Market Overview

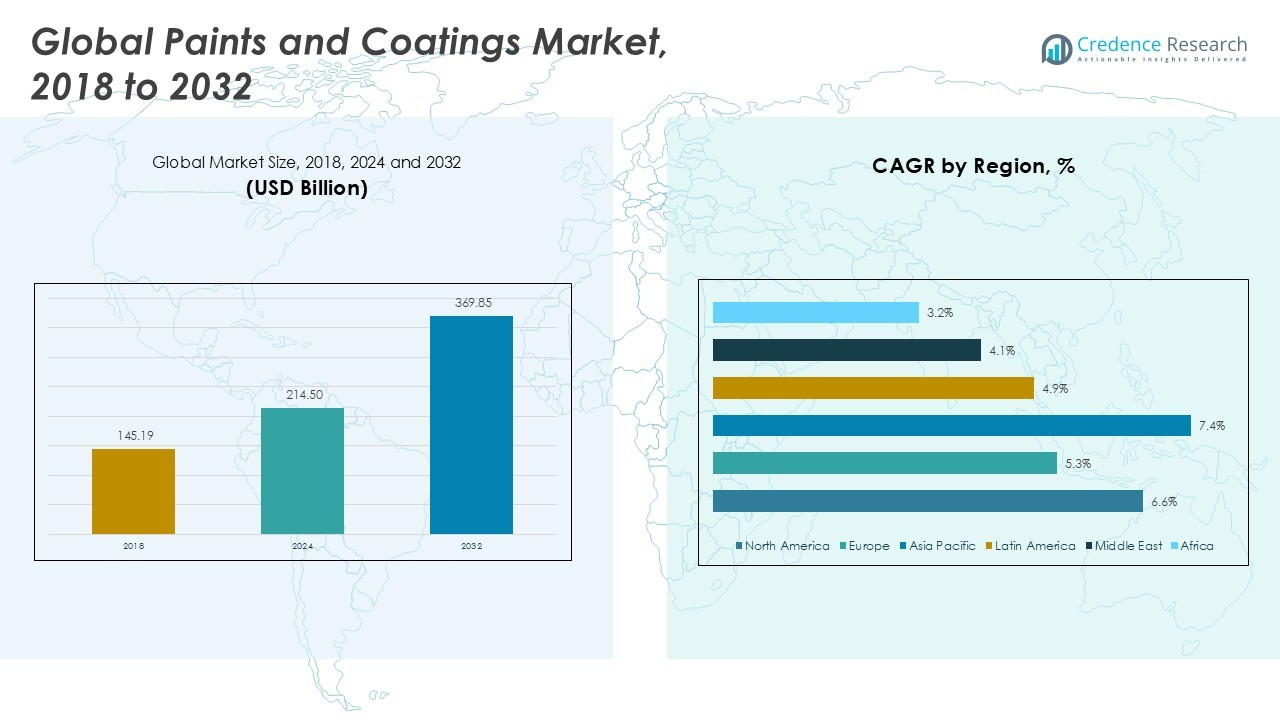

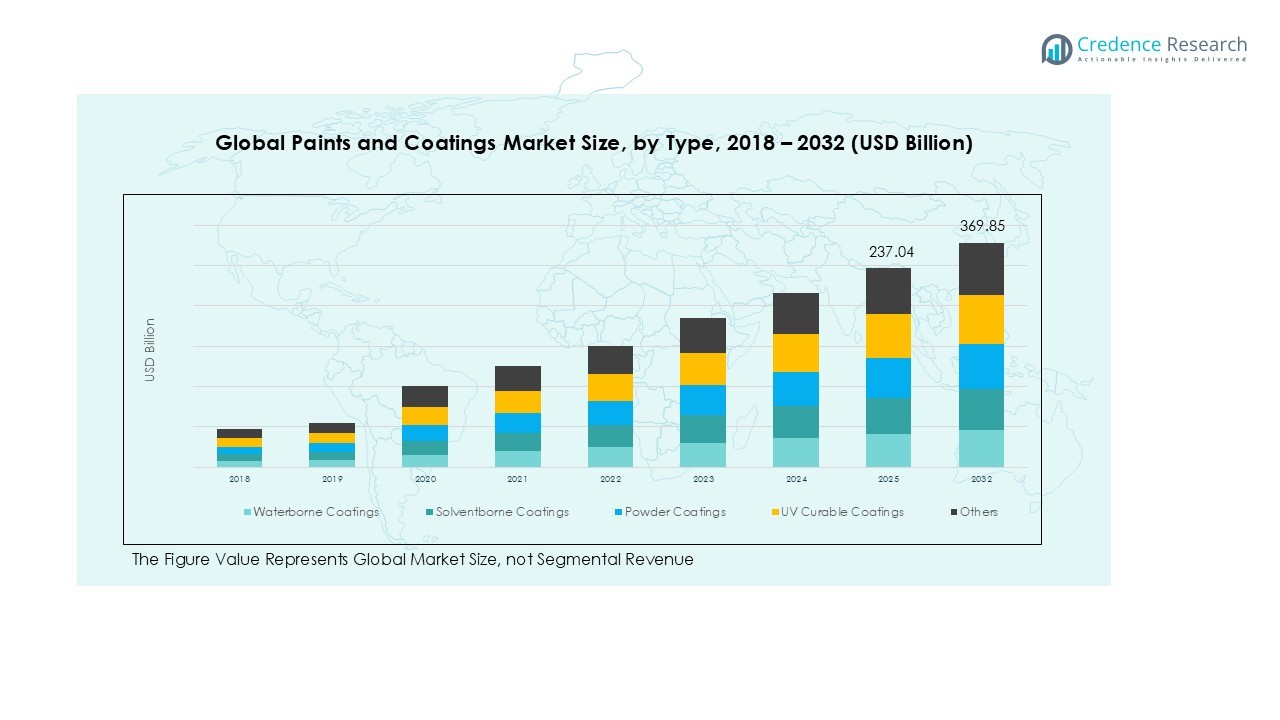

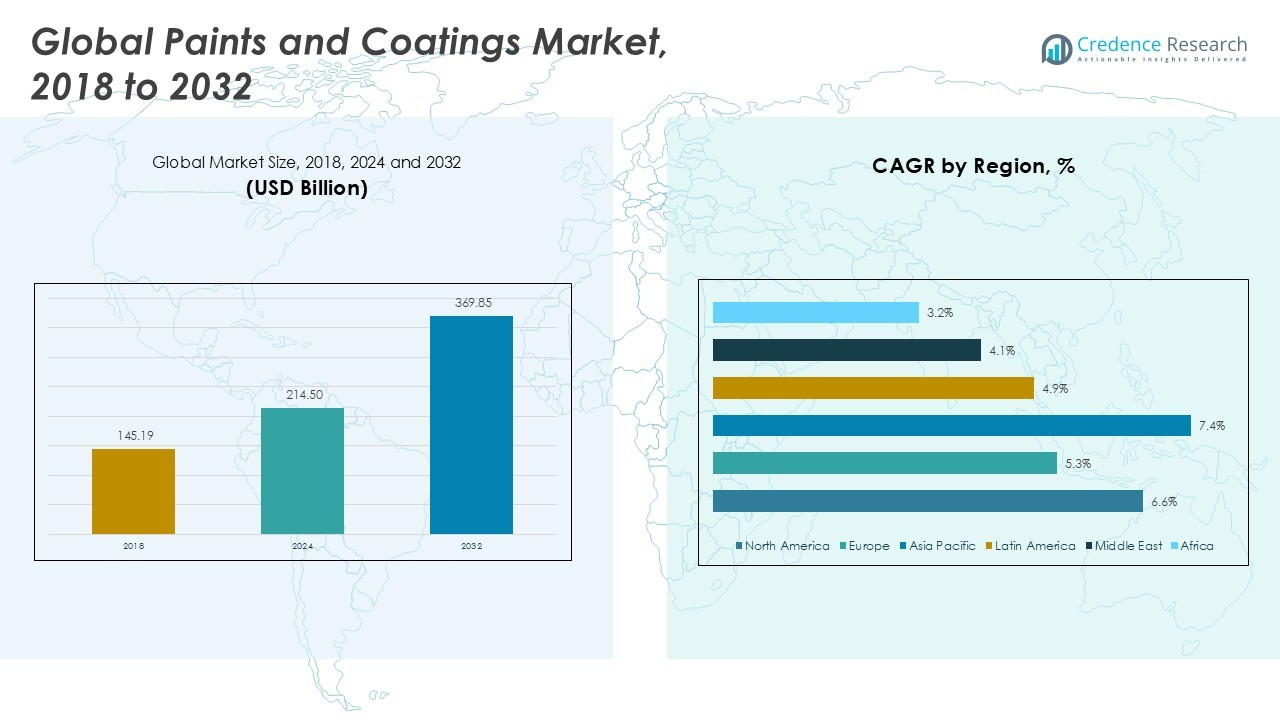

