Market Overview:

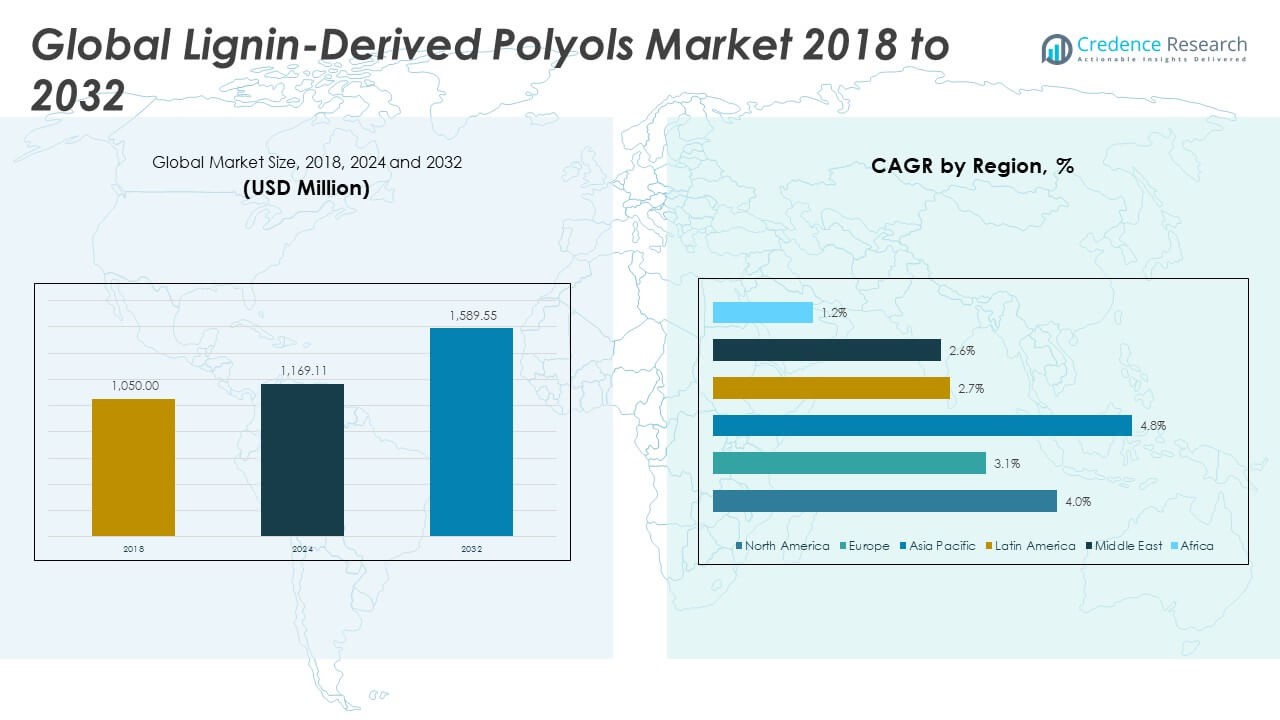

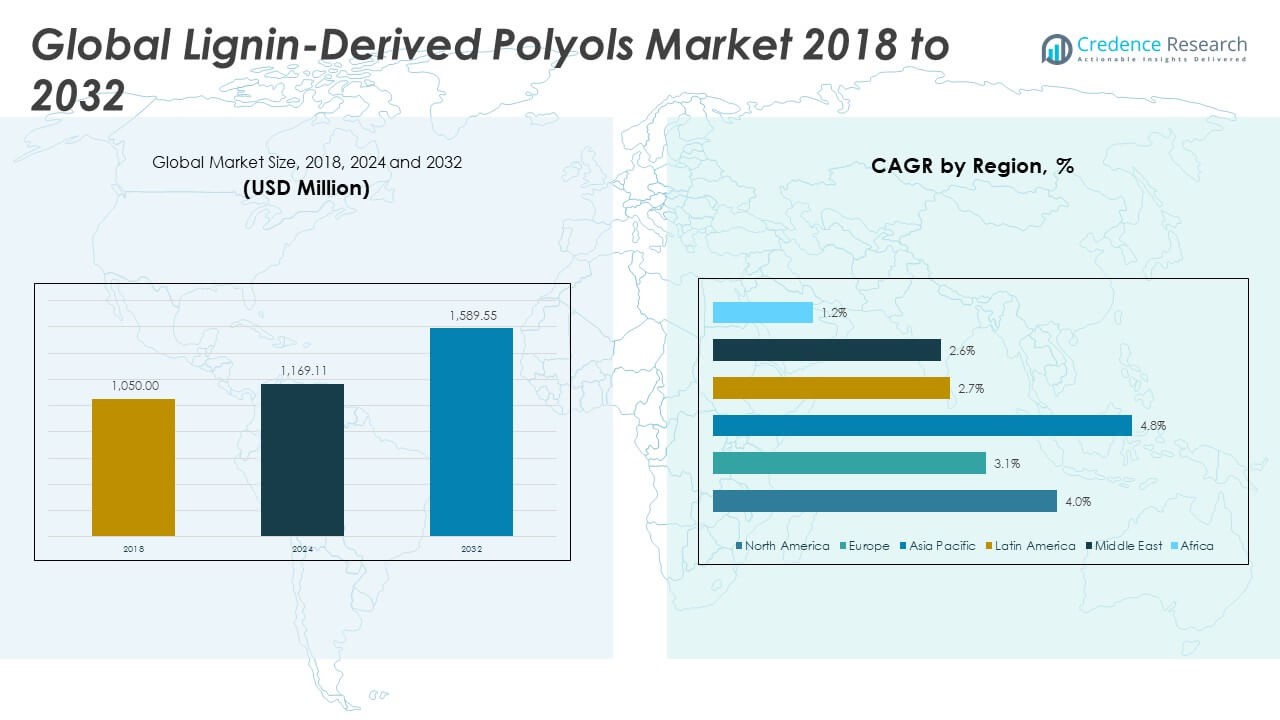

The Lignin‑Derived Polyols Market size was valued at USD 1,050.00 million in 2018 to USD 1,169.11 million in 2024 and is anticipated to reach USD 1,589.55 million by 2032, at a CAGR of 3.96% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Lignin‑Derived Polyols Market Size 2024 |

USD 1,169.11 Million |

| Lignin‑Derived Polyols Market, CAGR |

3.96% |

| Lignin‑Derived Polyols Market Size 2032 |

USD 1,589.55 Million |

Growth in the Lignin‑Derived Polyols Market is driven by the rising demand for bio-based and sustainable alternatives to petroleum-derived polyols in applications such as polyurethane foams, adhesives, and coatings. Increasing regulatory pressure to reduce carbon footprints, combined with advancements in lignin valorization technologies, has led manufacturers to explore high-performance renewable feedstocks. Lignin’s abundant availability as a by-product in pulp and paper industries supports cost-effective sourcing, while innovations in depolymerization processes are enhancing product yield, performance, and commercial viability, fueling broader industry adoption.

Geographically, Europe leads the Lignin‑Derived Polyols Market, supported by stringent environmental regulations, active R&D investment, and early adoption of green chemistry practices. North America follows, driven by the growing emphasis on renewable materials across automotive and construction sectors. The Asia Pacific region is emerging rapidly due to expanding manufacturing capabilities and rising environmental awareness in countries such as China and India. Strong governmental support for biobased materials and an expanding bioeconomy in these regions are positioning them as key future growth markets for lignin-derived polyols.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Lignin‑Derived Polyols Market was valued at USD 1,169.11 million in 2024 and is expected to reach USD 1,589.55 million by 2032, growing at a CAGR of 3.96%.

