| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| 5G Tester Market Size 2024 |

USD 3,753.49 million |

| 5G Tester Market, CAGR |

8.4% |

| 5G Tester Market Size 2032 |

USD 7,121.29 million |

Market Overview:

The Global 5G Tester Market size was valued at USD 2,850.00 million in 2018 to USD 3,753.49 million in 2024 and is anticipated to reach USD 7,121.29 million by 2032, at a CAGR of 8.4% during the forecast period.

Strong market drivers include the accelerating deployment of 5G infrastructure across the telecom, automotive, healthcare, and industrial sectors. Telecom operators are investing heavily in network densification, including small cell installations and massive MIMO systems, which demand precise and high-capacity testing tools. The increasing adoption of technologies such as network slicing, beamforming, edge computing, and virtualized radio access networks has added complexity to 5G networks, necessitating more advanced and flexible testing solutions. The rising penetration of connected devices and IoT applications also amplifies the need for comprehensive testing to ensure interoperability, minimal latency, and uninterrupted connectivity. In parallel, enterprises are deploying private 5G networks, particularly in manufacturing and logistics, further expanding the application of testers beyond traditional telecom domains. This growing complexity across multiple layers of the 5G ecosystem continues to drive innovation in cloud-based testing, remote monitoring, and automation.

Regionally, the Asia Pacific region leads the Global 5G Tester Market due to strong government support, significant investments in infrastructure, and the presence of major telecom and electronics manufacturers in China, Japan, South Korea, and India. The region is characterized by large-scale 5G network deployments, widespread consumer device manufacturing, and a competitive landscape that fosters continuous innovation. North America maintains a substantial share, driven by advanced technology adoption in the U.S. and Canada, especially in autonomous vehicles, smart cities, and enterprise connectivity. The market in Europe is shaped by regulatory support for interoperability and green network initiatives, with countries like Germany, the UK, and France emphasizing Open RAN development and testing. Emerging regions such as Latin America, the Middle East, and Africa are gradually scaling up 5G infrastructure and leveraging vendor partnerships to introduce affordable testing solutions. These regions show increasing demand for field testing, device validation, and network monitoring, laying the groundwork for long-term growth across the global 5G tester landscape.

Market Insights:

- The Global 5G Tester Market was valued at USD 2,850.00 million in 2018, reached USD 3,753.49 million in 2024, and is projected to grow to USD 7,121.29 million by 2032, at a CAGR of 8.4% during the forecast period.

- Accelerated deployment of 5G infrastructure across telecom, automotive, industrial, and healthcare sectors is increasing demand for high-capacity, precise testing tools capable of validating latency, coverage, and network performance.

- The rising complexity of 5G-enabled devices and applications is driving the need for advanced testing tools that ensure real-time compliance, throughput, and performance across diverse network conditions.

- Industrial adoption of 5G in mission-critical areas like manufacturing, smart cities, and connected vehicles is boosting the demand for testers that validate ultra-reliable and low-latency communications.

- Integration of AI, machine learning, and cloud-based analytics into 5G test platforms is reshaping the market with virtualized testing environments, real-time diagnostics, and automated fault detection capabilities.

- High costs of mmWave and advanced 5G testing equipment pose adoption challenges for small and mid-sized operators, requiring vendors to offer modular, scalable, and cost-efficient testing solutions.

- Asia Pacific leads the market with large-scale deployments in China, Japan, South Korea, and India, while North America and Europe show strong momentum; emerging regions like Latin America, the Middle East, and Africa are steadily increasing investments in 5G infrastructure and testing tools.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Surge in 5G Deployments and Network Infrastructure Modernization is Fueling Demand for Test Equipment:

The rapid global rollout of 5G infrastructure is a primary driver of the Global 5G Tester Market. Telecom operators are accelerating investments in base stations, small cells, and core networks to meet growing consumer and enterprise data demands. These developments create an urgent need for reliable testing solutions that can validate network performance, latency, coverage, and interoperability. Equipment must support both non-standalone and standalone 5G architectures, ensuring seamless integration with legacy systems. Testers also help identify vulnerabilities in new frequency bands, particularly mmWave and sub-6 GHz. The expanding infrastructure landscape necessitates precise, scalable, and future-proof testing platforms.

