Market Overview:

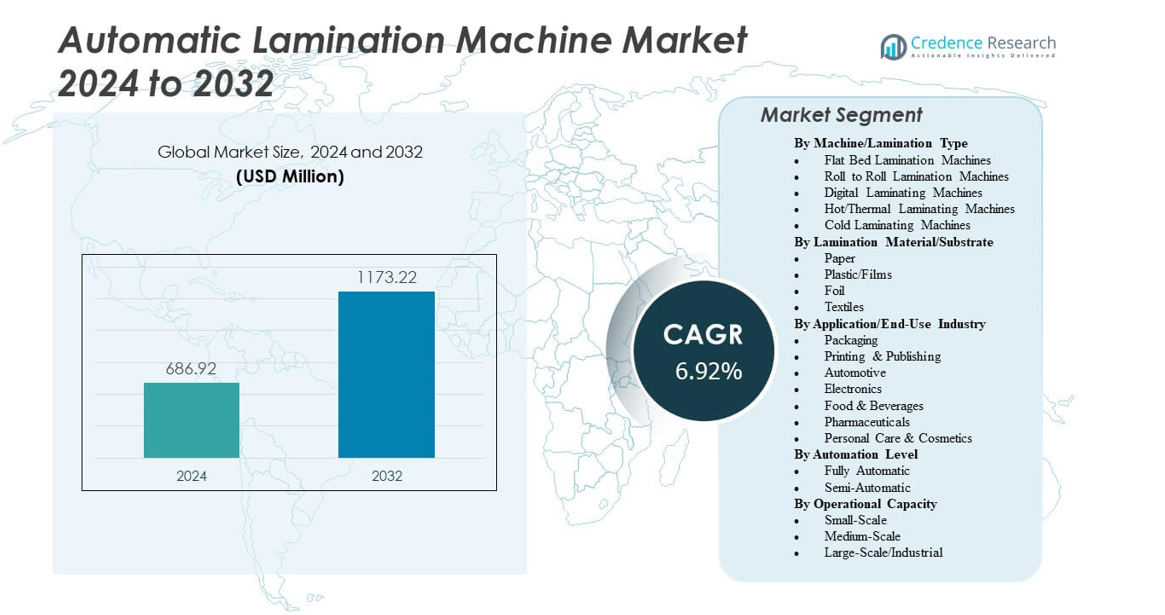

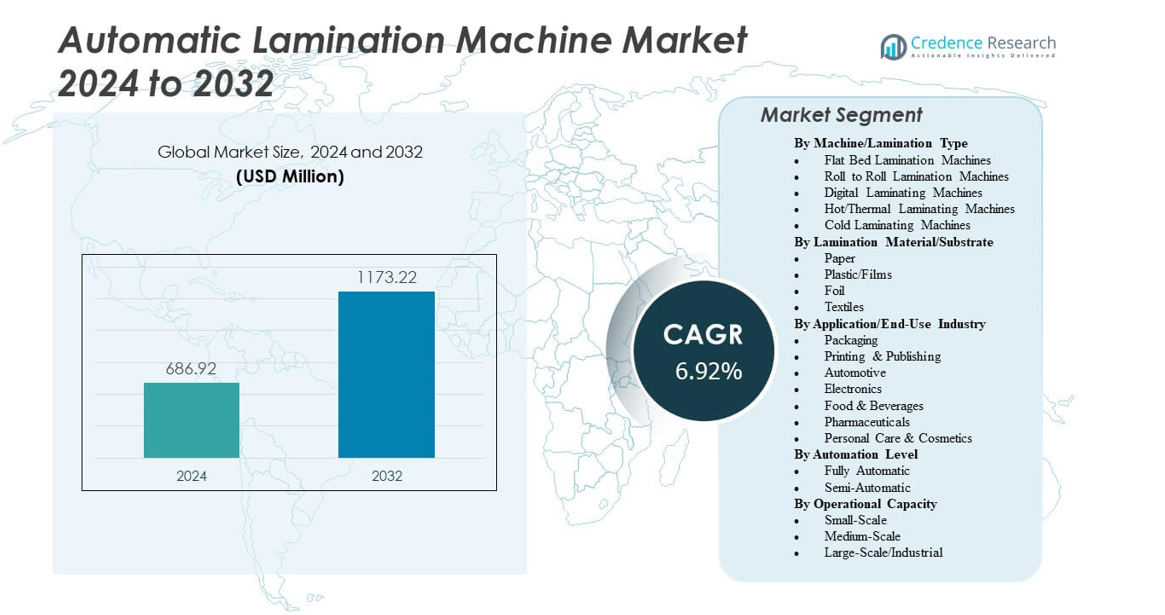

The Automatic Lamination Machine Market is projected to grow from USD 686.92 million in 2024 to an estimated USD 1,173.22 million by 2032, with a compound annual growth rate (CAGR) of 6.92% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automatic Lamination Machine Market Size 2024 |

USD 686.92 million |

| Automatic Lamination Machine Market, CAGR |

6.92% |

| Automatic Lamination Machine Market Size 2032 |

USD 1,173.22 million |

The market growth is driven by the rising adoption of automation across printing, packaging, and electronics industries. Manufacturers seek higher precision, reduced manual effort, and faster turnaround times, leading to strong demand for fully automatic lamination systems. Increasing preference for eco-friendly materials, energy-efficient equipment, and improved film technologies further accelerates adoption. Continuous R&D and innovation in machine design enhance reliability, quality, and productivity across global manufacturing sectors.

North America leads the market, supported by advanced manufacturing infrastructure and strong demand in packaging and commercial printing. Europe follows closely, driven by sustainability standards and high-quality finishing applications. The Asia-Pacific region shows the fastest expansion, supported by industrialization and rising investment in automated production systems across China, India, and Japan. Latin America and the Middle East & Africa represent emerging markets, showing gradual uptake due to growing packaging and industrial applications.

Market Insights:

- The Automatic Lamination Machine Market is projected to grow from USD 686.92 million in 2024 to USD 1,173.22 million by 2032, registering a CAGR of 6.92%.

- Increasing automation in printing and packaging industries drives demand for high-speed, precision lamination systems.

- Growing adoption of eco-friendly materials and energy-efficient machinery strengthens market expansion globally.

- High initial installation and maintenance costs restrain adoption among small and medium enterprises.

- North America dominates due to advanced manufacturing and strong packaging industry presence.

- Asia-Pacific records the fastest growth, supported by industrialization and higher automation investments.

