Market overview

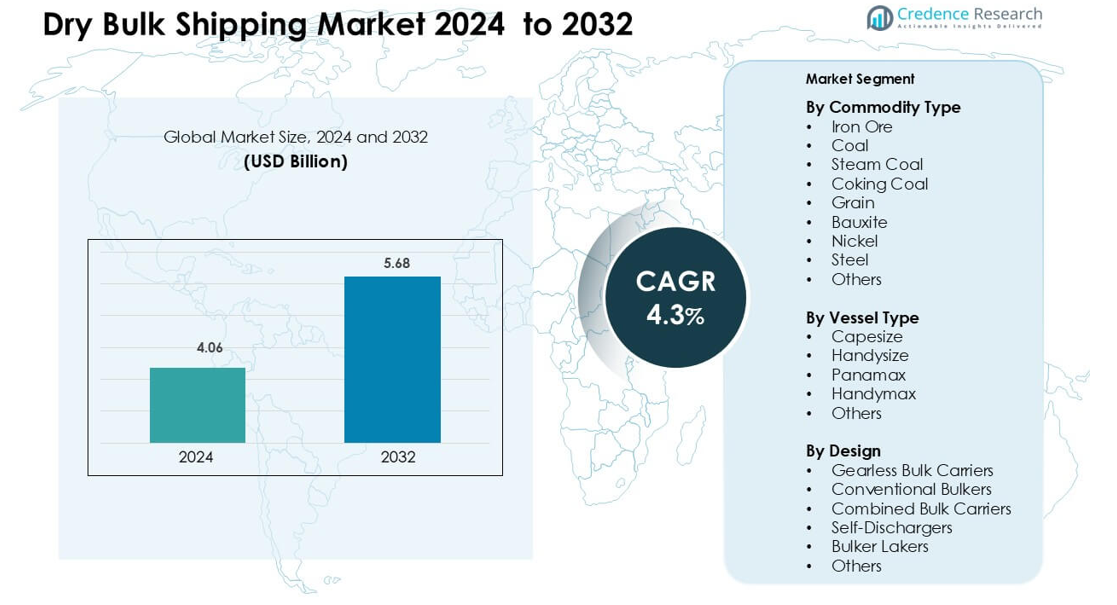

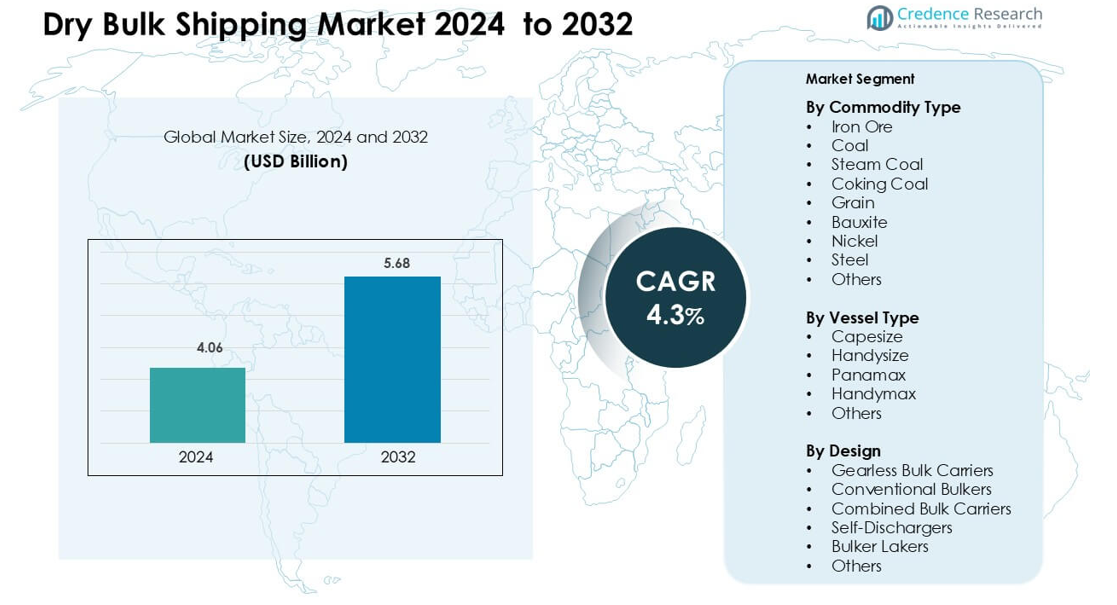

Dry Bulk Shipping Market was valued at USD 4.06 billion in 2024 and is anticipated to reach USD 5.68 billion by 2032, growing at a CAGR of 4.3 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dry Bulk Shipping Market Size 2024 |

