Market Overview

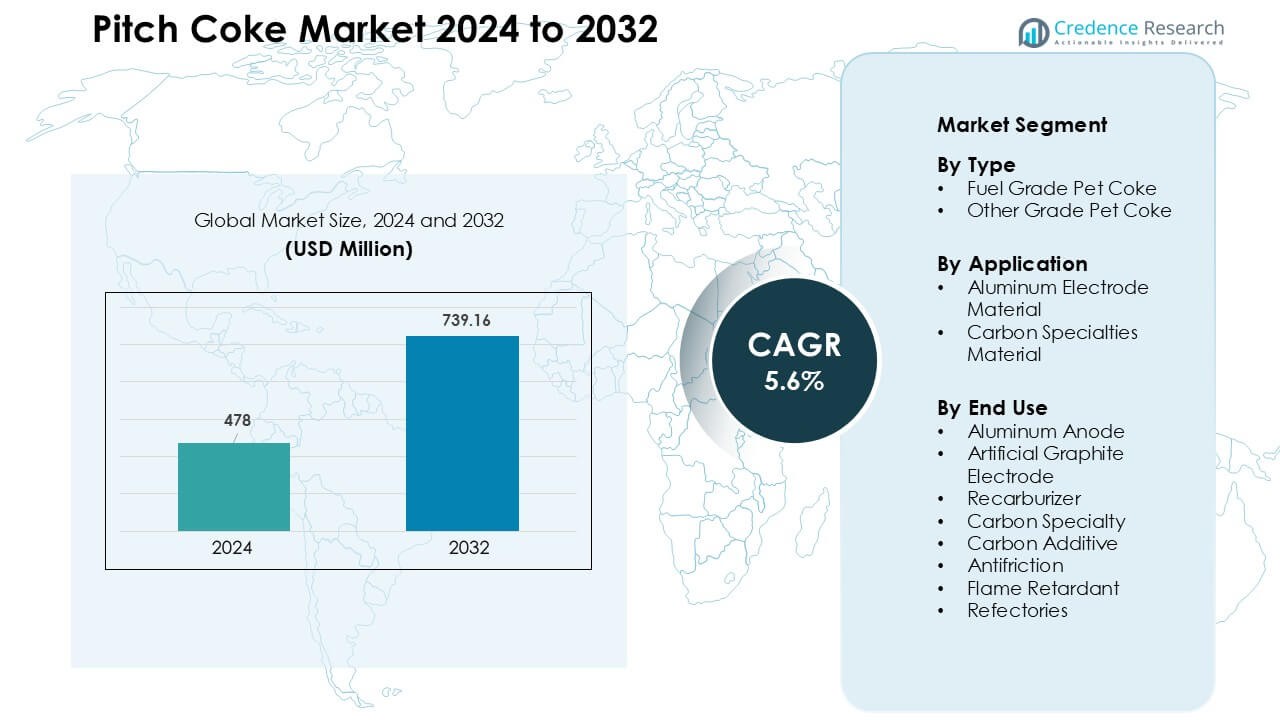

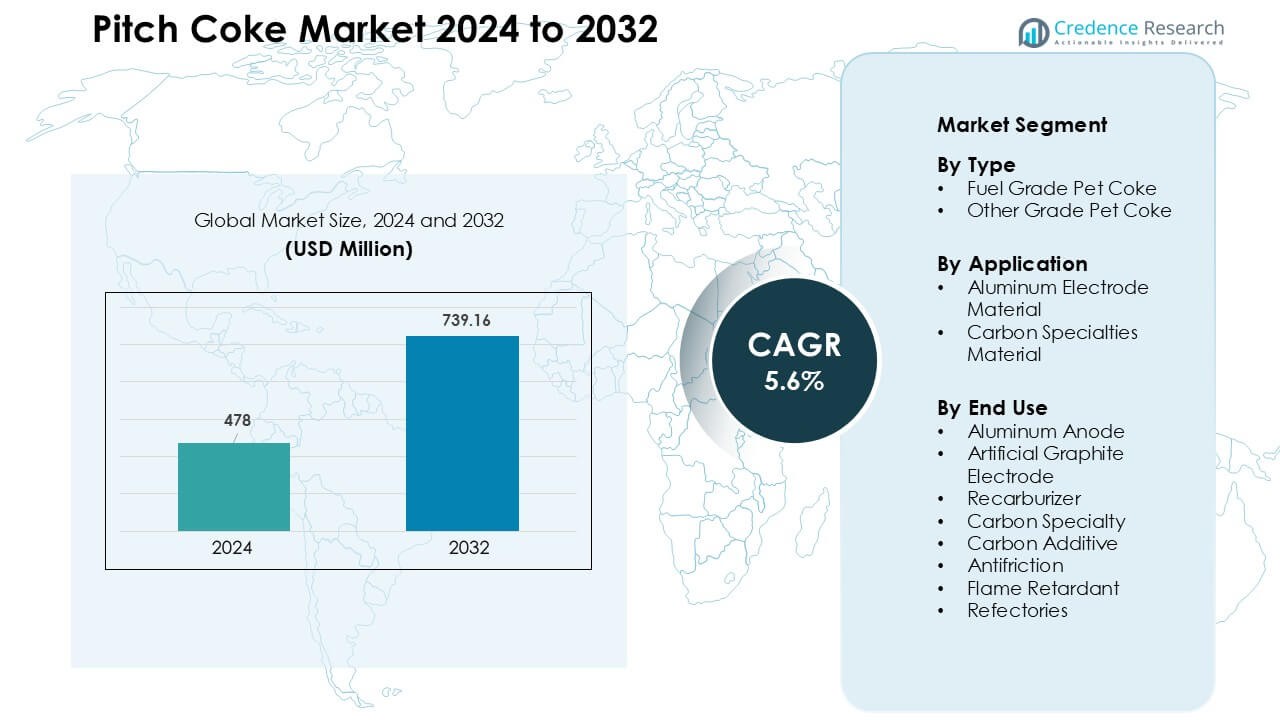

Pitch Coke Market was valued at USD 478 million in 2024 and is anticipated to reach USD 739.16 million by 2032, growing at a CAGR of 5.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pitch Coke Market Size 2024 |

USD 478 Million |

| Pitch Coke Market, CAGR |

5.6% |

| Pitch Coke Market Size 2032 |

USD 739.16 Million |

The pitch coke market is shaped by key players such as Mitsubishi Chemical, Shamokin Carbons, Bilbaina de Alquitranes, DONGSUNG CORPORATION, Tianjin Yunhai Carbon Element Products, Sojitz JECT Corporation, Ukrgraphit, RESORBENT S.R.O., SUMMIT CRM Limited, and Rain Carbon Inc., all competing through advanced calcination, high-purity pitch processing, and strong supply partnerships with aluminum and graphite producers. These companies focus on improving carbon quality, reducing impurities, and expanding capacity across major industrial hubs. Asia-Pacific led the global market with nearly 52% share in 2024, driven by large-scale aluminum smelting, strong electrode manufacturing growth, and abundant access to raw materials.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The pitch coke market reached USD 478 million in 2024 and is projected to hit USD 739.16 million by 2032, registering a CAGR of 5.6 % during the forecast period.

- Growing aluminum smelting activity drives demand, as aluminum anode applications held about 46% share in 2024, supported by the need for high-purity carbon materials.

- Rising use of artificial graphite and carbon specialties boosts long-term adoption, with trends favoring high-purity, low-sulfur pitch coke for electrodes, composites, and advanced industrial applications.

- Competition intensifies among leading companies focusing on calcination efficiency, sulfur reduction, premium-grade production, and long-term contracts with smelters and electrode manufacturers.

