Market Overview

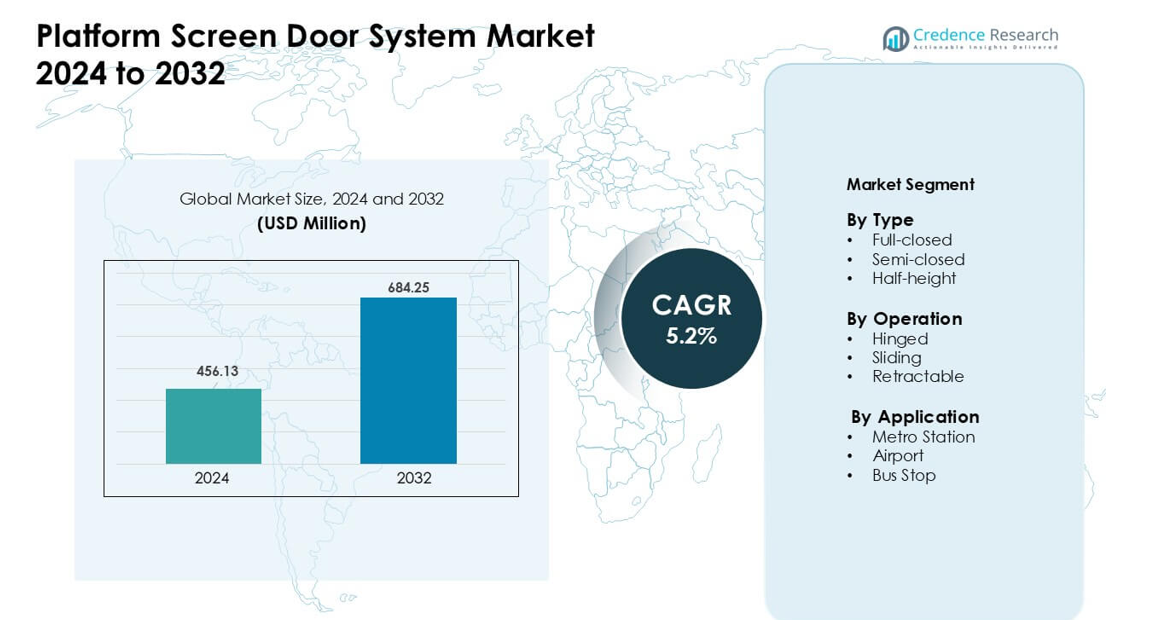

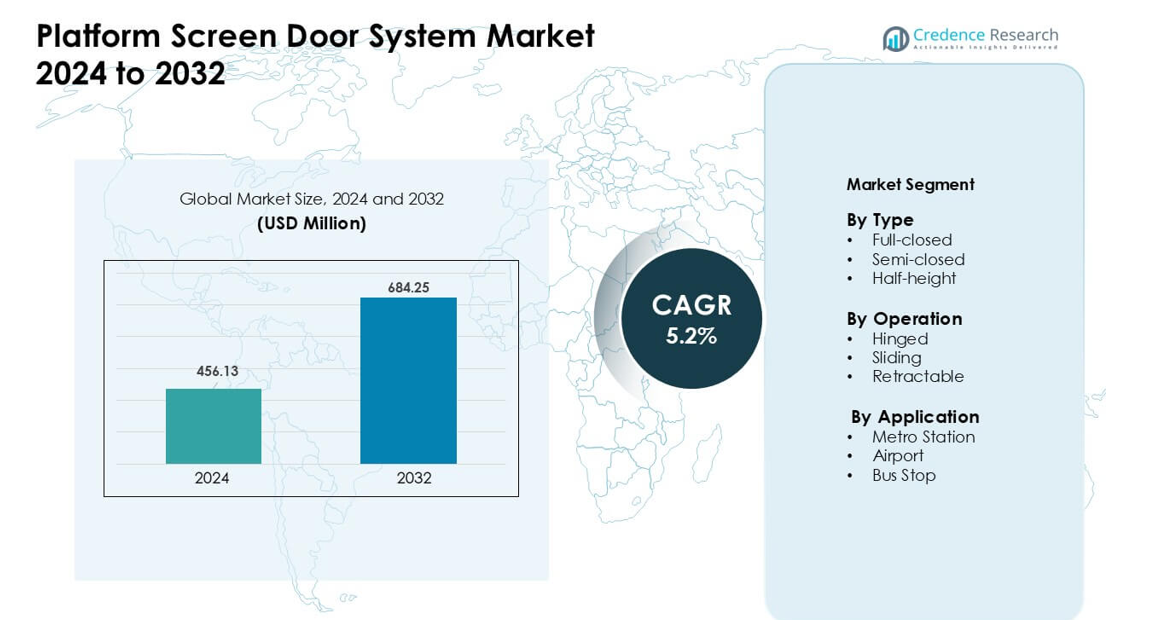

Platform Screen Door System Market was valued at USD 456.13 million in 2024 and is anticipated to reach USD 684.25 million by 2032, growing at a CAGR of 5.2 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Platform Screen Door System Market Size 2024 |

USD 456.13 million |

| Platform Screen Door System Market, CAGR |

5.2% |

| Platform Screen Door System Market Size 2032 |

USD 684.25 million |

The Platform Screen Door System Market includes major players such as Schaltbau Holding AG, Samjung Tech Co., Ltd., Nippon Signal Co., Ltd., Singapore Technologies Engineering Ltd, Nanjing Kangni Mechanical & Electrical Co., Ltd., Overhead Door Corporation, Kyosan Electric Manufacturing Co., Ltd., Westinghouse Air Brake Technologies Corp (Wabtec Corporation), Zhuzhou CRRC Times Electric Co., Ltd., and Knorr-Bremse AG. These companies compete through advanced safety features, automation-ready designs, and large metro project portfolios. Asia-Pacific remained the leading region in 2024, holding about 48% market share, driven by rapid metro expansion, high commuter density, and strong government investment in automated transit systems.

Market Insights

- The Platform Screen Door System Market reached USD 456.13 million in 2024 and is projected to hit USD 684.25 million by 2032 at a CAGR of 5.2%.

- Strong safety mandates and expanding metro networks drive demand, with full-closed systems holding the largest share due to high protection and operational control.

- Automation trends continue to rise, with sliding-door systems dominating as cities adopt smart rail technologies and faster boarding solutions.

- Competition intensifies as key players enhance sensor accuracy, reduce maintenance needs, and target retrofit projects across mature transit systems. High installation costs and geometric constraints on curved platforms remain major restraints.