USD 4.06 billion |

| Dry Bulk Shipping Market, CAGR |

4.3% |

| Dry Bulk Shipping Market Size 2032 |

USD 5.68 billion |

The dry bulk shipping market is dominated by key players including Bahri, Diana Shipping Inc., Eagle Bulk Shipping Inc., Eurodry Ltd., Euronav, Fednav, Genco Shipping & Trading Limited, Golden Ocean Group, Navios Maritime Partners L.P., and Oldendorff Carriers, which collectively lead through large, modern fleets, global route networks, and strategic chartering capabilities. These companies leverage operational efficiency, fleet diversification, and technological adoption to maintain competitiveness in both spot and long-term contracts. Regionally, the Asia-Pacific market emerges as the leader, accounting for approximately 48% of the global market share, driven by high demand for iron ore, coal, and agricultural commodities, coupled with strong infrastructure development and long-haul trade flows. The combination of leading operators and a robust regional market positions the sector for continued growth and sustained ton-mile expansion in the foreseeable future.

Market Insights

- The global dry bulk shipping market was valued at USD 4.06 billion in 2024 and is projected to grow at a CAGR of 4.3% during 2025‑2032.

- Growth is driven by increasing demand for iron ore, coal, and agricultural commodities, especially from Asia-Pacific, which accounts for 48% of the market, and expanding industrialization in emerging economies.

- Key trends include adoption of green shipping technologies, digitalisation for fleet optimisation, and deployment of larger Capesize and Panamax vessels to improve efficiency and reduce operational costs.

- The competitive landscape is fragmented, with major players such as Bahri, Diana Shipping Inc., Genco Shipping, Golden Ocean Group, and Oldendorff leveraging fleet modernisation, strategic alliances, and global trade networks to maintain market leadership. Iron ore and coal segments dominate cargo volumes, contributing over 60% of total shipments.

- Market restraints include freight rate volatility, regulatory compliance costs, and limited port infrastructure in certain regions, which can impact profitability and fleet utilisation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Commodity Type

The iron ore segment dominates the dry bulk shipping market, accounting for approximately 35% of total volume share, driven by strong steel production and infrastructure development globally. Coal, particularly coking coal, follows closely, fueled by rising energy demand and industrial applications. Grain shipments are also significant, supported by expanding agricultural exports from major producing regions. The growth in bauxite, nickel, and steel cargo reflects increasing industrial and metallurgical activities. Overall, the commodity-driven demand is influenced by global trade flows, raw material availability, and fluctuations in commodity prices, which determine shipping frequency and vessel utilization.

- For instance, Genco Shipping & Trading Limited’s fleet consisted of 42 vessels including 16 Capesize carriers with a combined capacity of approximately 4,446,000 dwt, enabling significant iron‑ore and bauxite cargo movements.

By Vessel Type

Capesize vessels lead the market with a share exceeding 40%, primarily due to their suitability for transporting bulk commodities like iron ore and coal over long distances. Panamax and Handymax vessels follow, catering to medium-haul routes and serving grain, coal, and bauxite shipments efficiently. Handysize vessels maintain steady demand for regional trade, offering flexibility in smaller ports. Growth in the segment is driven by the increasing size of trade cargoes, optimization of shipping routes, and rising demand for cost-efficient logistics. Technological improvements and fleet modernization further enhance operational efficiency for each vessel type.

- For instance, Golden Ocean Group has a total fleet of around 91 dry bulk vessels (including Kamsarmax and Newcastlemax vessels, which are variations of Capesize), with an aggregate capacity of approximately 13.7 million dwt across its entire fleet.

