Market Overview:

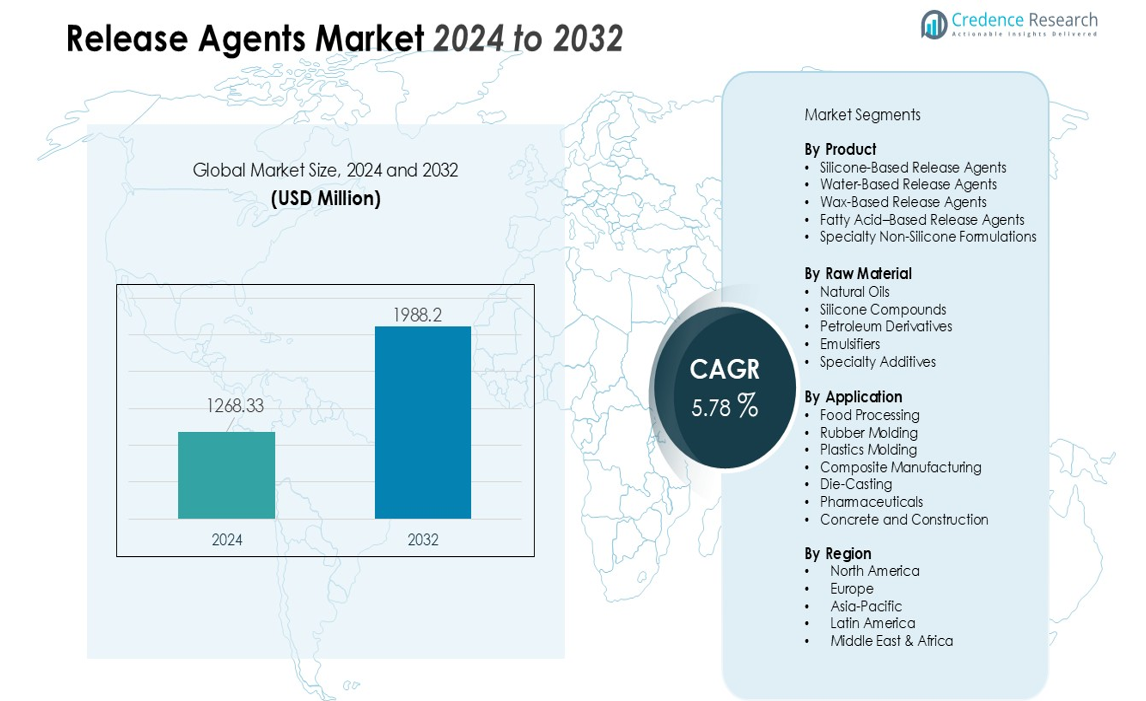

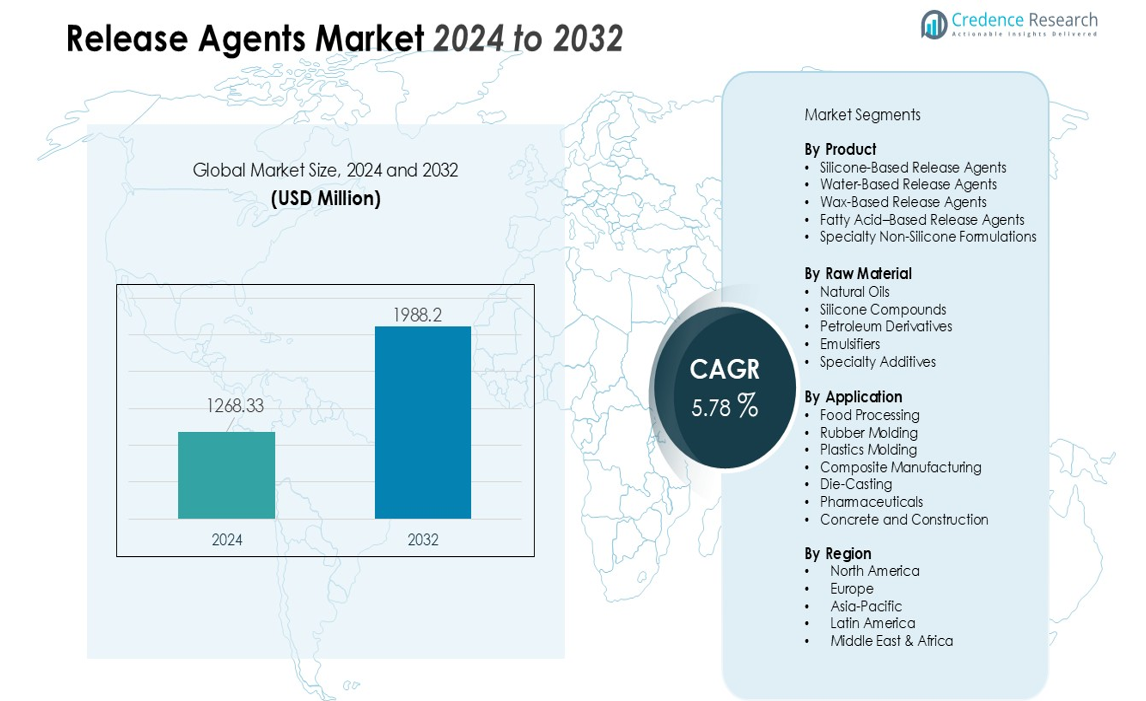

The release agents marketsize was valued at USD 1268.33 million in 2024 and is anticipated to reach USD 1988.2 million by 2032, at a CAGR of 5.78 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Release Agents Market Size 2024 |

USD 1268.33 million |

| Release Agents Market, CAGR |

5.78% |

| Release Agents Market Size 2032 |

USD 1988.2 million |

Market growth is driven by increasing industrial automation, rising adoption of high-precision molding technologies, and the need to reduce downtime linked to adhesion and surface defects. Food manufacturers rely heavily on release agents to ensure consistent product appearance and minimize waste, while metal and composite producers employ advanced agents to enhance mold efficiency and extend mold life. The transition toward clean-label, non-GMO, and allergen-free ingredients in the food sector, along with VOC-compliant options in industrial applications, further boosts product innovation and adoption.

Regionally, North America leads due to strong food processing and automotive manufacturing bases, followed closely by Europe, where stringent environmental standards accelerate demand for eco-friendly formulations. Asia-Pacific is the fastest-growing region, supported by rapid industrialization, expanding packaging, automotive, and electronics manufacturing, and rising investments in high-capacity production facilities across China, India, and Southeast Asia.

Market Insights:

- The release agents market is valued at USD 1268.33 million in 2024 and is expected to reach USD 1988.2 million by 2032, growing at a CAGR of 5.78%.

- Rising demand for high-precision molding in automotive, food processing, plastics, and die-casting industries boosts adoption of engineered release agents for improved productivity.