- Growing demand for sustainable polyurethanes in construction, automotive, and furniture industries is driving market expansion.

- Technological advancements in lignin depolymerization processes are improving polyol performance and enabling industrial adoption.

- High production costs and variability in lignin feedstock quality remain key barriers to large-scale commercialization.

- Europe leads adoption due to strong environmental regulations and active innovation in bio-based chemicals.

- Asia Pacific is the fastest-growing region, supported by industrial expansion and favorable government policies.

- North America maintains steady growth, backed by investments in green technologies and bio-refinery infrastructure.

Market Drivers:

Growing Shift Toward Sustainable and Renewable Raw Materials in Polyurethane Applications

The rising global demand for sustainable materials is driving the adoption of lignin-derived polyols as alternatives to petrochemical-based polyols in foam, adhesive, and coating industries. Regulatory bodies are enforcing stricter carbon emission norms, prompting manufacturers to explore renewable resources. The Lignin‑Derived Polyols Market benefits from lignin’s abundant availability as a by-product of the pulp and paper industry, ensuring a cost-effective and scalable feedstock. This shift is aligned with global sustainability goals, making lignin-based solutions more attractive to stakeholders. Government policies supporting green chemistry further encourage market adoption. Increased awareness among end-users regarding environmental footprints is transforming procurement strategies. Large-scale polyol consumers, especially in construction and automotive, are adopting bio-based substitutes.

