Market overview

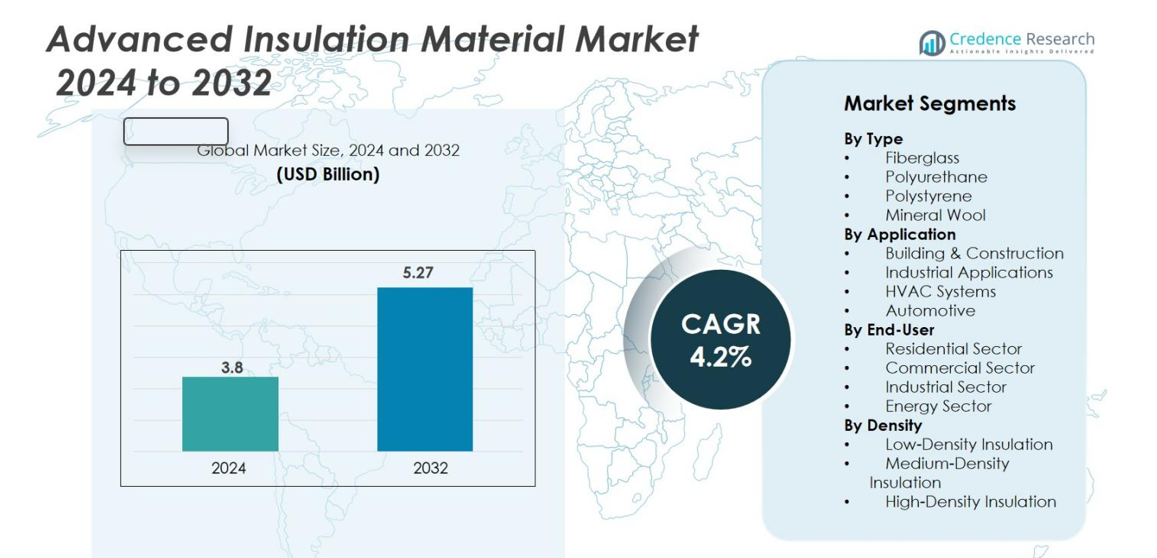

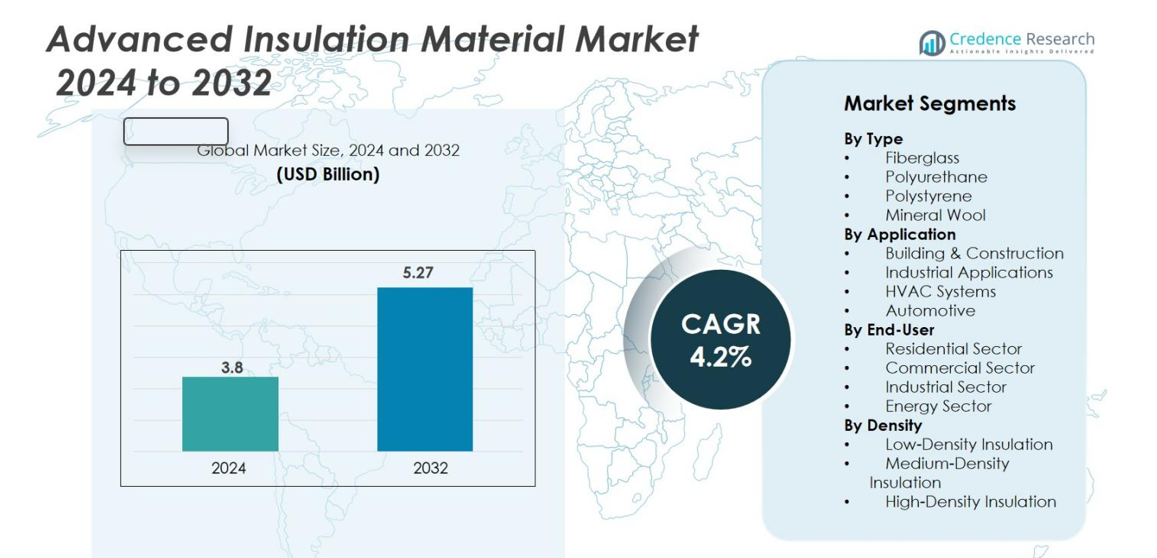

The Advanced Insulation Material market size was valued at USD 3.8 Billion in 2024 and is anticipated to reach USD 5.27 Billion by 2032, at a CAGR of 4.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Advanced Insulation Material Market Size 2024 |

