Market Overview

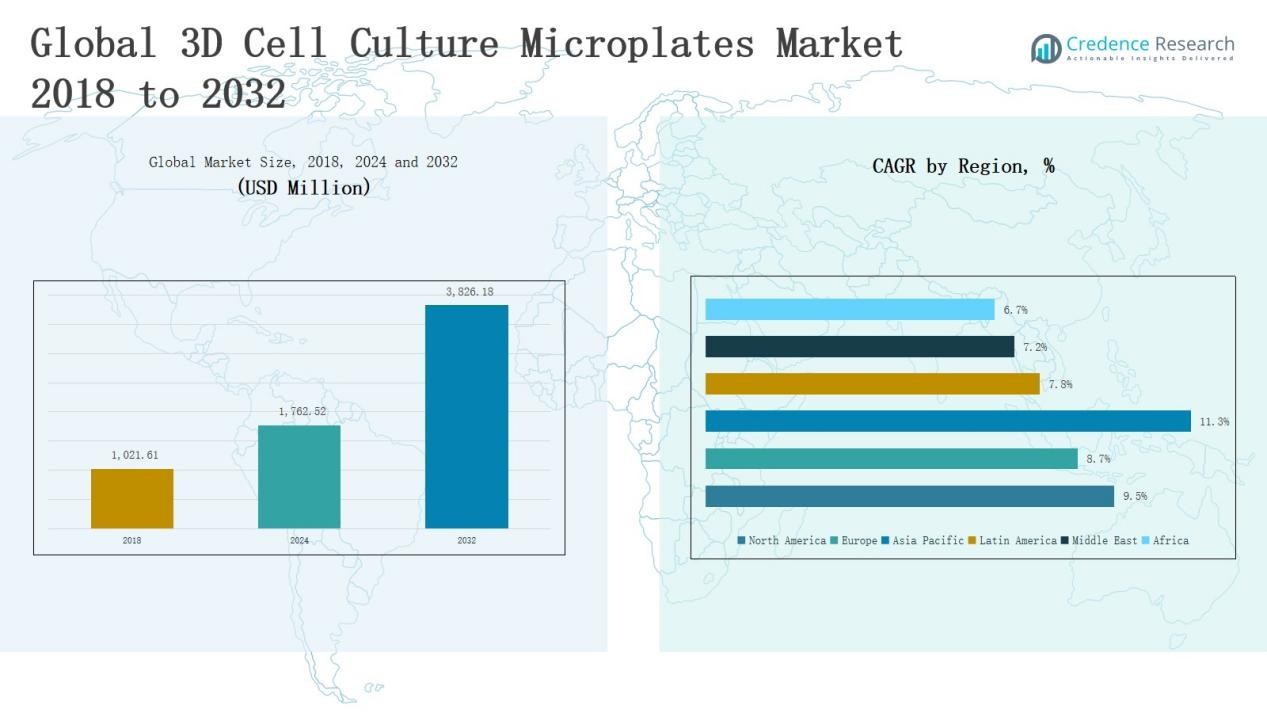

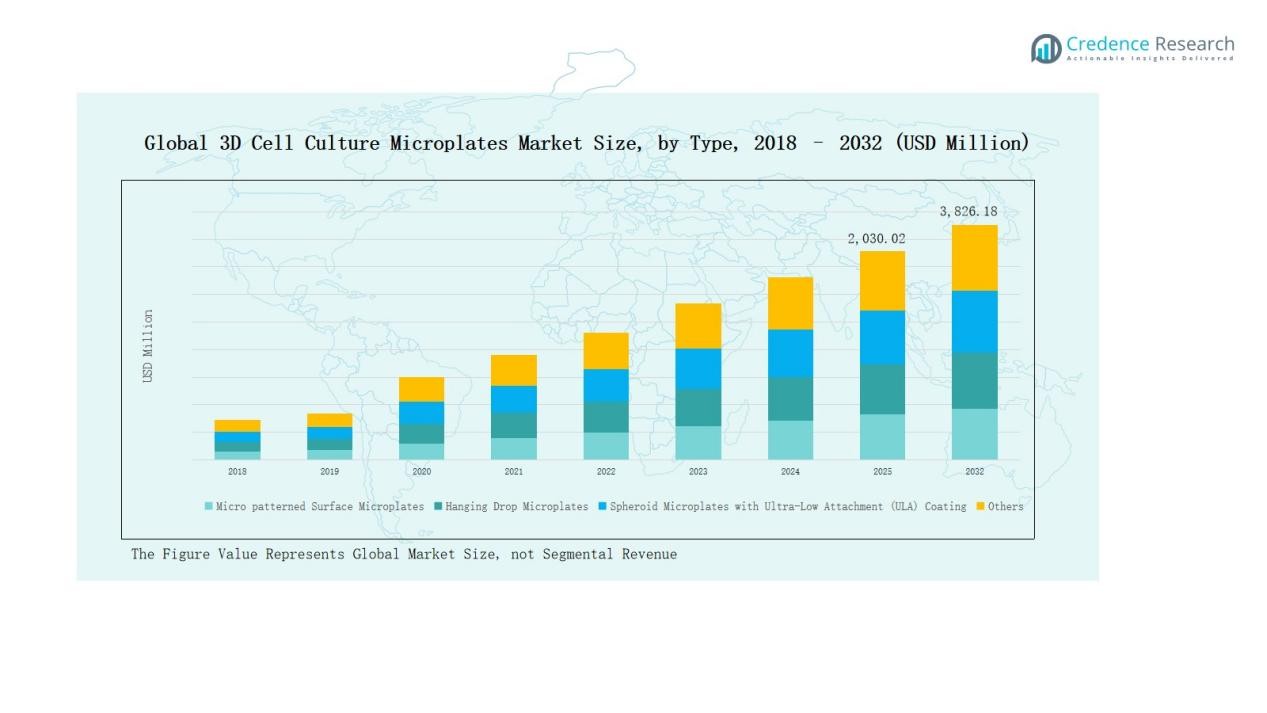

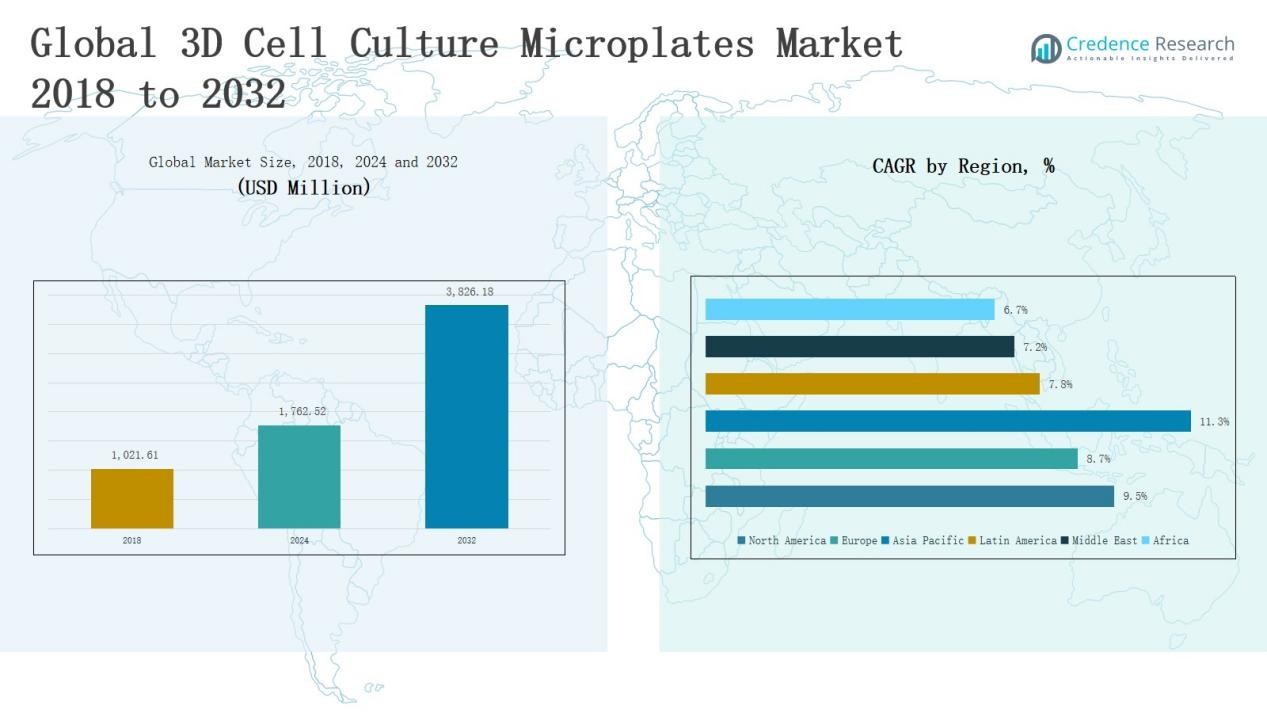

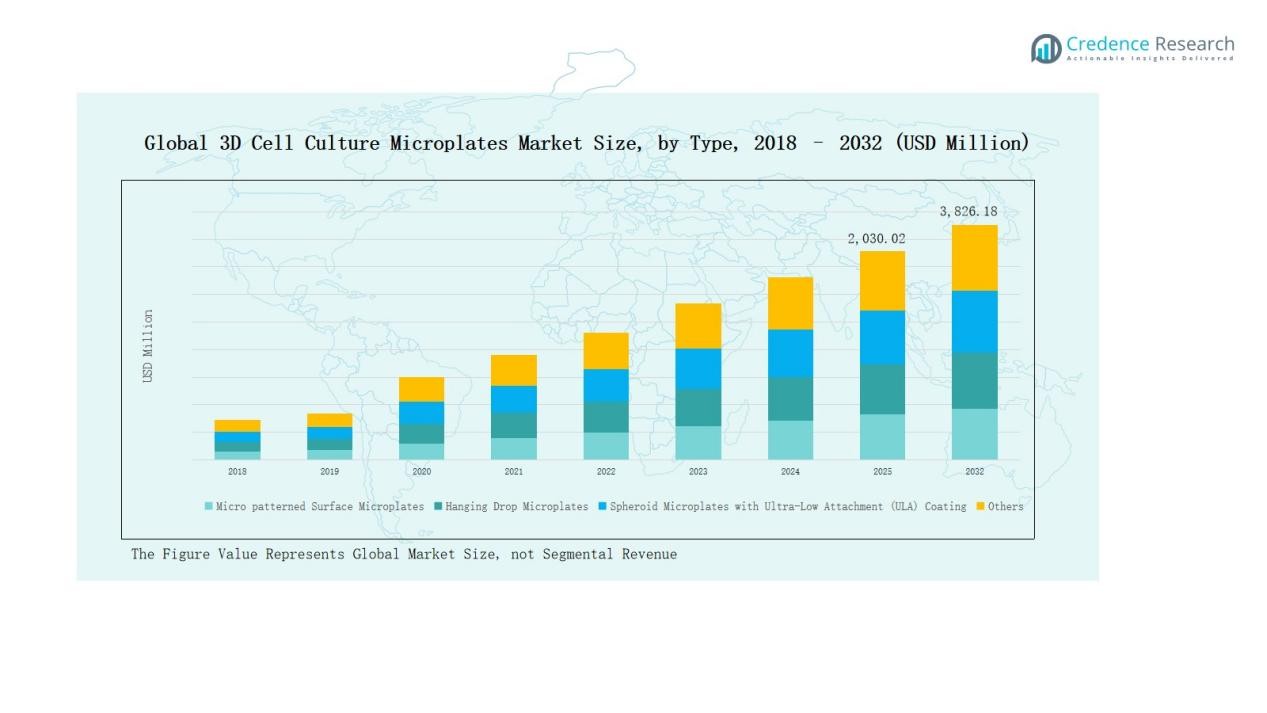

The 3D Cell Culture Microplates Market was valued at USD 1,021.61 million in 2018, grew to USD 1,762.52 million in 2024, and is anticipated to reach USD 3,826.18 million by 2032, expanding at a CAGR of 9.48% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| 3D Cell Culture Microplates Market Size 2024 |

