| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polycarboxylate Ether (PCE) Market Size 2024 |

USD 8,420.83 million |

| Polycarboxylate Ether (PCE) Market, CAGR |

5.85% |

| Polycarboxylate Ether (PCE) Market Size 2032 |

USD 13,711.94 million |

Market Overview

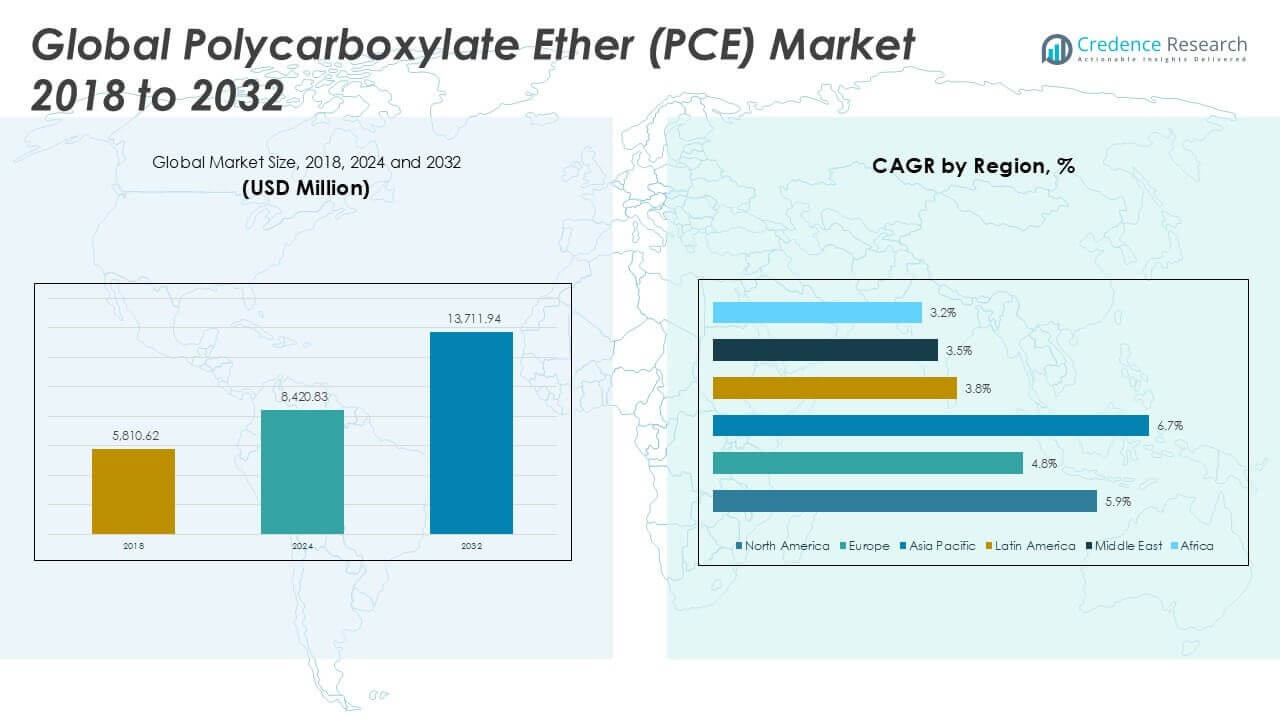

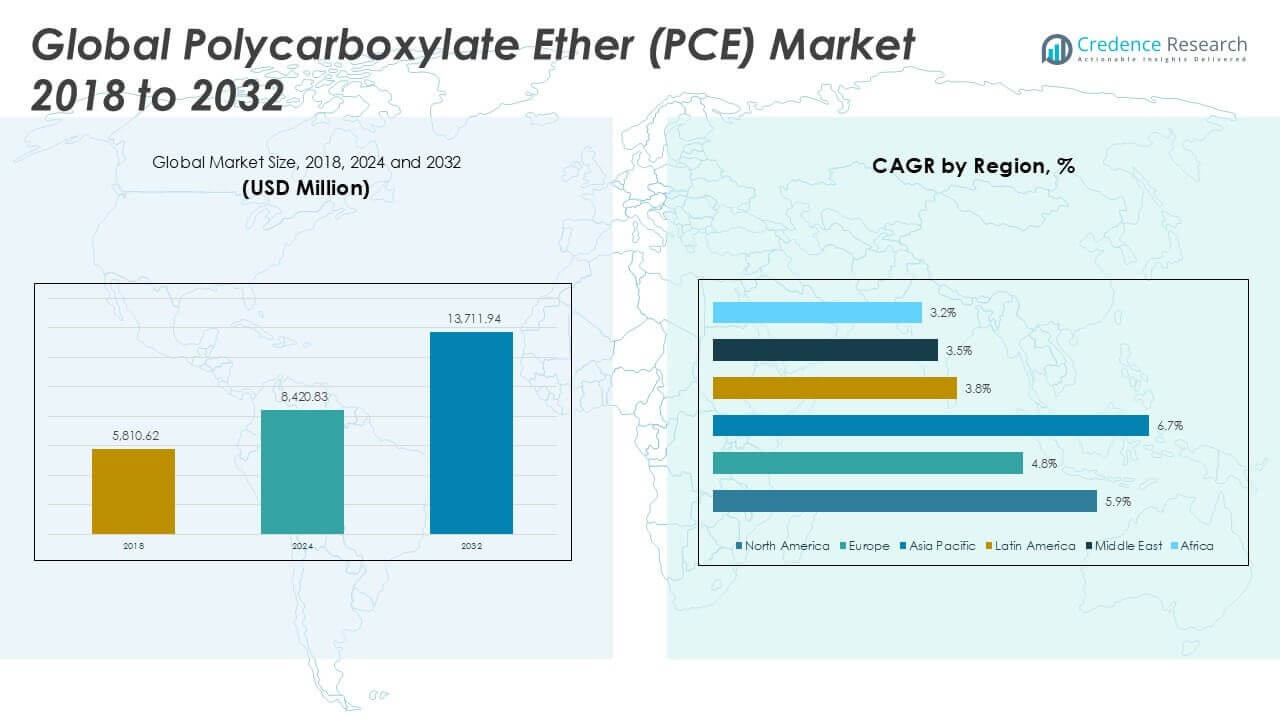

Polycarboxylate Ether (PCE) Market size was valued at USD 5,810.62 million in 2018 to USD 8,420.83 million in 2024 and is anticipated to reach USD 13,711.94 million by 2032, at a CAGR of 5.85% during the forecast period.

The Polycarboxylate Ether (PCE) market is driven by increasing demand for high-performance concrete in infrastructure and construction projects worldwide, as PCEs offer superior water reduction and improved workability compared to traditional admixtures. Rapid urbanization, government investments in smart cities, and the expansion of commercial and residential construction activities are accelerating market growth. Additionally, the adoption of sustainable building practices and the shift toward eco-friendly materials boost the need for advanced admixtures like PCE. Technological advancements in polymer chemistry have led to the development of next-generation PCE products with enhanced performance characteristics, further stimulating market adoption. Key market trends include growing usage of PCEs in precast concrete, rising focus on green building certifications, and the integration of automated batching systems in ready-mix concrete plants. These factors collectively position PCE as a critical component in modern construction, supporting both efficiency and environmental objectives.

The geographical analysis of the Polycarboxylate Ether (PCE) Market highlights strong growth across Asia Pacific, North America, and Europe, with Asia Pacific leading due to rapid urbanization and large-scale infrastructure projects in countries like China and India. North America and Europe continue to benefit from advanced construction technologies and increasing demand for sustainable building materials in key markets such as the United States, Canada, Germany, and the United Kingdom. Latin America, the Middle East, and Africa are witnessing steady adoption, driven by urban development and infrastructure investment in regions such as Brazil, the UAE, and South Africa. Among the leading players shaping the Polycarboxylate Ether (PCE) Market are BASF, Sika, and Dow, all of which focus on product innovation, global reach, and strategic collaborations to strengthen their presence and meet evolving industry requirements across diverse regional markets.

Market Insights

- The Polycarboxylate Ether (PCE) Market grew from USD 5,810.62 million in 2018 to USD 8,420.83 million in 2024 and is projected to reach USD 13,711.94 million by 2032, at a CAGR of 5.85%.

- Rising demand for high-performance concrete in construction and infrastructure is a primary growth driver, supported by rapid urbanization and government investments in smart city projects.