- Europe maintains steady growth through strict sustainability standards and premium product demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Automation and Efficiency in Production Lines

The Automatic Lamination Machine Market benefits from industries pursuing faster and more consistent lamination outcomes. Manufacturing sectors, especially packaging and printing, are upgrading to automated systems to reduce manual errors. Automation helps companies enhance operational productivity and meet large-scale orders within shorter timelines. It drives energy-efficient production with improved precision in coating and lamination. Businesses prefer fully automatic systems with programmable controls and monitoring features. Growing focus on smart factories and Industry 4.0 integration further strengthens adoption. It enhances throughput and reduces dependency on skilled labor. Automation remains a major factor propelling equipment demand across global markets.

- For instance, Bobst’s NOVA SX 550 laminator achieves a production speed of up to 450 meters per minute, requires less than 1 minute for setup of job parameters, and enables a complete job changeover in 15 minutes. Its patented automatic washing cycle completes in five minutes or less, supporting short order productivity and consistent lamination quality.

Increasing Adoption in Packaging, Electronics, and Printing Industries

Demand from the packaging sector drives large-scale installation of automatic laminators. The packaging industry requires consistent lamination for protection, durability, and improved product aesthetics. In electronics, lamination ensures insulation, scratch resistance, and surface finish. Printing companies invest in machines capable of handling varied film materials, supporting premium-quality finishes. The Automatic Lamination Machine Market experiences steady growth with these industrial applications. New models allow seamless integration into existing workflows. Compact and modular designs fit both large factories and small workshops. It continues to find traction across industries needing high-speed precision lamination.

- For instance, the Komfi Amiga 52 laminator, widely adopted by commercial print houses, delivers lamination speeds of up to 25 meters per minute with a maximum monthly recommended machine capacity of 100,000 sheets. It accommodates a wide range of sheet sizes up to 560 x 800 mm and provides sheet overlap accuracy of ±1 mm, meeting the rigorous consistency demands of the packaging and printing sectors.