- For example, UPM, a Finnish forest industry company, operates a biorefinery in Leuna, Germany, with a total annual production capacity of 220,000 tonnes. The facility produces multiple wood-derived products, including Bio‑MEG, Bio‑MPG, industrial sugars, and notably lignin-based Renewable Functional Fillers (RFF). These lignin-derived fillers are being developed to replace carbon black and silica in applications such as rubber, plastics, adhesives, coatings, and polyurethane formulations.

Advancements in Depolymerization and Lignin Conversion Technologies

Technological innovations in lignin depolymerization and conversion processes are enhancing the quality, reactivity, and compatibility of lignin-derived polyols. These advancements have enabled consistent production of functional polyols with performance metrics matching or surpassing their petroleum-based counterparts. The Lignin‑Derived Polyols Market is experiencing increased interest from research institutions and chemical firms investing in scalable and selective lignin valorization methods. Improved catalysts, solvent systems, and biorefinery configurations are lowering production costs. These developments expand the range of polyols suitable for rigid and flexible polyurethane applications. Industrial adoption is gaining traction due to enhanced material consistency and processing behavior. Equipment retrofitting needs are also reducing due to compatibility improvements.

Rising Demand in Automotive and Construction Sectors for Low-Emission Materials

The automotive and construction industries are actively sourcing low-emission and lightweight materials, increasing demand for bio-based polyols. The Lignin‑Derived Polyols Market is gaining traction from these sectors due to the insulation and structural capabilities of polyurethane foams. Automakers are under pressure to enhance fuel efficiency and meet environmental regulations, which polyols support through weight reduction and greener material use. Construction firms are integrating sustainable materials in insulation and paneling to meet green building certifications. The recyclability and biodegradability advantages of lignin-based polyols support circular economy goals. Lignin-derived inputs also offer performance durability in demanding applications. This market shift supports product differentiation and green branding.

Government Support and Investment in Bioeconomy and Biochemicals

National governments and international organizations are investing in biorefineries and circular bioeconomy frameworks that promote lignin utilization. The Lignin‑Derived Polyols Market is benefiting from research grants, tax incentives, and policy mechanisms encouraging renewable feedstocks. Public-private partnerships are facilitating pilot and demo-scale projects, reducing commercialization risk. Government procurement strategies increasingly include bio-based materials in infrastructure and public housing. Export-oriented economies are also positioning lignin-based chemicals as value-added products. Supportive frameworks are accelerating commercialization timelines and investor confidence. Funding initiatives have led to collaborative R&D hubs focused on lignin functionalization. Public awareness campaigns for sustainable packaging and materials are amplifying downstream adoption.

- For example, A DOE-funded consortium led by Clemson University (supported by Michigan State and Montana State Universities, ORNL, and NIST) successfully used the ALPHA fractionation protocol to convert hybrid poplar lignin into rigid PU/PIR foam, achieving up to 80% polyol substitution from lignin; the resulting foams met relevant ASTM performance criteria. The purified A‑HP lignin contained <0.5% ash and had a PDI below 5.0. By the mid-2020 Go/No-Go review, the team had met DOE’s target of >60% carbon conversion of lignin into on-spec bioproducts including foam, activated carbon, and carbon fiber.

Market Trends

Growing Integration of Lignin-Derived Polyols into Advanced Polyurethane Systems

Companies are integrating lignin-derived polyols into high-performance polyurethane systems used in specialized applications. These include rigid insulation foams, automotive seat cushions, and appliance interiors. The Lignin‑Derived Polyols Market is evolving to support both open-cell and closed-cell foam systems, expanding product applicability. Material scientists are refining formulations to maintain structural integrity and thermal resistance. Bio-based content labeling is influencing consumer preferences, strengthening brand positioning. Performance parity with fossil-based polyols has led to pilot-scale launches across several industrial applications. Large chemical firms are patenting tailored lignin-polyol blends for niche markets. It is enhancing its role in premium product segments. This trend is transforming biopolyols into mainstream alternatives.

Emergence of Decentralized Biorefineries for On-Site Lignin Valorization

Decentralized biorefineries are being established near pulp and paper plants to convert lignin waste into polyols and related chemicals on-site. The Lignin‑Derived Polyols Market is witnessing modular refinery designs that reduce logistics and raw material costs. These setups enable flexible processing tailored to lignin variability across feedstocks. Small and mid-sized chemical firms are leveraging this infrastructure to scale specialty polyol production. Distributed manufacturing reduces bottlenecks and enables regional customization. The proximity to lignin sources ensures higher throughput efficiency. New entrants are entering the market by licensing such modular systems. It increases regional supply chain resilience. The shift toward localization aligns with ESG reporting priorities.