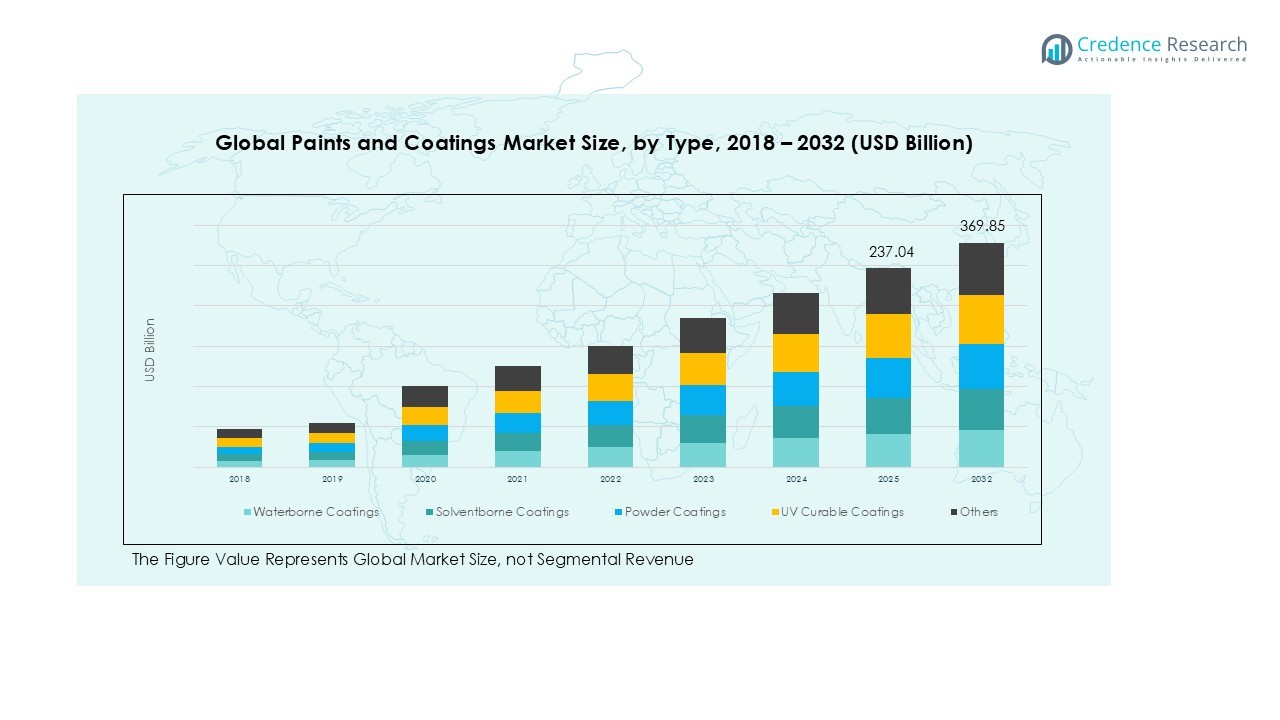

The global Paints and Coatings market size was valued at USD 145.19 billion in 2018 and grew to USD 214.50 billion in 2024. It is anticipated to reach USD 369.85 billion by 2032, registering a CAGR of 6.56% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Paints and Coatings market Size 2024 |

