Market Overview

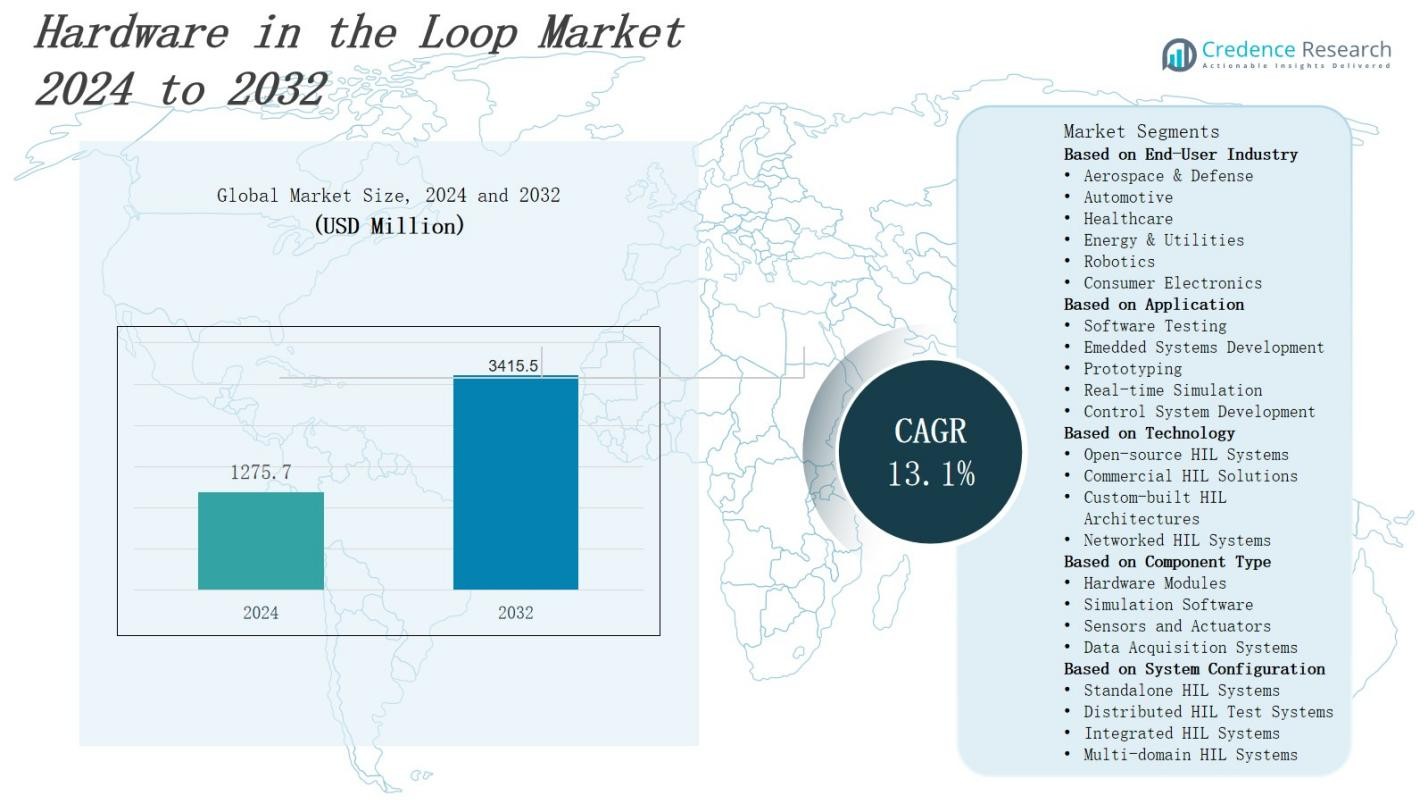

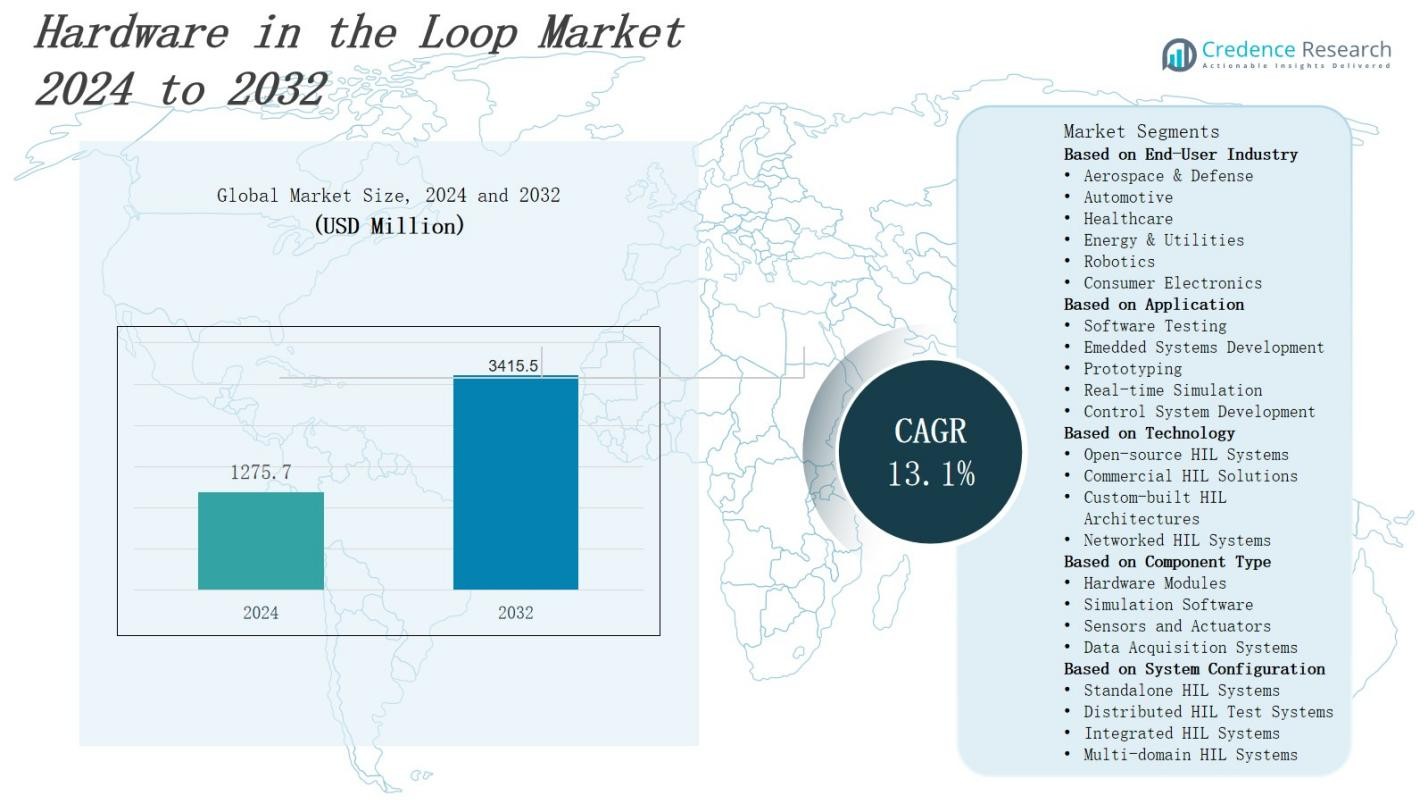

The hardware-in-the-loop market is projected to grow from USD 1,275.7 million in 2024 to USD 3,415.5 million by 2032, registering a CAGR of 13.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hardware-In-The-Loop Market Size 2024 |

USD 1,275.7 Million |

| Hardware-In-The-Loop Market, CAGR |

13.1% |

| Hardware-In-The-Loop Market Size 2032 |

USD 3,415.5 Million |

Market growth in the hardware-in-the-loop market is driven by the rising demand for real-time simulation and testing in automotive, aerospace, and industrial automation sectors to enhance product reliability and reduce development cycles. The increasing adoption of electric and autonomous vehicles fuels the need for advanced control system validation, while stricter safety and regulatory standards accelerate integration. Trends include the growing use of HIL in renewable energy systems, expansion of modular and scalable platforms, and the integration of AI and machine learning for predictive testing. Cloud-based simulation and remote testing capabilities are also gaining traction, improving accessibility and operational efficiency.