- For instance,Stora Enso’s Sunila biorefinery in Finland is recognized as the world’s first commercial-scale facility to produce 50,000 tonnes annually of kraft lignin. Stora Enso has also established a partnership with Hexion to co-develop lignin-based resins and bio-based polyols for advanced materials applications, demonstrating the industrial adoption of on-site lignin valorization strategies near lignin sources.

Collaborations Between Research Institutions and Industry for Product Innovation

Research collaborations between universities and industry players are accelerating innovation in lignin-derived polyol chemistry. The Lignin‑Derived Polyols Market benefits from cross-sector partnerships focusing on functional performance and commercial scalability. Academic breakthroughs are moving from lab to pilot stage through industrial funding and co-development. Innovations in ring-opening reactions and functional group optimization are yielding application-specific polyols. Collaborative IP development is enabling early mover advantages for partnering companies. Technical seminars and innovation hubs are fostering knowledge exchange. Companies are aligning with institutions to shape the next generation of renewable polymers. It fosters long-term product pipelines and market adaptability. These alliances reduce development lead time and risk.

- For instance, researchers at Purdue University have developed lignin-based polyols with hydroxyl values in the range of 250–340 mgKOH/g, enabling the formulation of polyurethane foams with improved mechanical properties compared to traditional counterparts.

Increasing Focus on Carbon Footprint Reduction in Supply Chain Metrics

Corporates are prioritizing Scope 3 emission reduction and incorporating bio-based inputs like lignin polyols into their sustainability matrices. The Lignin‑Derived Polyols Market is seeing increased procurement inquiries driven by emissions tracking and lifecycle analysis requirements. Companies are mapping material carbon intensity and using renewable polyols to meet net-zero targets. This shift is also influencing supplier selection criteria and vendor certifications. Procurement departments are evaluating feedstock traceability and renewable content verification. Demand is shifting toward cradle-to-gate impact transparency. Regulatory disclosures such as CSRD and SEC climate rules are intensifying focus on upstream emissions. It aligns the polyol market with climate-focused investment criteria. The trend ensures long-term demand consistency.

Market Challenges Analysis

Feedstock Inconsistency and Process Complexity Hinder Large-Scale Commercialization

Variability in lignin feedstock composition, depending on wood type and pulping method, poses challenges to polyol production consistency. The Lignin‑Derived Polyols Market faces difficulty in standardizing polyol outputs across different sources, affecting product performance. Processing techniques require careful tuning to maintain quality, which adds operational complexity. Limited availability of high-purity lignin grades further constrains scalability. Handling and preprocessing lignin often require customized infrastructure, increasing capital expenditure. The conversion efficiency remains lower than petroleum-based systems, affecting cost competitiveness. Technical barriers in depolymerization and functionalization add to production overheads. Process reproducibility issues slow technology adoption. These challenges create hesitation among large industrial buyers.

Limited Commercial Supply Chain and Low Market Awareness Slow Adoption

The commercial supply chain for lignin-derived polyols remains fragmented and geographically concentrated. The Lignin‑Derived Polyols Market lacks large-scale distribution networks capable of meeting global industrial demand. End-users are unfamiliar with material specifications, processing behaviors, and performance validation. Marketing channels for bio-based polyols remain underdeveloped compared to traditional petrochemical counterparts. Limited real-world application data affects customer confidence and slows qualification cycles. Equipment suppliers and formulators may require reconfiguration to integrate lignin polyols. Training and education gaps exist among stakeholders in downstream industries. This low awareness hinders procurement decisions and commercial pilot testing. Building trust across the value chain remains a key hurdle.

Market Opportunities

Expanding Role of Bio-Based Polyols in High-Growth End-Use Sectors

Emerging applications in automotive interiors, insulation foams, and green building materials present strong opportunities for lignin-derived polyols. The Lignin‑Derived Polyols Market can benefit from growing demand in these sectors seeking to reduce environmental impact. Product developers are exploring customized polyol blends to meet industry-specific performance criteria. Commercial interest is rising in thermoset and thermoplastic blends incorporating lignin. End-users are prioritizing supply resilience and local feedstock availability. Product expansion into coatings and adhesives opens new volume channels. Diversification enhances revenue streams and reduces dependence on traditional polyurethane segments. Growth in these markets supports sustainable product differentiation.