By Design

Gearless bulk carriers hold the dominant position, representing over 50% of the market share, as they efficiently transport large volumes of iron ore and coal without onboard cargo-handling equipment. Conventional bulkers and self-discharging vessels follow, with self-dischargers gaining traction in regions requiring port-independent unloading. Combined bulk carriers and bulker Lakers cater to niche routes and specialized cargo, contributing to market diversity. The segment growth is driven by the need for operational efficiency, reduced turnaround time, and compliance with environmental regulations, prompting investments in modern, fuel-efficient vessel designs.

Key Growth Drivers

Expansion of Global Raw Material Demand

The global appetite for raw materials, such as iron ore, coal and grains, is driving growth in the dry bulk shipping market. Industrialisation in the Asia‑Pacific region—particularly infrastructure build‑out in India, Southeast Asia and Africa—has increased seaborne trade volumes of these commodities, thus boosting demand for bulk carriers. Long‑haul trade routes for iron ore and coal, supported by large‑capacity vessels, have become vital. At the same time, agricultural commodity movement (grain, bauxite) is rising in response to global population growth and food‑security concerns. As a result, ship‑owners and operators are seeing sustained utilisation rates and charter opportunities, reinforcing investment in fleet capacity and longer‑term service contracts.

- For instance, Fednav is Canada’s largest international dry bulk shipping company and transports over 30 million tonnes of total cargo (including agricultural products, fertilizers, and industrial minerals) annually across all its routes.

Infrastructure Development and Trade Route Expansion

Rapid infrastructure development across emerging economies is catalysing demand for dry bulk shipping services. Major port, rail, and road investments facilitate larger cargo flows and improve connectivity between production centres and global markets. With greater transport efficiency, shipping operators can deploy larger vessels for long‑haul routes, improving ton‑mile performance and cost‑effectiveness. Moreover, the extension of trade corridors and unlocking of new export markets—for example in Africa and Southeast Asia—creates fresh growth avenues for bulk carriers. These dynamics encourage fleet expansion, route diversification and enhanced service offerings tailored to high‑volume commodity transport.

- For instance, Oldendorff Carriers has leveraged its fleet of 700 vessels, including 128 Capesize and 263 Panamax ships, to efficiently serve expanding trade corridors in Africa and Southeast Asia, transporting bulk commodities such as iron ore, coal, and grain

Technological Innovation and Operational Efficiency Gains

Technological advancements are reshaping the dry bulk shipping market by enabling higher operational efficiency and supporting compliance with evolving regulatory standards. Digitalisation of route planning, onboard analytics, fuel‑optimisation systems and IoT‑enabled tracking are gaining traction in the sector. At the same time, new vessel designs, improved hull forms and alternative‑fuel propulsion systems are becoming more prevalent, helping operators reduce fuel consumption and emissions. This focus on innovation not only lowers unit costs but positions fleet operators to capture premium freight via sustainable and reliable service offerings, particularly as environmental regulation tightens.

Key Trend & Opportunity

Sustainability and Green Shipping Adoption

A major trend and opportunity in the dry bulk shipping market lies in the adoption of green shipping solutions—alternative fuels, energy‑efficient designs and emission‑reduction technologies. The shift reflects regulatory pressure from bodies like International Maritime Organization and growing stakeholder focus on the environmental footprint of maritime logistics. Early adopters of green technologies stand to gain competitive advantage via fuel savings, regulatory incentives and access to increasingly eco‑conscious cargo owners. This trend also opens pathways to specialised vessels and premium chartering, especially for routes where sustainability credentials matter. Investing in green capabilities now positions firms for the transition and helps mitigate regulatory‑compliance risk.

- For instance, Golden Ocean has consistently pursued a strategy of improving fleet efficiency through both acquiring scrubber-fitted vessels and installing energy-saving devices, often highlighted in their reports and news releases.

