| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Patient Warming Systems Market Size 2024 |

USD 1,714.4 million |

| Patient Warming Systems Market, CAGR |

4.07% |

| Patient Warming Systems Market Size 2032 |

USD 1,714.4 million |

Market Overview:

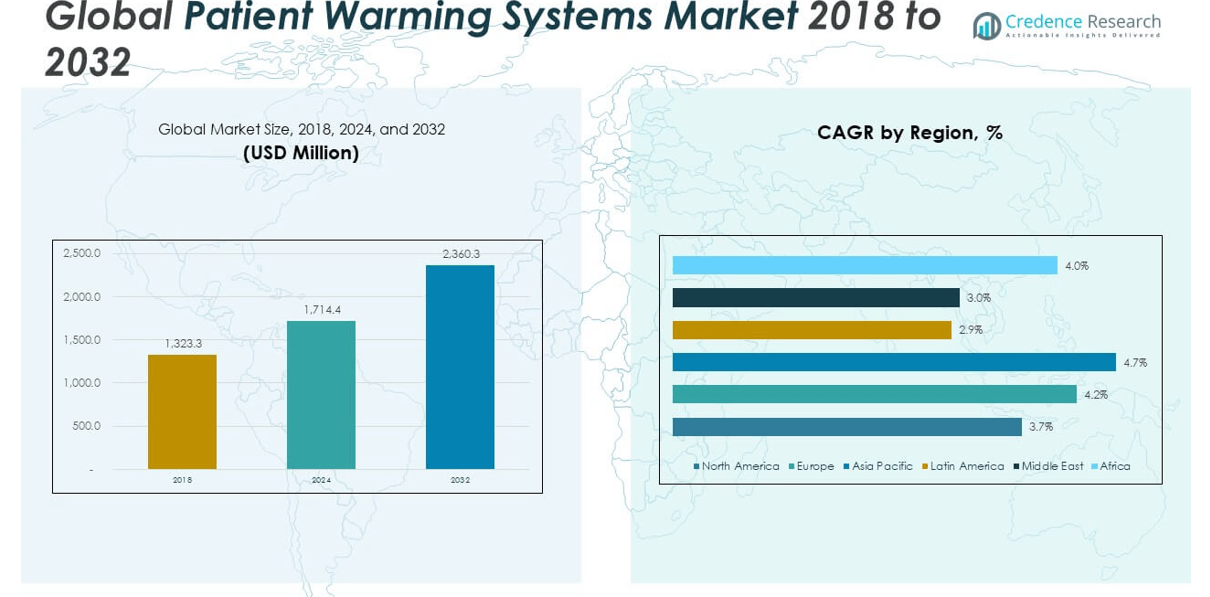

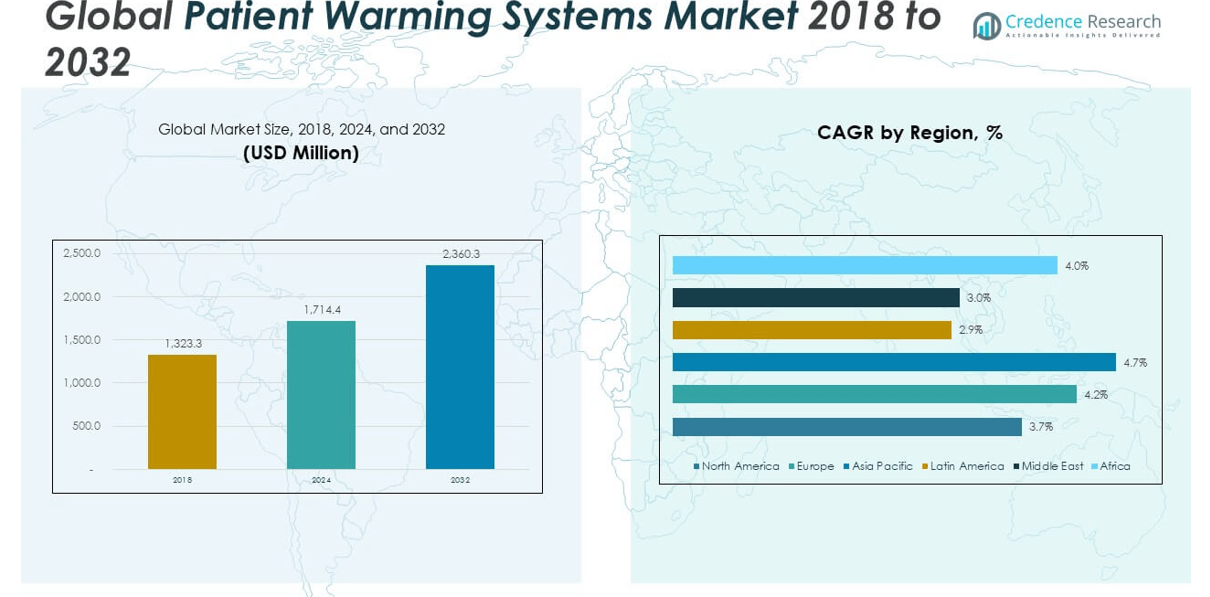

The Patient Warming Systems Market size was valued at USD 1,323.3 million in 2018 to USD 1,714.4 million in 2024 and is anticipated to reach USD 1,714.4 million by 2032, at a CAGR of 4.07% during the forecast period.

The market is driven by several key factors. The growing volume of surgeries globally, particularly among geriatric and high-risk patient groups, has significantly increased the need for effective perioperative temperature management. Rising clinical awareness about the adverse effects of unintended hypothermia such as infections, extended recovery times, and cardiac complications has led to widespread adoption of patient warming technologies. Additionally, advancements in device design, such as energy-efficient forced-air systems and fluid warming devices integrated with smart monitoring capabilities, are enhancing usability and effectiveness. Regulatory bodies and healthcare organizations are also pushing for normothermia maintenance as a standard of care in surgical protocols, further accelerating market penetration. Emerging economies are experiencing rapid hospital expansion, which is fueling demand for warming systems in both surgical and post-operative environments.

Regionally, North America dominates the Patient Warming Systems Market due to its advanced healthcare infrastructure, high surgical procedure volume, and early adoption of technologically sophisticated devices. The United States, in particular, maintains a strong growth trajectory due to favorable reimbursement policies