- For instance, Keysight Technologies’ 5G Network Visibility Solutions are used by Vodafone, which serves over 330 million customers, to ensure high-quality mobile broadband experiences during 5G transitions. Keysight’s 5G test solutions have supported more than 600 validated test cases for major U.S. mobile operators and are deployed in over 120 countries.

Rising Complexity in 5G Devices and Applications Is Driving Advanced Testing Capabilities:

The growing variety of 5G-enabled devices, including smartphones, routers, autonomous systems, and IoT modules, is increasing the need for comprehensive testing tools. Each device requires validation under different environmental and network conditions, making performance, compliance, and interoperability testing critical. The Global 5G Tester Market is benefitting from this complexity, with vendors developing high-precision test instruments that simulate real-world usage scenarios. 5G testers enable engineers to evaluate antenna performance, signal quality, and data throughput across multiple use cases. It also helps manufacturers maintain product quality while reducing time to market. Advanced testers are supporting evolving standards, including 3GPP releases, to ensure compatibility and certification.

- For instance, the Rohde & Schwarz R&S CMX500 radio communication tester supports 5G NR protocol conformance testing, with 41 test cases accepted by the Global Certification Forum (GCF) for different FR1 and LTE band combinations. The CMX500 is widely used in R&D, conformance, and device certification labs for its advanced features and scalability.

Emergence of Industry 4.0 and Mission-Critical Use Cases is Increasing 5G Testing Requirements:

The adoption of 5G in mission-critical sectors like healthcare, automotive, manufacturing, and public safety is pushing the need for rigorous testing protocols. Industrial use cases demand ultra-low latency, high reliability, and seamless mobility, making performance assurance vital before deployment. The Global 5G Tester Market is responding with purpose-built solutions for industrial automation, smart cities, and connected vehicles. These testers evaluate KPIs such as network slicing, beamforming efficiency, and handover success rates. They also support testing of private 5G networks, which enterprises are increasingly deploying for internal operations. It is essential to verify these networks under varied stress conditions to ensure system integrity.

Advancements in Virtual Testing and AI-Powered Analytics Are Reshaping Testing Ecosystems:

The shift toward cloud-native and software-defined networks is transforming the testing environment. Vendors are integrating AI, machine learning, and big data analytics into 5G test platforms to provide predictive insights and automate fault detection. These technologies enable continuous monitoring and simulation of network behavior under diverse conditions, improving reliability and reducing manual intervention. The Global 5G Tester Market is evolving beyond traditional hardware-based testing, with virtualized solutions gaining prominence in lab and field testing. It allows telecom operators and OEMs to reduce operational costs while increasing testing speed and flexibility. The move toward automated and software-driven testing aligns with the dynamic nature of 5G networks.

Market Trends:

Proliferation of Multi-Vendor Ecosystems Is Shaping Interoperability Testing Needs:

The transition to open and disaggregated network architectures is encouraging telecom operators to integrate solutions from multiple vendors. This shift is driving a significant trend toward interoperability testing, where 5G testers must validate the seamless functioning of hardware and software components sourced from different suppliers. Open RAN initiatives, for example, demand rigorous multi-vendor validation across layers of the radio access network. The Global 5G Tester Market is seeing a surge in demand for flexible and adaptable testing platforms that support diverse interfaces and protocols. It is critical for operators to avoid service disruptions and optimize integration timelines. The ability to test hybrid environments efficiently is becoming a key value proposition for test equipment providers.

- For instance, VIAVI Solutions’ TM500 O-RU Tester is used in automated Open RAN Lab-as-a-Service facilities, offering over 500 test cases compliant with O-RAN and 3GPP specifications.

Integration of Virtual Reality, Augmented Reality, and Gaming Applications Is Influencing Use Case-Specific Testing:

Next-generation user experiences powered by VR, AR, and cloud gaming are gaining traction across consumer and enterprise domains. These applications demand ultra-low latency, high throughput, and consistent performance under varying network loads. Testers are now being optimized to simulate such bandwidth-intensive scenarios and validate performance at the edge. The Global 5G Tester Market is responding with tools tailored to content delivery networks, mobile edge computing, and immersive service environments. It must support end-to-end testing of the user experience, from core network to application layer. This trend is prompting testers to incorporate Quality of Experience (QoE) metrics into standard testing protocols.

