Market Overview

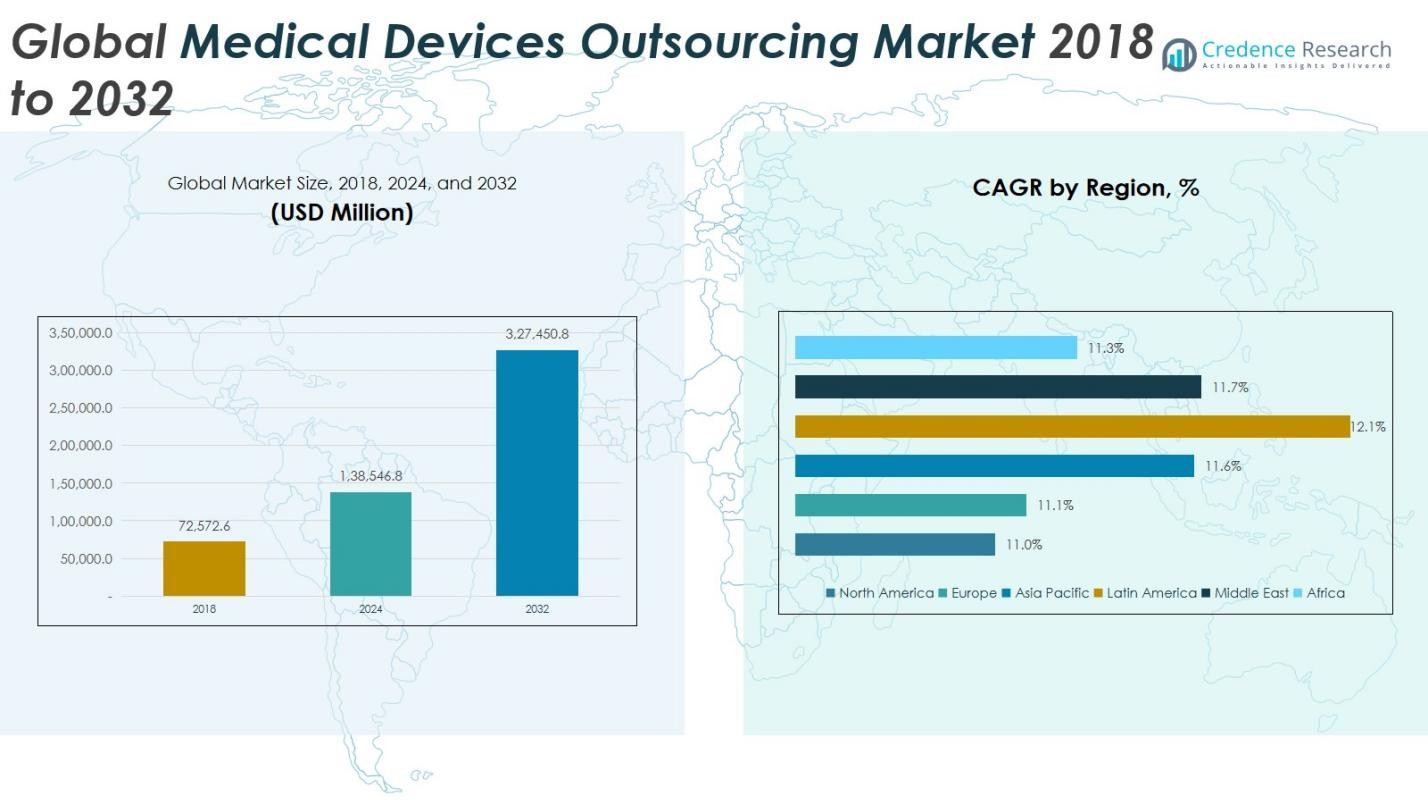

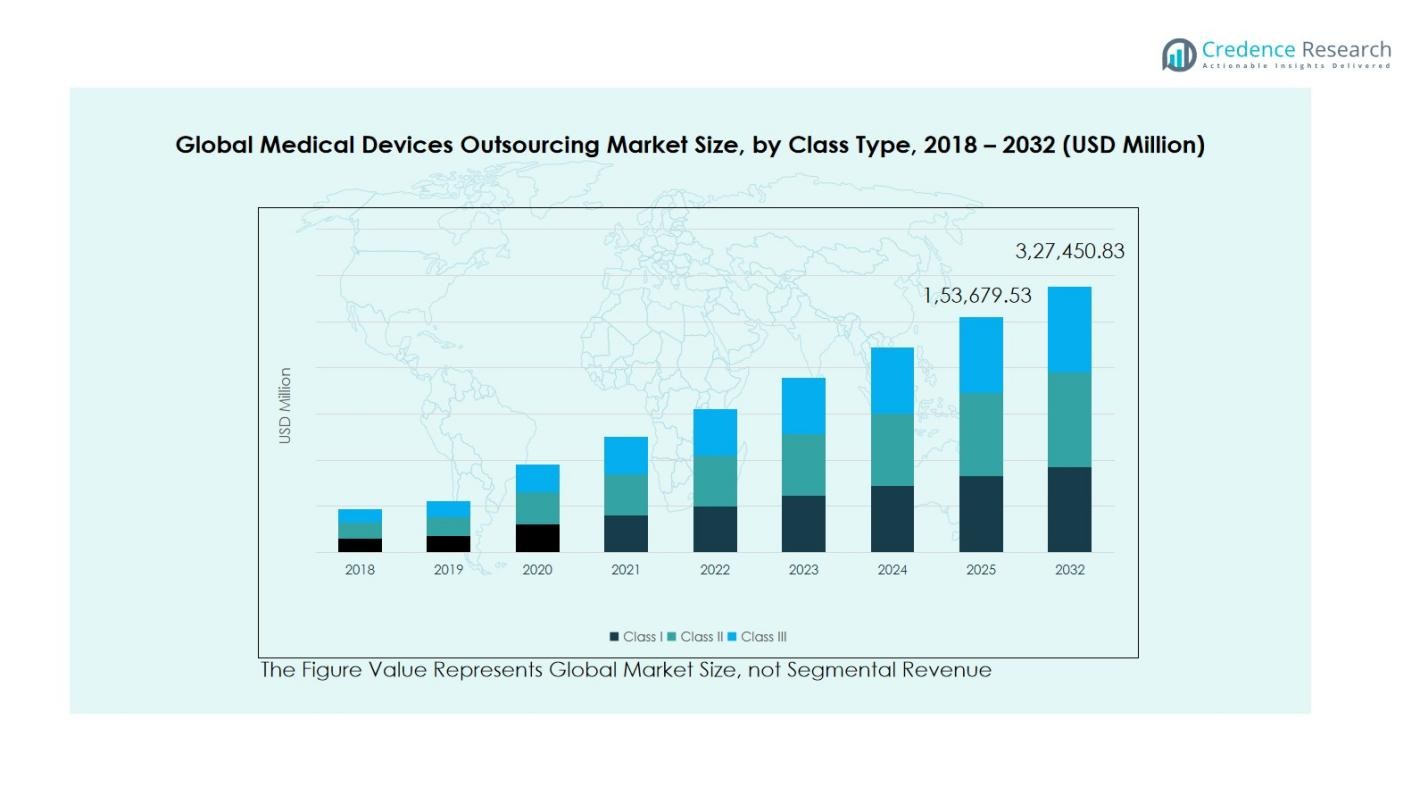

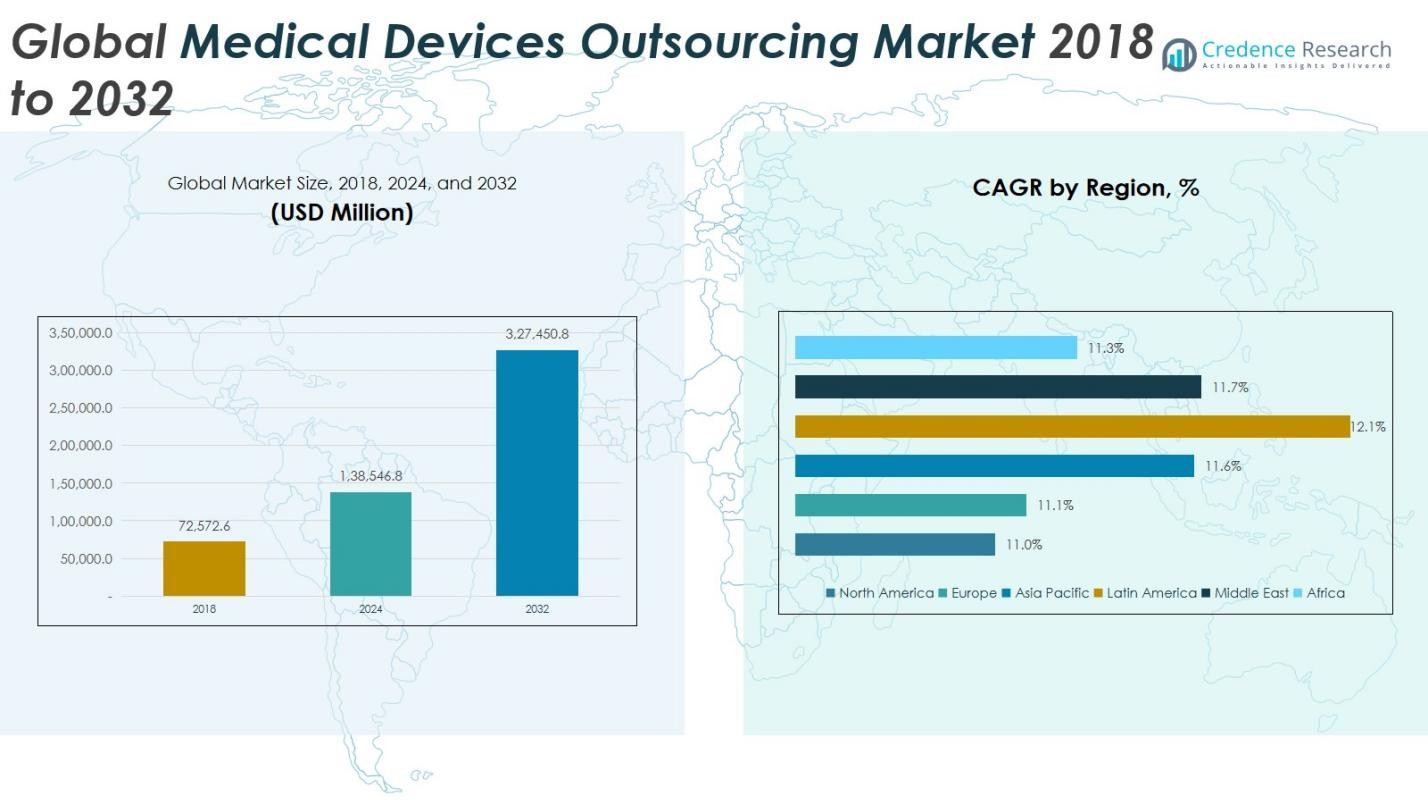

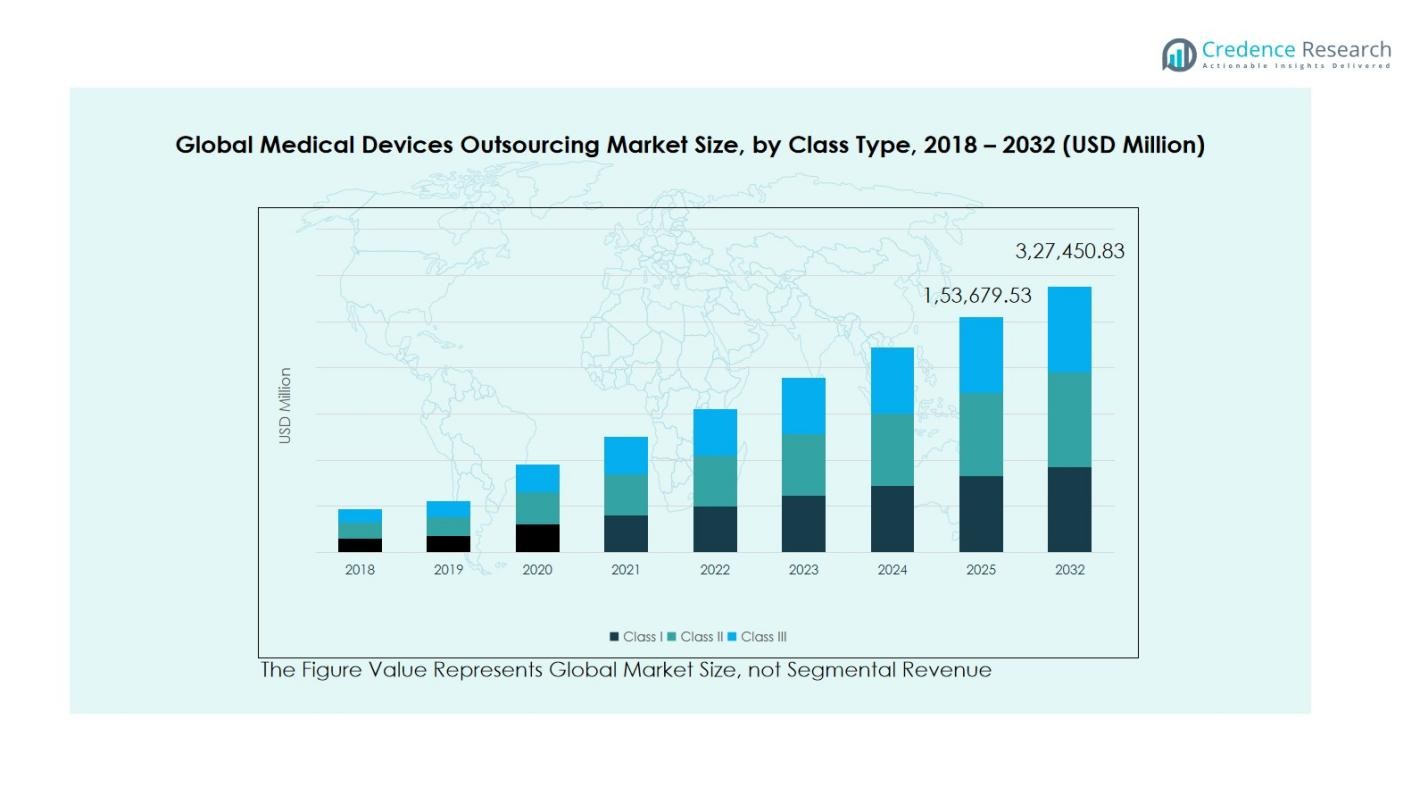

The Global Medical Devices Outsourcing Market size was valued at USD 72,572.6 million in 2018, which increased to USD 138,546.8 million in 2024 and is projected to reach USD 327,450.8 million by 2032, registering a CAGR of 11.41% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Medical Devices Outsourcing Market Size 2024 |

USD 138,546.8 Million |

| Medical Devices Outsourcing Market, CAGR |

11.41% |

| Medical Devices Outsourcing Market Size 2032 |

USD 327,450.8 Million |

