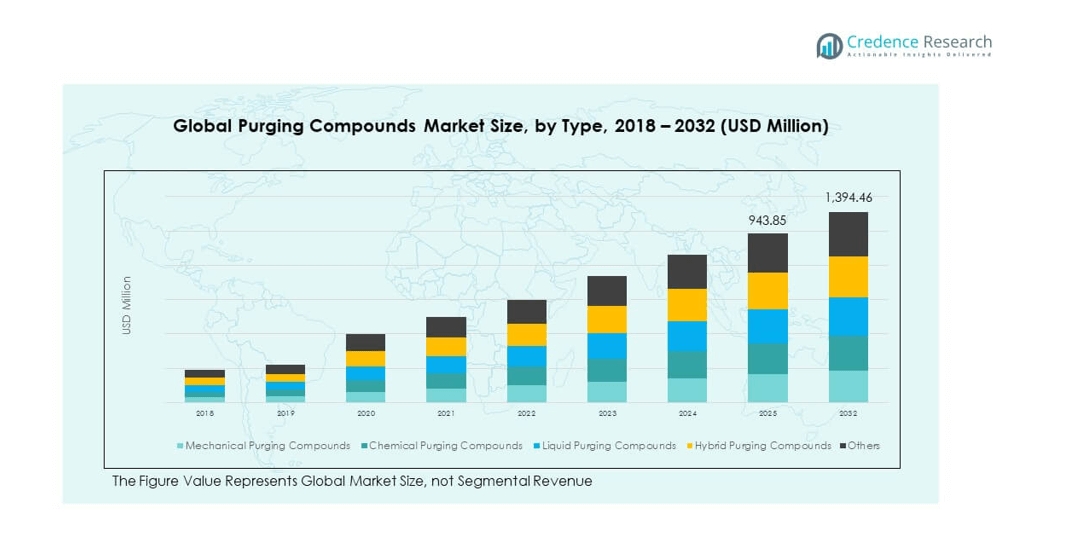

CHAPTER NO. 9 : PURGING COMPOUNDS MARKET – BY TYPE SEGMENT ANALYSIS 53

9.1. Purging Compounds Market Overview, by Type Segment 53

9.1.1. Purging Compounds Market Volume Share, By Type, 2023 & 2032 54

9.1.2. Purging Compounds Market Revenue Share, By Type, 2023 & 2032 54

9.1.3. Purging Compounds Market Attractiveness Analysis, By Type 55

9.1.4. Incremental Revenue Growth Opportunity, by Type, 2024 – 2032 55

9.1.5. Purging Compounds Market Revenue, By Type, 2018, 2023, 2027 & 2032 56

9.2. Mechanical Purging Compounds 57

9.3. Chemical Purging Compounds 58

9.4. Liquid Purging Compounds 59

9.5. Hybrid Purging Compounds 60

CHAPTER NO. 10 : PURGING COMPOUNDS MARKET – BY PROCESS SEGMENT ANALYSIS 61

10.1. Purging Compounds Market Overview, by Process Segment 61

10.1.1. Purging Compounds Market Volume Share, By Process, 2023 & 2032 62

10.1.2. Purging Compounds Market Revenue Share, By Process, 2023 & 2032 62

10.1.3. Purging Compounds Market Attractiveness Analysis, By Process 63

10.1.4. Incremental Revenue Growth Opportunity, by Process, 2024 – 2032 63

10.1.5. Purging Compounds Market Revenue, By Process, 2018, 2023, 2027 & 2032 64

10.2. Extrusion 65

10.3. Injection molding 66

10.4. Blow molding 67

10.5. Others 68

CHAPTER NO. 11 : PURGING COMPOUNDS MARKET – REGIONAL ANALYSIS 69

11.1. Purging Compounds Market Overview, by Regional Segments 69

11.2. Region 70

11.2.1. Global Purging Compounds Market Volume Share, By Region, 2023 & 2032 70

11.2.2. Global Purging Compounds Market Revenue Share, By Region, 2023 & 2032 70

11.2.3. Purging Compounds Market Attractiveness Analysis, By Region 71

11.2.4. Incremental Revenue Growth Opportunity, by Region, 2024 – 2032 71

11.2.5. Purging Compounds Market Revenue, By Region, 2018, 2023, 2027 & 2032 72

11.2.6. Global Purging Compounds Market Volume & Revenue, By Region, 2018 – 2023 (Metric Tons) (USD Million) 73

11.2.7. Global Purging Compounds Market Volume & Revenue, By Region, 2024 – 2032 (Metric Tons) (USD Million) 73

CHAPTER NO. 12 : PURGING COMPOUNDS MARKET – NORTH AMERICA 75

12.1. North America 75

12.1.1. Key Highlights 75

12.1.2. North America Purging Compounds Market Volume, By Country, 2018 – 2032 (Metric Tons) 76

12.1.3. North America Purging Compounds Market Revenue, By Country, 2018 – 2023 (USD Million) 77

12.1.4. North America Purging Compounds Market Volume, By Type, 2018 – 2023 (Metric Tons) 78

12.1.5. North America Purging Compounds Market Revenue, By Type, 2018 – 2023 (USD Million) 79

12.1.6. North America Purging Compounds Market Volume, By Process, 2018 – 2023 (Metric Tons) 80

12.1.7. North America Purging Compounds Market Revenue, By Process, 2018 – 2023 (USD Million) 81

12.2. U.S. 82

12.3. Canada 82

12.4. Mexico 82

CHAPTER NO. 13 : PURGING COMPOUNDS MARKET – EUROPE 83

13.1. Europe 83

13.1.1. Key Highlights 83

13.1.2. Europe Purging Compounds Market Volume, By Country, 2018 – 2032 (Metric Tons) 84

13.1.3. Europe Purging Compounds Market Revenue, By Country, 2018 – 2023 (USD Million) 85

13.1.4. Europe Purging Compounds Market Volume, By Type, 2018 – 2023 (Metric Tons) 86

13.1.5. Europe Purging Compounds Market Revenue, By Type, 2018 – 2023 (USD Million) 87

13.1.6. Europe Purging Compounds Market Volume, By Process, 2018 – 2023 (Metric Tons) 88

13.1.7. Europe Purging Compounds Market Revenue, By Process, 2018 – 2023 (USD Million) 89

13.2. UK 90

13.3. France 90

13.4. Germany 90

13.5. Italy 90

13.6. Spain 90

13.7. Russia 90

13.8. Belgium 90

13.9. Netherland 90

13.10. Austria 90

13.11. Sweden 90

13.12. Poland 90

13.13. Denmark 90

13.14. Switzerland 90

13.15. Rest of Europe 90

CHAPTER NO. 14 : PURGING COMPOUNDS MARKET – ASIA PACIFIC 91

14.1. Asia Pacific 91

14.1.1. Key Highlights 91

14.1.2. Asia Pacific Purging Compounds Market Volume, By Country, 2018 – 2032 (Metric Tons) 92

14.1.3. Asia Pacific Purging Compounds Market Revenue, By Country, 2018 – 2023 (USD Million) 93

14.1.4. Asia Pacific Purging Compounds Market Volume, By Type, 2018 – 2023 (Metric Tons) 94

14.1.5. Asia Pacific Purging Compounds Market Revenue, By Type, 2018 – 2023 (USD Million) 95

14.1.6. Asia Pacific Purging Compounds Market Volume, By Process, 2018 – 2023 (Metric Tons) 96

14.1.7. Asia Pacific Purging Compounds Market Revenue, By Process, 2018 – 2023 (USD Million) 97

14.2. China 98

14.3. Japan 98

14.4. South Korea 98

14.5. India 98

14.6. Australia 98

14.7. Thailand 98

14.8. Indonesia 98

14.9. Vietnam 98

14.10. Malaysia 98

14.11. Philippines 98

14.12. Taiwan 98

14.13. Rest of Asia Pacific 98