- Asia-Pacific led the market with about 48% share, followed by Europe at nearly 23% and North America at 19%, while metro stations accounted for the dominant application share at 68% in 2024.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Full-closed systems led the type segment in 2024 with about 54% share. Transit agencies favored these systems due to strong safety control, noise reduction, and better climate efficiency on platforms. Full-closed designs also helped rail operators cut accidental track intrusions and align with rising global safety norms. Semi-closed and half-height doors grew in cost-sensitive networks, yet demand stayed lower as these formats provide limited isolation. Rapid metro expansion in Asia and Europe kept full-closed systems in a strong leadership position.

- For instance, Seoul Metro in South Korea has installed automated full‑height platform screen doors at over 300 of its stations nearly its entire network using laser‑ or sensor‑based PSD systems

By Operation

Sliding doors dominated this segment in 2024 with nearly 62% share. Urban rail networks chose sliding units for smooth motion, high durability, and seamless integration with platform edges. These doors handled heavy passenger flow and reduced maintenance downtime, which supported wider adoption across high-density cities. Hinged and retractable systems saw smaller uptake due to higher mechanical complexity or limited suitability. Growing upgrades of legacy door systems continued to push sliding designs ahead.

- For instance, global train‑door equipment data shows that sliding plug doors remain the most widely deployed door mechanism in metro and suburban trains particularly in Asia and Europe, where they account for a leading share among all train‑door types.