The hardware in the loop market spans North America, Europe, Asia-Pacific, and the Rest of the World, each contributing to its global growth. North America leads with strong automotive and aerospace adoption, while Europe benefits from stringent safety regulations and advanced manufacturing. Asia-Pacific experiences rapid expansion in EV, robotics, and electronics sectors, and the Rest of the World sees rising demand in energy, defense, and automation. Key players include DSpace GmbH, National Instruments, Vector Informatik, Siemens, Robert Bosch Engineering, MicroNova AG, Opal-RT Technologies, LHP Engineering Solutions, Ipg Automotive GmbH, Typhoon HIL, Speedgoat GmbH, and Eontronix.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The hardware-in-the-loop market is projected to grow from USD 1,275.7 million in 2024 to USD 3,415.5 million by 2032, at a CAGR of 13.1%, driven by rising demand for real-time simulation and testing in multiple industries.

- Growing adoption in automotive, aerospace, and defense sectors enables engineers to validate embedded systems under realistic conditions, improving reliability and reducing development time.

- The surge in electric and autonomous vehicle development fuels demand for advanced control algorithm validation and performance optimization before physical trials.

- Integration of AI, machine learning, and cloud-based platforms enhances testing accuracy, supports predictive modeling, and enables remote collaboration among global engineering teams.

- Renewable energy and industrial automation sectors increasingly adopt HIL for validating control systems in wind turbines, solar inverters, and smart grids, supporting Industry 4.0 transformation.

- Challenges include high initial investment, complex implementation, and compatibility issues across diverse hardware and software ecosystems, which can delay adoption.

- North America holds 38% market share, followed by Europe at 27%, Asia-Pacific at 24%, and Rest of the World at 11%, with key players including DSpace GmbH, National Instruments, Vector Informatik, Siemens, Robert Bosch Engineering, MicroNova AG, Opal-RT Technologies, LHP Engineering Solutions, Ipg Automotive GmbH, Typhoon HIL, Speedgoat GmbH, and Eontronix.

Market Drivers

Rising Demand for Real-Time Simulation and Testing

The hardware in the loop market experiences significant growth due to the increasing requirement for real-time simulation in automotive, aerospace, and defense industries. It enables engineers to test complex embedded systems under realistic conditions without risking actual hardware. This approach reduces development time and costs while improving system reliability. Growing emphasis on safety, compliance, and early detection of design flaws drives adoption. It supports faster prototyping, reducing delays in product launches.

- For instance, Saab Aerospace applied National Instruments’ HIL technology to test electronic control units in its Gripen fighter aircraft, allowing comprehensive corner-case scenario testing that improves safety and reduces integration costs.

Expansion of Electric and Autonomous Vehicle Development

The surge in electric and autonomous vehicle projects fuels the hardware in the loop market, as it is essential for validating advanced control algorithms. It allows manufacturers to simulate dynamic driving scenarios and evaluate performance under varying conditions. This capability accelerates innovation in energy management, autonomous navigation, and safety systems. OEMs and suppliers leverage HIL to optimize vehicle systems before physical testing, ensuring compliance with evolving industry standards.

- For instance, Impedyme developed an energy-efficient EV simulation model integrated with real-time HIL deployment to validate motor controllers, battery management systems, and power electronics, enabling precise testing of battery performance and regenerative braking systems under diverse conditions.

Integration of Advanced Technologies for Enhanced Accuracy

Integration of AI, machine learning, and cloud-based platforms into hardware in the loop systems boosts testing efficiency and accuracy. It enables predictive modeling, adaptive test scenarios, and faster identification of potential failures. Cloud connectivity supports remote simulation, enabling global collaboration among development teams. The demand for such advanced capabilities grows with the increasing complexity of modern embedded systems, enhancing operational flexibility and reducing the need for extensive physical prototypes.

Rising Adoption Across Renewable Energy and Industrial Automation

Industries such as renewable energy and industrial automation adopt hardware in the loop solutions to validate control systems for wind turbines, solar inverters, and smart grids. It enables accurate simulation of real-world operational variables, ensuring performance optimization and system stability. The trend toward digitization and Industry 4.0 supports wider application, allowing companies to meet stringent performance standards. This expansion into diverse sectors strengthens the market’s long-term growth prospects.