CHAPTER NO. 15 : PURGING COMPOUNDS MARKET – LATIN AMERICA 99

15.1. Latin America 99

15.1.1. Key Highlights 99

15.1.2. Latin America Purging Compounds Market Volume, By Country, 2018 – 2032 (Metric Tons) 100

15.1.3. Latin America Purging Compounds Market Revenue, By Country, 2018 – 2023 (USD Million) 101

15.1.4. Latin America Purging Compounds Market Volume, By Type, 2018 – 2023 (Metric Tons) 102

15.1.5. Latin America Purging Compounds Market Revenue, By Type, 2018 – 2023 (USD Million) 103

15.1.6. Latin America Purging Compounds Market Volume, By Process, 2018 – 2023 (Metric Tons) 104

15.1.7. Latin America Purging Compounds Market Revenue, By Process, 2018 – 2023 (USD Million) 105

15.2. Brazil 106

15.3. Argentina 106

15.4. Peru 106

15.5. Chile 106

15.6. Colombia 106

15.7. Rest of Latin America 106

CHAPTER NO. 16 : PURGING COMPOUNDS MARKET – MIDDLE EAST 107

16.1. Middle East 107

16.1.1. Key Highlights 107

16.1.2. Middle East Purging Compounds Market Volume, By Country, 2018 – 2032 (Metric Tons) 108

16.1.3. Middle East Purging Compounds Market Revenue, By Country, 2018 – 2023 (USD Million) 109

16.1.4. Middle East Purging Compounds Market Volume, By Type, 2018 – 2023 (Metric Tons) 110

16.1.5. Middle East Purging Compounds Market Revenue, By Type, 2018 – 2023 (USD Million) 111

16.1.6. Middle East Purging Compounds Market Volume, By Process, 2018 – 2023 (Metric Tons) 112

16.1.7. Middle East Purging Compounds Market Revenue, By Process, 2018 – 2023 (USD Million) 113

16.2. UAE 114

16.3. KSA 114

16.4. Israel 114

16.5. Turkey 114

16.6. Iran 114

16.7. Rest of Middle East 114

CHAPTER NO. 17 : PURGING COMPOUNDS MARKET – AFRICA 115

17.1. Africa 115

17.1.1. Key Highlights 115

17.1.2. Africa Purging Compounds Market Volume, By Country, 2018 – 2032 (Metric Tons) 116

17.1.3. Africa Purging Compounds Market Revenue, By Country, 2018 – 2023 (USD Million) 117

17.1.4. Africa Purging Compounds Market Volume, By Type, 2018 – 2023 (Metric Tons) 118

17.1.5. Africa Purging Compounds Market Revenue, By Type, 2018 – 2023 (USD Million) 119

17.1.6. Africa Purging Compounds Market Volume, By Process, 2018 – 2023 (Metric Tons) 120

17.1.7. Africa Purging Compounds Market Revenue, By Process, 2018 – 2023 (USD Million) 121

17.2. Egypt 122

17.3. Nigeria 122

17.4. Algeria 122

17.5. Morocco 122

17.6. Rest of Africa 122

CHAPTER NO. 18 : COMPANY PROFILES 123

18.1. Calsak Corporation 123

18.1.1. Company Overview 123

18.1.2. Product Portfolio 123

18.1.3. Swot Analysis 123

18.1.4. Business Strategy 123

18.1.5. Financial Overview 124

18.2. Plastic Solutions, Inc. 125

18.3. Neutrex, Inc. 125

18.4. Perfect Colourants & Plastics Pvt. Ltd. 125

18.5. Asahi Kasei Corporation 125

18.6. Chem‑Trend L.P. 125

18.7. 3M 125

18.8. Company 8 125

18.9. Company 9 125

18.10. Company 10 125

18.11. Company 11 125

18.12. Company 12 125

18.13. Company 13 125

18.14. Company 14 125

List of Figures

FIG NO. 1. Global Purging Compounds Market Volume & Revenue, 2018 – 2032 (Metric Tons) (USD Million) 29

FIG NO. 2. Porter’s Five Forces Analysis for Global Purging Compounds Market 35

FIG NO. 3. Value Chain Analysis for Global Purging Compounds Market 36

FIG NO. 4. Global Purging Compounds Market Import Volume/Revenue, By Region, 2018 – 2023 38

FIG NO. 5. Global Purging Compounds Market Export Volume/Revenue, By Region, 2018 – 2023 39

FIG NO. 6. Global Purging Compounds Market Production Volume/Revenue, By Region, 2018 – 2023 40

FIG NO. 7. Global Purging Compounds Market Price, By Region, 2018 – 2023 42

FIG NO. 8. Global Purging Compounds Market Price, By Type, 2018 – 2023 43

FIG NO. 9. Company Share Analysis, 2023 44

FIG NO. 10. Company Share Analysis, 2023 45

FIG NO. 11. Company Share Analysis, 2023 45

FIG NO. 12. Company Share Analysis, 2023 46

FIG NO. 13. Purging Compounds Market – Company Volume Market Share, 2023 47

FIG NO. 14. Purging Compounds Market – Company Revenue Market Share, 2023 48

FIG NO. 15. Purging Compounds Market Volume Share, By Type, 2023 & 2032 54

FIG NO. 16. Purging Compounds Market Revenue Share, By Type, 2023 & 2032 54

FIG NO. 17. Market Attractiveness Analysis, By Type 55

FIG NO. 18. Incremental Revenue Growth Opportunity by Type, 2024 – 2032 55

FIG NO. 19. Purging Compounds Market Revenue, By Type, 2018, 2023, 2027 & 2032 56

FIG NO. 20. Global Purging Compounds Market for Mechanical Purging Compounds, Volume & Revenue (Metric Tons) (USD Million) 2018 – 2032 57

FIG NO. 21. Global Purging Compounds Market for Chemical Purging Compounds, Volume & Revenue (Metric Tons) (USD Million) 2018 – 2032 58