- Asia-Pacific dominated with nearly 52% share, driven by large-scale smelting and electrode production, while North America and Europe maintained steady demand from specialty carbon and EAF steelmaking industries.

Market Segmentation Analysis:

By Type

Fuel Grade Pet Coke dominated the type segment in 2024 with about 63% share, supported by strong demand from metal smelters and carbon product manufacturers seeking high-carbon, low-ash feedstock. This grade gained wider adoption because producers preferred stable combustion performance and lower production costs compared with other carbon sources. The segment expanded further due to rising aluminum production and growth in integrated carbon plants across Asia. Other Grade Pet Coke recorded moderate growth, mainly driven by usage in premium carbon applications, but Fuel Grade Pet Coke remained ahead due to its large-scale industrial utility.

- For instance, in the aluminum industry, it is estimated that producing one metric ton of aluminum requires roughly 0.5 metric ton of calcined petcoke (or anode-grade coke) as a carbon anode feedstock.

By Application

Aluminum Electrode Material held the leading share in 2024 with nearly 58%, driven by rapid expansion of global aluminum smelting capacity and rising demand for high-purity pitch coke in anode production. Smelters relied on pitch coke because it supports strong electrical conductivity and improves anode density. Carbon Specialties Material grew steadily due to adoption in advanced carbon composites and battery components, yet aluminum applications remained dominant. Continued investments in electrolytic aluminum projects in China, India, and the Middle East strengthened this segment, ensuring stable long-term demand from primary metal producers.