Policy Alignment and Green Investment Fuel New Business Models

Government incentives, sustainability-linked loans, and ESG investments are creating favorable conditions for bio-based polyol expansion. The Lignin‑Derived Polyols Market is well-positioned to attract capital through green financing frameworks. Regional development agencies and cleantech investors are targeting scalable bio-chemical platforms. Startups and SMEs are leveraging this momentum to pilot lignin valorization technologies. These conditions promote risk-sharing and co-investment models. Industry players can align with policy frameworks for early compliance and recognition. The rise of public procurement for sustainable materials boosts institutional demand. Such drivers foster ecosystem growth and market accessibility.

Market Segmentation Analysis:

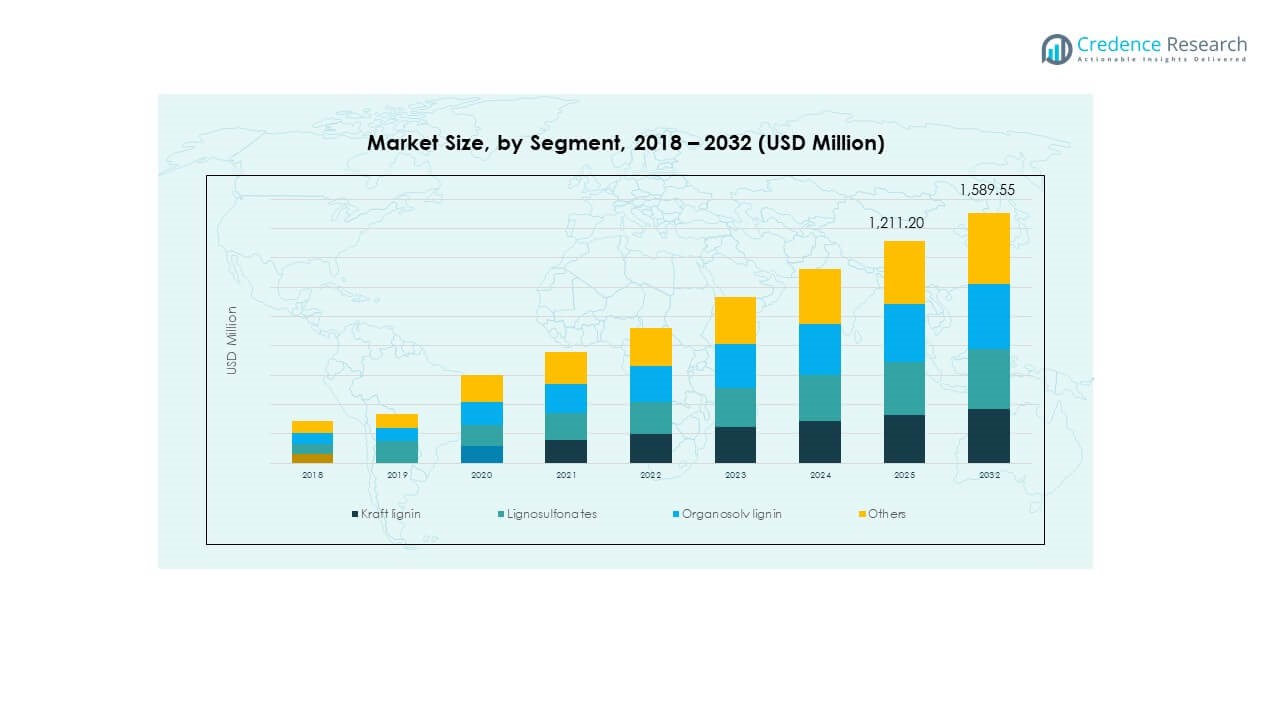

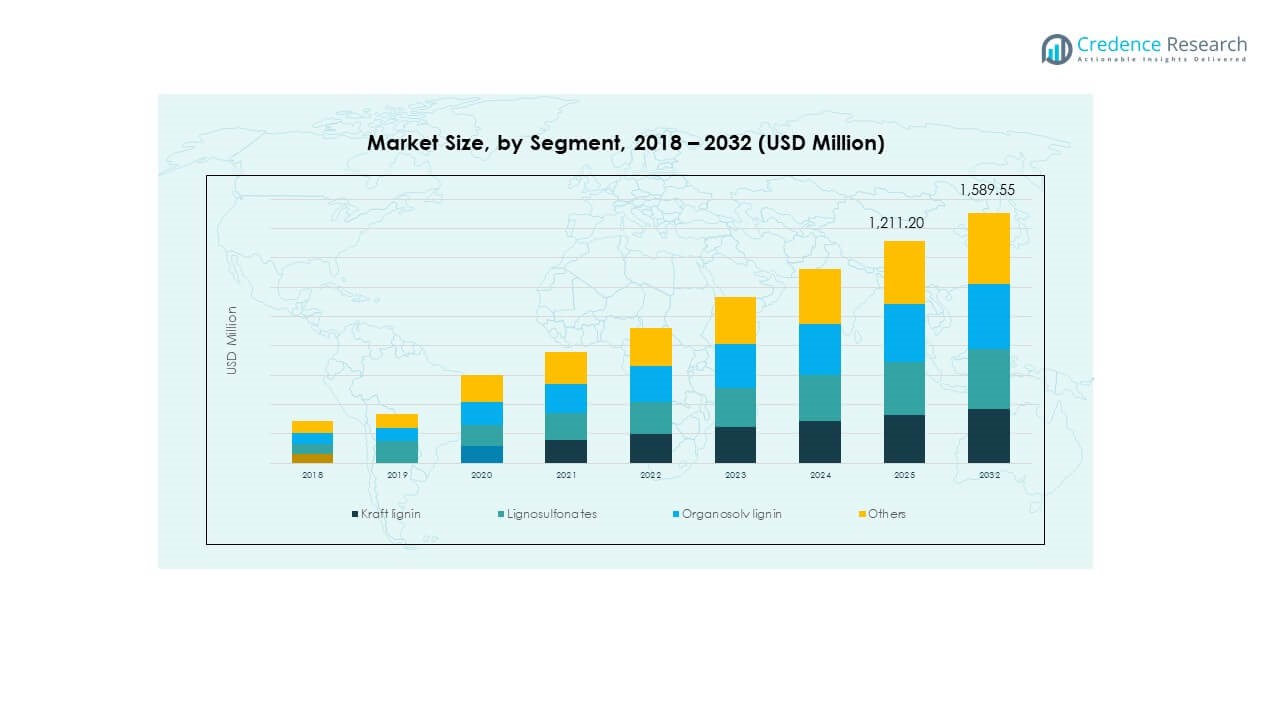

The Lignin‑Derived Polyols Market is segmented by feedstock, application, and type.

By feedstock,

kraft lignin dominates due to its wide availability and cost-effective extraction from the pulp and paper industry. It offers favorable characteristics for polyol synthesis. Lignosulfonates follow, supported by their water solubility and ease of processing in liquid formulations. Organosolv lignin is gaining traction for its high purity and low sulfur content, making it suitable for high-performance applications. The “others” category includes soda lignin and hybrid lignin forms used in niche or customized blends.

By application,

rigid foam leads the market due to high demand in insulation and construction, where thermal and structural performance is critical. Flexible foam is widely used in automotive and furniture sectors, supporting its share. Coatings and adhesives segments benefit from the growing push for bio-based binders, while sealants and elastomers represent emerging areas for innovation and commercial validation.

