Market Overview

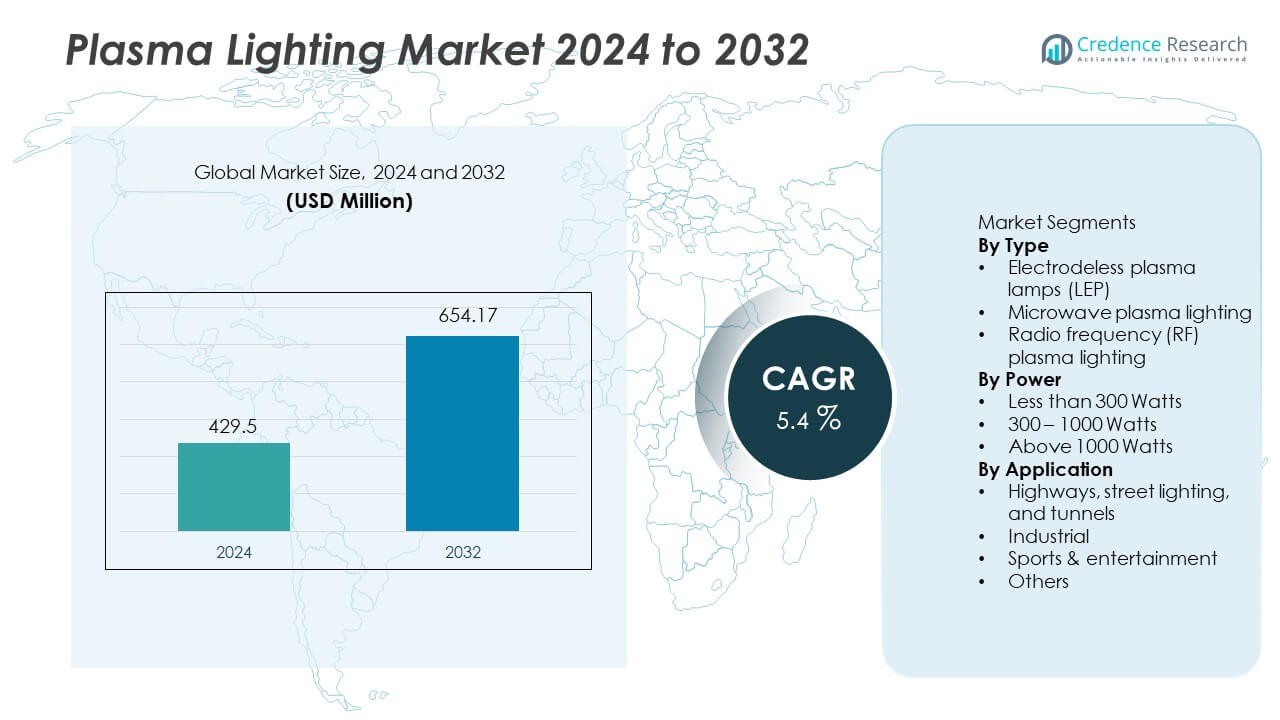

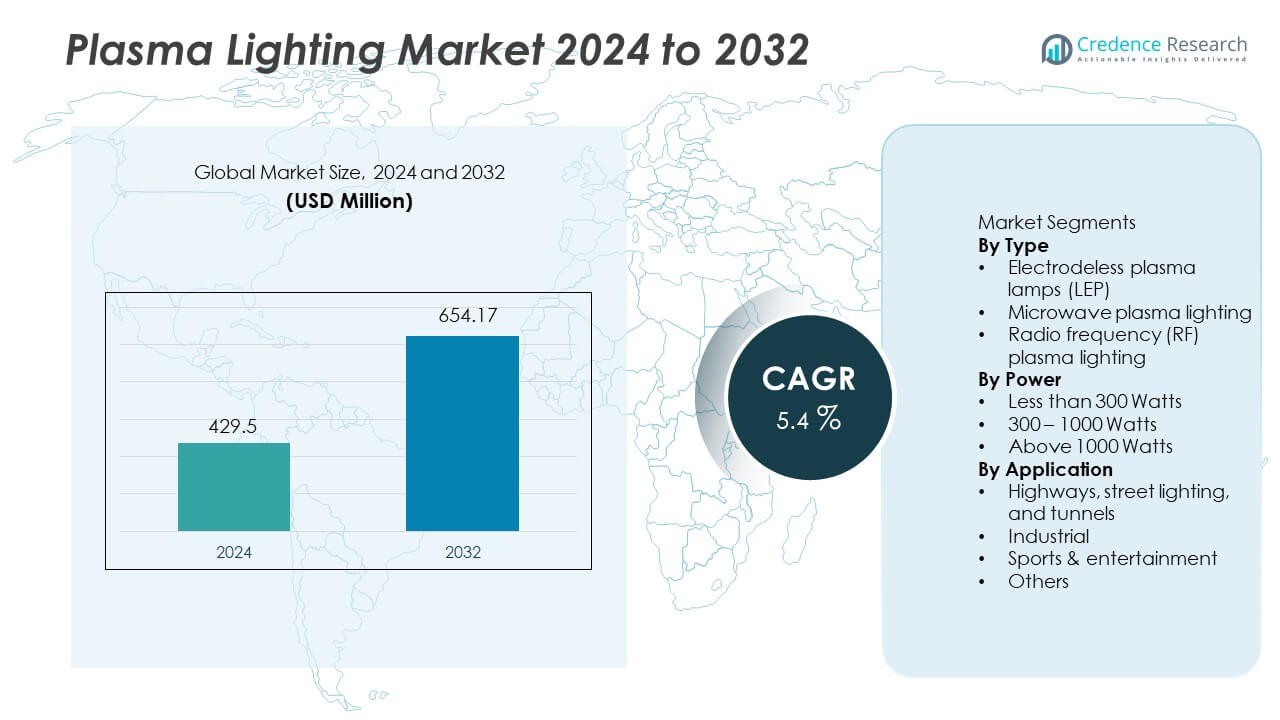

The Plasma Lighting Market was valued at USD 429.5 million in 2024 and is projected to reach USD 654.17 million by 2032, registering a CAGR of 5.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Plasma Lighting Market Size 2024 |

USD 429.5 Million |

| Plasma Lighting Market, CAGR |

5.4% |

| Plasma Lighting Market Size 2032 |

USD 654.17 Million |

Top players in the Plasma Lighting market include Hive Lighting, Solaronix, Topanga USA, Ceravision, Plasma International, Ushio Lighting, Luxim Corporation, Gavita Holland, Ka Shui International, and M B Tech. These manufacturers focus on high-intensity illumination systems that support smart city lighting, industrial operations, and large-area outdoor applications. Asia Pacific leads the market with a 33% share, driven by rapid urban development and growing investments in transportation infrastructure across China and India. North America follows with a 30% share, supported by tunnel and roadway upgrades, while Europe holds a 27% share due to strong sustainability programs and infrastructure modernization across major economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Plasma Lighting market reached USD 429.5 million in 2024 and will reach USD 654.17 million by 2032 at a CAGR of 5.4% during the forecast period.

- Infrastructure growth and rising need for energy-efficient outdoor lighting drive steady adoption, with Electrodeless plasma lamps holding a 46% share supported by strong illumination and long operating life in public lighting and industrial settings.

- Market trends show increased use of smart controls, remote monitoring, and long-life plasma discharge technologies that support industrial modernization and advanced urban lighting systems across developing regions.

- Competitive activity focuses on high-intensity platforms, microwave and RF systems, and heat-resistant components, while high initial investment and competition from LED technologies remain primary restraints in cost-sensitive applications.