FIG NO. 22. Global Purging Compounds Market for Liquid Purging Compounds, Volume & Revenue (Metric Tons) (USD Million) 2018 – 2032 59

FIG NO. 23. Global Purging Compounds Market for Hybrid Purging Compounds, Volume & Revenue (Metric Tons) (USD Million) 2018 – 2032 60

FIG NO. 24. Purging Compounds Market Volume Share, By Process, 2023 & 2032 62

FIG NO. 25. Purging Compounds Market Revenue Share, By Process, 2023 & 2032 62

FIG NO. 26. Market Attractiveness Analysis, By Process 63

FIG NO. 27. Incremental Revenue Growth Opportunity by Process, 2024 – 2032 63

FIG NO. 28. Purging Compounds Market Revenue, By Process, 2018, 2023, 2027 & 2032 64

FIG NO. 29. Global Purging Compounds Market for Extrusion, Volume & Revenue (Metric Tons) (USD Million) 2018 – 2032 65

FIG NO. 30. Global Purging Compounds Market for Injection molding, Volume & Revenue (Metric Tons) (USD Million) 2018 – 2032 66

FIG NO. 31. Global Purging Compounds Market for Blow molding, Volume & Revenue (Metric Tons) (USD Million) 2018 – 2032 67

FIG NO. 32. Global Purging Compounds Market for Others, Volume & Revenue (Metric Tons) (USD Million) 2018 – 2032 68

FIG NO. 33. Global Purging Compounds Market Volume Share, By Region, 2023 & 2032 70

FIG NO. 34. Global Purging Compounds Market Revenue Share, By Region, 2023 & 2032 70

FIG NO. 35. Market Attractiveness Analysis, By Region 71

FIG NO. 36. Incremental Revenue Growth Opportunity by Region, 2024 – 2032 71

FIG NO. 37. Purging Compounds Market Revenue, By Region, 2018, 2023, 2027 & 2032 72

FIG NO. 38. North America Purging Compounds Market Volume & Revenue, 2018 – 2032 (Metric Tons) (USD Million) 75

FIG NO. 39. Europe Purging Compounds Market Volume & Revenue, 2018 – 2032 (Metric Tons) (USD Million) 83

FIG NO. 40. Asia Pacific Purging Compounds Market Volume & Revenue, 2018 – 2032 (Metric Tons) (USD Million) 91

FIG NO. 41. Latin America Purging Compounds Market Volume & Revenue, 2018 – 2032 (Metric Tons) (USD Million) 99

FIG NO. 42. Middle East Purging Compounds Market Volume & Revenue, 2018 – 2032 (Metric Tons) (USD Million) 107

FIG NO. 43. Africa Purging Compounds Market Volume & Revenue, 2018 – 2032 (Metric Tons) (USD Million) 115

List of Tables

TABLE NO. 1. : Global Purging Compounds Market: Snapshot 27

TABLE NO. 2. : Drivers for the Purging Compounds Market: Impact Analysis 31

TABLE NO. 3. : Restraints for the Purging Compounds Market: Impact Analysis 33

TABLE NO. 4. : Global Purging Compounds Market Production Volume, By Region, 2018 – 2023 (Metric Tons) 41

TABLE NO. 5. : Global Purging Compounds Market Volume & Revenue, By Region, 2018 – 2023 42

TABLE NO. 6. : Global Purging Compounds Market Volume & Revenue, By Type, 2018 – 2023 43

TABLE NO. 7. : Global Purging Compounds Market Volume & Revenue, By Region, 2018 – 2023 (Metric Tons) (USD Million) 73

TABLE NO. 8. : Global Purging Compounds Market Volume & Revenue, By Region, 2024 – 2032 (Metric Tons) (USD Million) 73

TABLE NO. 9. : North America Purging Compounds Market Volume, By Country, 2018 – 2023 (Metric Tons) 76

TABLE NO. 10. : North America Purging Compounds Market Volume, By Country, 2024 – 2032 (Metric Tons) 76

TABLE NO. 11. : North America Purging Compounds Market Revenue, By Country, 2018 – 2023 (USD Million) 77

TABLE NO. 12. : North America Purging Compounds Market Revenue, By Country, 2024 – 2032 (USD Million) 77

TABLE NO. 13. : North America Purging Compounds Market Volume, By Type, 2018 – 2023 (Metric Tons) 78

TABLE NO. 14. : North America Purging Compounds Market Volume, By Type, 2024 – 2032 (Metric Tons) 78

TABLE NO. 15. : North America Purging Compounds Market Revenue, By Type, 2018 – 2023 (USD Million) 79

TABLE NO. 16. : North America Purging Compounds Market Revenue, By Type, 2024 – 2032 (USD Million) 79

TABLE NO. 17. : North America Purging Compounds Market Volume, By Process, 2018 – 2023 (Metric Tons) 80

TABLE NO. 18. : North America Purging Compounds Market Volume, By Process, 2024 – 2032 (Metric Tons) 80

TABLE NO. 19. : North America Purging Compounds Market Revenue, By Process, 2018 – 2023 (USD Million) 81

TABLE NO. 20. : North America Purging Compounds Market Revenue, By Process, 2024 – 2032 (USD Million) 81

TABLE NO. 21. : Europe Purging Compounds Market Volume, By Country, 2018 – 2023 (Metric Tons) 84

TABLE NO. 22. : Europe Purging Compounds Market Volume, By Country, 2024 – 2032 (Metric Tons) 84

TABLE NO. 23. : Europe Purging Compounds Market Revenue, By Country, 2018 – 2023 (USD Million) 85

TABLE NO. 24. : Europe Purging Compounds Market Revenue, By Country, 2024 – 2032 (USD Million) 85

TABLE NO. 25. : Europe Purging Compounds Market Volume, By Type, 2018 – 2023 (Metric Tons) 86

TABLE NO. 26. : Europe Purging Compounds Market Volume, By Type, 2024 – 2032 (Metric Tons) 86

TABLE NO. 27. : Europe Purging Compounds Market Revenue, By Type, 2018 – 2023 (USD Million) 87

TABLE NO. 28. : Europe Purging Compounds Market Revenue, By Type, 2024 – 2032 (USD Million) 87

TABLE NO. 29. : Europe Purging Compounds Market Volume, By Process, 2018 – 2023 (Metric Tons) 88

TABLE NO. 30. : Europe Purging Compounds Market Volume, By Process, 2024 – 2032 (Metric Tons) 88

TABLE NO. 31. : Europe Purging Compounds Market Revenue, By Process, 2018 – 2023 (USD Million) 89

TABLE NO. 32. : Europe Purging Compounds Market Revenue, By Process, 2024 – 2032 (USD Million) 89

TABLE NO. 33. : Asia Pacific Purging Compounds Market Volume, By Country, 2018 – 2023 (Metric Tons) 92