- Stricter environmental regulations accelerate the shift toward sustainable, water-based, low-VOC, and biodegradable formulations across industrial applications.

- Automation and high-capacity production lines increase the need for consistent, high-performance release agents that reduce downtime and ensure stable operations.

- Asia-Pacific is the fastest-growing region due to rapid industrial expansion in automotive, electronics, packaging, and food manufacturing sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for High-Precision Manufacturing Across Core Industries

Manufacturers in automotive, food processing, rubber, plastics, and die-casting sectors seek higher productivity and consistent product quality, which strengthens adoption of advanced release agents. The release agents market grows as industries pursue flawless mold separation, reduced cycle time, and lower scrap rates. Companies invest in engineered formulations that improve surface finish and extend mold life. It supports production efficiency in high-volume environments where downtime creates significant operational losses.

- For instance, BMW employs precision manufacturing techniques achieving component tolerances within ±0.01 mm, reducing defect rates and improving engine performance consistency.

Shift Toward Sustainable, Water-Based, and Low-VOC Formulations

Stricter environmental regulations encourage manufacturers to replace solvent-based agents with safer and greener alternatives. It aligns with global efforts to lower VOC emissions and enhance worker safety in industrial facilities. Producers introduce biodegradable, silicone-free, and non-toxic formulations that meet regulatory and corporate sustainability goals. The release agents market benefits from broader acceptance of water-based systems that support clean manufacturing standards.