- Asia Pacific leads regional demand with a 33% share, followed by North America at 30% and Europe at 27%, supported by smart transportation projects and large-scale outdoor lighting programs across highways, tunnels, and industrial corridors.

Market Segmentation Analysis:

By Type

Electrodeless plasma lamps lead this segment with a 46% share, supported by energy efficiency and long operating life across industrial and outdoor lighting applications. These lamps deliver high lumen output and stable performance for continuous lighting needs in large outdoor spaces. Microwave plasma lighting follows due to strong adoption in high-power settings that require reliable brightness and reduced maintenance cycles. Radio frequency plasma lighting serves niche applications where specific frequency control and illumination quality matter. Growing demand for advanced lighting in infrastructure and urban projects strengthens preference for electrodeless systems with lower operating cost.

- For instance, Luxim’s STA 41-02 LEP (light-emitting plasma) lamp produces a large quantity of lumens and runs for tens of thousands of hours – making it suited for high-intensity applications such as street lights and large parking-lot luminaires.

By Power

The 300–1000 Watts category holds a 49% share, driven by strong demand in medium to large-scale industrial lighting, public infrastructure, and commercial facilities. These systems offer balanced illumination intensity while controlling power consumption in long-duration operating environments. Lower wattage products support smaller installations such as street corridors or compact industrial sites. Above 1000 Watt plasma lighting serves specialized heavy-duty environments, stadiums, and industrial yards with large area coverage. Demand increases as public authorities adopt efficient mid-power lighting to reduce maintenance cycles and improve energy performance in urban infrastructure programs.

- For instance, Ceravision’s ionCORE plasma luminaires scale from 100 Watts up to 5,000 Watts, enabling coverage of large stadiums and industrial yards with a single lamp.

By Application

Highways, street lighting, and tunnels represent the largest application with a 48% share, supported by government investments in smart urban lighting and roadway safety enhancements. Plasma lighting delivers high intensity and long-distance visibility that supports safe night-time driving conditions. Industrial installations follow due to large area coverage needs and heat-resistant lighting in production zones. Sports and entertainment applications require high lumen density and uniform illumination during events and broadcasts. Adoption grows as municipalities upgrade public lighting networks and integrate energy-efficient plasma systems for outdoor and transit infrastructure across many developing regions.

Key Growth Drivers

Key Growth Drivers

Rising Demand for Energy-Efficient High-Intensity Lighting

Demand for energy-efficient illumination grows as governments promote low-carbon lighting solutions. Plasma lighting provides strong lumen output and long service life for highways, tunnels, and industrial environments. These systems help reduce electricity use and maintenance cost in long-running applications. Infrastructure upgrades across developing regions drive new installations in public lighting. Industries adopt plasma due to high brightness and reduced heat load in heavy-duty settings. Rising energy prices support adoption of cost-saving illumination across outdoor and commercial spaces.

- For instance, Gavita Holland reports plasma fixtures delivering a particular photon efficacy in controlled horticulture applications, supporting reduced thermal load in sealed grow rooms.

Infrastructure Development and Urban Expansion Projects

Growing infrastructure programs expand street lighting and tunnel illumination needs. Smart city initiatives promote advanced outdoor lighting with remote control and performance monitoring. Road safety regulations drive replacement of older lamps with high-intensity plasma units. New expressways, metro networks, and transportation corridors support installation growth. Government investments in public lighting projects open wider demand for durable high-output systems. Urban expansion across Asia and the Middle East strengthens long-term opportunities for plasma lighting providers.

- For instance, Ushio Lighting highlights high intensity discharge lamps with a high color temperature, providing high-visibility lighting suitable for large outdoor areas and industrial settings.