and stringent surgical standards. Europe holds the second-largest market share, supported by national guidelines emphasizing perioperative normothermia and ongoing investments in surgical and critical care infrastructure. Countries such as Germany, France, and the UK continue to invest in innovative thermal management technologies. Meanwhile, the Asia-Pacific region is expected to witness the fastest growth during the forecast period, driven by expanding healthcare access, a growing middle-class population, and increased awareness of surgical safety protocols in countries like China, India, and South Korea. Latin America and the Middle East & Africa represent emerging markets with steady demand, spurred by improving medical infrastructure and gradual policy enhancements to support patient care standards.

Market Insights:

- The Patient Warming Systems Market grew from USD 1,323.3 million in 2018 to USD 1,714.4 million in 2024 and is projected to reach USD 2,343.9 million by 2032, growing at a CAGR of 4.07%.

- Increasing global surgical volumes, particularly among aging and high-risk populations, are driving the need for reliable perioperative temperature management technologies.

- Smart features, energy efficiency, and real-time monitoring capabilities in next-gen warming systems are attracting widespread adoption across hospitals and surgical centers.

- Regulatory support from bodies like WHO and ERAS is pushing hospitals to integrate warming systems into standard operating protocols for improved patient outcomes.

- Healthcare infrastructure expansion in emerging markets like India, Brazil, and China is opening new opportunities for warming system deployment in surgical and post-surgical care.

- High equipment costs and limited budgets in rural or underfunded hospitals remain a key barrier, especially in low-income regions.