USD 3.8 Billion |

| Advanced Insulation Material Market, CAGR |

4.2% |

| Advanced Insulation Material Market Size 2032 |

USD 5.27 Billion |

The Advanced Insulation Material market is shaped by strong competition among major manufacturers such as BASF SE, UBE Industries Ltd., Johns Manville Corporation, Aspen Aerogels Inc., Armacell International S.A., and Nitto Denko Corporation. These companies focus on high-performance fiberglass, polyurethane foams, aerogels, and polystyrene products to meet strict energy-efficiency and fire-safety standards in construction, industrial plants, and HVAC systems. North America leads the market with a 34% share, driven by large commercial projects and industrial insulation demand, while Europe follows due to strong sustainability mandates. Asia-Pacific expands rapidly as infrastructure development, manufacturing growth, and urbanization increase insulation requirements.

Market Insights

- The Advanced Insulation Material market reached USD 3.8 Billion in 2024 and is forecast to reach USD 5.27 Billion by 2032 at a 4.2% CAGR.

- Growing demand for energy-efficient buildings and industrial facilities drives adoption of fiberglass, polyurethane, polystyrene, and aerogel-based insulation across major construction and retrofit projects.

- Leading trends include the shift toward recyclable, lightweight, and high-temperature insulation, with companies such as BASF SE, Aspen Aerogels Inc., and Armacell International S.A. investing in sustainable and thin-profile solutions.

- Cost sensitivity in developing regions and performance concerns in harsh environments restrain adoption, particularly where cheaper traditional insulation remains widely used.

- North America leads with 34% share, followed by Europe at 28%, while Asia-Pacific holds 25% and remains the fastest growing. By type, fiberglass is dominant with 32% share, while the commercial sector leads end-use demand at 35%, supported by large-scale urban construction and retrofitting.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Fiberglass leads the market with a 32% share due to strong thermal resistance, low cost, and broad installation flexibility. It remains a preferred choice in residential and commercial insulation because manufacturers offer standardized rolls and batts for walls, attics, and duct lining. Polyurethane and polystyrene follow due to high R-value and moisture barrier benefits, while mineral wool gains traction in fire-rated structures. The shift toward energy-efficient retrofitting in old buildings supports fiberglass demand, as contractors use lightweight fiberglass blankets to minimize heat transfer and reduce long-term heating and cooling loads.

- For instance, Owens Corning produces fiberglass insulation known for its superior thermal performance and sustainability credentials, widely used in residential and commercial buildings.

By Application

Building & Construction dominates the segment with a 41% share, driven by strict energy-efficiency codes and higher demand for thermal and acoustic control. Builders prefer composite fiberglass and polyurethane panels for roofs, facades, and wall cavities. Industrial applications are rising due to high-temperature insulation in oil, gas, and process plants, while HVAC systems use polystyrene boards and flexible mineral wool to reduce energy loss in ducting. Automotive manufacturers adopt lightweight aerogel-based insulations to improve cabin comfort and meet emissions rules linked to fuel efficiency.

- For instance, automotive manufacturers have adopted lightweight aerogel-based insulation materials, produced by suppliers like Aspen Aerogels, to enhance cabin safety and energy efficiency while helping meet stringent emissions and fuel efficiency standards.