Technological Innovation in Machine Design and Process Optimization

Machine manufacturers focus on high-speed performance with lower energy use. Innovations include digital control panels, automatic feeding systems, and error diagnostics. These technologies reduce downtime and material wastage. Enhanced sensor-based systems maintain film alignment and temperature accuracy. The Automatic Lamination Machine Market benefits from consistent upgrades that improve quality and productivity. Integration of robotics further supports customization and scalability. Automation software allows users to track performance in real time. It pushes the industry toward smarter and more adaptive manufacturing solutions.

Sustainability and Shift Toward Eco-Friendly Lamination Materials

Sustainability influences production design and purchasing decisions in lamination systems. Companies adopt machines capable of using biodegradable films and recyclable laminates. Equipment upgrades focus on lowering adhesive consumption and power demand. The Automatic Lamination Machine Market grows alongside environmental commitments from large converters and print houses. Energy-efficient motors and optimized heating modules improve green compliance. Reduced waste generation appeals to firms under stricter emission policies. It promotes broader usage across markets with environmental certifications. Sustainable designs align with the industry’s global transition toward circular production.

Market Trends

Integration of Smart Monitoring and IoT Connectivity in Lamination Systems

IoT-enabled lamination machines provide real-time performance insights. These systems alert operators about component wear or maintenance schedules. Smart sensors optimize temperature, pressure, and film feed rates. It enables manufacturers to reduce downtime and ensure operational stability. The Automatic Lamination Machine Market increasingly adopts connected machinery compatible with digital management platforms. Remote troubleshooting and predictive analytics lower service costs. Continuous data feedback helps track production efficiency. Smart connectivity becomes a defining characteristic of next-generation lamination systems.

- For instance, FRIMO’s Multipurpose Machine (MPM) integrates a central robot and independent PLC-controlled tools, which support rapid product and process changes at the push of a button while providing precise temperature management and ongoing quality data for lamination cycles.

Shift Toward Compact and Modular Machine Configurations

Manufacturers design flexible machines to meet diverse space and capacity needs. Compact systems fit small workshops while modular variants support scalable production lines. The Automatic Lamination Machine Market reflects rising preference for plug-and-play models. These machines reduce setup time and simplify operation. Quick component replacement enhances uptime and user convenience. Compactness also improves portability across multiple production sites. Flexible layouts suit custom packaging and printing firms. Modular structures allow adaptation to changing product demands.

Growing Popularity of Thermal and Dry Lamination Technologies

Thermal and dry lamination systems are gaining momentum due to solvent-free operation. These methods support fast curing, low emissions, and enhanced adhesion. Printing and photo finishing firms prefer dry lamination for sustainability goals. The Automatic Lamination Machine Market benefits from industries adopting clean technology. Reduced odor and shorter setup cycles increase production speed. Thermal lamination ensures consistent finishes for luxury packaging and media printing. These trends reflect an ongoing transition to safer and eco-conscious manufacturing practices.

Customization for Industry-Specific Applications and Material Types

Producers now design lamination systems to suit varied substrates and coating requirements. Machines handle diverse films such as PET, BOPP, and PVC. The Automatic Lamination Machine Market aligns with multi-material compatibility trends. Users in textiles, automotive, and construction seek machines for specialized coatings. Digital controls and pressure regulation maintain uniform lamination on sensitive materials. Demand for flexible, custom-built models continues to rise. Manufacturers emphasize tailored engineering that supports niche product applications.

- For instance, Kingchuan Packaging supplies BOPP thermal lamination films in gloss, matte, metalized, embossed, textured, and printable varieties, meeting rigorous FDA and international quality standards. The services include customization by thickness, size, surface coating, and lamination construction, allowing customers from industries such as textiles, food, and label manufacturing to specify exactly what’s required for their applications.

Market Challenges Analysis

High Initial Investment and Maintenance Complexity Restrict Adoption

Small and medium enterprises face cost constraints in upgrading to automatic systems. Initial installation and integration expenses remain substantial. The Automatic Lamination Machine Market sees hesitation from firms with limited capital budgets. Maintenance requires technical expertise, which raises service dependency. Downtime during repair can disrupt output schedules. Replacement parts and specialized components increase operational expenditure. It limits accessibility among smaller producers and slows full automation adoption. Complex system calibration adds another layer of challenge in sustaining consistent quality.