- For instance, Chem-Trend, a leader in release agent technology, has developed a water-based mold release agent that reduces VOC emissions by 80% compared to traditional solvent-based agents while maintaining performance and worker safety in manufacturing settings.

Expansion of Automated and High-Throughput Production Lines

Industries adopt automation and advanced molding technologies to improve operational throughput and reduce manual intervention. Automated systems require uniform mold release performance, which raises demand for high-quality and consistent formulations. It helps maintain process stability across continuous production cycles. The release agents market gains traction due to the integration of smart coating technologies that enhance precision and reduce rework.

Growing Application in Food Processing and Bakery Production

Food manufacturers rely on safe, compliant, and high-efficiency release agents to ensure smooth demolding of bakery, confectionery, and processed food products. It reduces product waste, prevents sticking, and supports uniform appearance in mass production settings. Clean-label and allergen-free formulations meet evolving consumer and regulatory expectations. The release agents market sees stronger adoption in modern food plants that prioritize hygiene, consistency, and cost control.

Market Trends:

Emergence of Eco-Friendly, Clean-Label, and High-Performance Formulations

Sustainability remains a dominant trend as industries seek water-based, biodegradable, silicone-free, and low-VOC release agents that align with global environmental standards. Manufacturers reformulate products to support safer workplaces and reduce regulatory risks. Clean-label trends in the food sector accelerate demand for non-GMO, allergen-free, and plant-derived components. It pushes suppliers to improve stability, heat resistance, and uniform coating properties without compromising safety. Rapid adoption of green chemistry strengthens innovation pipelines across major producers. The release agents market responds with advanced formulations that balance environmental responsibility and performance efficiency.

- For instance, Sam’s Club launched a ‘Made Without’ initiative to remove over 40 synthetic ingredients, including artificial colors and aspartame, in their Member’s Mark brand, with the goal of 100% compliance by the end of 2025, showcasing industry alignment with clean-label demands.

Integration of Smart Coating Technologies and Process Automation

Industrial manufacturers implement automated dispensing systems and precision-coating equipment to ensure consistent mold release performance. It improves operational reliability and supports high-speed production lines in automotive, packaging, rubber, and plastics sectors. Smart technologies enable real-time monitoring of coating thickness, surface condition, and release quality. Companies introduce digital tools that optimize dosage control and reduce material wastage. Demand rises for specialty agents tailored for complex geometries and high-temperature molding. The release agents market evolves through technologies that enhance traceability, production control, and equipment compatibility.

- For instance, Marco Systems integrates gantry robots with high-precision dispensing systems, allowing cleanroom-compatible, automated applications that enhance production capacity and product quality.

Market Challenges Analysis:

Complex Regulatory Environment and Rising Compliance Costs

Manufacturers face stricter regulations on VOC emissions, food-grade safety, and worker exposure limits, which increases the complexity of formulation development. Companies invest heavily in testing, certification, and reformulation to meet evolving global standards. It creates cost pressure for producers that manage multiple regulatory frameworks across regions. Frequent updates to environmental and food-contact regulations disrupt long-term product planning. Smaller players struggle to keep pace with compliance requirements. The release agents market experiences slower product approvals in sectors with rigid safety mandates.

High Performance Requirements and Variability in Industrial Processes

End users expect consistent release performance across diverse substrates, temperatures, and molding conditions, which challenges formulation stability. Complex mold geometries and high-speed manufacturing lines demand tailored solutions that often require premium raw materials. It increases production cost and limits standardization across industries. Supply chain volatility in specialty chemicals creates uncertainty for manufacturers that depend on high-purity inputs. Equipment upgrades in modern factories often require compatibility adjustments. The release agents market faces performance gaps when legacy processes and advanced production technologies coexist.