The Global Medical Devices Outsourcing Market is led by prominent players such as SGS SA, Eurofins Scientific, Intertek Group plc, Charles River Laboratories, Pace Analytical Services Inc., Laboratory Corporation of America Holdings, Veol Medical Technologies, and Scapa Healthcare. These companies dominate through their extensive service portfolios, strong regulatory expertise, and global manufacturing capabilities. They focus on innovation, automation, and strategic partnerships to enhance product quality and operational efficiency. In 2024, Asia Pacific emerged as the leading region, commanding approximately 33% of the global market share. The region’s dominance is driven by cost-effective manufacturing, skilled labor availability, and growing investments from international medical device companies seeking to expand production capacity and ensure faster time-to-market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Global Medical Devices Outsourcing Market was valued at USD 138,546.8 million in 2024 and is projected to reach USD 327,450.8 million by 2032, registering a CAGR of 11.41% during the forecast period.

- Growing demand for cost-efficient and high-quality manufacturing drives the market as medical device companies increasingly outsource production, testing, and regulatory services to focus on innovation and faster product approvals.

- The market is witnessing trends such as the integration of digital technologies, automation, and AI-driven design solutions to improve precision, compliance, and time-to-market across medical device categories.

- Key players including SGS SA, Eurofins Scientific, Intertek Group plc, and Charles River Laboratories dominate the landscape through global expansion, mergers, and technology partnerships, while regional firms cater to niche testing and design needs.

- Asia Pacific leads the market with 33% share in 2024, driven by low-cost manufacturing, followed by North America at 28%, with contract manufacturing holding the largest segment share.