- For instance, a major carbon-materials supplier Rain Carbon serving aluminium smelters produces calcined petroleum coke that meets the quality standards for anode manufacture, ensuring low ash and sulfur content and consistent electrical conductivity for stable smelter performance.

By End Use

Aluminum Anode emerged as the dominant end-use segment in 2024 with around 46% share, driven by heavy consumption of pitch coke in the fabrication of high-strength anodes used in aluminum smelting. Producers favored pitch coke because it improves anode performance, reduces energy loss, and enhances cell life in electrolytic operations. Artificial Graphite Electrode and Recarburizer applications grew due to steel sector expansion, while Carbon Specialty and Carbon Additive gained traction in high-tech industries. Despite broader end-use diversification, aluminum anodes-maintained leadership due to continuous growth in primary aluminum production.

Key Growth Drivers

Rising Aluminum Production Worldwide

The expansion of global aluminum smelting is a major growth driver for the pitch coke market. Primary aluminum producers continue to increase capacity in Asia, the Middle East, and Europe to meet rising demand from construction, transportation, and packaging industries. Pitch coke plays a central role in anode manufacturing because it delivers high carbon purity, structural integrity, and strong electrical conductivity. The shift toward energy-efficient smelting technologies has further increased demand for low-impurity anode materials. Large smelters in China, India, and the Gulf countries are investing in modern electrolytic cells that rely on consistent-quality pitch coke for stable performance. This strong dependence strengthens long-term consumption trends and creates steady procurement cycles, especially among integrated metal producers. As lightweight aluminum use accelerates in automotive components, beverage cans, and renewable infrastructure, pitch coke demand is expected to rise in parallel. Continued industrialization in emerging economies reinforces this upward trajectory.

- For instance, global primary aluminum production recently reached record levels annualized output hit ~71.2 million metric tons when smelters globally operated at high run-rates. This scale of production intensifies demand for quality carbon inputs in anode manufacture.

Growth in Artificial Graphite and Specialty Carbon Materials

Rising production of artificial graphite electrodes and high-performance carbon products drives significant demand for pitch coke. Artificial graphite is widely used in electric arc furnaces (EAFs), which are expanding due to growing scrap steel recycling and decarbonization efforts in the steel industry. Pitch coke serves as a key precursor material that enhances electrode density, conductivity, and thermal stability. Beyond steelmaking, rapid growth in specialty carbon materials including carbon composites, carbon brushes, friction products, and battery-grade carbon creates new opportunities. The electronics and energy storage industries are adopting advanced carbon grades for their high temperature resistance and mechanical strength. Many manufacturers are shifting toward coal- and petroleum-based pitch coke because it supports precision forming and high structural consistency. As global investment increases in EV batteries, semiconductor manufacturing, and advanced industrial components, specialty carbon applications continue to elevate the demand for high-quality pitch coke.

- For instance, the global market for graphite electrodes widely produced from synthetic/artificial graphite using petroleum coke or pitch coke feedstock is experiencing rising demand due to the increased use of EAF-based steel production globally.

Expanding Applications in Recarburizers and Metallurgical Additives

The growing use of recarburizers in steel and foundry operations significantly boosts pitch coke consumption. Pitch coke is valued for its high carbon content, low sulfur presence, and excellent solubility, making it effective for restoring carbon levels during molten metal processing. Foundries and metallurgical plants prefer pitch coke over traditional carbon additives because it provides more predictable absorption rates and enhances metallurgical quality. Growth in ductile iron production, alloy steel manufacturing, and precision castings has intensified demand for high-purity recarburizers. Increasing automation and quality control in foundries further strengthen this shift toward engineered carbon additives. The automotive, machinery, and heavy equipment sectors are expanding, which raises consumption of cast components that rely on high-grade carbon inputs. With industrial development accelerating across Southeast Asia, Africa, and Latin America, consumption of pitch-coke-based recarburizers continues to rise, reinforcing its importance in modern metallurgical processes.

Key Trends & Opportunities

Advancements in High-Purity Pitch Coke for Battery and EV Technologies

A major emerging trend is the rising use of high-purity pitch coke in lithium-ion batteries and next-generation energy storage technologies. As electric vehicle adoption accelerates, battery manufacturers are looking for advanced carbon materials that enhance anode stability, cycle life, and conductivity. High-purity pitch coke offers a strong opportunity due to its ability to produce engineered carbon with uniform microstructure. Companies are investing in purification technologies, such as advanced calcination and solvent extraction, to upgrade pitch coke for battery-grade material. The expansion of gigafactories in China, Europe, and the United States adds strong momentum to this trend. Battery firms are exploring pitch-derived carbon as a competitive alternative to synthetic graphite, especially for high-performance anodes. This shift creates a major opportunity for pitch coke manufacturers to diversify beyond traditional metallurgical applications and enter the fast-growing EV and energy storage markets.