USD 214.50 Billion |

| Paints and Coatings market, CAGR |

6.56% |

| Paints and Coatings market Size 2032 |

USD 369.85 Billion |

The global Paints and Coatings market is highly competitive, dominated by key players such as Sherwin-Williams Company, Akzo Nobel N.V., PPG Industries, Inc., BASF SE, RPM International Inc., Asian Paints Limited, Nippon Paint Holdings Co., Ltd., Kansai Paint Co., Ltd., Axalta Coating Systems, and Jotun A/S. These companies maintain market leadership through continuous product innovation, strategic acquisitions, and expansion into emerging markets. They focus on eco-friendly, high-performance, and technologically advanced coatings to meet evolving customer demands across residential, commercial, automotive, and industrial sectors. Asia Pacific emerges as the leading region, commanding a market share of approximately 41% in 2024, driven by rapid urbanization, industrial growth, and increasing demand for decorative and protective coatings in countries such as China, India, and Japan. The region’s robust construction and automotive activities continue to fuel growth, making it the most influential market globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global Paints and Coatings market was valued at USD 214.50 billion in 2024 and is projected to reach USD 369.85 billion by 2032, growing at a CAGR of 6.56%. Waterborne coatings hold the largest segment share at approximately 42%, while epoxy coatings lead the technology segment with around 38%.

- Market growth is driven by rising construction activities, expanding automotive production, and increasing adoption of eco-friendly and low-VOC coatings across industries. Demand is particularly strong in residential and commercial construction sectors.

- Technological advancements, including UV curable, nanocoatings, and hybrid formulations, are shaping market trends. Smart coatings with self-cleaning, anti-corrosive, and multifunctional properties are gaining traction across automotive, industrial, and electronics applications.

- The competitive landscape features major players such as Sherwin-Williams, Akzo Nobel, PPG Industries, BASF, RPM International, Asian Paints, Nippon Paint, Kansai Paint, Axalta, and Jotun, focusing on product innovation, strategic partnerships, and regional expansions.

- Regionally, Asia Pacific dominates with a 41% market share, followed by North America at 28% and Europe at 17%, supported by urbanization, industrialization, and infrastructure growth.