USD 1,762.52 Million |

| 3D Cell Culture Microplates Market, CAGR |

9.48% |

| 3D Cell Culture Microplates Market Size 2032 |

USD 3,826.18 Million |

The 3D Cell Culture Microplates Market is led by major companies including Corning Incorporated, Thermo Fisher Scientific Inc., Merck KGaA (Sigma-Aldrich), Greiner Bio-One International GmbH, PerkinElmer Inc., InSphero AG, MIMETAS B.V., Lonza Group AG, Synthecon, Inc., and Advanced BioMatrix, Inc. These players dominate through continuous innovation in microplate coatings, material design, and automation-compatible formats that enhance reproducibility and scalability. Strategic collaborations, product advancements, and strong global distribution networks reinforce their competitive advantage. North America emerged as the leading region in 2024, capturing 44.0% of the global market share, driven by advanced research infrastructure, high R&D spending, and early technology adoption across biopharmaceutical and academic institutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The 3D Cell Culture Microplates Market grew from USD 1,021.61 million in 2018 to USD 1,762.52 million in 2024 and is expected to reach USD 3,826.18 million by 2032, expanding at a CAGR of 9.48%.

- The market is led by key companies such as Corning Incorporated, Thermo Fisher Scientific Inc., Merck KGaA (Sigma-Aldrich), Greiner Bio-One International GmbH, and PerkinElmer Inc., emphasizing innovation and automation compatibility.

- By type, the Spheroid Microplates with Ultra-Low Attachment (ULA) Coating segment dominated with a 7% share in 2024, driven by high reproducibility and efficiency in cancer and drug testing.

- By application, the Cancer segment led with 2% share in 2024, supported by increasing use in tumor modeling and personalized therapy research.

- North America remained the top regional market in 2024, holding a 0% global share, supported by strong R&D funding, early technology adoption, and presence of major market players.

Market Segment Insights

By Type:

The Spheroid Microplates with Ultra-Low Attachment (ULA) Coating segment dominated the 3D Cell Culture Microplates Market in 2024, accounting for 42.7% of the total share. Its dominance is driven by superior cell aggregation efficiency, reduced interference in cell morphology, and compatibility with high-throughput screening. These microplates enable consistent spheroid formation for cancer and drug testing applications. Increasing adoption in oncology and regenerative medicine research further strengthens the demand for ULA-coated microplates across academic and industrial laboratories.

- For instance, Corning launched its new 96-well ULA-coated microplates, which demonstrated over 90% spheroid formation efficiency in breast cancer cell assays, supporting enhanced drug screening workflows.

By Application:

The Cancer segment held the leading position in the 3D Cell Culture Microplates Market in 2024, capturing 45.2% of the overall market share. The segment’s growth is supported by the rising use of 3D cultures in tumor modeling, personalized therapy development, and anti-cancer drug screening. Pharmaceutical and biotechnology companies increasingly rely on 3D cell microplates for mimicking in vivo tumor environments, enhancing predictive accuracy and reducing the need for animal testing in oncology research.

- For instance, Thermo Fisher Scientific introduced its Gibco™ 3D Cell Culture Microplates, which have been widely implemented by oncology researchers to simulate complex tumor microenvironments for drug efficacy assessments.

By End-User:

The Biotechnology and Pharmaceutical Industries segment emerged as the largest end-user in the 3D Cell Culture Microplates Market in 2024, representing 49.5% of the global share. Strong R&D investments, drug discovery initiatives, and regulatory focus on predictive preclinical models drive this dominance. Companies utilize 3D microplates to optimize compound screening and toxicity testing, improving data reliability. Growing collaborations between pharmaceutical firms and academic institutions continue to expand microplate adoption for advanced biological research and therapeutic innovations.

Key Growth Drivers

Rising Adoption in Drug Discovery and Cancer Research

The 3D Cell Culture Microplates Market is expanding due to growing use in drug discovery and cancer modeling. These systems offer more physiologically relevant cell environments than traditional 2D cultures, improving accuracy in preclinical testing. Pharmaceutical and biotechnology firms increasingly integrate 3D microplates for high-throughput screening, reducing development time and cost. Their enhanced ability to replicate tumor microenvironments accelerates personalized medicine research and supports the growing demand for advanced oncology therapeutics worldwide.