- For instance, recent research has demonstrated that carbon derived from petroleum- or pitch-based coke can be processed into graphite-anode materials suitable for lithium-ion batteries, with controlled carbonization and graphitization, delivering stable electrochemical performance comparable to synthetic graphite.

Increasing Investments in Carbon Composite and High-Performance Materials

Pitch coke demand is rising as industries shift toward lightweight and high-strength carbon composites used in aerospace, automotive, industrial machinery, and electronics. The need for structural components that provide heat resistance, chemical stability, and reduced weight has accelerated the adoption of carbon-based materials. Pitch coke serves as a key feedstock for producing carbon fibers, carbon matrix composites, and advanced friction materials. Manufacturers are focusing on upgrading pitch coke quality to suit precise mechanical and thermal requirements. Countries investing in advanced manufacturing such as Japan, South Korea, Germany, and the United States are driving new opportunities for specialty carbon applications. The continued move toward electrification, renewable energy systems, and thermal insulation technologies further expands the scope for pitch-coke-based composites. This trend positions pitch coke as an essential raw material for high-value engineering applications.

Key Challenges

Environmental Restrictions and Emission Control Regulations

Stringent environmental policies form a major challenge for the pitch coke market. Manufacturing processes such as distillation, calcination, and carbonization emit particulate matter, sulfur oxides, and volatile organic compounds. Governments across North America, Europe, and Asia are imposing tighter emission norms on carbon processing plants. Compliance requires costly investments in flue-gas desulfurization, carbon capture, dust-control systems, and energy-efficient furnace technologies. Smaller manufacturers face operational strains due to higher environmental compliance costs. Additionally, public and regulatory pressure to reduce dependence on fossil-based carbon materials is creating long-term uncertainty. Many downstream users, particularly in metals and automotive sectors, are exploring low-carbon alternatives, which could temper demand. These evolving regulations increase production costs and limit expansion for pitch coke producers.

Volatility in Feedstock Availability and Price Fluctuations

Pitch coke production depends heavily on the availability of coal tar pitch, petroleum residue, and other heavy feedstocks. Price volatility in these raw materials poses a significant challenge for market stability. Refinery operating rates, coking capacity shifts, and constraints in coal tar production directly influence pitch coke supply. Unexpected disruptions, such as refinery shutdowns or fluctuations in metallurgical coke production, can trigger supply shortages. These conditions lead to inconsistent pricing and reduced predictability for manufacturers and downstream industries. Producers must also manage feedstock quality variations, which affect the consistency of the final product. As supply chains experience pressures from geopolitical tensions, energy market swings, and transportation bottlenecks, manufacturers face increased procurement risk. This instability limits long-term planning and impacts profitability for pitch coke producers.

Regional Analysis

North America

North America held roughly 22% share of the pitch coke market in 2024, supported by strong demand from aluminum smelters, specialty carbon producers, and steel recyclers. The United States remained the primary consumer due to its large EAF steelmaking base and growing investments in carbon composites for aerospace and defense. Canada contributed steady demand from aluminum operations and engineered carbon applications. Technological adoption in calcination and purification improved product quality, while regional manufacturers focused on high-value carbon specialties. However, stricter emission norms and higher operating costs continued to shape production strategies across the region.

Europe

Europe accounted for around 18% share in 2024, driven by strong demand from specialty carbon manufacturers and advanced material producers. Germany, Norway, and France remained key consumers due to established aluminum smelting and carbon composite production. The region’s focus on energy-efficient manufacturing and low-impurity anode materials supported moderate growth. European policies promoting recycling increased reliance on EAF steel, which boosted electrode-related consumption. However, reduced coal tar availability and stringent environmental regulations created sourcing challenges for regional processors. Despite this, Europe stayed important for premium carbon applications used in aerospace, industrial machinery, and high-performance engineering.