By Application

Metro stations held the lead in 2024 with about 68% share. Large city networks adopted platform screen doors to raise passenger safety, cut delay risks, and improve air management in tunnels. Strong investment in new metro lines across China, India, and the Middle East sustained growth. Airports and bus stops expanded slowly as projects focused on selective lanes or premium terminals. Rising urban congestion and demand for automated rail services kept metro stations as the core application for platform screen door systems.

Key Growth Drivers

Rising Focus on Passenger Safety and Accident Prevention

Growing concern over platform accidents continues to push global transit operators toward platform screen door system adoption. Passenger fall incidents, intrusion risks, and track-level hazards drive authorities to install protective barriers that ensure controlled platform access. Many high-density metro networks now mandate safety shields, which boosts deployment in new and existing stations. Modern PSD systems reduce human error by synchronizing train and door movement, which creates predictable boarding patterns. Operators also improve punctuality by cutting track disruptions. These safety gains align with strict regulatory frameworks in Asia and Europe, where authorities push for higher standards in public rail transport. Strong public demand for safer transit conditions supports this shift.

- For instance, the Seoul Metro (South Korea) installed full-height PSDs across 121 of its stations between 2005 and 2012. After installation, fatal subway suicides dropped by 89%.

Expansion of Urban Metro Networks in Developing Economies

Large-scale metro expansion in developing countries remains a strong growth engine for the platform screen door system market. Governments invest heavily in mass transit to manage congestion, reduce pollution, and support sustainable mobility. China, India, the UAE, and Southeast Asian nations plan new rail corridors that require standardized platform barriers for operational safety and automation. PSD systems also support advanced train control technologies that modern networks now adopt, making them essential for high-frequency routes. As more cities pursue urban rail development, demand for full-closed and sliding-door PSD solutions increases. These markets also favor long-term contracts for installation and maintenance, creating stable revenue cycles. Growing public preference for reliable rail transport further strengthens market momentum.

- For instance, in systems like Seoul Metro, the retrofitting of full‑height PSDs across existing stations enabled cleaner, controlled platform environments reducing dust and noise, and iproving climate control by isolating platforms from tunnel airflow.

Integration of Automation and Smart Transit Technologies

Digital transformation across public transportation drives stronger adoption of platform screen doors. Modern rail systems use automation to raise service precision, and PSDs play a key role in this shift by enabling driverless and semi-autonomous train operations. The doors enhance synchronization accuracy, reduce dwell time variation, and help maintain tight schedules. Smart sensors, IoT modules, and predictive maintenance tools also enter PSD infrastructure, improving uptime and system responsiveness. These enhancements reduce operational cost for transit agencies and extend equipment life cycles. As cities embrace smart mobility plans, platform doors become a foundational element in automated metro ecosystems. Their compatibility with advanced signaling systems further attracts global operators.

Key Trend & Opportunity

Growth in Retrofit Projects for Aging Metro Infrastructure

A major opportunity lies in upgrading legacy metro systems that lack platform safety barriers. Many mature networks in Europe, North America, and parts of Asia now launch retrofit campaigns to boost safety without full station reconstruction. Advances in modular PSD designs allow easier installation in narrow or curved platforms, which once hindered adoption. Retrofit-friendly systems reduce downtime and help authorities meet new safety standards. Vendors that offer flexible engineering, custom door profiles, and advanced synchronization software gain a competitive edge. Public awareness and regulatory pressure strengthen the case for retrofits, turning older networks into a significant revenue pool.

- For instance, modular PSD systems from global suppliers such as Knorr‑Bremse are explicitly designed to support retrofit allowing installation in older stations without major station‑wide reconstruction.

Adoption of Energy-Efficient and Low-Maintenance PSD Designs

Transit operators now seek solutions that reduce energy consumption and long-term service costs. Manufacturers respond with lightweight materials, improved motor efficiency, and enhanced ventilation integration in platform door structures. These innovations help reduce HVAC load at stations by supporting better climate control. Predictive maintenance features also cut repair expenses and reduce downtime. As agencies push for sustainable transit systems, PSD suppliers that offer greener and maintenance-optimized designs stand to benefit. The shift toward eco-friendly metro operations creates new opportunities for advanced PSD technology providers.