- Sustainability and environmental considerations drive market trends, with increasing adoption of eco-friendly admixtures and green building certifications influencing purchasing decisions.

- Product innovation and technological advancements, such as next-generation PCE formulations, help manufacturers meet diverse performance and compatibility requirements across global projects.

- The competitive landscape features major players like BASF, Sika, and Dow, which focus on expanding portfolios, strategic partnerships, and global reach to maintain a competitive edge.

- Raw material price volatility and technical compatibility issues with different cement types present significant restraints, impacting pricing strategies and broader market adoption.

- Asia Pacific leads regional growth due to extensive infrastructure investment in China, India, and Southeast Asia, while North America and Europe maintain robust demand driven by advanced construction practices and regulatory focus on sustainable materials

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Surging Demand for High-Performance Concrete in Infrastructure Projects

The construction industry’s pursuit of high-performance materials fuels growth in the Polycarboxylate Ether (PCE) Market. Major infrastructure projects, such as highways, bridges, and tunnels, require concrete with superior strength, durability, and workability. PCE admixtures enable manufacturers to produce concrete with lower water-cement ratios without sacrificing flow characteristics. The ability to enhance early and ultimate strength supports large-scale construction timelines and performance requirements. Urban expansion in emerging economies increases the scale and complexity of projects, elevating the need for advanced admixtures. Governments are prioritizing robust infrastructure to support economic growth, directly influencing the adoption of PCE.

- For instance, government investments in infrastructure development, including highways and bridges, are driving demand for high-performance concrete solutions.

Rising Adoption of Sustainable Construction Practices and Green Building Initiatives

A global shift toward sustainable construction has accelerated the use of eco-friendly materials in building projects. The Polycarboxylate Ether (PCE) Market benefits from this trend, as PCE-based admixtures help lower carbon emissions by enabling the production of high-strength concrete with reduced cement content. Construction firms seek materials that meet environmental standards and support green building certifications such as LEED and BREEAM. The market responds to evolving regulations and consumer expectations by introducing products with low VOC emissions and recyclable content. Developers and contractors prefer solutions that align with sustainability goals while maintaining performance. Growing awareness of environmental impact encourages adoption of advanced admixtures across the sector.

- For instance, the adoption of PCE admixtures aligns with green building certifications such as LEED and BREEAM, promoting sustainable construction practices.

Technological Advancements in Polymer Chemistry Driving Product Innovation

Continuous research and development in polymer chemistry have transformed the Polycarboxylate Ether (PCE) Market, enabling the launch of next-generation admixtures. New formulations improve workability retention, setting time, and compatibility with various cement types. Manufacturers invest in proprietary technologies to differentiate products and address specific customer requirements. Product innovations allow ready-mix concrete producers to optimize mix designs for challenging conditions and diverse applications. Enhanced performance characteristics contribute to cost savings and improved construction efficiency. Market players capitalize on R&D to maintain a competitive edge and expand application potential.

Expanding Urbanization and Commercial Construction Accelerating Market Growth

Rapid urbanization across Asia Pacific, the Middle East, and Latin America significantly boosts demand for advanced construction materials. The Polycarboxylate Ether (PCE) Market experiences strong uptake in commercial, residential, and industrial building projects. Developers seek admixtures that improve quality, speed up construction, and reduce costs. Urban infrastructure initiatives, such as smart cities and mass transit systems, drive bulk consumption of high-performance concrete. Construction companies recognize the value of reliable admixtures in meeting stringent specifications and tight project deadlines. It remains a preferred solution for future-focused construction, supporting both structural integrity and operational efficiency.

Market Trends

Shift Toward Eco-Friendly and Sustainable Construction Practices Drives PCE Adoption

The Polycarboxylate Ether (PCE) Market is witnessing a strong emphasis on sustainable building practices and eco-friendly materials in the construction sector. Green building standards and certifications, such as LEED and BREEAM, are now essential criteria for new projects in many regions. It enables concrete manufacturers to meet stringent environmental regulations by reducing the overall cement content and supporting lower carbon emissions. The market sees significant investments in research to develop low-VOC and recyclable PCE admixtures, aligning with the growing demand for sustainable construction. Companies are positioning themselves as leaders in environmental responsibility, leveraging PCE’s performance benefits to secure contracts for large infrastructure and urban development projects. Demand for sustainable solutions continues to expand across both developed and emerging economies, accelerating market penetration.