By End-User

The Commercial Sector holds a 35% share, making it the leading end-user due to rapid construction of malls, offices, hospitals, airports, and data centers. Facility developers choose high-density fiberglass, polyurethane foams, and mineral wool panels to comply with fire-safety and building insulation standards. The residential sector benefits from renovation projects and green housing programs, while the industrial and energy sectors use advanced insulation in turbines, pipelines, and heat-intensive systems. Rising electricity consumption and strict carbon-reduction policies continue to push commercial users toward advanced insulation solutions that lower operational costs.

Key Growth Drivers

Rising Demand for Energy-Efficient Infrastructure

The push for reduced energy consumption across residential, commercial, and industrial facilities drives the adoption of advanced insulation materials. Governments enforce strict energy codes and green building certifications, such as LEED and BREEAM, which require high-performance insulation in walls, roofs, HVAC ducts, and industrial equipment. Builders and manufacturers prefer materials like fiberglass, polyurethane, and aerogel due to strong thermal resistance and reduced heat transfer. Aging building stock in North America and Europe also fuels retrofit projects, as property owners replace outdated insulation to meet modern standards and lower monthly energy costs. The continued rise in electricity prices strengthens the value proposition, making high-efficiency insulation an attractive long-term investment for developers and facility owners.

- For instance, Johns Manville offers formaldehyde-free fiberglass insulation that is dimensionally stable, does not settle, and maintains thermal performance over time, making it widely used in HVAC systems and commercial buildings.

Growth in Industrial Manufacturing and Process Applications

Industrial segments such as oil and gas, chemicals, power generation, and food processing rely on advanced insulation to manage heat flow, protect machinery, and reduce energy waste. High-temperature materials like mineral wool and aerogel blankets provide stability under extreme conditions and improve worker safety. Many plants upgrade pipelines, boilers, turbines, and storage vessels with new insulation technology to minimize heat loss and emissions. Regulations on industrial efficiency and carbon output accelerate adoption, while emerging markets expand manufacturing capacity. As energy-intensive industries continue to expand in Asia-Pacific and the Middle East, demand for reliable thermal insulation rises, positioning advanced solutions as key to operational efficiency and environmental compliance.

- For instance, Thermaxx Jackets improved energy efficiency at TE Connectivity by insulating steam traps, valves, and boiler piping, demonstrating measurable therm savings and operational cost reductions through bespoke insulation solutions.

Expanding Use of Lightweight Materials in Automotive and Aerospace

Vehicle and aircraft manufacturers seek lightweight insulation to reduce fuel consumption, improve cabin comfort, and meet emission reduction targets. Aerogel composites, polystyrene foams, and fiberglass mats provide effective thermal and acoustic insulation without adding significant mass. Electric vehicle platforms also require insulation for battery systems, thermal management units, and soundproofing. Aerospace companies integrate thin, flexible insulation layers to protect components against temperature variations at altitude. With global sales of EVs and lightweight vehicles growing steadily, suppliers invest in innovative solutions with high thermal resistance, low density, and moisture protection. This trend supports new opportunities for specialized insulation material producers targeting next-generation mobility platforms.

Key Trends & Opportunities

Shift Toward Sustainable and Recyclable Insulation Materials

Sustainability influences purchasing decisions as end-users prefer eco-friendly materials with low embodied carbon and recyclability. Fiberglass producers incorporate recycled glass content, while manufacturers of polystyrene and polyurethane explore bio-based resins and cleaner blowing agents. Green construction policies in Europe and North America reward low-emission insulation products, opening opportunities for suppliers with certified sustainable solutions. The market also sees rising interest in aerogels and vacuum insulated panels due to high performance at lower thickness, which supports space-saving building designs. As climate goals tighten, demand continues shifting toward materials that combine durability, energy savings, and environmental responsibility.

- For instance, Saint-Gobain UK is establishing a new stone wool manufacturing facility in Melton Mowbray, which will utilize all-electric furnaces powered by renewable energy, aiming for a net-zero carbon footprint by 2050.

