Market Overview:

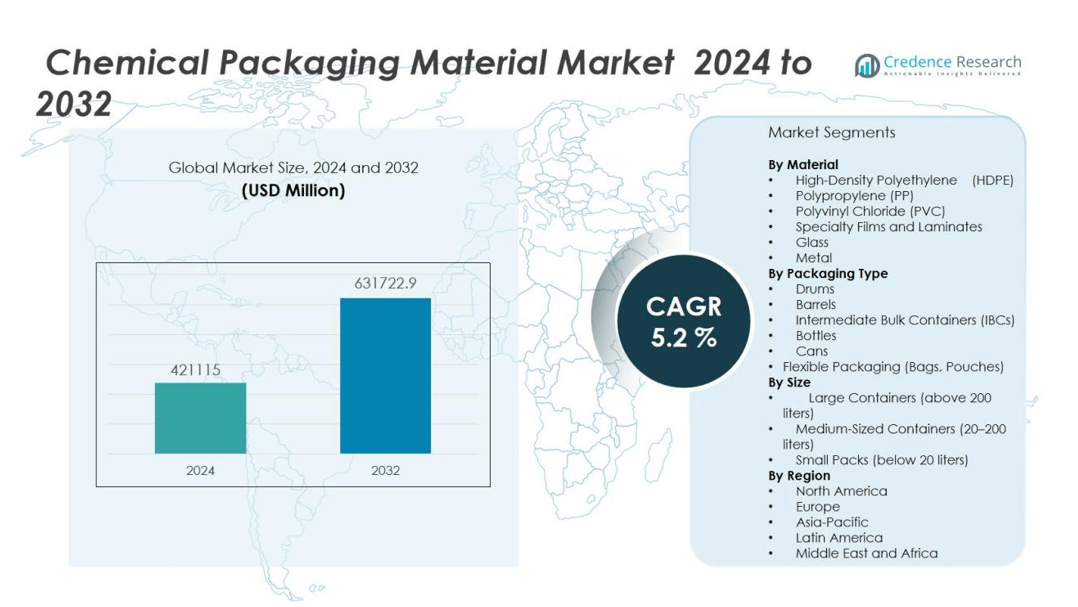

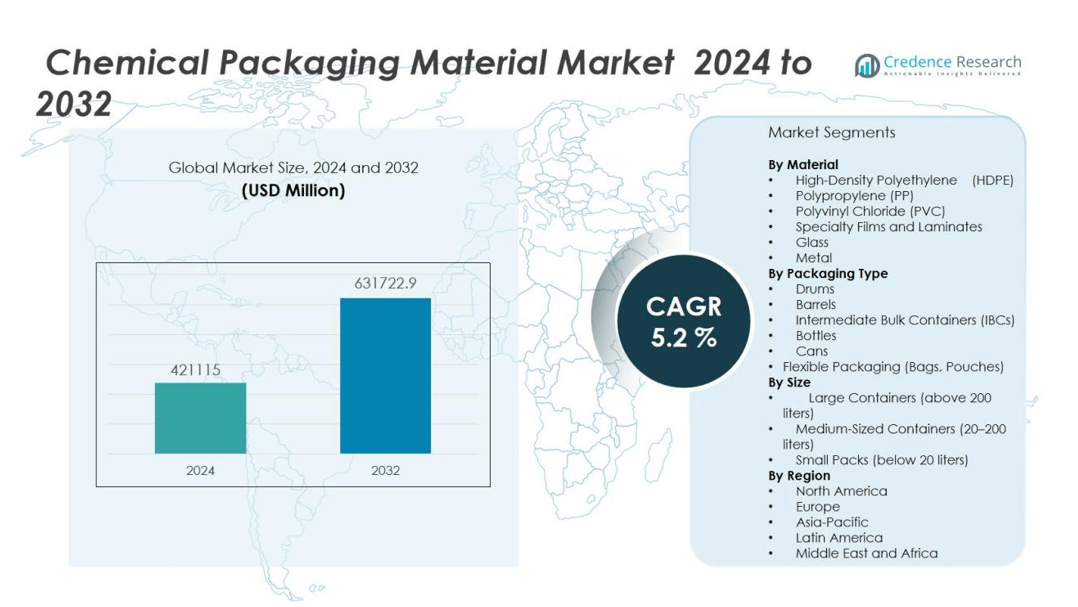

The chemical packaging material market size was valued at USD 421115 million in 2024 and is anticipated to reach USD 631722.9 million by 2032, at a CAGR of 5.2 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Chemical Packaging Material Market Size 2024 |