- For instance, Spirent Communications reported over 50 unique 5G Standalone (SA) customer engagements in 2024, with a strong focus on quality-of-experience (QoE) testing for services like gaming, voice over new radio (VoNR), and multi-access edge computing (MEC). These engagements highlight the industry’s emphasis on end-to-end user experience validation in commercial and pre-commercial 5G deployments.

Growing Adoption of Cloud-Native 5G Networks Is Driving Testing in DevOps Environments:

5G core networks are increasingly deployed on cloud-native platforms using microservices, containers, and orchestration tools like Kubernetes. This shift is promoting a DevOps-centric approach to network development, where continuous integration and continuous testing are vital. The Global 5G Tester Market is aligning with this trend by offering cloud-compatible, API-driven, and automated testing frameworks. It enables operators and developers to validate functions across CI/CD pipelines, ensuring faster deployment cycles without compromising quality. Virtual test functions and containerized testing solutions are gaining popularity in lab and pre-deployment environments. The focus is moving toward real-time testing, dynamic scalability, and rapid issue resolution.

Rising Importance of Energy Efficiency and Sustainability in 5G Networks Is Reflecting in Test Strategies:

Telecom providers are under pressure to reduce the energy consumption of 5G infrastructure, particularly with the high density of small cells and massive MIMO deployments. This has led to a growing emphasis on testing energy efficiency at both component and system levels. The Global 5G Tester Market is evolving to include energy profiling tools that measure power usage under various operating conditions. It enables equipment vendors and network operators to identify energy-saving opportunities during design and operation. Testers are also supporting compliance with emerging green standards and sustainability benchmarks. This trend underscores a broader industry shift toward environmentally conscious 5G deployment practices.

Market Challenges Analysis:

High Cost of Advanced Testing Equipment and Limited Budget Allocation by End Users Restrain Market Growth:

The cost of 5G testing equipment remains a major challenge, particularly for small and mid-sized telecom operators, OEMs, and research institutions. Advanced testers capable of handling mmWave frequencies, network slicing, beamforming, and high-throughput validation require substantial investment. Many organizations face budget constraints that prevent them from upgrading legacy test systems to support 5G requirements. The Global 5G Tester Market must navigate this barrier by offering scalable, modular, or rental-based solutions. It faces pressure to balance technological innovation with affordability to widen adoption. Delayed ROI and the high total cost of ownership also discourage early-stage adopters in price-sensitive markets.

Rapid Evolution of 5G Standards and Network Architectures Creates Testing Complexity:

The continuous evolution of 5G standards across 3GPP releases challenges test solution providers to keep pace with changing requirements. Each update introduces new use cases, spectrum bands, and features such as URLLC, network slicing, or private networks, all of which require validation. The Global 5G Tester Market struggles with the need to deliver agile and upgradeable tools that accommodate frequent protocol changes. Testing in dynamic multi-layer environments, across core, RAN, and edge, adds to the complexity. Inconsistent regulatory frameworks and varied spectrum policies across regions further complicate product standardization. It must ensure backward compatibility while supporting future releases to maintain relevance and customer trust.

Market Opportunities:

Expansion of Private 5G Networks Across Enterprises Is Creating New Testing Revenue Streams:

Enterprises in sectors such as manufacturing, logistics, healthcare, and energy are deploying private 5G networks to improve operational efficiency, security, and automation. These deployments require robust and customized testing solutions to validate performance, reliability, and compliance before full-scale rollouts. The Global 5G Tester Market can tap into this opportunity by offering application-specific testing tools tailored to unique enterprise requirements. It enables vendors to provide end-to-end validation for latency, coverage, and mobility in controlled environments. Rising demand for localized networks in smart factories and critical infrastructure is expanding the customer base beyond telecom operators. This shift is broadening the market’s addressable scope.