- For instance, India’s construction sector is increasingly shifting toward sustainable building materials, with PCE playing a vital role in the development of eco-friendly concrete solutions.

Rising Demand from Rapid Urbanization and Infrastructure Expansion

Polycarboxylate Ether (PCE) Market demand is rising due to rapid urbanization and large-scale infrastructure development worldwide. Major economies in Asia Pacific, the Middle East, and Latin America are investing heavily in roads, bridges, housing, and commercial buildings. It serves as a preferred admixture for these high-performance concrete applications, meeting stringent project requirements and sustainability goals. Construction companies value the ability to achieve improved durability, reduced water usage, and enhanced workability, all of which PCE provides. Growth in urban population and government focus on smart city initiatives further accelerate the need for advanced admixtures. The market continues to benefit from these macroeconomic drivers, positioning PCE as a critical solution in the evolving construction landscape.

- For instance, urban infrastructure initiatives, such as smart cities and mass transit systems, are driving bulk consumption of high-performance concrete.

Technological Advancements Fuel Innovation in PCE Product Development

Ongoing research in polymer chemistry is transforming the Polycarboxylate Ether (PCE) Market, resulting in more advanced and efficient admixtures. Companies are launching next-generation PCE products that deliver improved workability retention, better compatibility with various cement types, and enhanced early and ultimate strength. It enables ready-mix producers and contractors to optimize mix designs for complex construction environments. Proprietary technologies and custom formulations help address specific customer requirements, improving quality and performance on-site. Product differentiation remains a key focus as manufacturers compete to meet evolving needs in the construction industry. Rapid innovation continues to expand application potential, supporting growth across commercial, residential, and infrastructure projects.

Increased Integration of Automated Concrete Production Solutions

The Polycarboxylate Ether (PCE) Market is experiencing increased integration of automated batching systems and digital solutions in concrete production. Automation helps ensure precision and consistency in admixture dosing, supporting higher quality and reduced waste in large-scale construction. It supports the demand for ready-mix concrete in urban projects, where efficiency and accuracy are critical to success. Companies investing in smart plant technologies are able to deliver faster project timelines and improved product reliability. The trend toward digitalization is also driving adoption of cloud-based monitoring and quality control systems, strengthening the value proposition for PCE admixtures. Automated processes further reinforce market growth by delivering operational efficiencies and superior performance.

Market Challenges Analysis

Complex Product Formulation and Technical Compatibility Issues Hamper Broader Adoption

Polycarboxylate Ether (PCE) Market adoption sometimes encounters technical barriers related to product formulation and compatibility with diverse cement types. Variations in cement composition across regions and projects can impact the performance of PCE admixtures, requiring tailored formulations and extensive field trials. It places demands on manufacturers to invest in research and technical support, increasing operational complexity. Unresolved compatibility issues may result in suboptimal concrete performance or delayed project timelines, causing reluctance among contractors and engineers. The market must continuously address these technical hurdles to support widespread use, particularly in emerging economies where local cement quality and standards can vary significantly.

- For instance, unresolved compatibility issues between PCE admixtures and certain cement types have led to performance inconsistencies, requiring additional testing and adjustments.

Raw Material Price Volatility and Supply Chain Constraints Impact Market Stability

The Polycarboxylate Ether (PCE) Market faces persistent challenges due to fluctuations in raw material prices and disruptions across the global supply chain. Key ingredients such as acrylic acid and other chemical feedstocks often experience unpredictable price swings influenced by crude oil volatility and geopolitical factors. It can lead to increased production costs and shrinking profit margins for manufacturers, making pricing strategies difficult to maintain. Transport bottlenecks, port delays, and regional shortages further complicate timely delivery of finished products to end-users. Supply chain constraints affect inventory planning and may force construction firms to seek alternative admixtures. The market’s ability to maintain reliable supply and cost stability remains under continuous pressure from these external variables.

Market Opportunities

Growing Demand for Advanced Concrete in Infrastructure and Urban Development Projects

The Polycarboxylate Ether (PCE) Market offers significant opportunities through the increasing need for high-performance concrete in global infrastructure and urban development. Rapid urbanization and government investment in smart cities drive demand for durable, sustainable, and cost-effective construction materials. It enables concrete producers to achieve superior workability and strength while meeting environmental and regulatory standards. Emerging economies in Asia Pacific, the Middle East, and Africa continue to launch large-scale infrastructure initiatives, presenting new growth avenues for PCE suppliers. Construction firms recognize the value of admixtures that optimize mix designs and enhance project outcomes. The market stands to benefit from continued urban expansion and the ongoing shift toward green building practices.