Digitalisation and Data‑Driven Logistics

Another compelling trend is the increased integration of digital tools, data analytics and connected systems into bulk shipping operations. With trade flows becoming more complex and the need for supply‑chain visibility growing, operators are leveraging technologies to optimise vessel routing, manage port congestion and monitor performance in real time. The opportunity lies in deploying smart‑fleet management, predictive‑maintenance frameworks and digital twin models that reduce downtime and improve reliability. Such capabilities support efficient utilisation and create value‑added services for charterers, helping differentiate operators in a competitive marketplace.

- For instance, Navios Partners does operate modern, environmentally friendly vessels, some of which are equipped with advanced technology to optimize energy efficiency and safety, such as the HMM Ocean, which is LNG dual fuel powered.

Emerging Market Penetration and New Trade Flows

Growing commodity demand in emerging regions and new inter‑regional trade flows present a significant opportunity for the dry bulk shipping sector. As countries in Africa, Southeast Asia and Latin America expand infrastructure and industrial capacity, they generate additional demand for bulk cargo transport. At the same time, shifts in global supply‑chains and trade patterns (for example moving away from traditional East‑West flows) open new route possibilities and ton‑mile gains for vessel operators. Capturing these emerging lanes early offers the potential for first‑mover advantages, new charter contracts and expansion of service footprints.

Key Challenge

Regulatory Pressure and Escalating Compliance Costs

The dry bulk shipping industry faces substantial regulatory pressure as the global maritime sector moves toward lower emissions and stricter environmental standards. Operators must invest in fuel‑efficient vessels, retrofits, alternative fuels and compliance infrastructure—often at significant cost. These regulatory demands increase operating expenses and may delay return on investment for older tonnage. Moreover, smaller ship‑owners or those lacking capital may struggle to compete effectively, prompting fleet renewal or consolidation. The challenge is compounded by uncertainty around fuel‑types, future mandates and timing, making investment decisions more complex and potentially blocking growth if not managed proactively.

Freight Rate Volatility and Supply‑Demand Imbalance

Despite the fundamental growth drivers, the dry bulk shipping market remains highly cyclical and exposed to freight‑rate volatility stemming from commodity price swings, global economic downturns and oversupply of vessels. Fleet expansion without matching cargo growth can depress charter rates and profitability. In addition, disruptions such as port congestion, route rerouting or demand drop‑offs create utilisation risk. To navigate this environment, operators must maintain agile capacity management, cost discipline and strategic chartering—failure to do so may lead to margin compression and weaker asset‑returns.

Regional Analysis

Asia‑Pacific

The Asia‑Pacific region holds the largest share of the global dry bulk shipping market, accounting for approximately 45‑50% of the total. Robust demand for iron ore, coal and grains in countries such as China, India and Japan underpins growth. Infrastructure build‑out, rapid industrialisation and raw‑material import dependence drive high bulk‑cargo volumes in long‑haul trades. The dominance of large Capesize and Panamax vessel operations in the region further reinforces ton‑mile contributions. Given persistent commodity flows and rising intra‑regional trade, Asia‑Pacific will remain the growth engine for dry bulk shipping.

Europe

Europe commands around a 23‑25% share of the dry bulk shipping market Its well‑established port infrastructure, high industrial import dependency (for iron ore, coal, and agricultural bulk) and mature logistics systems support consistent volume. The region’s inland‑sea and coastal bulk trade (for steel‑making materials, cement, grain) generate substantial demand. Environmental regulation and fleet‑modernisation initiatives in Europe also encourage newer vessels and efficient shipping. While growth is more modest compared to emerging markets, Europe remains a stable contributor and conversion to greener fleet operations offers incremental opportunity.

North America

North America is estimated to contribute roughly 18‑20% of the global dry bulk shipping market. The region’s strong agricultural export base (particularly grain and soy), mineral and coal shipments, and developed port systems underpin this share. Bulk‑carrier operations from Gulf, Atlantic and Pacific ports handle major seaborne flows to Asia and Europe. While lower growth is expected compared to Asia due to maturity and slower industrial expansion, the region benefits from stable demand, diversion of trade flows and modernisation of fleet and port infrastructure supporting efficient bulk shipping.