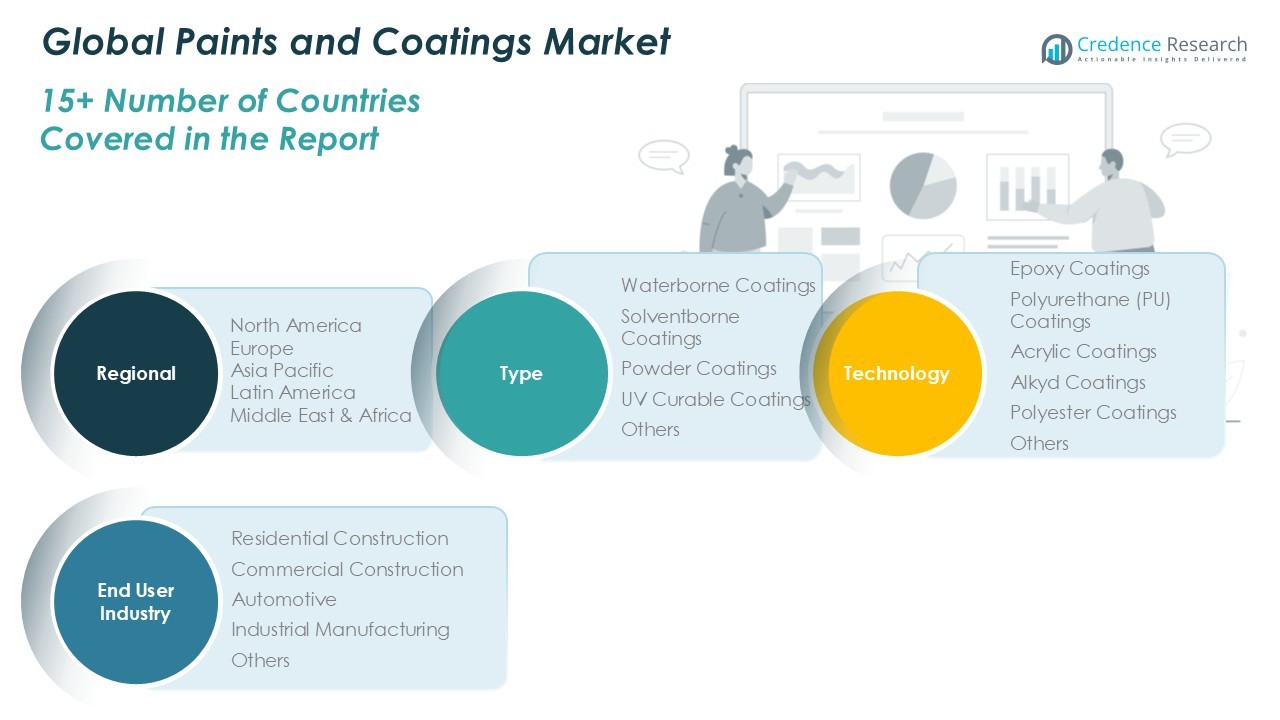

Market Segmentation Analysis:

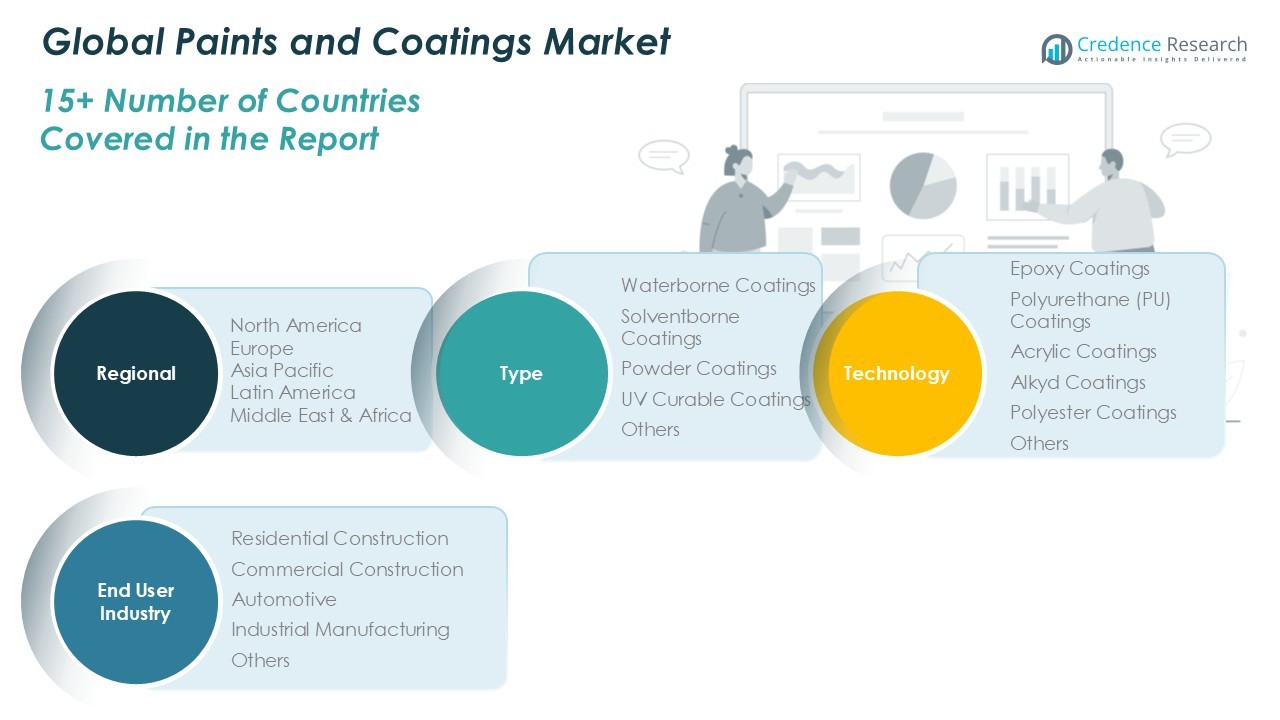

By Type:

The Paints and Coatings market by type is led by waterborne coatings, accounting for approximately 42% of the market share in 2024. Waterborne coatings are increasingly favored due to their low VOC emissions, regulatory compliance, and environmental sustainability. Solventborne coatings hold a significant portion as well, driven by their superior durability and performance in industrial applications. Powder coatings and UV curable coatings are gaining traction, particularly in automotive and electronics sectors, due to their efficiency and fast curing times. The “others” category, including specialty coatings, contributes a modest share, primarily driven by niche industrial applications.