- For instance, during the first retrofit of PSDs on an active metro system, MTRCL’s project in Hong Kong not only enhanced safety but also reportedly helped reduce peak‑hour station temperatures from over 30 °C to about 25 °C, improving passenger comfort and reducing air‑conditioning load.

Increasing Use of AI and Sensor-Driven Monitoring Systems

AI-enabled monitoring tools create new growth opportunities by improving system reliability and passenger flow management. Platforms now use thermal sensors, crowd analytics, and fault-detection algorithms that enhance PSD performance and safety. These tools prevent mechanical failure, detect obstruction patterns, and optimize door timing. Transit agencies value these features because they support smoother operations during peak hours and unexpected congestion. The continued expansion of smart station ecosystems accelerates PSD digital integration. This shift boosts demand for intelligent door systems with embedded analytics and real-time diagnostics.

Key Challenge

High Installation and Retrofit Cost Burden

The initial cost of platform screen door systems remains a major barrier for adoption, especially in cost-sensitive markets. Full-closed variants require complex structural work, electrical integration, and synchronization systems that push installation budgets higher. Retrofit projects are even more expensive due to platform constraints and service disruptions. Many transit agencies in emerging economies delay adoption because they lack large upfront capital. These cost challenges slow market penetration and force vendors to innovate cost-efficient, modular designs. Balancing performance, safety, and affordability remains a key challenge across global networks.

Technical Limitations on Curved and Narrow Platforms

Platform geometry constraints hinder PSD deployment in several older metro systems. Curved platforms create alignment issues with train doors, while narrow platforms leave insufficient space for support structures. These constraints lead to higher engineering costs and longer installation timelines. Some networks face operational risk during adaptation of legacy signaling and rolling stock with new PSD systems. Vendors must develop more adaptable designs to overcome these barriers. Despite progress in modular and flexible solutions, geometric challenges still limit adoption across many mature metro lines.

Regional Analysis

North America

North America held about 19% share of the Platform Screen Door System Market in 2024, supported by rising upgrades in metro and airport transit hubs. Large cities invested in PSD installations to cut track-related accidents and improve operational safety. Modernization of legacy networks in the U.S. and Canada also boosted demand for half-height and sliding door systems. Growth remained steady as transit agencies adopted automation and sensor-driven monitoring tools. Federal and state-level funding for rail safety programs further strengthened uptake. Ongoing expansion of light rail and airport people-mover projects continued to support regional market growth.

Europe

Europe accounted for nearly 23% share in 2024, driven by strict safety norms and strong emphasis on rail modernization. Countries such as the U.K., France, Germany, and Spain adopted full-closed PSD systems to enhance passenger protection and reduce disruptions. The region also saw increased retrofit activity across older metro lines, supported by EU funding. Energy-efficient designs and smart-door integration aligned with Europe’s sustainability goals. High passenger volumes across major metro networks reinforced the need for advanced safety barriers. Demand remained stable as cities expanded automated rail systems and upgraded congested platforms.

Asia-Pacific

Asia-Pacific dominated the market in 2024 with about 48% share, led by large-scale metro expansion in China, India, South Korea, and Southeast Asia. Rapid urban growth and rising commuter density pushed cities to adopt PSD systems for safety and crowd control. Strong government investment in new rail corridors accelerated demand for full-closed and sliding PSD designs. The region’s focus on automated and driverless metro lines also boosted adoption. High-capacity stations required doors that supported fast boarding cycles and enhanced platform climate control. APAC remained the fastest-growing market due to continuous infrastructure development.

Latin America

Latin America captured around 6% share in 2024, driven by selective adoption of platform screen doors in major urban metros. Countries such as Brazil, Mexico, and Chile focused on safety upgrades in busy stations but faced funding constraints that slowed widespread deployment. New metro line expansions created steady demand for cost-efficient half-height PSD systems. Regional governments also explored retrofit possibilities in older tunnels, though progress remained gradual. Rising urban population and increased public transport reliance continued to support long-term demand. Vendor partnerships with local engineering firms improved project feasibility and reduced installation costs.