Rising Investments in Smart and High-Performance Insulation Systems

Smart building trends push adoption of advanced insulation systems that integrate moisture control, thermal monitoring, and fire-resistant composites. Developers use hybrid insulation panels with layered structures to offer better protection in high-rise buildings, hospitals, and data centers. Manufacturers experiment with nanomaterials, reflective coatings, and phase-change insulation for superior energy retention. Vacuum panels and aerogels gain commercial viability as costs gradually decline. These technologies deliver thin-profile insulation with excellent thermal performance, enabling architects to reduce wall thickness while preserving energy efficiency.

- For instance, Wedge Group Limited incorporates phase-change materials in their smart insulation systems to dynamically regulate thermal energy by absorbing and releasing heat, optimizing indoor climate control.

Key Challenges

High Material Costs and Limited Awareness in Developing Regions

Advanced insulation materials often carry higher upfront costs than traditional alternatives, slowing adoption in price-sensitive markets. Many builders in emerging regions continue using low-cost fiberglass or conventional foam products, despite lower long-term savings. Limited awareness of lifecycle cost benefits and energy rebates further reduces uptake. The lack of skilled installation professionals can also result in performance losses, discouraging contractors. To overcome this barrier, suppliers must provide training, widen distribution networks, and offer cost-effective product lines suited for mass construction. Incentives and education programs will play an important role in improving adoption rates.

Performance Degradation and Moisture Sensitivity in Harsh Operating Conditions

Some insulation materials face challenges such as moisture absorption, reduced thermal resistance over time, and mechanical wear in extreme conditions. Polystyrene and polyurethane can degrade under prolonged UV exposure, while mineral wool may lose effectiveness if improperly sealed. Industrial sites with high temperatures, humidity, or chemical exposure require specialized designs and protective cladding, adding installation complexity. Failures in insulation systems can lead to energy loss, corrosion under insulation (CUI), and safety risks. Manufacturers respond by developing composite barriers and hydrophobic coatings, but the need for technical expertise and precise installation remains a challenge for many end-users.

Regional Analysis

North America

North America dominates the Advanced Insulation Material market with a 34% share, supported by strict building energy codes and high adoption in commercial and industrial applications. The U.S. leads demand due to large-scale construction, data centers, and petrochemical plants requiring high-performance fiberglass, mineral wool, and polyurethane foams. Retrofitting of aging residential structures also boosts sales. Government incentives for energy-efficient buildings further encourage replacement of outdated insulation. The growing penetration of EVs and lightweight vehicles supports advanced insulation in automotive applications. Manufacturers expand capacity and launch sustainable product lines to meet rising customer expectations.

Europe

Europe holds a 28% share, driven by strong sustainability targets, green building certifications, and carbon-neutral construction mandates. Countries including Germany, the U.K., and France lead adoption of fiberglass, mineral wool, and vacuum insulation panels for residential and commercial projects. Demand rises in industrial settings as manufacturers upgrade insulation to reduce thermal losses and comply with emission rules. The region’s focus on recyclable materials and low-carbon alternatives accelerates the use of bio-based and recycled content insulation. Continuous innovation in aerogels and thin-profile insulation supports space-efficient architectural designs and high-performance refurbishments across urban centers.

Asia-Pacific

Asia-Pacific commands a 25% share and remains the fastest-growing region due to rapid urbanization, rising power consumption, and large infrastructure projects. China, India, Japan, and South Korea invest heavily in commercial buildings, industrial plants, and HVAC systems that require efficient thermal control. Manufacturers increase production of fiberglass, polyurethane foam panels, and polystyrene insulation to meet high construction volumes. Growth in data centers, cold storage, and electronics manufacturing fuels demand for advanced thermal protection. Favorable government policies promoting energy-efficient buildings and expansion of renewable-powered industries continue to support sustained market expansion.