Market Trends

Growing Adoption of Modular and Scalable HIL Platforms

The hardware in the loop market witnesses increasing demand for modular and scalable solutions that adapt to evolving testing requirements. Manufacturers focus on creating flexible architectures that accommodate varying hardware configurations and simulation models. This trend enables cost-effective upgrades, extending the lifecycle of testing systems. It supports industries in addressing diverse project needs without complete system replacements. Scalable platforms also enhance collaboration between multidisciplinary teams, ensuring consistent performance across different stages of product development.

- For instance, OPAL-RT has helped companies like magniX reduce testing time by about 50% via automated HIL testing of power electronics, demonstrating how scalable HIL platforms streamline development cycles by enabling comprehensive simulation scenarios before physical prototype testing.

Integration of Cloud-Based and Remote Testing Capabilities

Cloud-based simulation and remote accessibility are emerging as major trends in the hardware in the loop market. These capabilities allow teams to conduct real-time tests from different locations, reducing travel and operational costs. It enables faster decision-making by providing instant access to test results and performance data. Remote HIL systems improve resource utilization and scalability, aligning with the growing shift toward distributed engineering teams and global product development cycles.

- For instance, Elektrobit uses cloud orchestration to deploy large-scale HIL server farms that run parallel simulations, drastically reducing validation time for thousands of miles of autonomous driving tests.

Incorporation of AI and Machine Learning for Predictive Testing

AI and machine learning integration into hardware in the loop systems is transforming testing precision and speed. Predictive analytics help identify potential failures before they occur, reducing risks during physical deployment. It enables adaptive test scenarios that adjust in real time based on system behavior. This trend enhances fault detection capabilities, supports advanced automation, and aligns with the growing demand for intelligent validation processes across automotive, aerospace, and industrial automation applications.

Expansion into Renewable Energy and Smart Infrastructure Applications

The hardware in the loop market is expanding into renewable energy and smart infrastructure testing, driven by the need for reliable control systems. HIL validates operational performance for smart grids, energy storage systems, and distributed power generation. It helps simulate variable environmental and operational conditions, ensuring optimal performance and regulatory compliance. This diversification opens new growth opportunities beyond traditional automotive and aerospace sectors, strengthening the market’s relevance in sustainable technology development.

Market Challenges Analysis

High Initial Investment and Complexity of Implementation

The hardware in the loop market faces challenges due to the significant upfront investment required for advanced simulation systems, specialized hardware, and software integration. Many small and medium-sized enterprises find it difficult to allocate resources for such high-cost setups. It demands skilled professionals to configure, maintain, and operate HIL systems, adding to operational expenses. Complex system architecture and integration with existing development environments increase implementation time. This barrier often delays adoption, particularly in cost-sensitive sectors.

Technical Limitations and Compatibility Issues

Another major challenge is the technical limitation in replicating highly complex real-world conditions with complete accuracy. The hardware in the loop market often encounters compatibility issues when integrating with diverse hardware and software ecosystems. It requires constant updates to keep pace with rapidly evolving embedded systems and communication protocols. Inadequate interoperability between simulation platforms and actual control hardware can hinder testing efficiency. These constraints can limit performance validation, especially in fast-paced innovation environments.

Market Opportunities

Expansion into Emerging Industries and Applications

The hardware in the loop market holds strong opportunities in emerging sectors such as renewable energy, smart infrastructure, and advanced medical device development. It enables precise control system validation for wind turbines, solar inverters, energy storage solutions, and healthcare automation. The growth of Industry 4.0 creates new demand for HIL in robotics, process control, and industrial IoT systems. These applications benefit from reduced downtime, enhanced safety, and improved performance optimization, driving long-term adoption potential.

Advancements in AI, Machine Learning, and Cloud Integration

Technological advancements in AI, machine learning, and cloud computing present significant growth avenues for the hardware in the loop market. It can leverage these technologies to create intelligent, adaptive, and remotely accessible testing environments. AI-driven predictive analytics improve fault detection, while cloud platforms facilitate global collaboration and real-time data sharing. The rising focus on digital twins and virtual prototyping further amplifies HIL’s value proposition, enabling faster innovation and reduced physical testing requirements.