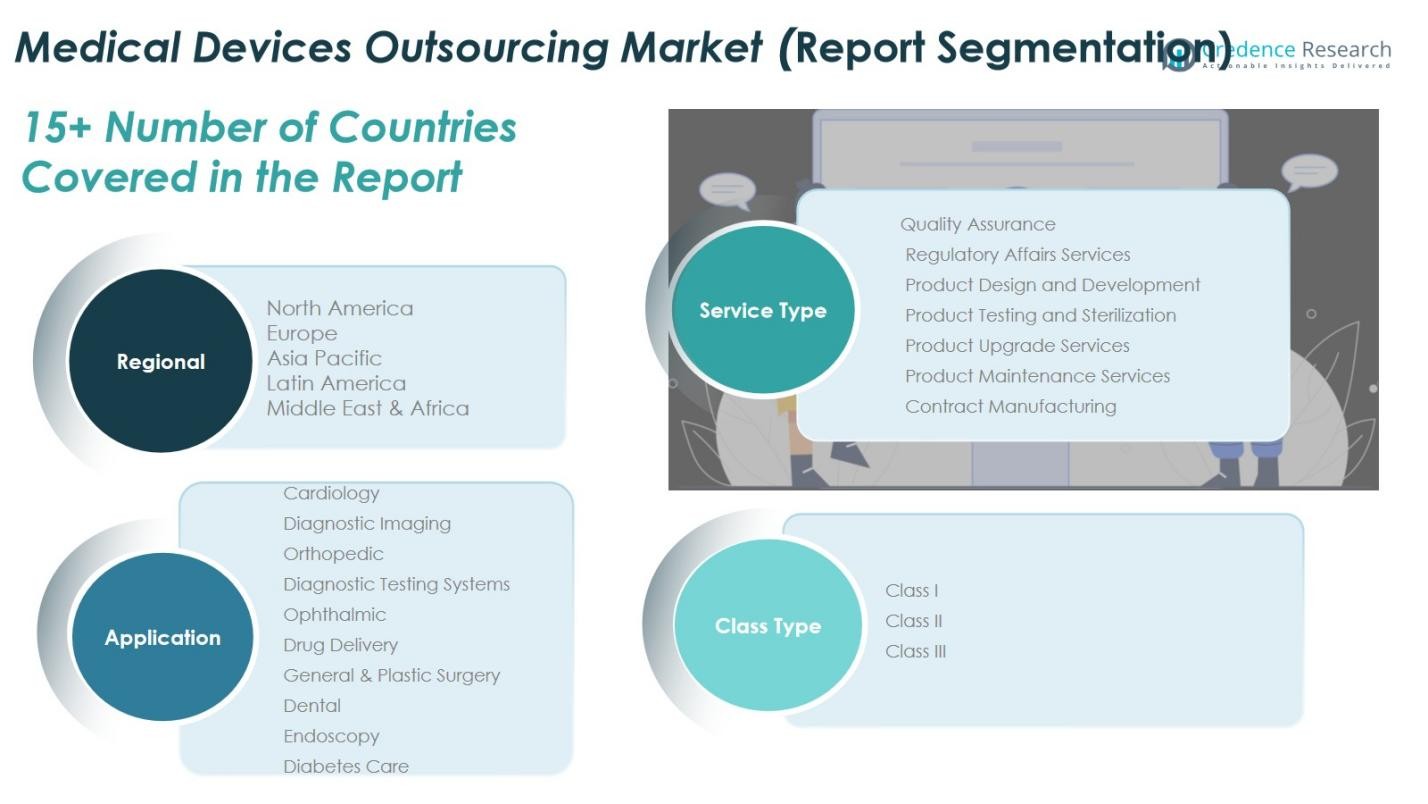

Market Segmentation Analysis:

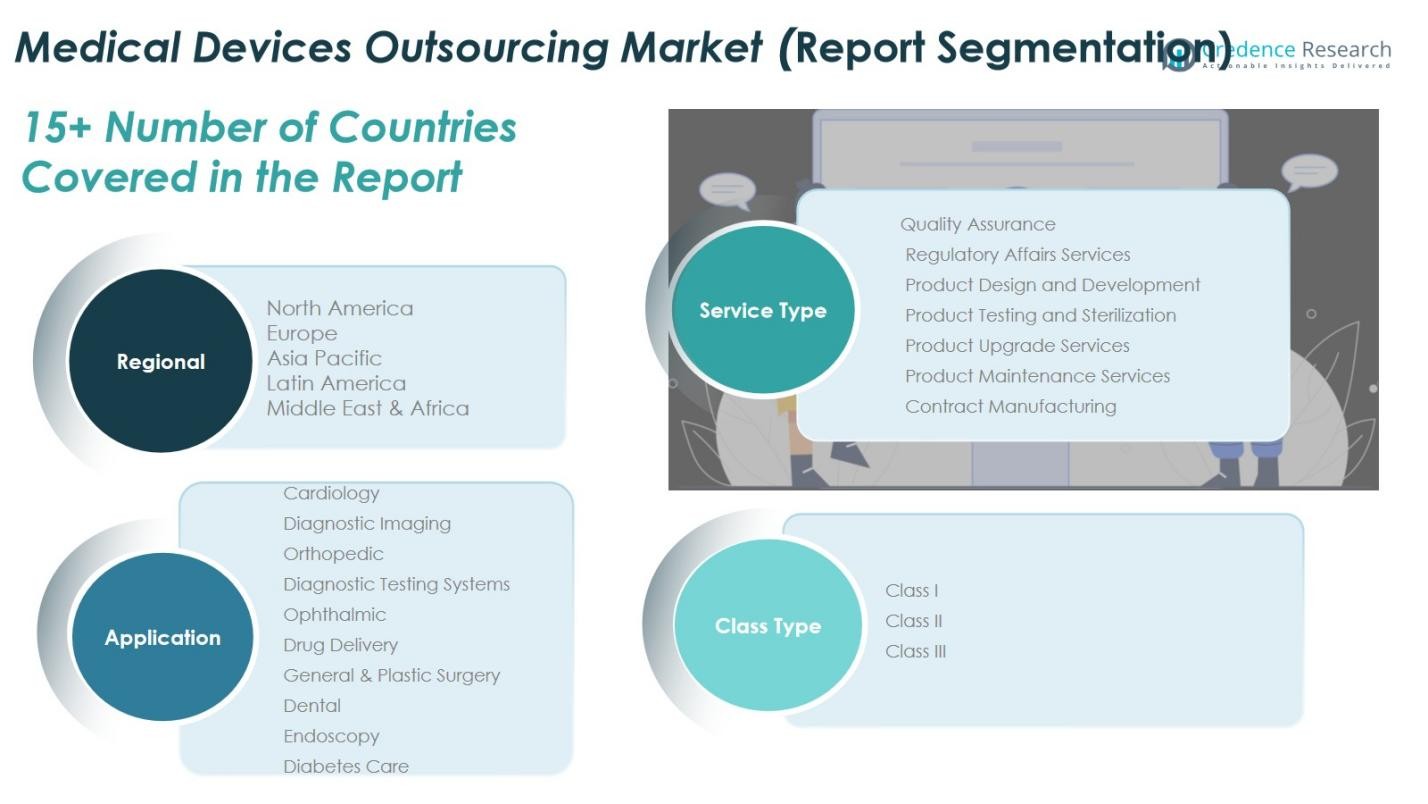

By Service Type:

The Global Medical Devices Outsourcing Market by service type is dominated by the contract manufacturing segment, accounting for around 38% of the total market share in 2024. The growth is driven by the increasing demand for cost-efficient production, scalability, and specialized expertise among OEMs. Rising regulatory compliance complexities have further encouraged manufacturers to outsource production and assembly processes. Quality assurance and product design and development services also hold notable shares, supported by the growing emphasis on maintaining high product standards and accelerating innovation cycles in medical device development.

For instance, Sanmina collaborates with cardiac device manufacturers to produce complex pacemakers, leveraging integrated PCB/PCBA and systems assembly capabilities to ensure reliability and compliance.

By Application:

Based on application, the diagnostic imaging segment leads the global medical devices outsourcing market with approximately 24% market share in 2024. This dominance is attributed to the rising prevalence of chronic diseases, increased imaging equipment demand, and continuous innovation in diagnostic technologies. Outsourcing in this segment enables faster development and compliance with international standards. Other major contributors include cardiology and orthopedic applications, driven by the expanding geriatric population and the increasing adoption of minimally invasive procedures across healthcare facilities.

By Class Type:

In terms of class type, Class II devices hold the largest share, representing nearly 46% of the global medical devices outsourcing market in 2024. The segment’s growth is fueled by the high production volume of mid-risk devices such as diagnostic tools, infusion pumps, and surgical instruments, which require strict regulatory validation and precision manufacturing. Outsourcing helps OEMs manage production efficiency, ensure quality consistency, and comply with global safety standards. Class III devices follow, supported by the growing demand for implantable and life-support devices requiring specialized expertise and rigorous testing.

For instance, IQVIA offers integrated services including regulatory support and clinical testing for medical devices like diagnostic tools, enabling efficient global market entry.

Key Growth Drivers

Rising Demand for Cost-Effective Manufacturing

The growing emphasis on reducing production costs while maintaining high product quality is a major driver for the global medical devices outsourcing market. Outsourcing enables manufacturers to access advanced technologies and skilled expertise at lower operational expenses. This cost advantage allows companies to focus on innovation and core competencies, especially in competitive markets. Additionally, emerging economies with strong manufacturing infrastructure, such as China and India, provide significant cost benefits, fueling global outsourcing partnerships and enhancing supply chain efficiency.

For example, Medtronic engages in outsourcing various aspects of its medical device production, leveraging external partners’ expertise and facilities to accelerate time-to-market and ensure regulatory compliance.

Stringent Regulatory Requirements and Compliance Support

Increasingly complex regulatory frameworks across regions such as the U.S., Europe, and Asia have encouraged medical device companies to outsource compliance-related activities. Specialized outsourcing firms offer expertise in quality management, documentation, and certification, helping manufacturers meet international standards efficiently. This has accelerated the adoption of outsourcing for regulatory affairs and quality assurance services. The growing need for faster approvals and consistent adherence to safety norms continues to strengthen the demand for professional regulatory outsourcing services globally.

For instance, Philips employs contract regulatory teams in Asia to ensure adherence to Japan’s PMDA and China’s NMPA requirements.