- For instance, a team developing kraft lignin-based RPUFs reported substitution levels of up to 30 wt% lignin polyol in rigid foam formulations. These foams achieved thermal conductivity around 025 W/m·K, comparable to traditional rigid foam, with compressive strength of ~250 kPa at 10% deformation, meeting requirements for building insulation.

By type,

polyether polyols hold the larger share, driven by their compatibility with conventional polyurethane systems and established processing methods. Polyester polyols are expanding steadily, supported by their superior mechanical strength and chemical resistance. The market shows strong alignment with sustainability trends across segments, positioning lignin-based polyols as viable substitutes for petroleum-derived counterparts.

- For instance, a review article on biomass-derived lignin conversion reported that polyurethane films constructed from lignin-based polyester polyols achieved tensile strength up to 19.35 MPa and elongation at break as high as 188%, which is on par with many conventional thermoset polyurethanes

Segmentation:

By Feedstock Segments

- Kraft Lignin

- Lignosulfonates

- Organosolv Lignin

- Others

By Application Segments

- Rigid Foam

- Flexible Foam

- Coatings

- Adhesives

- Sealants

- Elastomers

By Type Segments

By Regional Segments

- North America (U.S., Canada, Mexico)

- Europe (UK, Germany, France, Italy, Spain, Russia, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, India, Australia, Southeast Asia, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East (GCC, Israel, Turkey, Rest of Middle East)