Market Segmentation Analysis:

By End-User Industry

The hardware in the loop market serves diverse sectors, with aerospace and defense utilizing HIL for mission-critical control systems and safety validation. Automotive dominates adoption for electric, hybrid, and autonomous vehicle development. Healthcare applies HIL for medical device control and performance testing, while energy and utilities use it for smart grids and renewable energy systems. Robotics benefits from precision control validation, and consumer electronics leverage HIL for embedded device optimization and performance reliability.

- For instance, Saab Aerospace uses National Instruments’ HIL-simulation technology for integration testing of electronic control units (ECUs) in its Gripen fighter aircraft, enabling realistic testing of failure scenarios without physical prototypes.

By Application

HIL plays a critical role in software testing by validating control logic under realistic conditions. It supports embedded systems development for advanced hardware integration. Prototyping benefits from reduced physical trials, accelerating product readiness. Real-time simulation enables engineers to replicate complex environments accurately, while control system development relies on HIL to ensure precision, stability, and compliance with performance standards. These applications collectively enhance innovation speed and system safety across industries.

- For instance, Vector Informatik specializes in tightly integrated HIL systems for the automotive industry, complementing its extensive embedded software tools portfolio. Their systems are pivotal in validating complex ECUs and ADAS functionalities to meet vehicle safety and performance standards.

By Technology

Technologies in this market include open-source HIL systems that offer flexibility and customization for research and development. Commercial HIL solutions provide turnkey systems with vendor support, meeting industrial-grade performance requirements. Custom-built HIL architectures address highly specific project needs, offering tailored configurations. Networked HIL systems facilitate distributed testing environments, improving collaboration and resource sharing across teams. It allows industries to choose solutions that align with their operational scale, complexity, and integration requirements.

Segments:

Based on End-User Industry

- Aerospace & Defense

- Automotive

- Healthcare

- Energy & Utilities

- Robotics

- Consumer Electronics

Based on Application

- Software Testing

- Embedded Systems Development

- Prototyping

- Real-time Simulation

- Control System Development

Based on Technology

- Open-source HIL Systems

- Commercial HIL Solutions

- Custom-built HIL Architectures

- Networked HIL Systems

Based on Component Type

- Hardware Modules

- Simulation Software

- Sensors and Actuators

- Data Acquisition Systems

Based on System Configuration

- Standalone HIL Systems

- Distributed HIL Test Systems

- Integrated HIL Systems

- Multi-domain HIL Systems

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds 38% share of the hardware in the loop market, driven by strong adoption in automotive, aerospace, and defense sectors. The presence of major technology developers and research institutions accelerates innovation in HIL systems. It benefits from high R&D spending, advanced testing infrastructure, and strong regulatory compliance frameworks. Automotive manufacturers use HIL extensively for autonomous and electric vehicle development. Defense programs rely on it for mission simulation and avionics testing. The region’s focus on digital transformation in manufacturing further boosts adoption across industries.

Europe

Europe accounts for 27% share of the hardware in the loop market, supported by its robust automotive manufacturing base and stringent safety regulations. Leading automakers and aerospace companies implement HIL for compliance testing and performance validation. It benefits from government-backed Industry 4.0 initiatives and collaborative research programs. Renewable energy applications, particularly in wind and solar control systems, drive further growth. The region’s commitment to sustainable technologies enhances HIL demand in industrial automation and smart grid development.

Asia-Pacific

Asia-Pacific holds 24% share of the hardware in the loop market, fueled by rapid industrialization and expansion of automotive and electronics manufacturing. It experiences high demand for HIL in electric vehicle R&D, robotics, and consumer electronics testing. Countries such as China, Japan, and South Korea lead adoption due to their strong electronics and automotive industries. Government investments in renewable energy and smart infrastructure projects create new opportunities. The growing focus on technology exports strengthens the region’s market position.