TABLE NO. 34. : Asia Pacific Purging Compounds Market Volume, By Country, 2024 – 2032 (Metric Tons) 92

TABLE NO. 35. : Asia Pacific Purging Compounds Market Revenue, By Country, 2018 – 2023 (USD Million) 93

TABLE NO. 36. : Asia Pacific Purging Compounds Market Revenue, By Country, 2024 – 2032 (USD Million) 93

TABLE NO. 37. : Asia Pacific Purging Compounds Market Volume, By Type, 2018 – 2023 (Metric Tons) 94

TABLE NO. 38. : Asia Pacific Purging Compounds Market Volume, By Type, 2024 – 2032 (Metric Tons) 94

TABLE NO. 39. : Asia Pacific Purging Compounds Market Revenue, By Type, 2018 – 2023 (USD Million) 95

TABLE NO. 40. : Asia Pacific Purging Compounds Market Revenue, By Type, 2024 – 2032 (USD Million) 95

TABLE NO. 41. : Asia Pacific Purging Compounds Market Volume, By Process, 2018 – 2023 (Metric Tons) 96

TABLE NO. 42. : Asia Pacific Purging Compounds Market Volume, By Process, 2024 – 2032 (Metric Tons) 96

TABLE NO. 43. : Asia Pacific Purging Compounds Market Revenue, By Process, 2018 – 2023 (USD Million) 97

TABLE NO. 44. : Asia Pacific Purging Compounds Market Revenue, By Process, 2024 – 2032 (USD Million) 97

TABLE NO. 45. : Latin America Purging Compounds Market Volume, By Country, 2018 – 2023 (Metric Tons) 100

TABLE NO. 46. : Latin America Purging Compounds Market Volume, By Country, 2024 – 2032 (Metric Tons) 100

TABLE NO. 47. : Latin America Purging Compounds Market Revenue, By Country, 2018 – 2023 (USD Million) 101

TABLE NO. 48. : Latin America Purging Compounds Market Revenue, By Country, 2024 – 2032 (USD Million) 101

TABLE NO. 49. : Latin America Purging Compounds Market Volume, By Type, 2018 – 2023 (Metric Tons) 102

TABLE NO. 50. : Latin America Purging Compounds Market Volume, By Type, 2024 – 2032 (Metric Tons) 102

TABLE NO. 51. : Latin America Purging Compounds Market Revenue, By Type, 2018 – 2023 (USD Million) 103

TABLE NO. 52. : Latin America Purging Compounds Market Revenue, By Type, 2024 – 2032 (USD Million) 103

TABLE NO. 53. : Latin America Purging Compounds Market Volume, By Process, 2018 – 2023 (Metric Tons) 104

TABLE NO. 54. : Latin America Purging Compounds Market Volume, By Process, 2024 – 2032 (Metric Tons) 104

TABLE NO. 55. : Latin America Purging Compounds Market Revenue, By Process, 2018 – 2023 (USD Million) 105

TABLE NO. 56. : Latin America Purging Compounds Market Revenue, By Process, 2024 – 2032 (USD Million) 105

TABLE NO. 57. : Middle East Purging Compounds Market Volume, By Country, 2018 – 2023 (Metric Tons) 108

TABLE NO. 58. : Middle East Purging Compounds Market Volume, By Country, 2024 – 2032 (Metric Tons) 108

TABLE NO. 59. : Middle East Purging Compounds Market Revenue, By Country, 2018 – 2023 (USD Million) 109

TABLE NO. 60. : Middle East Purging Compounds Market Revenue, By Country, 2024 – 2032 (USD Million) 109

TABLE NO. 61. : Middle East Purging Compounds Market Volume, By Type, 2018 – 2023 (Metric Tons) 110

TABLE NO. 62. : Middle East Purging Compounds Market Volume, By Type, 2024 – 2032 (Metric Tons) 110

TABLE NO. 63. : Middle East Purging Compounds Market Revenue, By Type, 2018 – 2023 (USD Million) 111

TABLE NO. 64. : Middle East Purging Compounds Market Revenue, By Type, 2024 – 2032 (USD Million) 111

TABLE NO. 65. : Middle East Purging Compounds Market Volume, By Process, 2018 – 2023 (Metric Tons) 112

TABLE NO. 66. : Middle East Purging Compounds Market Volume, By Process, 2024 – 2032 (Metric Tons) 112

TABLE NO. 67. : Middle East Purging Compounds Market Revenue, By Process, 2018 – 2023 (USD Million) 113

TABLE NO. 68. : Middle East Purging Compounds Market Revenue, By Process, 2024 – 2032 (USD Million) 113

TABLE NO. 69. : Africa Purging Compounds Market Volume, By Country, 2018 – 2023 (Metric Tons) 116

TABLE NO. 70. : Africa Purging Compounds Market Volume, By Country, 2024 – 2032 (Metric Tons) 116

TABLE NO. 71. : Africa Purging Compounds Market Revenue, By Country, 2018 – 2023 (USD Million) 117

TABLE NO. 72. : Africa Purging Compounds Market Revenue, By Country, 2024 – 2032 (USD Million) 117

TABLE NO. 73. : Africa Purging Compounds Market Volume, By Type, 2018 – 2023 (Metric Tons) 118

TABLE NO. 74. : Africa Purging Compounds Market Volume, By Type, 2024 – 2032 (Metric Tons) 118

TABLE NO. 75. : Africa Purging Compounds Market Revenue, By Type, 2018 – 2023 (USD Million) 119

TABLE NO. 76. : Africa Purging Compounds Market Revenue, By Type, 2024 – 2032 (USD Million) 119

TABLE NO. 77. : Africa Purging Compounds Market Volume, By Process, 2018 – 2023 (Metric Tons) 120

TABLE NO. 78. : Africa Purging Compounds Market Volume, By Process, 2024 – 2032 (Metric Tons) 120

TABLE NO. 79. : Africa Purging Compounds Market Revenue, By Process, 2018 – 2023 (USD Million) 121

TABLE NO. 80. : Africa Purging Compounds Market Revenue, By Process, 2024 – 2032 (USD Million) 121