Product Innovation and Customization Drive Market Differentiation

Polycarboxylate Ether (PCE) Market players have opportunities to differentiate through product innovation and tailored solutions. Advances in polymer chemistry allow manufacturers to create admixtures with improved compatibility, setting control, and performance in extreme conditions. It helps address the unique requirements of complex projects, such as precast concrete, underwater structures, and high-rise buildings. The ability to offer customized PCE formulations strengthens relationships with contractors and ready-mix producers, expanding the customer base. Companies investing in research and technical support can unlock new applications and address emerging challenges in the construction industry. The market’s focus on continuous improvement and technological advancement creates a path for sustained growth and leadership.

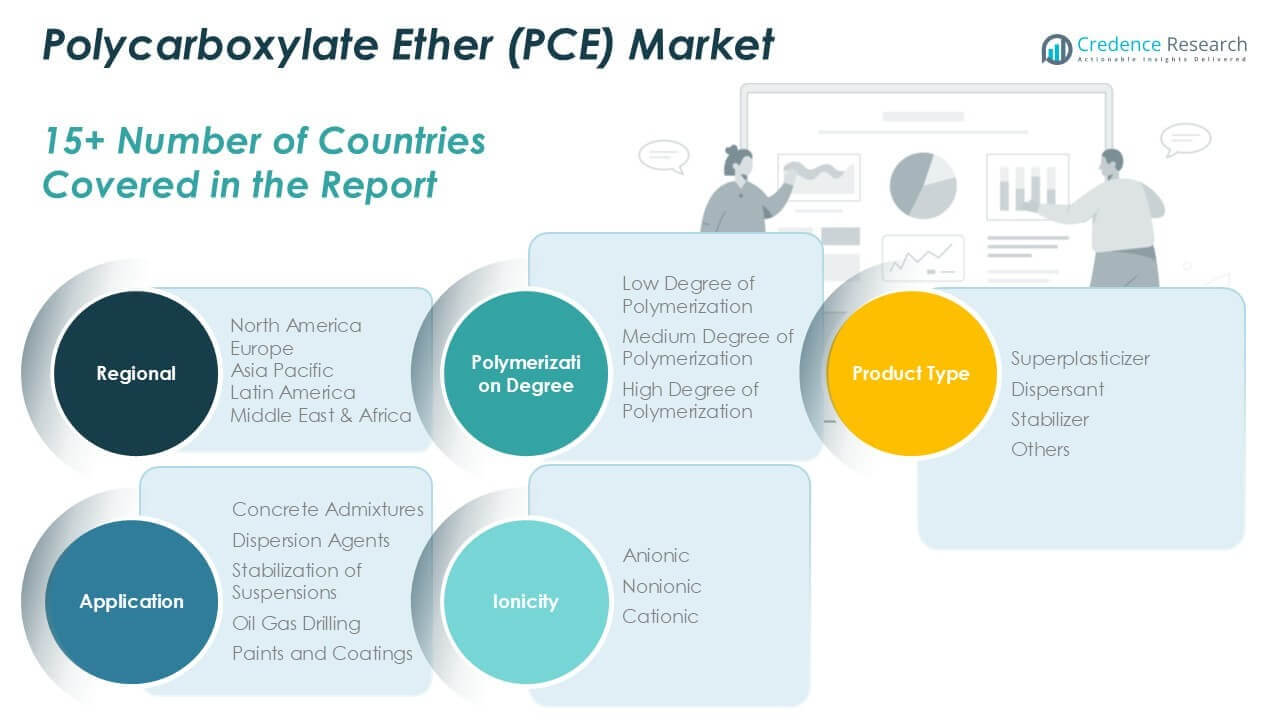

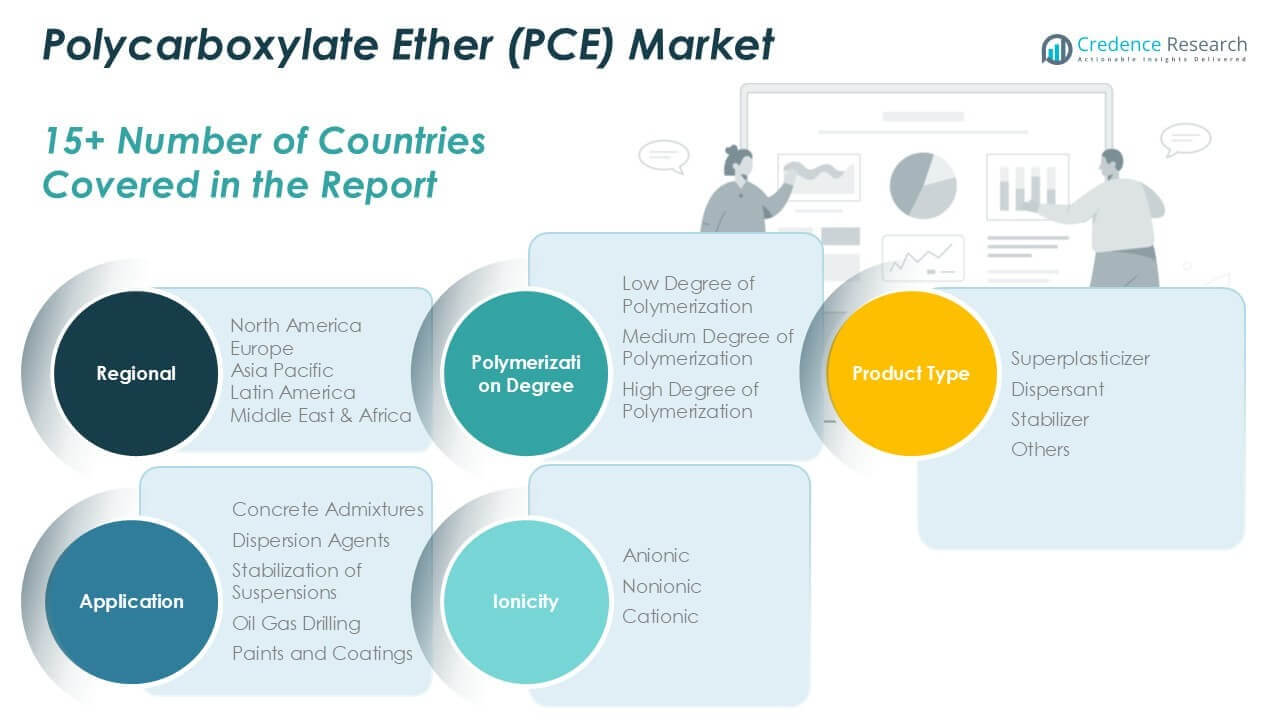

Market Segmentation Analysis:

By Polymerization Degree:

The market comprises low, medium, and high degrees of polymerization. Low degree PCEs are valued for their cost efficiency and suitability for standard concrete applications, while medium degree PCEs offer a balance between workability and performance, supporting a wide range of construction needs. High degree of polymerization PCEs provide superior water reduction and flow characteristics, meeting the stringent requirements of advanced infrastructure and high-performance concrete projects. The demand for high degree variants continues to rise as modern construction projects increasingly specify superior admixture capabilities.

By Product Type:

The Polycarboxylate Ether (PCE) Market is segmented into superplasticizer, dispersant, stabilizer, and others. Superplasticizers account for the largest share due to their essential role in improving concrete workability, enhancing strength, and facilitating reduced water usage. Dispersants serve niche functions in ensuring uniform particle distribution in concrete mixtures, supporting better performance and durability. Stabilizers find applications in specialized formulations, where maintaining mix integrity is critical during transportation and placement. The ‘others’ category includes products tailored for unique customer requirements, providing flexibility in project-specific solutions.

By Application:

Application-based segmentation reflects the versatile use of PCE across multiple industries. Concrete admixtures represent the dominant application, driven by the rising need for high-performance and sustainable construction materials. It enables builders to achieve targeted performance standards and environmental certifications. Dispersion agents and stabilization of suspensions are important for specialty concrete and industrial formulations, where precise control over mix properties is necessary. Oil and gas drilling utilizes PCE for its capacity to enhance drilling fluid performance and stability under challenging conditions. Paints and coatings employ PCE as an effective dispersant and stabilizer, supporting uniform pigment distribution and improved application results. The diverse segment landscape underscores the critical role of PCE in delivering high-quality, efficient, and sustainable solutions across the construction, industrial, and energy sectors.