Rest of the World

The Rest of the World accounts for 11% share of the hardware in the loop market, driven by emerging adoption in Latin America, the Middle East, and Africa. It sees growth in energy and utilities, particularly in grid modernization and renewable energy control systems. Aerospace and defense programs in the Middle East adopt HIL for simulation and mission readiness. Industrial automation projects in Latin America increase demand for cost-efficient HIL solutions. Regional growth is supported by partnerships with global technology providers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- LHP Engineering Solutions

- MicroNova AG

- Typhoon HIL

- Robert Bosch Engineering

- Speedgoat GmbH

- Opal-RT Technologies

- Eontronix

- DSpace GmbH

- Siemens

- Ipg Automotive GmbH

- Vector Informatik

- National Instruments

Competitive Analysis

The hardware in the loop market is highly competitive, with a mix of established global corporations and specialized technology providers focusing on innovation, customization, and scalability. Key players such as DSpace GmbH, National Instruments, Vector Informatik, Siemens, Robert Bosch Engineering, MicroNova AG, Opal-RT Technologies, LHP Engineering Solutions, Ipg Automotive GmbH, Typhoon HIL, Speedgoat GmbH, and Eontronix dominate through advanced simulation platforms, broad application coverage, and strategic industry collaborations. It is driven by continuous demand from automotive, aerospace, energy, and industrial automation sectors, prompting companies to expand their product portfolios and integrate emerging technologies such as AI, cloud computing, and digital twins. Vendors invest in R&D to enhance real-time performance, interoperability, and modularity, enabling customers to simulate increasingly complex systems. Strategic partnerships with OEMs, research institutions, and government agencies strengthen market positioning and open new application areas. Competitive strategies include offering flexible deployment models, from open-source and custom-built architectures to commercial turnkey solutions.

Recent Developments

- In March 2025, Emerson introduced the NI LabVIEW+ Suite for HIL, a unified software package integrating test, validation, and data analysis tools to streamline embedded software testing workflows.

- In February 2025, Elektrobit collaborated with Cognizant to embed its Adaptive AUTOSAR solution into Cognizant’s Software-Defined Vehicle (SDV) accelerator, enabling OEMs and Tier 1 suppliers to build scalable, flexible SDV architectures and speed up development.

- In November 2024, OPAL-RT Technologies hosted its inaugural real-time simulation conference, RT24-IN, in Bengaluru, India, unveiling the OP1400-BM Bench, a Power-Hardware-in-the-Loop (PHIL) system designed for academic environments.

- In January 2025, dSPACE GmbH partnered with Microsoft to apply generative AI in advancing virtual electronic control unit (V-ECU) development, enhancing software-in-the-loop (SIL) testing and accelerating V-ECU creation, updates, and validation cycles.

Market Concentration & Characteristics

The hardware in the loop market demonstrates moderate to high concentration, with a mix of global leaders and specialized technology providers competing through innovation, customization, and strategic partnerships. It is characterized by strong entry barriers due to high capital requirements, complex technology integration, and the need for skilled expertise. Established players leverage advanced R&D capabilities to develop scalable, high-performance simulation platforms catering to automotive, aerospace, energy, and industrial automation sectors. The market emphasizes precision, interoperability, and real-time processing, driving continuous technological upgrades. Strategic alliances with OEMs, research institutions, and government programs expand application scope and strengthen competitive positioning. Demand for AI integration, cloud-enabled testing, and predictive simulation further fuels differentiation among key vendors. Regional dominance is shaped by industrial maturity, with North America and Europe leading adoption, while Asia-Pacific shows rapid growth through industrial expansion and EV development. This competitive landscape fosters innovation while maintaining a focus on reliability and compliance.

Report Coverage

The research report offers an in-depth analysis based on End-User Industry, Application, Technology, Component Type, System Configuration and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption will expand across automotive, aerospace, defense, and industrial automation sectors to meet rising validation needs.

- Electric and autonomous vehicle development will drive demand for advanced control system simulation.

- AI and machine learning integration will enhance predictive testing and fault detection capabilities.

- Cloud-based platforms will enable remote collaboration and real-time simulation access.

- Renewable energy applications will increase use for optimizing wind, solar, and smart grid control systems.

- Modular and scalable architectures will gain traction for flexible deployment.

- Industry 4.0 initiatives will accelerate adoption in manufacturing and robotics.

- Vendor competition will intensify, leading to more customizable and cost-efficient solutions.

- Interoperability improvements will reduce integration challenges with diverse hardware and software ecosystems.

- Regional growth in Asia-Pacific and emerging markets will reshape global market share distribution.