- North America leads the market with 29% share, followed by Europe at 26%, while Asia Pacific shows the fastest growth due to rising healthcare access and modernization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Surgical Procedure Volumes and Rising Perioperative Hypothermia Awareness

The increasing number of surgical procedures worldwide significantly drives the demand for thermal regulation technologies. Procedures involving anesthesia often lead to unintended hypothermia, which can result in complications such as delayed wound healing, infection, and cardiovascular stress. The Patient Warming Systems Market benefits from growing awareness among healthcare providers regarding the importance of maintaining normothermia during and after surgeries. Many hospitals now include warming protocols as part of their surgical safety checklist. Regulatory guidelines from bodies such as the World Health Organization and national health authorities reinforce the importance of temperature management. This heightened focus on patient safety and clinical outcomes positions warming systems as essential components of perioperative care. It continues to gain traction across both public and private hospitals.

- For example, 3M’s Bair Hugger system has been used in over 300 million surgeries worldwide as of 2024, demonstrating its widespread integration in perioperative care. According to 3M company data, their Bair Hugger forced-air warming blankets can maintain core patient temperatures within ±0.5°C of the target set point, significantly reducing the incidence of perioperative hypothermia.

Advancements in Device Technologies and Integration of Smart Features

Manufacturers are incorporating advanced technologies into patient warming systems, including intelligent sensors, feedback-controlled heating mechanisms, and wearable formats. These innovations enable precise and consistent temperature management, reducing the risk of overheating or underheating during treatment. The Patient Warming Systems Market is seeing strong demand for devices that integrate seamlessly into operating rooms, emergency care, and post-anesthesia units. Smart connectivity features allow clinicians to monitor patient temperature in real time and adjust settings with minimal intervention. The adoption of user-friendly interfaces and energy-efficient systems also aligns with broader hospital goals to reduce staff workload and lower operational costs. It benefits from continuous investments in research and development aimed at improving both patient safety and system efficiency.

Regulatory Support and Emphasis on Normothermia Protocols in Clinical Guidelines

National and international healthcare agencies continue to emphasize the need for normothermia maintenance as part of evidence-based care pathways. Guidelines such as Enhanced Recovery After Surgery (ERAS) and the Surgical Care Improvement Project (SCIP) include temperature control measures as critical components of post-operative care. The Patient Warming Systems Market is supported by these protocols, which influence procurement policies and drive equipment standardization across surgical centers. Hospitals are increasingly required to demonstrate compliance with such clinical standards to secure accreditation and insurance reimbursements. The integration of temperature management into quality-of-care metrics incentivizes healthcare providers to adopt reliable warming systems. It benefits from this regulatory alignment, which creates consistent demand across various care settings.

- For example, in the United States, compliance with the Surgical Care Improvement Project (SCIP) Inf-10 measure requiring perioperative temperature management is a prerequisite for hospital accreditation and reimbursement by the Centers for Medicare & Medicaid Services (CMS)

Expanding Infrastructure and Healthcare Modernization in Emerging Markets

Developing regions are rapidly expanding their healthcare infrastructure, driven by population growth, rising incomes, and public sector investments in medical services. This transformation is leading to the construction of new hospitals, surgery centers, and emergency care units where patient warming systems are being integrated into standard care protocols. The Patient Warming Systems Market is capturing opportunities in countries such as India, Brazil, China, and the UAE, where hospital operators are upgrading their clinical capabilities. These markets are adopting modern equipment to meet global care standards and attract international accreditation. It gains momentum in emerging economies as they increasingly adopt perioperative technologies to improve patient safety, reduce post-surgical complications, and shorten recovery times. The expanding healthcare landscape offers a strong foundation for long-term market growth.

Market Trends:

Shift Toward Non-Invasive and Portable Warming Devices Across Care Settings

There is a clear shift toward non-invasive, portable warming solutions that support greater mobility and faster deployment in various clinical environments. Hospitals and ambulatory centers are adopting lightweight, battery-operated devices that can be used in preoperative, intraoperative, and recovery phases. These devices reduce setup time and enhance patient comfort without the need for complex installations. The Patient Warming Systems Market is seeing increased demand for transport-friendly units used in emergency vehicles, military field hospitals, and outpatient surgery centers. Healthcare providers prioritize flexibility and ease of use, especially when dealing with unpredictable patient volumes. It continues to evolve with growing interest in compact, energy-efficient warming systems designed for dynamic clinical workflows.