29

CHAPTER NO. 3 : PURGING COMPOUNDS MARKET – INDUSTRY ANALYSIS 30

3.1. Introduction 30

3.2. Market Drivers 31

3.2.1. Increasing demand for reduced machine downtime and faster material changeovers 31

3.2.2. Rising emphasis on high-quality plastic processing and defect-free outputs 32

3.3. Market Restraints 33

3.3.1. High cost of specialty purging compounds compared to basic resins 33

3.4. Market Opportunities 34

3.4.1. Market Opportunity Analysis 34

3.5. Porter’s Five Forces Analysis 35

3.6. Value Chain Analysis 36

3.7. Buying Criteria 37

CHAPTER NO. 4 : IMPORT EXPORT ANALYSIS 38

4.1. Import Analysis by Region 38

4.1.1. Global Purging Compounds Market Import Volume/Revenue, By Region, 2018 – 2023 38

4.2. Export Analysis by Region 39

4.2.1. Global Purging Compounds Market Export Volume/Revenue, By Region, 2018 – 2023 39

CHAPTER NO. 5 : PRODUCTION ANALYSIS 40

5.1. Production Analysis by Region 40

5.1.1. Global Purging Compounds Market Production Volume/Revenue, By Region, 2018 – 2023 40

5.1.2. Global Purging Compounds Market Production Volume, By Region, 2018 – 2023 (Metric Tons) 41

CHAPTER NO. 6 : PRICE ANALYSIS 42

6.1. Price Analysis by Region 42

6.1.1. Global Purging Compounds Market Price, By Region, 2018 – 2023 42

6.1.2. Global Type Market Price, By Region, 2018 – 2023 42

6.2. Price Analysis by Type 43

6.2.1. Global Purging Compounds Market Price, By Type, 2018 – 2023 43

6.2.2. Global Type Market Price, By Type, 2018 – 2023 43

CHAPTER NO. 7 : ANALYSIS COMPETITIVE LANDSCAPE 44

7.1. Company Market Share Analysis – 2023 44

7.1.1. Global Purging Compounds Market: Company Market Share, by Volume, 2023 44

7.1.2. Global Purging Compounds Market: Company Market Share, by Revenue, 2023 45

7.1.3. Global Purging Compounds Market: Top 6 Company Market Share, by Revenue, 2023 45

7.1.4. Global Purging Compounds Market: Top 3 Company Market Share, by Revenue, 2023 46

7.2. Global Purging Compounds Market Company Volume Market Share, 2023 47

7.3. Global Purging Compounds Market Company Revenue Market Share, 2023 48

7.4. Company Assessment Metrics, 2023 49

7.4.1. Stars 49

7.4.2. Emerging Leaders 49

7.4.3. Pervasive Players 49

7.4.4. Participants 49

7.5. Start-ups /SMEs Assessment Metrics, 2023 49

7.5.1. Progressive Companies 49

7.5.2. Responsive Companies 49

7.5.3. Dynamic Companies 49

7.5.4. Starting Blocks 49

7.6. Strategic Developments 50

7.6.1. Acquisitions & Mergers 50

New Product Launch 50

Regional Expansion 50

7.7. Key Players Product Matrix 51

CHAPTER NO. 8 : PESTEL & ADJACENT MARKET ANALYSIS 52

8.1. PESTEL 52

8.1.1. Political Factors 52

8.1.2. Economic Factors 52

8.1.3. Social Factors 52

8.1.4. Technological Factors 52

8.1.5. Environmental Factors 52

8.1.6. Legal Factors 52

8.2. Adjacent Market Analysis 52

CHAPTER NO. 9 : PURGING COMPOUNDS MARKET – BY TYPE SEGMENT ANALYSIS 53

9.1. Purging Compounds Market Overview, by Type Segment 53

9.1.1. Purging Compounds Market Volume Share, By Type, 2023 & 2032 54

9.1.2. Purging Compounds Market Revenue Share, By Type, 2023 & 2032 54

9.1.3. Purging Compounds Market Attractiveness Analysis, By Type 55

9.1.4. Incremental Revenue Growth Opportunity, by Type, 2024 – 2032 55

9.1.5. Purging Compounds Market Revenue, By Type, 2018, 2023, 2027 & 2032 56

9.2. Mechanical Purging Compounds 57

9.3. Chemical Purging Compounds 58

9.4. Liquid Purging Compounds 59

9.5. Hybrid Purging Compounds 60

CHAPTER NO. 10 : PURGING COMPOUNDS MARKET – BY PROCESS SEGMENT ANALYSIS 61

10.1. Purging Compounds Market Overview, by Process Segment 61

10.1.1. Purging Compounds Market Volume Share, By Process, 2023 & 2032 62

10.1.2. Purging Compounds Market Revenue Share, By Process, 2023 & 2032 62

10.1.3. Purging Compounds Market Attractiveness Analysis, By Process 63

10.1.4. Incremental Revenue Growth Opportunity, by Process, 2024 – 2032 63

10.1.5. Purging Compounds Market Revenue, By Process, 2018, 2023, 2027 & 2032 64

10.2. Extrusion 65

10.3. Injection molding 66

10.4. Blow molding 67

10.5. Others 68

CHAPTER NO. 11 : PURGING COMPOUNDS MARKET – REGIONAL ANALYSIS 69

11.1. Purging Compounds Market Overview, by Regional Segments 69

11.2. Region 70

11.2.1. Global Purging Compounds Market Volume Share, By Region, 2023 & 2032 70

11.2.2. Global Purging Compounds Market Revenue Share, By Region, 2023 & 2032 70

11.2.3. Purging Compounds Market Attractiveness Analysis, By Region 71

11.2.4. Incremental Revenue Growth Opportunity, by Region, 2024 – 2032 71

11.2.5. Purging Compounds Market Revenue, By Region, 2018, 2023, 2027 & 2032 72

11.2.6. Global Purging Compounds Market Volume & Revenue, By Region, 2018 – 2023 (Metric Tons) (USD Million) 73

11.2.7. Global Purging Compounds Market Volume & Revenue, By Region, 2024 – 2032 (Metric Tons) (USD Million) 73

CHAPTER NO. 12 : PURGING COMPOUNDS MARKET – NORTH AMERICA 75

12.1. North America 75

12.1.1. Key Highlights 75

12.1.2. North America Purging Compounds Market Volume, By Country, 2018 – 2032 (Metric Tons) 76

12.1.3. North America Purging Compounds Market Revenue, By Country, 2018 – 2023 (USD Million) 77

12.1.4. North America Purging Compounds Market Volume, By Type, 2018 – 2023 (Metric Tons) 78

12.1.5. North America Purging Compounds Market Revenue, By Type, 2018 – 2023 (USD Million) 79

12.1.6. North America Purging Compounds Market Volume, By Process, 2018 – 2023 (Metric Tons) 80

12.1.7. North America Purging Compounds Market Revenue, By Process, 2018 – 2023 (USD Million) 81

12.2. U.S. 82

12.3. Canada 82

12.4. Mexico 82

CHAPTER NO. 13 : PURGING COMPOUNDS MARKET – EUROPE 83

13.1. Europe 83

13.1.1. Key Highlights 83

13.1.2. Europe Purging Compounds Market Volume, By Country, 2018 – 2032 (Metric Tons) 84

13.1.3. Europe Purging Compounds Market Revenue, By Country, 2018 – 2023 (USD Million) 85