- For instance, Merck KGaA has developed modular 3D culture platforms and extracellular matrices, providing pharmaceutical and biotechnology firms with scalable tools for automation and personalized oncology research, strongly referenced in academic-industry collaborations.

Advancements in Microplate Design and Material Innovation

Continuous innovation in microplate coatings, materials, and well structures drives market growth. Manufacturers are developing ultra-low attachment coatings and micro-patterned surfaces that enhance cell adhesion, uniform spheroid formation, and reproducibility. These technological upgrades support complex cell studies such as organoids and tissue regeneration. Integration with automated systems and imaging tools further strengthens product appeal, enabling researchers to streamline workflows while maintaining precision and consistency in data generation across pharmaceutical and academic research laboratories.

- For instance, Dynex Technologies Inc. partnered with Tecan Group Ltd. to distribute automated ELISA and chemiluminescence microplate systems, improving diagnostic test accessibility and throughput in the US healthcare market.

Expanding Applications in Regenerative Medicine and Stem Cell Research

The expanding use of 3D cell culture microplates in regenerative medicine and stem cell research strongly boosts demand. These platforms provide controlled environments that promote cell differentiation and tissue formation, essential for developing therapeutic models. Researchers employ 3D systems to study cell behavior, tissue engineering, and gene expression in physiological conditions. The growing focus on regenerative therapies and organ-on-chip models enhances adoption among biotech companies and academic institutions, positioning 3D microplates as core tools for next-generation biomedical research.

Key Trends & Opportunities

Integration of Automation and High-Throughput Screening Platforms

Automation and robotics integration is a major trend in the 3D Cell Culture Microplates Market. Laboratories are adopting automated systems to handle large-scale experiments with higher precision and repeatability. Combining 3D microplates with imaging, liquid handling, and data analytics platforms enhances productivity and accelerates assay development. This trend presents growth opportunities for manufacturers offering microplates compatible with robotic instruments, enabling faster drug screening and reducing human error in complex biological and pharmaceutical research processes.

- For instance, RoboCulture, a platform using a 7-axis robotic manipulator, autonomously performs yeast cell culture experiments on 96-well plates, integrating liquid handling, pipette exchanges, and growth monitoring to enhance precision and repeatability.

Growing Demand for Personalized and Predictive Medicine

Rising demand for personalized and predictive medicine is creating new opportunities in the market. 3D cell culture microplates enable patient-derived cell studies, helping researchers predict individual drug responses more accurately. This capability supports the development of tailored therapies for cancer and rare diseases. Growing investments in personalized oncology programs and organoid-based disease models are expected to expand the adoption of 3D systems across research centers, hospitals, and pharmaceutical companies focused on precision health solutions.

- For instance, a 3D-printed microfluidic tumor-on-a-chip device was developed to sustain patient-derived multicellular spheroids over extended periods, enabling multiple drug screenings that closely matched patients’ clinical outcomes.

Key Challenges

High Cost of Advanced 3D Culture Systems

The high cost associated with 3D cell culture microplates and related equipment remains a significant challenge. Specialized coatings, complex fabrication processes, and compatibility with advanced imaging systems increase production and operational expenses. Smaller research institutes and academic labs face budget constraints that limit adoption. Manufacturers must balance performance and affordability to encourage wider use, particularly in emerging markets where funding for advanced cell-based research remains limited compared to developed economies.

Limited Standardization and Reproducibility

A lack of standardized protocols for 3D culture methods poses a barrier to market expansion. Differences in cell types, assay conditions, and microplate formats often lead to inconsistent results across laboratories. This variability affects data reliability and complicates regulatory acceptance of 3D-based drug testing. Efforts toward developing harmonized testing frameworks, validation guidelines, and reference models are essential to establish reproducibility and confidence in 3D microplate applications within pharmaceutical and biotechnology research workflows.

Technical Complexity and Skill Gaps

Implementing 3D cell culture microplate systems requires technical expertise and specialized training. Many research teams lack experience in handling complex culture environments, data interpretation, and advanced imaging analysis. This skill gap delays adoption and limits the effective use of 3D platforms. Companies and institutions must invest in training programs, user-friendly designs, and automated tools to simplify workflows. Bridging this gap will be vital to fully leverage the potential of 3D culture technologies in life science research.