Middle East & Africa

The Middle East & Africa region held nearly 4% share in 2024, supported by high-profile metro and airport projects in the UAE, Saudi Arabia, and Qatar. These countries invested in premium PSD systems to meet global safety benchmarks and enhance automated rail operations. Mega-cities pursuing smart mobility initiatives adopted full-closed doors for modern metro networks. In Africa, adoption grew slowly due to limited funding, yet planned metro projects in Egypt and South Africa offered growth potential. Increasing focus on digital transit infrastructure and climate-controlled platforms continued to attract PSD investments across select markets.

Market Segmentations:

By Type

- Full-closed

- Semi-closed

- Half-height

By Operation

- Hinged

- Sliding

- Retractable

By Application

- Metro Station

- Airport

- Bus Stop

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Platform Screen Door System Market features established global players and region-focused manufacturers that compete through technology upgrades, large-scale project capabilities, and long-term service contracts. Companies such as Schaltbau Holding AG, Samjung Tech Co., Ltd., Nippon Signal Co., Ltd., Singapore Technologies Engineering Ltd, Nanjing Kangni Mechanical & Electrical Co., Ltd., Overhead Door Corporation, Kyosan Electric Manufacturing Co., Ltd., Westinghouse Air Brake Technologies Corp (Wabtec Corporation), Zhuzhou CRRC Times Electric Co., Ltd., and Knorr-Bremse AG focus on full-closed and sliding-door systems that support automated metro networks. Vendors invest in smart sensors, predictive maintenance software, and modular retrofitting solutions to meet rising safety and efficiency demands. Partnerships with metro authorities and turnkey EPC firms strengthen their bid pipelines. Many suppliers also expand production capacity in Asia-Pacific, where metro construction accelerates rapidly. Competitive intensity remains high as operators prioritize reliability, low maintenance cost, and strong integration with signaling systems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Schaltbau Holding AG

- Samjung Tech Co., Ltd.

- Nippon Signal Co., Ltd.

- Singapore Technologies Engineering Ltd

- Nanjing Kangni Mechanical & Electrical Co., Ltd.

- Overhead Door Corporation

- Kyosan Electric Manufacturing Co., Ltd.

- Westinghouse Air Brake Technologies Corp (Wabtec Corporation)

- Zhuzhou CRRC Times Electric Co., Ltd.

- Knorr-Bremse AG

Recent Developments

- In July 2025, Zhuzhou CRRC Times Electric Co., Ltd. Zhuzhou CRRC Times Electric, via CRRC Zhuzhou Institute, deployed its self-developed FAO signaling system on Ningbo Metro Line 8. The system integrates closely with platform screen door systems to automate door operations and improve safety and efficiency.

- In December 2024, Knorr-Bremse AG Knorr-Bremse Rail Systems equipped Greece’s driverless Thessaloniki Metro with new platform screen doors. The deployment focuses on reducing accidents and improving passenger flow across all stations on the line.

- In August 2024, Schaltbau Holding AG Change in leadership at Pintsch GmbH (Schaltbau’s rail infrastructure / PSD-related subsidiary): Schaltbau announced a management change at Pintsch (new spokesman Nicolas Hélary) relevant because Pintsch is the Group unit that handles level crossings and platform barrier / PSD projects

Report Coverage

The research report offers an in-depth analysis based on Type, Operation, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Global metro expansion will sustain strong demand for advanced platform screen door systems.

- Full-closed PSD designs will gain wider adoption due to higher safety and operational control.

- Sliding-door systems will remain dominant as cities prioritize fast and reliable passenger flow.

- Retrofit projects in older metro networks will accelerate as safety standards tighten.

- Smart sensors and AI-based monitoring will enhance door performance and reduce failures.

- Energy-efficient and low-maintenance PSD solutions will attract transit agencies seeking long-term savings.

- Automation and driverless train operations will increase reliance on synchronized PSD technology.

- Growth in airport and bus rapid transit systems will open new application opportunities.

- Vendors will strengthen partnerships with EPC firms to secure large public transport contracts.

- Asia-Pacific will continue to lead market growth due to rapid urbanization and heavy rail investment.