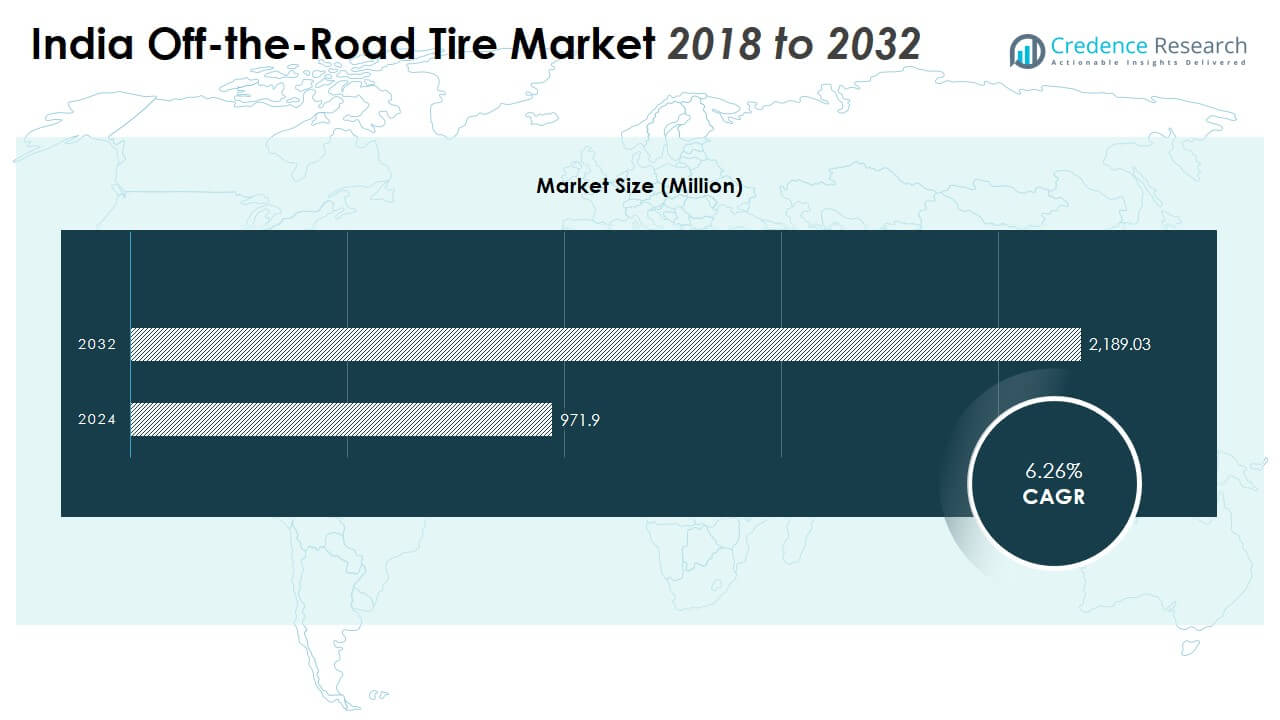

According to a new market report published by Credence Research, “India Off-the-Road Tire Market By Tire Type (Pneumatic Tires, Solid Tires, Bias Tires, Radial Tires, Foam-Filled Tires); By Application (Construction, Mining, Industrial, Others); By Material (Rubber Compound, Reinforcing Material, Others); By Distribution Channel (OEM, After Market) – Growth, Share, Opportunities & Competitive Analysis, 2024 – 2032” The India Off-the-Road (OTR) Tire Market was valued at USD 971.90 million in 2018 and increased to USD 1,326.47 million in 2024. The market is expected to reach USD 2,189.03 million by 2032, expanding at a compound annual growth rate (CAGR) of 6.26% from 2025 to 2032.

Off-the-road tires are designed for use on heavy equipment operating in mining, construction, agriculture, industrial, and other non-paved applications. India’s infrastructure expansion, growing industrialization, and high construction investment are increasing the demand for specialized, durable tire solutions.

Market Driver

Infrastructure Development and Equipment Use Fuel Market Expansion

India’s infrastructure sector is expanding at a rapid pace, driven by government spending and private investments. Under the Sagarmala program, 839 projects worth ₹5.79 lakh crore have been identified, with 272 projects completed and ₹1.41 lakh crore already invested as of March 2025. The Bharatmala Pariyojana targets 34,800km of highways, with over 75% yet to be constructed and completion slated for 2026–27 ensuring a multi‑year project pipeline.

The Smart Cities Mission spans 100 cities, underpinning steady urban development activity. Projects under the Smart Cities Mission, Bharatmala, Sagarmala, and industrial corridors are creating a steady demand for construction equipment. Earthmoving machinery alone accounted for 57.10% of unit sales in 2024, with backhoe loaders contributing more than half of that volume; diesel‑hydraulic platforms represented 95.15% of deliveries, reflecting rugged duty cycles that intensify tire requirements. These machines require durable, load‑bearing, terrain‑adapted off‑road tires.