Fluctuating Raw Material Supply and Energy Cost Concerns

Volatile prices of lamination films, adhesives, and electrical components impact production costs. High energy consumption adds to the overall burden, especially for continuous operations. The Automatic Lamination Machine Market experiences uncertainty due to global supply chain disruptions. Manufacturers struggle with inconsistent input availability and fluctuating import tariffs. Rising energy rates challenge firms to maintain profit margins. It encourages focus on low-energy technologies but delays large-scale adoption in price-sensitive regions.

Market Opportunities

Expansion of Packaging and Printing Industries in Emerging Economies

Rapid industrialization in Asia-Pacific, Latin America, and the Middle East boosts lamination machine demand. Expanding packaging operations across e-commerce, food, and pharmaceuticals drive investments in automation. The Automatic Lamination Machine Market gains traction from local manufacturers upgrading production capacity. Governments promoting industrial automation through incentives increase adoption rates. Urbanization and changing consumer lifestyles support higher packaging output. It creates favorable ground for machine suppliers to strengthen regional presence.

Innovation Toward Hybrid Machines and Sustainable Manufacturing Solutions

R&D investments focus on hybrid systems combining mechanical precision with digital controls. These designs enhance flexibility while supporting sustainable materials. The Automatic Lamination Machine Market benefits from research targeting waste reduction and faster cycle times. Hybrid machines reduce adhesive usage and operate with minimal heat loss. Demand grows for smart, green technologies aligned with environmental policies. It presents long-term opportunities for producers developing energy-saving and recyclable-friendly machines.

Market Segmentation Analysis:

By Machine/Lamination Type

The Automatic Lamination Machine Market includes flat bed, roll to roll, digital, hot/thermal, and cold lamination machines. Roll to roll systems hold a major share due to their efficiency in continuous production lines. Flat bed machines find use in heavy-duty and industrial applications requiring thicker substrates. Digital laminators serve small-scale printing and photo industries needing fast job turnaround. Hot and thermal machines dominate high-quality finishing needs, while cold laminators cater to temperature-sensitive materials. It maintains balanced growth across diverse production requirements.

- For instance, the Komfi Delta 52 automatic thermal laminating machine achieves a verifiable maximum lamination speed of 35 meters per minute and supports sheet sizes up to 52 cm x 74 cm, as confirmed in its technical documents.

By Lamination Material/Substrate

Key materials used include paper, plastic films, foil, and textiles. Paper remains the largest substrate category supported by packaging and publishing industries. Plastic and film lamination grow in electronics and food packaging sectors due to enhanced durability and moisture resistance. Foil-based applications gain relevance in premium and protective wrapping products. Textile lamination expands in automotive interiors and technical fabrics. It demonstrates steady material diversification driven by end-user innovation.

By Application/End-Use Industry

Packaging leads the segment, supported by rising consumption in food, pharmaceutical, and retail sectors. Printing and publishing maintain demand for decorative and protective finishes. The Automatic Lamination Machine Market also benefits from adoption in electronics and automotive industries, where laminated films ensure insulation and surface protection. Personal care, cosmetics, and pharmaceuticals increasingly require laminated containers for extended shelf life. It reflects broad industrial application and continuous usage expansion.

By Automation Level

Fully automatic systems dominate due to higher accuracy, reduced labor cost, and improved consistency. These machines integrate sensors and smart controllers for efficient workflow. Semi-automatic variants serve medium enterprises with flexible batch needs. It balances between affordability and performance, offering scalability for future upgrades.

- For instance, Heidelberg’s Promatrix 106 CS boasts an official rated output of up to 8,000 sheets per hour and processes substrates from 90 to 2,000 gsm, in line with published technical documentation from Heidelberg.

By Operational Capacity

Large-scale or industrial machines hold the highest share due to bulk production demand. Medium-scale setups attract regional converters and contract manufacturers. Small-scale units cater to startups and customized production lines. It ensures that automation benefits reach both global manufacturers and local processors.

