Rising Collectible Value, Strong Cultural Influence, and Digital Transactions Drive Europe Classic Cars Market Growth During the Forecast Period 2024–2032

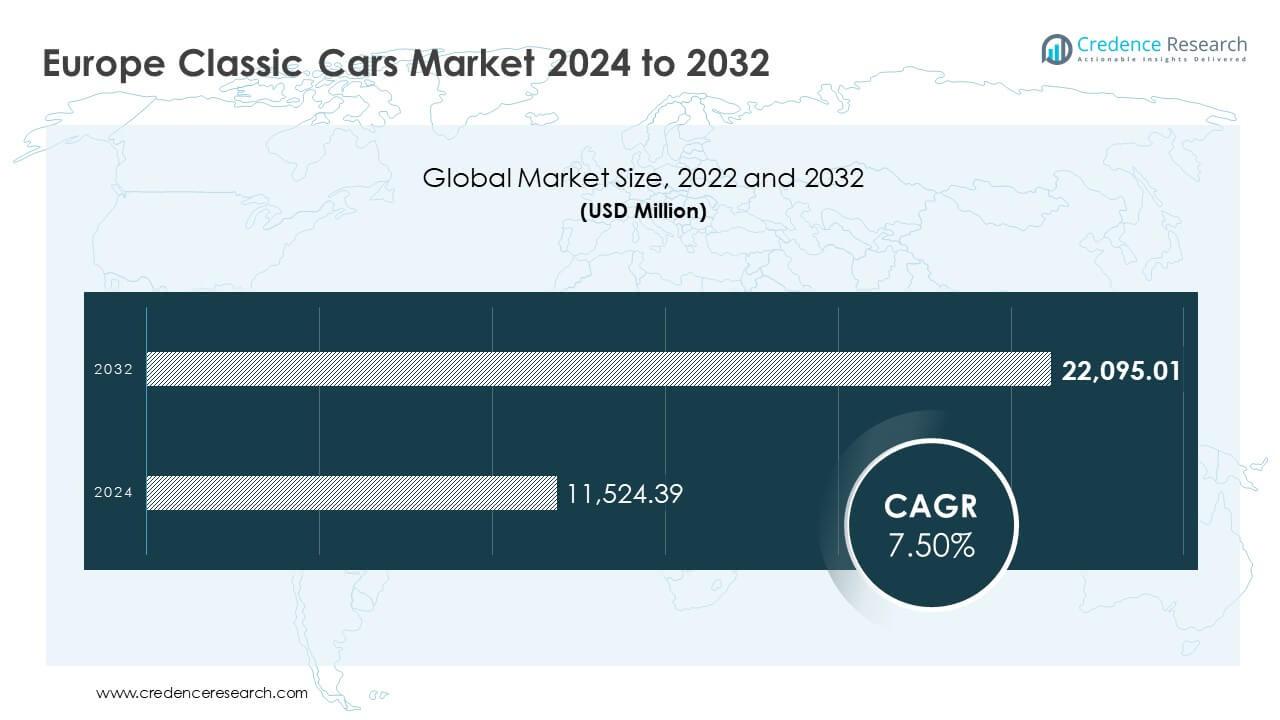

According to a recent report published by Credence Research, Inc., “Europe Classic Cars Market By Type (Passenger Cars, LCV , HCV ) By Function (Sports Car , Luxury Cars , Convertibles , Sedans , Others ) By Price Range (High, Low & Medium) By Distribution Channel (Auction Houses , Classic Car Dealerships, Online Platforms, Car Shows & Events, Others); By Region – Growth, Share, Opportunities & Competitive Analysis, 2024 – 2032”, the Europe Classic Cars market generated revenue of USD 11,524.39 million in 2023 and is anticipated to reach USD 22,095.01 million by 2032, expanding at a CAGR of 7.50% from 2024 to 2032.

Market Overview

The Europe classic cars market is gaining momentum due to growing investment interest, heritage preservation, and technological integration. High-net-worth individuals and collectors are acquiring classic vehicles as long-term assets. Online platforms are enabling easier access to vehicles across national borders. Regulatory restrictions and rising maintenance costs, however, remain significant limiting factors.

Browse market data figures spread through 220+ pages and an in-depth TOC on “Europe Classic Cars Market”

Download Free Sample Report

Rising Collectible Value and Investment Appeal Fuel Market Expansion

One of the primary drivers of market growth is the rising perception of classic cars as appreciating investment assets. Wealthy individuals are acquiring vintage vehicles not only for personal enjoyment but also as financial instruments. Brands such as Ferrari, Jaguar, and Porsche are consistently in demand, with limited production models seeing the highest valuation increases.

Auction houses across Europe report a steady increase in sales volume and price levels. These auctions showcase rare models with documented histories, increasing their appeal. Buyers are actively seeking models with racing pedigree, design uniqueness, or limited manufacturing runs. The investment case is supported by data showing higher returns on some vehicle classes compared to traditional assets.

Classic cars offer asset diversification, especially in uncertain economic conditions. The tangible nature of vehicles and their limited supply contribute to long-term value retention. Regulatory incentives, such as historic vehicle classification, provide tax advantages in some jurisdictions. These financial considerations are increasingly influencing purchase decisions, creating sustained market demand.