13.1.4. Europe Purging Compounds Market Volume, By Type, 2018 – 2023 (Metric Tons) 86

13.1.5. Europe Purging Compounds Market Revenue, By Type, 2018 – 2023 (USD Million) 87

13.1.6. Europe Purging Compounds Market Volume, By Process, 2018 – 2023 (Metric Tons) 88

13.1.7. Europe Purging Compounds Market Revenue, By Process, 2018 – 2023 (USD Million) 89

13.2. UK 90

13.3. France 90

13.4. Germany 90

13.5. Italy 90

13.6. Spain 90

13.7. Russia 90

13.8. Belgium 90

13.9. Netherland 90

13.10. Austria 90

13.11. Sweden 90

13.12. Poland 90

13.13. Denmark 90

13.14. Switzerland 90

13.15. Rest of Europe 90

CHAPTER NO. 14 : PURGING COMPOUNDS MARKET – ASIA PACIFIC 91

14.1. Asia Pacific 91

14.1.1. Key Highlights 91

14.1.2. Asia Pacific Purging Compounds Market Volume, By Country, 2018 – 2032 (Metric Tons) 92

14.1.3. Asia Pacific Purging Compounds Market Revenue, By Country, 2018 – 2023 (USD Million) 93

14.1.4. Asia Pacific Purging Compounds Market Volume, By Type, 2018 – 2023 (Metric Tons) 94

14.1.5. Asia Pacific Purging Compounds Market Revenue, By Type, 2018 – 2023 (USD Million) 95

14.1.6. Asia Pacific Purging Compounds Market Volume, By Process, 2018 – 2023 (Metric Tons) 96

14.1.7. Asia Pacific Purging Compounds Market Revenue, By Process, 2018 – 2023 (USD Million) 97

14.2. China 98

14.3. Japan 98

14.4. South Korea 98

14.5. India 98

14.6. Australia 98

14.7. Thailand 98

14.8. Indonesia 98

14.9. Vietnam 98

14.10. Malaysia 98

14.11. Philippines 98

14.12. Taiwan 98

14.13. Rest of Asia Pacific 98

CHAPTER NO. 15 : PURGING COMPOUNDS MARKET – LATIN AMERICA 99

15.1. Latin America 99

15.1.1. Key Highlights 99

15.1.2. Latin America Purging Compounds Market Volume, By Country, 2018 – 2032 (Metric Tons) 100

15.1.3. Latin America Purging Compounds Market Revenue, By Country, 2018 – 2023 (USD Million) 101

15.1.4. Latin America Purging Compounds Market Volume, By Type, 2018 – 2023 (Metric Tons) 102

15.1.5. Latin America Purging Compounds Market Revenue, By Type, 2018 – 2023 (USD Million) 103

15.1.6. Latin America Purging Compounds Market Volume, By Process, 2018 – 2023 (Metric Tons) 104

15.1.7. Latin America Purging Compounds Market Revenue, By Process, 2018 – 2023 (USD Million) 105

15.2. Brazil 106

15.3. Argentina 106

15.4. Peru 106

15.5. Chile 106

15.6. Colombia 106

15.7. Rest of Latin America 106

CHAPTER NO. 16 : PURGING COMPOUNDS MARKET – MIDDLE EAST 107

16.1. Middle East 107

16.1.1. Key Highlights 107

16.1.2. Middle East Purging Compounds Market Volume, By Country, 2018 – 2032 (Metric Tons) 108

16.1.3. Middle East Purging Compounds Market Revenue, By Country, 2018 – 2023 (USD Million) 109

16.1.4. Middle East Purging Compounds Market Volume, By Type, 2018 – 2023 (Metric Tons) 110

16.1.5. Middle East Purging Compounds Market Revenue, By Type, 2018 – 2023 (USD Million) 111

16.1.6. Middle East Purging Compounds Market Volume, By Process, 2018 – 2023 (Metric Tons) 112

16.1.7. Middle East Purging Compounds Market Revenue, By Process, 2018 – 2023 (USD Million) 113

16.2. UAE 114

16.3. KSA 114

16.4. Israel 114

16.5. Turkey 114

16.6. Iran 114

16.7. Rest of Middle East 114

CHAPTER NO. 17 : PURGING COMPOUNDS MARKET – AFRICA 115

17.1. Africa 115

17.1.1. Key Highlights 115

17.1.2. Africa Purging Compounds Market Volume, By Country, 2018 – 2032 (Metric Tons) 116

17.1.3. Africa Purging Compounds Market Revenue, By Country, 2018 – 2023 (USD Million) 117

17.1.4. Africa Purging Compounds Market Volume, By Type, 2018 – 2023 (Metric Tons) 118

17.1.5. Africa Purging Compounds Market Revenue, By Type, 2018 – 2023 (USD Million) 119

17.1.6. Africa Purging Compounds Market Volume, By Process, 2018 – 2023 (Metric Tons) 120

17.1.7. Africa Purging Compounds Market Revenue, By Process, 2018 – 2023 (USD Million) 121

17.2. Egypt 122

17.3. Nigeria 122

17.4. Algeria 122

17.5. Morocco 122

17.6. Rest of Africa 122

CHAPTER NO. 18 : COMPANY PROFILES 123

18.1. Calsak Corporation 123

18.1.1. Company Overview 123

18.1.2. Product Portfolio 123

18.1.3. Swot Analysis 123

18.1.4. Business Strategy 123

18.1.5. Financial Overview 124

18.2. Plastic Solutions, Inc. 125

18.3. Neutrex, Inc. 125

18.4. Perfect Colourants & Plastics Pvt. Ltd. 125

18.5. Asahi Kasei Corporation 125

18.6. Chem‑Trend L.P. 125

18.7. 3M 125

18.8. Company 8 125

18.9. Company 9 125

18.10. Company 10 125

18.11. Company 11 125

18.12. Company 12 125

18.13. Company 13 125

18.14. Company 14 125

List of Figures

FIG NO. 1. Global Purging Compounds Market Volume & Revenue, 2018 – 2032 (Metric Tons) (USD Million) 29

FIG NO. 2. Porter’s Five Forces Analysis for Global Purging Compounds Market 35

FIG NO. 3. Value Chain Analysis for Global Purging Compounds Market 36

FIG NO. 4. Global Purging Compounds Market Import Volume/Revenue, By Region, 2018 – 2023 38

FIG NO. 5. Global Purging Compounds Market Export Volume/Revenue, By Region, 2018 – 2023 39

FIG NO. 6. Global Purging Compounds Market Production Volume/Revenue, By Region, 2018 – 2023 40

FIG NO. 7. Global Purging Compounds Market Price, By Region, 2018 – 2023 42

FIG NO. 8. Global Purging Compounds Market Price, By Type, 2018 – 2023 43

FIG NO. 9. Company Share Analysis, 2023 44

FIG NO. 10. Company Share Analysis, 2023 45

FIG NO. 11. Company Share Analysis, 2023 45

FIG NO. 12. Company Share Analysis, 2023 46

FIG NO. 13. Purging Compounds Market – Company Volume Market Share, 2023 47

FIG NO. 14. Purging Compounds Market – Company Revenue Market Share, 2023 48

FIG NO. 15. Purging Compounds Market Volume Share, By Type, 2023 & 2032 54

FIG NO. 16. Purging Compounds Market Revenue Share, By Type, 2023 & 2032 54

FIG NO. 17. Market Attractiveness Analysis, By Type 55

FIG NO. 18. Incremental Revenue Growth Opportunity by Type, 2024 – 2032 55

FIG NO. 19. Purging Compounds Market Revenue, By Type, 2018, 2023, 2027 & 2032 56