Growing Emphasis on 6G Research and Prototyping Opens Long-Term Testing Potential:

Global investment in 6G research and early prototyping is accelerating, with governments, universities, and tech companies exploring next-generation network technologies. The Global 5G Tester Market has an opportunity to align with this trend by developing forward-compatible testing platforms that support terahertz frequency bands, ultra-low latency, and AI-native architecture. It can position itself as a bridge between current 5G capabilities and future network paradigms. Early involvement in 6G testing frameworks allows solution providers to establish long-term relevance and secure strategic collaborations. This early groundwork supports innovation and revenue growth beyond the 5G lifecycle.

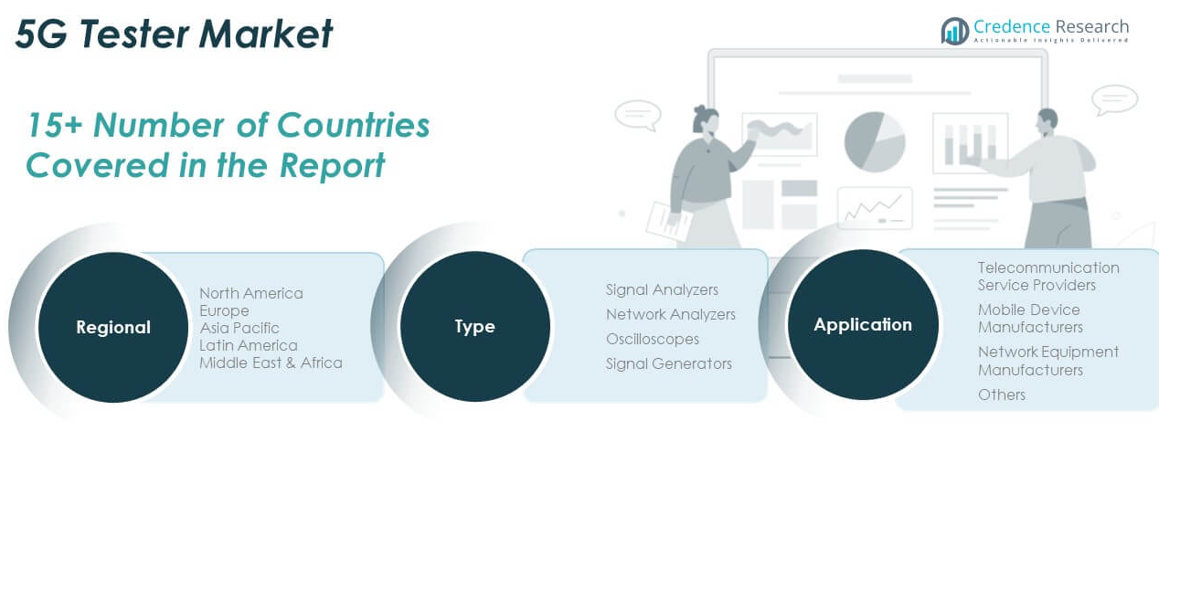

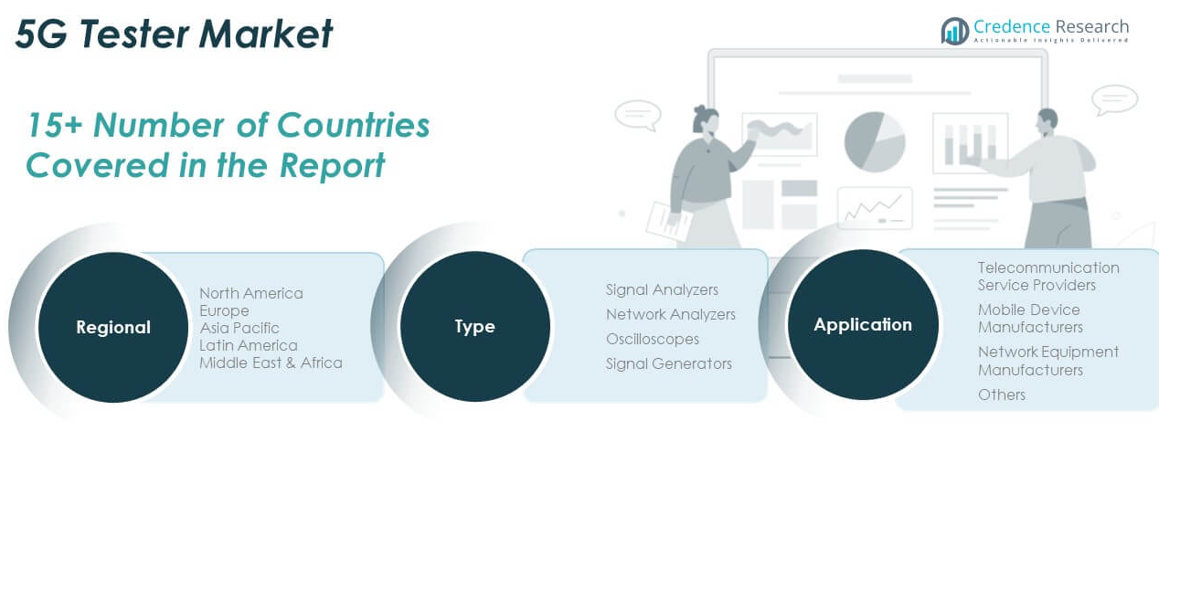

Market Segmentation Analysis:

By Type

The Global 5G Tester Market is segmented into signal analyzers, network analyzers, oscilloscopes, and signal generators. Signal analyzers account for a significant share, driven by their ability to measure signal characteristics such as power, frequency, and modulation accuracy, which are critical for ensuring compliance with 5G standards. Network analyzers are widely used to test signal integrity, impedance, and S-parameters, especially in antenna and RF component design. Oscilloscopes play an important role in debugging high-speed digital and analog signals, making them essential for validating signal timing and waveform accuracy in 5G circuits. Signal generators enable engineers to create precise test signals for evaluating device performance and stress-testing network components under simulated field conditions.

- For instance, the Anritsu MS2850A signal analyzer offers a maximum analysis bandwidth of 1 GHz and a frequency range up to 44.5 GHz, supporting simultaneous analysis of up to eight 100 MHz 5G carriers. This capability is essential for accurate measurement of 5G NR signals in both sub-6 GHz and mmWave bands.

By Application