USD 421115 million |

| Chemical Packaging Material Market, CAGR |

5.2% |

| Chemical Packaging Material Market Size 2032 |

USD 631722.9 million |

The chemical packaging material market is driven by stringent regulatory requirements that emphasize safety, chemical compatibility, and environmental sustainability. Companies are adopting advanced packaging materials like high-density polyethylene (HDPE), polypropylene (PP), polyvinyl chloride (PVC), and barrier films to meet strict safety standards and prevent chemical reactions or contamination during storage and transport. Additionally, rapid industrialization, particularly in emerging economies, elevates demand for chemical products and packaging solutions that ensure product integrity, enhance shelf-life, and reduce environmental impact. Technological advancements in packaging design, such as flexible intermediate bulk containers (FIBCs), drums, and innovative closure systems, further contribute to market expansion by improving usability and convenience.

Regionally, Asia-Pacific dominates the chemical packaging material market, holding 41% market share, driven by rapid industrialization, robust chemical manufacturing, and expanding pharmaceutical and agrochemical sectors in China and India. North America follows, accounting for 28% of the market, supported by strong demand from industries such as petrochemicals, specialty chemicals, and pharmaceuticals, combined with stringent packaging safety regulations from agencies like the FDA and EPA. Key companies operating in North America include Amcor, Huhtamaki Oyj, Sonoco Products, Greif, TriWall Packaging, and DS Smurfit Kappa Group, all of which leverage advanced packaging technologies and regulatory compliance. Europe captures a 24% market share, propelled by well-established chemical industries and robust regulatory frameworks prioritizing sustainable and recyclable packaging solutions. Latin America and the Middle East & Africa exhibit steady growth potential, driven by investments in chemical manufacturing infrastructure and rising adoption of standardized packaging solutions.

Market Insights:

- The chemical packaging material market reached USD 421115 million in 2024 and is projected to hit USD 9 million by 2032.

- Stringent regulations on safety, compatibility, and sustainability drive the adoption of HDPE, PP, PVC, and advanced barrier films.

- Rapid industrialization and chemical production in Asia-Pacific, especially China and India, fuel significant market growth.

- Technological advancements such as FIBCs, tamper-evident closures, and RFID-enabled smart packaging improve performance and safety.

- Complex regulatory frameworks and frequent updates challenge manufacturers, delaying approvals and increasing operational costs.

- Volatile raw material prices for plastics and bio-based inputs impact profit margins and complicate cost management.

- Asia-Pacific holds 41%, North America 28%, and Europe 24% of the market, each region shaped by unique regulatory and industrial dynamics.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Increasing Demand for Safe and Compliant Chemical Packaging Solutions:

The chemical packaging material market is significantly driven by stringent regulatory standards emphasizing safety and compliance. Chemical substances pose various hazards, including corrosiveness, volatility, and toxicity, necessitating specialized packaging to protect human health and the environment. Regulatory bodies such as the Environmental Protection Agency (EPA) and the Food and Drug Administration (FDA) impose rigorous packaging requirements, compelling manufacturers to adopt advanced packaging materials. These materials include high-density polyethylene (HDPE), polypropylene (PP), and polyvinyl chloride (PVC), recognized for chemical compatibility and safety standards. Manufacturers continually focus on improving packaging integrity, leak prevention, and contamination resistance to meet evolving regulations. The demand for compliant and safe packaging solutions continues to propel growth in this market.

- For instance, Thermo Fisher Scientific manufactures Nalgene bottles made from HDPE that withstand service temperatures up to 120°C, providing long-term chemical compatibility and break resistance required for compliant chemical storage.

Rapid Expansion in the Global Chemical Industry Stimulating Packaging Demand:

Robust growth in the global chemical industry remains a primary factor fueling the chemical packaging material market. Industries such as pharmaceuticals, agrochemicals, construction chemicals, and specialty chemicals experience consistent expansion worldwide. Economic development, particularly in emerging regions, significantly boosts chemical production volumes and drives the need for effective packaging materials. Chemical manufacturers prioritize reliable packaging solutions that maintain product stability and integrity during storage and transportation. Demand for bulk chemical transportation solutions, including intermediate bulk containers (IBCs) and drums, grows substantially in line with chemical industry expansion. This ongoing industrial growth ensures continuous demand for durable and reliable chemical packaging materials.