FIG NO. 20. Global Purging Compounds Market for Mechanical Purging Compounds, Volume & Revenue (Metric Tons) (USD Million) 2018 – 2032 57

FIG NO. 21. Global Purging Compounds Market for Chemical Purging Compounds, Volume & Revenue (Metric Tons) (USD Million) 2018 – 2032 58

FIG NO. 22. Global Purging Compounds Market for Liquid Purging Compounds, Volume & Revenue (Metric Tons) (USD Million) 2018 – 2032 59

FIG NO. 23. Global Purging Compounds Market for Hybrid Purging Compounds, Volume & Revenue (Metric Tons) (USD Million) 2018 – 2032 60

FIG NO. 24. Purging Compounds Market Volume Share, By Process, 2023 & 2032 62

FIG NO. 25. Purging Compounds Market Revenue Share, By Process, 2023 & 2032 62

FIG NO. 26. Market Attractiveness Analysis, By Process 63

FIG NO. 27. Incremental Revenue Growth Opportunity by Process, 2024 – 2032 63

FIG NO. 28. Purging Compounds Market Revenue, By Process, 2018, 2023, 2027 & 2032 64

FIG NO. 29. Global Purging Compounds Market for Extrusion, Volume & Revenue (Metric Tons) (USD Million) 2018 – 2032 65

FIG NO. 30. Global Purging Compounds Market for Injection molding, Volume & Revenue (Metric Tons) (USD Million) 2018 – 2032 66

FIG NO. 31. Global Purging Compounds Market for Blow molding, Volume & Revenue (Metric Tons) (USD Million) 2018 – 2032 67

FIG NO. 32. Global Purging Compounds Market for Others, Volume & Revenue (Metric Tons) (USD Million) 2018 – 2032 68

FIG NO. 33. Global Purging Compounds Market Volume Share, By Region, 2023 & 2032 70

FIG NO. 34. Global Purging Compounds Market Revenue Share, By Region, 2023 & 2032 70

FIG NO. 35. Market Attractiveness Analysis, By Region 71

FIG NO. 36. Incremental Revenue Growth Opportunity by Region, 2024 – 2032 71

FIG NO. 37. Purging Compounds Market Revenue, By Region, 2018, 2023, 2027 & 2032 72

FIG NO. 38. North America Purging Compounds Market Volume & Revenue, 2018 – 2032 (Metric Tons) (USD Million) 75

FIG NO. 39. Europe Purging Compounds Market Volume & Revenue, 2018 – 2032 (Metric Tons) (USD Million) 83

FIG NO. 40. Asia Pacific Purging Compounds Market Volume & Revenue, 2018 – 2032 (Metric Tons) (USD Million) 91

FIG NO. 41. Latin America Purging Compounds Market Volume & Revenue, 2018 – 2032 (Metric Tons) (USD Million) 99

FIG NO. 42. Middle East Purging Compounds Market Volume & Revenue, 2018 – 2032 (Metric Tons) (USD Million) 107

FIG NO. 43. Africa Purging Compounds Market Volume & Revenue, 2018 – 2032 (Metric Tons) (USD Million) 115

List of Tables

TABLE NO. 1. : Global Purging Compounds Market: Snapshot 27

TABLE NO. 2. : Drivers for the Purging Compounds Market: Impact Analysis 31

TABLE NO. 3. : Restraints for the Purging Compounds Market: Impact Analysis 33

TABLE NO. 4. : Global Purging Compounds Market Production Volume, By Region, 2018 – 2023 (Metric Tons) 41

TABLE NO. 5. : Global Purging Compounds Market Volume & Revenue, By Region, 2018 – 2023 42

TABLE NO. 6. : Global Purging Compounds Market Volume & Revenue, By Type, 2018 – 2023 43

TABLE NO. 7. : Global Purging Compounds Market Volume & Revenue, By Region, 2018 – 2023 (Metric Tons) (USD Million) 73

TABLE NO. 8. : Global Purging Compounds Market Volume & Revenue, By Region, 2024 – 2032 (Metric Tons) (USD Million) 73

TABLE NO. 9. : North America Purging Compounds Market Volume, By Country, 2018 – 2023 (Metric Tons) 76

TABLE NO. 10. : North America Purging Compounds Market Volume, By Country, 2024 – 2032 (Metric Tons) 76

TABLE NO. 11. : North America Purging Compounds Market Revenue, By Country, 2018 – 2023 (USD Million) 77

TABLE NO. 12. : North America Purging Compounds Market Revenue, By Country, 2024 – 2032 (USD Million) 77

TABLE NO. 13. : North America Purging Compounds Market Volume, By Type, 2018 – 2023 (Metric Tons) 78

TABLE NO. 14. : North America Purging Compounds Market Volume, By Type, 2024 – 2032 (Metric Tons) 78

TABLE NO. 15. : North America Purging Compounds Market Revenue, By Type, 2018 – 2023 (USD Million) 79

TABLE NO. 16. : North America Purging Compounds Market Revenue, By Type, 2024 – 2032 (USD Million) 79

TABLE NO. 17. : North America Purging Compounds Market Volume, By Process, 2018 – 2023 (Metric Tons) 80

TABLE NO. 18. : North America Purging Compounds Market Volume, By Process, 2024 – 2032 (Metric Tons) 80

TABLE NO. 19. : North America Purging Compounds Market Revenue, By Process, 2018 – 2023 (USD Million) 81

TABLE NO. 20. : North America Purging Compounds Market Revenue, By Process, 2024 – 2032 (USD Million) 81

TABLE NO. 21. : Europe Purging Compounds Market Volume, By Country, 2018 – 2023 (Metric Tons) 84

TABLE NO. 22. : Europe Purging Compounds Market Volume, By Country, 2024 – 2032 (Metric Tons) 84

TABLE NO. 23. : Europe Purging Compounds Market Revenue, By Country, 2018 – 2023 (USD Million) 85

TABLE NO. 24. : Europe Purging Compounds Market Revenue, By Country, 2024 – 2032 (USD Million) 85

TABLE NO. 25. : Europe Purging Compounds Market Volume, By Type, 2018 – 2023 (Metric Tons) 86

TABLE NO. 26. : Europe Purging Compounds Market Volume, By Type, 2024 – 2032 (Metric Tons) 86

TABLE NO. 27. : Europe Purging Compounds Market Revenue, By Type, 2018 – 2023 (USD Million) 87