- For instance, PPG’s waterborne coatings emit VOCs as low as 100-300g/L, compared to 700-900g/L in solventborne types, making them safer and more environmentally friendly for applications in automotive OEM and electronics.

By Technology:

Epoxy coatings dominate the technology segment with a market share of nearly 38%, owing to their excellent chemical resistance and strong adhesion properties, making them ideal for industrial and infrastructure applications. Polyurethane (PU) and acrylic coatings follow closely, supported by demand in automotive and architectural sectors for their durability, aesthetic appeal, and weather resistance. Alkyd and polyester coatings hold moderate shares, largely driven by cost-effectiveness in residential construction. The “others” sub-segment, encompassing hybrid and specialty technologies, is gradually expanding due to innovations in sustainable and high-performance coatings.

- For instance, Sakshi Coating Pvt Ltd offers chemical-resistant epoxy coatings that protect surfaces from harsh chemicals, solvents, acids, and bases, ensuring durability in industrial environments like chemical plants and marine settings.

By End-User Industry:

In terms of end-user industries, residential construction leads the market with a share of approximately 35%, driven by rapid urbanization, housing developments, and demand for decorative and protective coatings. Commercial construction follows closely, benefiting from infrastructure growth and renovation projects. The automotive sector accounts for a substantial portion as well, supported by increasing vehicle production and the need for durable, high-performance coatings. Industrial manufacturing contributes a moderate share, fueled by protective and functional coating requirements, while the “others” segment caters to specialized sectors such as aerospace, marine, and electronics.

Key Growth Drivers

Rising Construction Activities:

Rapid urbanization and increasing investments in residential and commercial infrastructure are driving demand for paints and coatings globally. The need for aesthetically appealing, durable, and protective coatings in housing projects, office buildings, and retail spaces has accelerated market growth. Waterborne and eco-friendly coatings are particularly favored in new construction due to environmental regulations. Additionally, government initiatives to develop smart cities and infrastructure modernization programs are further boosting demand, ensuring consistent growth across both mature and emerging markets.

- For instance, India’s government initiatives like the Smart Cities Mission and Housing for All are significantly raising demand for decorative and durable paints in new urban and residential developments, with major paint companies innovating around waterborne and eco-friendly coatings to meet market needs.

Automotive Industry Expansion:

The expanding automotive sector is a significant growth driver for the paints and coatings market. With rising vehicle production and increasing consumer preference for high-quality finishes, demand for durable and corrosion-resistant coatings such as PU and epoxy is growing. OEMs are adopting advanced coating technologies to enhance vehicle aesthetics and longevity. Furthermore, the shift toward electric vehicles is encouraging manufacturers to invest in innovative coatings that improve thermal management, lightweight design integration, and environmental compliance, driving technology adoption.

- For instance, BASF increased its production capacity for polyester and polyurethane resins at its plant in Shanghai to meet growing automotive demand.

Environmental Regulations and Sustainable Solutions:

Stringent regulations on VOC emissions and hazardous chemicals have accelerated the adoption of sustainable coatings. Waterborne, powder, and UV curable coatings are increasingly replacing solventborne solutions to meet environmental compliance. Growing awareness among consumers and industrial buyers about eco-friendly solutions is pushing manufacturers to innovate. Companies focusing on low-VOC, recyclable, and energy-efficient coatings are gaining a competitive edge. This regulatory landscape is driving research and development investments, fostering product diversification, and promoting market expansion across all regions.

Key Trends & Opportunities

Technological Advancements in Coatings:

Innovation in coating technologies is shaping market growth. Developments in UV curable, nanocoatings, and hybrid formulations offer enhanced durability, faster curing times, and better environmental performance. These advanced coatings cater to automotive, electronics, and industrial applications, creating new revenue streams. Increasing adoption of smart coatings with self-cleaning, anti-corrosive, and anti-microbial properties presents substantial opportunities for manufacturers. The trend toward multifunctional and customized coatings allows companies to differentiate products, capture premium segments, and expand their presence in high-growth industries.

- For instance, Nasiol’s nanocoatings offer hydrophobic and anti-corrosive properties that improve vehicle aerodynamics, extend battery life in electric vehicles, and protect automotive paint from UV damage.