Segments:

Based on Polymerization Degree:

- Low Degree of Polymerization

- Medium Degree of Polymerization

- High Degree of Polymerization

Based on Product Type:

- Superplasticizer

- Dispersant

- Stabilizer

- Others

Based on Application:

- Concrete Admixtures

- Dispersion Agents

- Stabilization of Suspensions

- Oil Gas Drilling

- Paints and Coatings

Based on Ionicity Segment:

- Anionic

- Nonionic

- Cationic

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Polycarboxylate Ether (PCE) Market grew from USD 1,790.37 million in 2018 to USD 2,556.45 million in 2024 and is projected to reach USD 4,179.20 million by 2032, reflecting a compound annual growth rate (CAGR) of 5.9%. North America is holding a 30% market share. The United States and Canada represent the primary markets, driven by advanced infrastructure development and sustained investment in smart city projects. It benefits from strong demand for high-performance concrete in both commercial and public infrastructure. Regulatory focus on green building standards further accelerates adoption. Major players in the region continue to innovate, introducing products tailored for demanding climatic and construction conditions.

Europe Polycarboxylate Ether (PCE) Market

Europe Polycarboxylate Ether (PCE) Market grew from USD 1,237.79 million in 2018 to USD 1,707.70 million in 2024 and is set to reach USD 2,561.31 million by 2032, with a CAGR of 4.8%. Europe captures a 19% market share. Key countries such as Germany, France, and the United Kingdom drive demand through large-scale public infrastructure and residential construction. The market leverages stringent environmental regulations and widespread adoption of green building certifications. It responds to government incentives for sustainable construction, with leading manufacturers introducing eco-friendly PCE variants. The focus remains on enhancing concrete durability and reducing environmental impact across major projects.

Asia Pacific Polycarboxylate Ether (PCE) Market

Asia Pacific Polycarboxylate Ether (PCE) Market grew from USD 2,309.80 million in 2018 to USD 3,483.27 million in 2024 and is forecasted to reach USD 6,050.92 million by 2032, growing at a CAGR of 6.7%. Asia Pacific commands a 44% market share, making it the largest regional market. China, India, and Japan are the principal growth engines, supported by rapid urbanization and massive infrastructure investments. It benefits from strong government focus on smart cities, mass transit, and large-scale housing. Local and multinational companies are scaling up production to meet rising demand, particularly in emerging economies. The market remains highly competitive with ongoing innovation to address diverse construction requirements.

Latin America Polycarboxylate Ether (PCE) Market

Latin America Polycarboxylate Ether (PCE) Market grew from USD 215.51 million in 2018 to USD 307.37 million in 2024 and is projected to reach USD 427.01 million by 2032, registering a CAGR of 3.8%. Latin America holds a 3% market share. Brazil and Mexico lead regional consumption, supported by public infrastructure modernization and private real estate development. The market benefits from increasing awareness of high-performance admixtures, although overall adoption rates remain moderate. It faces challenges from economic fluctuations, impacting long-term investment cycles. Companies are focusing on expanding distribution networks and promoting the technical advantages of PCE.

Middle East Polycarboxylate Ether (PCE) Market

Middle East Polycarboxylate Ether (PCE) Market grew from USD 154.72 million in 2018 to USD 203.96 million in 2024 and is anticipated to reach USD 277.27 million by 2032, posting a CAGR of 3.5%. The Middle East accounts for 2% market share. Key markets include Saudi Arabia, the United Arab Emirates, and Qatar, where ambitious infrastructure and urban development projects continue to drive demand. It supports the region’s focus on modernizing transport networks, commercial hubs, and residential areas. Market participants face unique climatic and logistical challenges, prompting the need for customized admixture solutions. Regional construction trends are shifting toward higher efficiency and sustainability standards.