- Africa (South Africa, Egypt, Rest of Africa)

Regional Analysis:

North America

The North America Lignin‑Derived Polyols Market size was valued at USD 309.23 million in 2018 to USD 339.15 million in 2024 and is anticipated to reach USD 460.34 million by 2032, at a CAGR of 4.0% during the forecast period. North America accounted for a 29% share of the global market in 2024. The market in this region is driven by strong demand from the automotive, construction, and industrial insulation sectors. Manufacturers are adopting lignin-based polyols to reduce carbon footprints and align with sustainability mandates. Ongoing investments in biorefineries and advanced material technologies support product innovation and scale-up. The U.S. leads in commercialization, supported by robust R&D funding and favorable regulatory frameworks. Canada also contributes significantly due to its established pulp and paper industry. Strategic collaborations between industry and research institutions help accelerate lignin valorization pathways. It continues to benefit from a mature supply chain and high consumer awareness.

Europe

The Europe Lignin‑Derived Polyols Market size was valued at USD 247.80 million in 2018 to USD 263.95 million in 2024 and is anticipated to reach USD 336.59 million by 2032, at a CAGR of 3.1% during the forecast period. Europe held a 23% share of the global market in 2024. The region leads in regulatory-driven adoption of bio-based chemicals, particularly in Germany, France, and the Nordic countries. Strict carbon emission targets and the EU Green Deal are pushing industries to transition toward renewable inputs. The market is supported by advanced pulp processing infrastructure and circular economy initiatives. European companies are investing in lignin conversion technologies and scaling pilot plants to meet local and regional demand. Public funding for green chemistry and clean tech innovation strengthens industry resilience. Local manufacturers are incorporating lignin polyols in insulation, furniture, and automotive components. It maintains a competitive position through environmental policy leadership and early technology adoption.

Asia Pacific

The Asia Pacific Lignin‑Derived Polyols Market size was valued at USD 383.67 million in 2018 to USD 439.87 million in 2024 and is anticipated to reach USD 640.11 million by 2032, at a CAGR of 4.8% during the forecast period. Asia Pacific represented a 38% share of the global market in 2024, making it the largest regional contributor. Rapid industrialization and increasing demand for sustainable materials in China, India, and Southeast Asia are driving growth. Government initiatives promoting bioeconomy development and renewable materials adoption are accelerating lignin-based polyol usage. Large-scale pulp production and low-cost feedstock availability support regional competitiveness. Infrastructure development, green building programs, and automotive manufacturing expansion contribute to increased consumption. Regional companies are forming partnerships to improve lignin sourcing and processing efficiency. Japan and South Korea are investing in R&D for high-performance bio-based materials. It is expected to maintain its leadership due to strong manufacturing capacity and favorable policy environment.

Latin America

The Latin America Lignin‑Derived Polyols Market size was valued at USD 51.87 million in 2018 to USD 57.04 million in 2024 and is anticipated to reach USD 70.37 million by 2032, at a CAGR of 2.7% during the forecast period. Latin America accounted for 5% of the global market in 2024. The market is in the early stages of development, driven by growing interest in sustainable construction and packaging materials. Brazil and Chile are key countries with active pulp and paper sectors that can support lignin recovery and conversion. Regional universities and research bodies are exploring value-added applications of lignin in polyurethane formulations. Lack of large-scale processing infrastructure limits commercial scalability. Import dependency for advanced bio-based inputs restricts broader adoption. Environmental awareness is rising, but industrial policy support remains limited. It holds potential for moderate growth as sustainability regulations strengthen. Local innovation and external investments may accelerate regional expansion.

Middle East

The Middle East Lignin‑Derived Polyols Market size was valued at USD 39.38 million in 2018 to USD 41.03 million in 2024 and is anticipated to reach USD 50.24 million by 2032, at a CAGR of 2.6% during the forecast period. The region held a 4% share of the global market in 2024. Market growth is modest due to limited local lignin production and underdeveloped bio-based manufacturing ecosystems. However, interest is rising in sustainable building materials, especially in the UAE and Saudi Arabia. These countries are pursuing net-zero strategies and exploring bio-based alternatives for construction insulation. Initiatives in circular economy and green procurement offer new opportunities for lignin-based polyols. The market depends heavily on technology imports and pilot collaborations. Investment in renewable materials is concentrated in selected industrial clusters. It shows potential for growth in infrastructure and real estate projects that prioritize eco-efficiency.