Expanding Adoption in Industrial and Sports Arenas

Industrial facilities adopt plasma lighting for long duty cycles, heat resistance, and large area coverage. Sports and stadiums require uniform illumination and high lumen density for professional events and broadcasting needs. Plasma lighting enables clear visibility with reduced glare, supporting player and audience safety. Industrial users shift from conventional high-pressure lamps to plasma solutions that reduce replacement intervals and maintenance shutdowns. Growth in entertainment venues and outdoor event infrastructure encourages adoption of high-output lighting platforms.

Key Trends and Opportunities

Integration of Smart Controls and Remote Monitoring

Plasma lighting integrates intelligent control systems that support remote operation, dimming, and performance tracking. Smart monitoring improves energy usage and manages maintenance through predictive analytics. Municipalities adopt connected lighting to support smart city standards and traffic safety. Vendors develop digital platforms that optimize illumination and extend component life. This trend creates new opportunities for service-based lighting models across urban areas.

- For instance, Topanga USA developed plasma fixtures using RF drivers that had control capabilities, allowing for light level adjustments while having potential for good lumen maintenance over a significant number of operating hours.

Replacement of Aging HID and High-Pressure Lamps

Many regions still rely on aging HID lamps in public lighting networks. Plasma lighting offers a long-life alternative that reduces operational cost and downtime. Government initiatives for sustainable lighting accelerate replacement of high-pressure sodium and metal halide systems. Sports facilities and industrial units adopt plasma solutions to enhance brightness and visibility. Replacement-driven demand supports steady adoption across developing markets.

- For instance, Solaronix plasma light sources provide a sun-like continuous light spectrum that can achieve Class A ratings under relevant testing standards, with an outstanding service life of many thousands of hours.

Key Challenges

High Initial Investment and Cost Competitiveness

Plasma lighting requires higher upfront investment compared to traditional lamps. Small municipalities and cost-sensitive industries face barriers to adoption. LED systems also compete on cost, energy saving, and standard availability. These factors limit plasma penetration in price-competitive segments. Vendors need to demonstrate lifetime savings and maintenance benefits to justify adoption.

Growing Competition from LED Technologies

LED lighting continues to advance in brightness, efficiency, and durability. Many applications shift from plasma to LED due to lower cost and wider product availability. Continuous LED innovation challenges plasma vendors to differentiate based on performance. Competitive pressure pushes plasma manufacturers to enhance system efficiency and reduce power consumption across large-area installations.

Regional Analysis

North America

North America holds a 30% share, driven by early adoption of energy-efficient lighting in highways, tunnels, and industrial facilities. The United States invests in smart transportation systems that require high-intensity and low-maintenance illumination. Public agencies replace older HID lamps with plasma solutions to reduce operational cost and improve visibility. Industrial plants adopt plasma lighting for large-area coverage and heat resistance in long duty cycles. Municipal sustainability programs encourage wider adoption in public lighting networks. Demand also grows in sports venues that require high lumen density and uniform visibility for professional events.

Europe

Europe accounts for a 27% share, supported by strict energy regulations and sustainability policies that favor long-life lighting systems. Countries including Germany, France, and the United Kingdom invest in advanced outdoor and road illumination. Plasma lighting adoption rises in major expressways and tunnel projects that require strong brightness and heat stability. The region’s strong industrial base supports installation in warehouses, processing plants, and logistics facilities. Replacement of high-pressure sodium lamps continues under energy-saving initiatives. Infrastructure modernization in Eastern Europe also contributes to market expansion for durable plasma lighting systems.

Asia Pacific

Asia Pacific leads the market with a 33% share, driven by rapid urbanization, expanding road networks, and large-scale construction projects. China and India continue to deploy plasma lighting in highways, flyovers, and public infrastructure. Industrial growth across Southeast Asia supports adoption in factories and logistics hubs. Increased focus on operational efficiency encourages replacement of conventional lamps in commercial spaces. Sports and entertainment venues also invest in high-intensity plasma systems for stadiums and outdoor events. Government initiatives promoting efficient public lighting strengthen long-term demand across developing markets.