- For example, Mistral-Air® Plus Warming Unit. This device is engineered for rapid deployment, offering temperature settings at 32°C, 38°C (default), and 43°C, with a fan-only mode for ambient air. The unit weighs approximately 6 kg, features a 1.8-meter hose, and is designed for easy mounting on IV poles, making it suitable for preoperative, intraoperative, and transport scenarios.

Increased Adoption of Disposable and Single-Use Warming Products to Limit Infection Risks

The trend toward infection control has accelerated the adoption of disposable patient warming components, including single-use blankets and warming pads. Hospitals are seeking solutions that minimize the risk of cross-contamination, particularly in high-turnover environments such as operating rooms and ICUs. The Patient Warming Systems Market is aligning with this trend by introducing sterile, single-use accessories that eliminate the need for cleaning and sterilization. This shift supports infection prevention goals and simplifies operational logistics for staff. Many healthcare facilities are now allocating budgets specifically for disposable warming products to meet regulatory and safety standards. It benefits from this rising preference for hygienic, maintenance-free components that support infection prevention initiatives.

Customization and Patient-Centric Warming Solutions for Sensitive Populations

Manufacturers are increasingly designing warming systems tailored to the specific needs of vulnerable patient groups, including neonates, burn victims, and the elderly. These populations require precise thermal management with minimal risk of overheating or skin damage. The Patient Warming Systems Market is seeing innovation in targeted solutions such as gel-based warming pads, infant warmers with radiant heat, and low-voltage systems for delicate skin. Hospitals are implementing these specialized products to improve clinical outcomes and enhance patient comfort. It reflects a broader shift toward personalization in medical devices that prioritize patient safety and individual care needs. The emphasis on customized solutions is reshaping product portfolios and development pipelines.

Sustainability-Focused Innovations Driving Environmentally Friendly Warming Devices

Environmental sustainability is emerging as a key focus area for manufacturers and healthcare institutions. Hospitals are increasingly seeking patient warming systems that align with green procurement standards and energy conservation goals. The Patient Warming Systems Market is responding with devices that use recyclable materials, energy-efficient heating elements, and low-power standby modes. Some systems are designed to reduce waste generation by optimizing reusability or incorporating biodegradable components. It is also seeing interest in products that meet sustainability certifications and support hospital ESG (Environmental, Social, and Governance) strategies. This trend reinforces the importance of balancing patient care excellence with environmental responsibility in healthcare technology.

- For example, reusable warming mattresses and blankets are designed to last 6–7 years, with controllers lasting up to 10 years. These devices consume as little as 0.17 kWh per use compared to 0.8 kWh for traditional forced-air systems and produce only 1% of the waste generated by single-use devices.

Market Challenges Analysis:

High Equipment Costs and Budget Constraints in Resource-Limited Settings

The high cost of advanced patient warming systems remains a significant barrier to broader adoption, particularly in small and mid-sized healthcare facilities. Sophisticated devices with integrated monitoring, smart controls, and multi-phase warming capabilities often come with steep pricing, making them less accessible in cost-sensitive markets. The Patient Warming Systems Market faces challenges in regions where capital equipment budgets are limited or inconsistent. Hospitals operating in developing countries or rural areas often prioritize basic medical infrastructure over specialized thermal management solutions. This cost barrier delays modernization efforts and restricts market expansion. It must address these affordability gaps to reach underpenetrated healthcare segments.

Technical Limitations, System Failures, and Inconsistent Clinical Training

While patient warming systems are crucial to surgical and post-operative care, some users report issues related to temperature control accuracy, device overheating, or inconsistent system response. These technical limitations can compromise patient safety and erode trust among clinical staff. The Patient Warming Systems Market must also contend with a lack of standardized training across facilities, which can lead to improper use or misinterpretation of system outputs. In emergency and high-pressure environments, staff may struggle to operate complex systems without adequate experience. It faces ongoing pressure to simplify device interfaces and reduce reliance on manual adjustments. The lack of user familiarity continues to hinder optimal system performance and outcomes.