Market Opportunities:

Rising Demand for Sustainable, High-Efficiency, and Specialty Formulations

Industries increasingly seek water-based, biodegradable, and low-VOC release agents that align with corporate sustainability goals. Manufacturers accelerate R&D programs to introduce high-performance formulations for complex molds and high-temperature processes. It creates strong opportunities for suppliers that offer tailored, environmentally compliant solutions. Growth in clean-label and non-GMO trends in food processing supports demand for safer and transparent ingredients. Automotive lightweighting and composite adoption further expand the need for advanced agents. The release agents market gains momentum from innovation that improves efficiency and reduces operational waste.

Expansion of Automated Production Lines and Smart Manufacturing Systems

Industrial facilities integrate automated dispensing systems and digital monitoring tools, which opens new opportunities for precision-engineered release agents. It encourages development of products designed for consistent application and reduced material usage. High-throughput manufacturing in rubber, plastics, aerospace, and packaging industries strengthens demand for technologically compatible formulations. Suppliers that offer sensor-enabled or smart-coating solutions secure stronger positions in modern plants. Growth in emerging economies increases investment in upgraded manufacturing infrastructure. The release agents market benefits from production environments that require reliability, traceability, and tighter process control.

Market Segmentation Analysis:

By Product

The release agents market includes silicone-based, water-based, wax-based, and fatty acid–based agents that support a wide range of molding and processing needs. Silicone-based products lead due to strong heat resistance and reliable performance in rubber, plastics, and die-casting operations. Water-based variants gain traction in food processing and industrial environments that prioritize cleaner and safer formulations. It helps manufacturers improve process consistency while reducing residue on molds and equipment. Demand for wax-based agents remains stable in metalworking and composite applications that require uniform coating.

- For instance, Shin-Etsu Chemical’s silicone mold release agent KF-965 demonstrates excellent thermal oxidation stability even at temperatures above 250°C, making it particularly effective in high-temperature rubber and plastic molding applications with proven heat resistance capabilities.

By Raw Material

Raw material segmentation includes natural oils, silicone compounds, petroleum derivatives, emulsifiers, and specialty additives. The release agents market benefits from an increasing shift toward natural and plant-derived oils that meet sustainability goals in food and packaging sectors. Silicone compounds maintain strong adoption due to superior durability and chemical stability. Petroleum-based inputs face scrutiny in regions with strict VOC rules, yet they retain relevance in heavy industrial processes. It drives producers to diversify sourcing strategies and invest in high-purity and low-toxicity inputs.

- For instance, in 2024, Croda International Plc reported a 6% increase in sales of their New and Protected Products (NPP), which includes innovative sustainable ingredients, highlighting demand for specialized solutions in a transitional market year for the company.

By Application

Key applications span food processing, rubber molding, plastics, composite manufacturing, die-casting, pharmaceuticals, and concrete construction. The release agents market grows as food producers adopt safe, allergen-free, and clean-label formulations for bakery and confectionery lines. Rubber and plastics industries rely on high-performance agents that support high-speed molding operations and complex geometries. Composite and die-casting sectors require high-temperature solutions that enhance surface finish and extend mold life. It strengthens demand for tailored formulations that improve productivity across diverse manufacturing environments.

Segmentations:

By Product

- Silicone-Based Release Agents

- Water-Based Release Agents

- Wax-Based Release Agents

- Fatty Acid–Based Release Agents

- Specialty Non-Silicone Formulations

By Raw Material

- Natural Oils

- Silicone Compounds

- Petroleum Derivatives

- Emulsifiers

- Specialty Additives

By Application

- Food Processing

- Rubber Molding

- Plastics Molding

- Composite Manufacturing

- Die-Casting

- Pharmaceuticals

- Concrete and Construction

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Strong Market Presence Across North America Driven by Advanced Manufacturing Needs

North America holds a leading position due to its mature food processing, automotive, rubber, and plastics industries. Manufacturers in the region prioritize efficiency, clean production, and regulatory compliance, which strengthens demand for high-performance release agents. The release agents market benefits from rapid adoption of water-based and low-VOC formulations in the U.S. and Canada. Industrial automation and high-volume production lines create steady need for consistent mold release performance. It supports growth in sectors such as bakery, die-casting, and composite manufacturing. Strong investment in R&D and product innovation enhances the competitive landscape.