Growth in Emerging Economies:

Emerging markets in Asia-Pacific, Latin America, and Africa are presenting significant opportunities for the paints and coatings industry. Rapid industrialization, urban infrastructure development, and rising disposable incomes are boosting demand for decorative and protective coatings. Increasing awareness of quality and durability is encouraging consumers to adopt premium products. Moreover, government initiatives promoting construction, automotive, and industrial sectors are creating favorable conditions for market expansion. Manufacturers are increasingly focusing on regional penetration strategies and local production to capitalize on these high-growth markets.

- For instance, PPG Industries expanded its powder coatings plant in Sumaré, Brazil, in September 2023. This expansion was designed to meet the increasing demand for powder coatings from regional manufacturers of appliances, agricultural machinery, transportation, and other industries, thereby strengthening PPG’s presence in the Latin American market.

Key Challenges

Volatility in Raw Material Prices:

Fluctuating prices of key raw materials such as titanium dioxide, solvents, resins, and pigments pose a major challenge for paints and coatings manufacturers. Price volatility can impact production costs, reduce profit margins, and affect pricing strategies. Dependence on imports for certain chemicals in emerging markets further exacerbates supply chain risks. Manufacturers must balance cost management with maintaining quality standards, while sudden price hikes can slow down market growth or discourage end-user adoption, especially in price-sensitive segments like residential and industrial construction.

Stringent Regulatory Compliance:

Compliance with environmental and safety regulations remains a critical challenge for the paints and coatings industry. Restrictions on VOC emissions, chemical usage, and waste disposal require continuous adaptation of formulations and manufacturing processes. Non-compliance can lead to penalties, product recalls, or market access limitations. Additionally, navigating varying regulations across regions complicates global operations. Manufacturers need to invest in R&D, eco-friendly technologies, and certification processes to ensure regulatory adherence, which can increase operational costs and extend product development timelines.

Regional Analysis

North America:

The North American Paints and Coatings market was valued at USD 42.28 billion in 2018 and expanded to USD 61.50 billion in 2024, with projections reaching USD 106.48 billion by 2032 at a CAGR of 6.6%. The region holds a significant market share of approximately 28%, driven by robust demand in residential and commercial construction, automotive production, and industrial applications. Strong regulatory compliance and the adoption of eco-friendly waterborne coatings are further propelling growth. Technological innovations and infrastructure modernization initiatives across the U.S. and Canada continue to strengthen the market outlook.

Europe:

Europe’s Paints and Coatings market reached USD 26.89 billion in 2018 and grew to USD 37.54 billion in 2024, with forecasts estimating USD 58.81 billion by 2032 at a CAGR of 5.3%. Holding nearly 17% of the global market, the region benefits from high demand for decorative, protective, and industrial coatings across automotive and construction sectors. Stringent environmental regulations are accelerating the adoption of low-VOC and waterborne coatings. Key markets including Germany, France, and the UK are driving innovation in specialty coatings, contributing to consistent regional growth.

Asia Pacific:

Asia Pacific dominates the global Paints and Coatings market, valued at USD 63.34 billion in 2018 and reaching USD 97.03 billion in 2024, with projections of USD 177.53 billion by 2032 at a CAGR of 7.4%. The region commands a market share of approximately 41%, fueled by rapid urbanization, industrialization, and automotive manufacturing in China, India, and Japan. Rising construction activities, increasing disposable incomes, and government infrastructure initiatives are boosting demand for decorative and protective coatings. Adoption of advanced waterborne, powder, and UV-curable coatings is further enhancing market growth.

Latin America:

Latin America’s Paints and Coatings market was valued at USD 6.86 billion in 2018 and grew to USD 10.01 billion in 2024, with expectations to reach USD 15.27 billion by 2032 at a CAGR of 4.9%. The region holds a market share of around 4%. Growth is primarily driven by construction projects, automotive production, and industrial development in Brazil and Argentina. Increasing awareness of high-quality and durable coatings is encouraging adoption of advanced technologies. Investment in urban infrastructure and expansion of commercial construction projects continue to support steady regional growth.