Africa

The Africa Lignin‑Derived Polyols Market size was valued at USD 18.06 million in 2018 to USD 28.06 million in 2024 and is anticipated to reach USD 31.90 million by 2032, at a CAGR of 1.2% during the forecast period. Africa contributed 2% of the global market in 2024. The market is nascent, with limited lignin valorization capacity and minimal industrial-scale production. Demand is slowly emerging in South Africa and select North African countries focused on sustainability initiatives. Agricultural biomass and forestry residues offer potential lignin sources, but infrastructure constraints hinder commercialization. Policy frameworks for bio-based materials are in early development stages. Local awareness of bio-based chemicals remains low among end-users. External support from international agencies and partnerships with European firms are enabling technology transfer. It requires strategic investment in biorefinery setups and skills development to unlock long-term growth. Africa remains an underdeveloped but strategically important future market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Borregaard LignoTech

- UPM-Kymmene (UPM Biochemicals)

- Stora Enso

- Lignin Industries AB

- MetGen

- Ingevity Corporation

- Lignolix

- Domtar Corporation

- West Fraser

- Nippon Paper Industries Co. Ltd.

- Metsä Group

- Domsjö Fabriker

- GF Biochemicals (Biofine)

- BASF SE

Competitive Analysis:

The Lignin‑Derived Polyols Market exhibits moderate competition with a mix of global chemical companies and niche biopolymer specialists striving to lead innovation. Major participants include Borregaard, Stora Enso, UPM Biochemicals, MetGen, Ingevity, and Lignolix, all investing in R&D to refine conversion technologies and enhance polyol properties. It leverages lignin valorization expertise and legacy pulp production capacity. Emerging players target tailored lignin-polyol blends for adhesives and foams while collaborating with academic institutions. UPM is progressing fast in scaling its biorefinery operations to generate lignin-based functional fillers and polyols. Larger chemical giants such as BASF, Dow Chemical, Covestro, Huntsman, and Cargill remain focused on vegetable oil–derived bio‑polyols, but they influence market dynamics and invest in adjacent technologies. It faces pressure to differentiate offerings on performance and cost. Continuous patenting and pilot-scale commercialization define competitive posture, while strategic collaborations reinforce market positioning.

Recent Developments:

- In June 2025, Stora Enso entered a strategic partnership with Matrix Pack to accelerate the global shift towards circular, bio-based packaging. As part of the agreement, Stora Enso acquired a minority stake in Matrix Pack and gained a board seat, enabling both companies to scale fiber-based packaging innovations that reduce reliance on plastics.

- In September 2022, MetGen entered into a joint development agreement with Ivy Farm Technologies, leveraging its ENZINE® platform to develop renewable solutions for the cultivated meat industry. While not directly in 2025, this partnership enhances MetGen’s role in sustainable, bio-based chemical production, including polyol precursors.

Market Concentration & Characteristics

The Lignin‑Derived Polyols Market remains fragmented with leading innovators driving early commercialization. It relies on specialized lignin supply chains and emerging biorefinery infrastructure. Products vary across lignin types and functional grades, so customization defines supplier strength. The segment lacks dominant volume producers, but companies like UPM, Borregaard, and Stora Enso hold influence through vertically integrated operations. Pricing remains higher than petroleum-based polyols, limiting broad adoption. It demands technical expertise in lignin functionalization and reaction control. Market characteristics include strategic partnerships, decentralized pilot plants, and technology licensing. Stakeholder roles differ from commodity polyol producers, favoring vertical integration and know‑how ownership. The industry still evolves toward standardized specifications and scale-based supply reliability.

Report Coverage:

The research report offers an in-depth analysis based on Feedstock, Application, and Type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Increasing demand for eco-friendly polyurethane foams will accelerate lignin-derived polyol adoption in construction and automotive industries.

- Advancements in lignin depolymerization and functionalization technologies will improve product quality and consistency.

- Expansion of modular biorefinery models will enhance regional production capacity and reduce logistics costs.

- Collaborations between research institutions and chemical companies will drive application-specific innovation.

- Government incentives and sustainability-linked financing will support new lignin polyol commercialization projects.

- Rising environmental regulations will push manufacturers to replace fossil-based polyols with bio-based alternatives.

- Integration of lignin polyols into circular economy frameworks will strengthen material life cycle value.

- Growing awareness of carbon footprint reduction will increase downstream customer interest.

- Market penetration will expand in Asia Pacific due to industrial growth and supportive policies.

- Strategic investments in supply chain development will improve scalability and market competitiveness.