Regional Analysis

North America:

North America dominated the 3D Cell Culture Microplates Market in 2024, accounting for 44.0% of the global share. The market was valued at USD 454.74 million in 2018, increased to USD 776.55 million in 2024, and is projected to reach USD 1,690.36 million by 2032, growing at a CAGR of 9.5%. The region’s leadership stems from strong pharmaceutical R&D investments, early adoption of 3D culture technologies, and the presence of key players such as Corning and Thermo Fisher Scientific. High demand for advanced cancer research and drug testing models further accelerates regional growth.

Europe:

Europe held a 27.6% share of the 3D Cell Culture Microplates Market in 2024. The regional market was valued at USD 292.42 million in 2018, reached USD 486.47 million in 2024, and is expected to attain USD 994.83 million by 2032, expanding at a CAGR of 8.7%. Robust funding for life sciences, supportive regulatory frameworks, and strong research infrastructure drive Europe’s market growth. Countries like Germany, the UK, and France lead adoption due to significant biopharmaceutical development and collaborations between academic and industrial research centers.

Asia Pacific:

Asia Pacific emerged as the fastest-growing region, capturing 19.3% of the global market in 2024. It was valued at USD 180.15 million in 2018, grew to USD 339.25 million in 2024, and is forecasted to reach USD 842.22 million by 2032, at the highest CAGR of 11.3%. Rapid biopharma expansion, government funding for stem cell and regenerative medicine research, and increasing biotechnology investments in China, Japan, and South Korea drive this growth. Rising focus on precision medicine and local production capacity further enhances market penetration across Asia Pacific.

Latin America:

Latin America represented 4.6% of the global 3D Cell Culture Microplates Market in 2024. The market value rose from USD 47.45 million in 2018 to USD 80.83 million in 2024, and is projected to reach USD 154.97 million by 2032, registering a CAGR of 7.8%. Growth is supported by increasing healthcare investments, expanding pharmaceutical manufacturing, and growing adoption of 3D culture technologies in Brazil and Mexico. Academic and clinical research institutions are progressively integrating 3D microplate systems to improve cancer modeling and drug screening accuracy in local biomedical studies.

Middle East:

The Middle East accounted for 2.6% of the 3D Cell Culture Microplates Market in 2024. It was valued at USD 28.96 million in 2018, reached USD 45.72 million in 2024, and is projected to attain USD 83.94 million by 2032, growing at a CAGR of 7.2%. Growth is driven by rising healthcare modernization, expanding biotechnology sectors, and strategic investments in academic research infrastructure across GCC nations. Government initiatives supporting translational medicine and collaborations with global biopharma firms are gradually increasing the adoption of 3D culture systems across the region.

Africa:

Africa contributed 1.9% to the global 3D Cell Culture Microplates Market in 2024. The regional market grew from USD 17.88 million in 2018 to USD 33.71 million in 2024, and is anticipated to reach USD 59.86 million by 2032, expanding at a CAGR of 6.7%. Market growth is supported by improving biomedical research infrastructure, increasing public–private funding, and growing focus on healthcare innovation in South Africa and Egypt. However, limited technical expertise and research funding continue to restrict large-scale adoption, though gradual capacity building is expected to drive future development.