Middle East:

The Middle East Paints and Coatings market reached USD 3.81 billion in 2018, growing to USD 5.11 billion in 2024, and is projected to hit USD 7.33 billion by 2032 at a CAGR of 4.1%. Representing nearly 3% of the global market, growth is supported by infrastructure expansion, oil and gas sector developments, and urban construction activities. Adoption of high-performance protective coatings and corrosion-resistant solutions is rising across industrial and commercial sectors. Government initiatives for urbanization and smart city projects, particularly in GCC countries, continue to boost regional demand.

Africa:

Africa’s Paints and Coatings market was valued at USD 2.01 billion in 2018 and increased to USD 3.31 billion in 2024, with projections reaching USD 4.43 billion by 2032 at a CAGR of 3.2%. The region contributes approximately 1% to the global market, driven by residential construction, infrastructure development, and industrial projects in South Africa and Egypt. Rising urbanization and demand for durable, cost-effective coatings are supporting growth. However, limited technological adoption and economic challenges restrain rapid expansion, though investment in sustainable and high-performance coatings is gradually increasing.

Market Segmentations:

By Type:

- Waterborne Coatings

- Solventborne Coatings

- Powder Coatings

- UV Curable Coatings

- Others

By Technology:

- Epoxy Coatings

- Polyurethane (PU) Coatings

- Acrylic Coatings

- Alkyd Coatings

- Polyester Coatings

- Others

By End-User Industry:

- Residential Construction

- Commercial Construction

- Automotive

- Industrial Manufacturing

- Others

By Region:

- North America (U.S., Canada, Mexico)

- Europe (UK, France, Germany, Italy, Spain, Russia, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, India, Australia, Southeast Asia, Rest of Asia Pacific)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East (GCC Countries, Israel, Turkey, Rest of Middle East)

- Africa (South Africa, Egypt, Rest of Africa)

Competitive Landscape

The competitive landscape of the global Paints and Coatings market is characterized by the presence of major players such as Sherwin-Williams Company, Akzo Nobel N.V., PPG Industries, Inc., BASF SE, RPM International Inc., Asian Paints Limited, Nippon Paint Holdings Co., Ltd., Kansai Paint Co., Ltd., Axalta Coating Systems, and Jotun A/S. These companies maintain their market positions through strategic mergers and acquisitions, product innovations, and expansion into emerging markets. Intense competition drives continuous development of eco-friendly, high-performance, and technologically advanced coatings to meet diverse end-user requirements. Key players focus on strengthening their distribution networks, enhancing R&D capabilities, and leveraging brand recognition to capture market share. Additionally, partnerships with construction, automotive, and industrial sectors allow manufacturers to expand their reach. The market remains fragmented at regional levels, fostering both innovation and competitive pricing strategies to address evolving customer demands globally.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In June 2025, JSW Paints acquired a 74.76% stake in Akzo Nobel India, strengthening its position as the fourth-largest player in the Indian paints sector.

- In October 2025, Sherwin-Williams completed the acquisition of BASF’s Brazilian architectural paints business, Suvinil, expanding its footprint in Latin America.

- In May 2025, WEG acquired U.S.-based Heresite Protective Coatings, enhancing its industrial coatings portfolio for HVAC and industrial applications.

- In February 2024, Grasim Industries launched its premium decorative paint range, ‘Birla Opus’, investing in six new manufacturing plants across India to capture a larger share of the decorative paints market.

Report Coverage

The research report offers an in-depth analysis based on Type, Technology, End User Industry, and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to witness steady growth driven by rising construction and infrastructure development globally.

- Increasing demand for eco-friendly and low-VOC coatings will shape product innovation and adoption.

- Advanced coating technologies such as UV curable and nanocoatings will gain prominence across industrial and automotive sectors.

- Rapid urbanization and industrialization in emerging economies will offer significant growth opportunities.

- Growing automotive production and the shift toward electric vehicles will boost demand for high-performance coatings.

- Residential and commercial construction projects will continue to drive decorative and protective coatings demand.

- Companies will focus on strategic expansions, partnerships, and acquisitions to strengthen market presence.

- Rising awareness of durability, aesthetics, and corrosion protection will encourage adoption of premium coatings.

- Regulatory compliance and sustainability initiatives will steer research and development investments.

- Digitalization and smart coating solutions will enhance application efficiency and create new market segments.