Growing Emphasis on Sustainable and Environmentally Friendly Packaging Alternatives:

Rising global awareness about environmental sustainability significantly influences the chemical packaging material market. Consumers and regulatory authorities increasingly demand eco-friendly and recyclable packaging solutions to minimize environmental impact. Companies in the chemical industry respond by shifting toward sustainable materials such as recyclable plastics, bio-based polymers, and reusable containers. Investment in developing eco-friendly packaging solutions becomes a strategic imperative, aligned with corporate sustainability targets. Adoption of sustainable practices reduces waste generation and aligns chemical companies with environmental regulations and consumer expectations. The focus on sustainable packaging alternatives thus provides strong momentum for market growth.

- For instance, Eastman’s new molecular recycling facility can process 110,000 metric tons of polyester scrap annually, reducing greenhouse gas emissions by up to 50% compared to traditional processes.

Technological Innovations Enhancing Packaging Performance and Efficiency:

Technological advancements and innovations play a crucial role in driving growth within the chemical packaging material market. Development of advanced barrier films, tamper-evident closures, and enhanced sealing technologies significantly improves packaging performance and efficiency. Innovations in flexible intermediate bulk containers (FIBCs), drums, and specialized containers enhance usability, durability, and ease of handling. Automation and digitization in packaging processes further optimize efficiency, reduce human error, and ensure product safety. Companies increasingly adopt smart packaging technologies, such as RFID tags and sensors, to enhance traceability and monitor chemical stability during transit. Continued investment in these technological advancements creates substantial opportunities for growth and competitive differentiation within the market.

Market Trends:

Adoption of Smart and Intelligent Packaging Technologies Enhancing Supply Chain Efficiency:

The chemical packaging material market witnesses a growing adoption of smart and intelligent packaging technologies. Companies integrate technologies such as RFID tags, sensors, and QR codes into packaging to improve traceability and real-time monitoring of chemical products. Smart packaging solutions enable manufacturers and end-users to track chemical stability, detect leaks, and assess product integrity during transportation. Intelligent systems provide crucial data analytics, aiding stakeholders in proactive supply chain management and reducing potential risks. The emphasis on digitalized packaging solutions aligns with increasing demands for transparency, efficiency, and improved logistical performance in chemical handling. Investments in such innovations enhance operational reliability and customer satisfaction in chemical packaging processes.

- For instance, Goodwin Company implemented RFID tags in liquid chemical packaging, enabling real-time tracking and achieving a bottling line speed of 70 bottles per minute for RFID-tagged products.

Shift Toward Lightweight and Sustainable Packaging Materials Driven by Regulatory Compliance:

A significant trend shaping the chemical packaging material market is the shift toward lightweight and sustainable packaging materials. Regulatory pressures and consumer preferences increasingly favor eco-friendly, recyclable, and biodegradable alternatives. Companies transition from traditional heavy-duty packaging materials toward lighter, high-performance options like recyclable HDPE, bio-based plastics, and flexible packaging formats. Lightweight packaging reduces transportation costs, improves handling efficiency, and decreases overall environmental footprint. Stakeholders prioritize the development and adoption of materials with lower carbon emissions and higher recyclability to achieve sustainability objectives. The focus on sustainable packaging solutions remains pivotal for chemical companies aiming to maintain compliance, meet consumer expectations, and gain competitive advantage in global markets.

- For instance, Braskem produces bio-based plastics from sugarcane-based bio-ethanol, allowing for up to 3.09kg of CO₂ to be captured and stored in every kilogram of green polyethylene produced, directly contributing to reduced atmospheric greenhouse gas emissions.

Market Challenges Analysis:

Complex Regulatory Frameworks Hindering Rapid Adoption of New Packaging Solutions:

The chemical packaging material market faces significant challenges due to complex and evolving regulatory frameworks across regions. Varying international, national, and local standards complicate compliance and certification processes for packaging materials. Manufacturers encounter difficulty navigating these stringent guidelines, resulting in delayed product approvals and increased operational costs. Frequent updates in environmental and safety regulations further exacerbate compliance challenges. Chemical compatibility and safety testing requirements remain stringent, prolonging development cycles for innovative packaging solutions. Such regulatory complexity limits agility and impacts timely market entry of new and advanced packaging materials.

Volatility in Raw Material Prices Affecting Cost Management and Profit Margins:

Volatility in raw material prices represents another critical challenge for the chemical packaging material market. Fluctuating prices of essential inputs such as polyethylene, polypropylene, PVC, and bio-based materials affect manufacturers’ cost structures. Price instability complicates financial planning, procurement strategies, and overall profitability for packaging providers. Companies must manage pricing pressures carefully without compromising packaging quality or regulatory compliance. Sustained raw material price volatility often leads to increased operational expenses, making long-term planning challenging. This instability poses a persistent threat to the profitability and competitiveness of market participants.