Middle East & Africa

The Middle East & Africa region holds about a 10% share of the dry bulk shipping market. Growth in the region is driven by exports of minerals, phosphate, construction materials and increased export‑oriented logistics from countries such as Saudi Arabia, South Africa and UAE. Investment in port facilities and mining infrastructure is gradually improving regional shipping connectivity. However, capacity constraints, less matured bulk‑logistics networks and regional trade volatility temper growth. Nonetheless, the region offers emerging‑market opportunity as mining and commodity‑export investments expand.

Latin America

Latin America currently accounts for around 5% or so of the global dry bulk shipping market. The region’s strength lies in agricultural bulk exports (grain, soy), mineral shipments (bauxite, nickel, iron ore) and growing infrastructure development in countries such as Brazil, Argentina and Chile. While port logistics and vessel availability limit some volume expansion, trade agreements and commodity‑driven flows into major consuming regions support moderate growth. Latin America presents a strategic niche for bulk carriers seeking diversification beyond traditional Asia‑Europe‑Americas routes.

Market Segmentations

By Commodity Type

- Iron Ore

- Coal

- Steam Coal

- Coking Coal

- Grain

- Bauxite

- Nickel

- Steel

- Others

By Vessel Type

- Capesize

- Handysize

- Panamax

- Handymax

- Others

By Design

- Gearless Bulk Carriers

- Conventional Bulkers

- Combined Bulk Carriers

- Self-Dischargers

- Bulker Lakers

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The dry bulk shipping market is highly competitive, with several major players dominating the industry. Companies such as Golden Ocean Group, Diana Shipping Inc., Eagle Bulk Shipping, and Oldendorff Carriers are significant contributors, with large fleets and strong global presence. Golden Ocean is recognized for its extensive fleet of Capesize and Panamax vessels, while Eagle Bulk specializes in mid-sized Supramax and Ultramax vessels, which cater to a wide range of dry bulk commodities. Diana Shipping and Oldendorff maintain diverse fleets across multiple vessel sizes and often secure long-term contracts to provide stability amidst volatile market conditions. Additionally, Fednav and Navios Maritime Partners have established themselves in niche markets, such as Arctic routes and specialized bulk shipping. The competitive edge in this market is largely influenced by fleet size, technological advancements, and the ability to adapt to the changing demands of the global economy.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In May 2024, Intermarine established “Intermarine Bulk Carriers” to set foot in the dry bulk shipping industry. Additionally, they are also planning to handle multi-purpose vessels and tonnage services for their parent company’s bulk carriers. This strategic move aligns with their current offerings and caters to rising demand in the project cargo segment.

- In December 2023, Wisdom Marine and Synergy Marine Group formed a joint venture, Wisdom Synergy Ship Management (WSSM), focused on managing Wisdom Marine s dry bulk vessels. Headquartered in Singapore, WSSM operates with key operational centers in Taiwan and India.

- In October 2023, Berge Bulk unveiled a vessel featuring steel-and-composite sails designed to reduce fuel consumption and carbon emissions. This revolutionary concept seeks to harness wind power and optimize efficiency. Berge Bulk plans to retrofit more ships on routes where favorable winds can be exploited for sustainable shipping practices that are eco-friendly. This is an important milestone for the dry bulking shipping market.

Report Coverage

The research report offers an in-depth analysis based on Commodity Type, Vessel Type, Design and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for dry bulk shipping will continue to grow due to rising industrialization and infrastructure projects globally.

- Asia-Pacific will remain the largest regional market, driven by iron ore, coal, and grain imports.

- Capesize and Panamax vessels will dominate long-haul trade routes because of their large cargo capacity.

- Adoption of green shipping technologies and alternative fuels will increase to meet environmental regulations.

- Digitalisation and fleet management systems will enhance operational efficiency and reduce downtime.

- Emerging markets in Africa and Latin America will offer new trade routes and growth opportunities.

- Consolidation and strategic alliances among key players will strengthen competitive positioning.

- Fleet modernization will focus on fuel efficiency, safety, and regulatory compliance.

- Volatility in freight rates and commodity prices will remain a challenge for operators.

- Investment in port infrastructure and logistics networks will support smoother cargo movement and higher utilization.