Technological Advancements and Innovation Acceleration

Rapid advancements in medical technologies, including digital health, miniaturization, and smart devices, are fueling the need for specialized outsourcing partnerships. Outsourcing supports quicker prototyping, product development, and market entry through access to cutting-edge R&D and manufacturing capabilities. Companies are increasingly collaborating with contract manufacturers to integrate automation, AI-driven design, and precision engineering. This trend not only improves product performance but also accelerates innovation cycles, enabling faster commercialization of next-generation medical devices across diverse healthcare applications.

Key Trends & Opportunities

Expansion of Contract Manufacturing in Emerging Markets

Emerging economies are becoming global hubs for contract manufacturing due to lower costs, skilled labor availability, and improving regulatory infrastructure. Countries like India, Malaysia, and Vietnam are witnessing strong investment inflows from global medical device companies seeking to expand production capacity. This trend presents opportunities for local contract manufacturers to form strategic partnerships and strengthen export potential. The shift toward nearshoring and regional diversification further enhances the outsourcing landscape in these fast-developing regions.

For instance, Vietnam’s strength lies in its integration with global free trade agreements, facilitating efficient exports to major markets like China, the United States, and ASEAN nations, making it a preferred manufacturing destination in Asia-Pacific.

Integration of Digital Technologies in Outsourcing Processes

Digital transformation is creating new opportunities in medical device outsourcing, with companies adopting AI, IoT, and data analytics to enhance quality, traceability, and efficiency. Smart manufacturing and digital twins are being integrated into product design and validation processes. This shift toward digital-enabled outsourcing improves collaboration, reduces errors, and ensures real-time monitoring of production. As healthcare technology evolves, digital integration is expected to redefine outsourcing standards, promoting greater transparency and innovation across the value chain.

For instance, Siemens Healthineers leverages its Digital Twin technology to simulate manufacturing conditions and optimize device performance before production.

Key Challenges

Data Security and Intellectual Property Concerns

Data protection and intellectual property (IP) management remain critical challenges in the medical devices outsourcing market. As companies share sensitive designs, clinical data, and manufacturing details with third parties, risks of data breaches and IP theft increase. Compliance with international data security regulations, such as GDPR and HIPAA, adds to operational complexities. Ensuring secure communication channels and confidentiality agreements has become essential for maintaining trust and protecting innovation in outsourcing partnerships.

Quality Control and Supply Chain Risks

Maintaining consistent product quality and reliability across geographically dispersed manufacturing units poses a significant challenge. Variations in supplier standards, logistics delays, and quality discrepancies can affect regulatory compliance and brand reputation. The pandemic further highlighted the vulnerability of global supply chains in medical device production. Companies are increasingly investing in supplier audits, digital monitoring tools, and local sourcing strategies to minimize risks and ensure continuous product quality across outsourcing operations.

Regional Analysis

North America:

The North America medical devices outsourcing market was valued at USD 20,574.33 million in 2018, increasing to USD 38,476.41 million in 2024, and is projected to reach USD 88,411.73 million by 2032, growing at a CAGR of 11.0%. The region holds around 28% of the global market share in 2024. Growth is driven by advanced manufacturing infrastructure, strong regulatory frameworks, and high R&D investments from leading medical device companies. The U.S. dominates the market with robust demand for product design, quality assurance, and contract manufacturing services aimed at cost optimization and faster product approvals.

Europe:

Europe’s medical devices outsourcing market stood at USD 15,886.14 million in 2018, reached USD 29,858.81 million in 2024, and is expected to attain USD 69,092.13 million by 2032, expanding at a CAGR of 11.1%. The region accounts for approximately 22% of the global market share in 2024. Growth is fueled by stringent regulatory compliance, high product quality standards, and technological innovation across Germany, the UK, and France. Increased outsourcing for quality assurance, testing, and sterilization services supports manufacturers in adhering to evolving EU MDR regulations and accelerating product market entry.

Asia Pacific:

The Asia Pacific medical devices outsourcing market was valued at USD 23,629.64 million in 2018, grew to USD 45,668.97 million in 2024, and is anticipated to reach USD 109,696.03 million by 2032, at a CAGR of 11.6%. Holding the largest 33% global market share, the region leads due to cost-effective manufacturing, skilled labor, and expanding healthcare infrastructure. China, India, and Japan are the major contributors, benefiting from supportive government policies and a growing base of contract manufacturing facilities. Global firms increasingly partner with regional players to enhance production capacity and innovation efficiency.

Latin America:

The Latin America medical devices outsourcing market stood at USD 8,469.22 million in 2018, increased to USD 16,827.49 million in 2024, and is projected to reach USD 41,848.22 million by 2032, advancing at a CAGR of 12.1%. Representing around 10% of the global market share, the region’s growth is driven by cost advantages, expanding healthcare infrastructure, and foreign direct investments in local manufacturing. Brazil and Mexico dominate due to rising regulatory alignment with global standards and growing contract manufacturing activities supporting exports to North America and Europe.