Market Opportunities:

Growing Demand for Eco-Friendly Packaging Creating Lucrative Market Potential:

The increasing preference for sustainable packaging solutions presents significant opportunities within the chemical packaging material market. Manufacturers capitalize on rising consumer awareness regarding environmental impacts by adopting eco-friendly materials such as recyclable plastics, biodegradable polymers, and reusable containers. Sustainable packaging aligns with corporate social responsibility goals and regulatory compliance, providing a competitive advantage for forward-thinking companies. Innovations in eco-compatible packaging materials allow businesses to meet evolving consumer expectations and expand into environmentally conscious markets. Investments in research and development for green packaging alternatives position companies to lead industry trends and capture new revenue streams. The shift toward sustainability continues to unlock substantial growth opportunities for packaging providers.

Technological Advancements Driving Adoption of Advanced and Intelligent Packaging:

Technological innovations offer considerable growth potential for the chemical packaging material market. Smart and intelligent packaging systems featuring RFID tags, advanced sensors, and digital tracking technologies enhance supply chain transparency, safety, and efficiency. Companies benefit from improved inventory management, reduced product waste, and enhanced traceability throughout chemical transportation processes. Integration of automation and digital monitoring tools significantly optimizes packaging operations, delivering higher productivity and lower operational costs. Adoption of advanced barrier materials and enhanced sealing technologies improves product protection and shelf-life, meeting stringent safety standards. Continued innovation in packaging technologies allows businesses to differentiate offerings and expand market presence effectively.

Market Segmentation Analysis:

By Material:

The chemical packaging material market features a diverse range of materials designed to ensure safety, chemical compatibility, and durability. High-density polyethylene (HDPE) dominates due to its robust chemical resistance, versatility, and cost-effectiveness. Polypropylene (PP) holds significant market share for its lightweight properties and performance in aggressive environments. Polyvinyl chloride (PVC) remains preferred for certain corrosive chemicals, while specialty barrier films address high-value applications demanding superior protection. Glass and metal containers serve niche segments, particularly for highly reactive or sensitive chemicals, ensuring product integrity during transport and storage.

- For instance, BASF’s new HDPE plant at its Zhanjiang Verbund site in China is slated to commence production with an annual capacity of 500,000 metric tons, marking a significant expansion in HDPE packaging applications by the end of 2025.

By Packaging Type:

Drums and barrels lead in the chemical packaging material market, widely used for bulk storage and transportation of liquids and powders. Intermediate bulk containers (IBCs) continue to gain traction across industrial supply chains due to their efficient space utilization and ease of handling. Bottles and cans serve smaller quantity needs, favored in laboratories and specialty chemical distribution. Flexible packaging formats, including bags and pouches, support granular or powder chemicals, offering lightweight, resealable solutions for multiple end users.

By Size:

Large containers above 200 liters dominate bulk transportation and industrial use, supporting high-volume movements across global supply chains. Medium-sized packaging, ranging from 20 to 200 liters, addresses needs in medium-scale manufacturing, agricultural, and specialty applications. Small packs below 20 liters meet laboratory, research, and retail requirements, emphasizing portability and precision in dosing. The segmentation by size ensures tailored packaging solutions for diverse industry needs and operational scales.

- For instance, Tosca’s intermediate bulk containers are widely used in logistics and offer capacities up to 1,000 liters, enabling safe and efficient transport of both liquid and dry materials for companies in the automotive and food sectors.

Segmentations:

By Material:

- High-Density Polyethylene (HDPE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Specialty Films and Laminates

- Glass

- Metal

By Packaging Type:

- Drums

- Barrels

- Intermediate Bulk Containers (IBCs)

- Bottles

- Cans

- Flexible Packaging (Bags, Pouches)

By Size:

- Large Containers (above 200 liters)

- Medium-Sized Containers (20–200 liters)

- Small Packs (below 20 liters)

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia-Pacific:

Asia-Pacific dominates the chemical packaging material market with 41% market share, driven primarily by rapid industrialization and robust chemical manufacturing activities. China and India remain key contributors, supported by substantial growth in pharmaceuticals, agrochemicals, and industrial chemical sectors. Expansion of production facilities boosts demand for bulk containers, drums, and flexible intermediate bulk containers (FIBCs). Rising urbanization in these economies creates significant demand for construction chemicals, further fueling packaging material consumption. Increasing regulatory focus on safe chemical transportation drives the adoption of advanced packaging solutions. The region’s dynamic manufacturing landscape and growing consumer markets position Asia-Pacific to maintain dominance and drive continuous market expansion.