Sustainability-Focused Growth and Process Modernization Across Europe

Europe records significant demand due to strict environmental rules that encourage replacement of solvent-based agents with safer alternatives. Industries in Germany, France, Italy, and the UK adopt biodegradable and silicone-free products to align with sustainability priorities. The release agents market expands as food processors and industrial manufacturers upgrade equipment to meet evolving performance standards. High adoption of precision molding technologies in automotive and aerospace sectors supports advanced formulation use. It stimulates demand for tailored solutions that improve productivity and reduce residue buildup. Strong regulatory oversight drives continuous reformulation and innovation.

Rapid Industrial Expansion and High Production Capacity in Asia-Pacific

Asia-Pacific represents the fastest-growing regional market due to large-scale manufacturing ecosystems across China, India, Japan, and Southeast Asia. Expanding automotive, electronics, packaging, and food industries strengthen regional consumption of release agents. The release agents market grows as companies invest in high-capacity plants that require reliable mold release performance. Demand rises for both conventional and sustainable formulations due to diverse industrial requirements. It encourages suppliers to expand regional production and distribution networks. Rising industrial modernization and infrastructure growth create long-term opportunities for product penetration.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Dow Inc.

- BASF SE

- Henkel AG & Co. KGaA

- Chem Trend L.P.

- Wacker Chemie AG

- Evonik Industries AG

- Momentive Performance Materials Inc.

- Shin-Etsu Chemical Co., Ltd.

- Daikin Industries Ltd.

- ROCOL (ITW)

Competitive Analysis:

The release agents market features strong competition driven by product innovation, regulatory compliance needs, and expanding application diversity. Key players include Dow Inc., BASF SE, Henkel AG & Co. KGaA, Chem Trend L.P., Wacker Chemie AG, and Evonik Industries AG, each focused on broadening portfolios with high-performance and sustainable formulations. Companies invest in R&D to enhance heat resistance, consistency, and environmental safety across food processing, rubber, plastics, composites, and die-casting sectors. It supports differentiation in markets where efficiency and clean manufacturing standards hold high importance.

Competitive strategies emphasize global distribution, long-term partnerships with industrial manufacturers, and tailored solutions for complex molding requirements. Leading companies strengthen their presence through product customization, technical support, and integration with automated dispensing systems. Strong regional expansion strategies help capture demand in Asia-Pacific, where rapid industrial growth accelerates adoption. Continuous innovation and compliance-driven reformulation shape long-term competitive positioning.

Recent Developments:

- In October 2025, Henkel AG & Co. KGaA expanded its partnership with Dow Inc. to reduce carbon emissions in their adhesives portfolio.

- In September 2025, Evonik Industries AG entered a strategic partnership with Ethris to expand offerings for nucleic acid therapies using proprietary lipid nanoparticle technology.

Report Coverage:

The research report offers an in-depth analysis based on Product, Raw Material, Application and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Rising demand for sustainable, water-based, and low-VOC formulations will drive steady product innovation across industries.

- Growing adoption of automated molding and smart manufacturing systems will increase the need for precision-engineered release agents.

- Expansion of composite materials in automotive and aerospace sectors will strengthen demand for high-temperature and specialty formulations.

- Food processing companies will adopt more clean-label, non-GMO, and allergen-free agents to support safety and transparency goals.

- Stricter regulatory frameworks worldwide will push manufacturers to reformulate products with safer and compliant ingredients.

- Advancements in digital monitoring and controlled-dispensing technologies will improve efficiency in high-volume industrial environments.

- Producers will invest in regional production facilities to meet rising demand across Asia-Pacific and reduce supply chain risks.

- Growth in die-casting and metalworking sectors will support adoption of agents that enhance surface finish and reduce residue buildup.

- Partnerships between chemical manufacturers and OEMs will accelerate development of customized and industry-specific solutions.

- The release agents market will move toward multi-functional formulations that improve process stability, reduce waste, and support long-term operational savings.