Market Opportunities:

Growing Demand for Home Healthcare and Outpatient Surgical Facilities

The rise of outpatient procedures and home-based care is creating new demand for compact, user-friendly warming systems. As healthcare providers shift low-risk surgeries and post-operative recovery to ambulatory centers and home settings, the need for portable, safe, and easy-to-operate devices is increasing. The Patient Warming Systems Market can expand by developing systems tailored for non-hospital environments where clinical infrastructure is minimal. Patients and caregivers seek solutions that maintain normothermia without complex setup or monitoring. It can leverage this opportunity by offering battery-powered, lightweight devices designed for remote or decentralized care. These evolving care models present untapped growth potential across both developed and emerging economies.

Integration with Digital Health Platforms and Remote Monitoring Capabilities

The trend toward digital health integration offers a strong opportunity for manufacturers to incorporate data-sharing and remote monitoring features into patient warming systems. Hospitals and surgical centers are investing in smart infrastructure that supports real-time data analytics and centralized monitoring of patient vitals. The Patient Warming Systems Market can benefit by embedding connectivity tools such as Bluetooth, Wi-Fi, or cloud-based dashboards into their systems. It allows clinicians to track temperature data, usage patterns, and system performance remotely. These digital enhancements improve workflow efficiency and patient safety while aligning with broader telemedicine and smart hospital initiatives.

Market Segmentation Analysis:

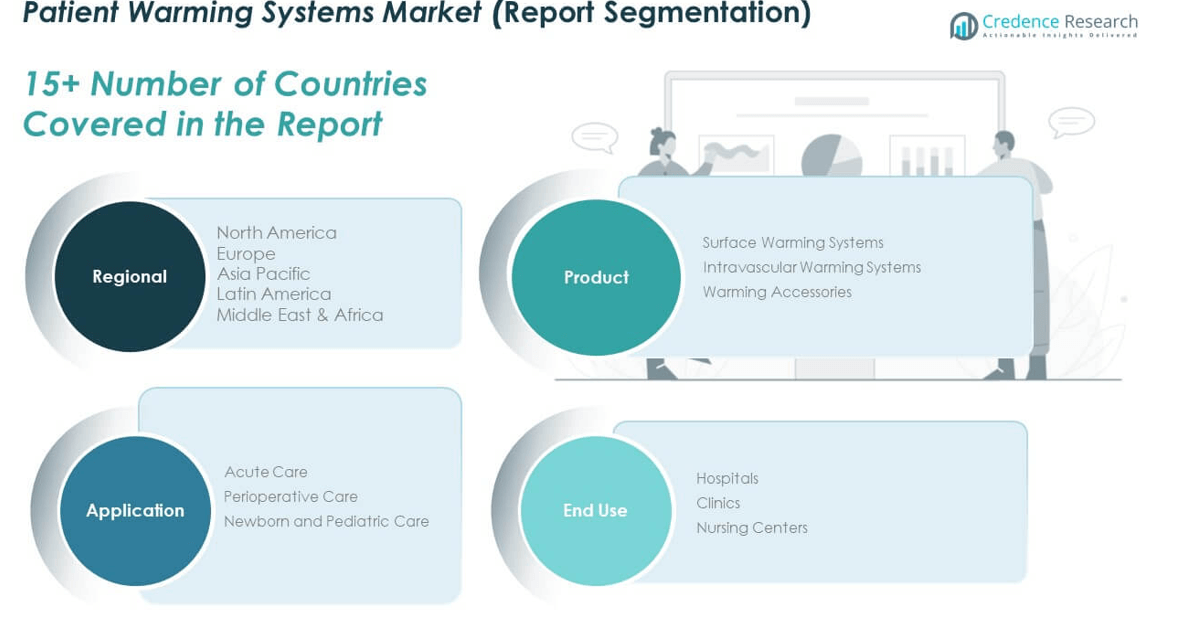

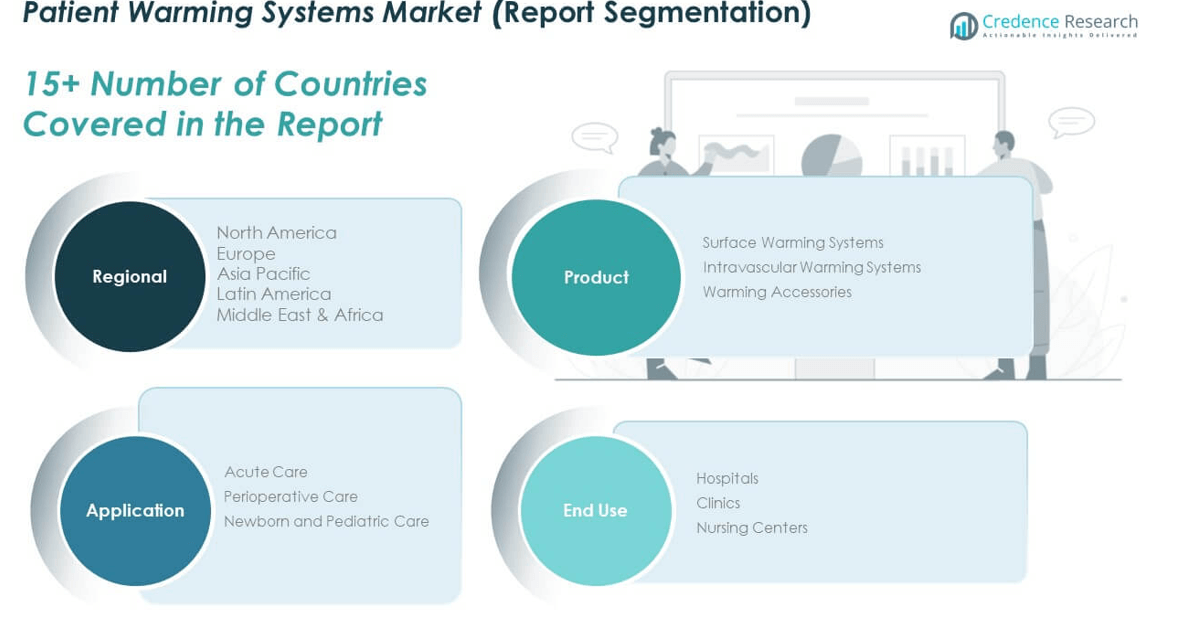

The Patient Warming Systems Market is segmented by product, application, and end use, each contributing uniquely to overall market growth.

By product, surface warming systems hold the largest share due to their widespread use in perioperative settings and ease of application. Intravascular warming systems are gaining traction in critical care and trauma units where rapid core temperature regulation is essential. Warming accessories, such as disposable blankets and pads, support system functionality and see consistent demand driven by infection control protocols.

- For example, the Gentherm Hemotherm® CE Intravascular Blood and Fluid Warmer is widely implemented in trauma and critical care units. It provides rapid core temperature regulation by circulating warmed fluids directly into the patient’s bloodstream, allowing for precise temperature control in cases of severe hypothermia or during cardiac surgery.

By application, perioperative care leads the market owing to the growing volume of surgeries and heightened awareness of hypothermia-related complications. Acute care is another key segment, driven by emergency and intensive care units requiring precise thermal management. Newborn and pediatric care is expanding steadily as neonatal units adopt warming systems to safeguard vulnerable patients.

- For instance, the Belmont® Rapid Infuser RI-2 is employed in emergency rooms and intensive care units for acute warming of patients experiencing massive blood loss or shock. It can deliver warmed fluids at rates up to 1,000 mL/min, ensuring rapid thermal management in critical care scenarios.

By end use, hospitals dominate due to high surgical throughput and advanced infrastructure. Clinics and nursing centers contribute moderately, with increasing adoption of portable and affordable warming solutions for outpatient procedures and elderly care. The Patient Warming Systems Market continues to grow across all segments as providers prioritize safe and standardized thermal regulation practices.