Middle East & Africa

The Middle East & Africa region holds a 7% share, supported by demand from commercial real estate, oil and gas processing, and district cooling networks. Hot climate conditions make thermal insulation critical for energy-efficient HVAC systems in malls, hotels, hospitals, and high-rise buildings. Industrial consumers use mineral wool and polyurethane insulation for pipelines, boilers, and refineries to reduce energy loss. Construction of smart cities and free-trade zones further accelerates use of high-performance materials. Although adoption remains lower than other regions, government energy codes and rising electricity costs are increasing usage across major urban markets.

Latin America

Latin America accounts for a 6% share, led by Brazil, Argentina, and Chile where construction and industrial end-users adopt advanced insulation to enhance energy efficiency and lower operating costs. Hot and humid conditions increase demand for moisture-resistant polystyrene and polyurethane panels in residential and commercial projects. Industrial sectors, including petrochemicals, food processing, and power generation, integrate mineral wool and high-temperature insulation to reduce thermal losses. Although economic fluctuations have limited large-scale investments, modernization of urban buildings and the growth of domestic manufacturing support steady market penetration of advanced insulation solutions.

Market Segmentations

By Type

- Fiberglass

- Polyurethane

- Polystyrene

- Mineral Wool

By Application

- Building & Construction

- Industrial Applications

- HVAC Systems

- Automotive

By End-User

- Residential Sector

- Commercial Sector

- Industrial Sector

- Energy Sector

By Density

- Low-Density Insulation

- Medium-Density Insulation

- High-Density Insulation

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Advanced Insulation Material market is characterized by strong participation from global chemical producers, insulation specialists, and high-performance material manufacturers. Key players include BASF SE, UBE Industries Ltd., Johns Manville Corporation, Aspen Aerogels Inc., Armacell International S.A., Nitto Denko Corporation, and AIR-CELL. These companies compete on product performance, thermal efficiency, fire resistance, and sustainability. Manufacturers invest in R&D to develop thinner, lightweight, and recyclable insulation that meets new energy-efficiency standards in construction, industrial processes, and HVAC systems. Strategic partnerships with builders, automotive OEMs, and industrial clients enhance adoption across large infrastructure and manufacturing facilities. Many suppliers expand production capacity in Asia-Pacific and Europe to address rising construction and industrial demand. Certifications, green building compliance, and advanced manufacturing technologies such as aerogel production and vacuum insulation panel design help leading companies differentiate their portfolios and strengthen market presence globally.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Aspen Aerogels, Inc.

- MASTERGLASS

- Armacell International S.A.

- YUBASE

- BASF SE

- Jrgens GmbH

- Nitto Denko Corporation

- AIR-CELL

- Johns Manville Corporation

- UBE Industries, Ltd.

Recent Developments

- In November 2025, Arsenal Capital Partners completed the acquisition of ThermoSafe, a global leader in bio‑based insulation materials and thermal solutions.

- In October 2025, TopBuild Corp announced the acquisition of Specialty Products & Insulation (SPI), a provider of mechanical insulation and spray‑foam insulation solutions, for approximately US$1 billion.

- In 2024, Recticel Group completed the acquisition of REX Panels & Profiles, enhancing its insulation panel business across Europe

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User, Density and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as governments enforce stricter energy-efficiency and green building standards.

- Adoption will grow in retrofitting projects as older buildings replace outdated insulation.

- Automotive and aerospace sectors will increase use of lightweight and high-temperature materials.

- Aerogel and vacuum insulation panels will gain share due to thin profiles and high performance.

- Manufacturers will invest in recyclable and bio-based insulation to meet sustainability goals.

- Smart insulation systems with moisture and temperature control will see wider commercial use.

- Industrial applications will expand as plants upgrade pipelines, turbines, and process equipment.

- Asia-Pacific will remain the fastest-growing region due to rapid urban development.

- Costs will decline gradually as production capacity increases and technologies scale.

- Partnerships between material suppliers and construction firms will accelerate adoption in large projects.