Africa Polycarboxylate Ether (PCE) Market

Africa Polycarboxylate Ether (PCE) Market grew from USD 102.43 million in 2018 to USD 162.09 million in 2024 and is expected to reach USD 216.21 million by 2032, with a CAGR of 3.2%. Africa represents 2% market share. South Africa, Nigeria, and Egypt drive the majority of regional activity, backed by government investment in infrastructure and housing. It experiences rising demand for high-quality construction materials amid growing urbanization. Market penetration remains at an early stage, with local suppliers playing a key role in meeting regional needs. The outlook is positive, supported by efforts to upgrade transportation and utility infrastructure.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Evonik

- Dow

- Ashland

- Lubrizol

- 3M

- Arkema

- Sika

- Huntsman

- Clariant

- BASF

- Italmatch Chemicals

- Croda International

- Wacker Chemie

- Kemira

- Solvay

Competitive Analysis

The competitive landscape of the Polycarboxylate Ether (PCE) Market is shaped by the strategic positioning of leading companies including BASF, Sika, Dow, Arkema, Evonik, Ashland, Lubrizol, 3M, Huntsman, Clariant, Italmatch Chemicals, Croda International, Wacker Chemie, Kemira, and Solvay. These players focus on expanding their product portfolios, improving formulation technologies, and strengthening global supply chains to meet rising demand across construction, infrastructure, and industrial applications. It reflects a competitive environment where innovation, technical support, and sustainability are key differentiators. Companies invest in advanced polymer research to develop next-generation PCEs that offer enhanced workability, durability, and compatibility with various cement types. Strategic collaborations, acquisitions, and regional expansion remain central to gaining market share and increasing customer proximity. Larger firms benefit from established distribution networks, brand equity, and regulatory expertise, enabling them to serve large-scale projects with consistency and reliability. Mid-sized and regional manufacturers compete through price efficiency, localized service, and tailored product solutions. The market favors companies that deliver performance-driven, eco-friendly products aligned with evolving construction standards and environmental regulations. Competitive intensity is expected to grow as demand for sustainable admixtures continues to rise globally.

Recent Developments

- In May 2023, BASF SE, a Germany-based firm, launched a new range of sustainable construction chemicals, including advanced polycarboxylate ether-based superplasticizers that aligns with its commitment to environmental sustainability and aims to meet the increasing demand for eco-friendly building materials.

- In June 2023, Switzerland-based Sika AG expanded its production capacity for PCE superplasticizers by opening a new manufacturing facility in China to cater to the growing demand in Asia Pacific.

Market Concentration & Characteristics

The Polycarboxylate Ether (PCE) Market exhibits moderate to high market concentration, with a few dominant multinational players accounting for a significant share of global revenues. Key companies such as BASF, Sika, Dow, and Arkema maintain strong positions through extensive product portfolios, geographic reach, and investments in R&D. It features a mix of established brands and regional suppliers, with the latter serving local demand in cost-sensitive markets. The market is characterized by high entry barriers due to the need for advanced formulation expertise, regulatory compliance, and established distribution networks. Buyers prioritize performance consistency, technical support, and supply reliability, which gives larger players a competitive advantage. Product differentiation based on polymerization degree, application compatibility, and sustainability attributes shapes competition. Innovation and customization remain critical for expanding customer base and meeting evolving construction needs across diverse regions. The market continues to evolve with growing emphasis on green chemistry, efficient logistics, and end-user collaboration.

Report Coverage

The research report offers an in-depth analysis based on Polymerization Degree, Product Type, Application, Ionicity Segment and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is projected to grow steadily, driven by increasing demand for high-performance concrete in construction and infrastructure projects.

- Rapid urbanization and infrastructure development in emerging economies, particularly in Asia Pacific, will continue to fuel market expansion.

- Growing emphasis on sustainable construction practices will boost the adoption of eco-friendly PCE formulations.

- Technological advancements in polymer chemistry are expected to lead to the development of next-generation PCE products with enhanced performance characteristics.

- The market will benefit from increased investment in smart cities and large-scale infrastructure projects globally.

- Rising demand for precast concrete elements will drive the use of PCEs to improve workability and strength.

- Manufacturers will focus on expanding their product portfolios and strengthening global supply chains to meet diverse regional demands.

- Collaborations and strategic partnerships among key players will play a crucial role in market growth and innovation.

- Regulatory support for green building initiatives will encourage the use of PCEs in sustainable construction materials.

- Continuous research and development efforts will aim to improve the compatibility of PCEs with various cement types and construction conditions.