Segmentation:

By Product:

- Surface Warming Systems

- Intravascular Warming Systems

- Warming Accessories

By Application:

- Acute Care

- Perioperative Care

- Newborn and Pediatric Care

By End Use:

- Hospitals

- Clinics

- Nursing Centers

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

The North America Patient Warming Systems Market size was valued at USD 354.38 million in 2018 to USD 448.99 million in 2024 and is anticipated to reach USD 599.51 million by 2032, at a CAGR of 3.7% during the forecast period. North America holds the largest share of the global Patient Warming Systems Market, accounting for 29%. High surgical volumes, well-established healthcare infrastructure, and widespread adoption of advanced medical technologies are key contributors to this leadership position. The U.S. drives most of the regional demand due to favorable reimbursement policies, strong regulatory oversight, and a robust presence of leading medical device manufacturers. Hospitals in the region prioritize perioperative temperature control to improve surgical outcomes and reduce post-operative complications. It also benefits from the rapid uptake of portable and energy-efficient warming devices in outpatient and emergency care settings. Government support for quality-driven healthcare practices continues to reinforce regional demand.

The Europe Patient Warming Systems Market size was valued at USD 305.81 million in 2018 to USD 400.32 million in 2024 and is anticipated to reach USD 558.67 million by 2032, at a CAGR of 4.2% during the forecast period. Europe accounts for 26% of the global Patient Warming Systems Market and shows steady growth driven by national clinical guidelines and regulatory initiatives promoting normothermia. Countries such as Germany, France, and the UK lead adoption due to strong surgical care standards and technological readiness. Public and private healthcare institutions are investing in warming systems that comply with Enhanced Recovery After Surgery (ERAS) protocols. The market benefits from increasing preference for disposable, infection-control-based warming accessories across high-risk units. It is further supported by ongoing healthcare modernization programs, particularly in Eastern Europe. Demand is expected to grow as healthcare providers expand specialized surgical units and critical care services.

The Asia Pacific Patient Warming Systems Market size was valued at USD 398.44 million in 2018 to USD 535.03 million in 2024 and is anticipated to reach USD 771.10 million by 2032, at a CAGR of 4.7% during the forecast period. Asia Pacific represents the fastest-growing region, contributing 34% of the global Patient Warming Systems Market. Demand is increasing rapidly due to expanding hospital infrastructure, rising surgical volumes, and growing awareness of hypothermia risks. China, India, Japan, and South Korea are leading contributors, with government investments in healthcare modernization accelerating device adoption. Hospitals are equipping surgical units with temperature management solutions to align with international clinical standards. It is gaining traction in both urban medical centers and secondary cities due to the increasing number of accredited surgical facilities. The region’s strong growth trajectory presents opportunities for both multinational and local device manufacturers.

The Latin America Patient Warming Systems Market size was valued at USD 107.45 million in 2018 to USD 130.98 million in 2024 and is anticipated to reach USD 165.22 million by 2032, at a CAGR of 2.9% during the forecast period. Latin America contributes 8% to the global Patient Warming Systems Market and shows moderate growth due to rising investments in healthcare infrastructure and surgical capacity. Brazil and Mexico are key markets, supported by public sector funding and increasing demand for perioperative safety technologies. Hospitals are gradually upgrading surgical departments with modern equipment, including thermal regulation systems. It continues to benefit from a growing awareness of best practices in surgical recovery and infection control. The private healthcare sector is also expanding its adoption of compact warming devices for use in outpatient procedures. Growth remains steady, though market penetration is uneven across rural and low-income areas.

The Middle East Patient Warming Systems Market size was valued at USD 62.19 million in 2018 to USD 76.17 million in 2024 and is anticipated to reach USD 96.77 million by 2032, at a CAGR of 3.0% during the forecast period. The Middle East holds 5% of the global market share, driven by healthcare development programs in countries such as the UAE, Saudi Arabia, and Qatar. These nations are actively upgrading hospital infrastructure and implementing global clinical care standards. The Patient Warming Systems Market benefits from strong government initiatives to enhance surgical care quality and patient safety. Demand is concentrated in tertiary care hospitals and specialty surgery centers. It also sees emerging interest in mobile and emergency medical units. Continued investment in healthcare diversification supports regional growth, though import dependence and cost sensitivity remain limiting factors.