Digitalization and Online Auctions Expand Market Access and Transparency

The transition to digital platforms is a key trend reshaping the Europe classic cars market. Online auction houses, dealer platforms, and dedicated marketplaces are enabling buyers and sellers to connect across borders. These platforms are streamlining the transaction process, reducing geographical barriers, and increasing market efficiency.

Digital platforms offer buyers access to inspection records, maintenance histories, and provenance documentation. Some marketplaces also offer third-party vehicle inspections and escrow services. These features increase transaction transparency and buyer confidence. The digital format also facilitates participation by younger collectors and international investors.

Established auction houses are adopting hybrid models, offering both in-person and online bidding. Online-only platforms are growing rapidly due to lower overhead and broader reach. Mobile applications and virtual showrooms enhance user experience and allow real-time monitoring of listings. These tools reduce time-to-sale and improve seller liquidity.

The digital trend is driving higher transaction volumes and price discovery across vehicle categories. It is also enabling data collection and analysis for pricing trends, buyer behavior, and model-specific demand. These insights are increasingly used by sellers to optimize inventory and timing of listings.

High Maintenance and Restoration Costs Limit Broader Market Adoption

High ownership costs remain one of the major challenges in the Europe classic cars market. Original parts for many vintage models are no longer in production. Sourcing parts requires engagement with specialist suppliers or custom fabrication. These practices significantly increase restoration and maintenance costs.

Restoration projects often require specialized labor. Skilled technicians with expertise in legacy systems, manual assemblies, and vintage bodywork are in short supply. Labor rates are high, and waiting periods for service appointments are long. These factors increase both upfront and ongoing expenses for owners.

Insurance premiums are elevated due to asset value, part scarcity, and usage restrictions. Many collectors must invest in climate-controlled storage facilities to preserve vehicle condition. Transporting vehicles to shows or auctions also adds logistical costs. These cumulative expenses restrict ownership primarily to high-income individuals.

In addition, local regulations related to emissions and vehicle use create operational barriers. Urban centers across Europe are adopting low-emission zones and restricting access for older vehicles. These rules reduce vehicle usability, limiting appeal for potential new entrants. As a result, the market remains dependent on wealthy collectors with access to private facilities and rural driving environments.

Market Segmentation

By Type

- Passenger Cars

- LCV

- HCV

By Function

- Sports Car

- Luxury Cars

- Convertibles

- Sedans

- Others

By Price Range

- High

- Low & Medium

By Distribution Channel

- Auction Houses

- Classic Car Dealerships

- Online Platforms

- Car Shows & Events

- Others

Key Players

- Citroën DS

- Chevrolet

- Lamborghini

- Lincoln Continental

- Cadillac

- Toyota

- Buick Riviera

- Jaguar / Land Rover

Regional Insights

The market in Europe is supported by a deep cultural connection to automotive heritage. Countries such as Germany, Italy, and the United Kingdom are major contributors to market growth. Each has a strong domestic base of collectors, brands, and supporting events.

Germany is home to heritage manufacturers like Porsche and Mercedes-Benz. The country supports robust domestic demand and hosts several high-profile auctions and car shows. Italy remains a global center for design-led classic vehicles, including Ferrari, Alfa Romeo, and Lamborghini. Collector interest is driven by style, performance, and brand legacy.

The United Kingdom has a vibrant classic car culture supported by clubs, events, and strong secondary markets. Historic registrations provide tax and usage benefits. Cross-border movement of vehicles remains active, supported by shared classification standards within the EU and simplified logistics.

Urban regulations are driving owners toward rural usage and private storage. Dedicated driving events, rallies, and museum exhibitions support ongoing demand and preservation. Government recognition of classic vehicles as heritage assets provides some regulatory protection and community support.

Market Outlook

The Europe classic cars market is expected to grow steadily through 2032. Investment appeal, digital infrastructure, and cultural support will continue to shape demand. Restomod vehicles, combining vintage design with modern technology, may expand the buyer base and improve usability.

Restoration and ownership costs will continue to be limiting factors for broad market participation. Regulatory developments regarding emissions and usage zones will influence future operating models. Platforms offering verified documentation, restoration support, and emissions-compliant upgrades may gain competitive advantage.

Manufacturers, collectors, and dealers operating in this market will need to balance authenticity with usability. Integration of sustainable practices and compliance with future regulations will be key to maintaining long-term growth. Investment-led demand is expected to remain strong in the premium vehicle segments.

Download Free Sample Report

About Us:

Credence Research is a viable intelligence and market research platform that provides quantitative B2B research to more than 2000 clients worldwide and is built on the Give principle. The company is a market research and consulting firm serving governments, non-legislative associations, non-profit organizations, and various organizations worldwide. We help our clients improve their execution in a lasting way and understand their most imperative objectives.

Contact Us

Credence Research Inc

North America – +1 304 308 1216

Australia – +61 4192 46279

Asia Pacific – +81 5050 50 9250

+64 22 017 0275

India – +91 6232 49 3207

sales@credenceresearch.com

www.credenceresearch.com