Latin America

Latin America represents an 8% share, supported by expanding urban infrastructure and improved road safety programs in Brazil and Mexico. Public authorities adopt high-intensity lighting for tunnels and highways where durability and low maintenance matter. Industrial users adopt plasma solutions for large warehouses, mining sites, and heavy-duty outdoor zones. Stadium upgrades and commercial construction support selective adoption in metropolitan areas. However, budget constraints slow replacement of older HID systems across smaller municipalities. Gradual infrastructure modernization and rising energy costs encourage long-term investment in efficient lighting.

Middle East and Africa

Middle East and Africa hold a 2% share, driven by focused installation in high-temperature industrial zones, oil and gas projects, and outdoor facilities. Gulf infrastructure development supports demand for long-life lighting in tunnels, highways, and ports. Large international sports events in the Middle East also favor high-intensity illumination for stadiums. Africa sees limited penetration due to cost sensitivity and slower infrastructure development. However, improving urban networks and industry activity in countries such as South Africa support gradual growth for advanced lighting systems across selected regions.

Market Segmentations:

By Type

- Electrodeless plasma lamps (LEP)

- Microwave plasma lighting

- Radio frequency (RF) plasma lighting

By Power

- Less than 300 Watts

- 300 – 1000 Watts

- Above 1000 Watts

By Application

- Highways, street lighting, and tunnels

- Industrial

- Sports & entertainment

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the Plasma Lighting market features key companies such as Hive Lighting, Solaronix, Topanga USA, Ceravision, Plasma International, Ushio Lighting, Luxim Corporation, Gavita Holland, Ka Shui International, and M B Tech. Leading players focus on high-intensity plasma solutions that deliver strong lumen output, durability, and long service life in outdoor and industrial settings. Many companies invest in advanced plasma discharge technologies, microwave and RF platforms, and heat-resistant components that support long operating cycles in tunnels, stadiums, and heavy-duty industrial areas. Vendors also expand smart control capabilities and remote monitoring systems to improve energy performance and lower maintenance requirements. Strategic partnerships with infrastructure and industrial developers drive adoption across smart cities and transportation projects. Continuous pressure from LED technologies motivates manufacturers to improve efficiency, reduce cost, and expand application suitability across global markets.

Key Player Analysis

- Hive Lighting

- Solaronix

- Topanga USA

- Ceravision

- Plasma International

- Ushio Lighting

- Luxim Corporation

- Gavita Holland

- Ka Shui International

- M B Tech

Recent Developments

- In January 2024, Excelitas Technologies Corp. announced that it had acquired the Noblelight business from Heraeus Group, a Germany-based technology company. Noblelight provides infrared and ultraviolet (IR/UV) light solutions for industrial, scientific, and medical applications.

- In December 2023 Lumartix developed a solar simulator that allows performing aging, characterization as well as stabilization tests. The simulator was dubbed as Solixon, which has features for solar simulation and light soaking. The Solixon devices use Lumartix plasma light engine as alternative Xenon arc lamp technology which is said to be low maintenance.

- In December 2023, Ushio Inc. and TNO, a Dutch research and technology organization, further consolidated their relationship with a new agreement aimed at maintenance and partnership over a five-year period. Ushio provided TNO with a high-intensity EUV light source for use in TNO’s EBL2 facility.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Power, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Future demand will rise due to growing infrastructure lighting projects.

- Outdoor and highway lighting will expand as urban networks increase.

- Mid-power systems will grow in industrial and commercial applications.

- High-intensity platforms will gain use in stadiums and event venues.

- Smart monitoring and control systems will support energy management.

- Replacement of HID lamps will continue in public lighting networks.

- Plasma technology will focus on longer operating life and heat resistance.

- Cost reduction initiatives will improve market penetration in new regions.

- Integration with smart city platforms will open additional opportunities.

- Competition from LED technologies will drive performance upgrades.

Key Growth Drivers

Key Growth Drivers