The Africa Patient Warming Systems Market size was valued at USD 95.01 million in 2018 to USD 122.95 million in 2024 and is anticipated to reach USD 168.99 million by 2032, at a CAGR of 4.0% during the forecast period. Africa accounts for 7% of the global Patient Warming Systems Market and is gradually expanding due to rising demand for surgical care and trauma management. Countries such as South Africa, Nigeria, and Kenya are investing in medical equipment to improve hospital readiness. The market remains underpenetrated but is witnessing increased adoption of basic warming technologies in public hospitals and emergency care units. It faces infrastructure limitations, but international aid and public-private partnerships are helping close the technology gap. Local production remains low, making regional markets reliant on imported systems. The ongoing expansion of maternal care and surgical services provides long-term growth prospects.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- 3M

- BD (Becton, Dickinson and Company)

- ZOLL Medical Corporation

- GE Healthcare

- Smiths Medical, Inc.

- Philips Healthcare

- Medtronic plc

- Stryker Corporation

- VitaHEAT Medical

- Cincinnati Sub-Zero Products, Inc.

- Other Key Players

Competitive Analysis:

The Patient Warming Systems Market is highly competitive, with leading players focusing on innovation, strategic partnerships, and portfolio expansion to strengthen their global presence. Key companies such as 3M, Smiths Medical, Stryker Corporation, GE Healthcare, and Inspiration Healthcare Group dominate the market through advanced product offerings and strong distribution networks. It features a mix of multinational corporations and regional manufacturers competing on technology, pricing, and clinical reliability. Companies are investing in research to develop smart, energy-efficient, and patient-specific warming solutions that align with evolving healthcare standards. Mergers and acquisitions continue to shape the competitive landscape, enabling firms to expand into high-growth regions. Smaller players are entering the market by offering cost-effective and portable solutions for emerging markets. The market’s competitive intensity is expected to rise with increasing demand for integrated, user-friendly systems that support both inpatient and outpatient care environments.

Recent Developments:

- In January 2025, 3M and Medline announced a partnership, to standardize use of 3M’s Bair Hugger warming gowns across surgical facilities. The collaboration aims to simplify inventory, streamline workflows, and support consistent perioperative warming protocols. It reinforces 3M’s commitment to enhancing patient thermal management through coordinated clinical and supply chain efforts.

- In April 2025, BD launched its new AI-enabled hemodynamic monitoring platform, HemoSphere Alta. The system employs predictive blood pressure algorithms to support clinicians in managing patient stability during temperature-critical procedures. It represents BD’s expanding investment in integrated temperature and patient management solutions tailored for procedural healthcare environments.

Market Concentration & Characteristics:

The Patient Warming Systems Market exhibits moderate to high market concentration, with a few global players accounting for a significant share of total revenue. It is characterized by strong brand loyalty, regulatory compliance requirements, and continuous technological innovation. Market leaders maintain their dominance through extensive R&D, wide product portfolios, and established relationships with healthcare institutions. Barriers to entry remain high due to strict safety standards, capital-intensive product development, and certification processes. The market favors companies that can offer integrated, user-friendly, and scalable solutions tailored to both large hospitals and smaller surgical centers. It shows a growing trend toward energy efficiency, portability, and infection control, shaping the development and purchasing decisions in this segment.

Report Coverage:

The research report offers an in-depth analysis based on product, application, and end use. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for portable and battery-operated warming systems will rise with the growth of outpatient and emergency care services.

- Integration of digital monitoring and data analytics will enhance system performance and clinical decision-making.

- Emerging markets in Asia and Africa will drive expansion through healthcare infrastructure investments.

- Regulatory mandates for perioperative normothermia will boost hospital procurement of compliant devices.

- Single-use and disposable warming accessories will gain traction due to infection control protocols.

- Strategic collaborations and acquisitions will increase as companies seek geographic and product line expansion.

- Custom-designed warming systems for neonates, geriatrics, and trauma patients will see higher adoption.

- Demand for sustainable, energy-efficient devices will grow in alignment with hospital ESG goals.

- Advances in smart textiles and phase-change materials will lead to next-generation product innovation.

- Home healthcare applications will create new opportunities for compact, user-friendly warming technologies.