On the ground, Bharatmala sites employ excavators, backhoe loaders, and wheel loaders extensively, emphasizing the need for high wear, cut, and heat‑resistant OTR tire constructions. The rise in mechanization across the construction sector further increases the number of earthmovers, graders, loaders, and dump trucks. Within equipment mix, telematics‑enabled “connected” assets are spreading, while earthmoving retains the dominant share of unit volumes, reinforcing the scale of OTR tire fitments across fleets.

In addition to public infrastructure, private sector investments in logistics parks, power plants, and port connectivity also contribute to rising OTR tire consumption. Port‑led development under Sagarmala and associated logistics nodes continue to absorb wheel loaders, forklifts, and reach stackers, broadening OTR tire usage beyond earthmoving fleets. As a result, tire suppliers must align their offerings with machinery specifications and evolving site conditions. Matching tread compounds, radial/all‑steel constructions, and load indexes to high‑volume classes (e.g., backhoe loaders and wheel loaders) and duty environments (haul roads, urban paving, port yards) is critical for performance and uptime.

The construction application segment remains the largest consumer, given the pace and scale of ongoing and planned projects, while mining and industrial activity further support this demand illustrated by increasing adoption of all‑steel radial tires for high‑capacity mining trucks and loaders as operations scale.

Browse market data figures spread through 220+ pages and an in-depth TOC on “India OTR Tire Market“

Market Trend

Increasing Shift Toward Radial Tire Technology

The market is experiencing a notable shift from bias tires to radial tires, especially in high-load and long-use applications. Radial tires offer better fuel economy, greater heat dissipation, longer operational life, and lower vibration. These features are essential in industries where equipment operates continuously and under extreme conditions.

Radialization also reduces tire pressure on the ground, which minimizes wear on surfaces and decreases fuel consumption. These benefits align with the needs of the mining and heavy construction sectors, where operational efficiency is essential.

Leading domestic manufacturers are investing in radial tire production to meet increasing demand and compete with multinational brands. Partnerships between tire makers and equipment manufacturers are supporting this transition by offering factory-fitted radial options.

With rising awareness among fleet operators about total cost of ownership, radial tires are gaining preference despite their higher upfront costs. Over the forecast period, radial tires are expected to see accelerated adoption, especially in mining and infrastructure projects.

Market Challenge

Price Instability of Natural Rubber and Import Dependency

Natural rubber is a critical raw material in tire manufacturing. The Indian OTR tire sector is heavily dependent on rubber prices, which are subject to volatility due to weather patterns, global demand, and geopolitical conditions. Domestic rubber production often falls short of industrial demand, leading to reliance on imports.

This price instability affects cost structures across manufacturers, especially for small and mid-sized firms. Currency exchange risks further increase procurement costs, reducing profit margins. Long lead times for imports also complicate inventory planning.

The tire industry also faces supply disruptions caused by regulatory shifts in producing countries. Environmental restrictions, trade controls, or labor shortages can constrain rubber supply, creating cost pressures.

To address this challenge, some manufacturers are increasing synthetic rubber usage and developing compounds that use lower quantities of natural rubber. However, performance and durability must be maintained, especially in demanding off-road conditions, limiting rapid substitution.

Market Segmentation

By Tire Type

- Pneumatic Tires

- Solid Tires

- Bias Tires

- Radial Tires

- Foam-Filled Tires

By Application

- Construction

- Mining

- Industrial

- Others

By Material

- Rubber Compound

- Reinforcing Material

- Others

By Distribution Channel

- OEM

- After Market

By Geography

- North India

- West India

- South India

- East India

- Central India

Key Player Analysis

- Apollo Tyres Limited

- Balkrishna Industries Limited

- Bridgestone Corporation

- CEAT Limited

- Continental AG

- JK Tyre & Industries Limited

- Michelin

- MRF Limited

- The Goodyear Tyre & Rubber Company

- The Yokohama Rubber Co. Ltd.

About Us:

Credence Research is a viable intelligence and market research platform that provides quantitative B2B research to more than 2000 clients worldwide and is built on the Give principle. The company is a market research and consulting firm serving governments, non-legislative associations, non-profit organizations, and various organizations worldwide. We help our clients improve their execution in a lasting way and understand their most imperative objectives.

Contact Us

Credence Research Inc

North America – +1 304 308 1216

Australia – +61 4192 46279

Asia Pacific – +81 5050 50 9250

+64 22 017 0275

India – +91 6232 49 3207

sales@credenceresearch.com

www.credenceresearch.com