Asia-Pacific

Asia-Pacific dominated the global pitch coke market with nearly 52% share in 2024, anchored by massive consumption from China, India, South Korea, and Japan. China led due to extensive aluminum smelting capacity and strong demand for anode-grade coke in electrolytic operations. India showed rapid growth in steelmaking, foundry recarburizers, and carbon additive applications. Expanding EV battery production and increased investment in specialty carbon materials supported regional demand. Asia-Pacific also benefited from competitive production costs, integrated supply chains, and abundant feedstock availability. This combination positioned the region as the central hub for both volume production and end-use industries.

Latin America

Latin America captured close to 5% share of the pitch coke market in 2024, driven mainly by Brazil’s aluminum and steel industries. Brazil’s robust primary aluminum production and expanding EAF steelmaking supported steady demand for anode materials and recarburizers. Mexico contributed additional consumption from automotive castings and metallurgical applications. Regional investments in mining, metal refining, and industrial components increased adoption of engineered carbon products. However, limited local pitch coke production and dependence on imported feedstock created supply constraints. Despite these challenges, Latin America continued to gain traction as metal processing activities expanded across the region.

Middle East & Africa

The Middle East & Africa region held nearly 3% share in 2024, supported by aluminum smelting hubs in the UAE, Bahrain, and Saudi Arabia. These countries invested heavily in modern electrolytic cells, which rely on consistent-quality pitch coke for anode production. South Africa added demand for metallurgical applications and specialty carbon uses in mining equipment and refractories. Access to competitive energy pricing and large-scale smelting facilities boosted material consumption. However, the region remained dependent on imported pitch coke due to limited manufacturing capacity. Ongoing industrialization and metal sector expansion are expected to strengthen long-term demand.

Market Segmentations:

By Type

- Fuel Grade Pet Coke

- Other Grade Pet Coke

By Application

- Aluminum Electrode Material

- Carbon Specialties Material

By End Use

- Aluminum Anode

- Artificial Graphite Electrode

- Recarburizer

- Carbon Specialty

- Carbon Additive

- Antifriction

- Flame Retardant

- Refectories

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the pitch coke market features a mix of global carbon producers, specialty material manufacturers, and integrated chemical companies focusing on high-purity carbon solutions. Leading players such as Mitsubishi Chemical, Shamokin Carbons, Bilbaina de Alquitranes, DONGSUNG CORPORATION, Tianjin Yunhai Carbon Element Products, Sojitz JECT Corporation, Ukrgraphit, RESORBENT S.R.O., SUMMIT CRM Limited, and Rain Carbon Inc. compete through advancements in calcination technology, upgraded pitch purification, and improved control of sulfur and volatile content. Many companies are expanding production capacity to meet demand from aluminum smelting, artificial graphite, and carbon specialties. Strategic supply agreements with smelters and electrode manufacturers strengthen market positioning, while geographic expansion across Asia-Pacific and the Middle East helps reduce feedstock risk. Firms increasingly invest in R&D for specialty-grade pitch coke aimed at EV batteries, aerospace composites, and high-performance carbon materials. Sustainability pressures also encourage producers to deploy emission control systems and energy-efficient processing lines.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Mitsubishi Chemical

- Shamokin Carbons

- Bilbaina de Alquitranes, S.A

- DONGSUNG CORPORATION

- Tianjin Yunhai Carbon Element Products Co., Ltd.

- Sojitz JECT Corporation

- Ukrgraphit

- RESORBENT S.R.O.

- SUMMIT CRM Limited

- Rain Carbon Inc.

Recent Developments

- In October 2025, the parent of DONGSUNG CORPORATION, Dongsung Chemical, reported completion of expansion of its organic‑peroxide production line at its Yeosu plant, and commencement of full‑scale operations.

- In 2025, a global pitch coke report profiled RESORBENT SRO capacity, production, and growth. The study confirmed RESORBENT as a key supplier in updated competitive benchmarks for the pitch coke market.

- In January 2025, Rain Carbon announced a new coal tar pitch facility in Andhra Pradesh. The site will process, blend, and upgrade pitch for high-grade carbon products.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as aluminum smelting capacity expands across Asia and the Middle East.

- High-purity pitch coke will gain traction due to growing artificial graphite production.

- Battery and EV industries will explore pitch-derived carbon for advanced anode materials.

- Carbon composite applications will create new opportunities in aerospace and automotive sectors.

- Producers will invest in cleaner calcination systems to meet strict emission norms.

- Supply chain integration will strengthen as companies secure long-term feedstock contracts.

- Specialty carbon grades will see higher adoption in electronics and high-temperature industries.

- Technological upgrades will improve pitch purity and reduce sulfur content.

- Recarburizer demand will increase as foundries shift toward high-efficiency carbon additives.

- Asia-Pacific will remain the dominant growth center due to large end-use industries.