Middle East:

The Middle East medical devices outsourcing market was valued at USD 2,743.24 million in 2018, reached USD 5,308.32 million in 2024, and is expected to reach USD 12,770.58 million by 2032, growing at a CAGR of 11.7%. The region accounts for about 4% of the global market share. Expansion is driven by increasing government healthcare investments, modernization of medical infrastructure, and regional collaborations with international outsourcing partners. GCC countries, Israel, and Turkey lead the market, focusing on technology transfer, product testing, and localized device assembly to meet rising healthcare demands.

Africa:

Africa’s medical devices outsourcing market was valued at USD 1,270.02 million in 2018, rose to USD 2,406.76 million in 2024, and is forecasted to reach USD 5,632.15 million by 2032, registering a CAGR of 11.3%. Holding around 3% of the global market share, growth is supported by improving healthcare access, government initiatives for local production, and increasing engagement from international outsourcing firms. South Africa and Egypt are the key markets, benefitting from rising investments in diagnostic device manufacturing, regulatory support services, and enhanced supply chain networks across the region.

Market Segmentations:

By Service Type

- Quality Assurance

- Regulatory Affairs Services

- Product Design and Development

- Product Testing and Sterilization

- Product Upgrade Services

- Product Maintenance Service

- Contract Manufacturing

By Application

- Cardiology

- Diagnostic Imaging

- Orthopedic

- Diagnostic Testing Systems

- Ophthalmic

- Drug Delivery

- General & Plastic Surgery

- Dental

- Endoscopy

- Diabetes Care

By Class Type

- Class I

- Class II

- Class III

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Global Medical Devices Outsourcing Market features prominent players such as SGS SA, Laboratory Corporation of America Holdings, Pace Analytical Services Inc., Eurofins Scientific, Intertek Group plc, Veol Medical Technologies, SurgiKart, Scapa Healthcare, and Charles River Laboratories. These companies focus on expanding their service portfolios, enhancing regulatory compliance capabilities, and strengthening global manufacturing networks. Strategic partnerships, mergers, and acquisitions remain central to their growth strategies, enabling them to improve efficiency and expand market reach. Leading firms are increasingly investing in advanced automation, digital quality assurance systems, and AI-driven product design to enhance precision and speed. Additionally, strong emphasis on regional expansion—particularly across Asia Pacific and Latin America—has allowed key players to leverage cost advantages and local expertise. The market is moderately consolidated, with top players dominating contract manufacturing and regulatory services, while smaller regional firms cater to niche testing and product development needs.

Key Player Analysis

- SGS SA

- Laboratory Corporation of America Holdings

- Pace Analytical Services, Inc.

- Eurofins Scientific

- Intertek Group plc

- Veol Medical Technologies

- SurgiKart

- Scapa Healthcare

- Charles River Laboratories

- Other Key Players

Recent Developments

- In July 2025, Meril (Micro Life Sciences) secured a US$200 million investment from the Abu Dhabi Investment Authority (ADIA), representing a 3% stake and valuing the Indian medical device firm at approximately US$6.6 billion.

- On January 20, 2025, Terumo’s blood & cell-technologies business (Terumo BCT) reached a strategic partnership with Shandong Institute of Medical Devices and Pharmaceutical Packaging Inspection in China, aimed at supporting high-quality development of medical-device manufacturing and outsourcing capabilities in the region.

- In May 2025, Quasar Medical announced the acquisition of Nordson Corporation’s contract manufacturing operations in Galway (Ireland) and Tecate (Mexico). This move strengthens Quasar Medical’s CDMO capabilities particularly in balloon and catheter design.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Service Type, Application, Class Type and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to expand rapidly, driven by increasing demand for cost-efficient and high-quality medical device production.

- Contract manufacturing will remain the leading segment due to rising outsourcing of complex device assembly and packaging.

- Asia Pacific will strengthen its position as the global outsourcing hub with growing investments and advanced manufacturing infrastructure.

- Regulatory affairs and quality assurance services will gain traction as compliance requirements become more stringent worldwide.

- Digital transformation and automation will enhance efficiency, traceability, and consistency in outsourced production.

- Strategic partnerships between OEMs and specialized service providers will increase to accelerate innovation and reduce time-to-market.

- Emerging economies will attract global players due to lower labor costs and supportive government policies.

- Technological advancements in AI, IoT, and smart manufacturing will reshape design and development processes.

- Sustainability and eco-friendly manufacturing practices will become key focus areas for outsourcing firms.

- The competitive landscape will witness consolidation as leading companies expand their global service networks.