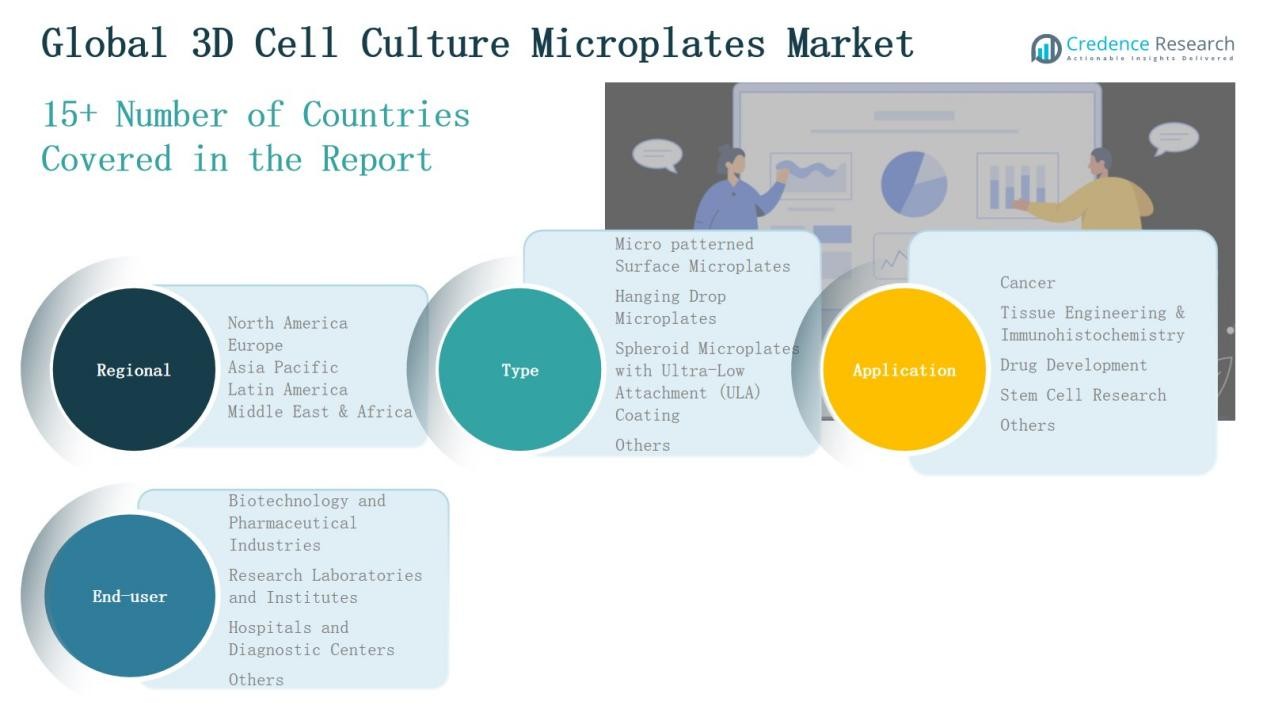

Market Segmentations:

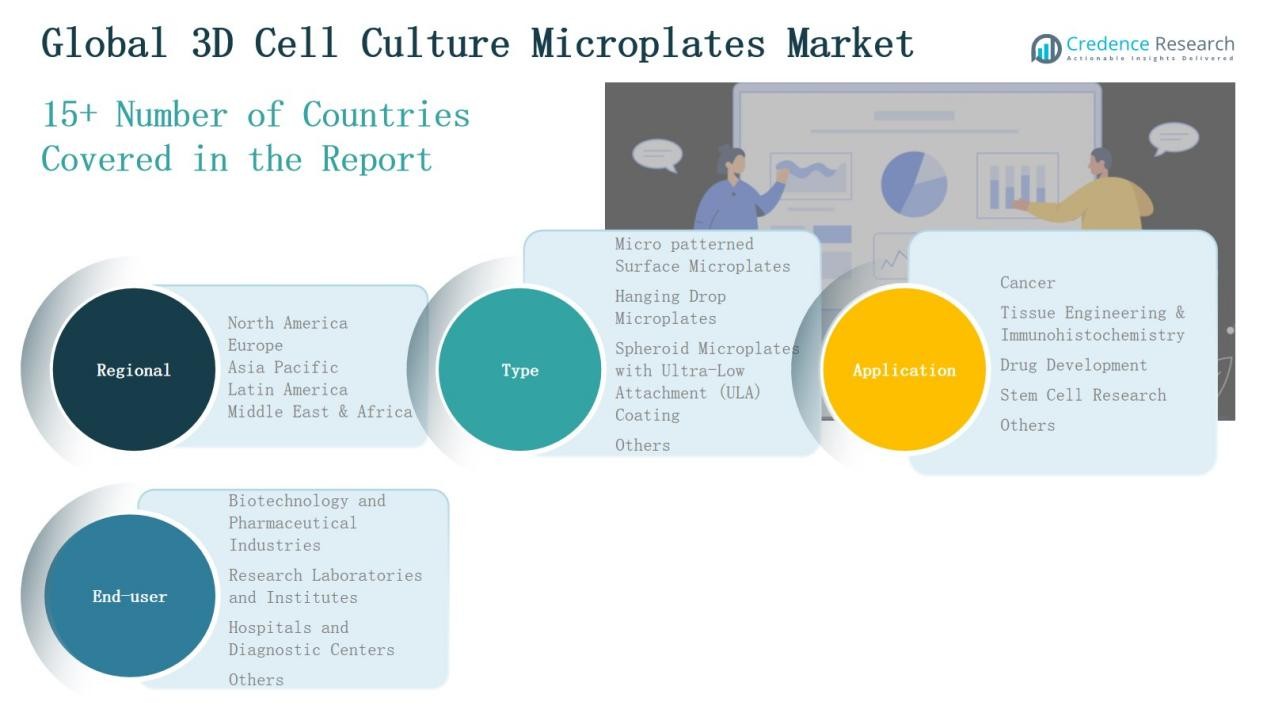

By Type:

- Micropatterned Surface Microplates

- Hanging Drop Microplates

- Spheroid Microplates with Ultra-Low Attachment (ULA) Coating

- Others

By Application:

- Cancer

- Tissue Engineering & Immunohistochemistry

- Drug Development

- Stem Cell Research

- Other

By End-User

- Biotechnology and Pharmaceutical Industries

- Research Laboratories and Institutes

- Hospitals and Diagnostic Centers

- Others

By Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Competitive Landscape

The 3D Cell Culture Microplates Market features a moderately consolidated competitive landscape, with several global and regional players focusing on innovation and product quality to strengthen their market position. Leading companies such as Corning Incorporated, Thermo Fisher Scientific Inc., Merck KGaA (Sigma-Aldrich), Greiner Bio-One International GmbH, and PerkinElmer Inc. dominate through extensive product portfolios, global distribution networks, and continuous R&D investment. These players focus on developing advanced coatings, micro-patterned designs, and automation-compatible platforms to enhance reproducibility and scalability in research. Emerging participants like InSphero AG, MIMETAS B.V., and Advanced BioMatrix, Inc. are gaining traction through customized 3D solutions, organoid modeling, and collaborative partnerships with pharmaceutical firms. The market is witnessing strategic alliances, mergers, and acquisitions aimed at expanding technology capabilities and regional presence. Competition increasingly centers on product performance, innovation speed, and integration with automated laboratory systems to meet the evolving demands of drug discovery and life science research.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Corning Incorporated

- Thermo Fisher Scientific Inc.

- Merck KGaA (Sigma-Aldrich)

- Greiner Bio-One International GmbH

- PerkinElmer Inc.

- InSphero AG

- 3D Biomatrix, Inc.

- Lonza Group AG

- Synthecon, Inc.

- MIMETAS B.V.

- Advanced BioMatrix, Inc.

Recent Developments

- In October 2025, Precision Cell Systems (PCS) acquired BennuBio to strengthen its presence in the 3D Cell Culture Microplates Market, adding BennuBio’s Velocyt imaging flow cytometer to its portfolio.

- In September 2025, Advanced Biomed introduced A+PerfusC™, an integrated perfusion 3D cell culture platform designed to enhance cell growth and viability.

- In June 2025, Mitsui Chemicals launched InnoCell™, a non-treated “N-type” microplate optimized for non-adherent cells, organoids, and spheroids.

- In February 2024, Cell Microsystems partnered with OMNI Life Science to expand access to the CERO 3D incubator and related microplate-based products across North America.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for 3D cell culture microplates will continue to rise in drug discovery and cancer research.

- Adoption of automation and AI-integrated screening systems will enhance research efficiency.

- Biopharmaceutical companies will expand use of 3D models for toxicity and efficacy testing.

- Advancements in microplate coatings and materials will improve reproducibility and accuracy.

- Partnerships between academic institutions and industry players will accelerate innovation.

- Personalized medicine and organoid-based studies will drive broader application of 3D systems.

- Emerging economies in Asia Pacific will experience faster adoption due to growing biotech funding.

- Integration with high-throughput and imaging technologies will support large-scale experiments.

- Sustainability and reusable microplate designs will gain attention among research laboratories.

- Ongoing standardization efforts will improve data comparability and promote regulatory acceptance.