The application segment includes telecommunication service providers, mobile device manufacturers, network equipment manufacturers, and others. Telecommunication service providers lead the market, using 5G testers to validate coverage, reduce network latency, and enhance reliability during rollouts. Mobile device manufacturers employ these tools to ensure device interoperability, radio frequency compliance, and optimal data throughput. Network equipment manufacturers depend on testers to assess performance of infrastructure components such as small cells, antennas, and base stations. The “others” category includes R&D institutions and regulatory bodies that rely on testers for standard compliance and advanced prototyping. The Global 5G Tester Market supports these diverse applications through increasingly specialized and integrated testing platforms.

- For instance, Nokia’s AirScale 5G base stations, validated using Keysight’s 5G test solutions, achieved verified peak data rates of 4.7 Gbps in commercial network deployments, demonstrating compliance with 3GPP standards and supporting high-performance 5G rollouts.

Segmentation:

By Type:

- Signal Analyzers

- Network Analyzers

- Oscilloscopes

- Signal Generators

By Application:

- Telecommunication Service Providers

- Mobile Device Manufacturers

- Network Equipment Manufacturers

- Others

By Region:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Regional Analysis:

North America: Mature Market with Strong Innovation Backbone

The North America 5G Tester Market size was valued at USD 867.83 million in 2018 to USD 1,126.40 million in 2024 and is anticipated to reach USD 2,133.55 million by 2032, at a CAGR of 8.4% during the forecast period.

North America holds a leading position in the Global 5G Tester Market due to early technology adoption, strong regulatory support, and the presence of top-tier vendors. The U.S. drives innovation with high demand for advanced testing in autonomous systems and industrial IoT. Canada and Mexico are strengthening their telecom infrastructure, contributing to regional growth. mmWave and ultra-low-latency applications are major focus areas. It supports high R&D activity, enabling faster commercialization of 5G services.

Europe: Emphasis on Open Standards and Interoperability

The Europe 5G Tester Market size was valued at USD 550.62 million in 2018 to USD 686.79 million in 2024 and is anticipated to reach USD 1,203.16 million by 2032, at a CAGR of 7.3% during the forecast period.