Segmentation:

By Machine/Lamination Type

- Flat Bed Lamination Machines

- Roll to Roll Lamination Machines

- Digital Laminating Machines

- Hot/Thermal Laminating Machines

- Cold Laminating Machines

By Lamination Material/Substrate

- Paper

- Plastic/Films

- Foil

- Textiles

By Application/End-Use Industry

- Packaging

- Printing & Publishing

- Automotive

- Electronics

- Food & Beverages

- Pharmaceuticals

- Personal Care & Cosmetics

By Automation Level

- Fully Automatic

- Semi-Automatic

By Operational Capacity

- Small-Scale

- Medium-Scale

- Large-Scale/Industrial

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

The North America region accounts for approximately 40 % of the global Automatic Lamination Machine Market share. Strong demand in the United States and Canada drives machine adoption in packaging, printing and electronics sectors. Manufacturers in this region adopt advanced automation and digital integration to meet production targets. Leading firms deploy efficient laminating machines to reduce labour costs and improve output. The regulatory environment in North America encourages energy-efficient and sustainable equipment deployment. It remains the largest regional contributor in the market’s near-term outlook.

Europe holds around 30 % of the global market share for the automatic lamination machine segment. Countries such as Germany, the UK and France lead investment in finishing technologies and eco-friendly systems. Equipment suppliers in Europe focus on sustainability, low-emission machines and recyclable lamination materials. The mature infrastructure supports roll-to-roll and digital lamination systems used in high-end printing and luxury packaging applications. Demand from automotive and electronics industries fuels growth in Western Europe. It remains a strong second largest region.

The Asia-Pacific region captures roughly 25 % of the total market share and shows the fastest growth rate among all regions. Countries such as China, India and Japan expand manufacturing capacities in packaging, food & beverage and consumer electronics. Local companies increasingly adopt fully-automatic laminating systems to meet rising production volume. Government industrialisation initiatives and growing exports support machine purchases. The Middle East, Latin America & Africa occupy the remaining share but show progressive uptake. It provides significant growth opportunities for suppliers targeting emerging economies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The competitive landscape of the Automatic Lamination Machine Market is moderately consolidated with several strong global players and many regional specialists. Firms such as D&K Group, Inc. lead with high-capacity automated lamination solutions and custom machine designs. Other major manufacturers include Comexi Group Industries, Black Bros. Co. and FRIMO Group GmbH, each focusing on specialised segments and regional strength. These companies invest in R&D to enhance machine speed, reduce adhesive waste and comply with environmental norms. They maintain broad distribution networks and service capabilities in key markets. New entrants and regional vendors operate in niche applications, promoting price competition and innovation. Competitive dynamics thus emphasise automation features, energy efficiency and region-specific customisation.

Recent Developments:

- In March 2025, Bagel Systems, a Spain-based manufacturer, launched the Digifav B3, a double-sided thermal digital laminator designed for B3 format applications. The Digifav B3 stands out for its high-speed operation, capable of processing up to 2,000 sheets per hour (SRA3), and supports sheet weights ranging from 130 to 450gsm. The machine accommodates sheet sizes from 210x297mm to 380x700mm, making it suitable for a wide range of commercial and industrial lamination needs.

- In May 2024, American Packaging Corporation (APC) launched a new Digital Printing Unit at its Center of Excellence in Columbus, Wisconsin. The unit is powered by two HP Indigo 200K Digital Presses and is equipped for flexible packaging production, including lamination. This investment enhances APC’s capabilities in producing high-quality, laminated flexible packaging for the food and beverage industry.

Report Coverage:

The research report offers an in-depth analysis based on Machine/Lamination Type, Lamination Material/Substrate, Application/End-Use Industry, Automation Level and Operational Capacity. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising automation in packaging and printing facilities will continue driving machine adoption.

- Growing preference for energy-efficient and eco-friendly laminators will shape product innovation.

- Integration of IoT and AI in machine operations will improve process monitoring and productivity.

- Demand for modular and compact systems will expand across small and medium manufacturers.

- Use of recyclable films and biodegradable substrates will influence equipment development.

- Expansion in food, pharmaceutical, and electronics packaging will sustain steady market growth.

- Asia-Pacific will emerge as the fastest-growing region driven by industrial modernization.

- Digital lamination technology will gain traction with increased on-demand printing needs.

- Partnerships between machine producers and material suppliers will enhance product compatibility.

- Strong after-sales support and automation upgrades will define long-term competitive positioning.