TABLE NO. 28. : Europe Purging Compounds Market Revenue, By Type, 2024 – 2032 (USD Million) 87

TABLE NO. 29. : Europe Purging Compounds Market Volume, By Process, 2018 – 2023 (Metric Tons) 88

TABLE NO. 30. : Europe Purging Compounds Market Volume, By Process, 2024 – 2032 (Metric Tons) 88

TABLE NO. 31. : Europe Purging Compounds Market Revenue, By Process, 2018 – 2023 (USD Million) 89

TABLE NO. 32. : Europe Purging Compounds Market Revenue, By Process, 2024 – 2032 (USD Million) 89

TABLE NO. 33. : Asia Pacific Purging Compounds Market Volume, By Country, 2018 – 2023 (Metric Tons) 92

TABLE NO. 34. : Asia Pacific Purging Compounds Market Volume, By Country, 2024 – 2032 (Metric Tons) 92

TABLE NO. 35. : Asia Pacific Purging Compounds Market Revenue, By Country, 2018 – 2023 (USD Million) 93

TABLE NO. 36. : Asia Pacific Purging Compounds Market Revenue, By Country, 2024 – 2032 (USD Million) 93

TABLE NO. 37. : Asia Pacific Purging Compounds Market Volume, By Type, 2018 – 2023 (Metric Tons) 94

TABLE NO. 38. : Asia Pacific Purging Compounds Market Volume, By Type, 2024 – 2032 (Metric Tons) 94

TABLE NO. 39. : Asia Pacific Purging Compounds Market Revenue, By Type, 2018 – 2023 (USD Million) 95

TABLE NO. 40. : Asia Pacific Purging Compounds Market Revenue, By Type, 2024 – 2032 (USD Million) 95

TABLE NO. 41. : Asia Pacific Purging Compounds Market Volume, By Process, 2018 – 2023 (Metric Tons) 96

TABLE NO. 42. : Asia Pacific Purging Compounds Market Volume, By Process, 2024 – 2032 (Metric Tons) 96

TABLE NO. 43. : Asia Pacific Purging Compounds Market Revenue, By Process, 2018 – 2023 (USD Million) 97

TABLE NO. 44. : Asia Pacific Purging Compounds Market Revenue, By Process, 2024 – 2032 (USD Million) 97

TABLE NO. 45. : Latin America Purging Compounds Market Volume, By Country, 2018 – 2023 (Metric Tons) 100

TABLE NO. 46. : Latin America Purging Compounds Market Volume, By Country, 2024 – 2032 (Metric Tons) 100

TABLE NO. 47. : Latin America Purging Compounds Market Revenue, By Country, 2018 – 2023 (USD Million) 101

TABLE NO. 48. : Latin America Purging Compounds Market Revenue, By Country, 2024 – 2032 (USD Million) 101

TABLE NO. 49. : Latin America Purging Compounds Market Volume, By Type, 2018 – 2023 (Metric Tons) 102

TABLE NO. 50. : Latin America Purging Compounds Market Volume, By Type, 2024 – 2032 (Metric Tons) 102

TABLE NO. 51. : Latin America Purging Compounds Market Revenue, By Type, 2018 – 2023 (USD Million) 103

TABLE NO. 52. : Latin America Purging Compounds Market Revenue, By Type, 2024 – 2032 (USD Million) 103

TABLE NO. 53. : Latin America Purging Compounds Market Volume, By Process, 2018 – 2023 (Metric Tons) 104

TABLE NO. 54. : Latin America Purging Compounds Market Volume, By Process, 2024 – 2032 (Metric Tons) 104

TABLE NO. 55. : Latin America Purging Compounds Market Revenue, By Process, 2018 – 2023 (USD Million) 105

TABLE NO. 56. : Latin America Purging Compounds Market Revenue, By Process, 2024 – 2032 (USD Million) 105

TABLE NO. 57. : Middle East Purging Compounds Market Volume, By Country, 2018 – 2023 (Metric Tons) 108

TABLE NO. 58. : Middle East Purging Compounds Market Volume, By Country, 2024 – 2032 (Metric Tons) 108

TABLE NO. 59. : Middle East Purging Compounds Market Revenue, By Country, 2018 – 2023 (USD Million) 109

TABLE NO. 60. : Middle East Purging Compounds Market Revenue, By Country, 2024 – 2032 (USD Million) 109

TABLE NO. 61. : Middle East Purging Compounds Market Volume, By Type, 2018 – 2023 (Metric Tons) 110

TABLE NO. 62. : Middle East Purging Compounds Market Volume, By Type, 2024 – 2032 (Metric Tons) 110

TABLE NO. 63. : Middle East Purging Compounds Market Revenue, By Type, 2018 – 2023 (USD Million) 111

TABLE NO. 64. : Middle East Purging Compounds Market Revenue, By Type, 2024 – 2032 (USD Million) 111

TABLE NO. 65. : Middle East Purging Compounds Market Volume, By Process, 2018 – 2023 (Metric Tons) 112

TABLE NO. 66. : Middle East Purging Compounds Market Volume, By Process, 2024 – 2032 (Metric Tons) 112

TABLE NO. 67. : Middle East Purging Compounds Market Revenue, By Process, 2018 – 2023 (USD Million) 113

TABLE NO. 68. : Middle East Purging Compounds Market Revenue, By Process, 2024 – 2032 (USD Million) 113

TABLE NO. 69. : Africa Purging Compounds Market Volume, By Country, 2018 – 2023 (Metric Tons) 116

TABLE NO. 70. : Africa Purging Compounds Market Volume, By Country, 2024 – 2032 (Metric Tons) 116

TABLE NO. 71. : Africa Purging Compounds Market Revenue, By Country, 2018 – 2023 (USD Million) 117

TABLE NO. 72. : Africa Purging Compounds Market Revenue, By Country, 2024 – 2032 (USD Million) 117

TABLE NO. 73. : Africa Purging Compounds Market Volume, By Type, 2018 – 2023 (Metric Tons) 118

TABLE NO. 74. : Africa Purging Compounds Market Volume, By Type, 2024 – 2032 (Metric Tons) 118

TABLE NO. 75. : Africa Purging Compounds Market Revenue, By Type, 2018 – 2023 (USD Million) 119

TABLE NO. 76. : Africa Purging Compounds Market Revenue, By Type, 2024 – 2032 (USD Million) 119

TABLE NO. 77. : Africa Purging Compounds Market Volume, By Process, 2018 – 2023 (Metric Tons) 120

TABLE NO. 78. : Africa Purging Compounds Market Volume, By Process, 2024 – 2032 (Metric Tons) 120

TABLE NO. 79. : Africa Purging Compounds Market Revenue, By Process, 2018 – 2023 (USD Million) 121

TABLE NO. 80. : Africa Purging Compounds Market Revenue, By Process, 2024 – 2032 (USD Million) 121