Europe is steadily expanding its 5G capabilities, with a focus on interoperability and Open RAN testing frameworks. Countries like Germany, the UK, and France lead in smart city and industrial use case deployments. Regulatory compliance with EU telecom directives requires precise multi-layer network testing. It experiences stable demand for protocol, RF, and security testing tools. Partnerships between government bodies and private tech firms accelerate regional adoption of 5G testing platforms.

Asia Pacific: Rapid Expansion and High-Volume Testing Demand

The Asia Pacific 5G Tester Market size was valued at USD 1,162.23 million in 2018 to USD 1,571.38 million in 2024 and is anticipated to reach USD 3,169.69 million by 2032, at a CAGR of 9.2% during the forecast period.

Asia Pacific leads the Global 5G Tester Market in terms of both growth and deployment scale. China, South Korea, Japan, and India are investing heavily in 5G infrastructure. It sees strong demand for end-to-end testing across RAN, core, and devices. Governments promote spectrum allocation and network densification, creating opportunities for vendors. Local test solution providers are gaining momentum, offering cost-effective and region-specific tools. High device manufacturing volume in the region drives extensive pre-launch validation efforts.

Latin America: Emerging Opportunities through Telecom Modernization

The Latin America 5G Tester Market size was valued at USD 145.92 million in 2018 to USD 189.89 million in 2024 and is anticipated to reach USD 328.08 million by 2032, at a CAGR of 7.2% during the forecast period.

Latin America is an emerging market with increasing momentum in telecom modernization and 5G pilot projects. Brazil, Mexico, and Argentina are at the forefront of regional adoption. The demand for versatile and cost-effective testers is rising among operators managing hybrid network environments. It shows potential in mobile network testing and spectrum monitoring. Public sector involvement in spectrum auctions is driving infrastructure investments. Vendors are targeting the region through channel partnerships and technology transfer.

Middle East: Investment in Smart Cities and Industrial Connectivity

The Middle East 5G Tester Market size was valued at USD 69.83 million in 2018 to USD 82.93 million in 2024 and is anticipated to reach USD 132.50 million by 2032, at a CAGR of 6.1% during the forecast period. Middle Eastern countries such as the UAE, Saudi Arabia, and Qatar are investing heavily in digital transformation and smart city projects. The market focuses on high-speed network validation and latency testing for public and private deployments. It emphasizes testing tools that support mission-critical applications in oil & gas, defense, and logistics. 5G rollout strategies tied to national vision programs further drive tester adoption. Field testing, spectrum analysis, and cloud-native network validation are key trends.

Africa: Gradual Adoption with Focus on Foundational Testing

The Africa 5G Tester Market size was valued at USD 53.58 million in 2018 to USD 96.10 million in 2024 and is anticipated to reach USD 154.31 million by 2032, at a CAGR of 5.7% during the forecast period.

Africa remains in the early stages of 5G adoption, with countries like South Africa, Nigeria, and Egypt initiating pilot rollouts. The focus is on foundational conformance testing and device connectivity validation. It presents potential in healthcare, education, and rural broadband applications. Infrastructure gaps pose a challenge, but public-private initiatives aim to improve coverage and capacity. Vendors are entering the market through partnerships and capacity-building programs. The region shows promise for mobile-first use cases and affordable testing solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Keysight Technologies

- Rohde & Schwarz GmbH & Co. KG

- Anritsu

- VIAVI Solutions

- Teradyne Inc.

- Spirent Communications

- LitePoint

Competitive Analysis:

The Global 5G Tester Market is highly competitive, with a concentrated presence of key players that possess strong technical capabilities and established industry relationships. Leading companies such as Keysight Technologies, Rohde & Schwarz, Anritsu, VIAVI Solutions, Teradyne Inc., Spirent Communications, and LitePoint dominate the market through continuous innovation and comprehensive product portfolios. These vendors focus on delivering advanced testing solutions that support evolving 5G features including mmWave, beamforming, and network slicing. The market demands high accuracy, scalability, and integration with automation and cloud platforms. Companies are expanding their market share through strategic partnerships with telecom operators, equipment manufacturers, and regulatory agencies. The Global 5G Tester Market relies on rapid adaptation to 3GPP standard changes and customer-specific needs. Differentiation is driven by performance, software capabilities, cost efficiency, and customer support. Emerging players face high entry barriers due to the complexity of 5G technology and the dominance of incumbent brands.