North America :

North America holds 28% market share in the chemical packaging material market, sustained by stringent packaging safety regulations and technological advancements. Prominent sectors including petrochemicals, pharmaceuticals, and specialty chemicals drive steady demand for high-performance packaging solutions. Compliance with rigorous standards imposed by regulatory bodies such as the FDA and EPA propels the adoption of advanced packaging technologies. Manufacturers increasingly deploy sustainable, recyclable packaging materials to align with environmental mandates. Technological innovations such as intelligent tracking systems, advanced sealing techniques, and smart packaging enhance efficiency and product safety. Continuous investment in research and development further supports market growth and positions the region for sustained demand.

Europe :

Europe accounts for 24% market share in the chemical packaging material market, driven by strict environmental regulations and sustainability initiatives. The region prioritizes recyclable and eco-friendly packaging materials to minimize environmental impact and meet stringent EU guidelines. Chemical manufacturers increasingly adopt bio-based plastics, recyclable HDPE, and reusable containers to align with circular economy principles. Europe’s robust regulatory frameworks ensure continuous improvement in packaging standards and materials. High demand from established chemical and pharmaceutical sectors supports consistent market growth in the region. Strong emphasis on innovation and sustainability provides European companies significant opportunities to enhance competitive positioning and long-term profitability.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Amcor

- Huhtamaki Oyj

- Sonoco Products

- Greif

- TriWall Packaging

- DS Smurfit Kappa Group

- International Paper

- Crown Holdings

- WestRock

- Bemis Company

Competitive Analysis:

The chemical packaging material market demonstrates intense competition among global and regional players. Leading companies such as Amcor, Huhtamaki Oyj, Sonoco Products, Greif, TriWall Packaging, and DS Smurfit Kappa Group maintain strong market positions by offering diverse product portfolios and investing in innovation. It features dynamic competition based on product quality, regulatory compliance, and the ability to deliver sustainable solutions tailored to end-user needs. Major players continually enhance packaging safety, functionality, and environmental performance to address evolving industry requirements. Strategic partnerships, acquisitions, and geographic expansion remain key strategies for market leadership. Smaller regional manufacturers focus on cost-effectiveness and local customization to secure niche segments within the chemical packaging material market.

Recent Developments:

- In July 2025, Amcor unveiled the Hector Child Resistant Closure (CRC) on July 22, 2025, a lightweight, recyclable closure for bleach and toilet cleaners, emphasizing both design appeal and sustainability.

- In April 2025, Huhtamaki announced on April 24, 2025, its acquisition of Zellwin Farms Company, a molded fiber packaging specialist based in Florida, to boost capacity and serve egg producers in the US.

- In June 2025, Sonoco Products launched a new Paper Can with a 100% paper bottom, made mainly from post-consumer recycled fiber, in North America in June 2025, advancing their sustainability focus

Market Concentration & Characteristics:

The chemical packaging material market demonstrates intense competition among global and regional players. Leading companies such as Amcor, Huhtamaki Oyj, Sonoco Products, Greif, TriWall Packaging, and DS Smurfit Kappa Group maintain strong market positions by offering diverse product portfolios and investing in innovation. It features dynamic competition based on product quality, regulatory compliance, and the ability to deliver sustainable solutions tailored to end-user needs. Major players continually enhance packaging safety, functionality, and environmental performance to address evolving industry requirements. Strategic partnerships, acquisitions, and geographic expansion remain key strategies for market leadership. Smaller regional manufacturers focus on cost-effectiveness and local customization to secure niche segments within the chemical packaging material market

Report Coverage:

The research report offers an in-depth analysis based on Material, Packaging Type, Size and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Adoption of sustainable materials will accelerate, with bio‑based polymers and recyclable plastics gaining prominence.

- Companies will integrate advanced sensing and tracking technologies, such as RFID and data loggers, to enhance supply chain transparency.

- Manufacturers will focus on lightweight packaging solutions that reduce transportation costs and promote eco‑efficiency.

- High-performance barrier films and seals will gain traction to protect sensitive chemical products and extend durability.

- Demand for flexible intermediate bulk containers (FIBCs) and modular packaging formats will rise across industrial sectors.

- Industry collaboration will boost, with partnerships emerging across raw material suppliers, packaging firms, and logistics providers.

- Regulatory updates will drive innovation in packaging design, safety features, and recyclability standards.

- Digital platforms will support smart inventory management, enabling predictive maintenance and chemical traceability.

- Investment in research and development will strengthen, leading to novel materials and functional packaging systems.

- Emerging markets will expand demand, with manufacturers targeting infrastructure and chemical industry growth in Asia‑Pacific and Latin America.