Recent Developments:

- In June 2025, Keysight Technologies showcased its latest microwave and radio frequency innovations at the IEEE MTT-S International Microwave Symposium (IMS) 2025. The company introduced next-generation RF circuit simulation and optimization tools, as well as the Advanced Design System (ADS) 2025 for 3D heterogeneous integration of RF modules. These solutions are designed to accelerate 5G network optimization and support the development of 6G technologies. Keysight also demonstrated its collaboration with Siemens to ensure performance assurance of industrial 5G networks, using the Nemo Cloud solution for real-time monitoring of private 5G networks in manufacturing environments.

- In June 2025, Spirent Communications launched a scalable over-the-air (OTA) solution to enable true end-to-end network testing with real handsets. This new solution supports comprehensive 5G Standalone (SA) and 5G-Advanced testing, addressing performance, security, and customer experience validation for service providers and network equipment manufacturers. Spirent’s 2025 5G Report highlighted over 50 unique 5G SA customer engagements in the previous year, with a focus on quality-of-experience (QoE) testing for services such as gaming, voice over new radio (VoNR), and multi-access edge computing (MEC).

- In March 2025, Anritsu completed the acquisition of a 32.72% stake in SmartViser, a French company specializing in test automation and remote monitoring solutions for mobile networks and devices. This strategic partnership aims to enhance Anritsu’s capabilities in delivering advanced testing solutions for telecommunications, combining SmartViser’s automation expertise with Anritsu’s communications test technologies. Additionally, in April 2025, Anritsu announced a strategic partnership with DEWETRON to expand innovation in battery and vehicle testing, and in March 2025, launched the Virtual Signalling Tester NR Software MX844030PC, a software-based test simulator for 5G IoT chipsets and devices.

- In March 2025, VIAVI Solutions expanded its Automated Lab-as-a-Service for Open RAN (VALOR™) testing facility with the industry’s first RF-shielded anechoic chamber for Massive MIMO and beamforming over-the-air (OTA) validation. This new test-as-a-service offering enables system-level Massive MIMO performance testing for up to 16 parallel spatial layers. In April 2025, VIAVI also announced a collaboration with TCS to co-create an end-to-end test framework for O-RAN device interoperability, further strengthening its portfolio of 5G Open RAN test solutions.

Market Concentration & Characteristics:

The Global 5G Tester Market is moderately concentrated, with a few major players holding a significant share due to their technological expertise, extensive product lines, and strong industry relationships. It is characterized by high entry barriers, including the need for specialized engineering, regulatory compliance, and continuous R&D investment. The market exhibits a strong focus on innovation, with rapid product cycles and demand for multi-functional, software-driven testing platforms. It serves a broad customer base, including telecom operators, device manufacturers, component suppliers, and enterprise network developers. Customization, real-time analytics, and cloud-native capabilities define competitive offerings. The market favors vendors that can quickly adapt to evolving 3GPP standards and customer-specific requirements.

Report Coverage:

The research report offers an in-depth analysis based on type and application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Global 5G Tester Market will see strong demand from telecom operators as 5G standalone deployments accelerate globally.

- Growth in private 5G networks across manufacturing, logistics, and healthcare will drive specialized testing solutions.

- AI and machine learning integration will enhance automated testing, predictive diagnostics, and real-time analytics.

- mmWave adoption will expand the need for high-frequency testing tools with advanced signal analysis capabilities.

- Cloud-native architectures and virtualized networks will increase demand for software-based and remote testing platforms.

- Device proliferation, including IoT modules and edge devices, will require compact, scalable testing solutions.

- Open RAN implementations will create opportunities for interoperability and multi-vendor conformance testing.

- Compliance with evolving 3GPP releases and global spectrum regulations will keep test solutions in continuous demand.

- Strategic collaborations between testing vendors and chipset or infrastructure providers will shape product innovation.

- Emerging economies will contribute to market expansion through network modernization and pilot 5G deployments.